Exploring Top Funds and Alpha: Which Sectors Are Worth Investing In?

TechFlow Selected TechFlow Selected

Exploring Top Funds and Alpha: Which Sectors Are Worth Investing In?

From a primary market perspective, appreciate the builders' dedicated efforts and strategic positioning.

Written by Jessica, Aaron, Rosie @A&T Capital

Summary: The Web3 market has entered a winter season, yet builders continue to work and invest persistently. Which sectors remain hot? What projects have top-tier funds invested in during this bear market? A&T Capital analyzed cryptocurrency market funding data from May 1, 2022 to August 13, 2022, summarizing primary market funding trends, Alpha & Beta project dynamics, and key investment preferences of leading institutions.

Table of Contents

-

Overview of Primary Market Funding Data

-

Summary of Alpha & Beta Project Trends

-

Investment Preferences of Select Leading Institutions

-

Investment Summary

Preface

First, let's define the investment directions covered in our research.

-

Layer 1 includes scaling solutions for the data layer, network layer, consensus layer, and incentive layer. Typical examples include Avalanche, Solana, etc.

-

Layer 2 includes contract-layer projects, with typical examples such as Perpetual Protocol, Scaling, etc.

-

The application layer covers 21 distinct industry categories, specifically including:

Web Builder: Refers to web3 network and blockchain construction services, distinguished from infrastructure

Legal: Compliance services

Environment: ESG-related services

01 Overview of Crypto Primary Market Financing

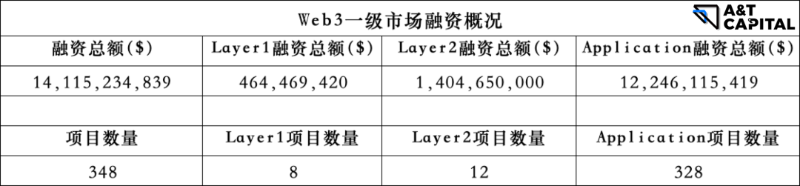

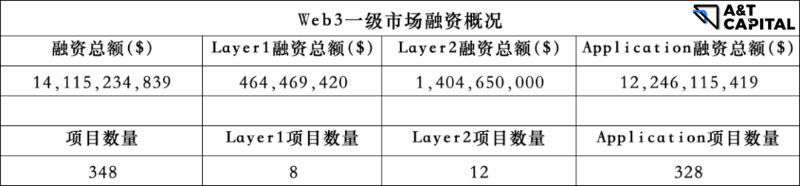

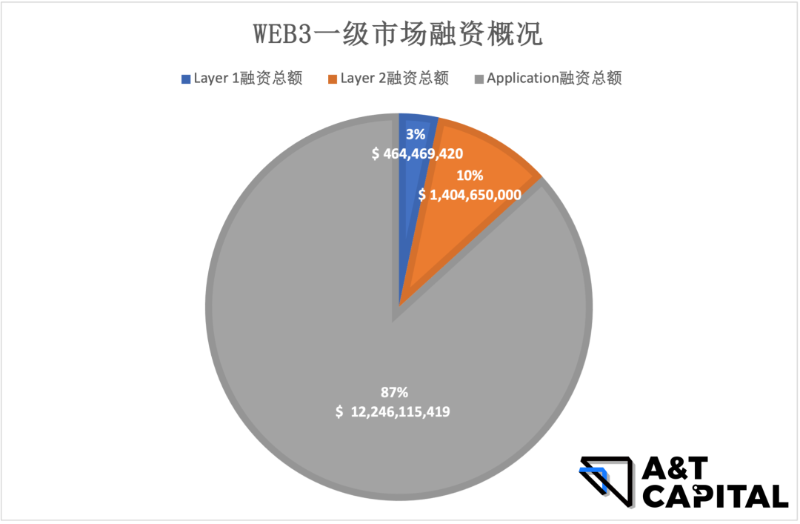

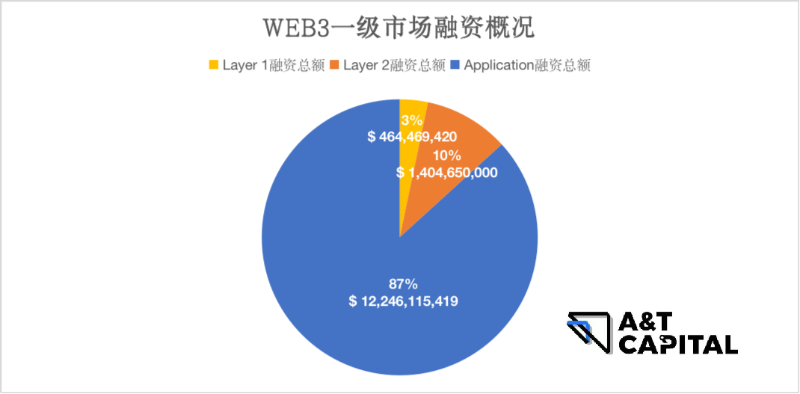

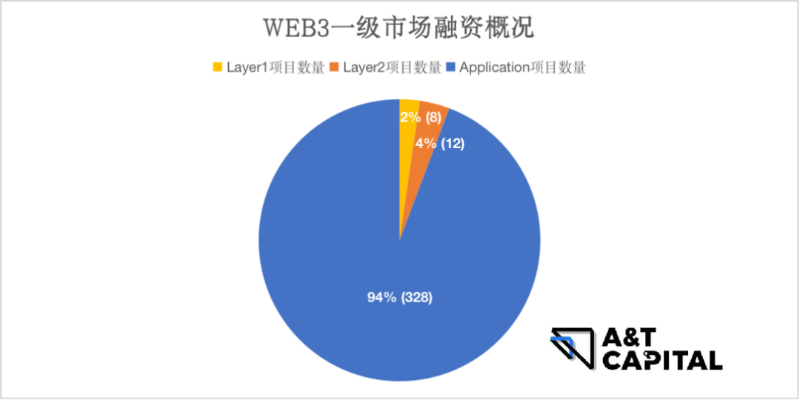

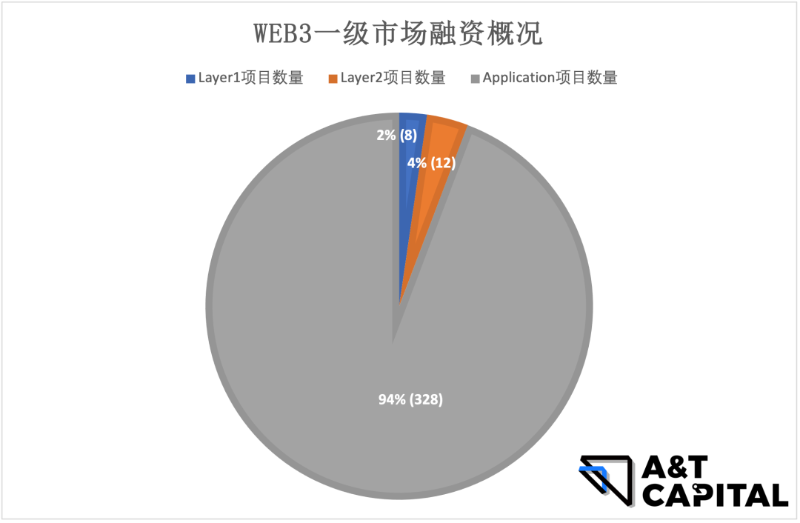

Based on the above statistics, the application layer received the most capital attention in the Web3 industry between May 1, 2022 and August 13, 2022, hosting the highest number of funded projects: 87% of funds flowed into the application layer, and 94% of financing events occurred at this level.

