A Deep Dive into Berachain: Could Proof of Liquidity Be the New Narrative Driving the Next DeFi Summer?

TechFlow Selected TechFlow Selected

A Deep Dive into Berachain: Could Proof of Liquidity Be the New Narrative Driving the Next DeFi Summer?

What sets Berachain apart from other L1s?

Author: BurstingBagel

Translation: TechFlow

Berachain is a Layer 1 blockchain featuring a decentralized stablecoin, native DEX, and perpetual contracts platform. It’s a capital-efficient Cosmos-based EVM chain designed with deep liquidity to support frequent DeFi activity.

This article aims to explore what sets Berachain apart from other L1s.

The Problem Berachain Solves

Current L1s face a liquidity issue: speculators move funds to a new L1 chain, focus on farming its local meme coins for 1–2 weeks, then rush to exit once the hype fades. As a result, the user base dries up and projects built on the chain eventually die—Boba being one example.

Berachain was created to solve this. The entire chain is designed from the ground up to align incentives for higher capital efficiency, giving users fewer reasons to leave.

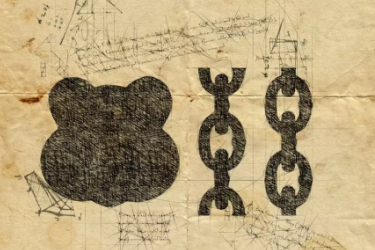

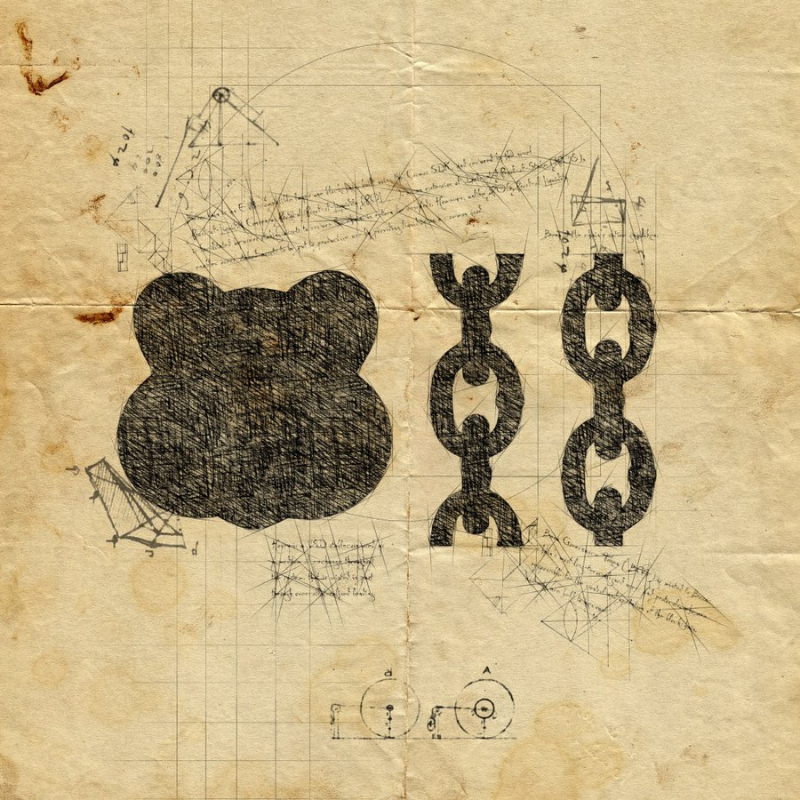

To achieve this, Berachain uses Proof of Liquidity—a twisted form of dPOS.

