Ethereum 2.0 is not the end — a look at several EIP proposals worth watching in the future

TechFlow Selected TechFlow Selected

Ethereum 2.0 is not the end — a look at several EIP proposals worth watching in the future

Although it has long been criticized for its slow pace of technological iteration, Ethereum undeniably possesses the largest developer community in the entire industry.

Author: Ans, Krypital Group

Editor: Krypital Group

This article is for informational and educational purposes only and does not constitute any investment advice.

What Is an EIP?

Short for Ethereum Improvement Proposals, EIPs are the fundamental units of governance in the Ethereum community.

An EIP contains technical specifications for proposed improvements, as well as discussions and standards development for Ethereum network upgrades and application protocols. These include networking proposals, interface proposals, and ERC (Ethereum Request for Comments) proposals—the last being the most widely recognized. ERCs define development standards and protocols on Ethereum, such as the commonly used ERC-20, ERC-721, and ERC-1155.

Anyone in the Ethereum community can create an EIP to suggest potential new features or processes. An EIP should clearly outline the technical details and rationale behind the proposed functionality. Ultimately, the core Ethereum development team decides whether to adopt it as a standard or include it in a network upgrade—such as the "Shanghai Upgrade" or "London Upgrade."

1. EIP-2612: Off-Chain Signature Authorization

Before diving into this EIP, consider this scenario: If a new wallet holds only USDC but no ETH for gas fees, can it still interact with smart contracts to perform actions like payments?

The answer is yes—and that’s possible because USDC implements EIP-2612, making it an ERC-2612 token.

EIP-2612 adds a new function called "permit" to the ERC-20 standard, which performs the same role as the "approve" function but takes a signature as input instead of requiring an on-chain transaction.

In other words, the user's signature within an ERC-2612 transaction already includes approval information. Once verified by the contract, the contract can execute a transferFrom operation. Moreover, service providers can pay the gas fees on behalf of users and deduct the cost directly from the transferred tokens (for example, USDC contracts may charge USDC as the gas fee).

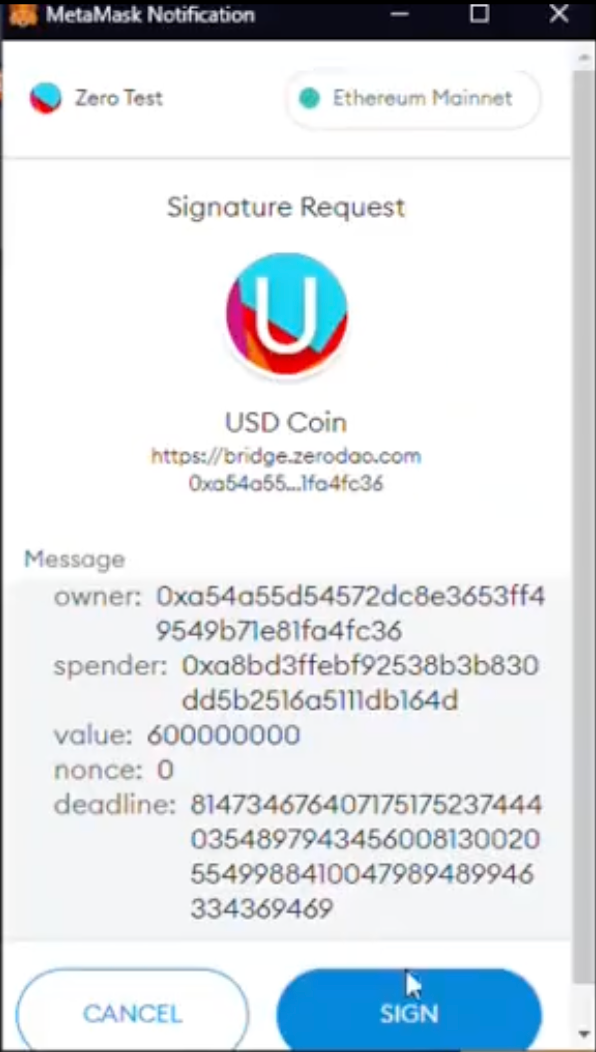

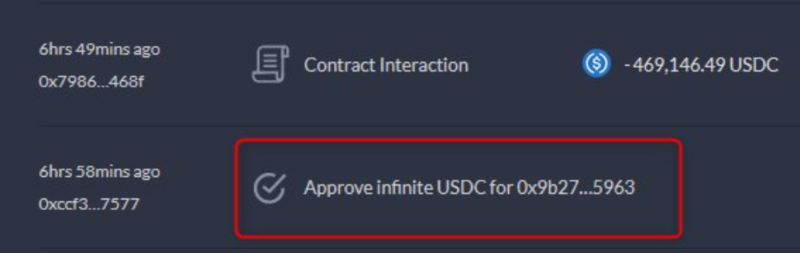

A user signed a malicious contract, resulting in the theft of 469,146 USDC

However, as this mechanism shows, while convenient, it also carries risks of abuse—an issue that wallets may need to address through improved warning systems.

