GCR: From Fantom to Sonic, Can Andre Cronje's Return Pave the Road to Redemption?

TechFlow Selected TechFlow Selected

GCR: From Fantom to Sonic, Can Andre Cronje's Return Pave the Road to Redemption?

This article will explore Sonic's core innovations, market response, and whether it will pave the way for Fantom's redemption.

Written by: GCR Research Team

Translation: Felix, PANews

Fantom was one of DeFi's major success stories in 2021, reaching a peak TVL of $8 billion. But when lead developer Andre Cronje departed and the bear market hit, Fantom lost its luster. Now Cronje is back, and Fantom has rebranded as Sonic. This isn't just a name change—it's a fresh start.

This article explores Sonic’s core innovations, market response, and whether it can kickstart Fantom’s redemption arc.

What Is Sonic

Sonic is more than just Fantom’s new name. According to Michael Kong, CEO of Sonic Labs, this is a complete reboot—a new chain built on entirely new technology, featuring a brand-new virtual machine that remains fully EVM-compatible. The team is rebuilding the blockchain from scratch because they couldn’t make the changes they wanted on the old chain. As Kong explained: “You can’t rebuild an airplane while it’s flying. It’s much easier to build a new plane on the ground and then take it into the air.”

The new chain will handle 10,000 transactions per second with sub-second finality—significantly faster than the L2 networks Sonic aims to compete with. While L2s are increasingly popular, locking up $34 billion, Sonic believes their models have fundamental flaws. According to Sonic Labs, these networks live off revenue from sequencer fees—money that should rightfully go to developers, the ones actually building useful applications. In their view, the value created by app developers isn’t being fairly compensated.

To solve this, Sonic puts developers first. Its key feature allows developers to earn up to 90% of the gas fees generated by their applications. Beyond that, Sonic gives developers true control over their apps. They can set custom fee structures and create smoother payment experiences for users. Everything on Sonic is built around this idea: equipping developers with the tools and incentives to build better applications. By supporting familiar languages like Solidity and Vyper, developers can focus on innovation instead of learning new tools.

Sonic is scheduled to launch in December 2024, entering the space of high-speed blockchains alongside Solana, Sui, and Aptos. While it doesn’t inherit Ethereum’s security like L2s do, it offers something unique—modern chain speed with the familiarity of Ethereum development tools. This positions Sonic intriguingly: it’s built for developers who need more performance than L2s offer but still want to stick with the Ethereum development environment. Currently, only Sei offers this combination, and Monad is attempting to achieve it. Therefore, aside from Ethereum L2s, these two chains may be Sonic’s primary competitors.

How Does the Technology Work?

Sonic Virtual Machine (SVM)

To eliminate bottlenecks caused by EVM’s scalability limitations, the Sonic Labs team built their own version of the EVM called the Sonic Virtual Machine (SVM). SVM is fully EVM-compatible but improves how code execution is handled. When someone’s code runs, SVM converts it within the client into a more efficient format. It identifies common patterns in the code and replaces them with optimized "super instructions." This makes everything run faster without changing how developers work. All standard tools still function, developers can continue using Solidity and Vyper, and the chain remains compatible with Geth 1.4.

Sonic Consensus Mechanism

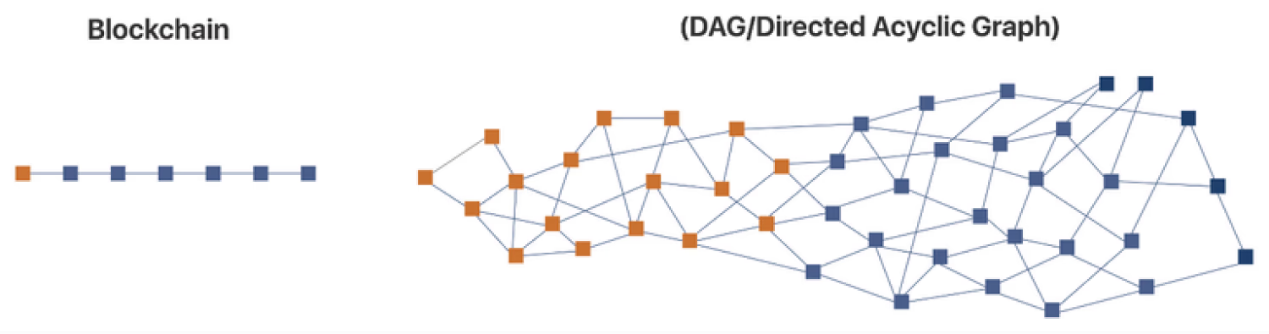

Sonic uses a Directed Acyclic Graph (DAG)-based consensus mechanism combined with Proof-of-Stake. Unlike single-chain systems where blocks must follow sequentially, each validator maintains their own local collection of transaction blocks (called a DAG). When transactions arrive, validators bundle them into “event blocks” and add them to their DAG.

