Latin America's Crypto Landscape: Extreme Adaptation to Macroeconomic Conditions & Local Innovation in Stablecoins

TechFlow Selected TechFlow Selected

Latin America's Crypto Landscape: Extreme Adaptation to Macroeconomic Conditions & Local Innovation in Stablecoins

Latin America's cryptocurrency ecosystem is no longer a "new phenomenon," but an irreversible force rewriting the rules of finance.

"Open Veins of Latin America" reveals: for five centuries, both old and new colonialism have turned Latin America into a periphery specialized in "bloodletting," where the richer the resources, the more deeply its veins are cut. Today, blockchain's autonomous nodes, open-source code, and distributed ledgers offer Latin America the technological possibility to rebuild its "circulatory system": developers in Argentina, Brazil, and Mexico are issuing local stablecoins denominated in pesos and reals, using smart contracts to slash cross-border transaction fees to mere cents, freeing remittances and trade finance from mandatory dollar clearing.

As with any technological revolution, some quickly embrace the new while most either fail to understand or fear change. In Latin America, the terms "cryptocurrency" or "stablecoin" still evoke complex emotions; despite growing exposure and romantic crypto narratives, only a minority truly grasp blockchain technology and its practical applications in daily life. Not to mention that USDT and USDC still dominate 90% of the regional market—interest rates set by the U.S. Federal Reserve and American regulations can tighten the valve overnight, making a new "monetary colonization" increasingly visible.

Following our previous article outlining the on-chain panorama of Latin America’s crypto financial payment ecosystem, this article will rely on the report "Frontera, LATAM crypto ecosystem: Leading the New Digital Economy" to conduct a deep, objective analysis of Latin America’s emerging crypto industry.

We will begin with a panoramic view of the region’s crypto ecosystem to examine use cases for cryptocurrencies and stablecoins: how exactly is Latin America adopting crypto, for what purposes, and which crypto projects, communities, and investors underlie these use cases? Then, through an examination of major countries (Argentina, Brazil, Colombia, Mexico, Peru), we will project the evolutionary path of stablecoin payment initiatives across Latin America.

An additional thought-provoking question: Is the difference between what Eduardo Galeano meticulously documented in his book and today’s reality merely that instead of silver mines and plantations, it is now everyone’s digital wallet; instead of guns and merchant ships, it is code and nodes—but the direction in which the “veins” are being cut still points to the same North?

