How to value Ethereum?

TechFlow Selected TechFlow Selected

How to value Ethereum?

Ethereum is becoming more and more valuable.

Original author: @Grayscale

Translation: Daling Think Tank

Smart contract platforms (SCPs) like Ethereum (ETH) are often referred to as decentralized computers, while payment-focused crypto assets like Bitcoin represent simpler decentralized ledgers. In this article, we will analyze the unique characteristics of smart contract platforms, discuss how their native tokens differ from traditional payment-based cryptocurrencies such as Bitcoin, and propose a valuation framework by examining supply and demand factors.

What Is a Smart Contract Platform?

“The biggest difference between Ethereum and Bitcoin is that with Bitcoin, the value of the ecosystem comes from the currency. But with Ethereum, the value of the currency comes from the value of the ecosystem.” — Vitalik Buterin (Ethereum co-founder)

While payment-oriented assets like Bitcoin can track interactions between addresses, smart contract platforms like Ethereum also allow transactions to store, retrieve, and compute arbitrary data. Smart contract platforms enable developers to write code for smart contracts that perform on-chain computational operations. This allows developers to create decentralized applications (DApps), automating processes traditionally requiring manual intervention. For example, smart contracts allow users to instantly deposit collateral and borrow assets within seconds without human involvement—unlike the weeks-long loan approval process at traditional banks. The benefits of using smart contracts are numerous: many processes become cheaper, faster, and more transparent through interaction with neutral code rather than intermediaries.

In this article, we focus primarily on Ethereum as a case study, as it is the most active smart contract platform in terms of users, transaction volume, total value transferred, and number of projects built.

Figure: Ethereum Metrics

Fundamentals

The framework for evaluating smart contract platforms resembles that of a commodity—they are consumable resource platforms. As demand for a commodity grows, the price people are willing to pay typically increases. Similarly, since many SCPs require users to burn native tokens (commonly known as gas fees) to conduct transactions, the price of native SCP tokens like ETH is often correlated with network utility: as the number of transactions on the network increases, so does the number of burned tokens, reducing available supply and potentially increasing token value. As more useful decentralized applications (DApps) are deployed on an SCP, demand for its native token used to pay for transactions may rise.

Supply / Economic Model

Like Bitcoin, Ethereum’s supply mechanism is pre-programmed. However, unlike Bitcoin, Ethereum’s supply mechanism has undergone multiple changes. Let's review two major milestones.

Key Milestones in Ethereum Supply Dynamics:

1. August 2021 – Implementation of Base Fee Burning. When Ethereum was first created, ETH supply was distributed to miners at a rate of 2 ETH per block, and 100% of transaction fees went to miners.

With the launch of the London upgrade, a fee-burning mechanism was introduced via Ethereum Improvement Proposal (EIP) 1559, resulting in base transaction fees being burned instead of awarded to miners. With more transaction fees being destroyed, Ethereum’s inflation rate decreased.

