Finding the Next Cycle of Startup Opportunities from Web3 History

TechFlow Selected TechFlow Selected

Finding the Next Cycle of Startup Opportunities from Web3 History

Reviewing historical development to identify the underlying logic, thereby providing sufficient insights for the next cycle of growth.

Author: web3fox.eth

Table of Contents

-

January 2020 – June 2020: Liquidity Shortage & Surge

-

December 2020 – May 2021: Musk Enters the Scene & SHIB Explosion

-

June 2021 – September 2021: GameFi Boom

-

October 2021 – November 2021: Meta Boom & SHIB on Robinhood

-

December 2021 – March 2022: NFT Prosperity and Ape Universe Drain

-

May 9, 2022: Terra Collapse, Liquidity Dries Up

-

Summary from Early 2020 to Present

-

Entrepreneurial Directions for the Next Cycle

-

DeSociety, Web3, Soul: My Chosen Entrepreneurial Path

Review: From Early 2020 to Present

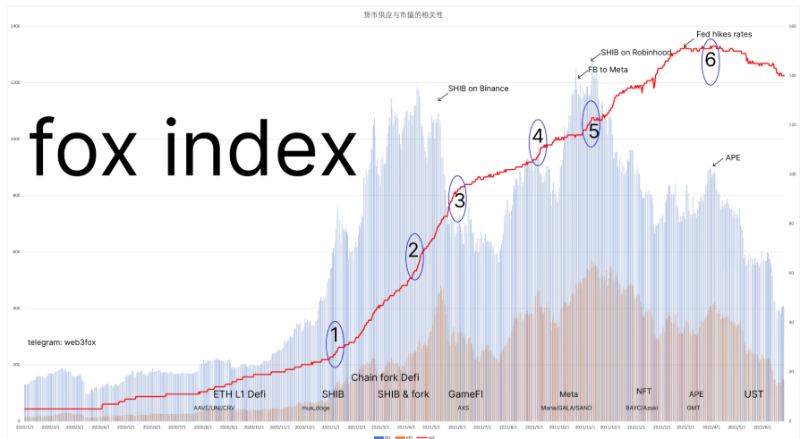

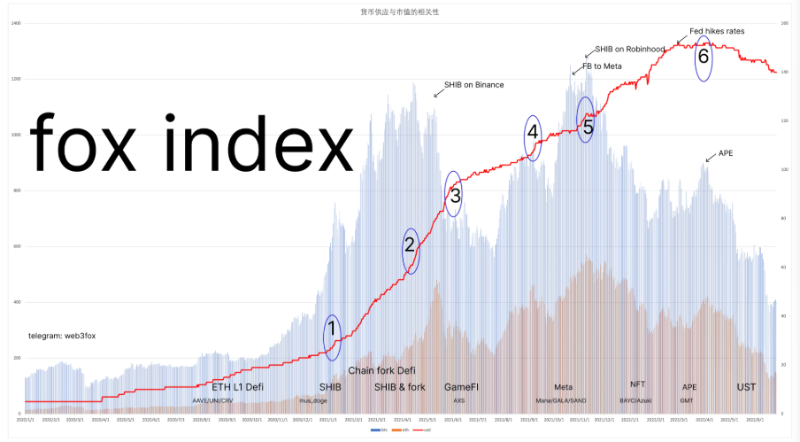

Fox Index (refer to image markers 1–6)

Overview

While analyzing the relationship between liquidity and market cap in the blockchain industry, I discovered several interesting time points worth sharing.

Since early 2020, the total market cap of stablecoins (USDT+USDC+BUSD) has surged from $4.6B to $139.6B—an increase of 30x.

Meanwhile, the overall cryptocurrency market cap rose from $191B to $950B—a 5x growth.

The peak occurred on November 9, 2021, reaching $2,937B.

Behind every surge lies an underlying logic—some need or category of needs being fulfilled, generating positive capital feedback.

This article aims to review historical developments, uncover the internal logic, and offer insights for the next cycle.

By reading through, you may gain fresh perspectives for investment or entrepreneurship. Investors and founders are welcome to reach out.

If you have connections with international media outlets, please contact me—I’d like to translate this piece into English for foreign publication.

Notes

-

The USD market cap mentioned below refers to the combined value of USDT+USDC+BUSD, which accounts for over 95% of all stablecoin market caps—used here as a proxy metric.

-

Data cutoff date is June 28, 2022.

-

"312" refers to March 12, 2020—the sharp crash triggered by U.S. stock market liquidity crisis.

