From Fantom to Sonic, ve(3,3) remains the core driver of flywheel growth

TechFlow Selected TechFlow Selected

From Fantom to Sonic, ve(3,3) remains the core driver of flywheel growth

Enter when no one else has noticed, exit when everyone knows.

Author: Foxi (DeFi / AI)

Translation: TechFlow

Someone has to do it!

I’ve created the ultimate Sonic guide for you all—especially those who are not yet familiar with the DeFi Flywheel.

@AndreCronjeTech has recently been promoting over 20 projects daily. I’ve handpicked some of the most promising ones to share with you.

I entered the world of crypto during the DeFi Summer boom in 2020, and now seeing AC and his chain make a comeback is incredibly exciting!

This article will dive deep into Sonic’s latest developments, just like previous guides. But before we begin, I’ll first outline the risks involved in participating in the DeFi Flywheel ecosystem for newcomers.

Important note: I am not responsible for any investment losses, but I hope this article helps you understand how the DeFi Flywheel works.

(If you're only interested in "CA", feel free to skip directly to Part IV.)

This article includes:

I. Flywheel = Ponzi? When to exit?

II. What is Sonic, and why choose Sonic?

III. The new Tokenomics

IV. Curated Ecosystem Opportunities (Recommended by Foxi)

I. Flywheel = Ponzi? When to exit?

A common phenomenon at the heart of many DeFi Flywheels is: a mismatch between when capital enters and when its real value is recognized by the market. This can be simply summarized as—"get in before others notice, exit when everyone knows."

Early liquidity injections typically generate momentum that attracts more users, creating a self-reinforcing growth cycle. In short, early participants benefit from compounding returns through liquidity accumulation and rising awareness of the system.

