WEB3 Startup Insights: Finding Your Moat – What Qualities Should Founders Possess?

TechFlow Selected TechFlow Selected

WEB3 Startup Insights: Finding Your Moat – What Qualities Should Founders Possess?

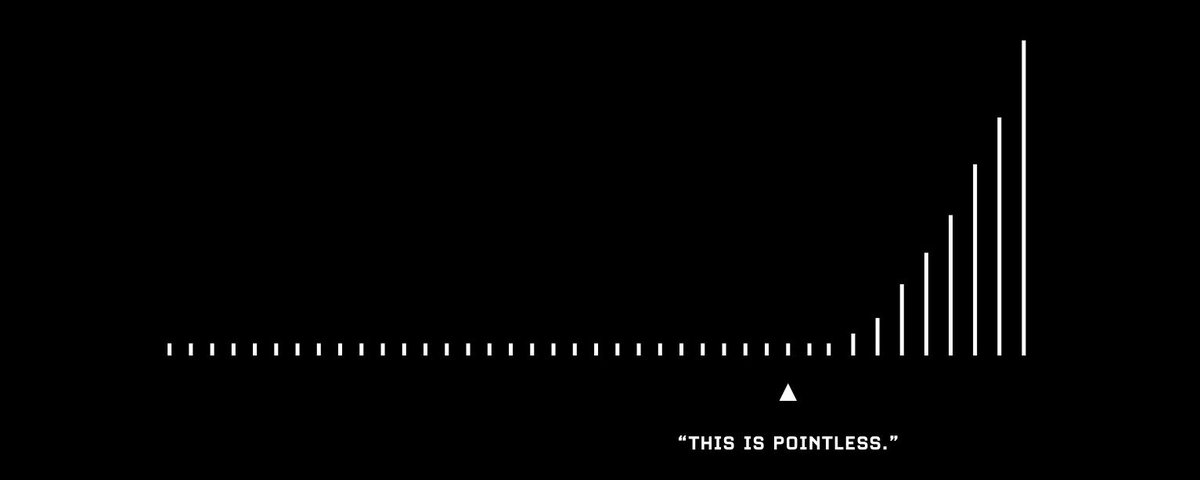

In the world of blockchain, survival—continuous survival—is what matters most.

By web3fox.eth

Recently finished reading Duan Yongping's investment Q&A (Business Logic Edition), and reflecting on the pitfalls I've encountered in my entrepreneurial journey since 2021, here are some takeaways. I hope to improve my path forward and offer insights to those who follow.

Why Start a Business?

Motivation for Entrepreneurship

In my view, entrepreneurship is about making money—specifically, making substantial wealth. It enables achievements beyond what salaried work can provide: fulfillment, financial freedom, social status, and class mobility.

Yet this path is littered with countless failures—people sacrificing capital, time, energy, even their lives in fierce competition. To earn returns above society’s average, one must pay costs far exceeding the norm.

The Era We Live In

Since the 2008 global financial crisis, countries have been printing money aggressively. In an era of relentless monetary expansion, our personal assets—the vessels holding these currencies—have become the most direct representation of individual wealth.

Among all assets, Bitcoin stands out as the brightest star, originally created precisely to counteract global currency devaluation.

Later, Ethereum leveraged smart contracts to create an independent token issuance platform outside traditional securities markets, hosting countless application tokens on its network, cementing its position as the leading public blockchain and second-largest cryptocurrency by market cap.

Amid chaotic centralized exchange wars, Binance decisively moved overseas after China's September 4, 2017 crackdown, pursuing global markets. From that moment, the landscape shifted. Embracing macro trends, adapting to globalization, respecting users, and other unspoken factors propelled Binance to become the undisputed top exchange by 2022.

With Bitcoin halvings marking four-year cycles—each year forming a mini-cycle—countless entrepreneurs apply their intellect, time, effort, and capital within this emerging blockchain industry to discover viable business models.

Business Models

The better the business model, the higher the certainty—or lower the risk—of investment. --- Duan Yongping

Right business, right people, right price. --- Warren Buffett

"Right business" refers to the business model; "right people" means corporate culture; price matters less. The business model and people matter most. --- Duan Yongping

These quotes come from the most respected minds in investing, profoundly influencing entrepreneurs across both China and the U.S.

