The Ultimate Battle of Cross-Chain: A Comparative Analysis of Polkadot, Cosmos, LayerZero, and More

TechFlow Selected TechFlow Selected

The Ultimate Battle of Cross-Chain: A Comparative Analysis of Polkadot, Cosmos, LayerZero, and More

Since a multi-chain ecosystem characterized by competition, compatibility, and coexistence has become inevitable, future conflicts may grow even more chaotic. Could inter-chain communication be the next sector poised for explosive growth?

Author: Jackson

Preface:

Before discussing the topic of this article, we need to clarify that this article represents only the author's personal opinions and thoughts. The analysis focuses on product and technical design without considering capital operations, marketing, or other aspects. Therefore, this article is neither investment advice nor a short report. The issues discussed here are primarily infrastructure-related—such sectors often have atomic characteristics: either they rapidly take off if meeting demand, or fail completely if heading in the wrong direction. Hence, the projects mentioned in this article should not be taken as investment recommendations from the author.

01. Information Cross-chain Reflections Triggered by Synthetix’s L1 and L2 Data Compatibility

This research report was prompted by SIP-156 and SIP-165 released in July and December respectively within the Synthetix community. Links are provided below:

https://sips.synthetix.io/sips/sip-156/

https://sips.synthetix.io/sips/sip-165/

Currently, both proposals remain at the Feasibility stage, meaning they haven't been implemented yet but their feasibility has gained some recognition. These two proposals aim to solve data compatibility issues between Synthetix’s Layer 2 and Layer 1. Readers familiar with my synthetic assets report from October would know that Synthetix, one of Ethereum's most complex DeFi projects, officially deployed on Optimism—a Layer 2 solution—this year. However, as multi-chain competition intensifies, although limited cross-chain communication exists between Layer 2 and Layer 1, it cannot currently extend to other sidechains or heterogeneous chains like Solana. This prevents synchronization of Synthetix’s global debt pool, resulting in significant "liquidity waste."

This "liquidity waste" is one of the biggest challenges faced by various DApps in today’s fragmented public blockchain landscape—especially for global debt-based projects like Synthetix (any project using shared risk models such as pool-to-user faces similar issues). When deploying across multiple chains, liquidity becomes fragmented across chains, requiring projects to re-incentivize liquidity generation from scratch on each chain.

Take the frequently criticized “DeFi For All” fund as an example: Polygon introduced Aave, Curve, Sushi, and recently Uniswap through this initiative. Yet these top-tier projects still need to rebuild liquidity incentives and capital deposits independently on Polygon.

You might argue that more economic incentives are better for yield farmers, but actual users face considerable inconvenience—for instance, the number of supported collateral and deposit assets on Aave’s non-Ethereum versions is far lower than on Ethereum; similarly, even popular assets on Sushiswap across other chains have significantly less liquidity compared to those on Ethereum.

From a developer’s perspective, suppose I want to deploy my own innovative collateralized lending protocol on a high-performance heterogeneous chain or an EVM-compatible sidechain like Polygon. I’d face a major issue: insufficient types of viable collateral because few assets on that chain possess enough liquidity to support large-scale liquidations.

Additionally, many chains host mainstream token trading AMM pools. Take ETH: at the time of writing, its total TVL on Uniswap V3 is $1.41B, while on Pancake V2 it’s about $0.3B. When executing the same ETH trade, slippage pressure on Pancake is nearly five times higher than on Uniswap V3 on Ethereum. The larger the transaction amount, the greater the slippage difference. This explains why transaction aggregators—and increasingly, cross-chain transaction aggregators—are gaining adoption.

Another example: interest rates vary when users borrow against collateral on different-chain versions of Aave. This occurs because data silos prevent inter-chain data sharing, so contracts calculate rates based solely on native chain data. While seemingly minor, consider this analogy: you earn a 4% interest rate depositing money at your local bank, but find it jumps to 6% when visiting another major city. Same bank, same currency—such discrepancies are impossible in traditional finance but common in blockchain due to data island problems.

Therefore, we must ask:

Given that multi-chain coexistence and competition are now inevitable—and future battles may grow even messier—is cross-chain information communication the next sector poised for explosive growth?