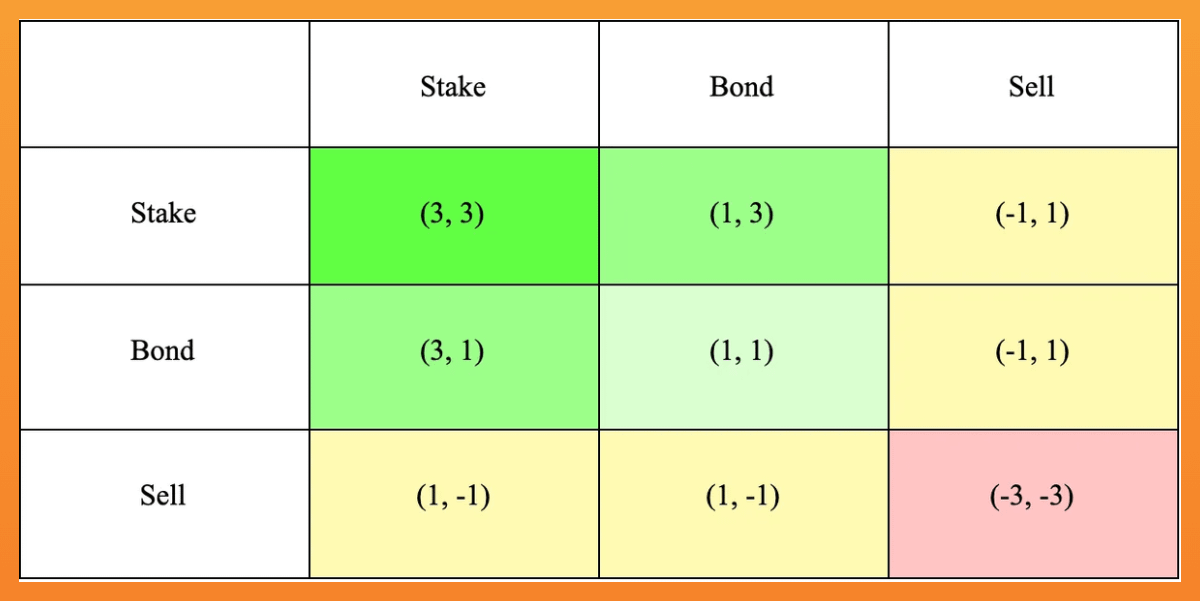

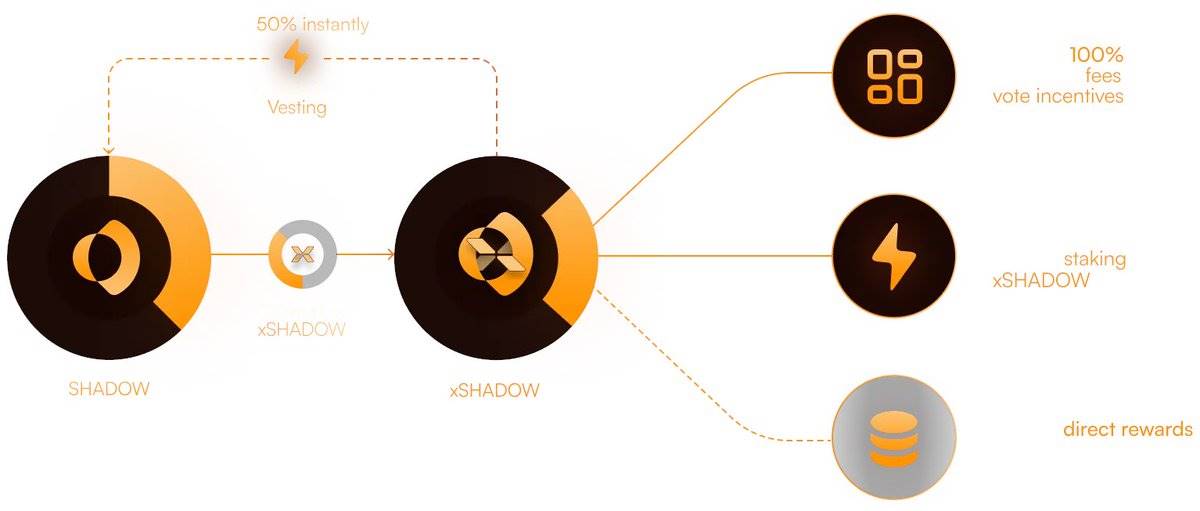

The classic ve(3,3) model was designed to incentivize everyone to "STAKE" tokens.

@AndreCronjeTech introduced the ve(3,3) tokenomics model via Solidly Exchange on the Fantom network in the last cycle.

