A Quick Overview of Fantom's Current Status and Ecosystem Development During the Bear Market

TechFlow Selected TechFlow Selected

A Quick Overview of Fantom's Current Status and Ecosystem Development During the Bear Market

What Fantom built during the bear market and future opportunities for the $FTM ecosystem.

Written by: Route 2 FI

Translated by: TechFlow

Since its surge in 2021, the Fantom Opera network and the ecosystem built on top of it have undergone significant changes. Let’s take a look at what they’ve built during the bear market, the current narrative, and all the opportunities ahead for the $FTM ecosystem.

Some quick $FTM statistics as of February 16, 2023:

- Price: $0.56

- Market Cap: $1.5 billion

- All-Time High (ATH): $3.46 (-83%)

- All-Time Low (ATL): $0.0019 (+29,500%)

Fantom attracted many DeFi speculators in 2021 due to its simplicity, low cost, speed, and stability. It remains one of my favorite chains.

In 2022, Fantom welcomed a new researcher: Professor Bernhard Scholz. He has been studying smart contract execution, security, and performance, seeking ways to improve network speed and scalability.

Another familiar face also made a public return to the Fantom Foundation team (though he may never have left behind the scenes): Andre Cronje.

The ecosystem hasn't stood still either. The Fantom Ecosystem Treasury has launched, aiming to fund projects building innovative dApps on Fantom.

At this year's Quantum Miami conference, the Fantom Foundation had some major announcements: FVM.

The Fantom Virtual Machine is the Foundation’s upgrade to Ethereum’s EVM.

They unveiled FVM in February. Based on test results, they estimate throughput of 4,500 transactions per second, with block finality time around 1 second.

Another interesting feature introduced by Andre Cronje is “Gas Subsidy,” which will launch in Q2/Q3 this year. It allows users to join and use DeFi protocols without needing $FTM tokens in their wallet for gas fees.

This is a step in the right direction, as it will make it easier for beginners to try out DeFi.

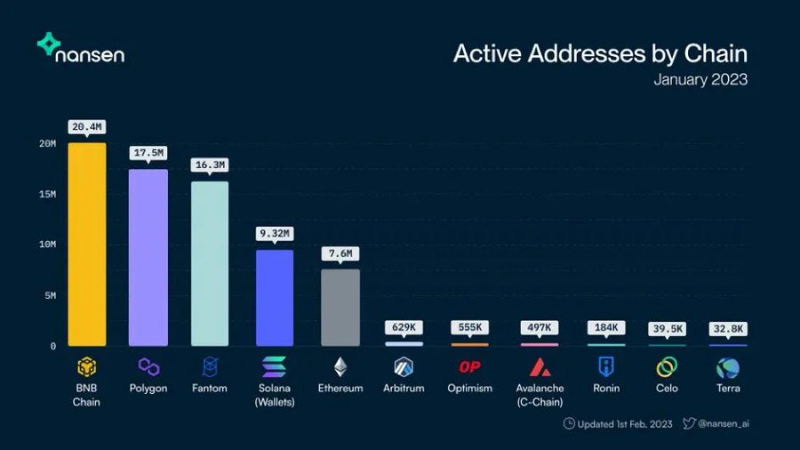

According to Nansen, Fantom ranks among the top chains in terms of active addresses. I believe this number will increase if DeFi picks up again.

But what truly reignited excitement around Fantom was the news shared by Andre Cronje last November.

To summarize: "November 2022 – over $450,000,000 in FTM, >$100,000,000 in stablecoins, >$100,000,000 in crypto assets, and $50,000,000 in non-crypto assets. Salary burn rate is $7,000,000/year. We have approximately 30 years remaining (without touching FTM)."

In other words: Fantom has positive cash flow and can operate for another 30 years without selling any of its $FTM tokens.

This news came at just the right time. At that moment, $FTM was priced at $0.18, but surged nearly 40% in the following days.

Now that we've covered the technical aspects, it's time to dive into on-chain projects and how things are evolving.

Fantom DeFi:

These statistics from DeFiLlama show total TVL across all chains, which might look discouraging—but remember, we’re in a bear market, and most tokens are down significantly (75–95% from ATH).

$FTM currently has a TVL of $535 million (down from an ATH of $7.5 billion), competing with Ethereum, Polygon, Avalanche, Arbitrum, Binance Smart Chain, and others.

SpookySwap remains the most prominent DEX in the $FTM space. Many users trade here or utilize its new cross-chain swap feature integrated with Axelar, enabling direct swaps from BNB on Binance Chain to Fantom.

It allows you to connect to a new chain without worrying about gas fees.

Do you remember Solidly? It was heavily hyped and brought substantial liquidity to Fantom—but ultimately failed.

With minor code adjustments, it became a massively forked protocol across other chains. Eventually, a new contender emerged on Fantom—Equalizer. So far, it has driven an impressive trading volume.

Beethoven X—still strong (second-largest DEX after Spooky)—but amid the hype around Solidly forks and Equalizer’s cross-chain capabilities, it hasn’t received the same level of attention it enjoyed in 2021 and 2022.

Following the success of perpetual DEX GMX, it was only a matter of time before a perpetual DEX appeared on $FTM.

$MMY—the first perpetual DEX on $FTM—has grown rapidly since launch, exceeding initial expectations.

Morphex ($MPX)—a newly launched project that has drawn high interest due to its developer (Morpheus), who is well-regarded within the Fantom community.

They are preparing to roll out several new features and plan to launch their platform by late February.

Beyond that, we have OG protocols like Tarot Finance and Liquid Driver preparing for cross-chain expansion, offering potentially high rewards through Thena.

Given the current bear market environment, I won’t offer any yield farming suggestions, but you can find them via Nanoly.

Personally, the DeFi protocols I’m most interested in right now are: $EQUAL, $MMY, and $MPX.

In summary, here’s why I’m bullish on $FTM:

- Andre Cronje is back

- Stable cash flow

- FVM

- Gas subsidies

- Easier onboarding into DeFi

- FTM Ecosystem Treasury

- Known as one of the most degen-friendly chains for DeFi speculation

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News