After AC's return, can Fantom reclaim its former DeFi glory?

TechFlow Selected TechFlow Selected

After AC's return, can Fantom reclaim its former DeFi glory?

Does $FTM still have upside potential in the next bull market?

Written by: Jake Pahor

Compiled by: TechFlow

Fantom Ecosystem Overview as of December 23, 2022:

• $FTM

• Price = $0.20

• Market Cap = $520 million – Rank #65

• PoS

• All-Time High = $3.46 (-94%)

• All-Time Low = $0.002 (+10,661%)

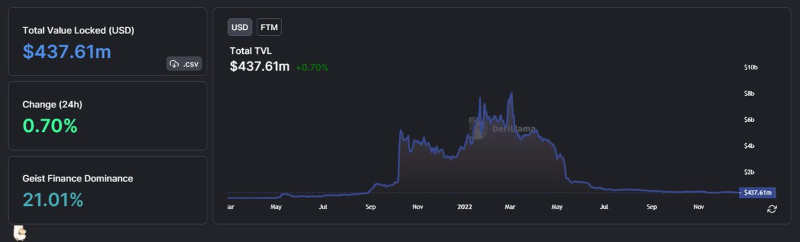

Fantom was one of the stars of DeFi Summer in 2021. It captured the attention of many DeFi degens and eventually reached a peak Total Value Locked (TVL) of $8 billion in March 2022.

Thanks to its low fees and high performance, a thriving ecosystem emerged with innovative projects and strong community development.

However, a series of unfortunate events led to its downfall during 2022 (down 95%):

-

AC's exit

-

Daniele’s controversial past resurfaced

-

Solidly’s complete failure

-

Bear market sentiment

Yet, these bearish factors are unrelated to the project itself or its underlying technology. Most were macro-driven.

Recently, with AC officially announcing his return, Fantom has gained some bullish momentum:

-

Operational runway of 30 years

-

FVM (Fantom Virtual Machine)

-

DApp Gas Monetization Program

So, does $FTM still have upside potential in the next bull market?

