Sharding Capital Partner: Why Young Talent Should Get Involved in Web3 Startups and Investments

TechFlow Selected TechFlow Selected

Sharding Capital Partner: Why Young Talent Should Get Involved in Web3 Startups and Investments

The Web3 world can overturn traditional entrepreneurship's age bias through elevated awareness, enabling faster and more positive exploration of personal value and experience accumulation.

This article summarizes the speech delivered by Belinda Zhou, Partner at Sharding Capital, at the AFIC Startup Competition in New York.

The translation and summary are as follows:

Recently, while attending blockchain events, I’ve met many young talents—like a 14-year-old Solana developer or a 16-year-old creative lead in an Avalanche GameFi project. This generation was born immersed in Web2, accustomed to creating and sharing; for them, Web2 is already traditional. In the Web3 world, they can leverage their understanding to challenge age-related biases in entrepreneurship, enabling faster and more positive personal growth and experience accumulation.

I entered the blockchain industry in 2017, having served both as a Web3 entrepreneur and investor—making me somewhat of a well-rounded Web3 practitioner. People often ask me how someone in their twenties could have so much professional experience and such extensive network connections. The answer lies precisely in my field: Web3—a rapidly evolving and transformative industry where many young individuals are both young and experienced because they’re given ownership. This, I believe, is especially valuable in the Web3 world.

Web3 Eliminates Age Bias and Enables Rapid Self-Value Exploration for Youth

Let me give a concrete example. As a programmer in Web3, with just basic competence, one can receive fair or even generous incentives based on contributions. You can participate in building ecosystems like Ethereum, Solana, or Near; submit your projects to open-source platforms and community funding platforms like Gitcoin; become a white-hat hacker on Web3 bug bounty platforms like Immunefi to audit smart contracts; or join decentralized autonomous organizations (DAOs) that interest you. In Web2, you might just be an ordinary coder without nearly as many standout opportunities.

Each year, Apple actively recruits talent and advances its technology at its iOS Developer Conference—but crucially, the iOS system remains exclusively owned by Apple. External developers have no say or revenue-sharing rights. By contrast, artists and musicians can directly profit by selling NFTs to fans and retain over 90% of their earnings.

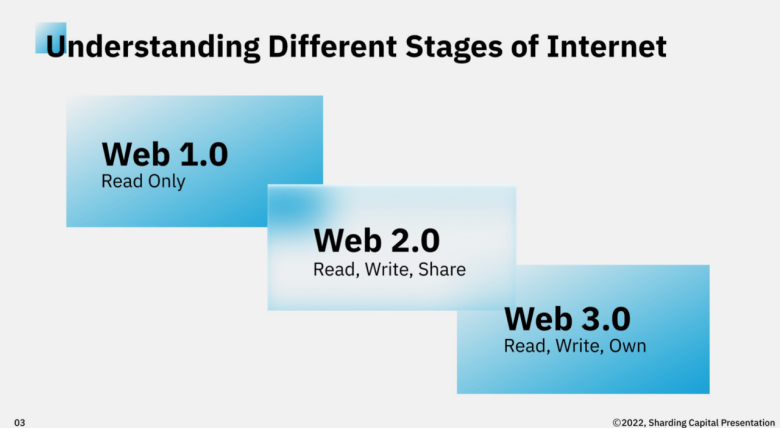

Understanding the Different Stages of the Internet: Web1/2/3

Since today’s audience has limited exposure to Web3, let’s first briefly explain the differences between Web1, Web2, and Web3.

The internet has mainly gone through three phases.

Web 1: Read Only

Users were primarily readers with minimal interaction. Representative companies include web portals like NetEase, Sina, and Sohu, built on underlying protocols such as HTTP/TCP.

Web 2: Read, Write, Share

User-generated content (UGC) became dominant, allowing users to create content and interact more. Key players include Meta (formerly Facebook), Instagram, etc. However, Web2 suffers from monopolistic practices—platforms control everything that happens within their domains, including censorship and surveillance. For instance, Wang Sicong recently had his Weibo account suspended, just as Trump was previously banned from Twitter.

Web 3: Read, Write, Own

Centered around blockchain data, creators will own the network (underlying assets). Examples include content creation platform Mirror and open-source platform Ethereum. Users truly become owners of their on-chain assets.

