Seven years of blockchain experience: what foundational knowledge should you learn for Web3?

TechFlow Selected TechFlow Selected

Seven years of blockchain experience: what foundational knowledge should you learn for Web3?

Lack of understanding, yet bold in innovation; reading too little, thinking too much, and being overly daring—this is a subjective reason behind the collapse of many DeFi and Web3 projects.

Web3 is a new interdisciplinary field where socio-economic disciplines such as economics, finance, law, and mechanism design converge with digital information technologies including IT, mathematics, and cryptography. It is so new that not only are there no authoritative scholars yet, but even a basic knowledge framework has not been established—people don't even know what they should be learning.

Most practitioners lack fundamental knowledge and conceptual grounding; they indulge in unfounded speculation while charging ahead unprepared, leading to the widespread popularity of shallow and absurd ideas, and giving rise to numerous projects that are fundamentally illusory from the outset. As a result, a promising future digital technology ends up smelling suspiciously similar to the mysticism of old-time martial sects.

On the other hand, most well-educated scholars look down from their ivory towers, imposing preconceived notions and mechanically applying theories and models from the traditional world. Few are willing to step into the arena and actively cultivate this wild yet vibrant new frontier, leaving them largely incapable of explaining real-world phenomena, let alone predicting or guiding trends. In short, Web3 today remains a theoretical wilderness.

Under these circumstances, if I were to boldly propose a "knowledge system" or "learning path" for Web3 and digital assets, it would surely be seen as presumptuous or self-serving, and readers would be justified in dismissing me as a quack peddling miracle pills.

However, based on seven years of personal experience studying and working in blockchain and Web3—having read hundreds of books, researched and followed dozens of projects, and personally launched startups overseas—if my efforts have yielded even a modest amount of insight, then perhaps I can summarize a few observations:

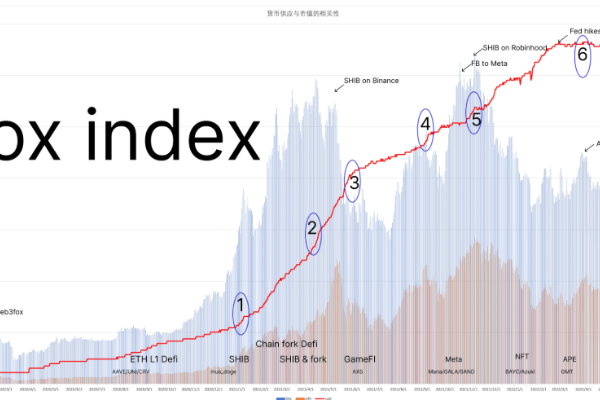

● Constantly analyzing why a particular digital asset or NFT became popular, trying to extract "fundamental" patterns and unlock wealth secrets, is utterly futile and often counterproductive—it's nothing more than putting a price tag on your own head;

● Trading manuals, technical analysis, and historical models are mostly useless once exposed to scrutiny. Refer to the previous point for context. Even if effective technical analysis models exist, they won’t be publicly shared; anything you can access is likely ineffective by design;

● Investment philosophies and principles may seem helpful, yet their concrete utility is elusive—you feel thoughtful when reading them, but clueless when applying them;

● Big data analytics and data visualization are essential tools across industries, Web3 included. However, advanced techniques like artificial intelligence and machine learning have extremely limited value in predicting Web3 markets, and often instill false confidence that leads to poor decisions;

● Economic thinking is useful, helping us understand Web3 through the foundational principles of market economies and judge broad trends. Yet the macroeconomic and microeconomic models that professional economists spend most of their time teaching and researching are mostly irrelevant;

● Austrian school ideas—libertarian economic thought, monetary theory, and business cycle theory—are helpful for understanding Web3’s value proposition and industry cycles, though they also contain dense, abstract debates of little relevance;

● New institutional economics offers real value, with many theories providing insight into key Web3 topics like network collaboration, decentralized governance, and contractual relationships;

● In finance, portfolio theory is intellectually stimulating but hard to apply in practice; for readers interested in DeFi, knowledge of basic financial instruments and derivatives is highly practical, whereas valuation models, pricing theories, and formulas involving stochastic differential equations are largely useless at this stage. That said, casually dropping terms like "alpha," "beta," "systematic risk," "idiosyncratic risk," CAPM, and APT does help socially, both domestically and internationally. But beyond that, name-dropping more advanced jargon tends to do more harm than good;

● If you're launching a Web3 startup, some understanding of corporate finance and financial statements is necessary. Although most Web3 startups lack formal accounting practices today, this knowledge is genuinely valuable and will likely become increasingly relevant in the future;

● Information economics developed during the internet era—such as natural monopolies arising from network effects—when combined with basic economic knowledge, proves highly beneficial for understanding industry dynamics and formulating strategic plans;

● Game theory should theoretically be one of the most applicable disciplines here, but in reality, existing game theory frameworks and tools fall far short of addressing real Web3 challenges. The primary benefit of studying it may lie in feeling more confident using terms like "prisoner's dilemma" and "Nash equilibrium" in conversation.