1.1 Layer 1

-

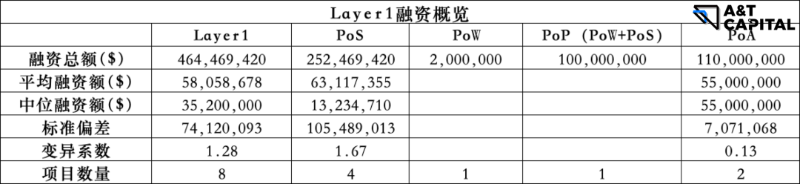

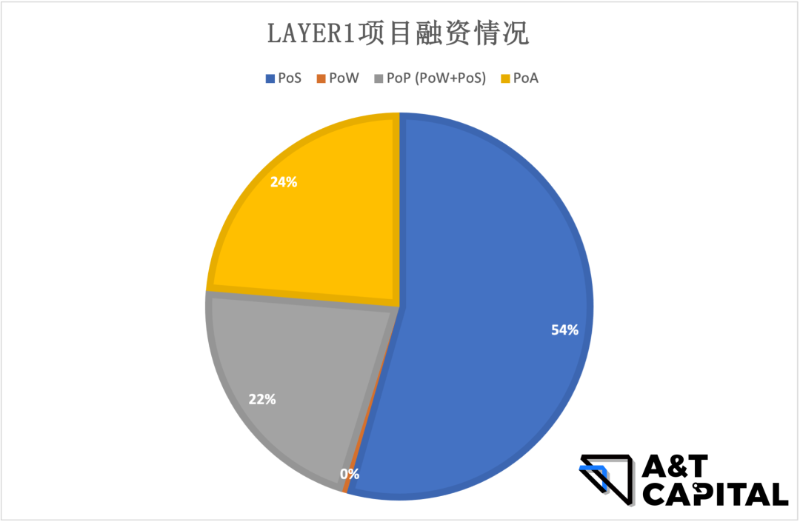

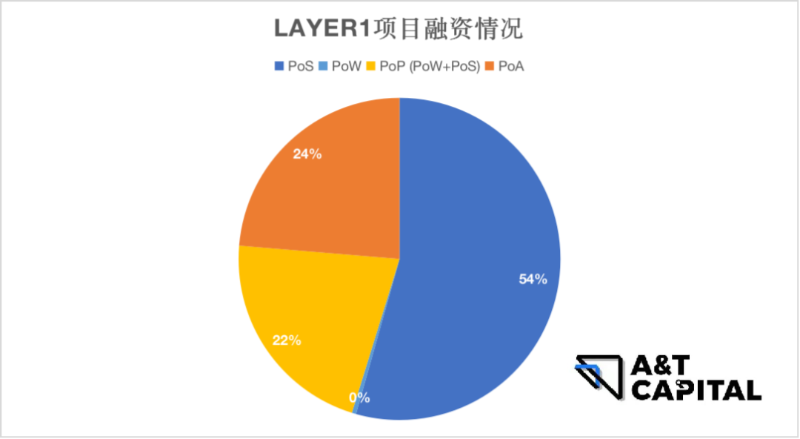

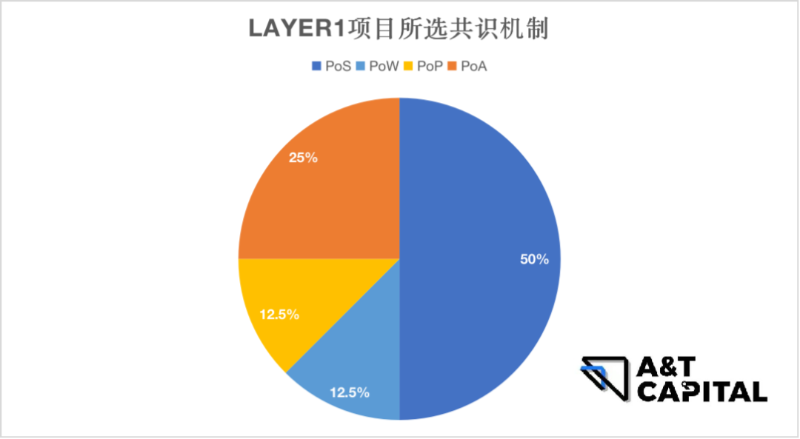

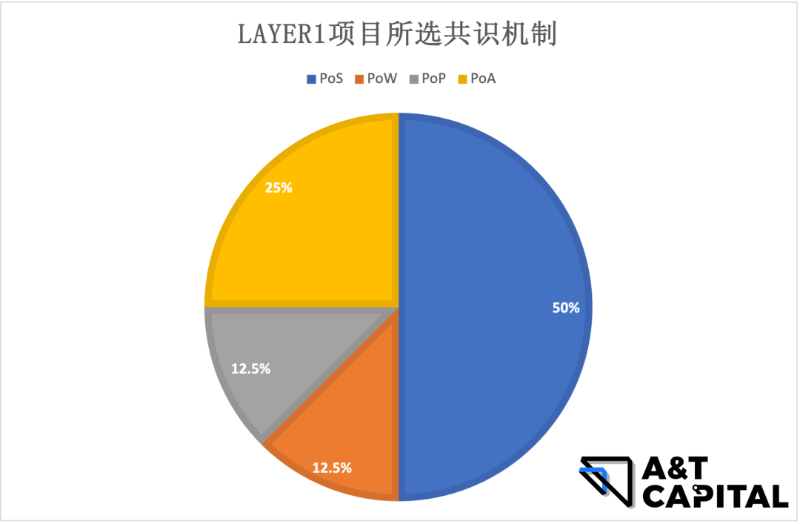

PoW accounts for a very small proportion, with funding less than 1% of total raised capital: This reflects widespread recognition of PoW’s numerous issues—excessive energy consumption, inefficiency at scale, and high hardware costs that foster capital-intensive mining operations and centralization trends. As a result, capital increasingly favors models beyond PoW.

-

PoS dominates Layer 1 fundraising, accounting for about 50% of total amounts raised, clearly outperforming other categories. Market sentiment strongly favors PoS Layer 1s due to their lower energy consumption, higher scalability, and greater transaction throughput compared to PoW.

-

PoP (hybrid PoW/PoS model): Accounts for 22% of total funding

Hybrid mechanisms combine advantages of both PoW and PoS

Avoids 1. centralization 2. security risks 3. MEV risks 4. DoS risks associated with pure PoS protocols

Also avoids PoW’s high energy consumption and low performance

-

PoA accounts for approximately 25% of funding. This model ensures speed and high performance without compromising security. While differing from traditional blockchain operations, it offers an emerging solution potentially ideal for private blockchain applications.

