Coin Bureau: A Deep Dive into COSMOS, Its Roadmap, Promises, and Concerns

TechFlow Selected TechFlow Selected

Coin Bureau: A Deep Dive into COSMOS, Its Roadmap, Promises, and Concerns

Cosmos is a cryptocurrency project aiming to create a fast, affordable, user-friendly, and truly interoperable multi-chain future.

Note: The content of this article is based on a video by Coin Bureau, a YouTube creator with over a million subscribers. It is shared for informational purposes only and does not constitute any investment advice. DYOR.

Content compilation: 0xbread, TechFlow

People often say the future of cryptocurrency is multi-chain. However, so far what we've seen are merely a collection of bridges between different blockchains—bridges that take significant time and cost to use. Cosmos is a cryptocurrency project aiming to create a fast, affordable, user-friendly, and truly interoperable multi-chain future.

Today, I'll give you a brief overview of Cosmos and quickly bring you up to speed on some of the project's most important updates.

What is Cosmos?

If you’ve never heard of Cosmos before, here’s what you need to know. Cosmos was founded in 2014 by Jae Kwon and Ethan Buchman.

Cosmos is built by Tendermint Inc., a for-profit software company based in the United States.

Development of Cosmos is coordinated by the Interchain Foundation, a non-profit organization based in Switzerland. In 2017, Cosmos raised $17 million through three token sales.

The Cosmos mainnet launched in March 2019 and has experienced no security issues since launch. This is because the Cosmos blockchain uses a novel Proof-of-Stake consensus mechanism called Tendermint, which is very fast and highly secure. However, this comes at the cost of centralization, as Tendermint chains are limited to around 130 validators, while Cosmos itself has only about 150 validators. ATOM is the native token of the Cosmos blockchain, used for staking, governance, and paying transaction fees.

Annual staking rewards for delegators and validators range between 14% and 15%; there is no minimum requirement, but there is a 21-day lock-up period. Validators must also stake enough ATOM to be among the top 150, and any misbehaving validator will have their stake slashed.

Regarding governance, at least 512 ATOM tokens must be bonded to submit a proposal. At least 40% of staked ATOM must participate in voting, with at least 50% of participating ATOM voting yes, and less than 33.4% voting no.

Any ATOM that fails to meet the minimum quantity or is rejected during a voting period within two weeks will be burned.

Cosmos staking and governance can be accessed via Keplr Wallet, available as a web wallet, browser extension, and mobile app for both Android and iOS devices.

In addition to Cosmos, Keplr supports over 16 cryptocurrencies whose blockchains are built using the Cosmos SDK—a development tool created by Tendermint Inc. that allows you to easily build fast and secure blockchains from scratch.

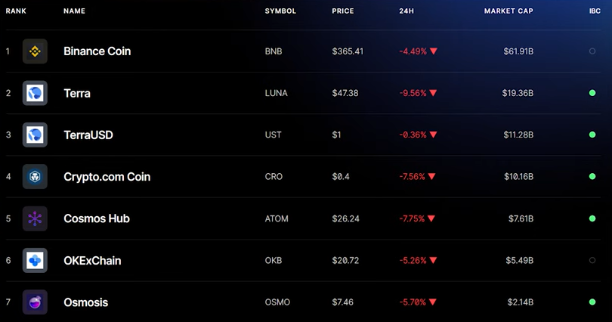

Over 50 cryptocurrencies have been built using the Cosmos SDK, including Binance Coin (BNB), Terra (LUNA), crypto.com coin (CRO), and Thorchain (RUNE).

Because all these cryptocurrencies use the same consensus mechanism, they can interoperate seamlessly, meaning you can transfer tokens across chains in seconds and for just cents. This is possible because Cosmos’ Inter-Blockchain Communication protocol (IBC) serves as an interoperability standard compatible not only with Cosmos-based blockchains but also with any Proof-of-Stake cryptocurrency that has fast finality, such as Solana and Polkadot.

Cosmos Updates and Iterations

It’s been several months since my last report on Cosmos, and a lot has happened since then. In mid-October, Cosmos announced a partnership with Forte, a blockchain gaming company. This will integrate the Cosmos ATOM token into the Forte wallet and open the door for any game wanting to run a Cosmos-based blockchain for NFTs.

