Can Latin America's unique environment drive mass adoption of cryptocurrency?

TechFlow Selected TechFlow Selected

Can Latin America's unique environment drive mass adoption of cryptocurrency?

If the industry wants innovative use cases and adoption, it needs to shift its attention and funding toward builders who are solving the problems that need to be addressed.

Author: Cami

Compiled by: TechFlow

I want to say: A huge amount of money has been poured into blockchain, but the results have been disappointing.

As Polynya previously tweeted: everything we’ve done so far might be all the progress we’ll ever make in blockchain. The technologies we're working on are either on the verge of changing the world or stuck in endless self-referential loops within our own bubble. We've successfully captured the world’s attention, but if we’re going to act and deliver real outcomes, we need to pivot quickly—or else risk heading down what I call the “European crypto” dead end.

I can’t find hard data to prove this, but based on my real-world experience interacting with peers in the field, most of the venture capital funding flowing into cryptocurrency goes to teams from Europe and North America. We keep seeing the same kinds of people from the same backgrounds building the same things—over and over again. If the industry wants innovative use cases and real adoption, it needs to shift its focus and funding toward builders who are solving actual pressing problems. The industry can keep building more L1s, zkEVMs, and NFT platforms, or it can invest in driving the next wave of blockchain innovation—but I believe that innovation will most likely come from Latin America.

Because I believe emerging regions are where the next groundbreaking use cases for cryptocurrency and blockchain will originate.

Why?

Demand breeds innovation.

The financial, political, and social challenges experienced in so-called "developing countries," combined with a maturing blockchain ecosystem, create fertile ground for developing some of the most impactful applications of our time.

Latin America is Crypto's Origin Point

Emerging markets face intense financial and social pressures. Latin America is particularly interesting because consumer behaviors indicate a strong appetite for exploring crypto-based alternatives—such as mobile-first digital payment infrastructure, widespread adoption of neobank apps, and cross-border remittance payments.

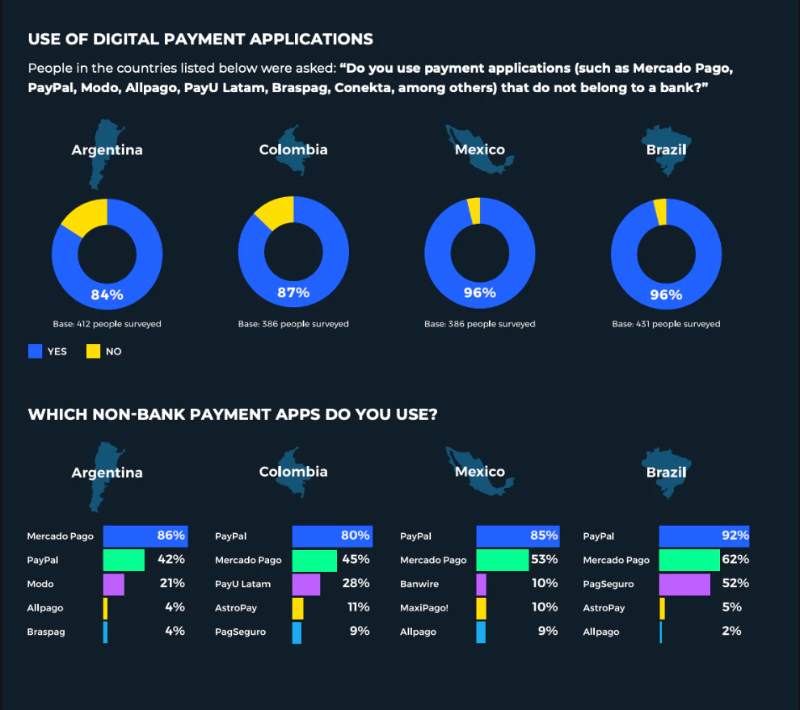

If you examine country-specific data around mobile finance, alternative payments, and banking, the case for these technologies becomes even stronger. According to research published by Rapyd, 96% of Mexicans and Brazilians frequently use non-bank payment apps like PayPal, Modo, and MercadoPago. Despite making up only 8% of the global population, Latin Americans received 20% of total global remittances in 2021.