Before creating a new event block, validators check two things: all transactions in the current block and some transactions received from other validators. Then, they share these blocks with other validators through a process that doesn’t require strict sequential ordering.

Source: https://docs.soniclabs.com/technology/consensus

Unlike traditional blockchains, this DAG-based approach doesn’t force validators to process only the latest block being produced, which limits throughput and finality. Validators can freely create event blocks containing transactions and asynchronously share them across the network, forming a non-linear transaction history. This greatly enhances transaction speed and efficiency.

When a validator creates an event block, it propagates across the network to other validators. Once a majority agrees on a block, it becomes a so-called “root event block.” These root blocks are then added to the main chain—the final, permanent record of all agreed-upon transactions.

The entire process—from initiation to completion—takes less than one second. Transactions go through four steps: first, the user sends the transaction; then, a validator places it into an event block; next, the block propagates until accepted by most validators; finally, it becomes part of the main chain. When you view Sonic via a block explorer, you only see this final main chain. All the complex work involving event blocks in the DAG happens behind the scenes.

Each validator keeps their own copy of the main chain, helping them process new blocks faster. This creates an elegant balance: the DAG structure allows validators to operate independently and quickly, while the main chain ensures everyone eventually converges on the same final record.

Sonic Token

The Sonic (S) token will serve as a standard L1 utility token—used for paying gas fees, participating in governance, and securing the network via staking. At launch, Fantom (FTM) tokens can be converted to Sonic (S) at a 1:1 ratio. Total supply will begin at 3.175 billion S tokens, matching Fantom’s current total supply, with approximately 2.88 billion tokens circulating at launch.

Sonic aims to avoid early inflation from validator rewards. For the first four years, the chain will fund validator rewards using leftover Fantom block rewards instead of minting new tokens. When half the network is staked, these rewards—around 70 million per year—will yield a 3.5% return for validators. After four years, the network will begin issuing new tokens periodically to maintain the 3.5% reward rate.

Developer Incentives

Sonic has established multiple programs leveraging its token to attract developers. An Innovation Fund has allocated 200 million S tokens to support new projects built on Sonic. These tokens will be granted to developers creating innovative applications.

The Fee Monetization Program changes how transaction fees work—but only for approved applications. Normal transactions on Sonic burn 50% of fees, pay 45% to validators, and send 5% to the ecosystem treasury. Developers can apply to join the Fee Monetization Program. If approved, their applications receive 90% of the fees they generate, with validators receiving the remaining 10%. This structure enables successful apps to earn sustainable revenue while still supporting network security.

Airdrop

Sonic plans to distribute 190.5 million tokens via airdrop, rewarding both past Fantom users and future Sonic adopters. The team says they’ve learned from mistakes in previous incentive campaigns—not focusing solely on rewarding large amounts of locked capital, but emphasizing actual usage. This means applications that don’t naturally require massive TVL (such as DEXs, NFTs, games, etc.) can benefit from user adoption metrics in this campaign, not just DeFi apps like lending protocols and AMMs that rely heavily on TVL.

Both historical activity on Fantom and future participation in Sonic will qualify for airdrop rewards. Past qualifying activities may include providing liquidity, validating, holding staked tokens (like sFTMx), and using NFTs. Future criteria could involve providing liquidity on Sonic staking, deploying contracts, participating in community events, and using bridges. Exact standards remain unclear, but based on information shared by the Sonic Labs team, active engagement will likely be rewarded more highly than passive liquidity provision.

In addition, the “Sonic Boom” program allows 30 projects to win additional airdrop allocations to distribute among their users.

