Analyzing the current state of the crypto market: When will it recover?

TechFlow Selected TechFlow Selected

Analyzing the current state of the crypto market: When will it recover?

Are we at the peak of fear?

Author: Onchain Wizard

Translation: TechFlow intern

So far, June 2022 has been Bitcoin’s worst-performing month since 2012, with prices dropping from around $32,000 to about $20,000—a decline of roughly 37%. ETH fell by 44%. Are we at the peak of fear? Let's examine the current situation through some data.

Looking at BTC inflows into exchanges, we can see that over the past week, BTC inflows have reached their highest level since 2018!

Additionally, observing exchange inflows via CDD (which indicates movements from long-term holders), June saw a sharp spike in outflows from long-term holders—an ultimate test of conviction.

Looking at historical price action during such sharp drawdown events for BTC (going back to 2018), they often signal some form of local bottom. For example, July 2021 (the 2021 bottom), March 2020 (the 2020 bottom), and November/December 2018 (the previous cycle bottom). Clearly, while the current macro environment differs from some of these historical periods, this could still serve as a benchmark for measuring fear peaks in BTC—and subsequently help determine pricing directions across other crypto ecosystems.

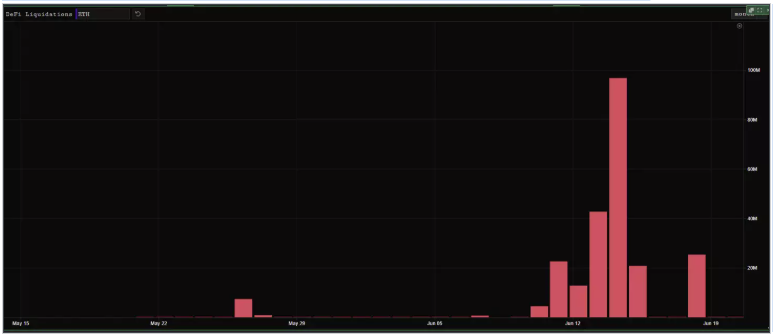

Over the past 60 days, ETH has significantly underperformed many altcoins, falling 64%. In DeFi, for instance, SNX, MKR, LINK, UNI, and 1INCH have all outperformed ETH over the same period. I believe this is driven by several factors, including leverage on ETH positions—approximately $235 million worth of ETH was liquidated on-chain over the past month alone.

There has also been forced selling from 3AC, which sent at least 170,000 ETH to exchanges over the past 60 days—equivalent to approximately $250 million in selling pressure.

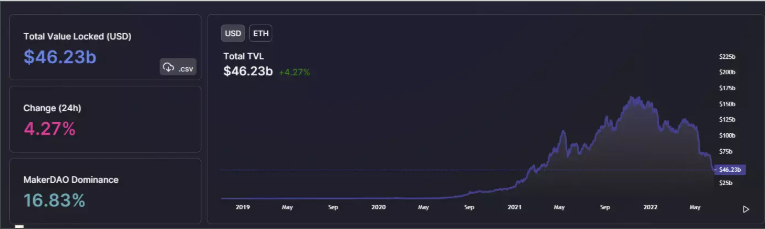

Although ETH has broken below its 2018 high of $1,300, there remains $46 billion in TVL within ETH DeFi protocols, meaning we've come a long way in terms of product-market fit. Total ETH DeFi TVL is down 70% from its November peak, while ETH itself is down 75%.

Here are TVL changes across each chain (from November 2021 – from DefiLlama):

-

BSC: Down from $20B to $6B, a 70% drop.

-

Tron: Down from $6.5B to $4B, a 38% drop.

-

AVAX: Down from $13B to $2.6B, an 80% drop.

-

SOL: Down from $14B to $2.5B, an 82% drop.

-

Polygon: Down from $5B to $1.7B, a 67% drop.

-

FTM: Down from $5.3B to $973M, an 82% drop.

-

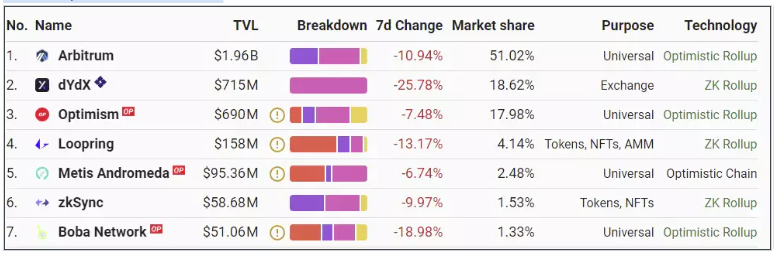

Arbitrum: Down from $3B to $2B, a 35% drop.