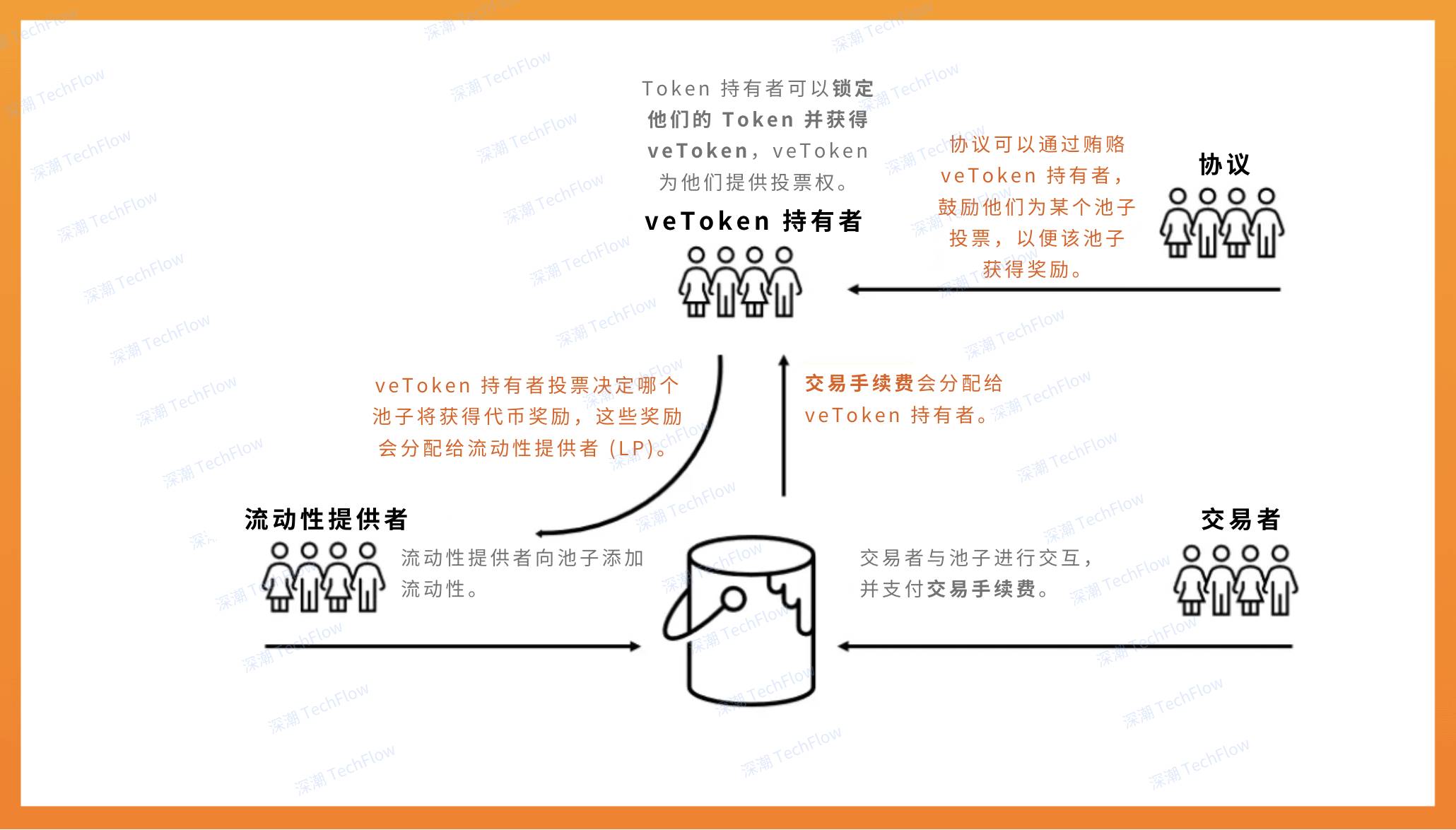

This model combines Curve Finance’s vote-escrow (ve) mechanism with Olympus DAO’s (3,3) game theory, aligning incentives for token holders and liquidity providers to reduce selling pressure and enhance system sustainability.

The core of the ve(3,3) model lies in rewarding locked-up users with trading fees, thus aligning internal incentives. It aims to solve the high inflation caused by liquidity mining by shifting focus toward value creation through trading fees rather than relying solely on passive token issuance.

As Fantom rebrands into Sonic, ve(3,3) (also known as DeFi Flywheel) remains the core philosophy behind Sonic’s DeFi ecosystem.

How ve(3,3) works. Original image by Foxi (DeFi / AI), translated by TechFlow

The Flywheel is one of the key engines driving DeFi booms. For example, Andre Cronje’s product @yearnfi is a classic case where the YFI token surged from $6 to over $30,000 in less than two months. However, like many other memecoins, such hype eventually fades. For most crypto projects (excluding Bitcoin), the most critical question always remains: when to enter, when to exit.

As a classic saying goes: "Get in before others notice, exit when everyone knows."

II. What is Sonic? Why choose Sonic?

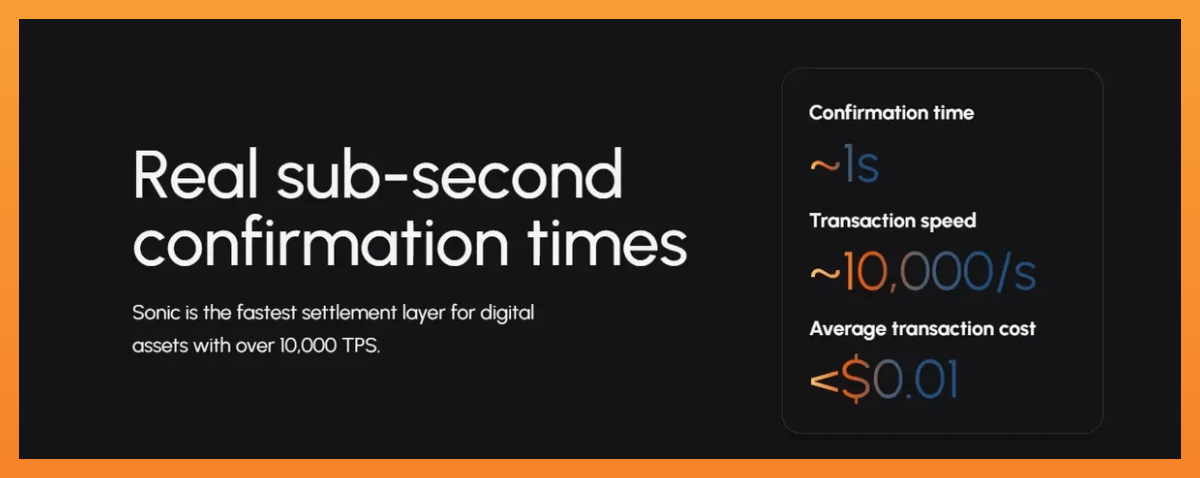

You may not have noticed, but Sonic's predecessor is Fantom. It is a high-performance Layer-1 blockchain capable of processing over 10,000 transactions per second with sub-second finality. Its native token $S is used for transaction fees, staking, and governance. Existing Fantom users can upgrade their $FTM to $S at a 1:1 ratio.

