One-Year Anniversary Celebration: Security and Speed Are cBridge's Long-Term Pursuits

TechFlow Selected TechFlow Selected

One-Year Anniversary Celebration: Security and Speed Are cBridge's Long-Term Pursuits

The journey to the stars and oceans has just begun.

Written by Morty, TechFlow

On July 18, Celer's official Twitter announced that the total value of cross-chain funds transferred through its product cBridge has exceeded $950 million. For the cross-chain bridge sector, this is an exceptionally rare achievement, firmly placing cBridge among the top-tier (T1) players in the space. Even more notably, cBridge has not experienced any security incidents to date.

Now one year on, cBridge has successfully passed its first anniversary. Meanwhile, Celer, founded in 2018, has become a veritable "living fossil" among crypto protocols. We can also glimpse the team’s original vision and aspirations from the protocol’s name—“Celer.”

In Latin, “Celer” means “swift” or “rapid.”

Since its inception, Celer has been driven by technology—starting with state channels, later engaging in Rollup technologies, and focusing on Layer2 scaling solutions. As the multi-chain landscape began to emerge, Celer launched a cross-chain bridge called “cBridge” in July 2021, and over the following year, gradually enabled asset and data transfers across 34 public blockchains and 129 tokens.

We can clearly observe that everything Celer does aims to enable users to perform on-chain operations more “swiftly”—using blockchains faster, moving seamlessly between different chains, and delivering a faster experience for investors on-chain.

Origins: A Shift in Product Direction

Parallel development across multiple blockchains is an outcome nearly everyone foresaw. It stems from Ethereum’s performance limitations after absorbing massive user demand. Ever since BSC launched, most new public chains have aimed primarily at capturing overflow traffic from Ethereum.

It was around this time that Celer began shifting its product direction.

The motivation behind launching cBridge was largely to address the growing, urgent need for cross-chain functionality among on-chain users. At its core, launching cBridge continues to embody the founding principle of the Celer team—“speed.” The rapid deployment of cBridge further demonstrates the technical strength and innovation capability of the Celer team.

A year later, how has cBridge performed?

As mentioned earlier, under stable asset transfers, excellent user experience, and zero security breaches, cBridge has facilitated over $950 million in cumulative cross-chain volume, supporting asset and information transfers across 34 blockchains and 129 tokens.

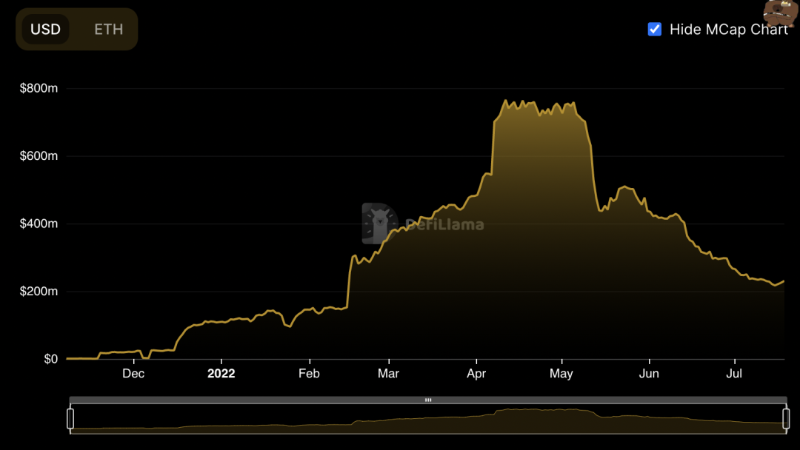

In terms of Total Value Locked (TVL), according to DeFiLlama, cBridge currently holds around $300 million in TVL, having peaked at $750 million. The significant drop occurred around May, clearly impacted by the collapse of LUNA/UST in the broader crypto market.

Viewing cBridge’s performance from an ETH-denominated perspective reveals a strong correlation between its TVL and the overall crypto market. However, during market downturns, user activity and adoption did not suffer severely. Once market confidence slightly recovered, the ETH amount locked in cBridge rebounded accordingly.

For users choosing cBridge, its greatest advantage lies in the Celer team’s rigorous technical approach to security and their human-centric pursuit of safety.

Pursuit of Security: cBridge’s Winning Edge

While blockchains showcase their unique strengths, an undeniable reality emerges: cross-chain bridges responsible for transferring assets and enabling communication between chains have increasingly become hackers’ cash machines due to the complexity and immaturity of cross-chain technology.

In August 2021, the cross-chain interoperability protocol Poly Network was hacked, causing severe losses for O3 Swap using the protocol, with total losses reaching $610 million.

In January 2022, Multichain officially acknowledged security risks in its bridge, warning certain tokens were vulnerable to attacks and urging users to revoke approvals immediately. Around the same time, Qubit Finance’s ETH-BSC bridge was exploited, losing over $80 million.

In February 2022, Wormhole, a key bridge between Ethereum and Solana, suffered a hack resulting in over $320 million in losses.