January 2020 – June 2020: Liquidity Shortage & Surge

After global pandemic shocks, U.S. equity market liquidity crisis, and the massive liquidations on "312", governments worldwide adopted quantitative easing to stimulate economies.

In this context, global capital sought undervalued assets. The blockchain sector became one of the few choices for smart money at that time.

As shown in the chart, from March to November, capital inflows into blockchain accelerated rapidly, with USD-pegged stablecoin supply increasing from $5B to $20B.

During this phase, lending protocols such as AAVE began to take off, along with decentralized exchanges (DEXs) led by Uniswap.

Historical Context

Before Uniswap gained broad acceptance, projects had to pay high listing fees to centralized exchanges (CEXs) for liquidity.

The emergence and widespread adoption of DEXes directly disrupted CEX dominance. At that time, traditional exchanges were caught off guard, prompting many to launch their own chains and native DEX protocols.

Once Uniswap was widely recognized, forks became inevitable—giving rise to the 2020 DeFi Summer.

Among these forked products, Sushi stood out by introducing one-click liquidity migration and launching its token first.

Curve, building upon Uniswap’s model, introduced a new approach optimized for large trades, addressing unmet demand and solidifying its position.

Successful projects never blindly chase trends—they focus early on a niche and persistently cultivate it.

Even after building something valuable, market recognition may not come immediately—it requires enduring solitude.

Cases

● Axie Infinity

On March 13, 2020, AXS released a teaser and spent eight months developing before going live.

From its token launch in November 2020 to its breakout in June 2021—over half a year later—it finally gained market recognition during a period of fading hype, achieving its moment of glory.

● AAVE (formerly ETHLend) & MANA

AAVE’s lending protocol endured four years of dormancy before shining when macro conditions shifted.

Similarly, Decentraland, originating from the previous cycle, rode the wave of the metaverse boom.

Meanwhile, so-called star projects from earlier eras faded into obscurity amid changing tides.

December 2020 – May 2021: Musk Enters the Scene & SHIB Explosion

The blockchain industry continued surging due to DeFi, attracting growing attention from capital. Among them, Elon Musk, the newly crowned world’s richest man, stood out most prominently.

Through Twitter, Musk brought broader awareness to blockchain, BTC, and Doge. During this phase, stablecoin supply grew from $20B to $30B.

It’s no exaggeration to say he single-handedly pulled about $10 billion into the blockchain market. For someone with a net worth in the hundreds of billions, his influence alone was enough to drive financial markets wild.

Musk openly endorsing Doge effectively mapped his personal influence onto the coin. Having accumulated positions early, he monetized his influence within the blockchain space via Doge.

See image marker [1]

At this point, SHIB capitalized on blockchain users' enthusiasm and Musk-related momentum, adopting provocative slogans like “feeding shit to dogs.”

SHIB, the “shit coin,” a pure meme token, surged under community-driven momentum and retail investors’ frustration toward coordinated manipulation by capital and project teams. Retailers poured their funds into SHIB en masse.

From January 2021 to May 2021, the entire market operated under SHIB’s explosive rally. Rising demand drew more external capital into crypto.

BTC, ETH, and the broader market experienced rapid price inflation.

SHIB’s listing on Binance marked the final glory of blockchain tokens. After absorbing this hype, with no new narratives or catalysts emerging, prices quickly collapsed.

See image marker [2]

Stablecoin supply increased from $23B to $93B

June 2021 – September 2021: GameFi Boom

After SHIB’s hype faded and the market cooled, capital naturally searched for new hotspots and value opportunities.

At this time, AXS, listed on Binance in November 2021, led the charge with consistent data and a relatively sound economic model, triggering the GameFi explosion.

With the gaming ecosystem booming, blockchains like Terra and Solana launched similar projects, absorbing significant capital and experiencing rapid price appreciation.

See image marker [3]

Stablecoin supply rose from $93B to $114B

October 2021 – November 2021: Meta Boom & SHIB on Robinhood

Facebook, facing business stagnation, attempted to revive investor interest by leveraging the blockchain-powered metaverse narrative.

By rebranding to Meta, a company valued at over $400 billion injected another $10 billion into the blockchain market.

This boosted valuations for metaverse-related firms like MANA, SAND, and GALA. See image marker [4]

Beyond the Meta rebrand, SHIB’s listing on Robinhood sparked another surge.

I thought SHIB’s Binance listing was already the pinnacle for blockchain. But WSB retail traders in the U.S. pushed SHIB even higher.

This brought fresh capital—not newly minted stablecoins, but real disposable funds from individual investors.