While there are already many low-latency Layer-1 solutions in the market, Sonic’s rise is driven by three core factors:

-

OG DeFi figure Andre Cronje has returned to personally lead the project.

-

Airdrop Program: To attract new users, Sonic plans to distribute 190.5 million $S (approximately 6% of total supply; details in Part III) through incentive campaigns.

-

DeFi Revival: Enthusiasm for memecoins is cooling down, and attention is shifting back to DeFi projects with fundamental value—a trend evident in the underperformance of $SOL.

Recent capital inflows also reflect growing market interest in Sonic:

-

The native token $S rose 113.5% within just 14 days.

-

Sonic’s Total Value Locked (TVL) grew 70% in 7 days—the best performance among chains of comparable size.

-

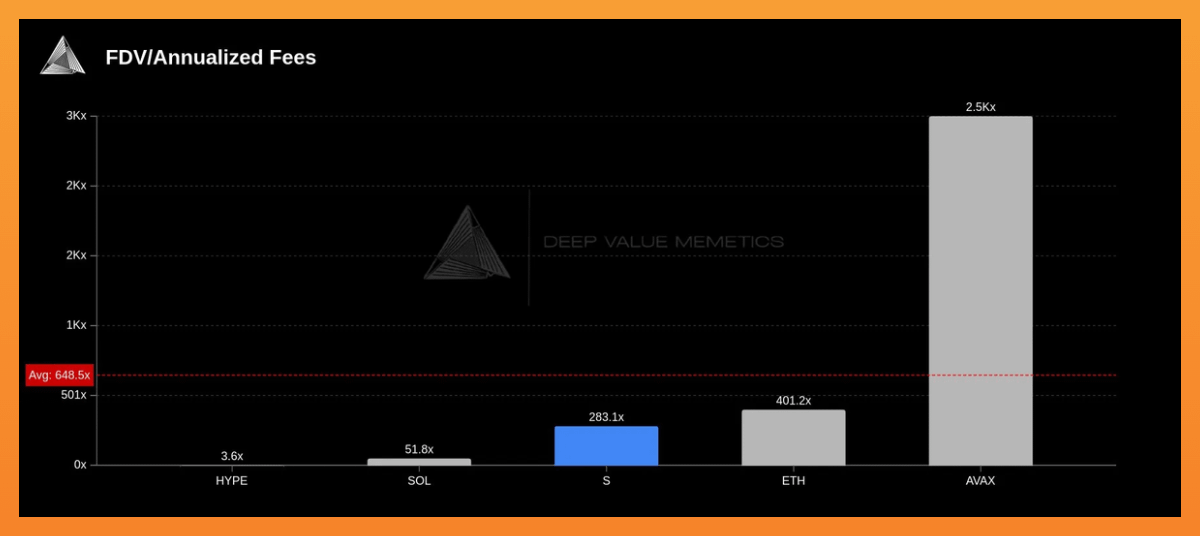

The FDV/Fee ratio stands at only 283x, 57% lower than similar projects, suggesting Sonic may be undervalued.

Source: @DV_Memetics

Sonic ranks #1 in 7-day TVL growth

III. The New Tokenomics (Key Information Worth Noting)

Supply and Inflation Mechanism

Fantom’s FTM had a total supply of approximately 3.175 billion (almost fully diluted). Sonic maintains the same initial supply, allowing existing FTM holders to exchange 1:1 for $S. However, $S is not a fixed-supply token—it employs a controlled inflation mechanism to support ongoing ecosystem growth.

About 6% of the total $S supply (around 190.5 million $S) has been minted for user and developer incentives and will be distributed via airdrops over roughly six months after launch. Therefore, no new tokens will be released (unlocked) before June 2025, which could present a favorable window for short-term trading.