I. The Panorama of Latin America’s Crypto Ecosystem

1.1 Overview

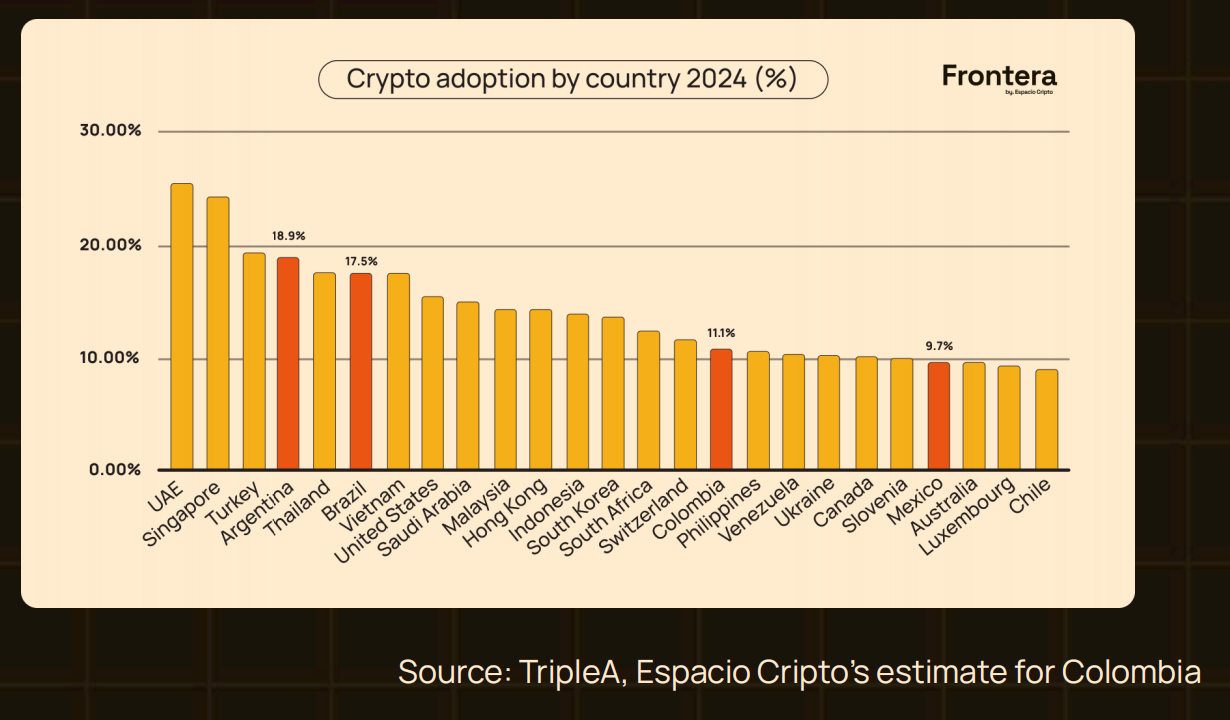

Over the past 15 years, cryptocurrency has evolved from a niche toy for libertarian geeks into a key component of the global financial landscape, fundamentally changing how we perceive and use money and value. According to TripleA data, the number of people globally holding virtual assets has grown to 562 million (up from 420 million in 2023), representing 6.8% of the world’s population.

While over half of users remain in Asia, **South America was last year’s fastest-growing region, nearly doubling its user base and rising to become the world’s third-largest crypto adoption market, surpassing Europe. Within Latin America, Argentina and Brazil lead the way—driven by different yet complementary socioeconomic factors—emerging as twin engines of stablecoin adoption.**

Argentina's persistent economic turmoil—years of hyperinflation and strict foreign exchange controls—has forced large segments of the population to turn to Bitcoin and stablecoins for wealth preservation. Despite government austerity measures, inflation remains rampant: consumer prices surged 193% year-on-year in October 2024 (the lowest increase in the year, down from 209% in September), marking the sixth consecutive month of deceleration. Even so, purchasing power erodes day by day, making crypto a lifeline and cementing stablecoins’ role in Argentina’s financial ecosystem. High internet and mobile device penetration provide fertile ground for this transition, offering a reliable alternative to traditional finance. Amid economic instability, DeFi, tokenization, and payment projects flourish.

Brazil, as Latin America’s most populous and diverse nation, sees rising crypto adoption fueled by strong tech-sector interest and a vibrant startup and fintech ecosystem. With one of the region’s highest mobile penetration rates, crypto apps and digital wallets are easily accessible. A young, tech-savvy population readily embraces new technologies. A central bank digital currency (CBDC) is already under discussion, regulatory frameworks are advancing rapidly, and the investment environment grows increasingly favorable. Universities and innovation centers are launching blockchain and crypto courses to cultivate local talent. Combined with Brazil’s leadership in regional financial services, crypto assets are gradually integrating into traditional financial products, accelerating mainstream adoption.

Mexico's crypto adoption is primarily driven by remittance dynamics. As one of the world’s largest recipients of remittances, billions of dollars flow annually from the U.S., highlighting the high cost and slow speed of traditional channels. Crypto solutions offer faster, cheaper alternatives. Compared to Argentina, Mexico enjoys greater macroeconomic stability, so crypto is seen more as a convenient tool and investment vehicle rather than an anti-inflation shield. Strong fintech momentum drives adoption, though diversity lags behind, and the ecosystem remains immature.

Colombia's adoption level is high but presents a different picture. While not as economically volatile as Argentina, demand for financial inclusion and remittance efficiency drives growth in its crypto community. Many Colombians work abroad, and remittances represent a significant share of GDP. Faster, cheaper crypto remittances are naturally favored. The government is also gradually introducing regulations, potentially paving the way for future adoption.

In summary, Latin America’s crypto ecosystem is shaped by diverse economic, technological, and social forces. Argentina and Brazil remain dual leaders—one driven by economic hedging, the other by technological dividends—while Mexico and Colombia take lower profiles, focusing on remittances and financial inclusion.

1.2 Latin America’s Preference for Stablecoins

Before dissecting the current state of the ecosystem, we must return to its origin: the user. Users are at the epicenter of this new crypto storm—any narrative must first answer their needs and use cases. Although Bitcoin is framed as a hedge against fiat depreciation, the vast majority of Latin American users still choose stablecoins. Kaiko Research’s latest study shows that over 40% of transactions in Latin America are settled in USDT; nearly half of trades denominated in Brazilian real (BRL) are conducted via stablecoins.

Since off-chain crypto transaction volumes are hard to measure precisely, Brazilian government data becomes crucial for verifying trends. Since 2019, Brazil’s Federal Revenue Service (Receita Federal) has enforced full reporting requirements, mandating all active exchanges and large individual users to file monthly reports. Official data confirms a surge in stablecoin usage: cumulative USDT trading volume exceeds 271 billion reais, compared to 151 billion reais for Bitcoin—nearly double.

Compared to global markets, stablecoins play a far more central role in Latin America. Using Binance, the largest centralized exchange, as a reference, Bitcoin dominates globally. In Latin America, however, user preference for stablecoins reflects regional characteristics—volatile local currencies, weak confidence, and difficulty accessing U.S. dollars through traditional channels make “stability” the rarest financial attribute.