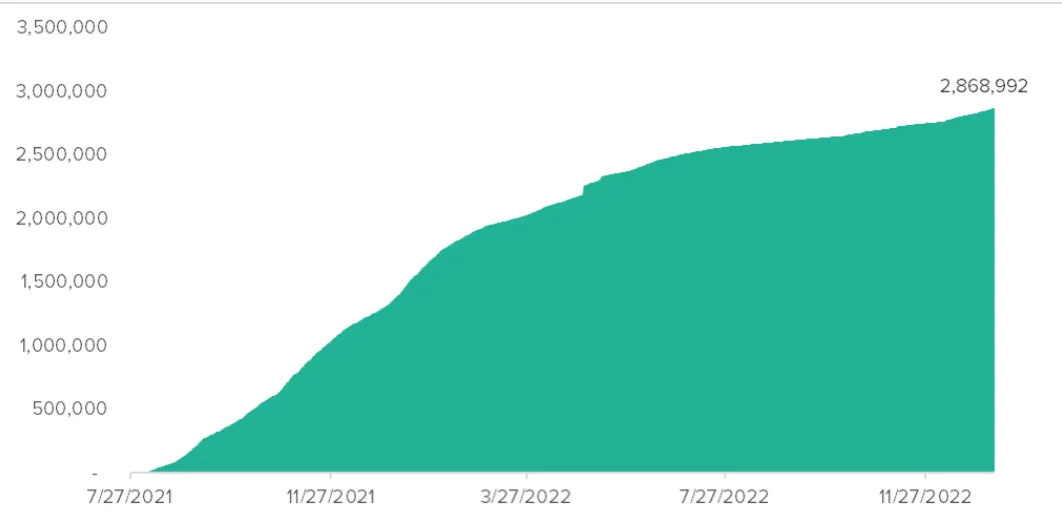

Figure: Total ETH Burned Since EIP-1559

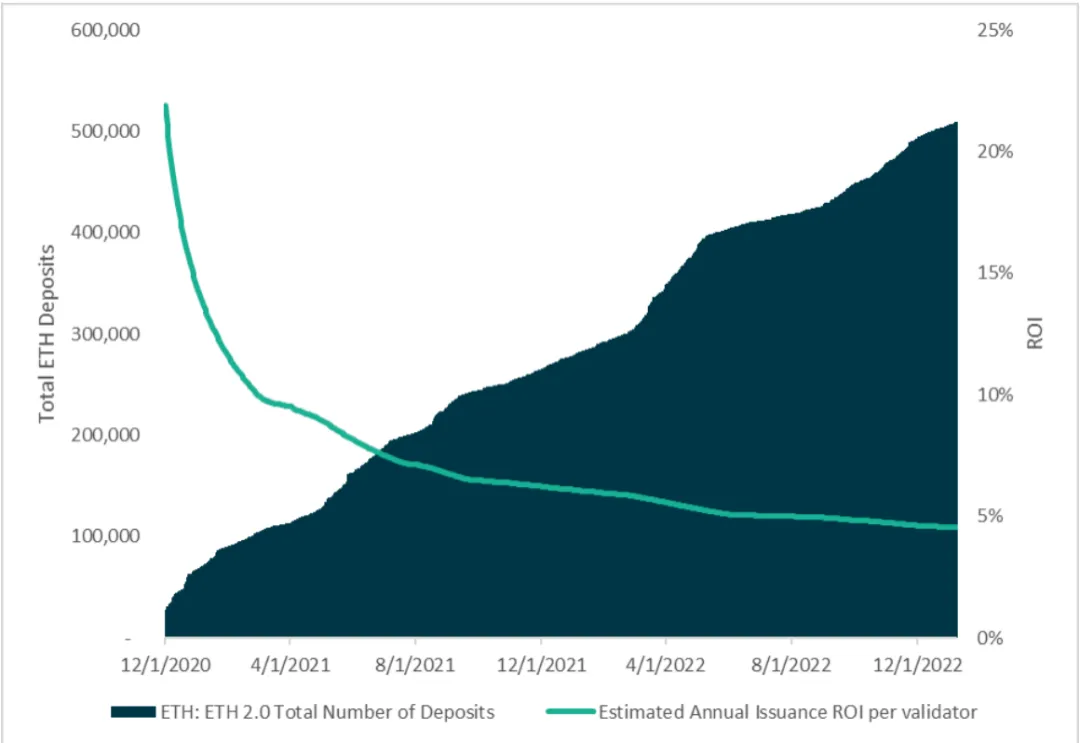

2. September 2022 – The Merge + Elimination of Miner Rewards. After the Merge, miners no longer receive block rewards. Instead, validators earn staking yields as rewards for locking up their ETH to validate transactions. Unlike mining, where successful miners received a fixed reward of 2 ETH per block, staking offers a variable annual percentage rate (APR) to all stakers depending on the total amount of ETH staked across the ecosystem. A higher total ETH staked results in a lower APR per staker, and vice versa. As of December 2022, an ETH staker earned an APR of approximately 4%, with a total stake of 15.9 million ETH.

Figure: ETH Staking APR vs. Total ETH Staked

Walkthrough: A Simple Model of Supply Dynamics

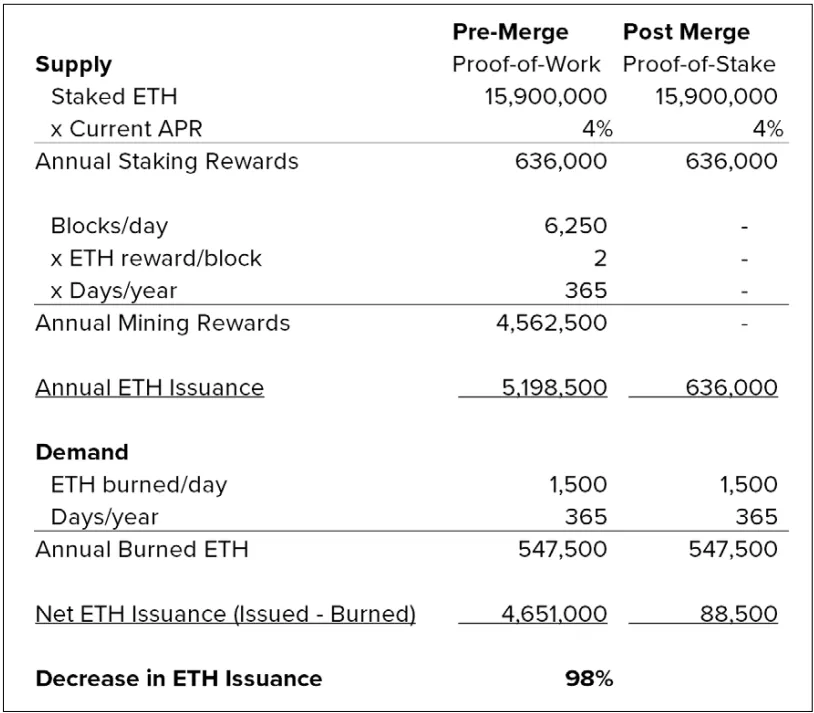

Considering these two events, investors can build a model of changing supply dynamics.

1. Framework: First, create two columns: pre-Merge and post-Merge. This allows comparison of inflation before and after the Merge.