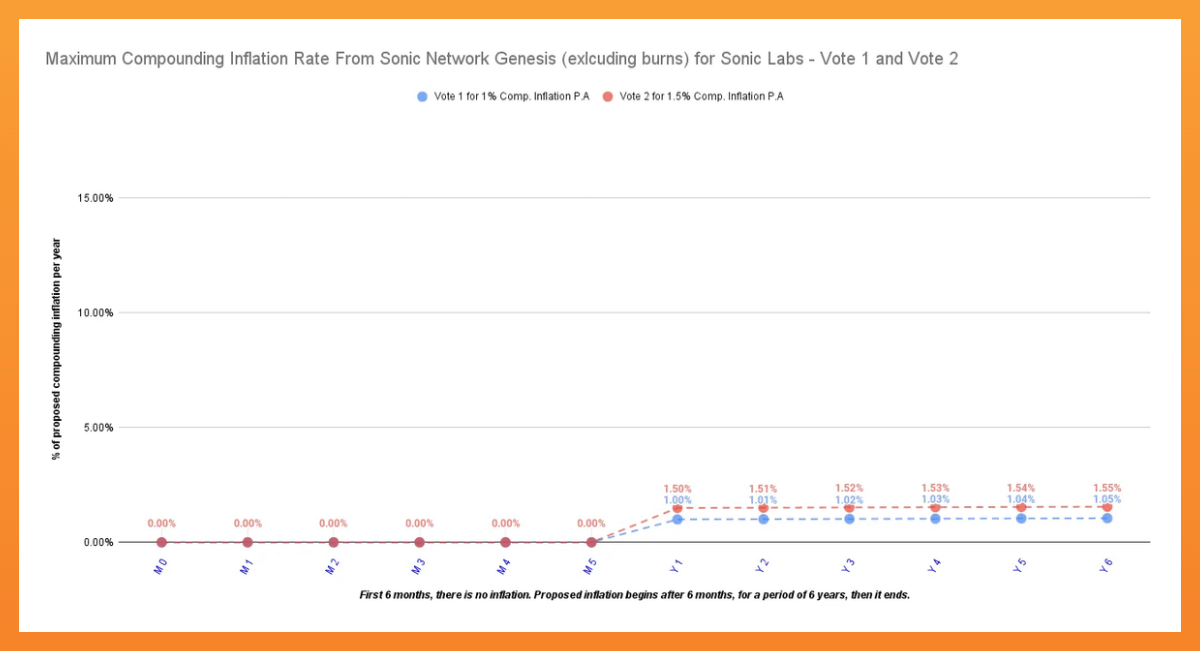

Inflation schedule

To support long-term ecosystem development, $S will inflate at 1.5% annually over the first 6 years (adding about 47.6 million $S in Year 1). If all these tokens are fully utilized, the total supply of $S could reach approximately 3.66 billion after 6 years. In contrast, FTM’s issuance is nearly complete, with no new allocation plans beyond remaining staking rewards. Sonic takes a different approach—moderate inflation to fuel growth, coupled with strict safeguards: any unused ecosystem fund tokens will be burned, mitigating the risk of excessive inflation.

Fee Burning and Deflationary Mechanisms

FTM’s economic model does not include large-scale fee burning. On Fantom’s Opera network, gas fees primarily go to validators (after 2022, 15% were allocated to developers), making FTM effectively inflationary (as issuance from staking rewards exceeds burns).

In contrast, Sonic’s $S introduces multiple deflationary mechanisms to balance new token emissions. For example, 50% of trading fees on Sonic are defaulted to be burned (for transactions not part of gas reward programs). If network usage is sufficiently high, $S could even become net-deflationary.

