Katie Haun: The New Queen of the Crypto World

TechFlow Selected TechFlow Selected

Katie Haun: The New Queen of the Crypto World

After co-leading three large funds at Andreessen Horowitz, Katie Haun is striking out on her own and raising a $1 billion crypto fund.

By Michal Lev-Ram

On March 23, according to The Block, Haun Ventures, the venture capital firm led by former a16z partner Katie Haun, has raised $1.5 billion for two cryptocurrency-focused funds—$500 million for early-stage investments and $1 billion for an "accelerator" fund. As the first female managing partner at a16z, a former federal prosecutor at the U.S. Department of Justice, Katie Haun carries an aura of mystery. This article offers a closer look at this new queen of crypto.

Main Text

Katie Haun invited me to tour her art collection. Conveniently, the viewing didn't require a trip to a gallery or even her home—Haun's preferred medium is NFTs, or "non-fungible tokens." So instead, we're scrolling through a full suite of digital images on her phone. In the tech world she inhabits, these digital collectibles, stored on blockchains much like cryptocurrencies, have become coveted status symbols.

To find her favorite piece, Haun quickly swipes past lush floral illustrations and more avant-garde, cyberpunk-inspired avatars. "My tastes are pretty eclectic," she admits. In the red-hot NFT market, some top works have sold for tens of millions of dollars. But this pixelated image—a girl with bright pink pigtails—cost her nothing. It was a birthday gift from her close friend Elena Silenok at the end of 2021. Notably, Elena is married to Chris Dixon, a partner at Andreessen Horowitz (a16z). Since Haun left the U.S. Department of Justice to enter venture capital, Dixon has co-led the firm’s crypto fund with her.

Yet while that pink-haired girl may live forever on the blockchain, real-world relationships can shift more easily. Here's a case in point. I came specifically because Haun had just announced big news: she’s leaving Dixon—and the powerful Andreessen Horowitz—to launch her own fund.

While most people may not know Haun, in the crypto and broader Web3 world, she has become an unexpected star. Web3 includes not only NFTs, Bitcoin, and Ethereum, but also the underlying blockchain infrastructure supporting them. When Haun entered the space in 2013, she wasn’t a naive crypto fan. Back then, she was a San Francisco-based federal prosecutor investigating how criminals exploited the technology.

"I didn’t choose that assignment," says Haun, whose prior legal work included prosecuting white-collar criminals, prison gangs, and corrupt federal agents. "But I did choose to stay in this field."

That choice came after a compelling offer from Andreessen Horowitz, commonly known as a16z—one of Silicon Valley’s largest and most prominent venture firms. While many VCs remained cautious about investing in crypto, a16z founders Marc Andreessen and Ben Horowitz became early believers in Web3. In Haun, they saw rare expertise they desperately needed: someone who could navigate the complex regulatory landscape emerging alongside the fledgling crypto industry.

The former prosecutor was soon hired as a16z’s first female investment partner. She co-founded and led a roughly 50-person crypto investment team with the firm’s partner Chris Dixon. Their previous fund raised a staggering $2.2 billion. Before long, the once-outsider became one of a16z’s most visible partners, backing high-profile companies like the cryptocurrency exchange Coinbase and the NFT marketplace OpenSea.

In mid-December 2021, Haun abruptly announced she would leave a16z to start her own venture firm. The news sent shockwaves across Silicon Valley via text messages: congratulations, admiration, and skepticism alike. It was a major event, especially given reports that she aimed to raise a $1 billion fund. If successful, it would be the largest crypto fund ever raised solely by a female venture capitalist.

"There aren’t many women in crypto investing," says Amy Wu, head of FTX Ventures, who recently joined the crypto exchange’s newly launched $2 billion fund in January. Indeed, few women write VC checks; in the U.S., female VCs make up only 15.4% of general partners.

Now, the former prosecutor faces a new challenge. Yes, Haun departs a16z after four years with rising popularity, extensive connections, and a stellar track record. But she’s also leaving behind the firm’s formidable team (a16z employs over 300 people), deep pockets, enviable resources, and prestige. Haun and her energetic six-person team now offer startup founders a very different proposition. Her new firm enters a world oscillating between dizzying gold rushes and gut-wrenching price corrections. Can Haun 2.0 survive such volatility and convince founders to sign on the dotted line?