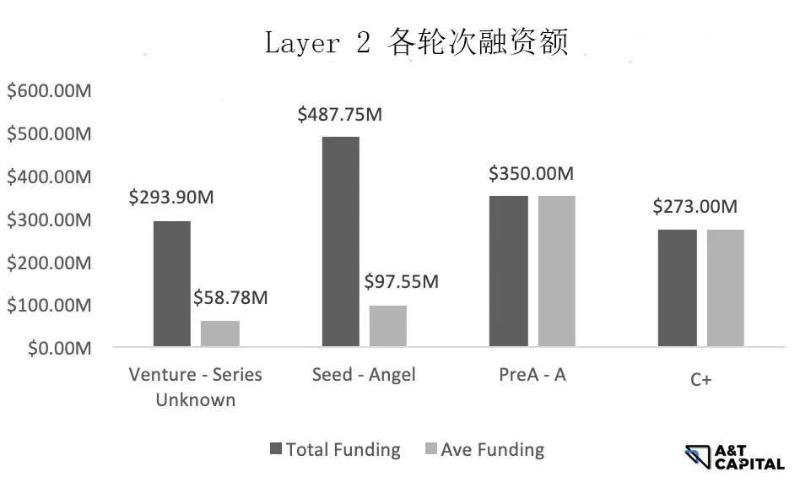

1.2 Layer 2

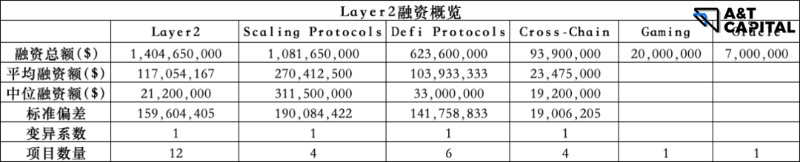

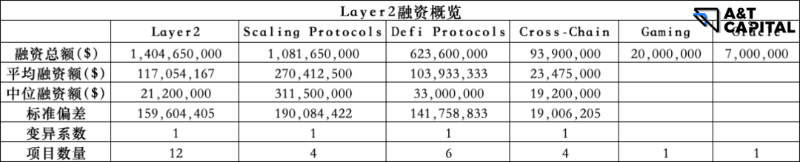

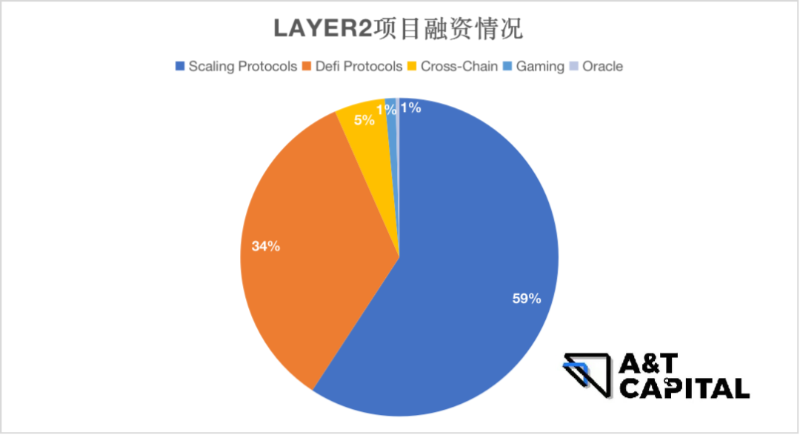

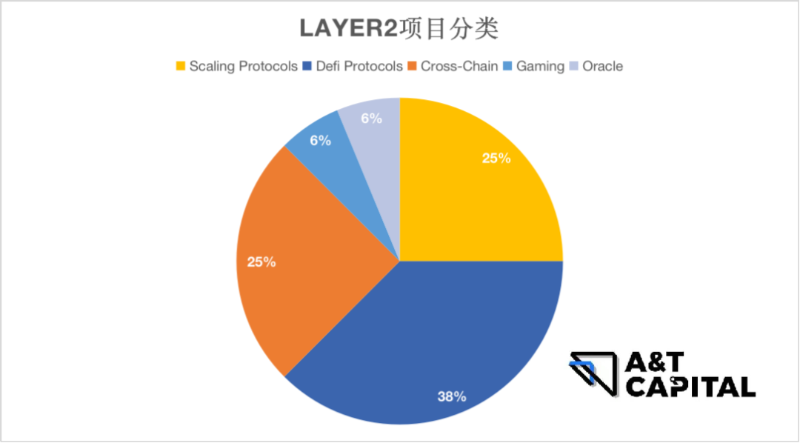

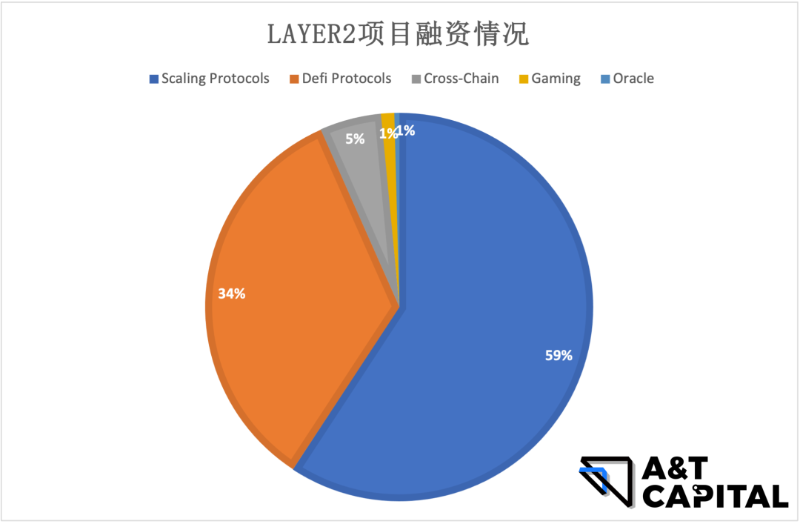

Overall, Scaling Protocols and DeFi Protocols show stronger fundraising performance.

-

Scaling Protocols

Investment firms are increasing bets across the entire scaling protocol sector

Market demand for scaling solutions is rising due to higher gas fees, TPS requirements, and latency concerns

-

DeFi Protocols

The DeFi Protocols sector overall attracts significant attention (34%)

66% of projects focus on cross-chain protocols (DEX cross-chain aggregators), but they underperform in funding amount, representing only 11.5% of total raised capital

Within DeFi Protocols, infrastructure accounts for 56% of funding, stablecoin lending protocols account for 32%