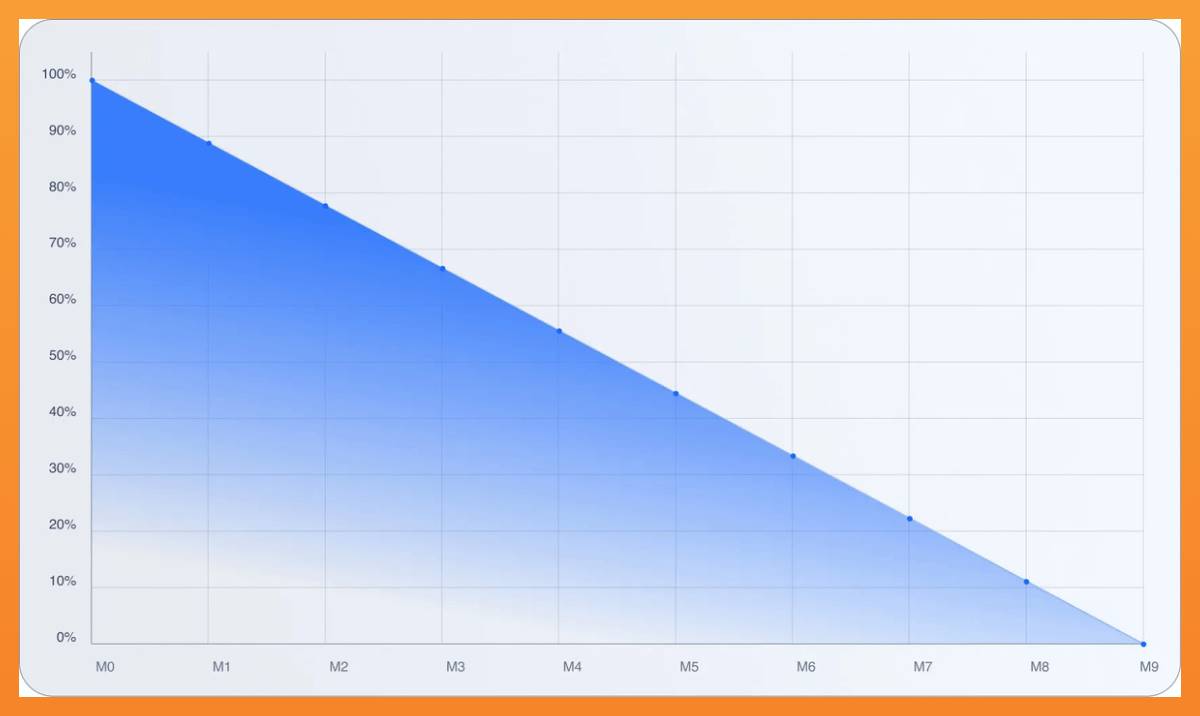

Additionally, Sonic’s airdrop design features a “claim-and-burn” mechanism: users can claim 25% of their airdropped tokens immediately, while the rest must be claimed gradually. Choosing faster unlocking requires forfeiting part of the tokens as a penalty, discouraging short-term dumping.

Burn mechanism in airdrop distribution

Finally, any unused portion of the annual 1.5% ecosystem fund will be burned. Combined with controlled token releases, these burn mechanisms aim to significantly reduce circulating supply pressure during the 6-year inflation period, helping $S transition toward deflation after the initial growth phase.

User Incentive Program! (Airdrop Benefits)