On a crisp January day, I met Haun for the first time at the Rosewood Hotel in Menlo Park, just steps from her former a16z office. We sat on an outdoor terrace overlooking the Santa Cruz Mountains—a convenient meeting spot for many local VCs. Yet the usually bustling hotel was quiet, nearly empty. Understandable: Omicron cases were surging in the Bay Area and beyond. Still, even if the place were packed with investors, Haun would stand out. With blonde hair and sharp blue eyes, I’ve never seen her wear a jacket bearing the Arc’teryx or Patagonia logo—the de facto uniform on Sand Hill Road, where venture capitalists congregate. Today, she wore a dress dotted with black-and-white polka dots. At our last meeting, she wore a pale pink Valentino suit.

Haun is elegant yet unpretentious. She possesses an elusive quality—an ability to connect easily with anyone, whether in a boardroom or courtroom. She’s persuasive and tenacious. Yet she also puts people at ease. Talking about her new company, she seemed genuinely excited—even a bit giddy.

Sources say Haun is raising at least $1 billion for her debut fund. Haun declines to confirm the figure, citing “legal and regulatory reasons” that bar her from commenting—a standard refrain among VCs fundraising. They fear saying the wrong thing might upset the Securities and Exchange Commission. But given the flood of capital pouring into crypto, $1 billion seems plausible, perhaps even conservative.

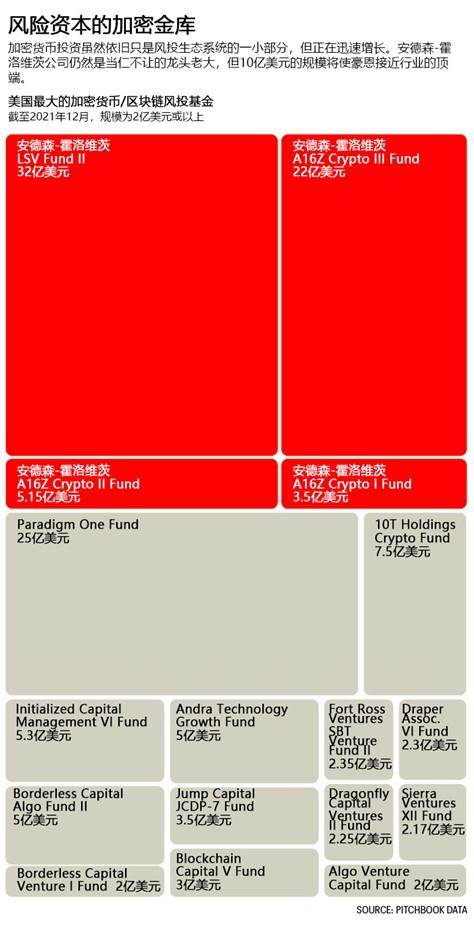

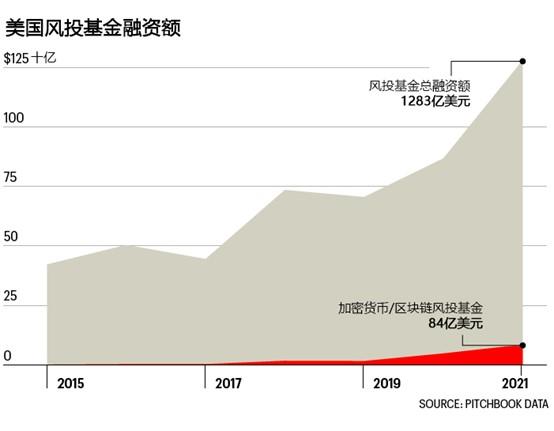

According to recent PitchBook data, U.S. venture funding hit a record $128.3 billion in 2021. The share flowing into crypto funds has surged—from less than 0.5% in 2017 to nearly 7% in 2021. As VCs deploy capital, their own investors, limited partners (LPs), are rushing in to fill their coffers. That trend, combined with Haun’s proven ability to access the hottest crypto deals, bodes well for her. Starting small and focusing exclusively on crypto could also be an advantage.

