Lightspeed Partner: Which sectors could give rise to killer crypto consumer applications?

TechFlow Selected TechFlow Selected

Lightspeed Partner: Which sectors could give rise to killer crypto consumer applications?

9 areas where crypto-native products have seen widespread adoption (wallets, NFT marketplaces) and several emerging sectors with strong potential to go mainstream soon.

Author: Mercedes Bent, Partner at Lightspeed

Translation: TechFlow intern

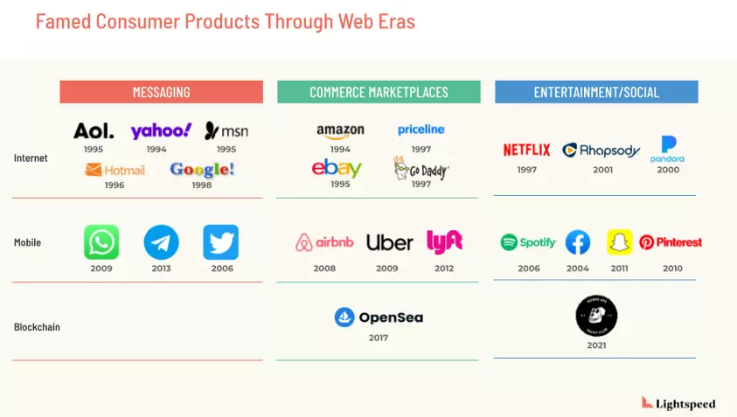

Every major technological shift eventually gives rise to a new wave of consumer tech companies. The emergence of the internet brought us information apps like AOL and Yahoo, online marketplaces such as Amazon and eBay, and entertainment services like Netflix and Pandora. The mobile transition led to the rise of Twitter, Uber, Facebook, and Snap.

We are now on the cusp of a third major structural shift—toward blockchain-based applications and services (Web3). Blockchain’s potential is immense, as it addresses many of the current internet’s issues around identity, transparency, and trust.

Today, crypto consumer tech companies are being driven by applications in art, music, and sports. Despite some cultural traction, beyond Coinbase, OpenSea, Yuga Labs/BAYC, and Metamask, few projects have achieved widespread brand recognition or become household names.

Why?

One reason is that blockchain apps reached mainstream audiences too early. In crypto, user motivation has largely been economic incentives and ownership. In contrast, successful consumer products tap into core human behavioral drivers: the need for meaning, connection and influence, self-expression and creation, a sense of security and belonging, social impact, stimulation, dopamine, achievement, and building.

This is what makes consumer products so unique—and difficult to build. You have mere seconds to capture attention, and even harder is driving repeat usage and sustained engagement once you’ve got it.

Building enduring crypto brands that meet these needs is both a challenge and an opportunity. Crypto-native companies will need to navigate how much average consumers value decentralization and whether it comes at the cost of user experience. Meanwhile, crypto firms are beginning to adopt key principles from consumer product design—trust and security, seamless UX, delight and surprise—while excelling in community building, which fosters strong feelings of belonging.

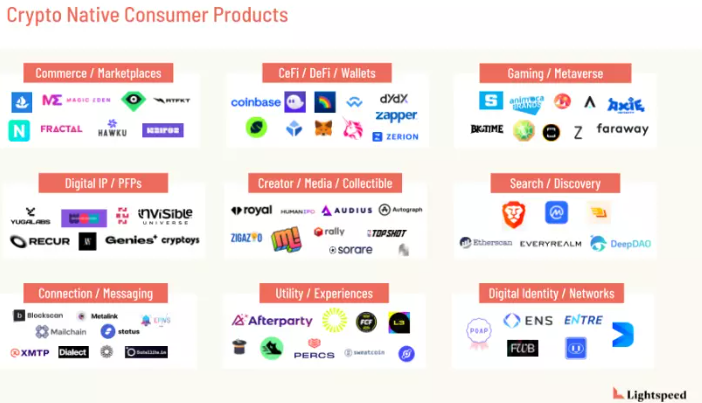

Many players are racing to seize this opportunity. Below, I outline 9 areas where crypto-native products have already seen mass adoption (like wallets, NFT markets), plus several emerging sectors with strong potential to go mainstream soon.

We’re heading into a correction phase in crypto. Crises like this create space for new consumer tech companies to emerge. A year from now, I believe several of the categories below will look very different.

Below are areas where we might see the rise of crypto-native consumer giants, roughly ordered from more mature categories to newer, emerging ones.

#1 Trading / NFT Marketplaces

Whether your focus is video, art, gaming, or music-related NFTs (non-fungible tokens), there’s a marketplace for it. NFT marketplaces are the town squares and trade hubs of crypto—they significantly shape the category’s popularity and perceived success.

● Before NFTs become trusted mainstream brands, they must overcome public distrust of crypto and improve the buying experience.

