Opinion: The era of stablecoin duopoly is coming to an end

TechFlow Selected TechFlow Selected

Opinion: The era of stablecoin duopoly is coming to an end

Multiple factors are working together to gradually break Tether and Circle's duopoly.

Author: Nic Carter

Translation: Saoirse, Foresight News

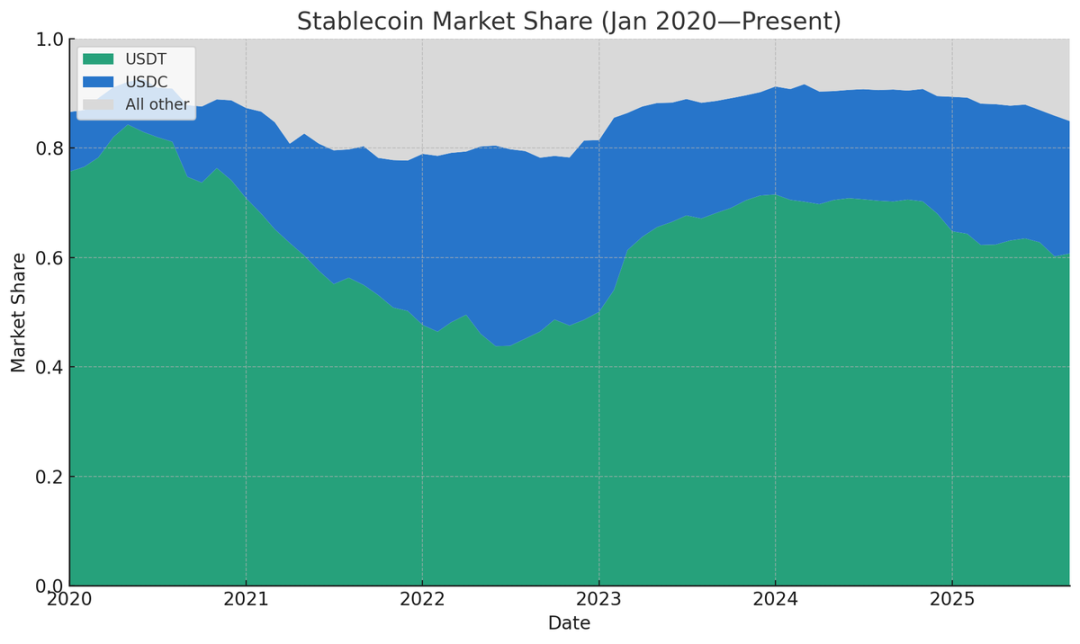

Circle’s equity valuation stands at $30.5 billion. Tether (issuer of USDT) is reportedly raising funds at a $500 billion valuation. Currently, the combined supply of these two major stablecoins reaches $245 billion, accounting for approximately 85% of the entire stablecoin market. Since the inception of the stablecoin industry, only Tether and Circle have consistently maintained significant market share, with all other competitors falling far behind:

-

Dai peaked at just $10 billion in market cap in early 2022;

-

Terra’s UST surged to $18 billion in May 2022, capturing around 10% of the market—yet this was short-lived and ultimately collapsed;

-

The most ambitious challenger was Binance’s BUSD, which reached a peak market cap of $23 billion (15% market share) by the end of 2022, but was later shut down by the New York Department of Financial Services (NYDFS).

Stablecoin relative supply share (Data source: Artemis)

The lowest recorded combined market share I could find for Tether and Circle was 77.71% in December 2021—when Binance USD, DAI, FRAX, and PAX collectively held a more substantial share. (Prior to Tether’s launch, there were earlier mainstream stablecoins like Bitshares and Nubits, but none have survived to date.)

In March 2024, the duopoly’s dominance peaked at 91.6% of total stablecoin supply, after which it began to decline. (Note: Market share here is measured by supply volume, an easily trackable metric; if measured by transaction value, number of trading pairs, real-world payment volume, or active addresses, their share would likely be even higher.) As of now, the duo’s market share has dropped from last year’s peak to 86%, and I believe this trend will continue. Key drivers include increased willingness among intermediaries to issue their own stablecoins, intensifying “race-to-the-bottom” on stablecoin yields, and new regulatory shifts following the passage of the GENIUS Act.

Intermediaries Are Launching Their Own Stablecoins

In previous years, launching a "white-label stablecoin"—a stablecoin built atop existing technical infrastructure—was extremely costly and heavily reliant on Paxos, a regulated fintech firm. Today, that has changed: Anchorage, Brale, M0, Agora, and Bridge (a subsidiary of Stripe), among others, now offer issuance partnerships. In our portfolio, some seed-stage startups have already launched proprietary stablecoins via Bridge—proving you no longer need to be an industry giant to enter the stablecoin issuance space.