2. Supply: Create a supply section and break down inflation into staking rewards and mining rewards.

-

Staking Rewards: Staking opened in December 2020 with an approximate yield of 4%. With around 15.9 million ETH locked in staking contracts, total annual staking rewards amount to 15.9 million ETH * 4%, or about 636,000 ETH per year.

-

Mining Rewards: Mining rewards existed only pre-Merge, offering 2 ETH per block. Given an average of ~6,250 blocks per day and 365 days per year, 2 ETH/block * 6,250 blocks/day * 365 days/year = ~4.6 million ETH/year. Mining rewards ceased after the Merge.

3. Demand: This can be estimated by calculating the average daily amount of ETH burned. Using 1,500 ETH/day as a baseline assumption: 1,500 ETH/day * 365 days/year = ~547,500 ETH burned annually.

Figure: ETH Issuance Model

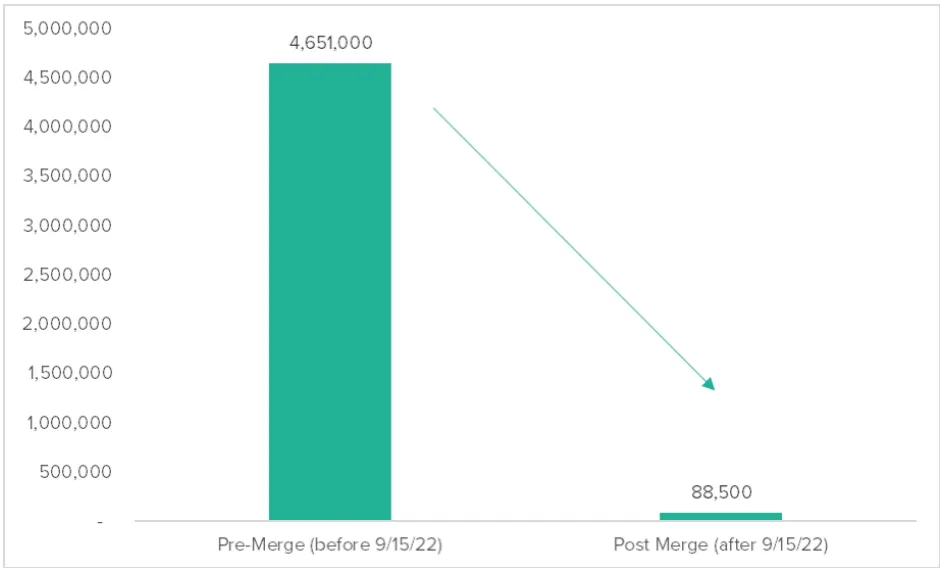

By comparing the previous proof-of-work issuance with the current proof-of-stake issuance and applying our model assumptions, we see that total annual issuance declined by over 98%.

Figure 5: Annual ETH Issuance Change

The change in ETH issuance is equivalent to more than three Bitcoin halvings. Assuming continued growth of the Ethereum ecosystem, increased transaction fees—and thus ETH burns—could exceed new issuance, potentially making ETH a deflationary asset. Monitoring upcoming changes to the Ethereum protocol and understanding their impact on total supply is crucial for any potential investor.

Unlike most payment-focused crypto assets (e.g., Bitcoin), which have seen little change in supply dynamics, SCPs tend to undergo more significant codebase changes due to their complex infrastructure. As a result, structural dynamics such as supply can occasionally shift dramatically. For investors, understanding the second-order effects of such large supply changes is essential. For instance, after a sharp drop in token inflation (as seen post-EIP-1559 and the Merge), imagine a scenario where Ethereum’s intrinsic value is perceived as relatively stable. Given that the annual sell pressure from miners (~4.5 million ETH) drops to zero (since miners no longer receive block rewards), and assuming prices remain relatively stable in the short term, one might ask:

-

"If there’s no 4.5 million ETH of sell pressure each year, what happens to price if demand stays constant?"

-

"If demand remains unchanged but ETH becomes deflationary, what happens to price?"

If investors believe the market hasn’t yet priced in the full impact of lower token inflation and view the effect as bullish, they may choose to buy the asset.

While the two preceding changes (EIP-1559 and the Merge) represent the most visible shifts in supply-demand dynamics, they are not exhaustive.

Other potential changes affecting these dynamics include:

1. Changes in Monetary Policy: If the Ethereum network alters how new ETH is created, this could significantly affect ETH supply and thus its price. As more individuals and organizations seek to use Ethereum, demand for the network may increase.

2. Changes in Use Cases: If modifications to the Ethereum codebase expand the range of applications that can be built on the platform, demand for ETH may rise as more users and organizations adopt the network.

3. Changes in Network Scalability: If the Ethereum codebase is modified to improve scalability, demand for ETH could grow as more users and organizations gain access to decentralized applications on the Ethereum network.