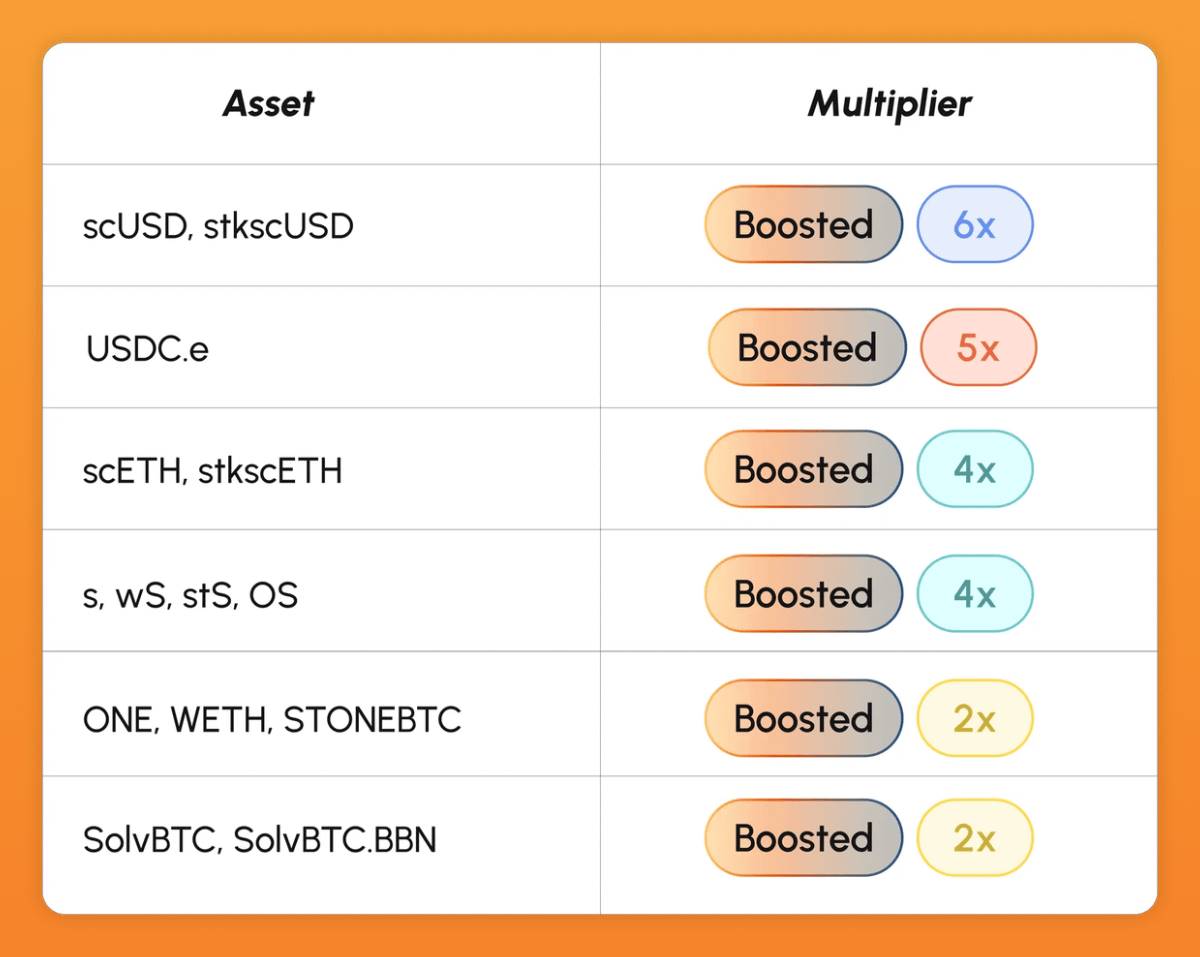

As mentioned earlier, Sonic will distribute 190.5 million $S as user rewards. You can participate in the airdrop through the following ways:

-

Hold whitelisted assets: Keep eligible assets in your wallet (note: do not hold them in centralized exchange wallets).

-

Participate in Sonic’s DeFi protocols: For example, stake $S, provide liquidity (LP) on DEXs, or engage in yield farming. Note that DeFi activity carries twice the points weight compared to simple asset holding, meaning active DeFi participants receive higher rewards. (For details visit: Sonic Labs platform)

Make sure your tokens are held in non-custodial wallets to avoid missing out on the airdrop!

