Understanding Arbitrum Lending Protocol Radiant: The Secret Behind Attracting $200 Million in Locked Value

TechFlow Selected TechFlow Selected

Understanding Arbitrum Lending Protocol Radiant: The Secret Behind Attracting $200 Million in Locked Value

A Guide to Arbitrum Lending Protocol Radiant

Written by: Rektdiomedes

Translated by: TechFlow intern

A fascinating lending protocol called Radiant Capital recently launched on Arbitrum. Today, its TVL is approaching $200 million. In this article, I’ll introduce you to this lending protocol.

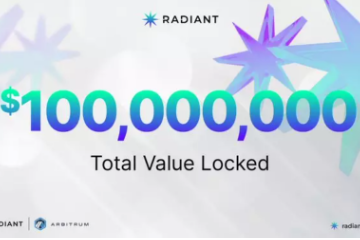

Radiant Capital is a lending protocol similar to Aave or Compound, but with the goal of being fully multi-chain—allowing users to deposit collateral on one chain and seamlessly borrow on another.

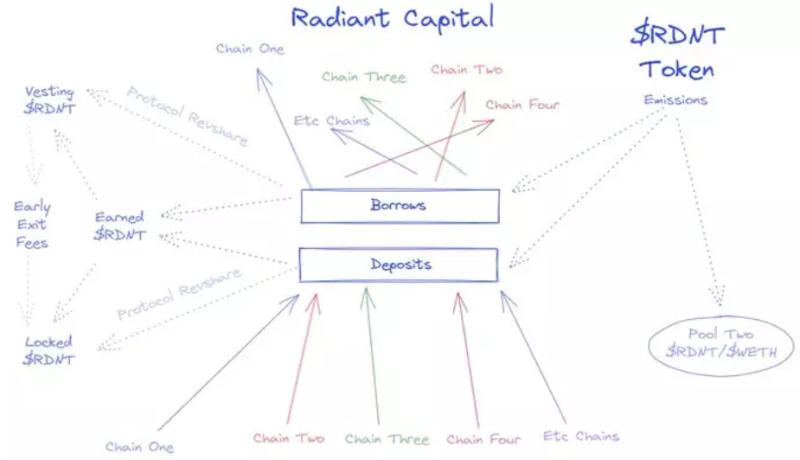

It has already attracted over $100 million in TVL (now actually $195 million), making it one of the largest protocols on Arbitrum.

The Radiant team chose to launch their V1 version on Arbitrum. In V2, they plan to leverage Stargate Finance's technology to achieve "multi-chain" or "omnichain" functionality.

Radiant Capital’s codebase is built upon Geist, a 2021 lending protocol from Fantom, which itself was built using Aave’s code repository.

DeFi veterans definitely know Geist—I’ve been a fan since day one. I thought its staking/locking mechanism, fee-sharing model, and UX were truly groundbreaking, and I believe many share that view.

However, I believe their fatal flaw was being confined to a single chain, preventing them from embracing DeFi’s multi-chain evolution. But Radiant Capital is different—it was built specifically for multi-chain/omnichain use.

