L2 Comparison: Analyzing dYdX, Arbitrum, Polygon, Optimism, and Loopring from Seven Perspectives

TechFlow Selected TechFlow Selected

L2 Comparison: Analyzing dYdX, Arbitrum, Polygon, Optimism, and Loopring from Seven Perspectives

Five projects related to Ethereum Layer 2 solutions.

Written by: Jake Pahor

Compiled by: TechFlow intern

I've researched all projects related to Ethereum Layer 2 solutions, including general-purpose L2s (Polygon) and application-specific L2s (dYdX), and selected my top five favorites from these outstanding projects.

1. Does It Generate Revenue?

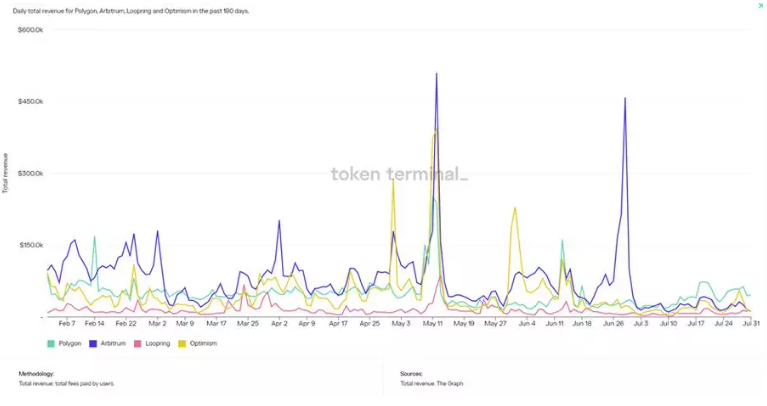

Delving into Token Terminal reveals some fascinating statistics. Over the past 180 days, total revenue (fees) collected was:

-

dYdX: $212.2 million

-

Arbitrum: $13.7 million

-

Polygon: $8.8 million

-

Optimism: $8.5 million

-

Loopring: $2.5 million

As you can see in the chart, dYdX dominates overwhelmingly compared to other projects. Arbitrum ranks second, but as shown, Polygon has been leading over the past month with strong momentum.

2. Treasury Allocation

Key factors examined include:

-

Do they hold diversified assets or only their native token (higher risk)?

-

How large is the treasury, and what growth runway does it provide?

Polygon: Information about the size and composition of Polygon’s treasury is scarce. However, we know that $1 billion has recently been committed to developing ZK projects, suggesting its total treasury is significantly larger.

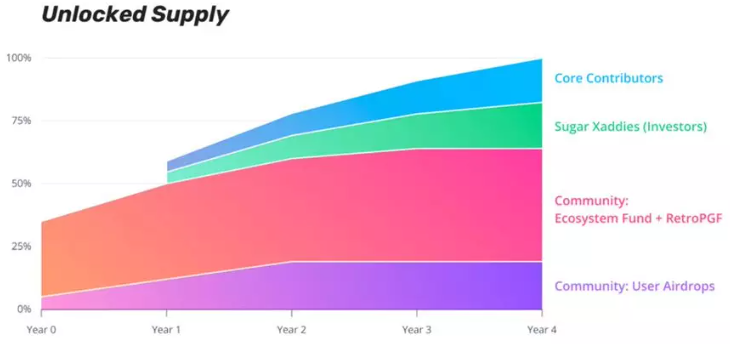

Optimism: 30% of the initial token supply (1.29 billion OP) will go to community funds (ecosystem fund + RetroPGF), equivalent to approximately $1.85 billion in OP tokens (based on current price of $1.43).