During this period, the market reached its all-time high valuation of $2,937B. See image marker [5]

Stablecoin supply increased from $113B to $126B

December 2021 – March 2022: NFT Prosperity and Ape Universe Drain

After the metaverse narrative faded, NFTs took center stage.

However, NFT markets suffer from poor liquidity due to peer-to-peer trading models.

Moreover, NFTs offered only limited identity signaling through profile pictures and community belonging—insufficient to sustain market expectations—leading to a downturn.

A brief resurgence followed BYAC’s APE airdrop, but prices soon declined. See image marker [6]

Following the APE airdrop, land auctions in the Ape metaverse further drained ETH liquidity.

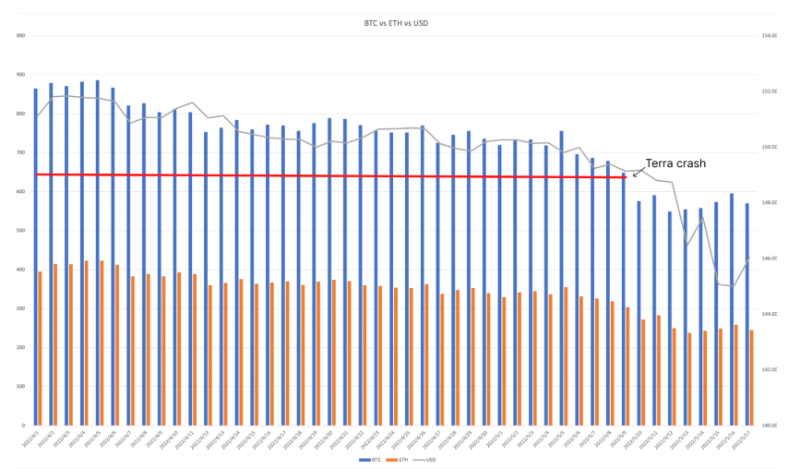

May 9, 2022: Terra Collapse, Liquidity Dries Up

Most people noticed Terra’s collapse around 9 PM on May 9, 2022—but signs of tightening USD liquidity appeared days earlier.

From April 3, 2022 onward, stablecoin supply showed a gradual downward trend.

As early as February, the Federal Reserve announced rate hikes totaling 150 basis points across March, May, June, July, September, and December—up from an initial projection of five hikes (125 bps).

More alarmingly, since the Fed’s announcement, stablecoin supply in crypto never grew again—remaining flat around $150B in February, March, and April, then declining in May.

Refer to the correlation between monetary supply and market cap, specifically the Fed rate hike timeline (Fed hikes rates).

Impacted by Fed tightening, just $2.7 billion in stablecoin liquidity was withdrawn—yet Terra collapsed under coordinated pressure.

UST’s failure accelerated systemic liquidity drying—comparable to the 312 event.

In the resulting chain reaction, stablecoin supply dropped by $8.84 billion.

Yet behind this, BTC lost $247B in market cap (-38%), ETH lost $158B (-52%).

Because UST was deeply integrated across DeFi protocols and institutional on/off-chain wealth products, the deleveraging wave caused cascading failures—3AC, BlockFi, Celsius, and others imploded.

Summary: From Early 2020 to Present

Looking back at this chart, your perspective might now differ.

Blockchain has evolved—from responding to global monetary expansion to figuring out how to utilize capital now trapped within the ecosystem.

Countless projects, individuals, and institutions have offered their answers and choices.

With hundreds of billions in retained capital and a multi-trillion-dollar crypto market, the key question remains: How do we effectively meet user needs, create new ones, and transform the real world? This is the challenge for all of us.

The Fox Index shows clearly: each time a new need is fulfilled, massive capital flows in and market cap expands.

Stablecoins act only as lubricants or catalysts—not root causes of demand.

Forking rarely creates real value—because behind every project are people, and great projects stem from exceptional talent.

Price and market cap surges are merely delayed positive feedback for meeting market demand.

Due to market immaturity and lag, early investors who identify promising projects can profit from timing differences.

Reflection

Now that the crypto market has grown into a multi-trillion-dollar ecosystem, how can we achieve further high growth?

How do we find breakthroughs in bull markets, and build sustainable projects in bear markets?

Humans are inherently curious. Every once in a while, someone comes up with a brilliant idea. Others build upon it, refining their own versions. Over time, remarkable tools and systems emerge. Some of these tools make it easier for people to generate new ideas. Though the wheel of invention turned slowly at first, it’s now accelerating—enabling feats once indistinguishable from magic.

My Answer

In the blockchain space, Vitalik Buterin stands apart. Though not Ethereum’s biggest beneficiary, he and the Ethereum Foundation continue making extraordinary contributions to the ecosystem.