Clearly, the only bright spots here are Arbitrum, which now holds up to 51% market share among L2s, and NEAR, which doubled its TVL to $2.9B.

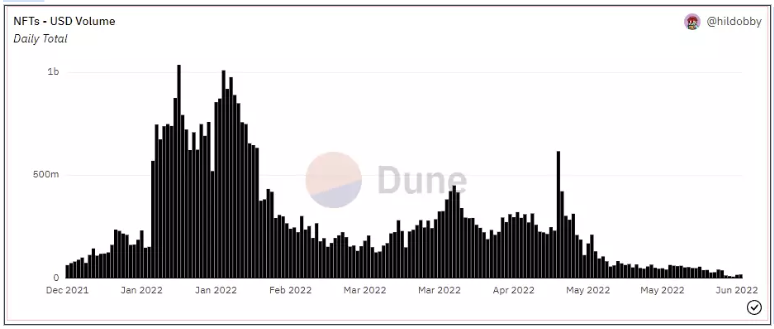

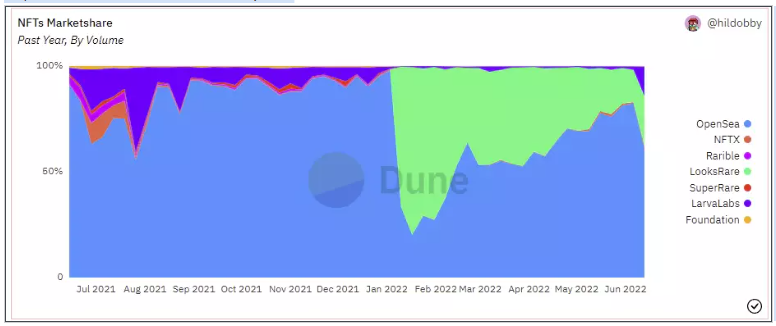

Turning to the NFT market, conditions are also bleak—daily trading volume has dropped from a peak of $1 billion in January 2022 to just $200 million today.

From the perspective of NFT marketplace market share, LOOKS has declined from a high of 70% earlier this year to just 20% (note: a large token unlock is expected in July).

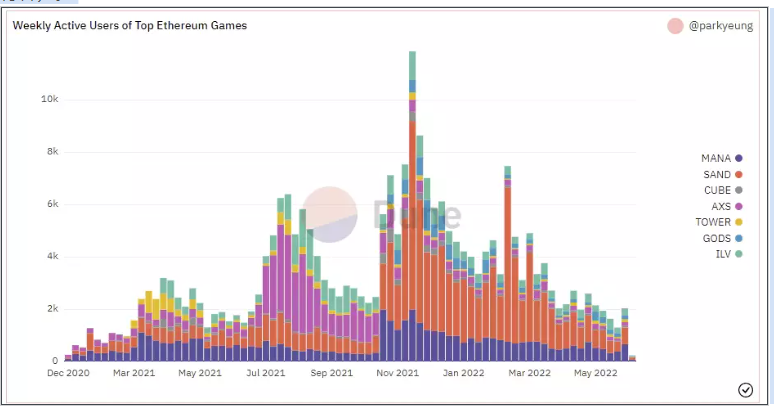

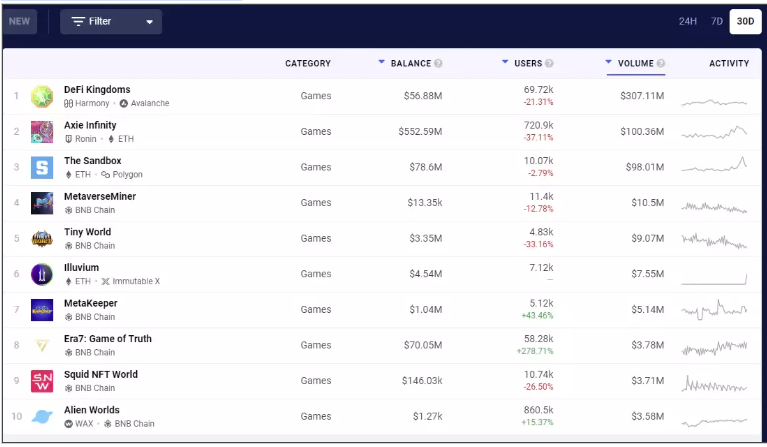

In the gaming sector, the number of ETH-based game users has dropped from nearly 12,000 weekly active users in November 2021 to just 2,000, with MANA and SAND dominating market share, while AXS users appear to have sharply declined (once the leading player).

According to DappRadar, DFK users dropped 21% over the last 30 days, AXS users fell 37%, while SAND users only declined by 3%.