Token Distribution

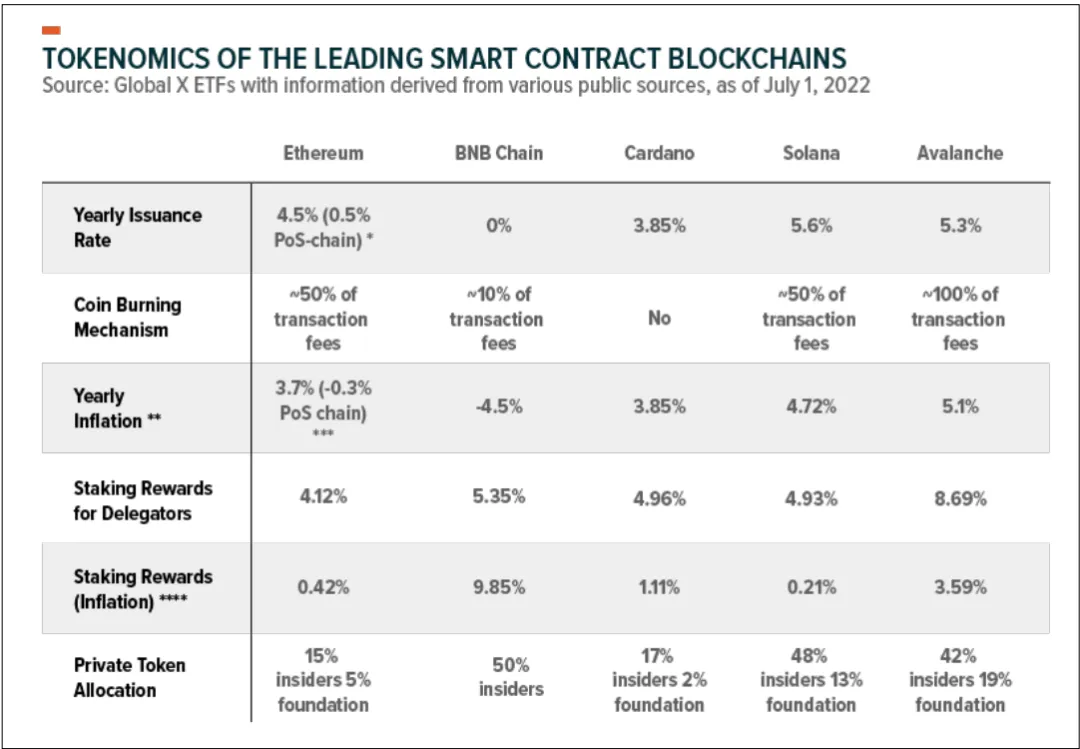

When analyzing supply dynamics, native token distribution and unlock schedules should also be considered. For most SCPs, founding teams typically allocate a portion of tokens to themselves and other insiders to fund early-stage development. These tokens are usually released over several years, though vesting periods vary widely across teams. For long-term investors, entering a token position after the initial lock-up period—when early team members may face higher selling pressure—could prove advantageous. The table below outlines private token allocations and economic models for various SCPs.

Figure: High-Level Token Economics of Various SCPs

Quantifying Demand Metrics

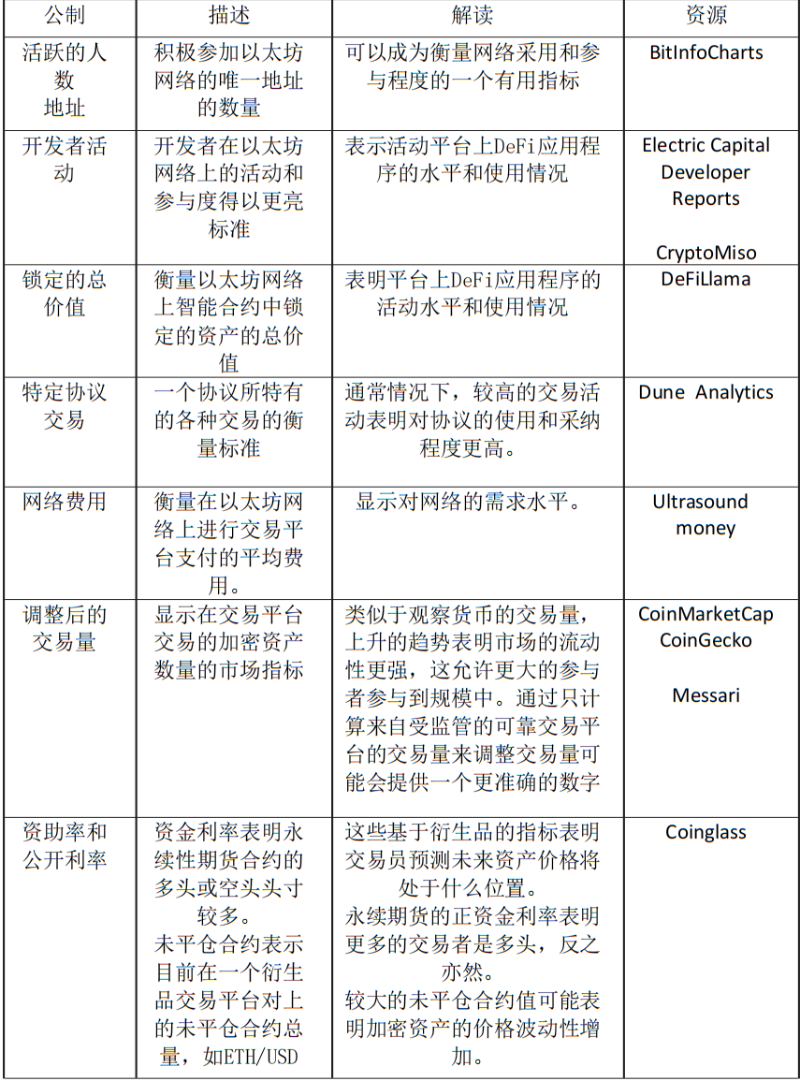

We used 1,500 ETH burned per day as a proxy for demand in the issuance model above, but what are some underlying drivers of this demand? Below, we examine quantifiable metrics that can help determine demand.