Cosmos also announced a new cryptocurrency called Sagan, which will serve as a live testnet for upcoming Cosmos upgrades, similar to how Kusama functions for Polkadot upgrades.

At the end of October, Terra integrated IBC, bringing its decentralized stablecoin UST to other blockchains via IBC.

A Malaysian bank also announced it would collaborate with Irisnet, an enterprise-focused Cosmos project, leveraging Cosmos technology for part of its operations.

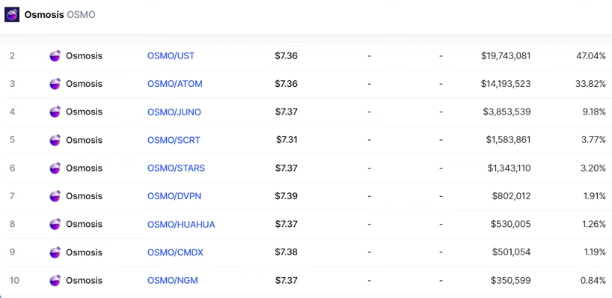

Another major announcement in October was Osmosis raising $21 million. Osmosis is the largest DEX in the Cosmos ecosystem, currently with over $1.2 billion in total value locked.

In early November, Forte announced a massive funding round of $725 million, backed by investors including Andreessen Horowitz, Animoca Brands, and even Warner Music Group.

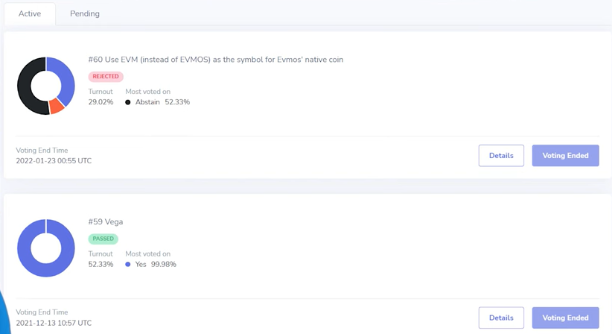

Cosmos also began its Vega upgrade, completed in December. Vega introduced new features to Cosmos such as fee delegation and various performance optimizations.

Mid-November saw the Cosmos-based project Persistence raise $10 million from various crypto VCs, including Three Arrows Capital, Galaxy Digital, Coinbase Ventures, Kraken Ventures, and Alameda Research, closely tied to the FTX exchange.

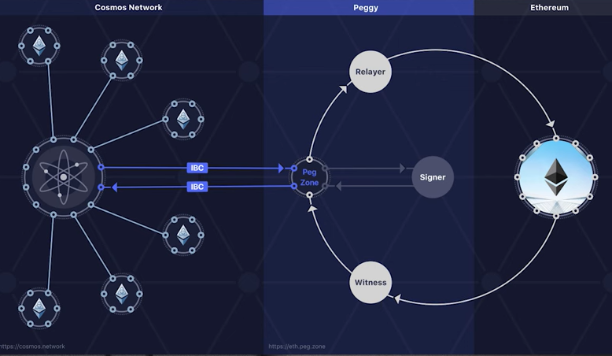

Mid-December, Cosmos announced the completion of the highly anticipated Gravity Bridge, enabling seamless interoperability between Cosmos blockchains and Ethereum. Note that Gravity Bridge has not yet connected to any Cosmos chain—but Osmosis appears likely to be the first.

Another Cosmos project, Sentinel, launched its latest decentralized VPN mobile app, allowing users to earn cryptocurrency by sharing bandwidth or paying for decentralized VPN services using fiat currency or Sentinel’s native DVPN coin.

At the end of December, Cosmos announced the winners of its million-dollar hackathon, three of which stand out.

The first is Evmos.me, which enables MetaMask and Keplr to work with Evmos—a soon-to-launch Cosmos project utilizing the Ethereum Virtual Machine to deploy smart contracts.

The second is a feature called Cosmos Omnibus Exchange, allowing validators on Cosmos-based blockchains to deploy their nodes on Akash Network—a decentralized storage Cosmos project.