Proof of Liquidity

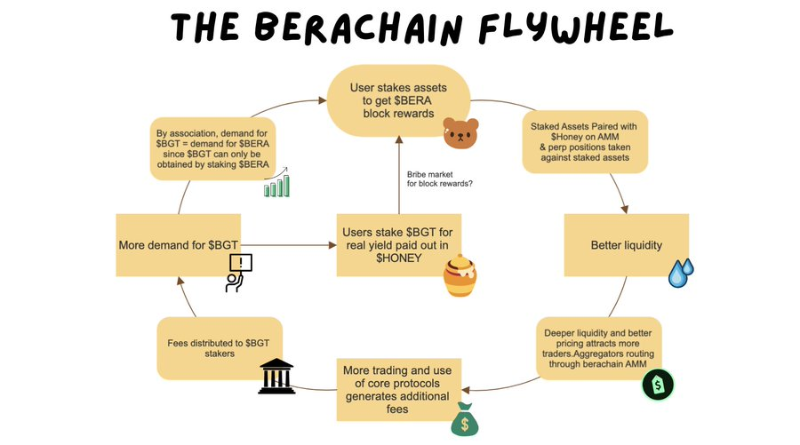

Unlike standard dPOS consensus, Berachain allows staking multiple assets (BERA, ETH, BTC, stablecoins, etc.) to validators. These staked assets are then used to provide liquidity to the chain's native virtualized AMM, creating a positive flywheel:

- Users stake to secure the network;

- Higher capital efficiency;

- Users earn $BERA block rewards;

- ETH becomes more liquid;

The team has confirmed that initially, block reward weights will favor major L1 tokens. Over time, however, the chain may be secured by existing or new DeFi protocol tokens native to Berachain.

This opens the possibility of using gauges to determine block reward weights for specific assets. Let me emphasize how significant this is for projects building on Berachain.

It means protocols aren’t just building on the chain—they become an integral part of Berachain itself. Not to mention the benefits of having on-chain protocol tokens help secure the network:

- Liquidity-as-a-Service: Tokens securing the network gain liquidity by pairing with $Honey in Berachain’s native AMM.

- Additional utility and yield sources for users: Earn $BERA block rewards from otherwise low-yield tokens.

Berachain’s Three-Token System

$BERA — Gas token, $HONEY — Stablecoin, $BGT — Governance token. $BERA needs no explanation (it's gas), but $HONEY and $BGT deserve a brief introduction.

$HONEY, Berachain’s Stablecoin

$HONEY is the chain’s native stablecoin. As the documentation explains, $HONEY represents money itself:

- Robust PSM: CDPs, perpetual funding rates, AMOs.

- Decentralized: Primarily backed without centralized assets.

- Liquid: All assets trade against $Honey via Berachain’s AMM.

$BGT

All profits generated by the chain are distributed to $BGT stakers in $HONEY.

- Transaction fees;

- $HONEY loan interest;

- Perpetual funding rates;

This takes the “real yield” narrative to an entirely new level across the entire L1.

However, $BGT cannot be bought on secondary markets. It is a non-transferable NFT awarded only to users who long-term support the ecosystem. The only way to obtain $BGT is by staking $BERA. $BGT holders also have voting rights over "determining new stakable assets" and "guiding $BERA incentives."

Why have a dedicated governance token?

Problems arise when governance is tied directly to token price. $BGT is a “time and commitment” token—only accessible to those who contribute to the network. $HONEY rewards further incentivize participation in governance.

DEX and Perps

From day one, you’ll be able to trade on Berachain’s native DEX and perpetuals exchange. These aren’t just built on the chain—they’re integrated into the chain itself. Let’s take a closer look:

DEX

Berachain’s native DEX leverages CrocSwap’s technology to deliver a familiar yet advanced AMM engine that enhances liquidity, improves pricing, reduces slippage, and lowers trading costs. Key features of CrocSwap’s AMM and its implementation on Berachain include:

- Tighter liquidity concentration within pools

- Single-sided pools: Staked assets securing the network are paired with $Honey

- Single contract architecture

- Dynamic pricing control

Perpetual Exchange

When users stake assets to validators, they can mint $HONEY as loans to trade spot or leverage positions on the native perpetuals exchange. All funding rates are paid in $Honey, serving as a secondary peg mechanism.

Conclusion

Thanks to Berachain’s core products, users are less likely to unstake their assets, since they can do everything they need on-chain while continuously securing the network.

The goal is to align incentives at the foundational level, ensuring the network’s longevity and sustainability. Combining DEX and perpetuals with staked assets that secure the chain benefits long-term growth.

To wrap up, here’s a beautiful flywheel infographic summarizing nearly everything discussed—the flywheel that will start spinning once the chain launches.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News