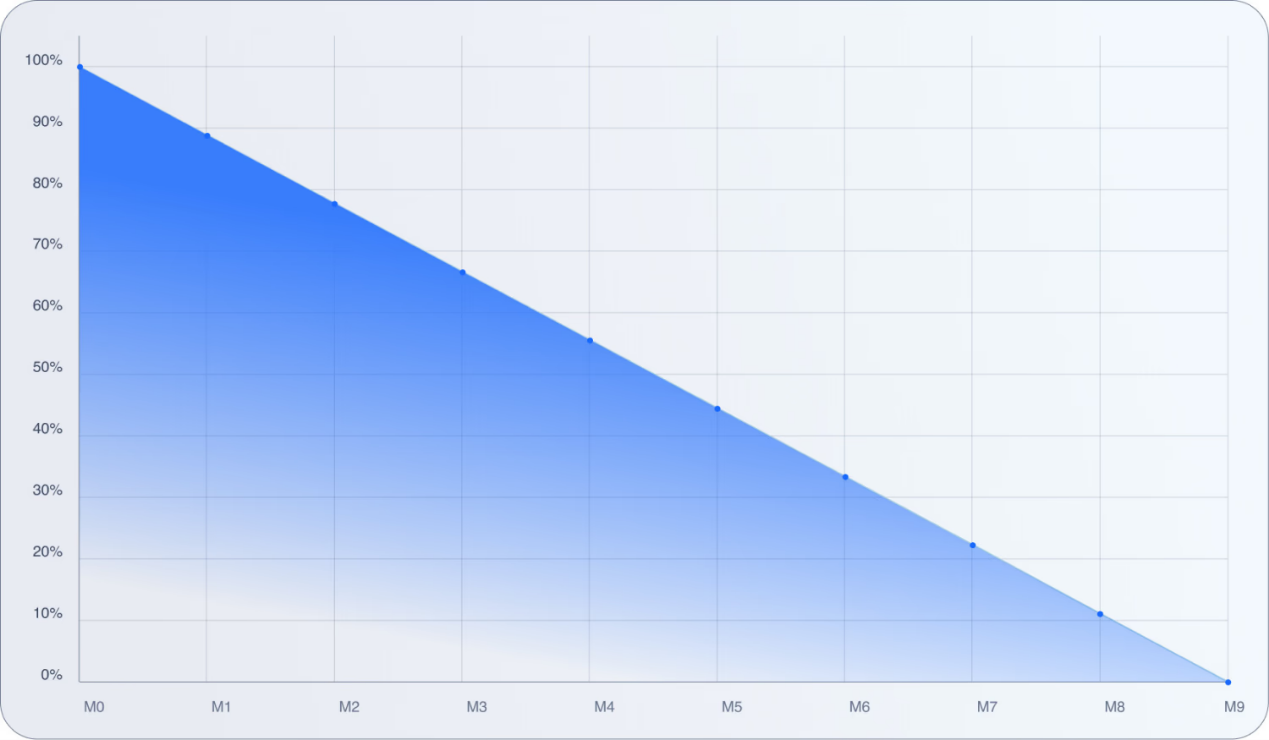

Finally, this airdrop features a novel claiming mechanism with a 270-day vesting period. The system releases 25% of the tokens on day one, with the remaining 75% represented as an NFT position. Users can claim the remainder at any time, but early redemption results in partial token burn. The longer the position remains unclaimed, the less is burned upon withdrawal. Those seeking immediate liquidity without burning tokens can sell their NFT positions on the open market.

Source: https://docs.soniclabs.com/funding/airdrop

Market Reaction

Since Sonic’s announcement in August 2023, Fantom’s token has seen modest gains. Price rose from $0.41 to $0.71—an increase of 75%—while Bitcoin climbed from $64,000 to nearly $100,000, up about 50%. While nothing extraordinary, this is still a solid performance given that Bitcoin outperformed many altcoins during the same period. However, it significantly lags behind top performers like Sui, whose price surged fivefold from $0.70 to $3.60. Especially after Bitcoin recently broke new all-time highs, Fantom has continued to underperform relative to other altcoins. This suggests the market remains skeptical about Sonic. Enthusiasm is currently muted.

Total value locked (TVL) in the Fantom protocol also shows little excitement. Despite the promised airdrop, the network’s TVL remains stable around $100 million—far below its previous bull market peak of $8 billion.

This could change when the Sonic mainnet launches, but recent history calls for caution. Other networks (like Scroll) saw temporary spikes in activity during their airdrops, only to experience rapid outflows once rewards dried up. High initial activity or TVL growth at launch may reflect short-term interest rather than lasting adoption.

Future Potential

Sonic enters a crowded赛道 where blockspace is more abundant than ever. While Ethereum L2s may not match the speeds Sonic promises, they’re fast enough to meet current demand. As a result, most Solidity developers choose to build on these L2s, making it difficult for alternative L1s to attract builders and users. Sonic will face the same challenge.

The team emphasizes rewarding developers through gas fee sharing, but this approach faces its own hurdles. History shows this may not be the compelling advantage Sonic hopes for. Major applications like Uniswap, Aave, and Raydium built successful businesses without gas rebates. NEAR Protocol attempted a similar model with limited success; what ultimately revived NEAR wasn’t developer incentives, but its focus on AI applications. Sonic’s anticipated low transaction fees further complicate this challenge, reducing the value of potential gas rebates.

For long-term success, Sonic needs to attract applications that truly leverage its superior speed and scalability. Think of today’s DeFi protocols, perpetual DEXs, DePIN networks, and complex financial applications. The ingredients for success are in place—substantial development and incentive funding, carefully designed incentive programs, and one of DeFi’s most inspiring leaders in Andre Cronje. The team seems aware of this—Cronje is actively pursuing partnerships with credit card companies and international banks.

Becoming just another high-speed blockchain hosting memecoin casinos won’t ensure lasting success. While such activity might provide early momentum, Sonic needs to establish itself in a clear niche where performance is paramount. From meticulously structured incentive campaigns and airdrops to institutional outreach, the team has a fighting chance. But succeeding in this competitive landscape requires more than good intentions. Sonic’s future depends on turning these plans into reality—demonstrating the true value of its high-performance infrastructure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News