Zach Abrams, co-founder of Bridge, explained the rationale behind self-issuance in an article on "open issuance":

For example, if you build a new type of bank using off-the-shelf stablecoins, you face three major issues: a) limited ability to capture yield and pass it back to users to create competitive savings accounts; b) inability to customize reserve asset composition to optimize both liquidity and returns; c) having to pay a 10 basis point (0.1%) fee when redeeming your own funds!

His points are valid. Using Tether offers almost no yield-sharing mechanism to reward customers (who increasingly expect yield on deposits); using USDC may allow some yield sharing, but requires negotiating revenue splits with Circle, who takes a cut. Additionally, third-party stablecoins impose numerous constraints: inability to set freeze/seizure policies, limited control over blockchain deployment, and potential increases in redemption fees.

I once believed network effects would dominate the stablecoin space, leaving only one or two dominant players. But my view has shifted: cross-chain swaps are becoming increasingly efficient, and swapping between different stablecoins on the same chain is easier than ever. Within the next one to two years, many crypto intermediaries may display user deposits simply as generic “USD” or “USD tokens” (rather than explicitly labeling them as USDC or USDT), guaranteeing users the ability to withdraw into any stablecoin of their choice.

Many fintech firms and neobanks already operate this way—they prioritize product experience over adherence to crypto-native conventions, displaying balances as plain “USD” while managing reserves in the backend.

For intermediaries—whether exchanges, fintech platforms, wallet providers, or DeFi protocols—there is a strong economic incentive to shift user funds from dominant stablecoins to proprietary ones. The reason is simple: if a crypto exchange holds $500 million in USDT deposits, Tether can earn roughly $35 million annually from the float generated by those idle funds, while the exchange earns nothing. There are three ways to convert this idle capital into revenue:

-

Negotiate yield-sharing agreements with stablecoin issuers (e.g., Circle shares revenue through incentive programs, though to my knowledge, Tether does not distribute earnings to intermediaries);

-

Partner with emerging yield-bearing stablecoins such as USDG, AUSD, or Ethena’s USDe, which are designed with built-in revenue-sharing mechanisms;

-

Issue your own stablecoin and internalize all yield.

For an exchange, the most direct strategy to convince users to switch from USDT to a proprietary stablecoin is launching a yield program—e.g., paying users interest based on U.S. short-term Treasury rates while keeping a 50-basis-point (0.5%) margin. For fintech products serving non-crypto-native users, even a formal yield program may not be necessary: simply display balances as generic USD, automatically convert funds to a proprietary stablecoin in the backend, and reconvert to Tether or USDC upon withdrawal.

This trend is already emerging:

-

Fintech startups commonly adopt the “generic USD display + backend reserve management” model;

-

Exchanges actively negotiate yield-sharing deals with stablecoin issuers (e.g., Ethena successfully promoted USDe across multiple exchanges through this model);

-

Some exchanges have formed stablecoin alliances, such as the Global Dollar Alliance, including members like Paxos, Robinhood, Kraken, and Anchorage;

-

DeFi protocols are exploring proprietary stablecoins—the clearest example being Hyperliquid, a decentralized exchange. It conducted a public tender to select a stablecoin issuance partner with the explicit goal of reducing reliance on USDC and capturing reserve yield. Hyperliquid received bids from Native Markets, Paxos, Frax, and others, ultimately selecting Native Markets (a controversial decision). Currently, USDC holdings on Hyperliquid amount to about $5.5 billion, representing 7.8% of total USDC supply—though its native USDH is unlikely to replace USDC soon, the very act of tendering damaged USDC’s image and may inspire more DeFi protocols to follow suit;

-

Wallet providers are also entering the space—Phantom, a leading Solana wallet, recently announced Phantom Cash, a yield-bearing stablecoin issued via Bridge and integrated with debit card payments. While Phantom cannot force adoption, it can use various incentives to drive migration.

In summary, as fixed costs for stablecoin issuance fall and yield-sharing models become widespread, intermediaries no longer need to surrender float income to third-party stablecoin issuers. As long as they are large enough and trusted enough to gain user confidence in their white-label stablecoins, self-issuance becomes the optimal choice.