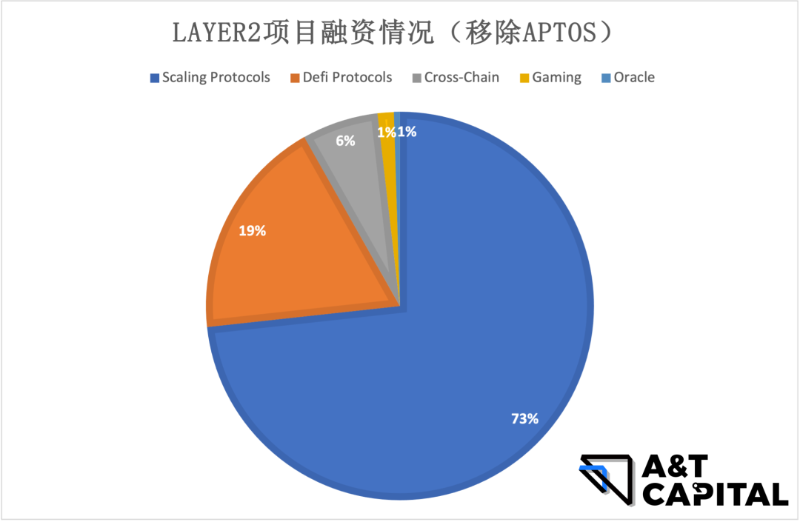

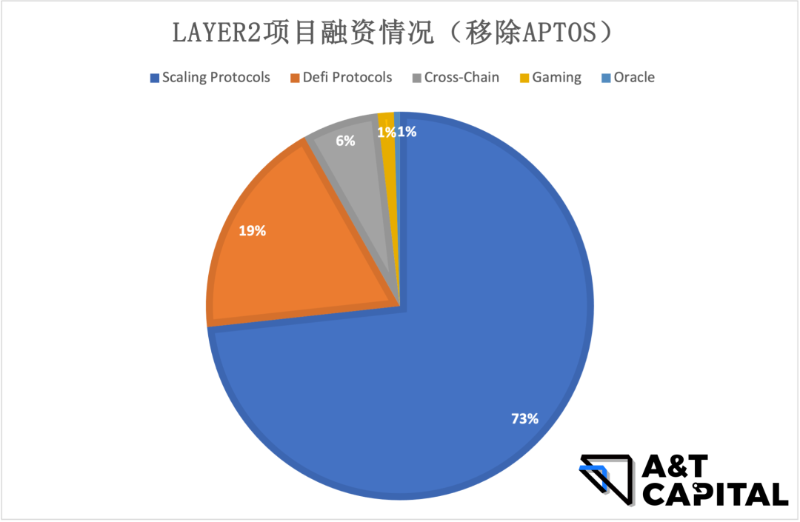

Aptos serves as an alpha outlier. Removing Aptos from DeFi Protocols reduces the sector’s funding share to 19%, indicating cooling interest. In contrast, Scaling Protocols dominate with an overwhelming majority (73%), becoming the most prominent trend.

-

Oracle

Very few Oracle-focused projects received funding, representing just 1% of total L2 funding. Possible reasons: 1) Lack of innovation in Oracle concepts; 2) Limited applicability requiring real-world data (e.g., insurance/real estate), whereas popular sectors like GameFi and NFTs generally do not require Oracles.

-

Gaming

GameFi has stricter demands on transaction speed and gas fees compared to other sectors like DeFi. General-purpose Layer 2 solutions offer potential scalability, but within our research scope, we observe dedicated protocols built specifically for GameFi. This suggests GameFi applications may have unique needs unmet by generic Layer 2s—an area worth further exploration.

