The "Disappeared" Founders of Top-Tier Crypto Projects

TechFlow Selected TechFlow Selected

The "Disappeared" Founders of Top-Tier Crypto Projects

Not sure where Gavin Wood is now, seems like there hasn't been news about him for a while...

Written by: Lvdong Xiaogong, BUBBLE

Founders are often embodiments of the narrative itself.

Whether it's Vitalik's geekiness, Jeff Yan's trader instinct, or Do Kwon's arrogance, each has defined the soul of their project in some way. Yet over the past few years, these "crypto celebrity founders" have one by one faded from the stage.

Recently, Jason Zhao, founder of Story Protocol, announced his resignation as CEO, reigniting public discussion. The young Korean-American—startup prodigy at MIT summer camp, student in Fei-Fei Li’s lab, youngest product manager at DeepMind—had a script that could have led straight into Silicon Valley stardom. But instead, he chose to write his chapter in crypto, only to walk away three and a half years later.

BlockBeats has compiled seven such “disappeared” founders—some left voluntarily, others were forced out; some departed with idealistic grace, while others fled amid scandal and controversy... Of course, they are just a microcosm. More and more founders will likely exit after token launches, moving on to what should be perfectly good next chapters.

The model child who moved from "metaphysical" to "real world"

On August 16, Jason Zhao posted an emotional message on X, announcing that after 3.5 years as CEO of Story, he would step down from full-time leadership to serve only as a strategic advisor, focusing instead on a new AI project called Poseidon (which recently secured a $15 million seed round from a16z). He said a new wave of industrial revolution in space, life sciences, and other frontier fields had rekindled his passion. Yet this post, seen by 5 million people, received only 2,000 likes.

Jason Zhao, a Korean-American raised in Austin, Texas, began leading the local TEDx AustinYouth during high school. At age 19, he co-founded PolitiFund, a political lobbying crowdfunding platform, during MIT’s Launch training camp. With a perfect 2400 SAT score, he turned down full scholarships from nearly every Ivy League school to attend Stanford University.

After earning a bachelor’s degree in philosophy from Stanford, he continued with a master’s in computer science, specializing in artificial intelligence. Under the mentorship of AI pioneer Fei-Fei Li at her computer vision lab, he later joined Google’s DeepMind as its youngest product manager. By any measure, this is the ultimate success story. Had he stayed in big tech AI, he might even have received a “big money transfer” offer from Zuckerberg—but fate had other plans.

The "DeFi Summer" of 2020 introduced him to blockchain. His background in philosophy and AI led him to envision “AI reshaping creativity and enriching content, while blockchain defines digital ownership and confers verifiable scarcity.” IP + AI + Blockchain—this fusion led to the birth of Story Protocol at age 25, a project that successfully raised $140 million. It aimed to make intellectual property (IP) programmable, track usage and distribution on-chain, and enable new business models like creator royalties, licensing, and AI training.

They launched Story Academy to support builder programs for entrepreneurs and developers. Partnered with Yakoa to use AI detecting IP duplication and manipulation; integrated with Pastel Network to ensure certificate rarity and asset scarcity; collaborated with Lit Protocol to enhance transaction security and privacy; teamed up with Stability AI to bring on-chain authorization and copyright tracking into AI model training.