Intensifying “Race-to-the-Bottom” on Stablecoin Yields

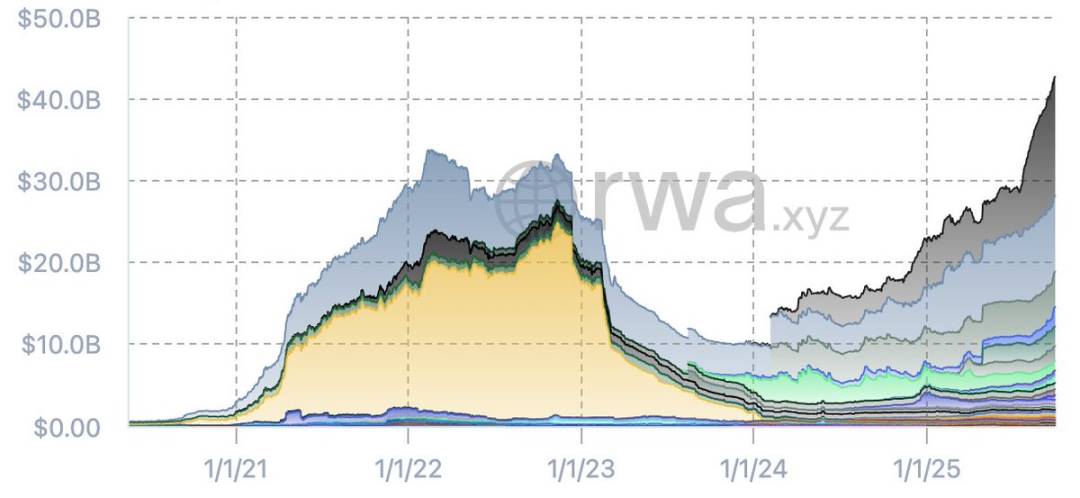

If you examine the stablecoin supply chart excluding Tether and USDC, you’ll notice a significant shift in the “other stablecoins” segment over recent months. In 2022, short-lived frontrunners emerged (like Binance’s BUSD and Terra’s UST), but after Terra’s collapse and the credit crisis, the landscape was reshuffled, giving rise to a new generation of stablecoins from the wreckage.

Stablecoin supply excluding USDT and USDC (Data source: RWA.xyz)

Today, the total supply of non-Tether/Circle stablecoins has reached an all-time high, with a more diversified set of issuers. Leading new entrants include:

-

Sky (an upgraded version of Dai from MakerDAO);

-

USDe issued by Ethena;

-

PYUSD issued by PayPal;

-

USD1 issued by World Liberty.

Others worth noting include Ondo’s USDY, Paxos’ USDG (as part of an alliance), and Agora’s AUSD. Bank-issued stablecoins are also expected to enter the market soon. Existing data already signals the trend: compared to the previous stablecoin boom, today’s ecosystem features more credible stablecoins with greater total supply—even as Tether and Circle still dominate market share and liquidity.

A common trait among these new stablecoins is a focus on “yield pass-through.” For instance, Ethena’s USDe generates yield via crypto basis trades and shares part of it with users, growing its supply to $14.7 billion—making it the most successful new stablecoin this year. Similarly, Ondo’s USDY, Maker’s SUSD, Paxos’ USDG, and Agora’s AUSD were all designed with yield-sharing mechanisms from the outset.

One might object: “The GENIUS Act prohibits stablecoins from offering yield.” This is partially true, but monitoring recent hyperbolic lobbying statements from banking groups shows the matter isn’t settled. In fact, the GENIUS Act does not ban third-party platforms or intermediaries from paying rewards to stablecoin holders—rewards funded precisely by issuer payments to those intermediaries. Mechanically, this loophole cannot—and arguably should not—be fully closed by regulation.

As the GENIUS Act progresses, I’ve observed a shift: the stablecoin industry is moving from “direct yield payments to holders” to “yield delivery via intermediaries.” The Circle-Coinbase partnership exemplifies this—Circle pays yield to Coinbase, which then passes part of it to USDC holders, and this model shows no sign of stopping. Nearly every new stablecoin includes a yield strategy, and the logic is clear: to persuade users to abandon highly liquid, widely accepted Tether for a new option, you must offer a compelling incentive—yield being the primary one.

I predicted this trend at TOKEN2049 in 2023, though the GENIUS Act delayed its timeline. Now, the pattern is unmistakable.

For less flexible incumbents like Tether and Circle, this yield-driven dynamic is disadvantageous: Tether offers no yield at all, while Circle shares yield only with a few partners like Coinbase, with unclear arrangements elsewhere. Going forward, agile startups may erode the market share of dominant stablecoins by offering higher yield shares, triggering a “race-to-the-bottom” on yield (more accurately, a “race-to-the-top” on yield payouts). This could favor institutions with scale advantages—similar to how the ETF industry saw fees drop to zero, culminating in a duopoly led by Vanguard and BlackRock. But the key question remains: if banks eventually join, can Tether and Circle still win?

Banks Can Now Officially Participate in Stablecoin Issuance

Following the enactment of the GENIUS Act, the Federal Reserve and other key financial regulators have updated their rules—banks can now issue stablecoins without needing new licenses. However, under the GENIUS Act, bank-issued stablecoins must comply with the following:

-

100% backed by high-quality liquid assets (HQLA);

-

Redeemable 1:1 into fiat on demand;

-

Comply with disclosure and audit requirements;

-

Be subject to oversight by relevant regulators.

