In-Depth Analysis of Assembly: Exploring Modular Blockchains for the Web3 Era Based on IOTA

TechFlow Selected TechFlow Selected

In-Depth Analysis of Assembly: Exploring Modular Blockchains for the Web3 Era Based on IOTA

In 2022, as Web3 emerged as a breakout concept, it naturally imposed new requirements on the underlying infrastructure supporting this concept—public blockchains.

Author: Li Xi, LD Capital

The Trend of Modular Blockchains

If you’ve been following the evolution of blockchain technology, you’re likely familiar with the term "modular."

In 2022, as Web3 gained mainstream attention, new demands emerged for its underlying infrastructure—blockchains. While monolithic blockchains still offer optimal composability and Solana appears to have maximized TPS, they inevitably make trade-offs—or sacrifices—in decentralization and security due to the constraints of the classic blockchain trilemma. Two recent network outages may have highlighted the limitations of single-chain architectures (although in theory, Solana could also deploy rollups for scalability).

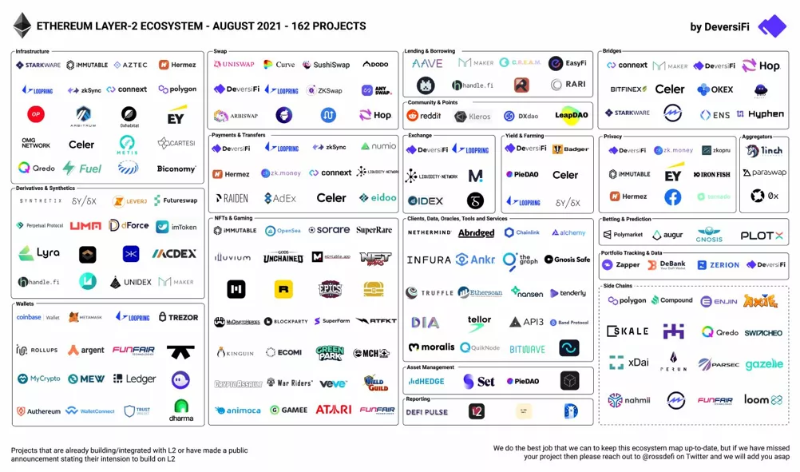

On the other hand, Ethereum’s Layer 2 solutions have officially launched. Arbitrum and Optimism have demonstrated the viability of fraud-proof-based rollup L2s, while ZK-Rollup projects like Starkware and ZkSync are expected to go live in 2022. Ethereum’s expansion via L2s has set a strong precedent for modular blockchains.

Yet this raises an important question: Is Ethereum the optimal Layer 1 for hosting modular blockchains?

Is Ethereum the Best Choice for Modularity?

Currently, we can identify three main issues:

「1」Strong liquidity fragmentation across multiple L2s – There are already around eight well-known Ethereum rollup L2s: Arbitrum, Optimism, Starkware, Zk-sync, Polygon, Aztec, Boba, and Metis. Seeing 10–20+ rollups in the future would not be surprising. While cross-chain bridges can partially alleviate this issue, Vitalik Buterin recently stated: “The future will be ‘multi-chain’ rather than ‘cross-chain,’ as cross-chain bridges face fundamental security limitations.”

「2」Uncertainty around ETH 2.0's transition from PoW to PoS and indefinite postponement of sharding – This introduces significant uncertainty regarding full scalability timelines, largely due to Ethereum’s technical legacy.

「3」A third point often overlooked—but perhaps the most crucial—is Ethereum’s ecosystem legacy: Its native L1 competes with L2s for resources, at least over the next several years.

Let’s elaborate slightly on this last point, which is critical and one of the key reasons behind our investment in Assembly.

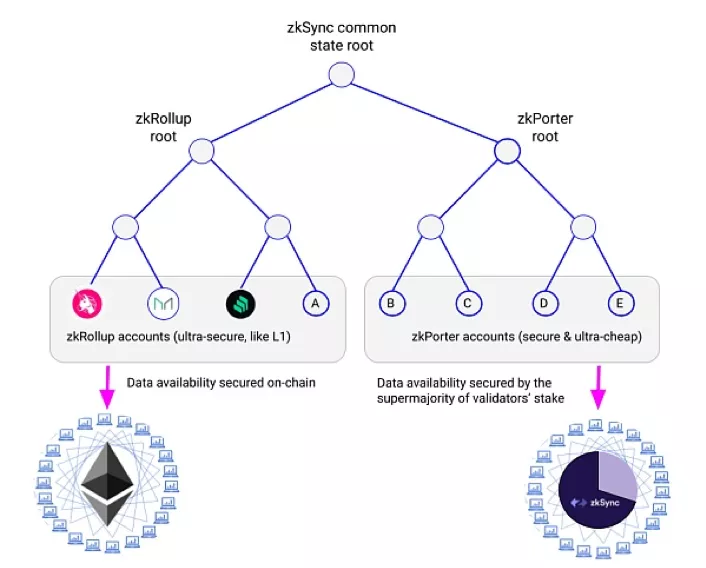

Ethereum currently scales via rollups—whether fraud-proof or ZK-Rollups. The L2 serves as the Execution Layer (EL), bundling and compressing transactions before periodically submitting them to Ethereum L1. Here, Ethereum L1 plays two roles: it acts as both the Rollup’s Settlement Layer (SL) and its Data Availability Layer (DA).