In blockchain entrepreneurship, I believe the best approach is identifying widespread industry problems and offering targeted solutions. By creating value and solving real issues, profits can be captured from expanding markets.

Example

Long ago, everyone drank water for free—by digging wells or drawing from rivers.

As industrialization advanced, water sources became polluted. Ordinary people could no longer access clean water at low or zero cost. Then came municipal water plants, purifying and disinfecting water so it was safe again. People realized filtering water themselves cost more than buying tap water, so they chose the latter.

Through large-scale industrial systems, water companies reduced per-unit purification costs, enabling consumers to obtain clean water more affordably while earning greater revenue. This was growth-market innovation—a win-win between provider and user.

As living standards improved, boiling tap water before drinking no longer satisfied certain consumers. Sharp entrepreneurs noticed this gap and adapted lab-grade filters into compact home filtration systems, further improving purity to deliver drinkable water straight from the tap.

These new entrants didn’t compete directly with water utilities. They recognized changing conditions and emerging needs. By serving new demand, they achieved commercial success in a fresh market segment.

Analysis

In the above case, we sadly observe: ordinary people did nothing wrong, yet they’re forced to bear rising water costs due to pollution. Meanwhile, the factories causing the damage either paid nothing or insufficient compensation.

Factories already paid taxes and followed emission standards—but those standards may not be effective, nor is compliance fully verifiable.

Due to enforcement costs and competitive pressures, factories naturally choose the most self-beneficial treatment methods. Everyone believes they’ve done nothing wrong, yet collectively society bears the consequences of environmental degradation.

Water utilities succeeded commercially under polluted conditions by offering low-cost purification.

Later, filter manufacturers identified evolving consumer demands within the same space and fulfilled them, achieving new commercial breakthroughs.

Entrepreneurs who grow markets like this deserve our respect and emulation.

In such polluted environments, there will inevitably be fraudulent products. These bad actors also accumulate wealth—but at the expense of the general public.

Victimized consumers may lose trust entirely, refusing to buy genuinely useful products later. Years later, some scammers might rebrand themselves as successful figures, regaining social acceptance. Yet behind their success lie unseen victims—those whose suffering goes unheard as they quietly fade away.

Moat: The Core of Any Strong Business Model

Let’s continue analyzing using the water example.

What is the water utility’s moat?

Stable supply of consistent water quality, long-established user payment habits, administrative monopolies within regions.

The first two stem from consumer trust built over time; the third comes from licensed monopoly operations.

What about home water filter makers?

First-mover advantage in early market voids, robust pre- and post-sales service, human-centered design, respect for customer intelligence, etc.

Why Choose Blockchain Entrepreneurship?

Differentiation Is the Foundation of a Good Business Model

Something users need but competitors fail to deliver --- Duan Yongping

Compared to hyper-competitive traditional industries and legacy internet sectors, blockchain still offers abundant opportunities.

Precisely because it’s imperfect and full of unsolved problems, it opens doors for newcomers.

Some may argue that after ten years of development, blockchain is dominated by entrenched interest groups, crowded with players across every niche—how can latecomers stand a chance?

Class rigidity is a challenge every generation faces.

People occupy different positions. Entrepreneurs solve localized problems; founders envision entire ecosystems.

How to sustain vitality in the Ethereum ecosystem—that’s the founder’s responsibility.

Finding web3's Soul a 37-page paper, points us toward that vision.

DeSociety, Web3, Soul, Soulbound Tokens

Ethereum’s ambition is enormous—not only to reshape finance, but to expand blockchain, centered around Ethereum, into every aspect of socio-economics, politics, culture, and daily life.

To build a decentralized society, we must first find the “soul” of the web3 era.

Given multiple interpretations of “soul”—person, spirit, central figure, etc.—the author cannot fully convey its deeper meaning here, hence retaining the English term.

In seeking this soul, we must first encode social trust relationships. Just as Bitcoin’s whitepaper once did, this 37-page manifesto redirects entrepreneurs toward a new frontier.

Within this new domain, many talented builders will likely develop concrete solutions based on the paper’s guidance. I am one of them.

Preparation Before Starting Up

When deciding to start a business, your first step is choosing the right field.

This field might be obscure, trending, saturated with giants, or completely barren.

Ask yourself: What existing problems can I solve on this path? Why am I capable of solving them?