The tokens of these games have also suffered massive declines over the past 60 days:

-

MANA -60%

-

APE -70%

-

AXS -69%

-

SAND -69%

-

GMT -75% (banned in mainland China)

-

GALA -71%

-

JEWEL -97%

To summarize so far: we’ve seen surrender from some large BTC and ETH holders or whales, broad-based TVL declines, with only Arbitrum holding relatively strong, NFT trading has dried up, and active gaming users have seen substantial drops. Is there anything to get excited about?

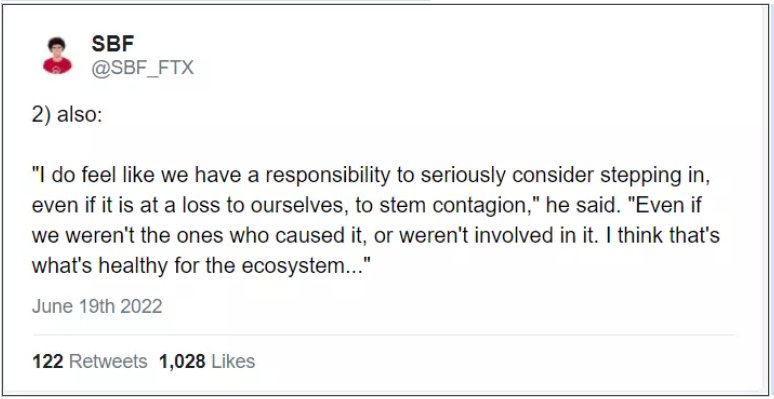

While concerns persist that bankruptcies like Celsius and 3AC could trigger a domino effect, SBF/Alameda tweeted yesterday that they would "step in to prevent deeper contagion."

Smart money (from Nansen) has finally started reallocating capital again—after seeing stablecoin holdings return to levels near previous peaks. The stablecoin market cap is now around $155 billion, while total crypto market cap stands at $892 billion—indicating a significant amount of dry powder remains on the sidelines, waiting for conditions to become “safe”.

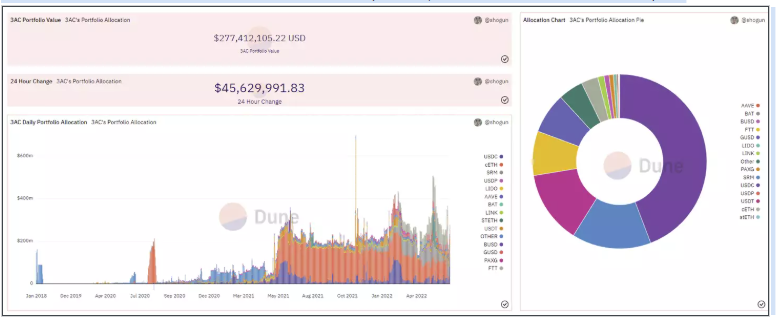

Moreover, although it's difficult to quantify the full risk of 3AC’s collapse, at least on-chain, the firm (based on known 3AC wallets) doesn’t have much left to dump. According to Dune’s 3AC wallet dashboard, the company holds $277 million in on-chain assets, but importantly, aside from stablecoins, its main positions are SRM ($41M), FTT ($23M), and only $8M in cETH. Barring other variables, the worst-case scenario for 3AC dumping may already be over.

Some positive signs:

-

ETH active addresses are only down 12% YoY

-

Arbitrum daily transaction volume continues to rise (despite market pressure), up 90x YoY

-

ETH and BTC managed to avoid some major liquidations

Are we out of the woods yet?

Possibly—but I remain cautious about potential outflows from crypto hedge funds over the coming weeks. According to PwC, total AUM of crypto hedge funds (excluding leverage) was $4.1 billion in 2021. Given the current macro environment and monetary policy, demand for risk assets has sharply declined, making fund redemptions between Q2 and end-Q3 likely, potentially creating incremental selling pressure in July. Additionally, with inflation still rising, a dovish turn from the Fed may not come soon (despite recent dovish comments). Major potential headwinds facing crypto include monetary policy, Celsius risk, 3AC collapse, and on-chain liquidations.

Crypto’s total market cap is now near the new highs seen in 2018—and yet we now have gaming, NFTs, and DeFi applications that, despite recent hardships, still retain user bases. Two key catalysts that could help crypto rediscover its "narrative" are: (1) the ETH merge, which appears increasingly likely within months, and any dovish shift in Fed policy. I won't make market predictions here, but it does seem we're closer to a bottom now.

Below are some projects I'm personally researching—not investment advice; please DYOR:

-

XMON/SUDO

-

GMX

-

DPX/rDPX

-

SYN

-

stETH

-

UMAMI

-

CVX

-

GameFi / Gaming Tokens

-

NFT Lending

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News