From the SL perspective, all settlement transactions must compete with native DApps on Ethereum L1 for limited resources. This isn’t usually problematic under normal conditions, but during Gas Wars—such as mass liquidations or high-demand NFT mints—all rollups suffer performance degradation.

From the DA perspective, storing data on Ethereum L1 is extremely expensive. This explains why Arbitrum and Optimism offer lower fees compared to Ethereum L1, yet remain costly relative to alternative L1s—the cost of the DA layer remains high (ZK-Rollups achieve lower costs than Optimistic Rollups due to superior data compression).

All these issues stem from Ethereum’s ecosystem legacy: For the foreseeable future, economic activity on Ethereum L1 will continue, competing directly with rollups for scarce and expensive L1 resources.

Could there be a Layer 1 that exclusively handles SL + DA without running any DApp execution layer (EL)?

Yes, absolutely. Next-generation blockchains such as Polkadot use their relay chain solely for SL + DA, delegating all computation to parachains. In the Cosmos ecosystem, designs like Celestia take this further by isolating the DA layer entirely, offering dedicated data availability services to all rollups.

One might argue that Ethereum offers the highest security, making it ideal for SL and DA. However, if security were the only market driver, we wouldn’t see today’s vibrant multi-chain landscape. Even Ethereum’s official L2, Starkware, provides users with a cheaper option to place DA off-chain rather than on Ethereum L1. As the balance between security and performance evolves, we’ll see diverse modular solutions emerge.

Assembly, the smart contract layer built on IOTA, represents another promising direction worth exploring.

The Modular Path Based on IOTA

IOTA may be a project forgotten by many veteran investors and unknown to newer ones.

Back in 2017–2018, IOTA was one of the leading projects using DAG (Directed Acyclic Graph) data structures. With its innovative Tangle ledger architecture and high TPS, it held a spot in the top ten cryptocurrencies by market cap for a considerable time. As the blockchain industry shifted toward smart-contract-driven DeFi, IOTA gradually faded from view, overtaken by newer DAG-based chains like Fantom and Avalanche that support smart contracts.

Key features of IOTA 1.0 included:

1) High concurrency and high TPS

2) UTXO model with no gas fees

3) No support for smart contracts

4) Centralized Coordinator node (operated by the foundation)

While low fees and high TPS were advantages, the lack of smart contract support and reliance on centralized nodes diverged sharply from mainstream blockchain trends—explaining IOTA’s decline in relevance over recent years.

However, with the rise of modular blockchains in 2022 and the release of IOTA 2.0 and Assembly, we believe IOTA has a strong chance to reclaim a position in the modular blockchain space.

Together, Assembly and IOTA 2.0 meet key requirements for modular blockchains in the Web3 era:

1)High TPS – Enabled by the underlying Tangle ledger’s DAG structure, ensuring high-concurrency transaction processing

2) Scalability – A multi-chain network similar to Cosmos or Polkadot, enabling continuous deployment of new contract chains

3) EVM compatibility and support for WebAssembly

4) Flexible customization of incentives and fees per chain for developers

5) MEV-free environment

6) Shared security

7) Technical overview of Assembly

Assembly’s technical whitepaper has been published. Below is a summary highlighting the core technical aspects of Assembly.

1. UTXO on DAG at the Base Layer

UTXO-based ledgers, exemplified by Bitcoin, allow concurrent writes and offer greater scalability advantages over account-based models like Ethereum. However, account models naturally suit smart contracts due to their global state, offering superior Turing completeness and functionality—hence most smart contract platforms adopt account models instead of UTXO.

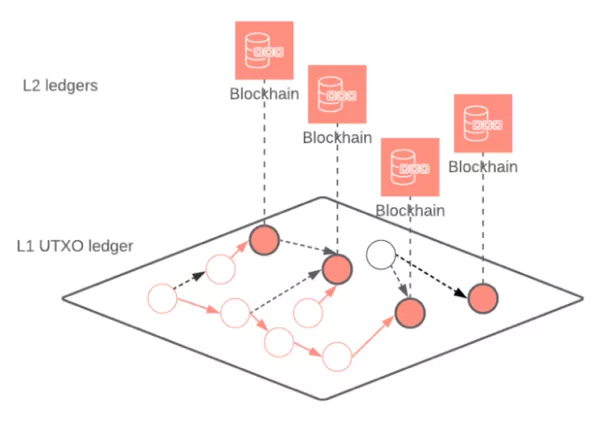

But consider this: in a modular stack, what if a UTXO-based L1 only needs to handle settlements, without executing any smart contracts or DApps?