Therefore, users must carefully review the content of any signature request, even if no explicit "approve" action is mentioned—assets like USDC based on ERC-2612 can still be compromised.

2. EIP-3074

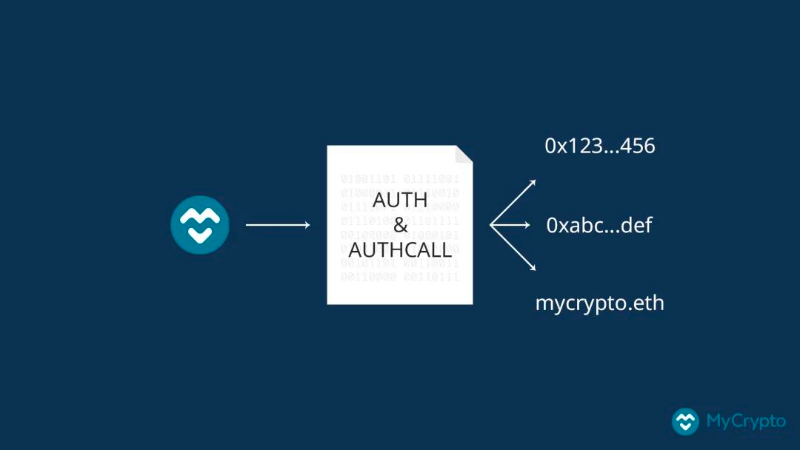

EIP-3074 is considered the most anticipated EIP since EIP-1559. It introduces two new EVM opcodes: AUTH and AUTHCALL. These allow externally owned accounts (EOAs)—standard Ethereum addresses—to delegate control of their accounts to a smart contract caller, enabling users to perform multiple operations in a single transaction, such as approve, transfer, and revoke approvals.

Recall the current experience on Ethereum: when swapping tokens, you first need ETH in your wallet to cover gas. Then, you submit an approve transaction followed by a transferFrom transaction to send tokens to the contract.

As previously noted, the approve step adds unnecessary gas costs, creates friction in user experience, and poses security risks—ERC-20 approval vulnerabilities have frequently led to exploits in recent years.

Due to its significant impact on Ethereum’s interaction model, EIP-3074 is still under review and has not yet been activated on mainnet. If successfully implemented, Ethereum could support batch transactions—executing multiple actions in one call to reduce fees. For example, approve and transferFrom could be combined into a single transaction. Additionally, EIP-3074 enables sponsored transactions: if an account lacks ETH, another account can pay the gas fee on its behalf.

3. EIP-4626: Tokenized Vault Standard

Proposed by Joey Santoro, founder of Fei Protocol, and Jet Jadeja, developer at Rari Capital, EIP-4626 introduces the ERC-4626 standard.

Significance of the ERC-4626 Standard

Yield-bearing tokens are assets that accrue interest over time, such as stETH, xSUSHI, or cUSDC from Compound. These tokens represent claims on underlying native tokens locked in vaults.

Many DeFi protocols now use yield-bearing tokens as incentives—for example, yield aggregators (Yearn, Rari, Idle), lending platforms (Compound, Aave, Fuse), and staking reward tokens (xSUSHI).

ERC-4626 aims to standardize key functions of DeFi yield vaults—including deposit, withdrawal, minting, and balance tracking—to improve composability, accessibility, and integration security. This turns vaults into standardized building blocks within the DeFi ecosystem.

Joey Santoro stated: “You can already see there are many use cases for yield tokens. The lack of standardization across DeFi vaults leads to fragmented implementations.” “Each protocol builds custom adapters, which are error-prone and waste developer resources. This is a systemic problem across the entire DeFi industry.”

Without a unified standard for yield-bearing tokens, interoperability between DeFi protocols becomes increasingly complex—raising both integration barriers for developers and security risks.

For instance, the Rari Capital ETH pool was exploited due to a vulnerability in its integration with Alpha Finance, resulting in the loss of xx ETH. The root cause was Rari’s integration with Alpha’s ibETH yield token. Rari’s developers failed to recognize that the ibETH.work function made external calls, allowing attackers to manipulate return values. With a standardized interface, developers would better understand each yield token’s mechanics and significantly reduce such risks.