II. Cryptocurrency Use Cases in Latin America

Latin America’s crypto users are diverse, encompassing individuals, businesses, and even government institutions from varied socioeconomic backgrounds. Understanding this diversity is key to assessing the regional impact of crypto assets.

2.1 Individual Users

A. Economic Hedging

In Argentina, Venezuela, and to a lesser extent Brazil, citizens use cryptocurrency as a shield against hyperinflation. With inflation exceeding 200%, millions of Argentines have switched to stablecoins like USDC and USDT to save their wealth from peso depreciation. For ordinary people, crypto assets are “digital dollars”—a stable store of value otherwise inaccessible under capital controls. Platforms like Lemon Cash have responded with crypto cards, allowing users to spend local currency with crypto settlements in the background and even earn Bitcoin cashback rewards—proving immensely popular.

B. Faster, Cheaper Remittances

Remittances are lifelines for families in El Salvador, Mexico, and Guatemala. Traditional remittance services charge high fees and suffer from slow settlement times. Cryptocurrencies eliminate intermediaries, reduce costs, and enable minute-long transfers—especially vital for low-income households dependent on every dollar sent from overseas relatives. Bitso, Mexico’s leading exchange, already captures ≥10% of the Mexico-U.S. remittance corridor.

C. Access to Financial Services

A large portion of Latin America—particularly rural populations—remains unbanked or underbanked. Crypto wallets allow them to save, pay, and even borrow without needing a traditional bank account. DeFi offers decentralized banking alternatives, especially attractive in areas with weak infrastructure, enabling individuals to take control of their financial futures.

D. Investment and Wealth Growth

Beyond inflation hedging, some Latin Americans view crypto as an investment asset. High-volatility, high-return digital assets like Bitcoin and Ethereum, with low entry barriers, have become part of their wealth-building strategies.

2.2 Businesses and Entrepreneurs

A. Crypto Payments and Receipts

To avoid high fees and delays from traditional banks, small and medium-sized enterprises in Latin America are beginning to accept Bitcoin and stablecoin payments. Some Brazilian merchants use crypto settlements to hedge against local currency fluctuations and connect with Asian customers already familiar with crypto payments, expanding their global reach.

B. Supply Chain Traceability

The transparency of blockchain is being adopted across industries. Costaflores Winery in Mendoza, Argentina, launched its "OpenVino" project, creating one of the world’s first open-source wineries: from grape cultivation to bottling, all data is recorded on-chain, allowing consumers to verify authenticity and sustainability practices. The winery also issues "wine-backed tokens," each representing one physical bottle.

C. Freelancers and Independent Workers

The rise of remote work has dramatically increased the number of freelancers receiving international payments. Usage of Argentine platform Takenos has surged, with many freelancers opting to receive payments in Bitcoin or stablecoins to avoid domestic currency volatility.

2.3 Government and Institutional Adoption

A. Blockchain for Public Administration

Beyond individuals and businesses, some Latin American governments are exploring blockchain to improve transparency and efficiency. For example, Guatemala uses blockchain to record votes, creating tamper-proof election ledgers to reduce fraud risks.

B. Central Bank Digital Currency (CBDC)

Brazil leads the region with its pilot "Digital Real" (DREX), aiming to modernize the financial system, lower costs, and improve transaction efficiency—especially for the unbanked.

Latin America’s crypto landscape is evolving rapidly, with growing numbers of users and use cases reflecting unique regional demands and challenges. From remittances and daily payments to inflation hedging and transparent governance, cryptocurrencies are reshaping Latin America in every dimension. Driven by both necessity and innovation, Latin America could emerge as a leader in the global crypto market, offering replicable models for the world.

III. Latin American Crypto Projects, Communities, and Investors

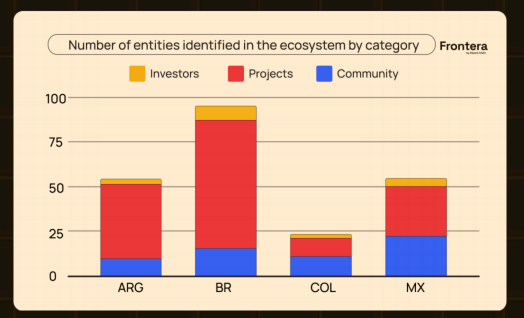

A comparison of four countries reveals a differentiated landscape in Latin America’s crypto ecosystem:

-

Brazil leads with 71 projects, 15 active communities, and strong institutional interest, boasting a complete and diversified structure.