1.3 Application Layer

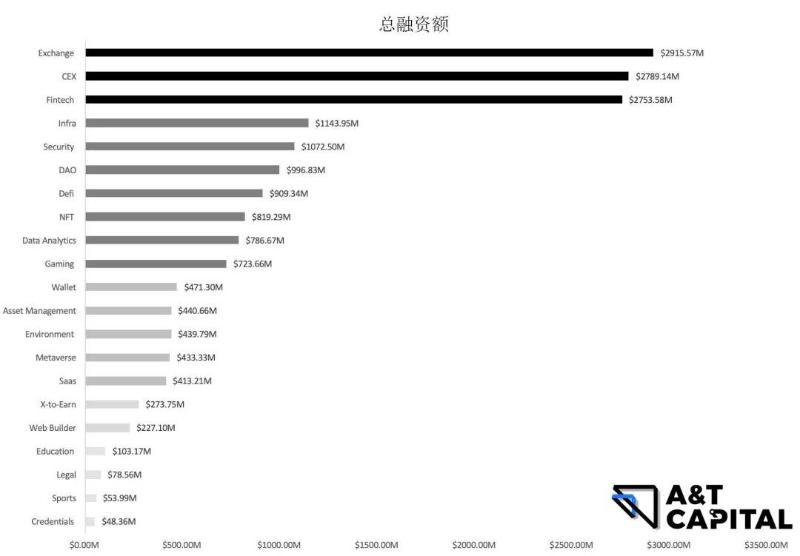

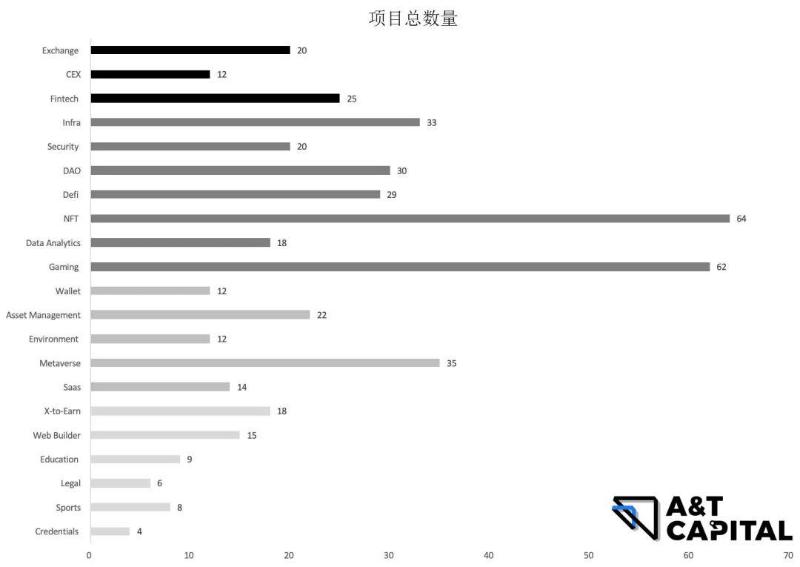

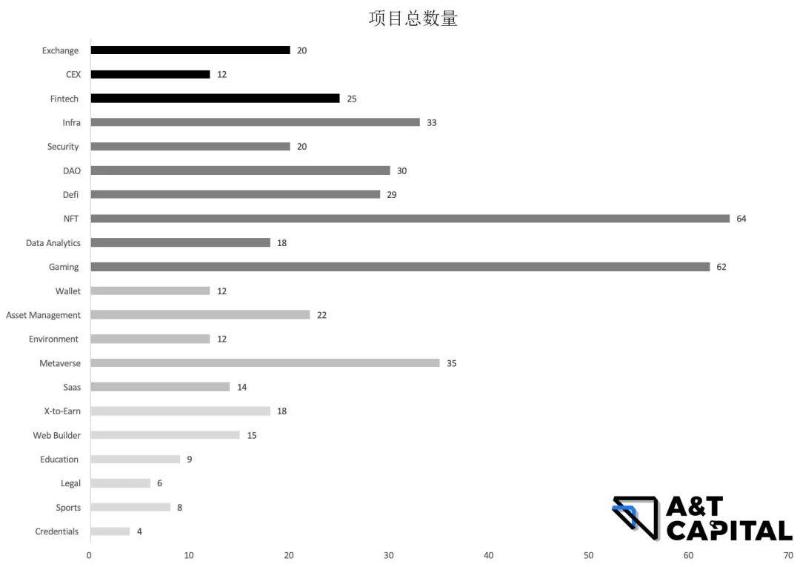

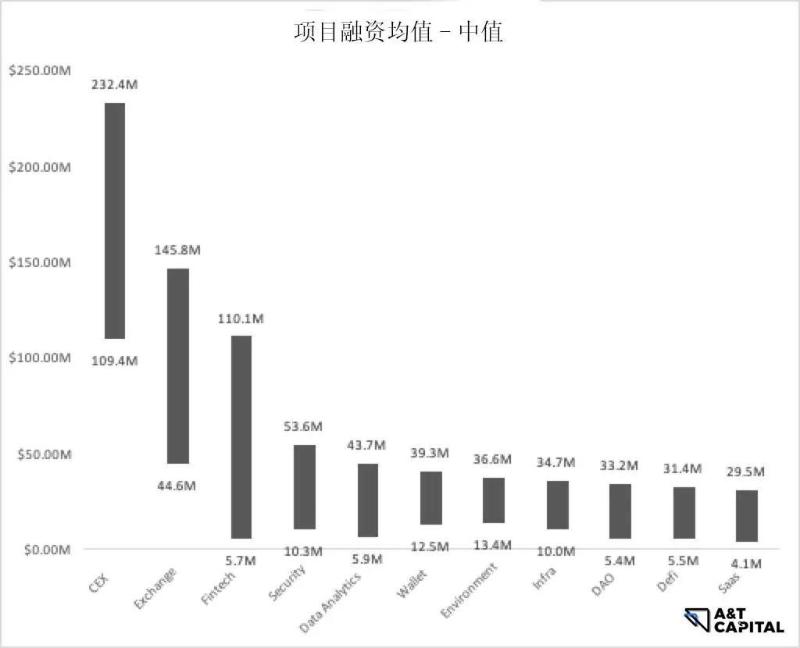

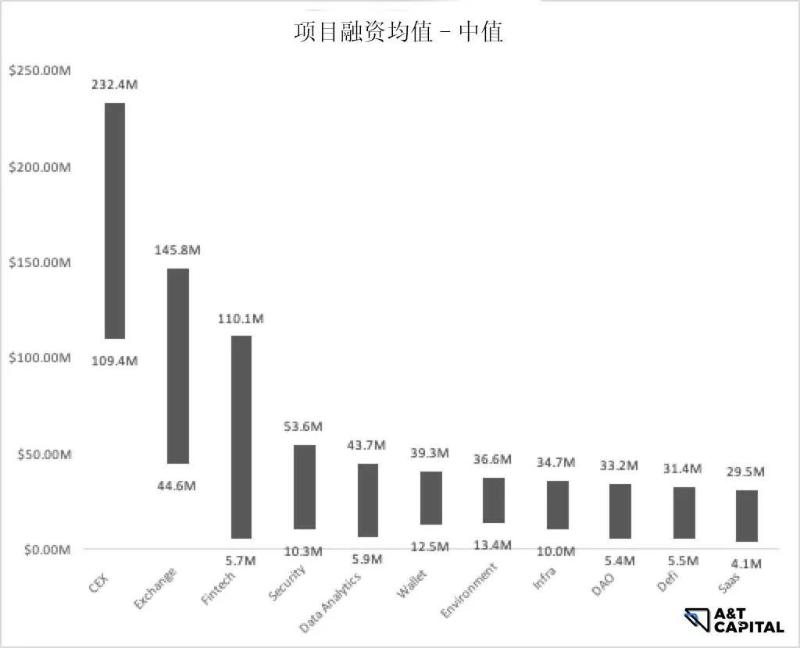

As shown above, exchanges and fintech together account for 47% of funded projects, while all others remain below 6%, with relatively even distribution.

Major Trend (Overall)

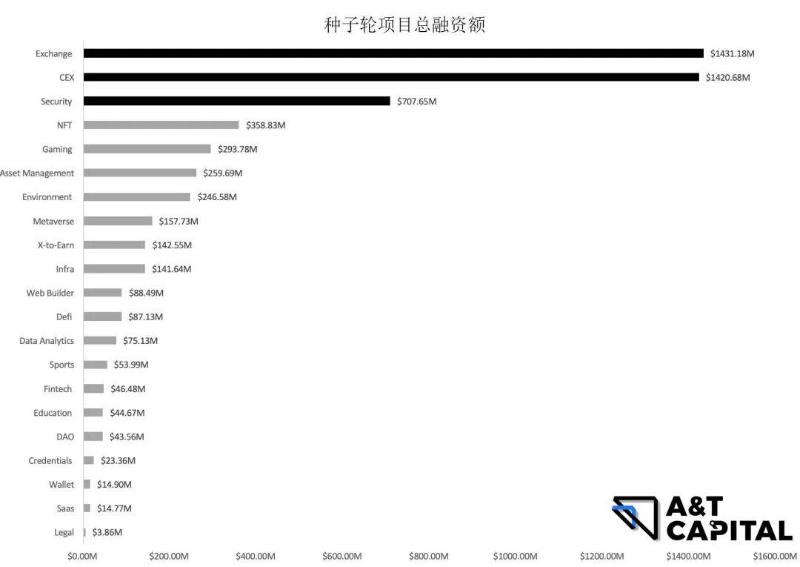

Top three categories by funding amount: Exchange, Centralized Exchange, Fintech.

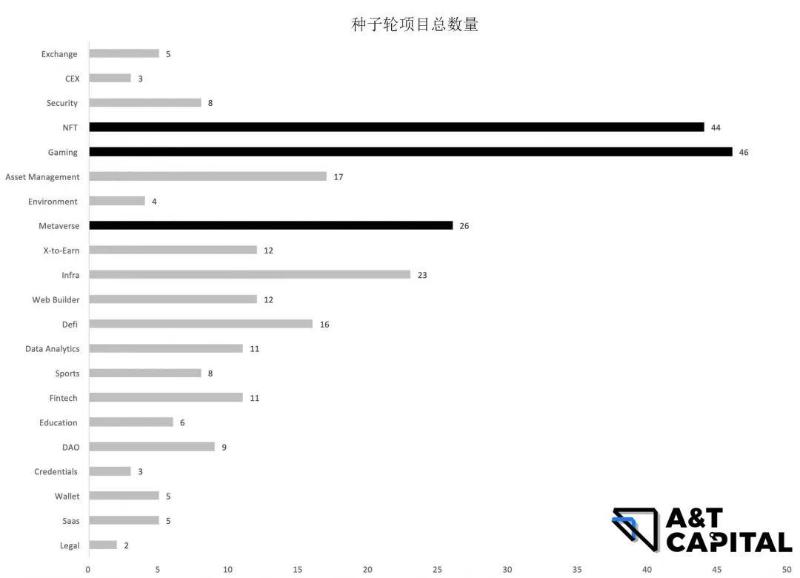

Top three categories by number of funded projects: NFT, Gaming, Metaverse.

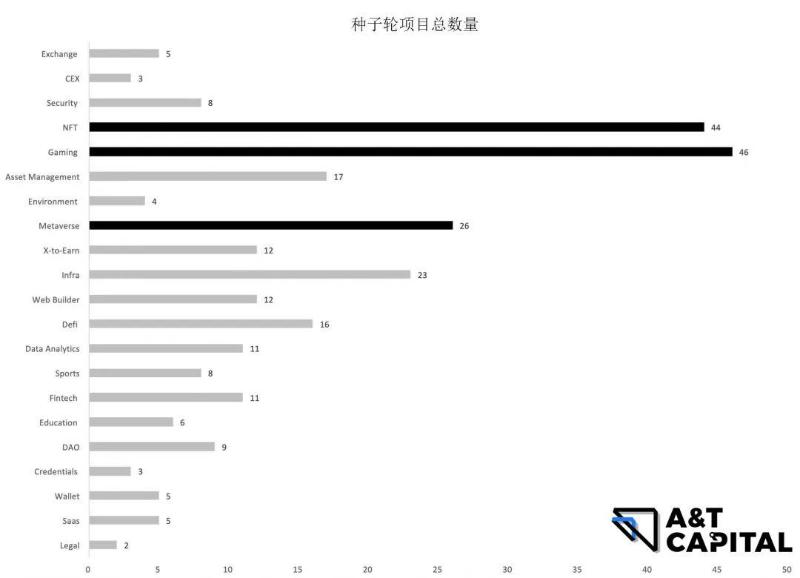

New Trend (Pre-seed to Pre-A Rounds)

As shown in the charts, top three categories by number of seed-funded projects: Gaming, NFT, Metaverse. Top three categories by seed funding amount: Exchange, Centralized Exchange, Security.