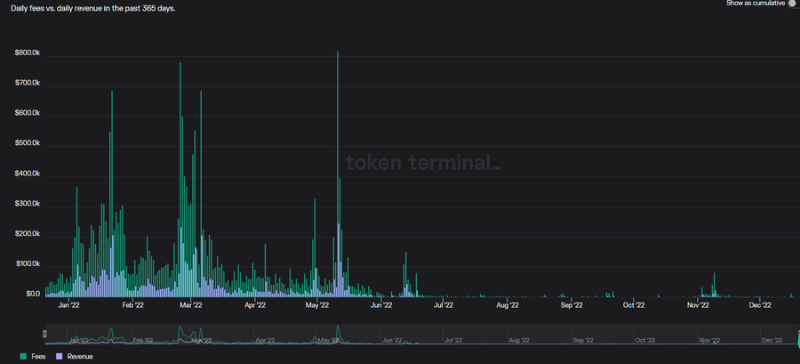

1. Revenue

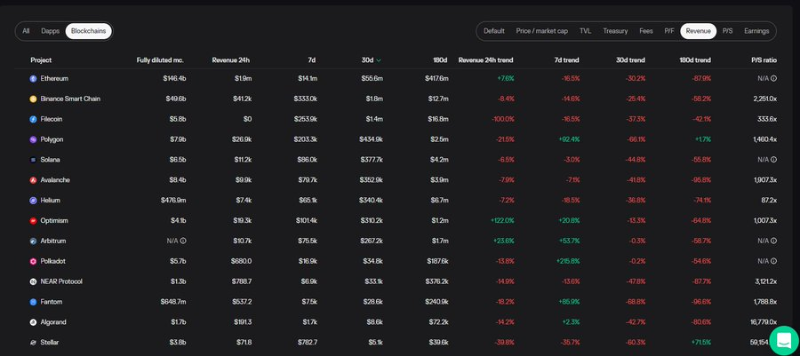

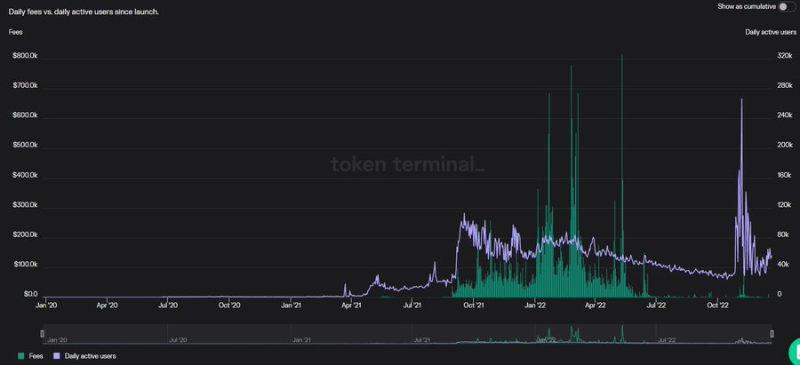

Since early 2022, Fantom’s revenue and fees have been on a downward trend. However, they now appear to be stabilizing, with FTM ranking 12th in 30-day blockchain revenue.

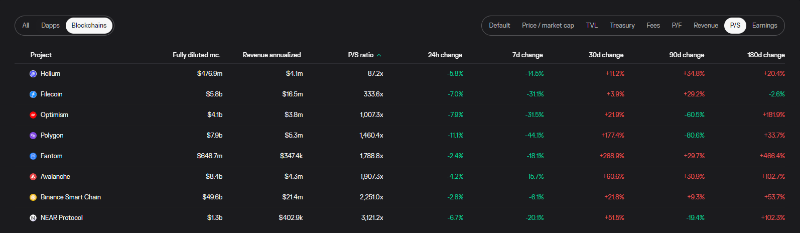

Looking at the P/S ratio (fully diluted market cap / annualized revenue), Fantom is the fifth most undervalued blockchain.

Lower P/S ratios are better.

2. Treasury

On November 28, AC published a Medium post detailing Fantom’s financial history. Here’s the TL;DR:

-

Over 450 million FTM = $90 million

-

Over $100 million in stablecoins

-

Over $100 million in crypto assets

-

$50 million in non-crypto assets

-

Total assets = $340 million

At the current burn rate of $7 million per year in salaries, the project can operate stably for 30 years without touching the FTM holdings. This is quite impressive.

3. Tokenomics

According to data from Coingecko:

-

Circulating supply = 2.54 billion

-

Total supply = 3.175 billion

-

Market cap = $520 million

-

FDV = $650 million

-

Market Cap / FDV = 0.8

The Fantom Foundation recently proposed reducing the gas burn rate from 20% to 5%.

The remaining 15% will be redirected to dApps built on Fantom. This is known as the "dApp Gas Monetization Program" and should attract more developers to the chain.

4. Locked Supply

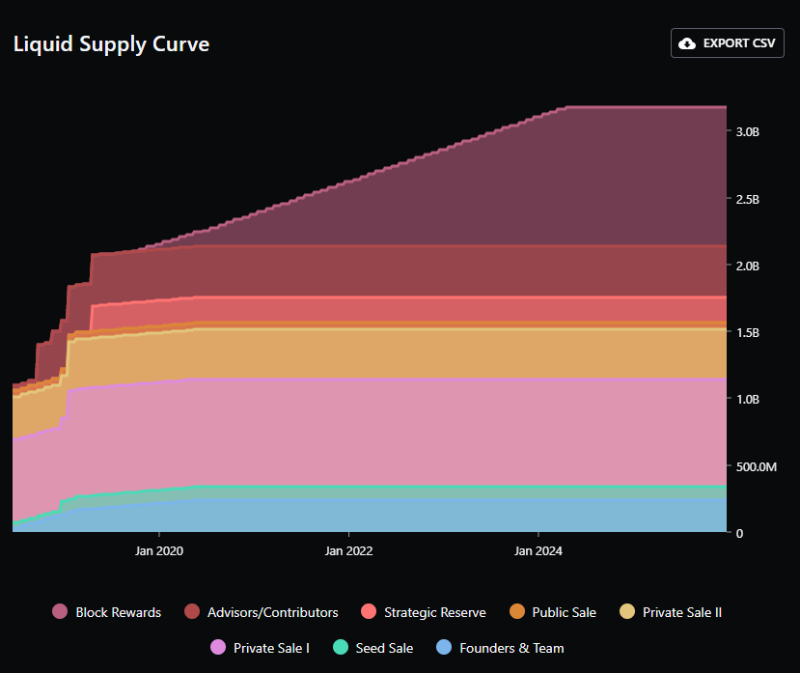

Current circulating supply is 2.54 billion. The total FTM supply cap is 3.175 billion, meaning approximately 80% of tokens are already in circulation.