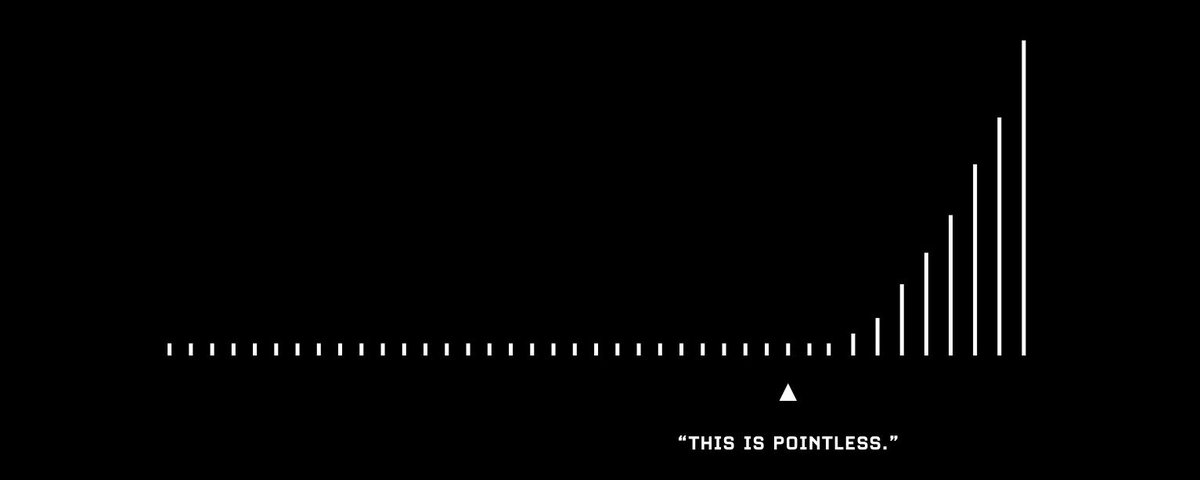

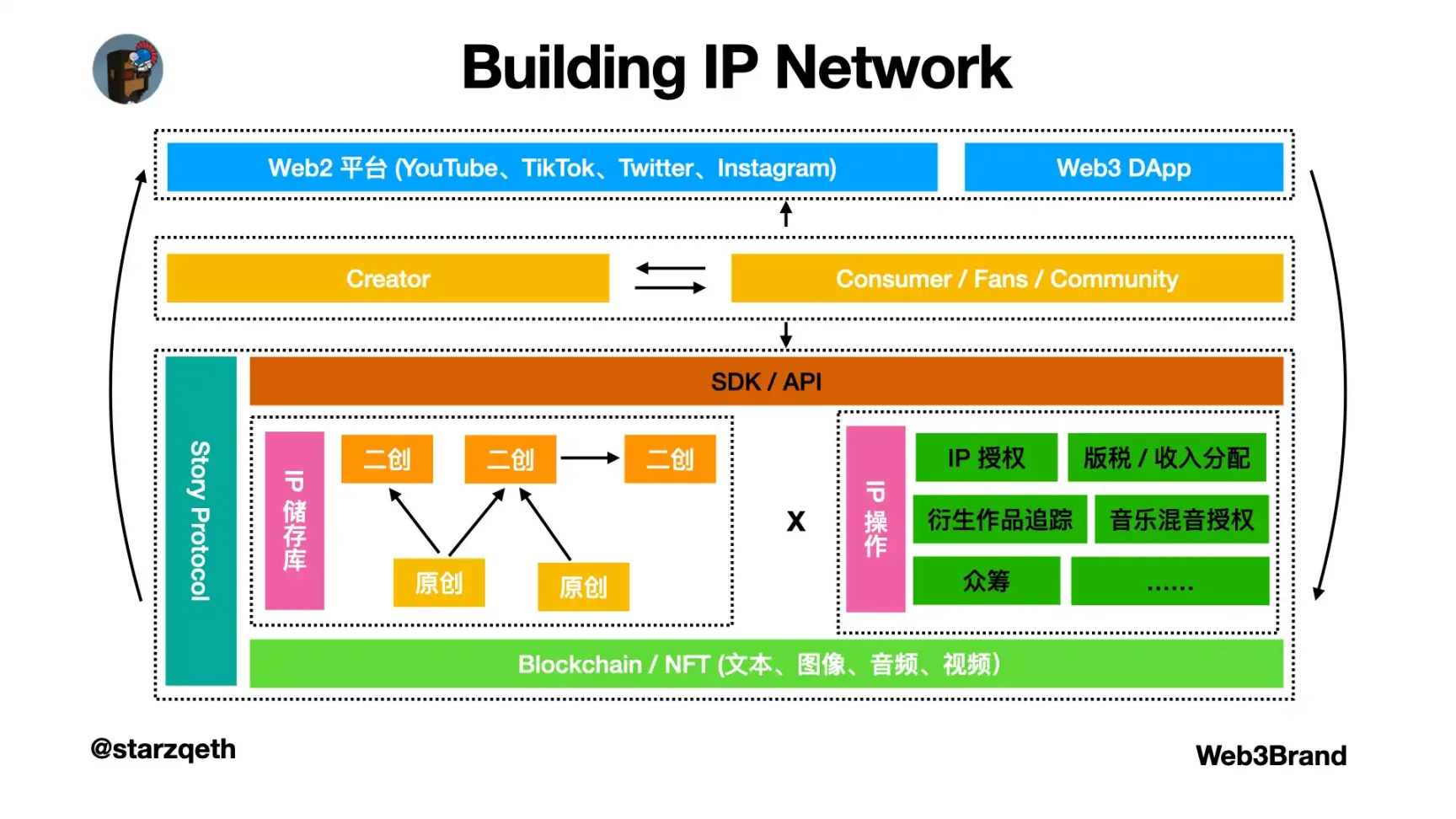

Story’s business logic, source: Starzqeth

Yet despite its grand narrative, Story—a product focused on connecting on-chain and real-world applications—seemed misaligned with current crypto trends. In the six months following TGE, they partnered with major brands like Justin Bieber, BTS, BlackPink, Adidas, and Crocs. But this didn’t change the fact that Story’s on-chain revenue mostly remained in single or double digits. Prominent VC analyst Adam Cochran pointed out that with a nearly $6 billion fully diluted valuation against such revenue, the project appeared to prioritize “flashy demos” over fundamentals.

In reality, however, Story still retained investor confidence before Zhao’s departure. Grayscale launched a Story IP Trust, and Heritage Distilling Holding Company (CASK) initiated its IP DAT program with a $220 million private placement, pushing the market value of IP assets to new highs when he left. His exit may not have been graceful, but neither was it disastrous. For a young man who lived half a lifetime before turning 26, perhaps his inner compass shifted—from Plato to Aristotle, from abstract IP to tangible physical AI infrastructure. He stepped into a new world, where perhaps wider frontiers await exploration.

Jason’s 'X' banner—the Raphael fresco 'School of Athens'. Left: Plato pointing upward to 'Ideas / Metaphysics'; Right: Aristotle gesturing downward to 'Experience / Real Order'

We haven't heard from Gavin Wood in a while…

"Wonder where Gavin Wood is now."

As Ethereum once again approached $4,000, someone suddenly remembered this core early co-founder of Ethereum—the author of the Ethereum Yellow Paper, creator of Solidity, and founder of Polkadot. The crypto world hasn't heard much from him lately.

In October 2022, Gavin Wood publicly announced his resignation as CEO of Parity Technologies—an intentional withdrawal from Polkadot. For the industry, this marked his second major project exit after Ethereum.