"Truly crypto-native funds are highly attractive to LPs," says Ilya Fushman, a partner at Kleiner Perkins. "They enable investors to attract exciting new founders."

Haun is seizing the moment. Her new firm has already made seven investments, including one in Autograph, a Los Angeles-based startup, though the amount remains undisclosed. Autograph helps athletes and celebrities launch and market NFTs. Fushman’s firm co-led this round, and both he and Haun will join Autograph’s board. Interestingly, the startup also has backing from Tom Brady, current superstar of the Tampa Bay Buccaneers. But guess which other firm co-led this $170 million round? a16z—Dixon will also join the board.

It may be hard to believe—after all, breakups often create tension—but both sides insist Haun and her former employer parted amicably. She describes her time at a16z as deeply rewarding and productive. She praises the firm’s founders for giving her a chance. "Not many people thought, 'Oh, she’ll be a great venture capitalist,'" Haun says.

But working closely with founders changed Haun’s thinking about what she wanted. "One thing I learned over the past four years is that I’m actually pretty good at starting things," she says. The moment a16z deployed its third crypto fund in 2021, she felt it was time to turn a new page. "That milestone prompted deep reflection," she says. "It was time to go out on my own. That’s all there was to it."

Haun points to a nearby patio. In December 2021, she and Dixon met there to discuss the details of her departure—such as how many staff she could take with her. (An insider described the negotiations as a “horse trade.”) Ultimately, they agreed Haun could bring six a16z employees, including her chief marketing officer Rachel Hoovler and the new firm’s global policy lead, Tommyika Tiller. They also decided a16z would become an early investor in her new fund. Clearly, in some deals, Haun’s new firm will compete directly with her former employer. But as an investor in her fund, a16z stands to benefit regardless of who wins. Beyond this arrangement, both Haun and a16z say they’ll continue collaborating on deals, as they did recently by jointly leading Autograph’s round.

"We still frequently discuss promising projects and teams, and continue serving together on multiple boards," Dixon said in a written statement provided to Fortune. "So we’ll remain very closely aligned."

Despite repeated requests, Dixon declined to speak with me directly—highlighting a stark contrast in media strategy between a16z and Haun. As you’d expect from a former prosecutor—a role that often leverages media to advance cases—Haun embraces the spotlight, regularly gives interviews, and is a frequent speaker at tech conferences (she’s spoken at three Fortune-hosted events). Meanwhile, a16z has grown increasingly media-averse. Co-founder Marc Andreessen is notorious in journalism circles for blocking reporters on social media. The VC giant has even begun running its own internal content operation to bypass traditional media entirely.

Know who else hates media? Celebrities.

But that didn’t stop Mindy Kaling from sharing her first impression of Haun with me. "She’s the kind of venture capitalist I’d actually want to go on vacation with," she told me via email. Kaling, an actress, writer, and producer, is best known for her role in the TV series *The Office*.

Kaling met Haun at a dinner in Los Angeles in autumn 2021, hosted for a group of women in entertainment. One goal: let Haun share insights with celebrities interested in entering Web3. According to sources, Gwyneth Paltrow attended that night. She later announced an investment in Bitcoin miner TeraWulf.

Photo Credit: COURTESY OF KATIE HAUN

In 2004, Haun posed with U.S. Supreme Court Justice Anthony Kennedy. From late 2004 to 2005, she served as his law clerk.

To differentiate herself from competitors, Haun plans to focus on specific "verticals" and bring in expert advisors for each. She hired Jared Cohen, CEO of Google’s think tank and incubator Jigsaw, and William Frenzen, another former prosecutor, to lead technology and government policy efforts respectively. When she needed an entertainment advisor, she called Kaling.

"I think I said yes before she even finished asking," Kaling says. "She’s legendary in the crypto community—who wouldn’t want to be around her?"