Tokens allocated to early investors have all been unlocked—reducing the risk of institutional dumping.

The remaining tokens are rewards for validators and delegators who create blocks. These will continue to be distributed until April 2024, when all staking rewards will cease.

Staking FTM helps secure the network, and currently offers an APR between 1.8% and 6%, depending on the lock-up duration.

5. Use Cases

Fantom is a novel Layer 1 project designed for scalability and low-cost transactions. Its native token $FTM is used to:

- Pay for transactions;

- Execute smart contracts;

- Secure the network via PoS;

- Governance voting;

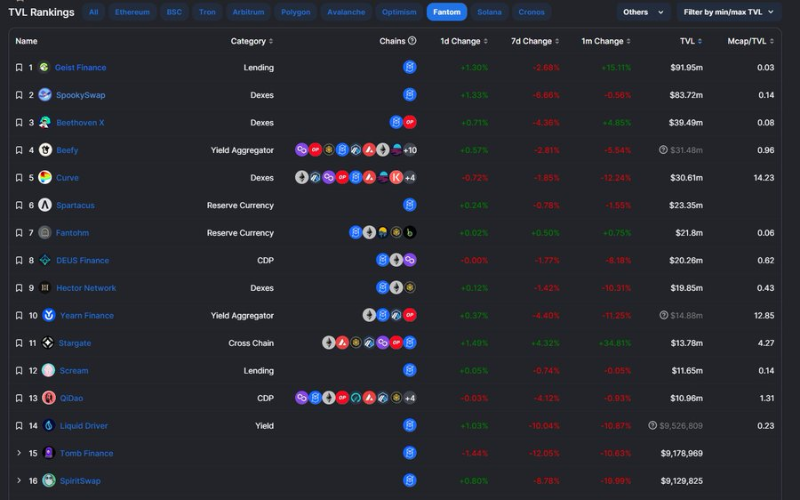

There is also a thriving DeFi ecosystem built on Fantom, including DEXs, yield aggregators, and lending protocols.

Many innovative projects are being built on Fantom—a positive sign—including SpookySwap, Beethoven x, Beefy, Yearn Finance, Qi Dao, and others.

While the TVL chart may not look great, I expect a rebound once macro conditions improve.

Among major blockchains, Fantom ranks 7th in daily active users, averaging around 55,000.

As you can see below, although the fee/revenue ratio has declined significantly since its ATH, daily active users have actually been trending upward since October.

6. Roadmap

The main focus for 2023 appears to be the development and implementation of the Fantom Virtual Machine—FVM—as recently outlined by Simone Pomposi (CMO) during an AMA.

Gitcoin voting is also live now, running until January 2, 2023. You can vote for your favorite Fantom projects, helping them secure matching funds.

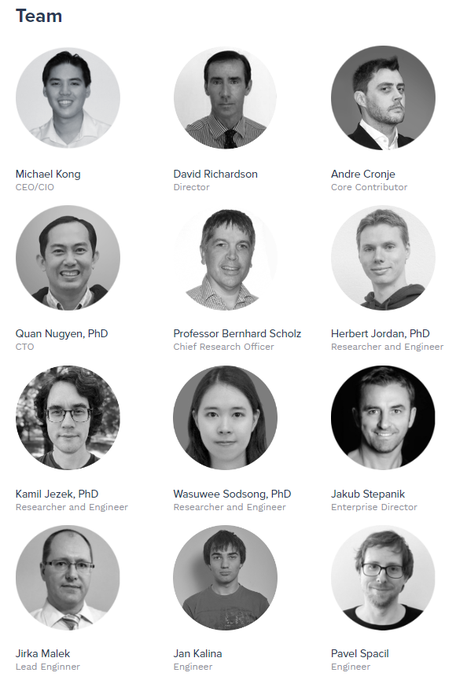

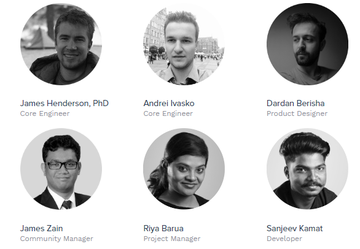

7. Team / Funding

There’s a perception that Fantom’s success hinges entirely on Andre.