Scoopy Trooples, co-founder of Alchemix, commented on ERC-4626: “I want this so badly.” “The biggest pain point in Alchemix v2 is having to audit a custom solution for every new yield token integration. If they were standardized, integration and interaction would become much easier.”

Joey Santoro added: “A tokenized vault standard will unlock explosive composability in DeFi, delivering better experiences for both developers and users.” “Though this proposal might seem like a small change, it could profoundly impact DeFi’s usability, liquidity, and utility—just as ERC-721 laid the foundation for the NFT boom.”

4. EIP-4907 (NFT Lending Protocol)

In recent years, scholarship programs run by play-to-earn guilds have greatly advanced GameFi and highlighted the importance of rental functionality. ERC-4907 allows defining two distinct roles for NFTs: “owner” and “user.” It introduces an expires function, automatically revoking the “user” role after a set duration. By separating ownership from usage rights, ERC-4907 establishes a unified standard for NFT rentals in Web3 gaming and metaverse applications, enhancing financial utility and unlocking greater liquidity.

Rental capabilities lower entry barriers, creating win-win scenarios between high-net-worth players and casual earners. ERC-4907 significantly reduces the integration cost of NFT leasing. Given GameFi’s continued significance in the blockchain space, widespread adoption of such standards makes it increasingly likely that major NFT marketplaces will soon offer built-in rental features.

5. EIP-4361 (Sign-In with Ethereum)

EIP-4361 was jointly developed by the Ethereum Foundation, Ethereum Name Service (ENS), and digital identity firm Spruce.

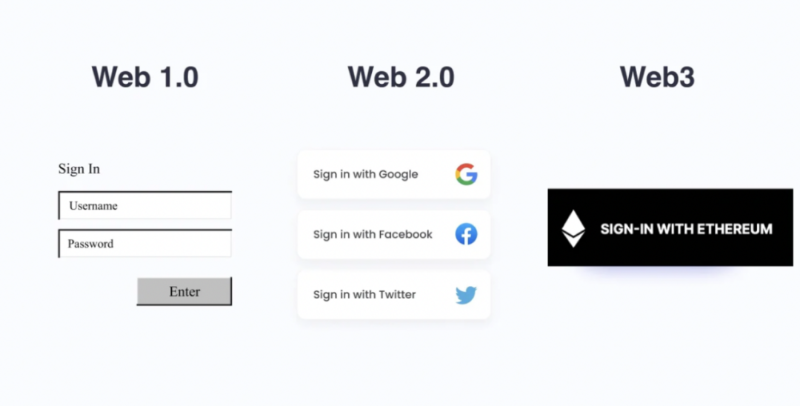

In Web2, logging into services typically requires entering a username/email and password—data stored in centralized databases. Centralized data ownership raises concerns about privacy breaches, misuse, cumbersome processes, and isolated account silos. Some platforms may even suspend accounts, risking user asset loss.

EIP-4361 aims to transform how we log into Web2 services by adopting methods common in Web3—using Ethereum wallets and dApps. Instead of usernames and passwords, users authenticate via signatures from their Ethereum accounts.

This model is essentially a decentralized, always-on, user-owned “Gravatar.” Data is no longer held by private entities but published on the Ethereum blockchain for universal access. Users maintain a single identity across multiple apps, all authenticated through their signed wallet interactions.