IV. Ecosystem Opportunities

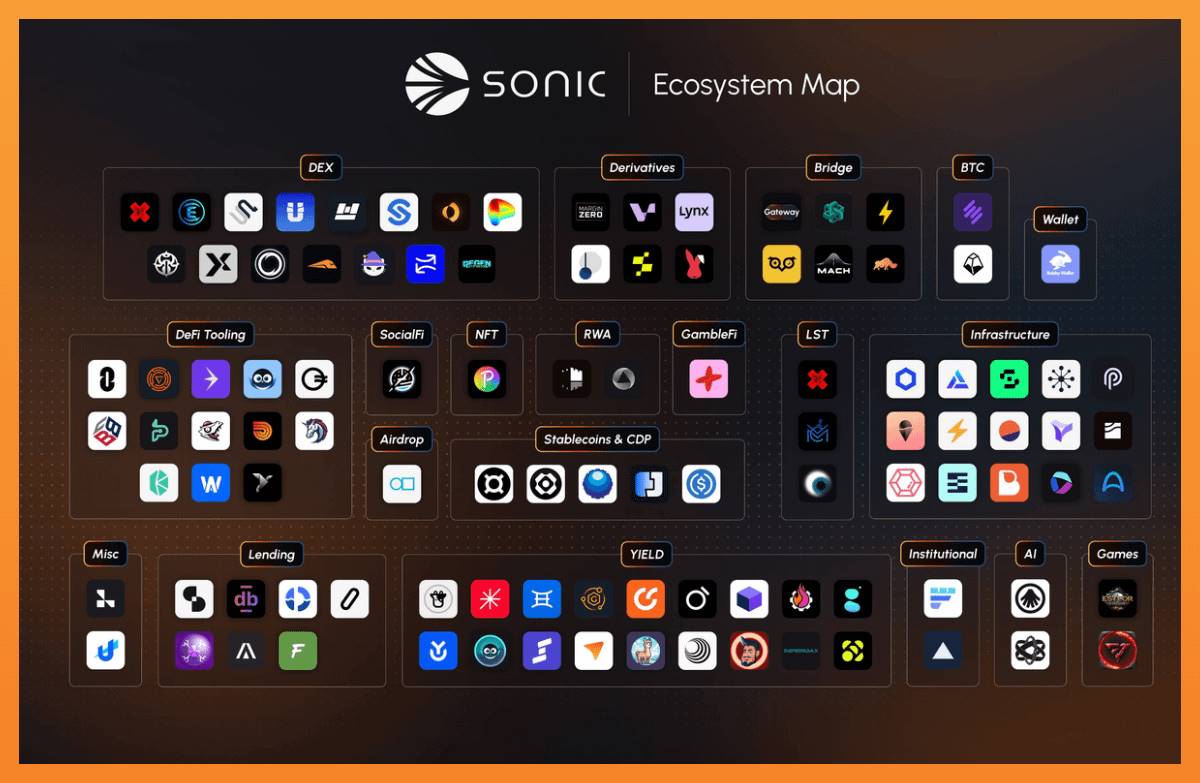

You can qualify for $S airdrops by holding eligible assets or engaging in Sonic’s ecosystem activities. As a brand-new ecosystem, many emerging projects on Sonic come with high founder risk—but they also offer potential for 10x or even 100x returns. Below are my carefully selected opportunities across four categories: decentralized exchanges (DEX), lending protocols, derivatives, and meme projects (all recommendations are unpaid and for personal reference only).

Note that while there are many projects on Sonic, most are not genuine "investment opportunities." Some aren't native to Sonic, while others have already been around for a while. Here are several standout projects worth special attention:

DEX

This is the main native DEX on Sonic, with current TVL exceeding $150 million and offering up to $13.73 million in weekly incentives. Its innovative x(3,3) token model offers greater flexibility: users can opt for immediate exit or phased unlocking to earn more rewards, without needing long-term lockups like ve(3,3). Additionally, the protocol uses a "PVP rebasing mechanism," imposing a 50% voting power penalty on users who exit early—reducing token dilution and encouraging long-term holding.

The key innovation lies in the "penalty" design: users can trade part of their earnings for early exit, achieving a balance between flexibility and stability.

MetropolisDEX is a decentralized exchange on Sonic using a Dynamic Liquidity Market Maker (DLMM) protocol, combining the strengths of AMMs with order book functionality. This design delivers more efficient trading experiences, particularly appealing to users familiar with Solana’s ecosystem and investors who previously participated in Meteora.

Vertex Protocol is a full-featured DEX offering spot trading, perpetual contracts, and money markets, with cross-margin support. Key advantages include ultra-low fees (0% maker, 0.02% taker), fast order execution, and cross-chain liquidity. Backed by an experienced team of DeFi veterans, it’s a trustworthy choice.

A native DEX on Sonic with outstanding performance—processing up to $1.2 billion in volume in under two months. Users earned over $3.6 million in fees through liquidity provision (LP) strategies. Leveraging Sonic’s speed and scalability, the protocol offers high-yield strategies and has the potential to become a strong competitor to Shadow.

Lending

A permissionless, risk-isolated lending protocol enabling rapid creation of new markets without additional integration. At its peak, it achieved a daily trading volume of $125 million, demonstrating strong market activity.

A smart contract-based lending platform supporting collateralized borrowing. The protocol includes features like trading fees and liquidation events, offering diverse lending options.

A modular lending protocol supporting permissionless borrowing operations, similar in function to Morpho on Ethereum—ideal for advanced users and developers.

A lending protocol focused on leveraged yield farming, also supporting undercollateralized loans, providing users with more flexible financial tools.

Derivatives

A meta-asset protocol focused on yield-bearing stablecoins. It provides deep liquidity to Sonic’s DeFi ecosystem and supports ecosystem projects through lock-up mechanisms.

An interest rate derivatives protocol allowing yield trading and fixed-rate functionality. It helps users hedge against yield volatility and offers extra interest rewards to liquidity providers.

A yield aggregator that simplifies yield farming operations and enables automatic portfolio rebalancing.

A volatility-focused trading platform, fully decentralized and oracle-free. Through an AMM model, it offers commission-free token trading and liquidity services—an innovative option.

A derivatives trading platform supporting perpetual contracts (Preps), focused on delivering efficient trading tools.

Meme

One of the most important NFT projects in the Sonic ecosystem, receiving significant community attention.

A native launchpad on Sonic, also launching its own NFT collection, offering users more diverse participation avenues.

A meme project based on the Sonic ecosystem with an active and loyal community—becoming a key part of the ecosystem’s culture.

Final Thoughts

Remember the phrase we mentioned at the beginning? "Get in before others notice, exit when everyone knows."

As more people discover and join Sonic’s growing ecosystem, its virtuous cycle becomes stronger and more sustainable. For every participant, this means deeper liquidity, firmer consensus, and more opportunities—moving beyond memecoin scams and short-term speculation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News