To explore this, my team and I conducted extensive research into various existing solutions (focusing on representative ones; more homogeneous alternatives aren’t covered here), aiming to analyze the strengths and weaknesses of each approach from multiple angles.

The following content involves diverse technical primitives. We’ll use plain language wherever possible to aid understanding. Though infrastructure sounds highly “technical,” blockchain solutions fundamentally reflect philosophical questions about organizational forms and production relationships. By grasping basic processes and logic—even without reading code—one can understand the significance behind these infrastructures.

02. Existing Cross-chain Communication Infrastructures

(1) Lightweight Plug-in Communication Protocol—LayerZero

LayerZero was a cross-chain communication infrastructure SeerLabs encountered back in August. It caught my attention initially, but I missed the investment window due to other priorities (regrettable). Later, I saw the protocol secured investments from Binance, Multicoin Capital, Delphi Digital—and then they stopped replying to me.

1. Overview

LayerZero promotes a lightweight, communication-layer-based solution aimed primarily at DApps across different chains, helping them achieve interoperability.

The LayerZero whitepaper describes the mechanism roughly as follows:

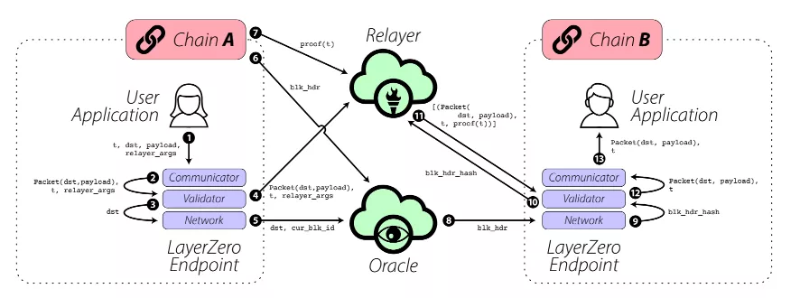

The diagram above illustrates steps involved in delivering a single LayerZero message, with each black-numbered step indicating a specific phase.

Step 1: A user application (AppA) on Chain A performs a series of actions as part of transaction t. We uniquely identify transaction T via identifier t, whose format may vary depending on Chain A. One action within T is transmitting data via LayerZero. For illustration and without loss of generality, assume AppA uses the template relayer provided by LayerZero. AppA sends a request to the LayerZero Communicator containing:

t: unique event identifier

dst: global identifier pointing to a smart contract on the destination chain

payload: any message data AppA wishes to send to AppB on Chain B

relayer_args: parameters for payment information submitted when AppA chooses the template relayer shown in the diagram (a customizable relayer offered by LayerZero)

Step 2: The Communicator constructs a LayerZero packet containing dst and payload, called packet(dst, payload), and forwards it along with t and relayer_args to the Validator.

Step 3: The Validator sends t and dst to the network, signaling that the current block header from Chain A needs to be sent to Chain B.

Step 4: The Validator forwards packet(dst, payload), t, and relayer_args to the Relayer, notifying it to pre-fetch the transaction proof for T and eventually deliver it to Chain B. This happens simultaneously with Step 3.

Step 5: The network sends the block ID (cur_blk_id) of the current transaction to the Oracle. This notifies the Oracle to fetch the current block header from Chain A and transmit it to Chain B. If multiple LayerZero transactions occur within the same block, Step 5 executes only once.

Step 6: The Oracle reads the block header (blk_hdr) from Chain A.

Step 7: The Relayer reads the transaction proof (proof(t)) associated with transaction T from Chain A and stores it off-chain. Steps 6 and 7 happen asynchronously.

Step 8: Once the Oracle confirms the blk_hdr block is stably committed on Chain A, it sends blk_hdr to the network on Chain B. The mechanism determining finality varies per chain but typically requires waiting for a certain number of block confirmations.

Step 9: The network sends the block hash specified as blkJhdrJhash to the Validator.

Step 10: The Validator forwards blkJhdrJhash to the Relayer.

Step 11: Upon receiving blk_hdr_hash, the Relayer sends a list of all packet(dst, payload), t, proof(t) tuples matching the current block. If multiple users simultaneously send messages between the same endpoints, multiple packets and corresponding transaction proofs may exist within the same block.