Where can you find differentiated angles for breakthroughs—doing things giants haven’t noticed or aren’t eager to pursue?

Common Pitfalls in Entrepreneurship

1. Avoid building infrastructure products from day one—they require massive capital.

2. Use APIs whenever possible in early stages instead of parsing raw blockchain data yourself—it saves significant time, money, and manpower.

3. From the outset, clearly define equity distribution, revenue sharing, and each member’s scope of responsibilities.

4. With limited funds initially, stay lean. Everyone should be multi-skilled; founders must do everything—even menial tasks. Otherwise, you risk wasting money or time being misled. Spend only when you understand exactly where the money goes, what function it serves, and which problem it solves. Otherwise, it’s wasted effort.

5. Once you have a clear solution and MVP, confidently approach VCs. If rejected, don’t worry—there’s no shortage of VCs in the market. Capital is never scarce; truly innovative, value-creating projects are.

6. If financially feasible, operate your team in a jurisdiction-friendly country. It brings peace of mind. Bear markets aren’t long, leaving ample time to refine your product quietly.

7. When fundraising, aim to raise enough capital to sustain your team for two years. Survive the bear market building solidly; soar during the bull run.

If you're building a data analytics product, I can share some foundational reference cases.

Qualities Founders Must Possess

1. Someone who has lived through full market cycles (bull and bear)

2. A certain sensitivity to data

3. Understand how code works—even if not coding personally

4. Know what data to collect and how to process it

5. Ability to sketch simple prototypes in Figma, reducing communication overhead

6. Understand user needs, market demands, and unresolved pain points

7. Capable of independently securing institutional funding and knowing which backers align best with future project growth

8. Able to recruit competent team members—early on, rockstars are unlikely, but solid developers who can execute your vision suffice

9. After MVP and feature expansion, know how to launch into market, acquire precise users, and create onboarding tutorials and videos

There may be many more responsibilities—payroll, office logistics, employee meals and housing—all potentially falling on the founder in a startup environment.

Because the founder’s competence, vision, and thinking determine the product’s upper limit, while team members merely set its floor.

For a data analytics product, beyond the qualified leader above, you’ll minimally need:

1. 2–3 backend engineers handling server infrastructure, database maintenance, and data processing—one of whom understands smart contracts.

2. 1–2 frontend developers responsible for website interface implementation, scaled according to workload.

3. 1 UI designer focused on visual design. While the founder can draft basic designs, excessive involvement wastes valuable time—clear communication suffices.

4. Product role led by the founder, as only they grasp the overall direction.

5. 1 operator—if budget-constrained, the founder can temporarily cover this role. Every dollar must be spent wisely.

In summary, a team needs at least seven members, with initial funding covering two years—requiring a minimum of $1 million USD.

● During fundraising, expect repeated rejections—don’t despair. Most institutions won’t commit without seeing tangible progress; they seek high returns on capital.

● Don’t undervalue yourself when seeking investment. Remember, VCs exist to fund projects. Their goal is securing high-potential deals at the lowest possible entry cost.

● Negotiation is always bilateral. Project teams need sufficient capital to survive, requiring equity or future token allocation; investors want favorable terms.

●Raising more money isn't necessarily better. Overvaluation resembles excessive leverage—more spending leads to diluted focus. Overreaching risks sudden collapse.

●Your product must maintain a core主线—this is your differentiation, your moat. All features and pages should extend from this foundation. Only then can you survive in the market.

Conclusion

A brief introduction: someone who discovered Bitcoin in 2012, traded it in 2013, went all-in on blockchain in 2017, experienced mining, community management, private investments, participated in both primary and secondary markets, worked with blockchain funds—still not financially free, but persistently building.

A Few Reflections

Society is complex. So are people.

In the world of blockchain, survival—ongoing survival—is paramount.

Only by surviving can you find new opportunities.

This holds true for investors, entrepreneurs, and institutions alike.

Blockchain remains a sunrise industry. Don’t complain or boast based on short-term wins or losses.

Stay hungry, stay foolish

Remain open-minded toward new ideas, and avoid over-relying on past successes.

Contact:

Telegram: @web3fox

Original link: https://mirror.xyz/web3fox.eth/cyzrJ9uVc9GG9XO_njSm-eoTumblkvkO9syu64w7GHE

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News