Gavin Wood was born in Lancaster, UK, and holds a PhD from Cambridge University, specializing in music visualization and human-computer interaction. Before entering crypto, he worked as a researcher at Microsoft and actively contributed to multiple open-source communities.

In 2013, he met Vitalik Buterin and became one of Ethereum’s earliest co-founders. He authored Ethereum’s first Yellow Paper and implemented its initial client, inventing the Solidity language along the way. He laid the foundational groundwork for smart contract usability.

But in 2016, due to ideological differences, he chose to leave Ethereum. He envisioned blockchain not merely as a virtual machine environment, but as a multi-chain interconnected ecosystem. This vision eventually materialized as Polkadot. In 2017, Gavin Wood co-founded Parity Technologies with Björn Wagner and others, driving Polkadot’s design and implementation. His Substrate framework made building blockchains as easy as assembling LEGO, while Polkadot’s relay chain and parachain architecture aimed to solve cross-chain interoperability and shared security.

In many ways, Gavin Wood resembles his former close collaborator, Vitalik. Within the Polkadot community, Wood remains the most symbolic engineer—more architect and thinker than manager. He excels at coding, writing documentation, and drafting manifestos, but struggles with managing large teams and complex stakeholder dynamics.

Hence, in October 2022, Gavin Wood stepped down as CEO of Parity Technologies, handing leadership to Björn Wagner. “The CEO role has never been my dream. I can perform well as CEO for a time, but it’s not where I find lasting happiness,” he said—a statement embodying classic engineer idealism.

Gavin Wood’s last two public appearances were telling: one was at EthCC7 in Brussels in July 2024, where he reunited with Vitalik Buterin and Joseph Lubin, two other Ethereum co-founders, for a historic photo; the other was at a Polkadot developer bootcamp, where he took the DJ booth, rekindling his passion for music. Perhaps this is where Gavin Wood feels most at ease.

BM is studying theology after leaving EOS

"Looking back at EOS seven years later"—Li Xiaolai’s words back then were unexpectedly prophetic, and now they seem eerily accurate.