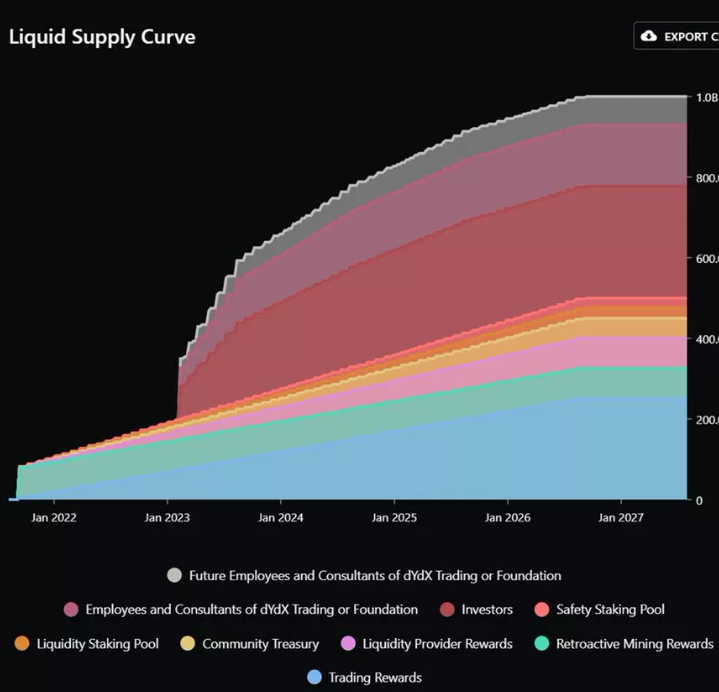

dYdX: 5% of the initial token supply (50 million DYDX) allocated to the community treasury. At today’s price ($2.27), this amounts to roughly $113 million.

Loopring: 20% of the token supply (275 million LRC) allocated to LEAF, worth approximately $110 million (based on current price of $0.40).

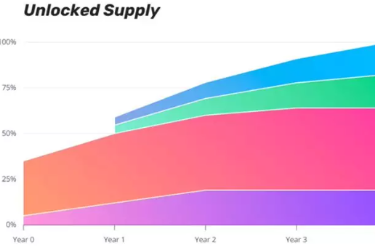

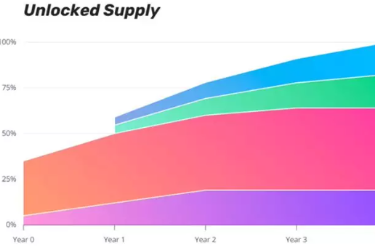

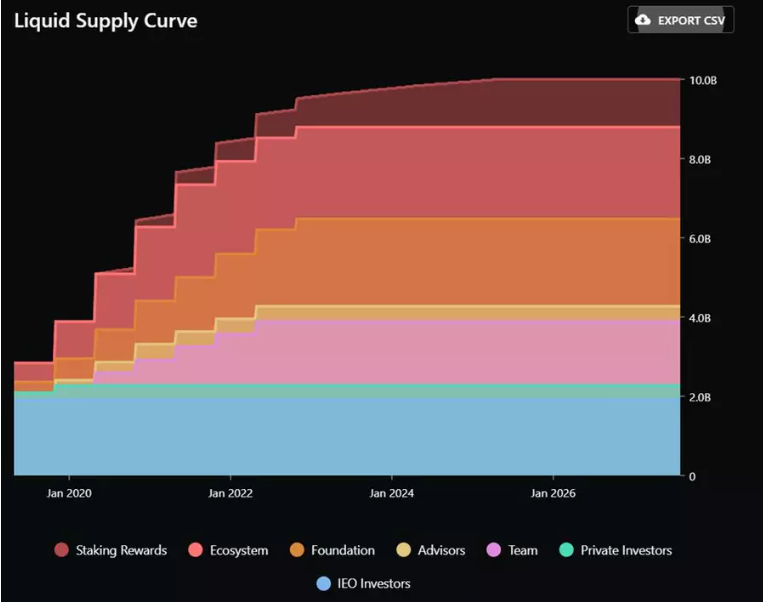

3. Locked Supply

If most tokens remain locked under vesting schedules, significant future sell pressure could occur.

Polygon: Approximately 92% of the supply has already been unlocked. The final 800 million tokens will unlock by May 2025. Current circulating supply = 91.8 million, total supply = 10 billion.

Optimism: About 5% of total supply has been unlocked via airdrop. Current circulating supply = 215 million, total supply = 4.29 billion.

dYdX: Approximately 11% of total supply has been unlocked. Current circulating supply = 112 million, total supply = 1 billion.

Loopring: Approximately 90% of total supply has been unlocked. Current circulating supply = 1.245 billion, total supply = 1.374 billion.

4. Utility and Use Cases

Polygon: MATIC tokens are used to pay transaction fees on the network. You can also stake your MATIC to earn rewards for securing the network.

Arbitrum: No token yet, but the network itself offers significant utility, providing cheaper transactions and scalability while maintaining Ethereum's security.