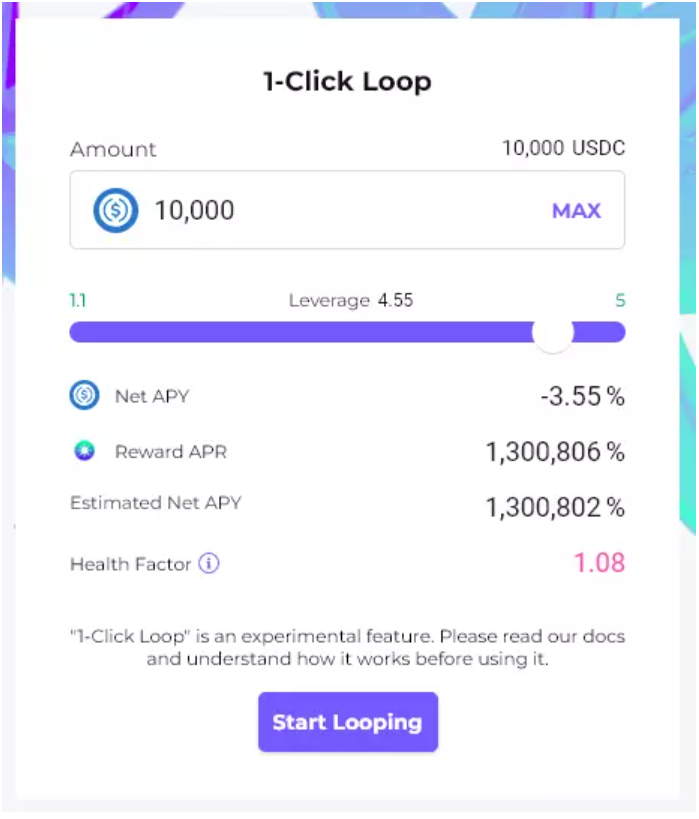

Depositing and borrowing on Radiant Capital works similarly to other DeFi lending protocols, so I won’t spend much time explaining that. However, they introduced an interesting innovation: one-click leveraged looping. This is extremely convenient if you want to maximize your deposited assets.

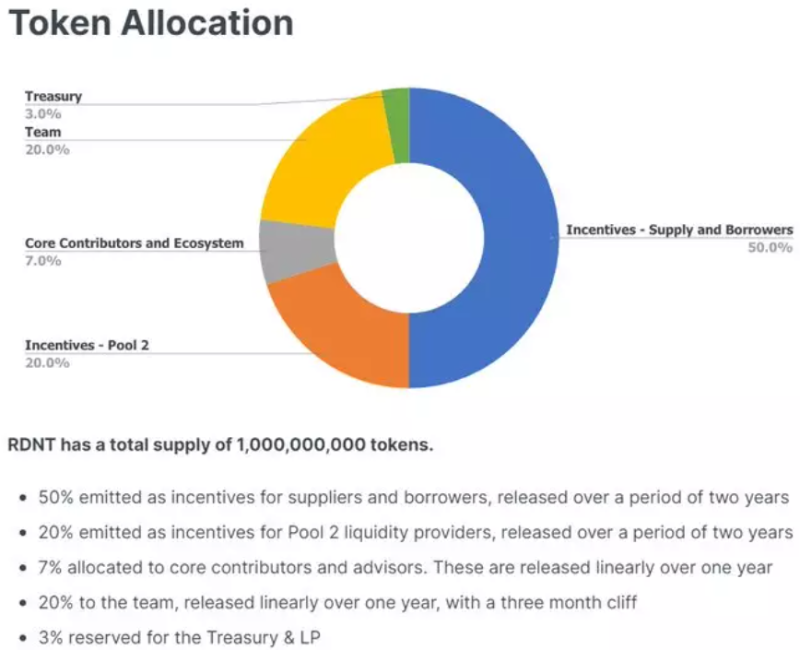

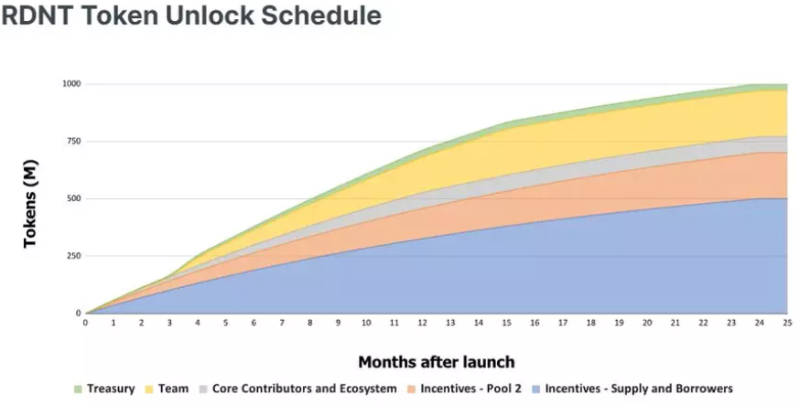

The protocol uses the $RDNT token to incentivize depositors and borrowers. Below are some details about $RDNT along with its vesting schedule:

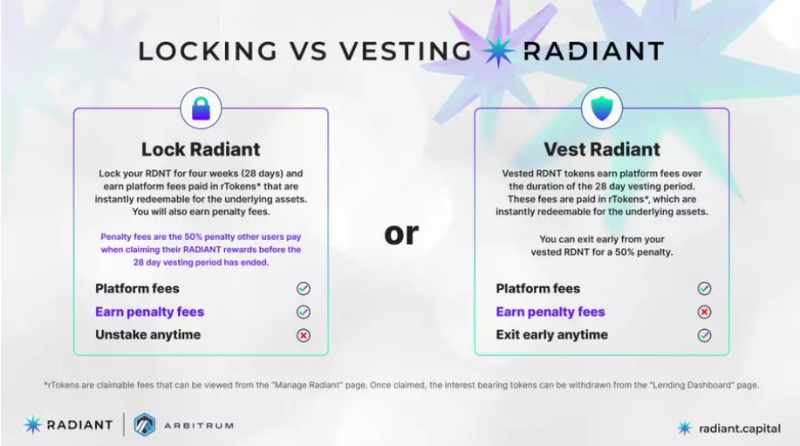

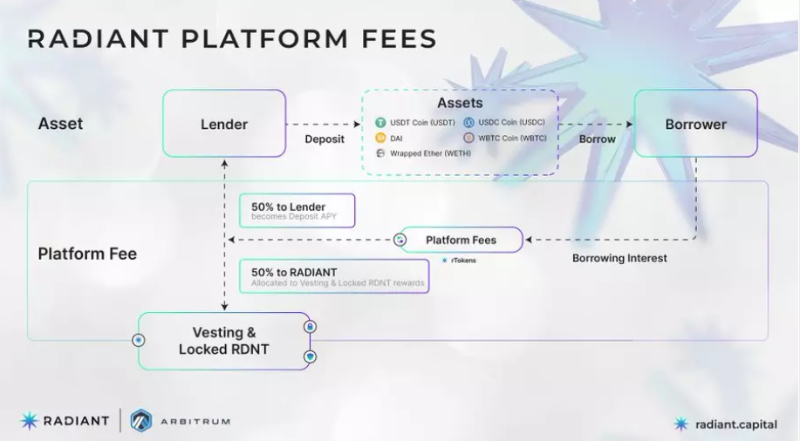

Earned $RDNT has a 28-day vesting period. Alternatively, users can withdraw early but will incur a 50% penalty. Users can also "lock" $RDNT in the short term to earn the 50% penalty paid by early withdrawers, as well as a portion of protocol fee revenue.

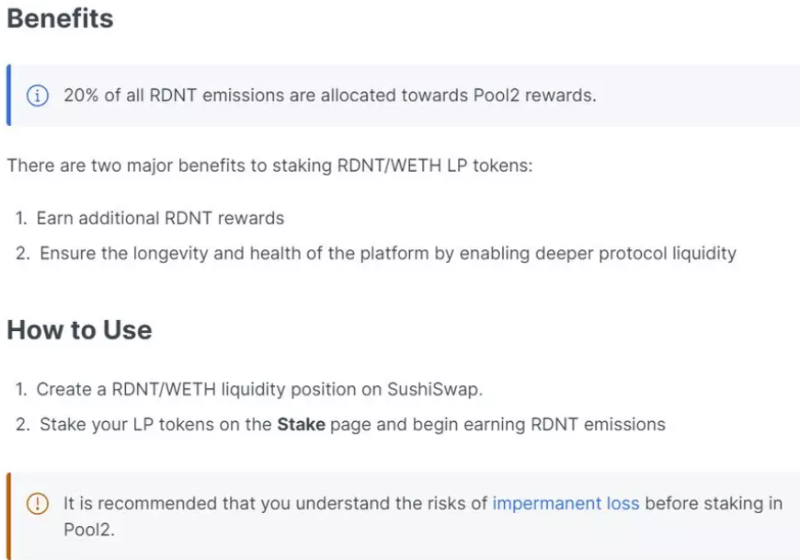

$RDNT tokens are also used to incentivize liquidity providers for the two pools, currently the $RDNT/$WETH pool on Sushiswap-Arbitrum. 20% of $RDNT emissions are allocated for these incentives:

I believe iterative improvements in lending protocols and AMM designs are a healthy aspect of DeFi. Some projects fail, while others—with superior technology or business development—ultimately become core components of DeFi.

Risk Disclosure: I do not own any $RDNT tokens and am not recommending anyone to purchase specific tokens (and as always, be cautious of fake tokens with new protocols). However, I might deposit a small amount of stablecoins to earn some $RDNT. DYOR!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News