All of the above reflects my personal impressions, which I don’t hold with absolute certainty—readers should take them as suggestions rather than prescriptions, and I have no intention to argue with those who disagree.

Now comes the main point. There are four fields of study that I can confidently say are genuinely helpful for learning about and understanding digital assets and Web3. I’ve benefited directly from studying them, and after recommending them to friends and colleagues, the feedback has consistently been positive—with virtually no one reporting wasted effort. Therefore, I can list them with full confidence:

First, foundational knowledge and skills in smart contract development and deployment. To truly understand blockchain, gaining basic familiarity with how smart contracts are written, deployed, triggered, and executed is essential. Conversely, once you understand smart contracts, you already possess core blockchain literacy. Many people dive into blockchain by reading stacks of theoretical books, only to feel like they’re still missing something. In such cases, those with even minimal programming background would do better to jump straight into learning smart contract technology—one precise strike to the heart, cutting through confusion instead of circling around it.

Second, systems thinking. This means adopting a systemic perspective—using concepts like feedback loops and stock-flow analysis—to qualitatively grasp the behavior rules of complex systems, deepen understanding, and enhance insight. It's a broadly applicable cognitive method, naturally useful in Web3. Historically, systems thinking emerged from system dynamics, but the latter goes too far for Web3 purposes—attempting mathematical modeling and precise simulation of complex system evolution. For a socio-economic system as intricate as Web3, such precision is neither practical nor reliable, and often misleading. Thus, sticking to systems thinking alone is sufficient—no need to delve deeply into system dynamics.

Third, the history of money and finance, along with political economy surrounding monetary systems. This area focuses on national economic development and global geopolitical evolution through the lens of money. Over the past decade, it has become a popular subject in Chinese-speaking circles, generating an enormous volume of literature. Some works are accessible and engaging, while others sensationalize or dramatize nearly to the point of fantasy—but sincere, high-quality writings also abound. Careful discernment and cross-referencing are needed. History makes one wise. Web3 itself is a product of the latest phase in the evolution of monetary and financial systems converging with digital technology, and it will undoubtedly become part of future historical narratives. Understanding how money and finance evolved over time greatly benefits our comprehension of Web3—not necessarily as direct tools, but subtly expanding your vision, deepening reflection, and providing mental models and stories that guide smarter choices and decisions.

Fourth, central banking, financial markets, and financial institutions. This may be the single most useful academic discipline for understanding and applying Web3, DeFi, and token economics. Typically part of monetary economics, a classic text in this field is Mishkin’s *The Economics of Money, Banking, and Financial Markets*—just the title reveals its breadth, encompassing much content. Broadly speaking, it examines how the real-world economy functions through the flow of money. However, not all parts are equally relevant to Web3. For instance, theories related to commercial banks have little bearing on Web3, since the credit-based creation of liquidity characteristic of commercial banks is unlikely to find a place in the Web3 world for the foreseeable future. Monetary theory, especially macroeconomic models estimating money demand, may sound insightful at first glance, but they offer only conceptual reference value and are practically unusable—reading a chapter in an introductory economics textbook suffices.

The truly practical components are central bank monetary policy and instruments, alongside financial markets and institutions. These explore how central banks, commercial banks, and non-bank financial institutions interact via market mechanisms to generate money within the banking system—the economic "heart"—and then distribute it throughout the economy via various financial instruments, adjusting and optimizing to achieve policy objectives. This knowledge offers direct and valuable insights into understanding Web3 operational mechanisms, assessing cycles, and designing token economic systems. I strongly recommend investing significant time in this area. I've given this advice to several friends and colleagues; those who dedicated themselves to serious study quickly experienced a noticeable upgrade in their understanding of Web3 and digital assets.

These are my main recommendations. That said, it must also be emphasized: everything mentioned above consists entirely of traditional knowledge—none of it was created for Web3, and none offers a guaranteed shortcut to becoming a Web3 expert. How to pour this old wine into the new bottle of Web3 is precisely the challenge you must tackle yourself. But conversely, therein lies the opportunity.

Additionally, if you aim to specialize in a specific application area of Web3—such as gaming, e-commerce, or trading—there will certainly be more specialized knowledge required. But in my view, what most people learning Web3 today generally lack is proper understanding of economics, money, and finance—not anything else. Hence, my recommendations emphasize these areas. A lack of foundational understanding, coupled with excessive eagerness to innovate, too little reading, too much theorizing, and reckless ambition—this mindset is a key subjective reason behind the collapse of many DeFi and Web3 projects. I hope this article helps motivated readers find a clearer path, avoid detours, and proceed with greater wisdom in their Web3 journey.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News