In 2025, the seventh year of the promise, the EOS community gained independence from its parent company, Block.one, which took with it over $4 billion raised during EOS’s fundraising—converted into 160,000 BTC. This massive liquidity was channeled into a new exchange platform, Bullish. Born with a silver spoon, Bullish became the second crypto exchange to go public in the US after Coinbase, with a market cap around $10 billion.

In what appears to be a clean break from the past, EOS’s token has since been renamed A, currently valued at $321 million—less than one-twentieth of Bullish’s valuation. Meanwhile, Daniel Larimer, the central figure behind EOS, resigned as CTO of Block.one back in 2020. In the crypto world, he is better known as "BM."

BM was born in Virginia, USA, and is a staunch libertarian. He claims his favorite book is *Atlas Shrugged*, believing free markets and censorship-resistant technologies protect individual life, property, and freedom.

Once in crypto, he launched projects at a rapid pace: experimenting with a crypto exchange in 2009; founding BitShares in 2013, introducing early models of decentralized exchanges (DEX) and stablecoins; launching Steemit in 2016, pioneering large-scale "blockchain social media"; and in 2017, teaming up with Brendan Blumer (BB) to form Block.one and launch EOS.

Within Block.one—a de facto family enterprise—BB’s sister was appointed chief marketing officer without prior experience, notable only for changing EOS’s brand color from tech blue to a "softer, earth-tone gray." BB’s mother ran the venture fund, which invested $150 million in Voice, a social app that attracted fewer than 10,000 users in its first year.

BM held little power. He joked on Twitter about having “no decision-making authority”—the so-called “genius programmer” reduced to a sidelined figure within the parent company. In 2021, the EOS community staged a “fork rebellion” to sever Block.one’s control. BM resigned as CTO and left the community.

Since then, BM’s trail has gone cold. He rarely posts crypto-related content. Recently, his tweets have focused almost exclusively on biblical interpretation, apocalyptic predictions tied to geopolitical conflicts, and critiques of mainstream Christianity.

Dirtier backstage maneuvers

"Who ruined Movement?" When the MOVE token was delisted by Coinbase due to scandal, many finally began questioning the young co-founder of Movement Labs—once passionately discussing how “Move will change Ethereum’s security model” on hackathons and podcasts—who ended up exiting center stage so dramatically.

Rushi Manche was born in Illinois, USA, and studied computer science and data science at Vanderbilt University. Like many Gen-Zers, he immersed himself in hackathons, AI labs, and blockchain codebases during college. In 2022, he and classmate Cooper Scanlon founded Movement Labs from their dorm room. Their inspiration wasn’t complicated: internships at Aptos revealed the potential of the Move language—a safer, parallel-processing smart contract language compared to Solidity. Yet Aptos had clear limitations: lack of liquidity and a small developer base. So they conceived a bold idea: “Bring Move to Ethereum.”

The startup quickly caught investors’ attention. In the pre-seed phase, they secured $3.4 million from over a dozen angel investors. A year later, Movement Labs raised $38 million in Series A funding, with top-tier funds like Polychain, Placeholder, and Archetype on board. In industry narratives, Movement Labs became the “flagship Move-language project in the EVM world.”

Rushi quickly became Movement’s public face. He frequently appeared on podcasts, tech conferences, and industry interviews, exuding the typical energy of a young entrepreneur—quick-witted, fast-talking, radiating confidence that “the industry needs new blood to reinvent itself.” Under his leadership, Movement Labs announced development of M2 Rollup (a ZK-based Move Layer 2) and Shared Sequencer, aiming to represent Ethereum’s next-generation scaling solutions.

By the end of 2024, the MOVE token launched. At TGE, Rushi seemed to stand at the pinnacle—until problems emerged.

Soon after, community members questioned whether the airdrop list was pre-determined. Movement’s “shadow advisor” Sam Thapaliya leaked that over 75,000 wallets were designated by co-founder Cooper, securing 60 million Move tokens as insider allocations—yielding profits far beyond ordinary users. But Sam wasn’t innocent either: two commercial memoranda later revealed Movement Labs had signed agreements with two “shadow advisors” (including Sam Thapaliya), promising up to 10% of the MOVE token supply (worth over $50 million)—the project’s first crack.