However, FTM has demonstrated this year that it can continue building even in AC’s absence.

AC’s recent announcement of his return is a major boost for the team, as he is one of the leading developers in the space.

I believe the team is now strong enough that the “AC risk” is greatly reduced.

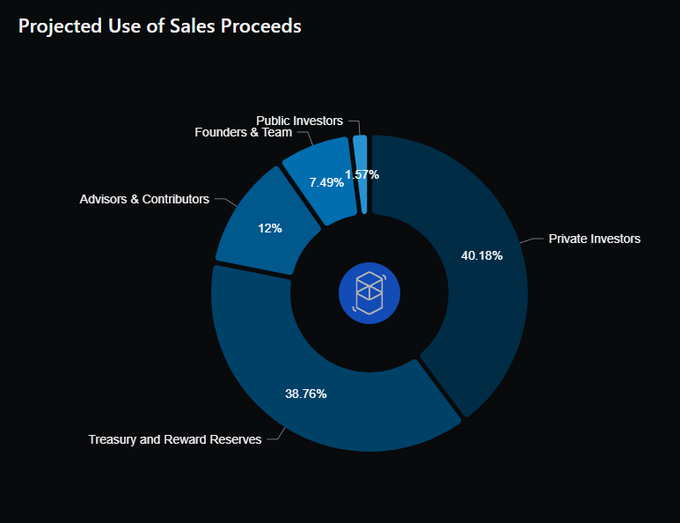

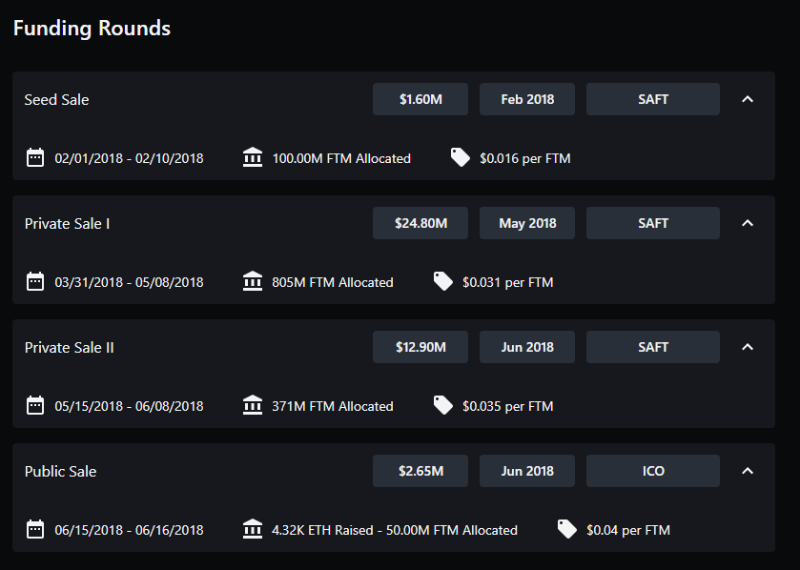

Four major funding rounds were completed in 2018. Investors include 8Decimal Capital, Alameda, Arrington XRP, Block Tower, Obsidian Capital, and others.

Fantom has also established a diverse set of partnerships with numerous companies and governments.

8. Summary

Overall, I’m impressed by how the Fantom team continued building throughout this bear market and navigated countless controversies in 2022.

Now that AC is back, the treasury is healthy, and there are exciting developments ahead in 2023. My only concern is that competition in the Layer 1 space is fierce, and Layer 2 scaling solutions (Optimism, Arbitrum) are rapidly capturing market share.

But FTM will definitely remain on my watchlist for 2023.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News