-

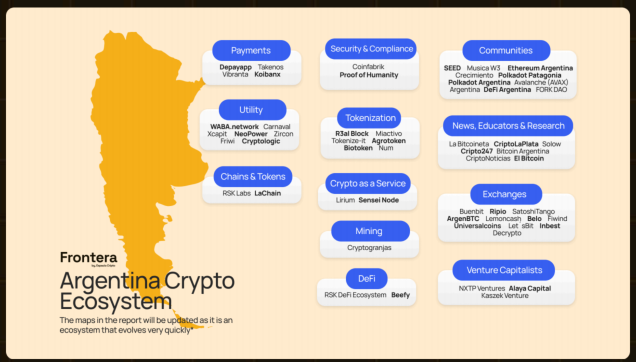

Argentina (42 projects) leverages economic hardship as an innovation incubator, particularly in asset tokenization and DeFi; smaller in scale but highly resilient and creative, producing solutions tightly aligned with local needs.

-

Mexico has 21 crypto communities—the most among the four—indicating rapid adoption growth, though project count (29) remains relatively low.

-

Colombia has only 10 projects and 11 communities, still in its infancy, requiring more capital and time to unlock potential.

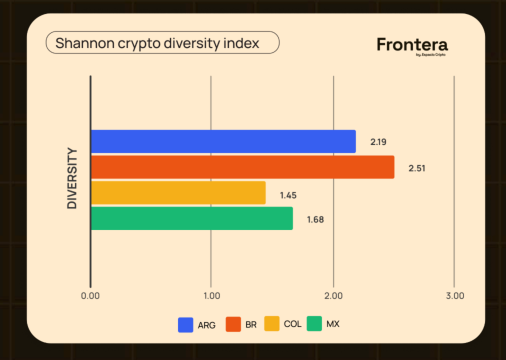

Diversity is the core metric determining the strength and potential of a crypto ecosystem. The more diverse the ecosystem—spanning projects, participants, and technical approaches—the stronger its resilience against regulatory, economic, or technological shocks. Diversity enables continuous innovation, reduces reliance on single sectors or giants, and spreads risk, making the system more robust; conversely, lack of diversity makes it fragile and slow to adapt.

The Shannon Diversity Index, borrowed from biology, quantifies this trait. It considers both "number of categories" and "distribution within categories," with higher values indicating greater balance and diversity. Typically ranging from 1–3, values >2 indicate a healthy, well-distributed ecosystem.

Calculated results for the four countries:

-

Brazil 2.51 — highest in the region, with balanced distribution across projects, communities, and investors, demonstrating the strongest resilience.

-

Argentina 2.19 — good diversity, slightly below Brazil but with rich and active dimensions.

-

Mexico 1.68 — moderate diversity, with higher concentration in certain sectors, posing single-point dependency risks.

-

Colombia 1.45 — lowest diversity, concentrated in a few fields, still in early development, with the greatest room for expansion and diversification.

In sum, Brazil and Argentina have developed balanced, diversified ecosystems with strong adaptability and risk resistance; Mexico and Colombia lag in diversity, facing challenges but also huge opportunities for improvement in future expansion.

3.1 Crypto Projects: Building What Users Need

The uniqueness of Latin American crypto projects lies in "extreme adaptation" and "local innovation." They directly respond to acute socioeconomic pain points: opaque supply chains, high financing barriers, inflation eroding savings... Entrepreneurs treat blockchain as a "patch," quickly assembling missing pieces of traditional systems—from traceable logistics to compliant DeFi, from community tokens to cross-border payments—use cases extending far beyond finance.

Beyond innovation, "collaboration" and "community" are another lifeline. Developers, investors, and users form tight networks, iterating ideas weekly, upgrading products monthly, pivoting teams overnight when market winds shift. This synergy allows Latin American projects to evolve rapidly amid turbulence.

They also look outward, proactively connecting with international capital and global nodes, leveraging external resources to scale local experiments into viable business models. Today, many projects appear in global pitch decks—not just as "Latin American stories," but as essential cases in "global赛道."

Of course, the regulatory gray rhino looms ahead. Until rules are clear, compliance costs hang overhead. But most teams have learned to "repair the ship while sailing"—preparing interfaces before legislation updates, switching modes swiftly when policies land. Ultimately, who prevails depends on the clarity of national regulatory frameworks. Brazil exemplifies the dividend of "clarity": clear top-level laws and predictable compliance checklists have attracted nearly half the region’s projects, drawing continuous capital and talent southward. In contrast, in Mexico, where regulations fluctuate or are absent, teams spend excessive energy "guessing policy," slowing innovation and prematurely welding shut the ecosystem’s ceiling.

In short: Latin American crypto projects, through a three-step leap of "pain-driven + community-accelerated + globally-integrated," have transformed geographic disadvantages into experimental advantages; next, whether they can convert regulatory uncertainty into institutional dividends will determine if they remain regional stars or become global mainstream players. As national frameworks mature, compliant projects will gain more room to grow; post-"Regulatory Arbitrage" era winners will be native Latin American projects that master global rules while deeply understanding local pain points.