Additionally, Haun plans significant changes compared to the fund she co-managed at a16z. She has no interest in scaling up massively. "We’re building a lean team to stay agile," she says. While a16z is known for offering portfolio companies a full suite of services—from marketing to legal—Haun wants a more targeted approach, clearly defining what her firm will and won’t do for founders.

For Haun, a small, focused operation doesn’t preclude global ambitions. She plans to seek startups far beyond Silicon Valley and other tech hubs. "Some of the best crypto founders are hidden in less obvious places," Haun says. "So one thing my new firm will do is cultivate a truly global perspective." (a16z notes that most of its crypto investments are with companies "incorporated" in the U.S., even if their teams are globally distributed.)

Of course, the new firm needs a name. So far, Haun has referred to it using the initials KRH—short for Katherine Rose Haun—mainly for convenience in signing legal documents. "I don’t want to rule anything out, but I won’t name the firm after myself," Haun told me. "I’m building a franchise. I fully expect it to eventually be run by someone else."

It’s hard to quantify Haun’s success as a venture capitalist. Partly, that’s inherent to the job—failed bets are common, and successful ones typically take over 10 years to "exit" via IPO or acquisition. Over the past four years, Haun and a16z’s crypto team made over 60 investments. To date, only one has exited: Coinbase, the cryptocurrency trading platform, went public in 2021 at a valuation nearing $100 billion. While Coinbase marked Haun’s entry into the inner circle of crypto (after leaving the Justice Department in 2017, Coinbase invited her to join its board), a16z had already made its first investment in the company back in 2013—before Haun joined the firm.

Still, many companies in her portfolio have seen explosive valuation growth—the most commonly cited proxy for VC success before an exit. For example, OpenSea has become the dominant NFT marketplace, its valuation soaring from $1.5 billion in 2021 to over $13 billion today.

"She’s like a heat-seeking missile," says Jesse Walden, a former a16z investor. "She knows exactly what’s happening in the space and who you need to know to stay ahead. That’s a superpower for an investor." Walden left a16z in 2020 to launch his own crypto fund.

Indeed, identifying the right founders and securing investment rights appears central to Haun’s achievements so far. At her new firm, she plans to leverage this superpower—to build her own team, help portfolio companies build theirs, source deals, and, of course, close them.

"That’s been my livelihood for over a decade," she says, referring to her prior career as a federal prosecutor. "I make deals, negotiate, and sit across from someone I have to quickly understand."

"Katie’s a seasoned player," says Justin Blau, co-founder and CEO of Royal, a company helping musicians sell royalty ownership to fans. "She’s been active in this space for a long time. Her network spans not just every corner of crypto, but far beyond the crypto community."

Photo Credit: COURTESY OF KATIE HAUN

After announcing her departure, Haun attended a farewell dinner with Dixon and the a16z team.

Emily Chang, COO of Coinbase, recalls a time when a potential director was considering a role at another company—until Haun stepped in. According to Chang, Haun invited the person to dinner, sat down, and told them it would be crazy not to join Coinbase. It worked. "She knows exactly what to say to change the outcome," Chang says. "She won’t stop until she gets what she wants."

Haun played a pivotal role in building a16z’s crypto team. Over four years, the team grew from two people to about 50. Haun says she personally recruited "most" members. (Dixon wrote in an email: "Hiring is a team effort, and Katie was a key part of that.")

Undoubtedly, Haun must keep attracting top talent to carve out space in the increasingly competitive crypto investment landscape. But she must also draw on the regulatory and legal expertise that first caught Silicon Valley’s attention. The crypto world may no longer be as mysterious as when a16z first knocked on its door, but it remains fraught with uncertainty—if not more so.

As crypto expands globally, so do its challenges and controversies. China outlawed crypto in 2021; other nations restrict its use amid fears it undermines government control over monetary systems. Another concern looms: certain digital currencies are energy-intensive, leaving massive carbon footprints. This issue has drawn growing scrutiny. During a U.S. House Energy and Commerce subcommittee hearing on January 20, lawmakers fiercely debated how to make crypto more environmentally sustainable.