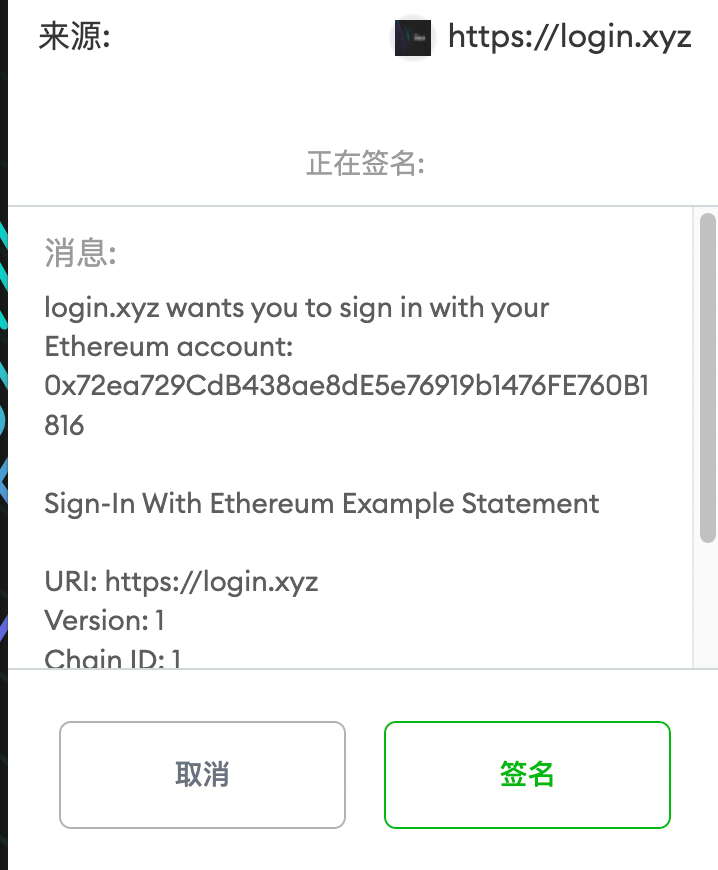

Signing an authentication message

Signing an authentication message

ENS

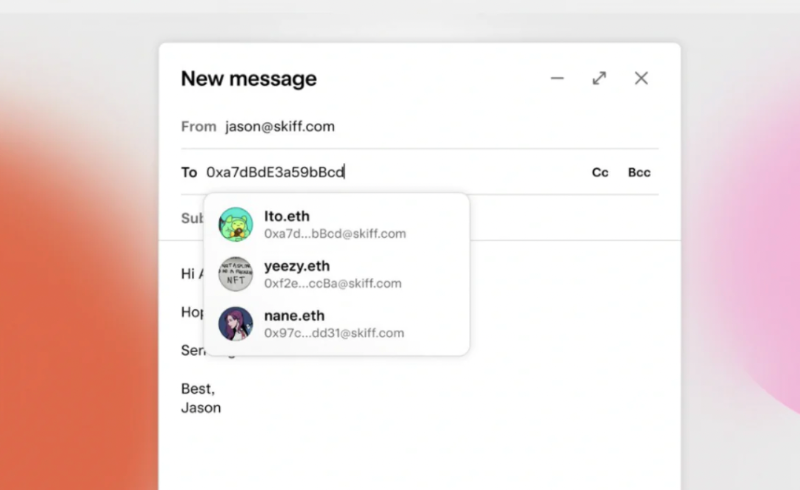

ENS is a decentralized domain name project incubated by the Ethereum Foundation and a key component of EIP-4361. It allows users to replace long Ethereum public addresses with simplified, human-readable names, making addresses easier to share, use, and remember.

Additionally, ENS lets users link their email, Twitter, NFT avatars, and other data to their domain, which third-party platforms can read and display—effectively creating an identity layer for the Web3 world.

At http://login.xyz, you can track the adoption progress of this EIP. With Vitalik’s support, most Ethereum applications now support ENS domains.

6. EIP-3525: Semi-Fungible Tokens (SFTs)

Proposed by Solv Protocol, EIP-3525 has not yet been officially adopted as a new token standard (ERC-3525). It introduces the concept of "SFT"—Semi-Fungible Token—a novel token type positioned alongside FTs and NFTs as a third universal category of digital assets.

As the name suggests, SFTs sit between fungible and non-fungible tokens—capable of both unique identification and divisible computation. They enable grouping of similar but non-identical tokens as “same class,” allowing special operations like transfers between them. Functionally, this enables merging, splitting, and fractionalization among tokens of the same class.

SFTs are ideal for representing digital items with quantitative attributes that may require merging or splitting.

-

For example, advanced virtual items, equipment, or virtual land in Web3 or the metaverse. Representing these as NFTs makes merging or subdividing difficult, whereas SFTs handle such operations effortlessly.

-

Similarly, upgradable or combinable in-game gear benefits greatly from SFTs’ computational and composable properties, simplifying development and boosting trading liquidity for virtual goods.

Using ERC-3525 to build membership cards, gift vouchers, or lottery tickets unlocks unprecedented functionality and enhances user experience in Web3 applications.

Furthermore, ERC-3525 can extend to advanced digital financial instruments such as financial notes, land deeds, bonds, options, and any standardized asset with intrinsic quantity. For example, two identical 500-yuan bonds are equivalent to one 1,000-yuan bond of the same terms.

Conclusion

While Ethereum has long faced criticism for slow technical iteration, it undeniably hosts the largest developer community in the industry, with countless contributors expanding Ethereum’s technological frontier and ecosystem scale.

This ensures Ethereum’s capacity for continuous, sustainable upgrades—and this advantage is expected to persist in the foreseeable future.

Beyond the EIPs discussed here, numerous other core proposals are under active development; space constraints prevent listing them all.

One thing is certain: driven by ongoing EIP upgrades, Ethereum 2.0 is not the end—its future holds far more possibilities.

References:

https://blog.mycrypto.com/sign-in-with-ethereum-an-alternative-to-centralized-identity-providers/

https://ethereum.org/zh/eips/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News