In March 2022, validator nodes of Axie Infinity’s sidechain Ronin and Axie DAO were compromised, allowing attackers to withdraw 173,600 ETH and $25.5 million in USDC via two transactions from the Ronin bridge.

...

Cross-chain bridge hacks are countless, and incidents continue to occur even today. What makes cBridge stand out is that throughout its first year, it has remained incident-free.

Regarding security, the Celer team has never stopped improving:

SGN Network

Governance attacks are a common hacking method. In the case of the Ronin bridge attack, compromised validator nodes allowed hackers to steal 173,600 ETH and $25.5 million in USDC.

To counter this, Celer employs the State Guardian Network (SGN) to secure cBridge. Built by Celer, SGN is a Tendermint-based (PoS) blockchain that provides Layer1-grade security for cBridge.

Intermediate Delay

“Intermediate delay” serves as a dual safeguard specifically designed by Celer. Cross-chain DApps can make different trade-offs regarding timing delays.

The reason is clear—there are numerous cases where bridges were instantly drained due to lack of delay. Celer aims to prevent scenarios where a single transaction empties an entire liquidity pool, thereby reducing systemic risk across the bridge.

Risk Control System

In executing its security philosophy, the Celer team has implemented multiple layers of protection for cBridge: a risk control system (monitoring overall bridge liquidity, asset status, and changes), rate limiting (transactions exceeding thresholds are delayed), 24/7 monitoring, and a $2 million bug bounty program.

But does absolute security exist in the crypto world? The answer is no. In this dark forest, no one can guarantee “absolute safety.” Yet Celer’s pursuit of security is long-term and unwavering. Only through persistent striving toward “absolute security” can the “swiftness” represented by Celer be truly realized.

Evolution: From Application to Ecosystem

As previously noted, after the crypto market crash, on-chain demand declined, leading to lower adoption rates for cross-chain bridges. The root cause lies in insufficient on-chain profits—DeFi failed to offer returns commensurate with the risks faced by investors, who then lost interest and hesitated to allocate capital into DeFi.

However, when attractive profits emerge, investor activity and cross-chain behavior surge rapidly. The popularity of Layer2 Arbitrum’s Odyssey campaign exemplifies this perfectly—at its peak, Arbitrum’s gas fees even surpassed those of Ethereum.

Nonetheless, it’s crucial to recognize that investors’ needs for cross-chain functionality are multi-layered and complex—from simple asset transfers to data messaging, and ultimately to demands for building cross-chain ecosystems. Moreover, the frequency and use cases for cross-chain interactions are expanding rapidly.

To meet these richer and more complex demands, Celer introduced the Celer Inter-chain Message framework (Celer IM). Celer IM is a plug-and-play tool and infrastructure for developers—requiring no modification to existing deployed contracts. With just a simple contract plugin, any DApp can be transformed into a natively cross-chain DApp, completely breaking down application-level barriers.

A simple example: a SushiSwap user can complete a single transaction to swap ETH on Arbitrum for BNB on BSC. Behind the scenes, the smart contract executes as follows:

Use SushiSwap (Arbitrum) to swap ETH for USDT;

As part of the Celer IM framework, transfer USDT from Arbitrum to BSC via cBridge;

Send an inter-chain message via Celer IM to SushiSwap (BSC) instructing it to swap USDT for BNB.

Currently, most multi-chain DApps simply deploy identical code across multiple chains. However, each instance operates in isolation—liquidity, logic, and state are entirely separated. Essentially, they function as distinct decentralized applications on separate chains. This inevitably leads to low liquidity and poor capital efficiency.

Celer IM enables DApps to share liquidity and maintain consistent application logic across multiple chains, significantly improving capital efficiency. In today’s multi-chain era, it embodies the team’s commitment to “speed.”

Setting Sail: Becoming the Leading Cross-Chain Solution

Before the Age of Exploration, limited communication and transportation technologies left civilizations isolated, interacting only with nearby ones in simple, direct ways. Over time, explorers ventured into the unknown, gradually connecting distant civilizations. Today’s multi-chain ecosystem mirrors this journey. As Ethereum struggles with performance and more developers seek high-performance chains, new blockchains continuously emerge, making cross-chain bridges essential infrastructure.

Guided by the principles of “security first, rapid technological innovation,” Celer advances both cBridge (to C) and Celer IM (to B), building an increasingly robust blockchain interoperability infrastructure that integrates into every cross-chain interaction we make.

As Columbus once said, “The world belongs to the brave.” Will you follow cautiously in step, or boldly explore new continents? Celer chooses the latter. For cBridge, the journey toward the stars and oceans has only just begun.

To celebrate cBridge’s first anniversary and thank partners and users for their trust and support, we’re hosting a $23,000 cBridge birthday party with generous rewards. Everyone is welcome to join!

https://twitter.com/CelerNetworkcn/status/1550300539505717248?s=20&t=8qM9DXklueMlDueVLY8eIg

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News