Additionally, bank-issued stablecoins are not considered “FDIC-insured deposits,” and banks may not lend out the collateral backing stablecoins.

When banks ask me whether they should issue stablecoins, my usual advice is “don’t bother”—just integrate existing stablecoins into core banking infrastructure instead of issuing their own. Nevertheless, some banks or banking consortia may still consider launching stablecoins, and I believe we’ll see such cases emerge within the next few years. Reasons include:

-

While stablecoins represent “narrow banking” (deposit-taking without lending), potentially lowering leverage ratios, the stablecoin ecosystem offers multiple revenue streams—custody fees, transaction fees, redemption fees, API integration fees, etc.;

-

If banks observe deposit outflows due to stablecoins (especially those offering yield via intermediaries), they may launch their own to counteract this trend;

-

Issuing stablecoins is relatively low-cost for banks: no regulatory capital required, and stablecoins are “full-reserve, off-balance-sheet liabilities,” less capital-intensive than traditional deposits. Some banks may explore tokenized money market funds, especially given Tether’s sustained profitability.

In extreme scenarios, if yield-sharing were fully banned and all “loopholes” closed, issuers could enjoy near “seigniorage-like” profits—e.g., earning 4% yield without passing anything back to users, yielding spreads even wider than those of high-yield savings accounts. But in reality, I believe the yield loophole won’t be shut, and issuer margins will gradually compress over time. Even so, for large banks, converting even a fraction of their deposits into stablecoins—retaining just 50–100 basis points (0.5%–1%)—could generate massive revenue, given their multi-trillion-dollar deposit bases.

In conclusion, I believe banks will eventually join the stablecoin space as issuers. Earlier this year, the Wall Street Journal reported that JPMorgan Chase (JPM), Bank of America (BoFA), Citigroup (Citi), and Wells Fargo have held preliminary talks about forming a stablecoin consortium. For banks, a consortium model is clearly optimal—no single bank can build a distribution network rivaling Tether’s, but a coalition can pool resources and enhance competitiveness.

Conclusion

I once firmly believed the stablecoin industry would converge to one or two dominant products, at most six, repeatedly emphasizing that “network effects and liquidity are king.” But now I’m reconsidering: do stablecoins truly benefit from network effects? Unlike Meta, X (formerly Twitter), or Uber—platforms whose value scales with user numbers—the real “network” is the blockchain itself, not the stablecoin. If users can frictionlessly move funds in and out of stablecoins, and cross-chain swaps are seamless and low-cost, network effects diminish significantly. When exit costs approach zero, users aren’t locked into any particular stablecoin.

Undeniably, dominant stablecoins—especially Tether—still hold a core advantage: extremely tight bid-ask spreads against major forex pairs across hundreds of global exchanges—an edge hard to replicate. Yet increasingly, service providers are offering conversions between stablecoins and local fiat at “wholesale FX rates” (interbank rates), both on and off exchanges—as long as the stablecoin is credible, they don’t care which one is used. The GENIUS Act plays a key role in standardizing compliance, and infrastructure maturation benefits the entire industry—except the current incumbents (Tether and Circle).

A confluence of factors is gradually dismantling the Tether-Circle duopoly: easier cross-chain swaps, nearly free on-chain stablecoin exchanges, clearinghouses enabling cross-stablecoin and cross-chain settlements, and the GENIUS Act promoting homogenization of U.S. stablecoins—all reduce the risk for infrastructure providers to hold non-dominant stablecoins, pushing stablecoins toward fungibility—a development that helps everyone except the current giants.

Today, the proliferation of white-label issuers has lowered entry barriers; positive Treasury yields incentivize intermediaries to internalize float income, crowding out Tether and Circle; fintech wallets and neobanks lead the charge, followed by exchanges and DeFi protocols—each intermediary eyeing user deposits as a potential revenue stream.

Although the GENIUS Act restricts direct yield offerings by stablecoins, it doesn’t fully eliminate indirect yield pathways, leaving room for new entrants. If this “yield loophole” persists, a “race-to-the-bottom” on yield sharing is inevitable, and if Tether and Circle respond slowly, their dominance may erode.

Moreover, we must not overlook the “off-field giants”—financial institutions with multi-trillion-dollar balance sheets. They are closely watching whether stablecoins trigger deposit outflows and how to respond. Regulatory changes and the GENIUS Act have opened the door for banks to enter. Once they do, today’s ~$300 billion stablecoin market cap will seem trivial. The stablecoin industry is only ten years old—the real competition has just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News