● There remains huge potential to build a niche NFT platform with world-class trust, security, and reliability. Utility-driven NFTs could appeal to broader audiences, and as real-world commerce evolves, we may see more embedded and platform-based commerce opportunities.

● OpenSea has dominated, but others like Magic Eden have recently surpassed it in users and volume. Other notable players today include LooksRare, Hawku, Fractal, Zora, and Autograph.

#2 CeFi / DeFi, Wallet Upgrades

Consumer fintech products are arguably one of the biggest successes so far—just look at Coinbase, Blockchain.com, Uniswap, Metamask, and high-engagement platforms like Zerion and Zapper. One area I’m particularly excited about within both centralized and decentralized finance is wallets:

Wallets are to crypto what email was to the first era of the internet. They are our gateway to connect, log in, and authenticate across services and the crypto-native world. But these products aren’t yet consumer-grade for the masses.

● Wallet usability and UX design remain suboptimal. You must create a wallet, remember a long recovery phrase, or risk being locked out, then transfer funds.

● After that, you often need to pay high gas fees before purchasing anything—so the system isn’t ready for mass adoption.

● The good news: there’s massive market potential in improving this process. I’m excited to see big players like Blockchain, Metamask, WalletConnect, Phantom, and Rainbow making improvements, along with new wallet-as-a-service providers like Triangle and Slaz redefining the space.

#3 Gaming / Metaverse

Back in October 2021, I wrote about why this time the metaverse is different. I hate overusing the term “metaverse,” but you can’t ignore the impact of crypto-native platforms like Sandbox and Decentraland, not to mention Web2 giants like Roblox, Minecraft, VRchat, and RecRoom, where a generation of players already treat these platforms as their primary social spaces:

● Open-world social games are where young people want to spend their time. That alone makes it the fastest-growing media category.

● Crypto connects these platforms to real-world economies for the first time, dramatically expanding player potential and utility.

● Crypto-native metaverses still face P2E (play-to-earn) sustainability issues, and many blockchain games simply aren’t fun enough.

● I’m excited to see companies like Faraway, Star Atlas, Defi Kingdoms, and Harvest, among many other blockchain gaming startups, making crypto gaming genuinely engaging.

#4 Digital IP / Crypto-Native Disney

Perhaps the most compelling successful crypto products so far are NFT profile pictures—BAYC, Cryptopunks, World of Women, Azuki, and others. In 2021, just the top three NFT collections drove 40% of OpenSea’s sales. These projects built communities and shared identities around art, bringing digital characters to life much like Disney and Pixar.

● Digital-first IP brands have advantages over traditional media IP development—they can iterate rapidly via social media, monetize through tokens as narratives unfold, and deepen community engagement early.

● These companies understand that compelling storytelling is key to engagement. Look at Crypto Coven or Invisible Universe: in Web3, projects aren’t just for passive consumption, but for interactive, collaborative experiences among community holders—living stories embedded in your audience’s lives.

● Top digital IP players are monetizing sustainably through diversified portfolios—integrating games, royalties—without relying solely on one-off transactions. Companies I’m watching in this space include Recur, Yuga Labs (BAYC), and Invisible Universe.

#5 Creators / Media-Entertainment / Collectibles

Entertainment and sports have been one of crypto’s biggest bridges to mainstream audiences—everyone knows the Staples Center (home of the Lakers) is now Crypto.com Arena. Some are reinventing music or TV, others are monetizing experiences and creating revenue streams via fan tokens. Back in October 2021, I wrote about fan tokens and the future of creator revenue. This category is still early, but highlights crypto’s transformative impact on creative work.

● Fan tokens let fans invest in individuals, turning fan communities into financial backers and personal brands into forms of currency.

● Tokens, NFTs, and crypto assets suit creators with volatile incomes who must constantly produce content or grow visibility to sustain earnings. It helps turn fans into a profitable community—where supporters know they own unique, rare pieces of a creator’s history.

● Creator tool companies are also emerging, enabling creators to publish articles, make music, etc., on crypto-native platforms like Mirror and Mayk.

● Sports have long been tied to collectibles. Entertainment collectible companies are taking existing Web2 behaviors and rebuilding them in Web3—verifiable, trustworthy, and scalable.

● Key players include HumanIPO, Mad Realities, Dapper/NBA TopShot, Audius*, Rally, Fan Controlled Football, Royal, and Autograph.

#6 Search/Discovery & Aggregation of Interest-Driven DAOs

Web1’s biggest innovation solved search and global access to information. Web3 adds an identity layer, making search more exciting—we can now easily trace ownership records via block explorers. Search drives discovery of new interests and hobbies. Yet today, discovering crypto passions—new NFT collections, DAOs, or people close to you—is hard before trading begins. Most default to Twitter.

