Binance Research: Despite centralization risks, optimistic about Arbitrum maintaining growth throughout the year

TechFlow Selected TechFlow Selected

Binance Research: Despite centralization risks, optimistic about Arbitrum maintaining growth throughout the year

As long as L1 is sufficiently powerful, most transactions can be conducted on L2, enabling further scalability and fast transactions with lower Gas costs.

Author: Binance Research

Translation: TechFlow

Binance Research has conducted an in-depth analysis of Arbitrum. Below are the key findings from our research:

As long as the L1 is sufficiently secure, most transactions can be executed on L2, enabling further scalability and fast transactions at lower gas costs.

Arbitrum is an Ethereum Layer 2 solution designed to enhance the speed and scalability of Ethereum smart contracts while adding enhanced privacy features. Furthermore, Arbitrum allows developers to run unmodified EVM contracts and transactions without compromising the security of the underlying Layer 1.

When building Layer 2 scaling solutions, it's critical that they inherit the base-layer chain’s fundamental security—this is one key distinction from sidechains, whose security relies on validators. By comparing different approaches, we observe trade-offs between speed and security. Optimistic and ZK-Rollups are clearly more secure than sidechains and Plasma, although they face greater constraints in terms of speed and execution.

Over the past few months, these two major rollup technologies have drawn significant attention.

Based on the characteristics of various Layer 2 scaling solutions—including sidechains—the research team believes ZK-Rollups offer the best overall balance in terms of security, performance, usability, and other important factors. However, until zkEVM becomes powerful enough to compete, Optimistic Rollups may continue to gain broader adoption.

Around a month ago, Arbitrum upgraded its platform to the "Nitro" version, marking a significant improvement for its long-term development.

With Nitro, transaction processing now occurs in two stages:

-

In the first stage, Nitro batches transactions into a sequence awaiting processing.

-

Then, once the sequence is published, a deterministic state transition function is applied to each transaction.

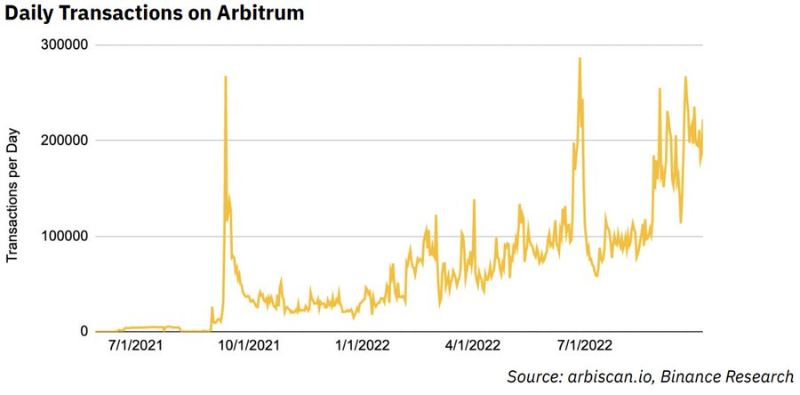

Looking solely at transaction activity on Arbitrum, we observe a positive growth trend since the beginning of the year. The research team views Arbitrum Odyssey as a key event driving further adoption; however, sustained long-term growth will likely require deeper integration with centralized exchanges.

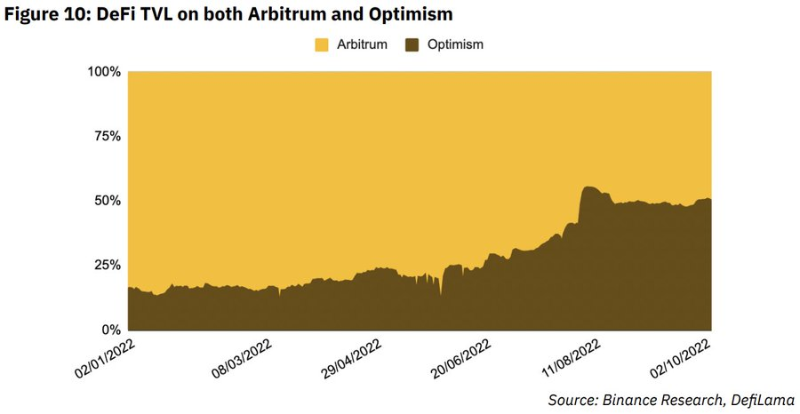

While DeFi TVL initially had a strong lead on Arbitrum, it is now nearly evenly split between Arbitrum and Optimism. Therefore, despite Arbitrum’s recent progress, we have not seen a significant increase in market share. However, when factoring in token balances, Arbitrum holds potential to capture more TVL.

Beyond OpenSea’s announcement supporting Arbitrum and its NFT ecosystem, the convergence of new infrastructure, new users from Odyssey, newly launched NFTs, and upcoming token emissions has created a perfect storm for continued growth on Arbitrum.

We conclude that, amid ongoing competition with Optimism and other scaling solutions, Arbitrum’s ecosystem continues to grow steadily throughout the year.

Although Arbitrum’s trade-off toward centralization in pursuit of lower gas fees is understandable in the short term, centralization remains a key risk factor worth highlighting. That said, Arbitrum is not alone in this regard, as most Layer 2 solutions face some degree of centralization risk to varying extents.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News