The third is a dApp called Nymdrive, essentially a decentralized cloud storage platform built on NYM, similar to Google Drive or Dropbox. On this note, CoinList recently announced a token sale for NYM—given that CoinList only hosts high-quality crypto projects, this is quite a promising token.

Another Cosmos project, Umee, also raised $32 million at the end of December from over 63,000 investors. Umee is clearly positioned to become a DeFi project similar to Aave.

ATOM Price Analysis

All of Cosmos' announcements, upgrades, and developments are positive for ATOM. However, since my last coverage of the project in September, it has only risen about 50%.

Beyond the general weakness seen in the crypto market since last December, ATOM has failed three times in recent months to break past the $45 mark. This suggests strong resistance may reappear if prices approach those levels again.

What's holding ATOM back isn't just the broader market or technical factors. For starters, ATOM is highly inflationary. Its annual inflation rate ranges between 7% and 20%, depending on the percentage of ATOM staked on the network.

This high inflation is intentional, designed to discourage speculation and incentivize active participation through staking—either directly with ATOM or by engaging with other Cosmos blockchains.

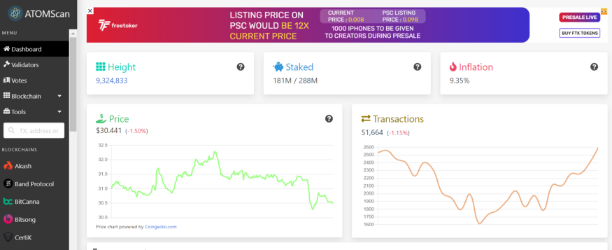

Cosmos targets a staking ratio of 67%, but as shown, only about 63% of ATOM is currently staked. According to ATOMScan explorer, this slight deviation from the ideal staking percentage corresponds to an annual inflation rate of over 9% for ATOM.

Curiously, since August, the circulating supply of ATOM has actually increased by about 25%, suggesting additional ATOM is coming from somewhere.

I suspect this extra ATOM is coming from Tendermint Inc. and the Interchain Foundation, whose ATOM allocations were completed last spring—meaning they could technically spend their ATOM holdings. If the million-dollar hackathon is any indication, they're ready to invest heavily in expanding the Cosmos ecosystem.

Assuming roughly another 66 million ATOM entering circulation were sold at an average price of $25, this represents up to $1.65 billion in selling pressure—though I believe much of this ATOM is being staked rather than sold.

Since the launch of IBC last year, demand for ATOM has been substantial. As far as I know, much of this demand comes from Osmosis DEX mentioned earlier. This is mainly because Osmosis cannot be accessed without ATOM, as the OSMO token itself is not available on any centralized exchange—meaning anyone wanting to access emerging Cosmos projects must first buy ATOM and transfer it to Osmosis.

Interestingly, exchanges have approached Osmosis about listing OSMO. But Osmosis founder Sunny Agarwal told them: if your users want OSMO, send them to the Osmosis DEX.

Additionally, some Cosmos projects launching initial DEX offerings on Osmosis accept only ATOM as investment, and some Cosmos projects airdrop their tokens to ATOM stakers or liquidity providers.

Roadmap Part 1

As for ATOM’s price potential, it's hard to say. Cosmos itself is a large-cap cryptocurrency, meaning ATOM will likely struggle to rise more than 3 or 4x before the bull market ends.

As always, it ultimately depends on the Cosmos roadmap. Released in July last year, it includes seven upgrades. Five remain, each with distinct milestones.

First is the Theta upgrade, expected by the end of this quarter. Theta will allow governance-modifiable liquidity pools—token pairs in Cosmos’ Gravity DEX—and enable transactions on other IBC-connected blockchains.

For example, you’ll be able to sign a transaction in your Osmosis wallet directly from your Cosmos wallet—eliminating the need to switch chains within wallets like Keplr.

More importantly, Theta will let you authorize other users or apps to sign transactions on your behalf across wallets on other chains—opening doors for interoperable, decentralized applications.

The second upcoming upgrade, called Row, is expected by the end of Q2—around June. Row will enable Cosmos’ governance module to interact with dApps and IBC-enabled blockchains. It will introduce NFTs to the Cosmos blockchain and also bring liquid staking. Without diving too deep into blockchain tech, liquid staking allows staked ATOM to be used within decentralized applications.