1.4 Summary

-

Layer 1 – PoS and hybrid chains are the dominant trends. Growing attention to hybrid chains indirectly indicates increasing awareness of potential security issues with PoS, prompting efforts to find balanced solutions combining security and efficiency.

-

Layer 2 – General-purpose scaling protocols are the main trend, with emerging interest in industry-specific Layer 2 chains.

-

Application Layer – Both major and emerging trends favor projects capable of short-term listing on secondary markets. A notable new direction gaining traction is security.

02 Alpha & Beta Trends

2-1 Alpha

First, defining Alpha:

Alpha market characteristics involve transaction-driven funding. Projects exhibiting Alpha must significantly outperform peers within the same layer category. In this report, Alpha projects are defined as those raising more than twice the average funding within their respective赛道.

2-1.1 Layer 1

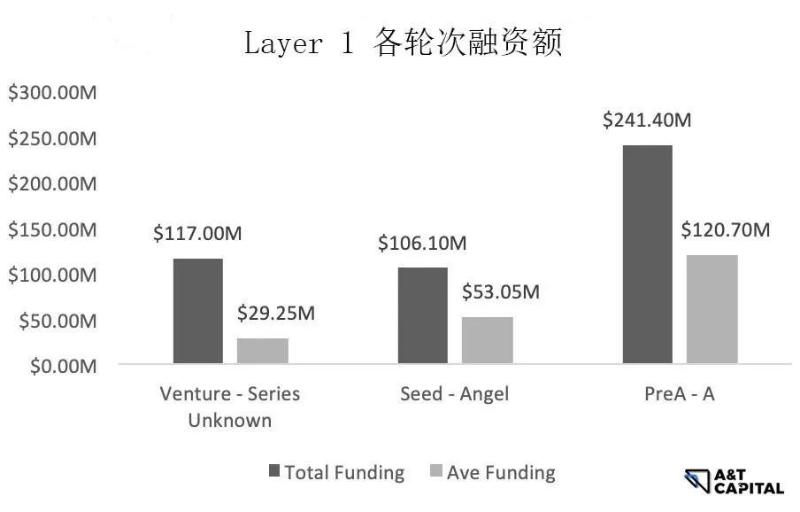

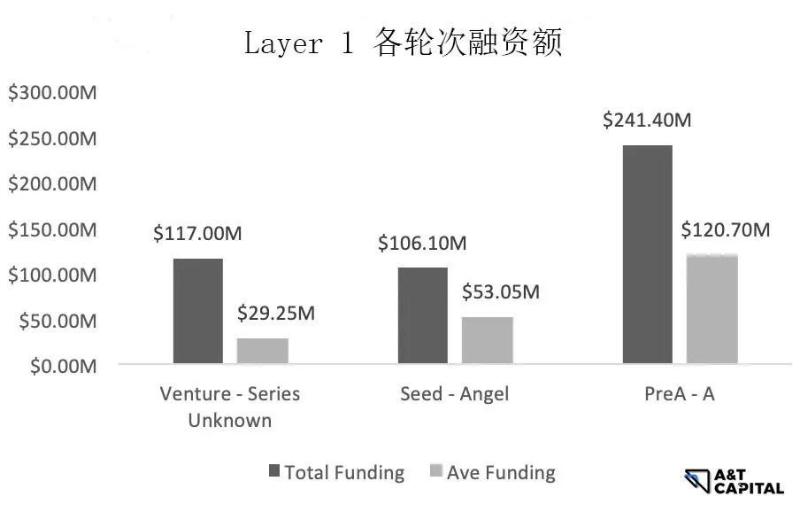

As shown in the charts, no Alpha is observed in Layer 1.

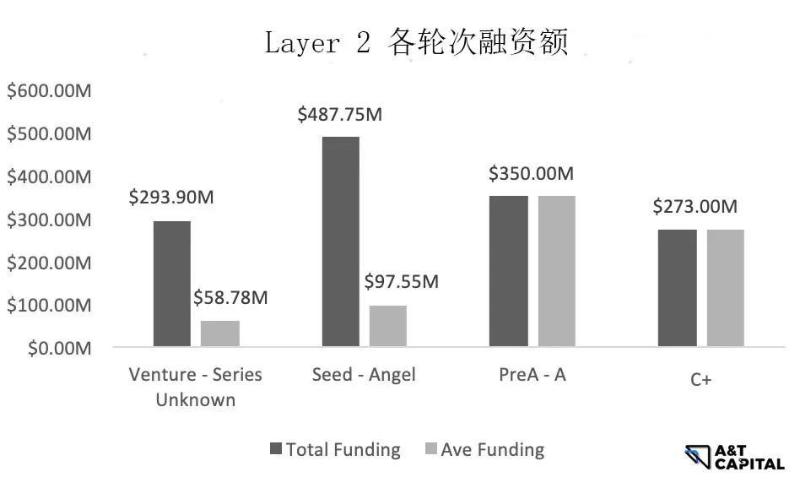

2-1.2 Layer 2

As shown, Alpha exists in the Seed-Angel stage of Layer 2, where Polygon stands out as the alpha project. No Alpha is found in later stages such as Pre-A to Series C or beyond.