Optimism: Rights to block space serve as a sustainable revenue source driving the OP economic model, growing alongside the network.

dYdX: Primarily a governance token; holders also receive trading fee discounts based on position size.

Loopring: Protocol fees are distributed to liquidity providers, insurers, and DAO participants, incentivizing positive behavior among token holders.

5. Roadmap

Polygon recently announced it will launch the first EVM-compatible ZK L2. Sandeep also plans to fully decentralize the blockchain within 2–3 years, while developing powerful products such as decentralized digital IDs.

Arbitrum hasn't released a full roadmap, but speculation suggests they may issue a native token via airdrop at some point.

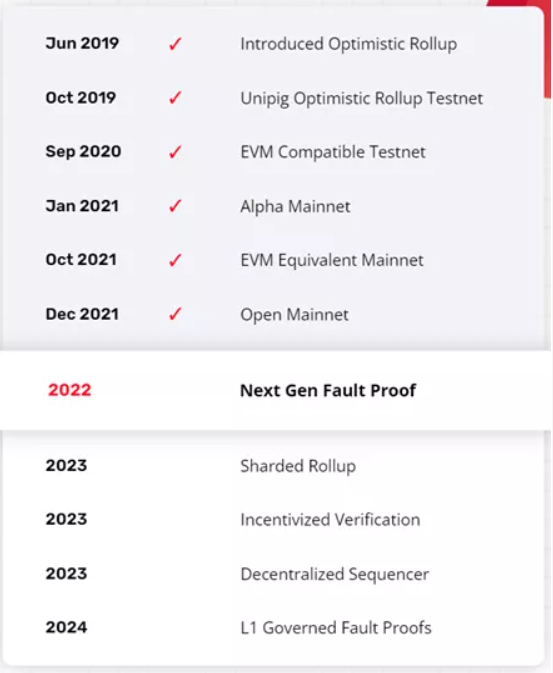

Optimism has outlined its roadmap in the chart below.

dYdX plans to become fully decentralized by the end of 2022 with its V4 upgrade. This appears to be their main focus and will represent a major milestone for the project.

Loopring plans several major upgrades in 2022, including Loopring Earn and zkEVM.

6. Sector Classification

The five projects on this list are fundamentally very similar. Polygon, Optimism, and Arbitrum are all competing for the same goal—becoming the premier L2 scaling solution.

At this stage, Polygon clearly leads in terms of market cap and "moat." However, Arbitrum and Optimism show higher usage rates and are growing rapidly.

7. Team and Funding

Polygon has a doxxed team (Anurag Arjun, Jayant Kanani, Mihailo Bjelic, and Sandeep Nailwal) and is backed by some of the industry’s most prominent investors (Alameda, Binance Labs, Coinbase Ventures), raising a total of $451.5 million. They’ve also recently announced strategic partnerships (Disney, Reddit, Meta, Stripe, DraftKings), demonstrating strong business development capabilities.

Arbitrum also has a well-known team and strong backers (Pantera, Alameda, Mark Cuban, Coinbase). Offchain Labs, the parent company, has raised $123.7 million in total.

Vitalik himself is a strong supporter of Optimism and has publicly endorsed their new governance structure. They are heavily backed by A16z, Paradigm, and IDEO, having raised $178.5 million in total.

dYdX raised $87 million from notable investors including Hashkey, Starkware, and A16z, and also has a doxxed team.

Loopring raised $45 million from Kosmos Ventures, G2H2, Neo, Fundamental Labs, and Obsidian.

8. Conclusion

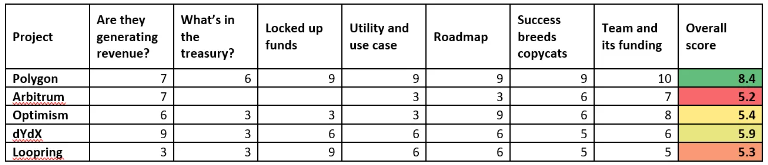

Based on my research and analysis, I scored each project across each category on a scale of 1–10. As you can see, the clear winner is Polygon.

The project is the most mature, boasts the largest market cap, and has recently gained attention due to the upcoming Ethereum merge. The other projects are also highly promising and have substantial potential for long-term success.

This is not investment advice—only my personal opinion and research conducted to better understand the L2 landscape. Please do your own research before investing in any project.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News