Row will also introduce options to redirect portions of ATOM inflation to community treasuries, other IBC-enabled blockchains, or even directly to dApps providing liquidity. This sounds very similar to Tezos’ own liquidity baking.

Roadmap Part 2

The third upcoming upgrade, Lambda, is expected by the end of Q3—around September. Lambda will be huge, as it includes three major components.

The first major component in Lambda is called "shared security," which will allow Cosmos validators to secure other Cosmos-based blockchains. This is important because one of the biggest barriers for new Cosmos projects is insufficient funds to secure their own chains. In Proof-of-Stake blockchains, security fundamentally comes from the total value of staked coins. That’s why even large Cosmos projects like Osmosis plan to leverage Cosmos’ shared security when it launches—since the value locked in Osmosis exceeds the value staked to secure it.

The second key feature in Lambda is enabling Gravity Bridge and Gravity DEX to exist on their own dedicated blockchain. This is important because it will relieve pressure on the Cosmos blockchain and minimize congestion risks.

The third major feature in Lambda is the introduction of Chain Name Service, which I interpret as a form of decentralized digital identity. This is important because it can enable stronger governance structures within the Cosmos ecosystem and open the door to things like decentralized credit scoring, allowing users to borrow more from DeFi protocols.

Cosmos’ fourth and fifth upgrades, Epsilon and Gamma, are expected at the end of this year and in Q1 2023 respectively. The specific goals for these upgrades aren’t yet detailed, and I expect they may evolve as we get closer—so stay tuned.

Other Cosmos milestones listed at the bottom of the roadmap include privacy, smart contracts, and rollups. Unfortunately, no dates or further details have been provided for these.

Additional milestones beyond the roadmap include the launch of Sagan—the live testnet I mentioned earlier—Emeris Alpha, the frontend for Gravity DEX, and the Emeris Web Wallet, described as a “blockchain comb for cross-chain.”

Simply put, the Emeris web wallet will interact with multiple cryptocurrency blockchains—not just Cosmos-based ones.

On that note, Peng Zhang, CEO of Tendermint Inc., hopes that once Ethereum transitions to PoS, it will be able to enable IBC—currently impossible due to slower transaction finality under Proof-of-Work.

Concerns About COSMOS

As for my concerns about Cosmos, I should first say that Cosmos is one of my favorite crypto projects, and I hold ATOM as part of my crypto portfolio.

Even so, certain aspects of the project still require significant improvement, starting with development.

Many of the goals outlined on the Cosmos roadmap I just mentioned were supposed to be completed last year. While I’m inclined to attribute this to developer shortages, a recent report on crypto developers found that the Cosmos ecosystem actually ranks third in developer count—over 1,000 developers—after Ethereum and Polkadot. The catch? This number seems to cover the entire Cosmos ecosystem, not just the Cosmos blockchain itself. In other words, many Cosmos developers may be working on other projects like Osmosis, which has drawn significant attention and liquidity within the Cosmos ecosystem.

This ties into my second concern: competition originating from within the Cosmos ecosystem itself. As Osmosis founder Sunny Agarwal admitted in an interview, the Cosmos ecosystem could continue to thrive even without the Cosmos blockchain, because none of the other Cosmos blockchains require Cosmos to operate, nor do they need ATOM to pay transaction fees. This is my biggest concern regarding Cosmos: ATOM’s value capture. Basic economics dictates that for a token’s price to rise, demand must exceed new supply—and ATOM appears to struggle maintaining this dynamic. Currently, ATOM’s primary utility is as a key to unlock access to the Cosmos ecosystem. But this role could easily be filled by another Cosmos-based token supported by exchanges. This means Cosmos developers need to create more demand drivers for ATOM.

Alternatively, the Cosmos community could adjust ATOM’s tokenomics to minimize new supply—an ongoing hot topic on the Cosmos governance forum. For what it’s worth, I believe Cosmos will find a way to enhance ATOM’s value both within and beyond its ecosystem. From my perspective, it seems focused on the Vega update. I truly believe that unless we enter another crypto winter, 2022 will be a pivotal year for Cosmos.

Video link:

https://www.youtube.com/watch?v=SsizxLsjo_Q

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News