Key quantitative metrics to monitor include:

1. Development Roadmap: A blockchain network’s development roadmap provides insight into its long-term vision and direction. Understanding Ethereum’s development priorities and goals—and how they evolve over time—is critical.

2. Community Engagement: The strength and engagement level of a blockchain’s community can serve as an indicator of its health and long-term prospects.

3. Regulatory Environment: The regulatory landscape in which a blockchain operates can significantly impact its adoption and development. Understanding the regulatory context surrounding Ethereum and its future implications is essential.

4. Institutional Adoption: Announcements from large or established financial institutions planning to offer services involving Ethereum can be bullish in the long run, as these platforms bring substantial user bases who may act as net buyers.

Case Study

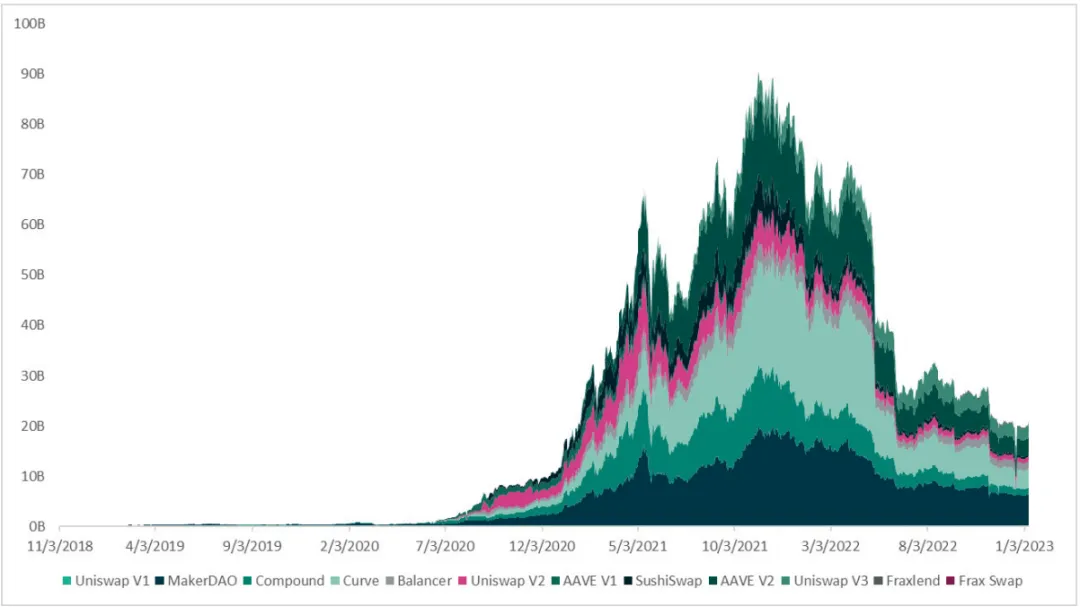

Since Ethereum’s value correlates with DApp usage, understanding which use cases have gained traction within the user ecosystem is highly valuable. Identifying the scope of successful applications on Ethereum helps pinpoint areas where demand may grow under broader adoption.

Figure: Total Value Locked in Top Ethereum DeFi DApps

Decentralized Exchanges / Automated Market Makers (DEX)

Imagine Alice and Bob want to trade digital assets but prefer not to use traditional centralized exchanges, avoiding risks associated with centralized entities. Instead, they opt for a decentralized exchange (DEX)—a platform enabling peer-to-peer trading without intermediaries. Compared to traditional exchanges, DEXs offer several advantages.

As shown in Figure 8 below, popularity has surged due to its permissionless nature.