3.2 Communities: Accelerating the Pulse of the Ecosystem

Communities are the core engine of Latin America’s crypto growth, playing a fundamental role. They are not just scattered groups of blockchain enthusiasts, but vibrant ecosystems deeply intertwined with the region’s diverse socioeconomic fabric. Here, passion and survival needs converge, creating a unique chemical reaction. Members include users, developers, entrepreneurs, investors, educators, and advocates who collectively push technology to its limits and drive social change.

The true distinctiveness of Latin American crypto communities lies in their origins: most began as passionate individuals convinced that "crypto can solve local problems," self-organizing from small circles into movements shaping regional discourse. They go beyond evangelism, becoming engines driving regional adoption. In Latin America, where traditional finance is limited or inaccessible, communities act as catalysts: they spread knowledge, organize events, hackathons, and workshops to accelerate blockchain adoption, and even connect startups with potential investors, democratizing opportunity. Educators and influencers freely disseminate knowledge via YouTube, Twitter, and Telegram, breaking down once-walled information into digestible Spanish and Portuguese versions, achieving knowledge equity.

Each country’s "drivers" differ: Argentina’s community centers on escaping inflation—crypto as a survival tool, not a trend; Brazil focuses on innovation and DeFi implementation; Mexico and Colombia emphasize remittances and financial inclusion. Buenos Aires, São Paulo, Mexico City, and Bogotá have become regional hubs, regularly hosting meetups, conferences, and hackathons to foster connections and collaboration.

What truly sustains community stickiness is "use," not "speculation." In Mexico and El Salvador, remittances are household economic lifelines; crypto shrinks cross-border transfers from "days" to "minutes," slashing fees to fractions of traditional channels. In remote areas beyond banking reach, communities don’t just promote digital assets—they treat them as tools to bridge the last mile of financial inclusion.

Collaboration is another core trait. These communities don’t just operate locally; they actively engage global projects, bringing new technologies, capital, and knowledge to Latin America. Simultaneously, cross-border collaboration within the region is frequent—Argentine developers, Mexican entrepreneurs, Colombian designers co-write code and launch tokens, forming a "borderless" innovation belt, making the local ecosystem more resilient through interconnectivity.

Social impact is equally significant. In regions with massive financial gaps, crypto is seen as an empowerment tool: saving, investing, and paying can bypass banks. Numerous community projects apply on-chain transparency to charitable donations and use crypto payments to support local small businesses, ensuring "technological dividends" reach corner stores and rural schools.

Conferences and hackathons serve as the community’s "offline fuel stations." Established events like LABITCONF (Latin American Bitcoin & Blockchain Conference) attract global developers, funds, and regulators annually, placing Latin America on the mainstream agenda; monthly meetups and hackathons across countries continue incubating new teams and use cases, sustaining high-speed innovation cycles.

Of course, shadows lurk beneath the enthusiasm. Regulatory uncertainty remains the biggest obstacle—divergent policies across countries often disrupt community initiatives with sudden rule changes. Yet in hyperinflation-hit nations like Argentina and Venezuela, economic collapse paradoxically becomes the best demonstration ground: communities use vivid examples like "convert salary to USDT immediately upon receipt" to turn crises into public lessons on crypto utility, showcasing remarkable resilience.

In essence, Latin American crypto communities are deeply embedded in the local socioeconomic fabric. They are not hobbyist clubs, but technology implementers, financial gap fixers, and regional innovation engines. As communities expand, they will play increasingly significant roles in the next chapter of the global crypto industry.

3.3 Investors: Funding the Future

Venture capital (VC) and various funds are decisively shaping the evolution of the crypto ecosystem, providing capital to the most innovative and disruptive startups. These investors not only inject funds into early-stage projects but also help scale operations through strategic expertise and critical resources. Collectively, they are turning their attention to Latin America: unique economic pain points, rapid penetration of crypto and blockchain, and innovative local startups form compelling reasons to "place bets." Over recent years, global top-tier firms like a16z, SoftBank, and Sequoia have heavily invested in local crypto projects, betting they can not only disrupt traditional finance but also rewrite rules across other pillar industries.

Local funds are equally indispensable. Early players like Kaszek Ventures and Monashees continuously "infuse blood" into seed rounds, helping teams turn prototypes into regionally scalable products. However, after explosive growth in 2021, with global rate hikes and tightening liquidity, 2023 marked a consolidation phase for Latin American VC. While total investment matches pre-pandemic levels, it sharply declined from 2021 peaks, with institutions becoming increasingly selective—funding only "hard" projects with clear profit paths and ability to generate internal cash flow during subsequent funding winters.

This rhythm mirrors the global trend: global VC totals peaked in 2021, then fell for two consecutive years, reaching less than half of 2021 levels in 2023, comparable only to 2020. But Latin America’s decline was steeper, with 2023 investments amounting to just 25% of 2021 levels. The reason lies in smaller market size and heightened sensitivity to global macro swings. Nevertheless, capital continues to flow in—albeit more cautiously; fintech, e-commerce and other "essential" sectors demonstrate resilience, proving Latin America retains appeal for risk capital.