Lack of smart contract support then becomes an advantage—no L1 DApps compete with L2s for resources. Moreover, transaction processing on the L1, enabled by UTXO and DAG, can theoretically support massive concurrency, allowing it to serve far more L2 chains.

2. Assembly – Layer 1.5

Assembly functions as a Layer 1.5—a smart contract framework layer—where individual smart contract chains built atop it are the true L2s.

For clarity, think of IOTA + Assembly as analogous to Polkadot’s relay chain—an L1 where all connected contract chains function like parachains, serving as L2s.

Similar to validators on other blockchains, Assembly uses POS staking of its native token ASMB. Validators who act incorrectly or maliciously face slashing penalties. The ASMB token also serves as governance power within the Assembly ecosystem, governing chain configurations, committee rotations, gas fee settings, and more.

3. Shared Security

Shared security is essential in multi-chain systems. Whenever cross-chain interactions occur, the weakest chain becomes the system’s vulnerability, undermining overall security. In next-gen “natively modular” blockchains, Polkadot achieves strict shared security through slot auctions.

Cosmos currently takes a decentralized approach with self-sovereign chains and no shared security (though Cosmos 2.0 in 2022 introduced shared security via the Atom Hub). Avalanche implements relative shared security by assigning each subnet a designated subset of the overall validator pool. Clearly, Polkadot prioritizes maximum security, though slot auctions can be prohibitive; Cosmos offers flexibility but faces security concerns; Avalanche strikes a relatively balanced middle ground.

Assembly adopts a mechanism similar to Ethereum 2.0’s fraud-proof rollups: Each validator stakes assets as a security bond. Any third party can monitor chain activity and submit fraud proofs if a validator attempts to update the chain with incorrect state, earning a reward in return. This ensures that as long as at least one honest validator exists in the committee, the chain’s state remains protected from malicious changes.

You might wonder: On Ethereum, validator staking, fraud proof adjudication, and slashing are enforced by smart contracts on the mainnet—acting as a “supreme court” and effectively providing shared security across all rollups. But since IOTA L1 does not support smart contracts, who fulfills this “supreme court” role?

The answer: a dedicated smart contract chain built on Assembly itself, designed to implement all necessary “supreme court” logic and secure all other smart contract chains. This special chain is called the “Root Chain.” The Root Chain achieves the highest level of security because its validators are a special set of nodes—specifically, high-MANA-value nodes selected from the IOTA 2.0 ledger. These high-MANA validators are owners of IOTA L1 nodes, chosen in a decentralized manner based on access mana and consensus mana as weighting factors.

This leads us to an unavoidable topic: IOTA 2.0’s underlying L1 and its Mana system.

4. IOTA 2.0

Compared to version 1.0, IOTA 2.0 includes numerous technical upgrades. Two of the most significant are summarized below:

First, removal of the Coordinator – The Coordinator was a special node protecting the network from attacks and aiding transaction confirmation, but operated centrally by the foundation, leading to high centralization. Removing the Coordinator is IOTA 2.0’s most critical upgrade (implemented in three phases; currently in phase one, moving toward phase two).

Second, introduction of the Mana system – Preventing Sybil attacks and managing network congestion are fundamental security and operational requirements for any blockchain or distributed ledger. Consensus mechanisms like PoW and PoS are largely designed around these goals. IOTA, strictly speaking, is not a blockchain and thus lacks traditional PoW/PoS, relying instead on the Mana system.

Mana measures influence across various modules, including FPC voting, dRNG (distributed random number generation), autopeering, and congestion control. Think of it as a reputation system for nodes: higher Mana indicates greater trustworthiness and security. Nodes with high Mana also have the strongest stake in the integrity of the L1 ledger. Therefore, by having high-MANA validators secure the Root Chain, the security assumptions of L2 smart contract chains become approximately equivalent to those of the IOTA L1 ledger.

Final Thoughts

To conclude, let’s revisit the modular blockchain architecture discussed earlier. What if a Layer 1 supports rollup-style L2s and also satisfies the following criteria?

「1」Relatively secure – Running on mainnet since 2016, six years without major incidents;

「2」High TPS, low fees, scalable;

「3」No L1 DApps competing with L2s for resources – L1 used exclusively for settlement or settlement + DA.

IOTA 2.0 fits this description perfectly. We have no doubt that Ethereum will continue leading blockchain innovation amid the modular wave. At the same time, with the addition of Assembly’s smart contract layer, we are highly optimistic about IOTA 2.0 + Assembly securing a meaningful position in the modular blockchain market in 2022.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News