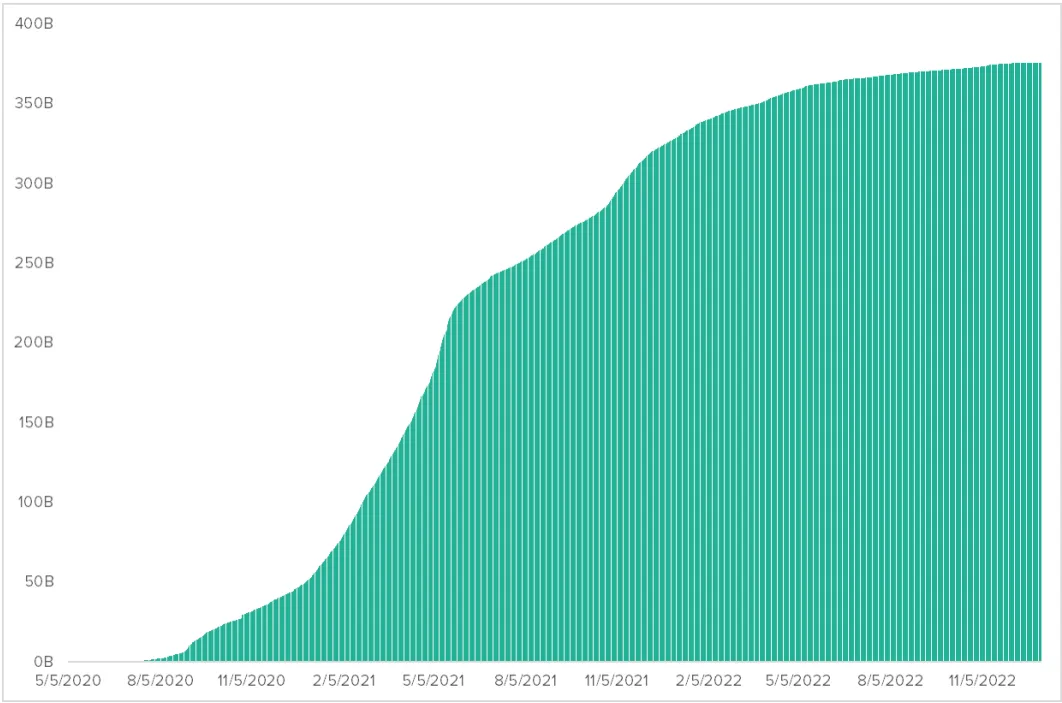

Figure: Uniswap’s Cumulative USD Trading Volume

Despite still being in early stages and lagging behind centralized exchanges in functionality and user experience, Uniswap processed over $350 billion in DEX volume on Ethereum by May 2022, indicating strong product-market fit. As DEXs continue to mature, they are poised to capture increasing market share from centralized exchanges.

Lending Protocols

Imagine Alice wants to borrow XYZ from Bob without selling her ETH. Alice sends some ETH to the protocol as collateral—a security deposit Bob can claim if Alice defaults. Bob agrees to lend Alice XYZ, and the lending protocol uses a smart contract to enforce loan terms and repayment schedules. The smart contract automatically tracks the loan balance, interest rate, and repayment timeline. When Alice repays, the contract returns her collateral. Once fully repaid, the contract marks the loan as complete.

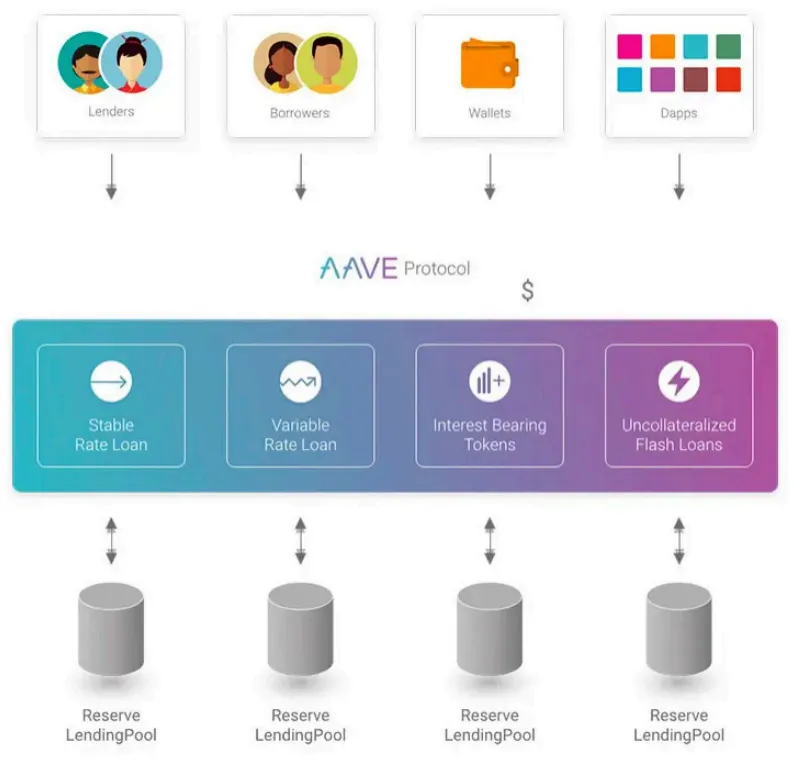

As illustrated below, protocols like Aave use smart contracts to provide users with various financial tools, including fixed-rate loans, variable-rate loans, and interest-bearing accounts. Through smart contracts, lending protocols like Aave offer automated access to financial services previously exclusive to traditional banks—as well as novel offerings like flash loans not found in traditional finance.