Months later, the real storm hit. In April 2025, CoinDesk exposed Movement’s market-making deal with obscure intermediary Rentech. Rentech gained control of 66 million MOVE tokens at TGE, selling off ~$38 million worth the next day, triggering a token crash. Binance even froze accounts to contain the chaos. Contracts further showed Rentech acted both as agent for the Movement Foundation and as subsidiary of Web3Port—playing dual roles in the transaction.

This was the final straw.

On May 2, 2025, Movement Labs announced Rushi Manche’s temporary suspension. Five days later, he was formally removed as co-founder, with a new leadership team taking over. Rushi issued no public response. His image transformed overnight—from a vocal young engineer preaching “blockchain security revolution” to the central figure in a token scandal.

His exit was abrupt, chaotic, even carrying hints of expulsion. No one knows exactly what happened—multiple parties offered conflicting accounts. MOVE was delisted by Coinbase, and Rushi sued Movement Labs in Delaware court seeking clarification of responsibilities. To this day, Rushi’s last post remains a retweet from May 8 disclosing Sam’s commercial memorandum. And who really ruined Movement? That question now goes unanswered, unasked—like so many blockchain projects, once offstage, all that remains is a mess.

From IO to OI: From “decentralized compute” to “super AI”

When the IO token launched on Binance Launchpool, a question echoed through the crypto community: “Why did Ahmad Shadid suddenly resign?” This entrepreneur, once an advisor to the Ethereum Foundation, was among the most prominent founders in DePIN. On June 9, 2024—just two days before IO’s public sale—he abruptly announced on X that he was stepping down as CEO of io.net, passing the role to COO Tory Green.

Ahmad Shadid’s journey didn’t start with GPUs or AI, but with quant finance. He began as a data analyst at Cordoba Partnerships in Saudi Arabia, then worked as a quantitative systems engineer at ArabFolio Capital and Whales Trader, deepening his technical expertise in GPU-related systems. Starting in 2018, he developed DarkTick, an ML-driven risk management engine—a tool using quantitative/statistical techniques to develop and test highly automated trading strategies for equities, non-equities, and statistical arbitrage.

In 2022, he began advising the Ethereum Foundation, focusing on scalability issues in smart contracts and infrastructure. As multi-chain and L2 narratives matured, he turned to another overlooked domain: computing power.

In 2023, the generative AI wave swept the globe. ChatGPT triggered a surge in demand for compute, making GPU supply the tightest resource in Silicon Valley. Shadid realized that if DeFi could liberate finance, DePIN could liberate physical resources. His answer: io.net, a network connecting idle GPUs to provide decentralized compute for AI models.

In his narrative, IO wasn’t just a company—it was the “world’s largest decentralized AI supercomputer.” This slogan quickly captured capital and community attention. From studios to cloud providers, everyone seemed eager to “supply compute” to IO.

Yet right before the token launch, Shadid stepped down. “I’m resigning as CEO not due to external criticism, but to allow the project to grow without distraction,” he wrote on X. Prior to this, community members accused io.net of exaggerating its GPU capacity, fearing he might cash out prematurely.

In response, Shadid chose a transparent handover: donating 1,000,000 IO tokens to the Internet GPU Foundation to support ecosystem growth, emphasizing that all team, advisor, and investor tokens were subject to a four-year lock-up, with partial unlocks only beginning after June 2025. While this sparked speculation, in the murky world of DePIN, such a donation-based exit appeared remarkably “clean.”

After leaving IO, he launched a new project, O.XYZ, whose governance token is OI, claiming it to be a community-governed “sovereign super AI.” He introduced Osol, a Solana-based index token comprising the top 100 AI project tokens on Solana, and recently unveiled an “AI CEO.” But claims like “connected to 100,000+ AI models” and “20x faster than competitors” faced community skepticism. The project’s token value has since plummeted repeatedly. After transitioning from IO to OI, and after repeated disappointments with the “CryptoAI” narrative, Shadid may no longer be as popular.

Mihailo, the ZK evangelist who exited Polygon

One morning in May 2025, Mihailo Bjelic decided to step down from the Polygon Foundation board and withdraw from daily operations at Polygon Labs—a formal farewell to a project he’d spent eight years with. For the crypto industry, this marked the third co-founder departure from Polygon; for him, it was a turn tinged with relief and divergence.