In discovery, one space I’m excited about is DAO discovery and aggregation. DAOs (decentralized autonomous organizations) enable communities to form around shared interests and act collectively, without hierarchy or bureaucracy. Because they rely on smart contracts (code), they’re arguably more transparent and trustworthy. For these reasons, they could become dominant consumer apps:

● DAOs can be created for almost any purpose—from supporting Ukraine (UkraineDAO) to longevity research (VitaDAO), social clubs (Friends With Benefits), or owning sports leagues (Fan Controlled Football).

● Whoever aggregates these DAOs and enables cross-community discovery could replace Facebook Groups with an embedded financial system that rewards contributions to each community.

● Potential candidates include DAO tool companies adding discovery features—CollabLand, Superdao, Syndicate—or analytics firms like DeepDAO. DAO tool companies are strong contenders since they already support DAO networks.

#7 Communication / Crypto-Native Messaging

Every major tech shift creates a new messaging giant. In Web1, it was email providers like AOL, Yahoo, Hotmail, and Gmail. Web2 saw explosive growth in mobile messaging via SMS, WhatsApp, and others. Why?

● Messaging is one of the highest-frequency social activities and a core value of the internet—human connection.

● Today, messaging someone based on the assets in their wallet—because you want to buy something or simply connect with like-minded people—is extremely difficult.

● Directly messaging wallets and paying for access removes intermediaries, allowing premium engagement value to flow directly into wallets.

● Companies like XMTP, Dialect, Waku, web3mq, and Satellite are building core infrastructure to enable this, while Blockscan, Metalink, and Mailchain aim to enable on-chain messaging at the application layer.

#8 Real-World Utility / Experiences

The success of NFTs in art often raises the question: “What can I actually do with them? What do they really offer?” Answers lie in X-to-Earn, NFT credentials/experiences, and task-based rewards—linking crypto purchases to real-world activities and tasks with crypto incentives. While X-to-Earn began with gaming (P2E), it has expanded to running, learning, sleeping, eating, meditating, and more.

● The challenge with X-to-Earn is sustainability. Our experience shows speculators seek quick returns, causing token prices to spike and later deflate. Until this is solved, true sustainability remains elusive.

● NFT credentials + experiences boost utility by granting access to exclusive events and loyalty programs—some one-time, others offering ongoing rewards, benefits, and social spaces.

● If credential+experience means “pay in crypto, get value,” another intriguing angle is “work, earn crypto.” These platforms reward users (with NFTs, stablecoins, or native tokens) for completing small tasks.

● Many challengers exist—established projects like Axie Infinity, Stepn, Sweatcoin, Layer3—and newcomers like Percs, Afterparty, TokenProof, Mintgate, Rabbithole, Coordinape, and Bitsports joining soon.

#9 Digital Identity / Social Networks

A person’s crypto wallet reveals vast insights into who they are and what they do on-chain—provided you know their wallet address. But today, there’s no elegant way to display all of someone’s on-chain activity. A few startups are tackling this problem.

● Proof of Attendance Protocol (POAP) lets you mint NFTs proving attendance at conferences, concerts, sports events, or DAO membership. Minting creates friction, but perhaps that’s a feature, not a bug.

● Entre acts like LinkedIn for blockchains, showing professional affiliations, while ENS (Ethereum Name Service) replaces long wallet addresses with easy-to-remember domains.

● Other players aggregating and sharing on-chain credentials include crypto fintech apps like Lemon Cash or Webull, Socket; NFT marketplaces like Magic Eden or Hawku; and social networks like Bitclout, Farcaster, Showtime, etc.

● Projects here must solve the puzzle of selectively sharing identity elements while preserving crypto’s prized privacy.

Worth noting: #10—there’s a vast infrastructure layer supporting these consumer products, some already mentioned. Many more deserve attention—identity protocols, social graphs, wallet security, DAO tools—all under active development.

An Evolving Industry

Clearly, we’re still very early in the world of crypto-native consumer startups—it’s too soon to say exactly where the next great crypto product will come from.

The latter categories I mentioned (#6–9) are especially nascent. And rightly so—there’s significant overlap between these categories:

● As NFTs become access keys for all kinds of rewards, marketplaces and utilities may converge;

● Creators and utilities are already merging with exclusive fan experiences and loyalty offerings;

● When your on-chain profile verifies real-world activities, digital identity and utility will merge, and discovery will evolve—we’ll start searching and joining various identity groups;

● As crypto-native IP expands into physical realms, entertainment, gaming, and digital IP will increasingly blend.

This article doesn’t fully answer the most exciting questions: Who will be the next great crypto consumer tech companies? Who will lead the next bull run? Which product areas will take off first? How will crypto elements enhance consumer experiences? And which sectors are truly innovating beyond Web2 to create something entirely new?

The field needs more founders experienced in building products people love—those who know how to build consumer companies here, who understand behavioral psychology, can foster positive habits, and design delightful user experiences. I believe we’ll get there.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News