Figure: Aave Lending Protocol

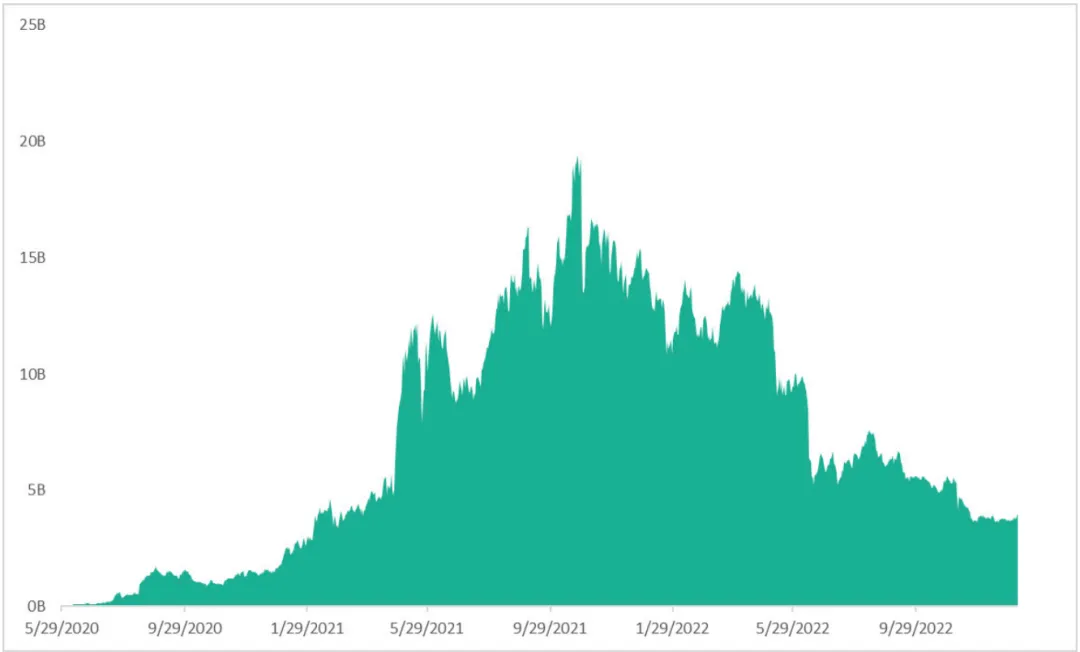

Like DEXs, lending protocols have grown increasingly popular, with billions of dollars worth of tokens deposited into Aave over the past two years:

Figure: Aave Total Value Locked

Lending protocols also offer benefits such as decentralization, privacy, and accessibility. Additional advantages over traditional lenders include:

-

Speed: Loans are instantly collateralized, allowing immediate borrowing without delays typical of traditional lenders.

-

Automation: Repayment schedules, interest payments, and liquidations are all handled automatically by the protocol’s smart contracts.

-

Earnings: Lending out crypto assets for interest allows users to earn yield from lending demand.

-

Transparency: Loan liquidation prices, collateral amounts, borrowing rates, and interest are fully transparent and verifiable on-chain by anyone.

These carry risks, however. One example is the need to assess asset liquidity before accepting it as collateral. Allowing low-liquidity assets as collateral could harm borrowers’ positions.

DApp Research

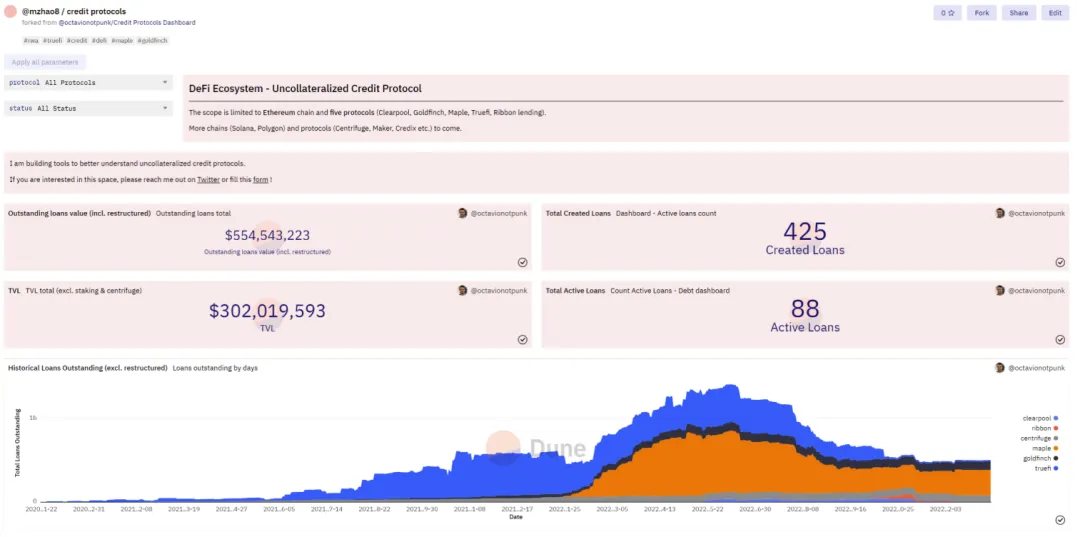

Different DApps serve different purposes; there’s no one-size-fits-all approach to measuring demand when researching projects. However, free data resources like Dune Analytics can help investors focus on industry-specific metrics. For example, someone interested in the total size of the uncollateralized credit protocol market on Ethereum can search “uncollateralized credit protocol” on Dune.com and find dashboards tracking key metrics such as total loans created and active loans.