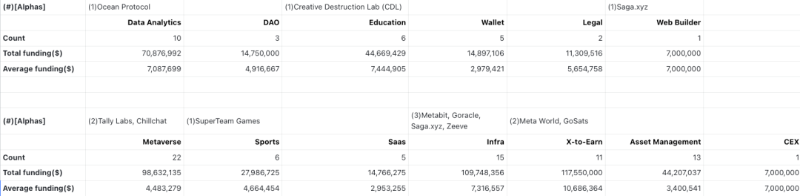

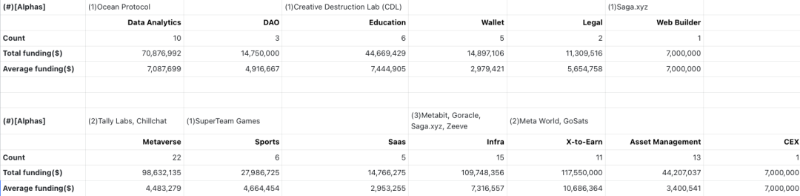

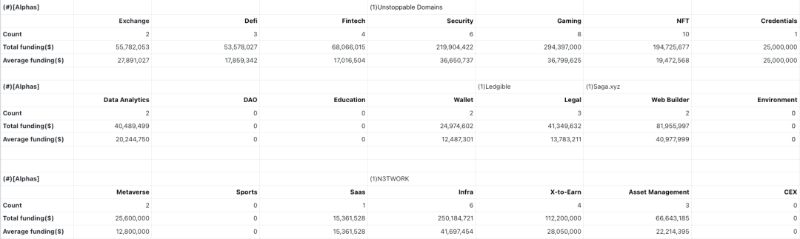

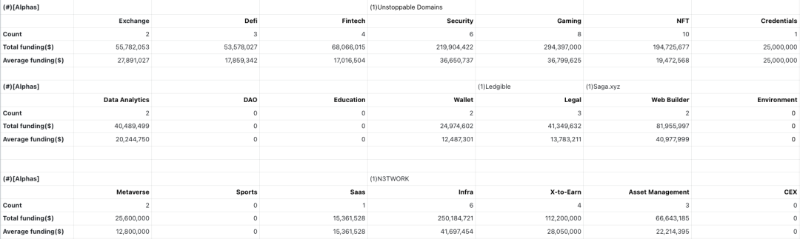

2-1.3 Application Layer

-

Seed-Angel

-

PreA-A

-

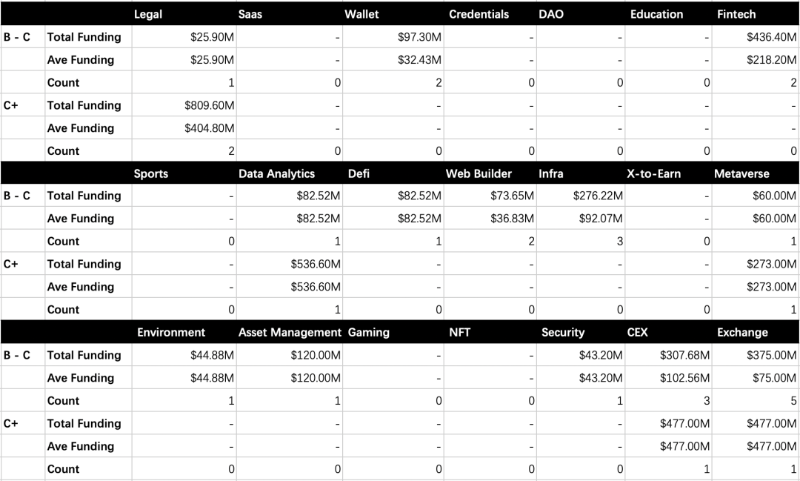

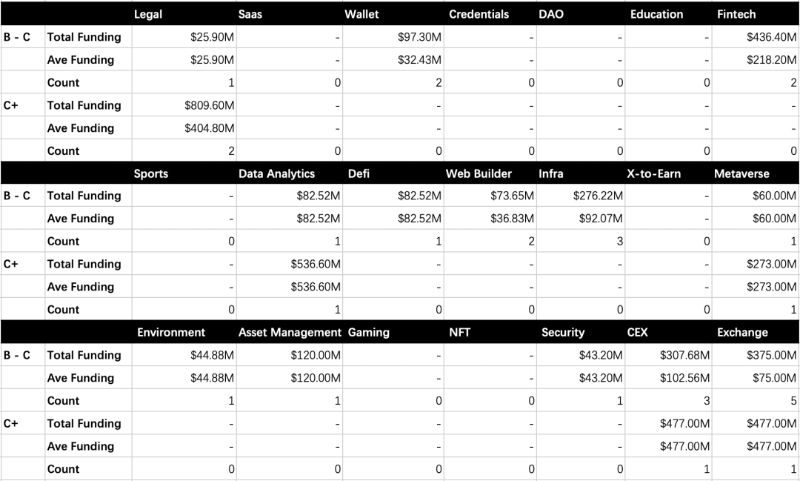

B-C & C+

2-2 Beta

Defining Beta:

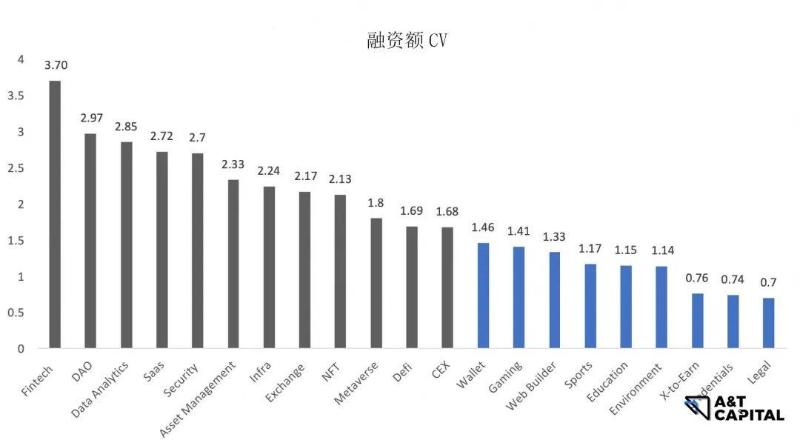

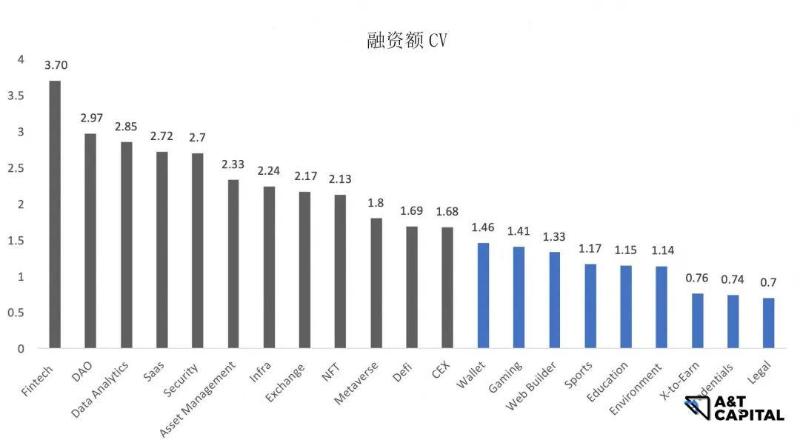

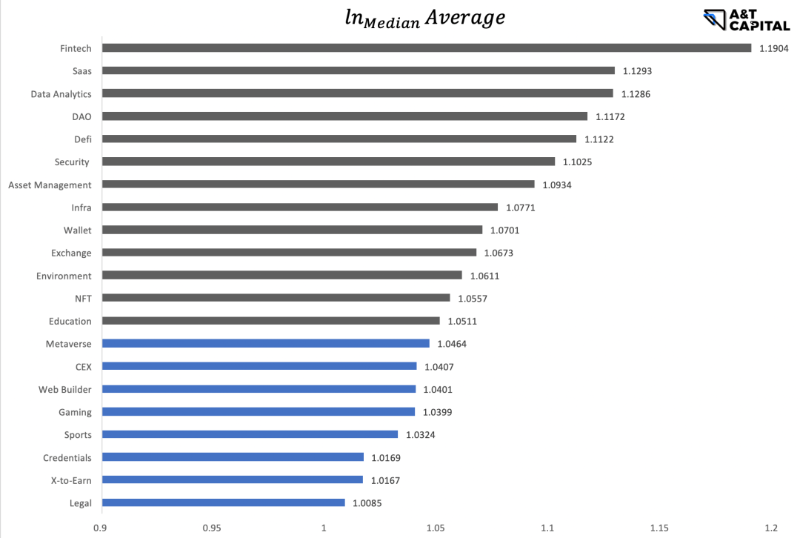

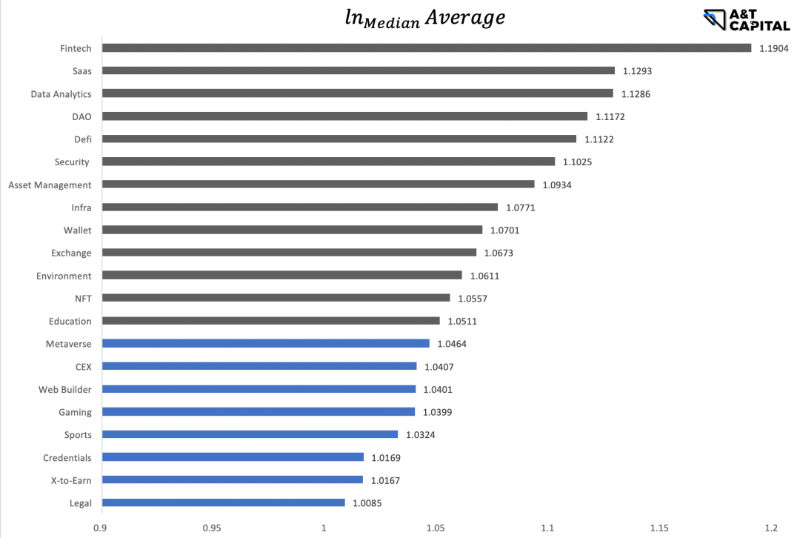

Beta market characteristics involve market-driven funding. Beta measures whether the market broadly favors a particular industry or technology category. Sectors with Beta attributes generally perform well in fundraising. Statistically, a lower coefficient of variation (CV) indicates less dispersion in funding, suggesting stronger beta characteristics. We further validate this using the difference between mean and median values. Markets with CV < 1.5 and log(average)/log(median) < 1.05 are considered to exhibit Beta traits.