As the global VC market gradually stabilizes, Latin America may see a new wave of capital inflow, especially projects addressing social and economic pain points, with solid compliance and scalable models becoming "hot commodities." In this more discerning capital environment, only teams with the strongest value propositions, lowest regulatory risks, and business models most resilient to stress tests will secure tickets to the next round.

Finally, we observe a group of traditional companies integrating crypto and blockchain into their operations, marking a significant step in digital transformation. This category includes established institutions like banks and e-commerce platforms that have integrated crypto services into existing offerings to meet market demand for more agile, decentralized solutions. Examples include:

-

Banks launching crypto custody services, allowing clients to securely store and manage digital assets;

-

E-commerce platforms directly opening crypto purchase, custody, and sale functions, delivering "one-stop" crypto experiences.

IV. Cryptocurrency Adoption Across Latin American Countries

4.1 Argentina

Argentina has become the "epicenter" of cryptocurrency adoption in Latin America—and this is no accident. Hyperinflation, the constant devaluation of the peso, and a collapse of trust in the traditional financial system have forced millions of Argentines to turn to digital assets as a safe haven. In this context, cryptocurrency is not merely an investment tool, but a means of preserving value amid extreme volatility. At the same time, a thriving local crypto community provides fertile ground for innovation and implementation of decentralized solutions. This diverse and rapidly expanding ecosystem—composed of active communities, innovative projects, and bold investors—faces significant challenges but holds immense opportunities.

Why Argentina? As the undisputed leader in crypto adoption, Argentina achieves the region’s highest transaction volume despite having only one-fifth of Brazil’s population. With a mature market, the largest active user base for real-time testing, and a globally influential cohort of blockchain application developers, the country possesses enormous entrepreneurial potential. Now is the time to leverage this momentum, position Argentina as a hub for blockchain technology and innovation, produce internationally competitive products, and further consolidate its leadership in the crypto ecosystem.

A. Community

The growth of the crypto community is the most iconic driver of Argentina’s ecosystem. They do more than educate—they build collaborative networks for exchanging ideas and launching disruptive projects. Key influential groups include:

-

Crecimiento: Focused on education and co-creation spaces, it has become a hub connecting innovators and blockchain enthusiasts nationwide. Recent large-scale events have attracted industry leaders and facilitated matchmaking between startups and investors.

-

Ethereum Argentina: A local branch of the global Ethereum network, promoting smart contracts and DApp adoption through hackathons and events.

-

Polkadot Patagonia & Polkadot Argentina: Dedicated to promoting the Polkadot ecosystem, organizing interoperability and parachain development events to strengthen national technical infrastructure.

-

FORK DAO: An emerging DeFi community committed to developing decentralized applications, positioning DeFi as a viable alternative to traditional finance.

B. Projects

Argentina’s project landscape is extremely diverse, spanning veteran exchanges to asset tokenization and DeFi platforms—reflecting entrepreneurs’ vitality in adapting blockchain across industries.

Exchanges

-

Ripio: A crypto "veteran" in Argentina, offering trading, lending, and crypto credit cards, bringing digital assets into everyday consumption.

-

Lemon Cash: Gained rapid popularity with "BTC cashback on every purchase," bringing crypto payments into countless households.

Asset Tokenization

-

Agrotoken: Tokens agricultural commodities like soybeans, corn, and wheat, enabling farmers to finance or liquidate holdings, opening new channels for agricultural finance.

-

R3al Block: Specializes in real estate tokenization, allowing high-value properties to be fractionally traded, enhancing liquidity and lowering investment thresholds.

Financial Solutions and DeFi

-

RSK Labs: Enables smart contracts on Bitcoin, with an ecosystem covering lending and stablecoins, contributing to financial inclusion.

-

Beefy: A yield aggregator that helps users earn higher returns in DeFi through automated strategies, becoming a new alternative to traditional investments.

Infrastructure

-

Coinfabrik: Provides blockchain development, security audits, and platform building—serving as the "construction crew + security team" of the local ecosystem.

-

Sensei Node: Operates blockchain nodes, enhancing network decentralization and security.

C. Investors

Despite complex economic conditions, both local and international funds regard Argentina as fertile ground for technological innovation.

-

Alaya Capital: Bets on crypto infrastructure and DeFi startups, helping evolve the financial system toward greater inclusivity and resilience.

-

Kaszek Ventures: One of Latin America’s largest VCs, focused on fintech and crypto products, driving regional ecosystem expansion.

-

NXTP Ventures: Deeply rooted in Latin American tech startups, has invested in multiple companies using blockchain to solve local pain points, helping scale projects and transform the financial industry.