Figure: Dune Dashboard Screenshot

For investors assessing whether potential demand for an SCP is sticky, tools like Dune allow visualization of various charts measuring protocol usage. If overall data shows high stickiness and usage rates among consumer DApps, this could support a long-term investment thesis in the SCP.

Competitive Landscape

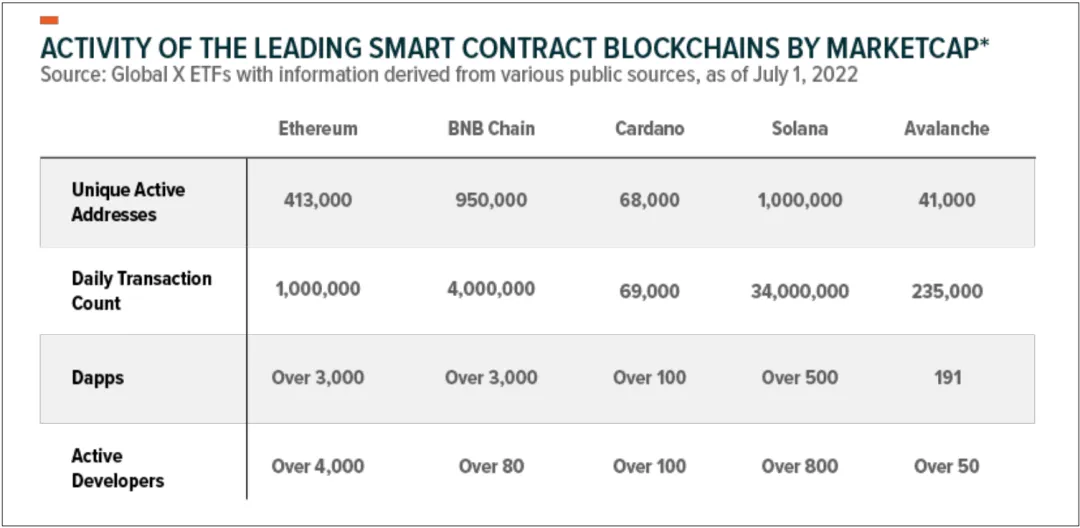

While Ethereum dominates in market cap and total value locked, other smart contract platforms compete directly:

-

Solana is a smart contract platform designed for speed and low transaction fees. The Solana Foundation claims it can process up to 65,000 transactions per second—faster than many other platforms.

-

Avalanche is a blockchain focused on decentralized finance and gaming, capable of processing thousands of transactions per second and fully compatible with Ethereum. Developers can easily port applications from Ethereum to Avalanche. Avalanche’s architecture includes subnets—dedicated networks running different types of DApps. Each subnet operates independently with its own validators, consensus rules, and governance, while leveraging the main network’s security and decentralization.

-

Polygon uses a sidechain architecture compatible with Ethereum’s mainnet. Due to Ethereum compatibility, developers can easily migrate DApps to Polygon, fueling rapid ecosystem growth. Additionally, Polygon enables faster transaction speeds and lower fees compared to Ethereum.

Figure: Activity on Leading Smart Contract Blockchains

Investor Checklist

General Information

1. Market Demand and Adoption: Platforms with strong market demand and adoption may be more attractive to investors, signaling robust user and developer communities.

2. Performance and Scalability: Consider platform performance and scalability, as these affect user experience and capacity to handle high transaction volumes.

3. Security: Security must be evaluated for any smart contract platform, as vulnerabilities or hacks can have severe consequences for users and investors.

4. Regulatory Environment: Understanding the regulatory environment is important, as it impacts legal and compliance risks associated with the platform.

5. Team and Governance: The team and governance structure influence the platform’s direction and success.

6. Ecosystem and Partnerships: The strength of the ecosystem and strategic partnerships are key indicators of long-term success.

Economic Model

1. Token Issuance and Distribution: How is the token issued and distributed? Is it pre-mined, mined via proof-of-work, or staked via proof-of-stake? How are tokens allocated to early supporters and developers, and how do they reach the broader market?

2. Token Use Cases: What are the primary use cases? Is it used for transaction fees, governance voting, or incentivizing behaviors like staking or network contributions?

3. Token Supply: What is the total token supply, and how is it expected to change over time? Is there a hard cap, or is supply uncapped?

4. Token Demand and Adoption: What is the current demand for the token, and what drives it? Is the token widely adopted within the ecosystem, or mostly held by speculators?

Conclusion

The supply and demand dynamics of smart contract platforms are driven by a range of factors, including market demand and adoption, performance and scalability, security, regulatory environment, team and governance, and ecosystem partnerships.

On the supply side, understanding economic models and upcoming upgrades provides context for major structural shifts—for example, analyzing Ethereum’s supply dynamics post-EIP-1559 and the Merge. On the demand side, tracking fundamental metrics from sources like Defi Llama and Dune Analytics—such as product-market fit of DApp offerings—can reveal concrete drivers of usage.

Understanding these factors and their interplay is crucial for investors assessing the investment potential of different platforms. In Ethereum’s case, declining issuance combined with growing DApp adoption suggests the token may be undervalued amid broader macro-driven sell-offs. As the smart contract platform market evolves, investors must stay informed about developments and trends to make sound investment decisions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News