This long-term vision ensures Ethereum’s trajectory will diverge fundamentally from other so-called smart contract platforms.

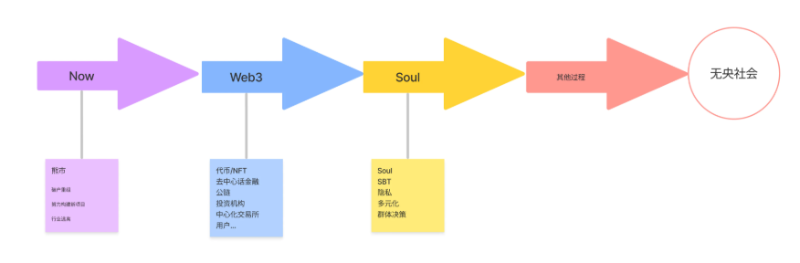

In a May 11, 2022 paper, he proposed seeking the “soul” of Web3 and building a decentralized society.

This direction may define the next major cycle. Financial innovation has limits.

But decentralized restructuring across social, economic, cultural, and political domains can absorb far greater capital.

Approaching this paper critically may reveal new frontiers. I’ll now interpret it and share my thoughts.

Entrepreneurial Directions for the Next Cycle

DeSociety, Web3, Soul

Decentralized society is too grand a goal for any single project or blockchain to solve.

Entrepreneurs should focus on identifying micro-opportunities that address emerging market needs.

Web3 is a broad concept, while Soul is more concrete—and remains central in Vitalik’s 37-page paper.

We should treat “Soul” as our primary breakthrough point.

My Chosen Entrepreneurial Path

Our society operates around human beings—every phenomenon reflects collective human behavior.

Each of us can be seen as a Soul—or rather, Soul is our digital embodiment in the blockchain realm.

In my view, Soul includes:

-

An individual’s blockchain addresses, assets held, and transaction history

-

Immutable real-world identity information, where any changes must leave an auditable trail

Soul connects the blockchain world with reality, combining on-chain data and real-world identity.

Our on-chain activity patterns, correlated with real-world events over time, deeply reveal who we are.

These records aren’t just proof of asset movement—they serve as credentials to find like-minded individuals. Wealth matters, but thinking patterns matter more.

Identifying communities based on actual behavior is far more meaningful than NFT avatars. Words can be faked; actions cannot.

Only through verifiable historical data analysis can we ensure each Soul—and the person behind it—builds a genuine, trustworthy personal brand.

This forms the foundation of a decentralized society. Within Soul lie deeper domains: privacy, diversity, collective decision-making, etc.

All of this relies on authentic data. Real, reliable, tamper-proof data is the metadata of an open society.

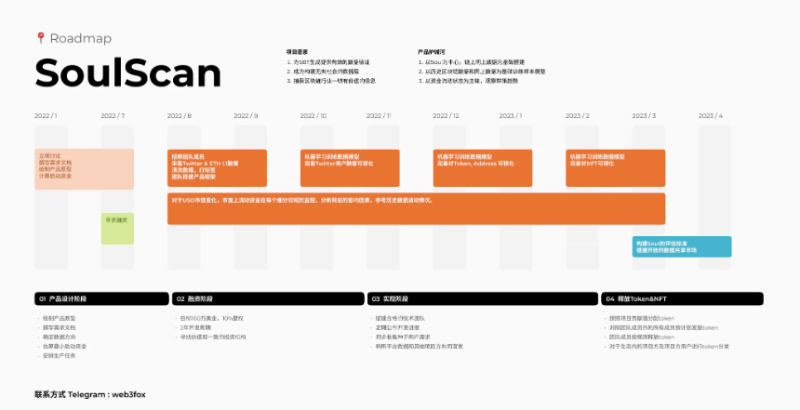

My chosen path builds atop raw blockchain data, using machine learning to analyze historical prices alongside online events.

Filtering and constructing the authentic data needed for Soul, aiming to become a critical reference and benchmark for projects evaluating Souls and distributing SBTs.

This requires extensive work: filtering, assessing, and tagging foundational data—similar to nansen.ai in the data analytics space.

It’s grueling—processing full blockchain datasets plus data from Twitter, Telegram, Discord, websites, and more.

Some investors may see this as too heavy for a small team. But certain paths and missions demand pioneers.

Within the global blockchain landscape, Chinese influence continues to wane, lacking standout projects.

This path I’ve chosen is truly laying the groundwork for Vitalik Buterin’s vision of DeSociety and the Soul of Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News