Latin America already has widespread adoption of mobile-first online payment systems such as PicPay in Brazil, PSE in Colombia, and Mercado Pago across Argentina, Brazil, Chile, Colombia, Mexico, Peru, Uruguay, and Venezuela. With the dominance of digital payments on mobile devices, high volumes of cross-border remittances, and increasing insecurity in traditional finance, Latin America possesses all the conditions necessary for cryptocurrency and blockchain to unlock global adoption.

A global, permissionless, peer-to-peer (P2P) payment infrastructure could offer an alternative to high remittance fees, long processing times, and severe currency devaluation—providing a secure financial foundation for over 666 million people in Latin America. However, the only path to broad adoption is through solutions tailored to individuals with an average monthly income of around $500—solutions that are secure, scalable, and affordable. Specifically, this means transactions must cost fractions of a cent, and DApp user experiences should look and feel just like standard modern web applications. Teams like Fuel, Biconomy, Lens, Mirror, and Geo are innovating—improving UX through parallel transaction execution, gasless transactions, batched signing, and removing wallet creation steps for first-time users.

Beyond Traditional Banking

Latin Americans are early adopters of new technologies, including neobanks, non-bank payment services, e-commerce platforms, internet-based messaging apps, and cryptocurrency. According to a Rapyd report surveying 1,687 respondents in Argentina, Brazil, Colombia, and Mexico, nearly half the population remains unbanked. As a result, the adoption and usage of neobank and non-bank payment apps continue to grow across all age groups and socioeconomic classes throughout Latin America. In Brazil and Colombia, most transactions are conducted via mobile phones, and the adoption of social commerce—making purchases through social media apps—is growing exponentially.

Mercado Pago stands out as a shining example of highly adaptive innovation happening in Latin America. Originally created as a payment platform to complement the e-commerce marketplace MercadoLibre, Mercado Pago has evolved into a full suite of financial services—from payment processing and gateways to mobile payments and credit cards. PicPay, Brazil’s leading digital payment app, boasts over 60 million users and processes BRL 6.8 billion ($1.32 billion) in monthly transactions (source: PicPay). In Colombia, PSE enables everyday payments between individuals and businesses. This mobile ACH service allows users to make online purchases and pay bills by debiting directly from their bank accounts.

The popularity of digital payments isn't limited to the countries mentioned above. 98% of Brazilian, 94% of Mexican and Colombian, and 89% of Argentine bank customers report frequent use of online payments. This trend extends beyond bank-provided services—the region shows extremely high usage of non-bank payment apps. 96% of Mexicans and Brazilians, 87% of Colombians, and 84% of Argentines regularly use apps like PayPal, Modo, and MercadoPago. Payments in Latin America are already operating largely outside the traditional banking system.

Blockchain Without Borders

A defining feature of Latin America is its residents’ heavy reliance on cross-border remittances (payments sent from one country to another) as a source of income. Latin Americans often migrate abroad for work and regularly send money home via remittance services. According to a World Bank report, remittances to Latin America and the Caribbean reached $131 billion in 2021—an increase of 25% compared to 2020. In 2021, remittances accounted for nearly 25% of GDP in Honduras and El Salvador, and 14.8% in Guatemala. Yet consumers pay a steep price for this essential service, averaging around 5% in fees per transaction.