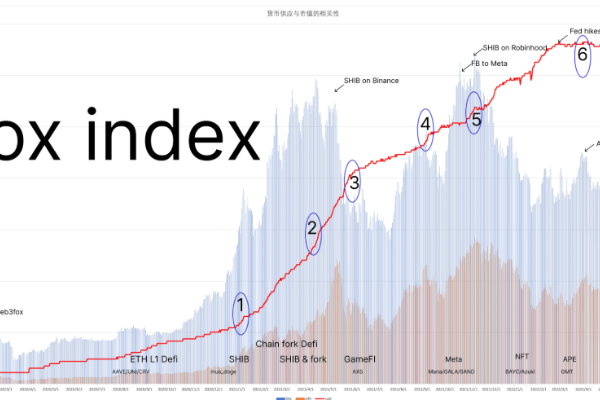

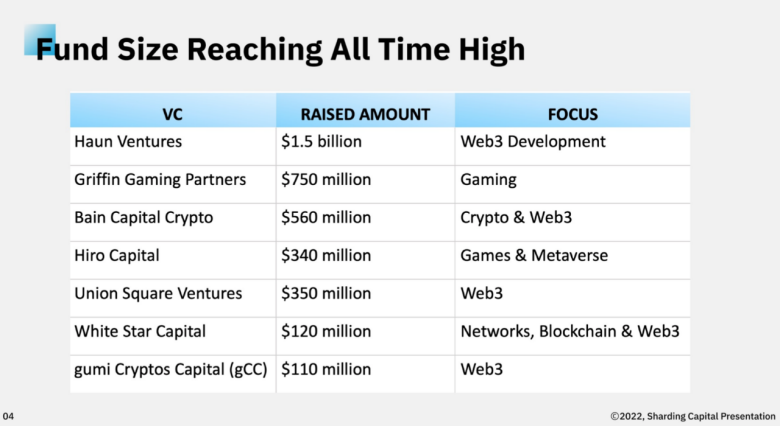

Traditional and New Institutions Enter Web3 En Masse, Funding Reaches Record Highs

Precisely because Web3 is widely seen as the next stage of the internet, venture funds focused on Web3 continue to emerge, especially densely in Q1 2022. Below is a non-exhaustive summary by Sharding Capital:

From this incomplete list, it's clear that shortly after Q1, numerous institutions are doubling down on Web3, launching dedicated Web3-focused venture funds.

Additionally, major completed financings show that traditional VCs are rushing into Web3, securing stakes in top-tier, mature Web3 projects via equity, token investments, or hybrid models. For example, on March 15, ConsenSys, an Ethereum infrastructure development company, closed a $450 million Series D round, reaching a $7 billion valuation. New investors included traditional giants such as Temasek, SoftBank Vision Fund II, and Microsoft. Chinese tech giant Tencent also invested in Immutable, an Australian NFT layer-2 scaling solution provider.

In our investment journey, Sharding Capital has also encountered many high-quality traditional institutions co-investing with us, such as Jump Trading and Jane Street.

With the Rise of Web3, What Are the Startup and Investment Opportunities?

These fundraising updates provide strong confidence for those in the Web3 space. Why? Because all this capital must eventually be deployed—to drive compelling narratives and technological progress.

On December 8, 2021, Sequoia Capital changed its Twitter bio to "Mainnet faucet. We help the daring buidl legendary DAOs from idea to token airdrops. LFG"—though it later reverted. LFG is slang for "Let’s Fucking Go," reflecting the highly energized spirit of Web3.

Here’s a fun fact: According to Crunchbase, funding for companies describing themselves with “Web3” and “decentralized networks” has surged dramatically. In the prior year, $380 million across 93 deals flowed into startups embracing the Web3 narrative—up sharply from $20.5 million across 30 deals in 2020.

This isn’t to suggest everyone should jump on the Web3 bandwagon blindly, but rather that choosing the right direction matters. My view is that the first principle of any endeavor is: get the money. Only when you get the money do you have the chance to change the world. This insight I learned from Chamath Palihapitiya, founder of Social Capital and a prominent figure in retail investing.

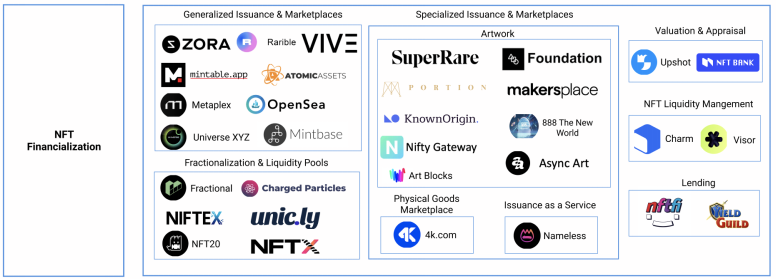

Below are some Web3 startup areas worth considering—also key focus areas for Sharding Capital:

Each sector contains numerous subcategories. For instance, within the NFT space, there are specific verticals such as marketplaces, rentals, and issuance platforms shown below. Due to time constraints, we won’t go into detail on each.

Image source: Massari, a leading crypto research firm

Final Thoughts

Capital needs talent and execution to unleash maximum momentum and capture the greatest value. Ultimately, we hope aspiring entrepreneurs who want to make an impact and change the world recognize that Web3 entrepreneurship and investment represent a rare opportunity in this era—because it treats youth equally and inclusively; offers abundant capital; features limitless upside; and delivers faster returns.

Sharding Capital is committed to investing in early-stage Web3 projects and providing comprehensive support and assistance to help them grow into unicorns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News