D. Challenges for Traditional Companies

Regulatory and economic uncertainties leave traditional enterprises struggling. Banco Galicia, one of the country’s largest private banks, attempted to launch crypto services but was forced to halt due to direct intervention by the central bank—highlighting the absence of a regulatory framework and authorities’ hesitation toward financial institutions entering crypto.

E. Argentina’s Regulatory Developments

Regulatory Status in 2024

2024 is a pivotal year for the regulatory landscape of Argentina’s crypto asset industry. In March, Law No. 27,739 took effect, amending Law No. 25,246 (Prevention of Money Laundering, Terrorist Financing, and Proliferation of Weapons of Mass Destruction). The new law formally defines "virtual assets" at the legal level for the first time and establishes a "National Registry of Virtual Asset Service Providers (VASP)" regulated by Argentina’s National Securities Commission (CNV), allowing them to operate compliantly under anti-money laundering/counter-terrorism financing frameworks. Meanwhile, VASPs are incorporated into the national AML/CFT system and supervised by the Financial Intelligence Unit (UIF).

This institutional shift paved the way for a series of regulatory measures and opened doors for crypto and blockchain technology to enter traditional scenarios, resulting in the following milestones:

-

Establishing companies with crypto assets. Under Law No. 27,739, VASPs play a key role in Argentina’s AML system, explicitly allowing virtual assets (VAs) as capital contributions and designating VASPs as verification bodies for "crypto equity." Key points: Bitcoin and USDC were officially recognized by IGJ as legitimate capital contribution instruments, usable for company registration in Argentina; Transparent valuation: Share quantities are calculated based on the market price of the crypto asset against the peso on the contribution date.

-

Argentina’s first tax amnesty including crypto assets. On July 8, 2024, Law No. 27,743 legally defined cryptocurrencies as reportable taxable assets for the first time, as part of a one-time tax normalization and asset disclosure program. The program allows Argentine citizens to "whiten" undeclared assets up to $100,000—paying a preferential one-time tax within a specified period. Conditions: Relevant cryptocurrencies must be held in exchanges registered as VASPs with the CNV and formally declared. The new system drove a record-high crypto deposit volume in September 2024, with Bitcoin deposits reaching triple the monthly average.

-

CEDEARs for Bitcoin and Ethereum ETFs. CNV Resolution No. 1030/2024 paves the way for issuing Argentine Depositary Receipts (CEDEARs) linked to Bitcoin and Ethereum ETFs on Argentina’s capital market. Investors can gain exposure to crypto prices via CEDEARs without directly custodizing crypto assets. Like underlying ETFs, these CEDEARs must be purchased through brokers authorized by CNV and do not involve actual custody or direct rights to the underlying assets.

Regulatory Outlook for 2025

As the crypto ecosystem becomes increasingly intertwined with traditional domains like capital markets and banking, there is an urgent need for regulations that promote such integration and broader adoption and usage; any excessive regulation of virtual assets or their service providers is unnecessary. To achieve this integration, focus should be placed on the following areas:

-

Tax treatment of virtual assets. Due to outdated measures (e.g., unclear whether virtual assets fall under banking loan tax), Argentina faces numerous challenges in taxing virtual assets. Law No. 27,743 took a step in the right direction by including these assets in asset normalization and disclosure programs for the first time, but inequality compared to other investment tools persists.

-

Tokenization of real-world assets. Tokenization of stocks, financial assets, and real estate requires regulatory updates to leverage blockchain’s efficiency and security for issuing, trading, and verifying ownership in digital form. This process is underway in multiple countries, enabling more agile, secure, and efficient access to investment opportunities. To advance this, the Argentine FinTech Chamber drafted a reform proposal advocating separate treatment of tokenized assets from traditional regulatory frameworks. The document emphasizes that blockchain, through features like distributed registries, verifiability, transparency, and immutability, can provide safeguards equivalent to traditional mechanisms; and highlights that smart contracts governed by autonomous rules—including lock-up/vesting clauses and automatic dividend distributions—can be utilized. This approach brings benefits such as enhanced liquidity, asset fragmentation, reduced intermediary costs, and truly inclusive investment access.

-

Building national strategic reserves with Bitcoin or virtual assets. Another key development this year was the submission of a draft bill proposing that Argentina’s Central Bank (BCRA) be allowed to buy, store, and mine Bitcoin, suggesting allocating part of central bank reserves to this cryptocurrency. Currently, BCRA’s charter does not explicitly address crypto mining; regarding purchasing crypto assets, existing regulations permit trading "financial assets" but do not clarify whether this definition includes cryptocurrencies.

-

Buenos Aires Crypto Economic Zone. In 2024, Argentina further solidified its status as Latin America’s crypto capital, attracting hundreds of startups, companies, and global developers to Aleph Tech Hub in Buenos Aires, known as "Ciudad de Crecimiento" (City of Growth). This was achieved by implementing a tailored regulatory framework with dedicated tax, labor, and social security systems, alongside infrastructure incentives, legal certainty, and investment incentives for this inherently borderless technology.