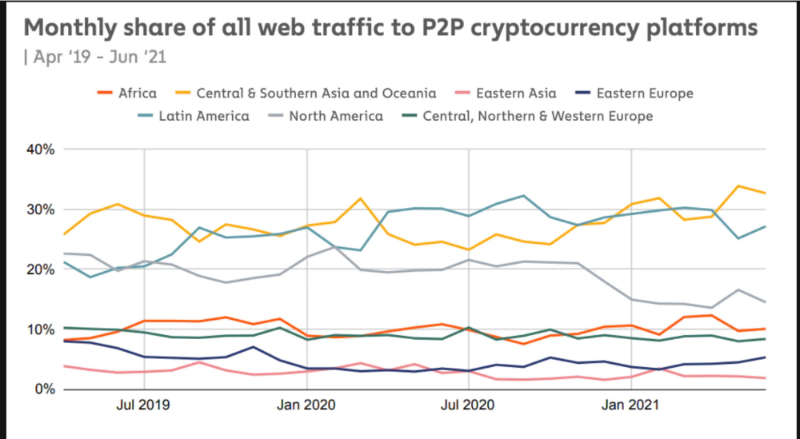

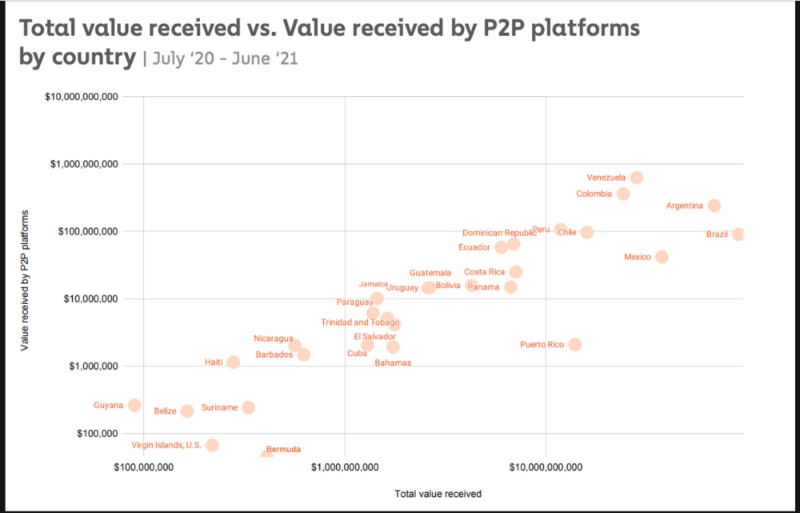

Two interesting data points from Chainalysis show that users have already turned to P2P cryptocurrency payments as a common method of sending money back to their home countries.

- First, P2P crypto activity in Latin America is above average, accounting for approximately 28% of all network traffic on P2P crypto platforms.

- Second, of all value received in Latin America, 11% is domestic while 89% comes from abroad.

Cryptocurrency transaction fees offer a more economical option for transferring funds across borders, while blockchain technology enables faster settlement—making blockchain a perfect fit for life in Latin America.

Where Finance, Politics, Culture, and Crypto Intersect

Faced with growing insecurity and political instability, people across Latin America are open to experimenting with bank-independent digital payment solutions. In the 2021 edition of Chainalysis’ Global Cryptocurrency Adoption Index—measured by on-chain received value, retail-sized received value, and P2P exchange volume—four Latin American countries ranked among the top 20.

Chainalysis further notes that Venezuela ranks high in the index primarily due to massive transaction volumes on P2P platforms. Over the past two years, Venezuela has endured intensified economic turmoil, with inflation reaching 2,000,000% in 2018. While Venezuela ranks 7th overall and Latin America accounts for 20% of the top 20 countries, the region does not rank highly in DeFi application users—suggesting that crypto adoption in the region is driven more by demand for store-of-value rather than access to DeFi products.

The chart above shows the total value received via P2P platforms versus total value received in each Latin American country. It clearly illustrates that countries with high P2P crypto transaction rates are precisely those currently experiencing periods of socioeconomic and sociopolitical conflict. Argentina, Venezuela, and Colombia have all faced record currency depreciation this year. Although the Chainalysis report doesn’t explicitly analyze the relationship between P2P transaction adoption and fundamental structural shifts in a country, much of the data suggests that nations facing the highest levels of political instability or social inequality exhibit significantly higher rates of crypto adoption and trading compared to more stable countries in the same region.

Adapt or Die

Latin America’s deep dependence on digital payments and cross-border remittances, coupled with low institutional trust, makes it a critical region to watch.

Diversity—diversity of experience, not just diversity of thought—is the catalyst for innovation. Every region presents unique challenges and opportunities shaped by its geography, cultivating distinct lived experiences for its people. No matter how hard we try, the West will never achieve the level of blockchain innovation possible in Latin America—simply because innovation there is overwhelmingly driven by necessity.

Crypto centered on Europe is a road to a dead end.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News