2-2-1. Layer 1 & Layer 2

Too few data points for statistical significance. Overall, Layer 1 and Layer 2 are high-funding, high-interest areas. When segmented by technical type, funding amounts do not vary significantly.

2-2-2. Application Layer

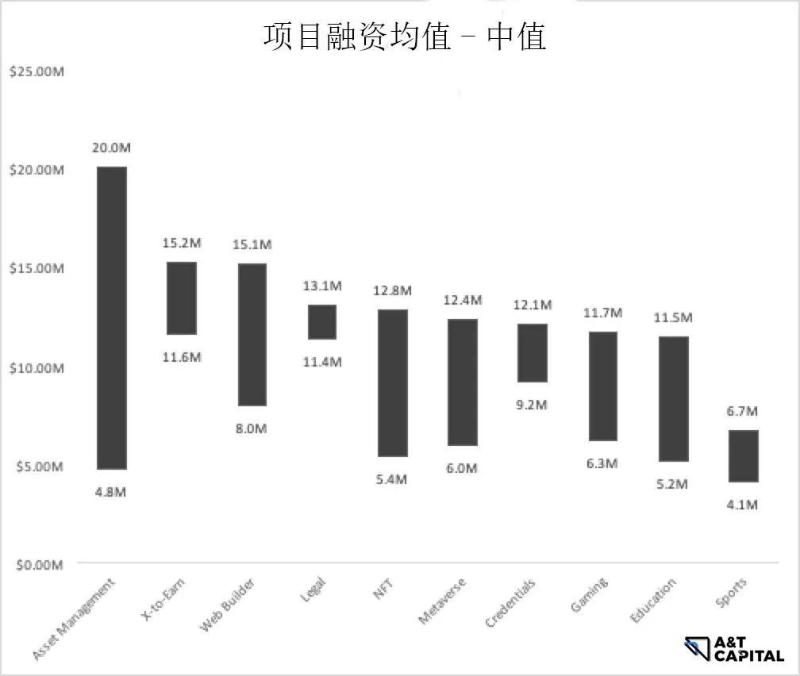

From the perspective of low dispersion (CV < 1.5), potential Beta markets include Wallet, Gaming, Web Builder, Sports, Education, Environment, X-to-earn, Credentials, and Legal. However, given quarterly data limitations affecting CV reliability, we cross-validate using Average vs Median comparisons below.

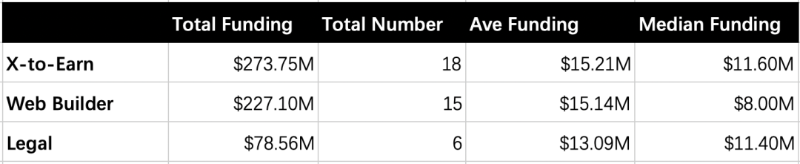

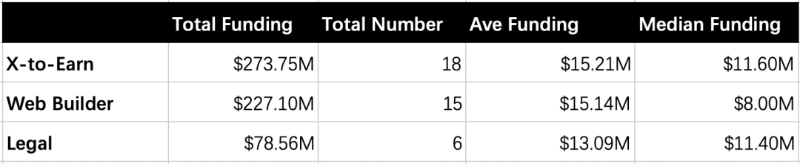

As shown, X-to-earn, Web Builder, and Legal are confirmed Beta sectors. Their specific funding data is shown below.

2-2-3. Summary

Within the application layer, using dual-method validation, X-to-earn, Web Builder, and Legal are identified as having clear Beta attributes.

03 Investment Preferences of Select Leading Institutions

3.1 Digital Currency Group

DCG invested in 10 projects total. No stage preference—investments spanned from seed to Series F. DCG’s only Layer 2 investment was Polygon; the remaining nine were all application-layer projects. Among these nine applications, preference ranking (high to low):

-

Wallet (including wallets built into exchanges)

-

Security (code audits, threat detection)

-

Analytics tools (data analysis, tracking, alerts)

3.2 A16Z Crypto

A16z Crypto made two application investments, both at the seed stage. Both were platform-type projects:

-

Creator platform aggregating creators, helping them tokenize original works

-

NFT pledging platform enabling players locked out of high-entry-barrier games to access them via NFT loans, eventually owning the NFT after completing payments through the platform

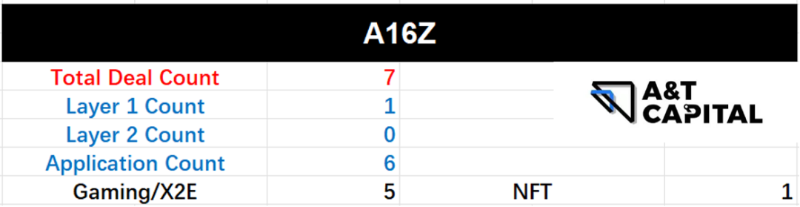

3.3 A16Z

A16Z invested seven times, including one Layer 1 project—Aptos—and six application projects.

Among the six application investments: two seed rounds, four Series A rounds. Focus areas:

-

Five gaming/x-to-earn projects

-

One NFT project

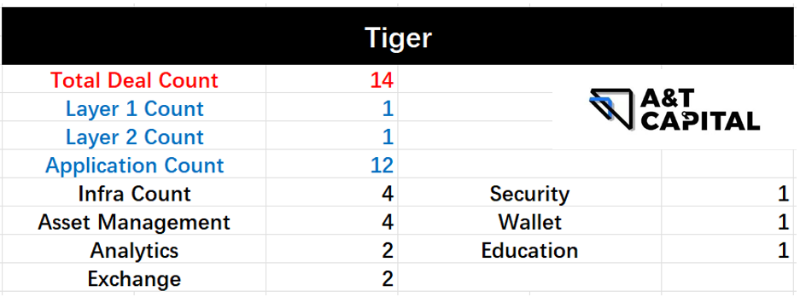

3.4 Tiger

Tiger invested 14 times: one Layer 1 (Aptos), one Layer 2 (Polygon), and 12 application projects. Investment stages ranged from seed to Series D, showing no stage bias.

Among the 12 application investments, preference ranking (high to low):

-

Four infrastructure projects: staking service, DID, deployment platform

-

Four asset management projects

-

Two analytics, two exchange projects

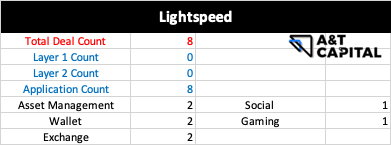

3.5 Lightspeed

Lightspeed invested seven times

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News