F. Challenges and Opportunities

With Javier Milei taking office, Argentina’s crypto ecosystem stands at a "crossroads." Milei publicly supports cryptocurrencies and proposed the first legalization plan, allowing taxpayers to declare crypto assets without additional proof. If he advances bold and progressive regulatory frameworks, Argentina could protect consumers and lead the region. However, macro indicators remain volatile, and economic instability keeps investors cautious. Once policies successfully mitigate risks, capital confidence and inflows could rebound rapidly. Strong demand for DeFi and asset tokenization, combined with Argentina’s innate entrepreneurial spirit, could spawn a new generation of market disruptors.

G. Future Outlook

Under Milei’s administration, Argentina’s crypto prospects will be rollercoaster-like. If regulation becomes clearer and friendlier, international capital may flood in, solidifying its status as the "crypto capital of Latin America." Should it overcome both regulatory and macro hurdles, Argentina could occupy a key position in the global crypto landscape, becoming a trendsetter and focal point for the Spanish-speaking world.

4.2 Brazil

Blockchain is penetrating every corner of Brazil at an astonishing pace—from Rio de Janeiro’s beaches to the most digitized favelas, cryptocurrency is everywhere. Economic factors like inflation and financial exclusion are jointly driving this "silent revolution": a once-niche sector has become an unstoppable mass movement.

The key driver behind this is Brazil’s crypto regulatory framework. Enacted in December 2022 and formally effective June 2023, it marks a milestone in Latin America: the Central Bank of Brazil (BCB) gains authority to regulate virtual asset service providers, while token projects deemed securities fall under the oversight of the Securities and Exchange Commission (CVM). The new regulations not only protect consumers but also set a benchmark for the region, potentially accelerating neighboring countries’ efforts to establish their own frameworks.

A. Community

Brazil’s crypto community operates like a constantly roaring engine, fueled by passion and the desire for change.

-

Blockchain Rio: An annual conference gathering developers, enterprises, and enthusiasts, serving as Latin America’s most important on-chain "social magnet."

-

Ethereum Brasil: Injects continuous momentum into smart contracts and DApps through hackathons and major events.

-

Praia Bitcoin: Brings Bitcoin lectures to the beach, truly "sunbathing" crypto into daily life.

-

Other active local nodes: Portuguese-language communities exist for ecosystems like Polygon, Solana, and Polkadot, creating a multi-chain "samba rhythm."

B. Projects

Brazil is fertile ground for crypto entrepreneurship, where creativity and courage thrive.

Exchanges

-

Mercado Bitcoin: The largest in the country and a benchmark in Latin America, pioneering asset tokenization and raising $200 million in a Series B round from SoftBank in 2021.

-

Mynt (BTG Pactual): A retail gateway launched by an investment banking giant, with traditional institutions directly entering the space.

Asset Tokenization

-

Liqi: Fragments real estate, equity, and agricultural startups onto the blockchain, turning high-barrier assets into tokens purchasable for 100 reais.

-

Amfi: A compliant token issuance platform with successful cases in hotel revenue rights and private equity.

Stablecoins

-

M^0 (M-Zero): A multi-issuer "decentralized crypto dollar" allowing minting against qualified collateral, reducing single-point risks, aiming to become an "on-chain Fed" for emerging markets.

Financial Solutions and DeFi

-

Hashdex: A pioneer in crypto ETFs, bringing 300,000 traditional investors into crypto via BITH11 (Bitcoin ETF) and HASH11 (Metaverse ETF).

-

Picnic: A one-stop DeFi gateway aggregating yield, staking, and insurance, featuring a "Brazilian Alipay"-style interface.

Infrastructure

-

Parfin: Offers Crypto-as-a-Service, providing custody, liquidity, and matching APIs for banks and brokers, serving clients like Itaú and BTG.

-

Cointrader Monitor: Real-time pricing, depth, and arbitrage radar—an essential "market intelligence tool" for local traders.

-

Atomic Fund: A market maker ensuring depth for local exchanges like Mercado Bitcoin and Foxbit.

-

Arthur Mining: A hydropower + solar-powered mining farm with PUE<1.05, fully embracing ESG narratives.

C. Investors

-

Canary: A $200 million early-stage fund that backed Hashdex, Liqi, and Picnic.

-

Monashees: A veteran Latin American VC heavily invested in DeFi and blockchain infrastructure.

-

Valor Capital Group: Focuses on cross-border fintech, channeling long-term U.S. LP capital into Brazil’s on-chain world.

D. Traditional Enterprises Enter the Space

Brazil’s traditional enterprises embrace crypto for both strategic and market

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News