Mihailo hails from Serbia and studied information systems and computer science at the University of Belgrade. He entered the crypto space relatively early, engaging with Bitcoin and Ethereum communities in 2013, gradually immersing himself in the question: “How can blockchain become truly usable?” After graduation, he worked at a startup providing AI/ML solutions for the automotive industry and dabbled in small software projects, but none truly ignited his passion. His true obsession was finding a path through the maze of blockchain scalability.

In 2017, he connected with the team then known as “Matic Network.” Ethereum was suffering network congestion from CryptoKitties, with soaring fees and frustrated developers. Mihailo saw this as his calling: building a truly usable Ethereum scaling solution.

Within Polygon, Mihailo earned the title “ZK evangelist.” He led technical strategy, especially around zero-knowledge proofs (ZK). Under his push, Polygon spent hundreds of millions acquiring Hermez and Mir, heavily betting on ZK technology and laying the foundation for Polygon zkEVM.

He wasn’t just a technical force but also a key voice in Polygon’s external narrative. Whether on podcasts, tech summits, or research forums, he helped shape the story: Polygon isn’t just a sidechain, but a multi-chain universe and a crucial piece of Ethereum’s scaling puzzle. He appeared in media interviews and stood on developer conference stages—part engineer, part evangelist.

But as the project grew, cracks formed. In 2023, Anurag Arjun, one of the four co-founders, left to build his own modular chain, Avail. Later that year, Jaynti Kanani also stepped back from daily operations. The once-close bonds between founders slowly eroded under the weight of time and growing complexity.

Two years later, Mihailo became the third to leave. In his statement, he cited “vision misalignment” and admitted he could no longer contribute at his best. The foundation would now be solely led by Sandeep Nailwal. Mihailo’s story involved no escape, no scandal, no dramatic collapse—his words were gentle, quiet, and clean.

Stepping down as Morph CEO, she left behind a “footprint meme”

Cecilia’s departure from Morph can be summarized as being pushed out amid internal conflict, power struggles, and external controversies.

In June this year, Cecilia Hsueh, co-founder and CEO of Morph, announced on social media her formal resignation, handing the CEO role to Goltra, a former YGG executive and Binance veteran. She called it a “well-considered decision,” stating she would continue supporting the team as an advisor.

Cecilia, born in Taiwan and based in Singapore, entered crypto through Phemex, where she served as CMO and briefly acted as CEO. Prior to that, her career focused on marketing and operations. In 2023, she was selected by Bitget and Foresight Ventures to team up with Azeem Khan, a former Gitcoin member, as co-founders of Morph, a newly incubated public chain. Cecilia took the CEO role, aiming to position Morph as a “consumer-grade public chain,” hoping to find the next L2 breakout after Coinbase’s Base.

In March 2024, Morph raised $20 million in seed funding at a $125 million valuation. News of the raise quickly boosted Morph’s profile, with the community hopeful it could rival Base. But cracks soon emerged: Cecilia and Khan had never met before and were “forcibly paired” as co-founders. Their visions diverged sharply—Khan focused on emerging markets, while Cecilia prioritized branding and marketing. Over time, tensions escalated.

Thereafter, Morph drew media attention for reckless spending and strategic confusion: spending hundreds of thousands in Singapore at Token2049, hiring K-pop group tripleS and DJ SODA; leasing office space on the 77th floor of NYC’s World Trade Center, shared with Foresight and The Block; paying over $200,000 to develop BulbaSwap, a Uniswap v2 clone that ranked only 200th globally.

Meanwhile, Morph’s mainnet transaction volume remained low, averaging just 16,000 daily transactions—far below Base’s millions. The planned token launch was repeatedly delayed, staff turnover soared, and some employees reportedly never received clear token agreements.

In early 2025, Khan announced his exit from Morph to launch a new blockchain, Miden. Cecilia remained nominally CEO, but her actual influence weakened further. Finally, in June 2025, she chose to leave.

More dramatically, Morph’s real leader may never have been the public-facing CEO. According to Blockworks, Forest Bai, co-founder of Foresight Ventures, was dubbed the “ghost captain” by employees. Though not on Morph’s management team, he deeply influenced strategy, budgeting, and personnel decisions—even being added directly to Slack channels to exert control. This cast serious doubt on Morph’s governance and power structure.

And somewhat absurdly, in the minds of most crypto community members, Cecilia’s image remains blurry. But because she once posted photos of her feet on social media, it’s her feet that left the strongest impression.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News