"Regulatory compliance is the most important topic in crypto this year," says Amy Wu of FTX Ventures.

Beyond external threats, crypto’s rapid growth has drawn criticism from within the tech ecosystem. Founders of major startups like Box’s Aaron Levie and Airbnb’s Brian Chesky have expressed skepticism about Web3’s adoption and impact. Within the crypto community itself, growing concerns suggest power is consolidating among a small elite—especially large startups backed by massive VC funding. For those passionate about Web3’s promise, this feels like a betrayal. Many hoped Web3 would drive "decentralization" of information control, dispersing power in ways never seen on the traditional internet.

Photo Credit: BLOOMBERG/GETTY IMAGES

Coinbase successfully went public in 2021.

In response to mounting criticism, Haun’s former firm a16z pushed back aggressively, arguing Web3 is still young and will ultimately fulfill its promise. True to form, Andreessen even blocked fellow tech titan Jack Dorsey on social media after the two publicly clashed over whether crypto companies promote "decentralization" or accelerate "centralization."

Haun takes a more nuanced approach. "I’m encouraged that people like Moxie Marlinspike [an industry skeptic] and Jack Dorsey are paying such close attention and offering thoughtful critiques," Haun says. "I welcome that."

Still, despite frequent criticism, Haun says she’s not worried about crypto’s future. Yes, the infrastructure isn’t fully built yet—but it’s on its way. Meanwhile, the technology’s potential is already exploding. When she entered investing in 2018, most believed crypto’s only meaningful application was financial innovation. "Now I see wow—there are so many more use cases than we ever imagined," Haun says.

More pressing issues remain. In January, during Haun’s fundraising campaign, the crypto market crashed, wiping out $1.4 trillion in value. Some called it a "bloodbath"; others a "correction." Haun isn’t fazed. She notes extreme volatility isn’t new to the space. "Running a crypto fund means embracing risk."

Many crypto investment structures—including those her new firm will make—are inherently risky. Unlike traditional VC deals involving cash-for-equity, many crypto investors accept so-called tokens as part of their stake. These tokens are digital securities stored on blockchains, subject to the same wild swings as the broader crypto market.

For Haun, however, it’s crucial to separate the field’s inherent risks from the unfamiliar uncertainty of going solo.

"Like many moments in my career, I believe things are either 'all-in' or 'not at all.' Whether joining a16z or deciding to go independent, I’ve always gone all-in. In my legal career, I’ve faced similar crossroads. I follow my instincts, passions, and inner voice. It’s really no different. Have I had any doubts in recent weeks about what I’m doing? Yes, absolutely. But I’m still fully committed. I know this is the right decision."

Betting on Blockchain

Haun has invested in some of the fastest-growing, most promising crypto startups. The industry is still young—many winners haven’t been crowned, and losers haven’t been eliminated. Below are some of Haun’s most notable investments where she serves on the board.

Arweave

This Berlin-based company claims to pioneer a new form of data storage—using blockchain technology to "store" information permanently. Haun led a $5 million token-only funding round in 2019, meaning investors bought digital securities recorded on the blockchain rather than traditional equity.

Autograph

Co-founded by football star Tom Brady, this NFT-focused startup raised $170 million in January. Haun’s new firm (alongside her former employer, Andreessen Horowitz) participated in the round, and Haun has joined Autograph’s board.

Coinbase

Haun became the first independent board member of this startup in 2017. That move eventually led her to join a16z, an early investor in the crypto exchange. Coinbase went public in April 2021 at a valuation near $100 billion—making it one of the rare VC exits in crypto history.

OpenSea

One of the hottest startups in the fast-growing NFT market, OpenSea now boasts a valuation exceeding $13 billion. While at a16z, Haun led two funding rounds and joined its board. Through her new firm, she reinvested, participating in the auction platform’s $300 million Series C round in January.

Royal

Another investment made during her time at a16z, Royal is a novel NFT application helping musicians sell royalty ownership to fans. In 2021, alongside other VCs, artists including electronic music duo The Chainsmokers and rapper Nas joined Royal’s $55 million Series A round.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News