Step 12: The Validator uses the received transaction proof together with the block header stored by the network to verify whether the associated transaction T is valid and committed. If the block header and transaction proof don’t match, the message is discarded. If they match, packet(dst, payload) is forwarded to the Communicator.

Step 13: The Communicator delivers packet(dst, payload) to AppB.

2. Key Advantages Promoted by the Solution:

(1) Lightweight and low cost

Unlike other approaches relying on nodes from an upper-layer chain over Chains A and B, LayerZero allows flexible deployment. Projects can use templates provided by LayerZero, and even design their own relayers. The whitepaper mentions ULN—an ultra-light node lighter than light nodes—but lacks detailed implementation specs. Still, this reflects its ultra-lightweight nature.

(2) Communication-layer-based solution

This is a key selling point promoted by the team. LayerZero claims to offer a new Layer 0-level communication protocol. We disagree—it isn’t a protocol akin to TCP, but rather a cross-chain data transfer protocol. In our view, it belongs at the application layer, positioned between Layer 2 and Layer 3.

(3) No reliance on third-party trust

The whitepaper references Anyswap and THORChain as examples of notary-style mechanisms (discussed next), arguing they rely on an intermediate consensus layer requiring user trust. In contrast, LayerZero positions itself as a peer-to-peer communication primitive independent of such layers.

(4) Summary

LayerZero presents an intriguing cross-chain mechanism that genuinely solves practical issues and remains highly lightweight. But beneath the surface, we see how such “technical” solutions can induce misleading perceptions.

3. Issues

(1) Not truly a communication-layer solution

LayerZero does not constitute a Layer 0 communication protocol. Its main components—endpoints and relayers—serve verification and message relay functions respectively. It’s merely a cross-chain data transmission protocol best categorized at the application layer, between Layer 2 and Layer 3.

(2) LayerZero still relies on an intermediate consensus layer

LayerZero’s design uses mutual validation between the relayer and Oracle to ensure security. However, the whitepaper acknowledges extreme scenarios—e.g., collusion between relayer and Oracle. While maintaining relative independence reduces such risks, relayers are usually deployed by project teams. LayerZero suggests using services like Chainlink as Oracles. Aside from Chainlink’s communication costs, this essentially means trusting that Chainlink won’t collude with project parties—making Chainlink itself an intermediate consensus layer.

4. Subjective Outlook

(1) Most users lack awareness of technical nuances

Thus, subtle narrative inductions rarely matter. Some “technical” projects exaggerate even more aggressively. To us, too many founder “writers” have already been seen.

(2) Lightweight deployment favors promotion and adoption

Compared to Anyswap, THORChain, Polkadot, Cosmos, and Axelar (to be discussed later), LayerZero demands much lower technical, ecosystem, and operational costs. There’s no need to build dedicated nodes, recruit validators, or maintain an intermediate consensus layer—all of which incur significantly higher expenses than simply offering tools.

Given equal resources, we believe LayerZero holds stronger potential for broader adoption within the cross-chain ecosystem.

(3) Limited narrative and ecosystem potential

Similar to auxiliary products like Anyswap and Chainlink, LayerZero can play a vital role, but its product nature limits storytelling and ecosystem expansion capabilities.

For example, Chainlink’s intermediate consensus layer ecosystem is quite mature, but its deeply entrenched identity as an oracle hampers its narrative appeal compared to Layer 1 chains like Solana. With its capabilities, Chainlink could arguably qualify as a Layer 3 for all chains.

Likewise, LayerZero’s tool-oriented positioning weakens its narrative strength. Clues emerge from two Medium articles: when contemplating scalability, the founders immediately considered collaboration with Cosmos IBC.

That’s effectively placing itself narratively at the level of just one component within Cosmos.

(2) Heterogeneous Cross-chain Communication Protocol—Axelar

This project is fascinating—the overall title and philosophy align perfectly with today’s discussion. From inception, Axelar aims to empower DApp developers and blockchain ecosystems by addressing incompatibility issues among heterogeneous chains under current conditions.

1. Officially Stated Vision

(1) For underlying developers

Connect your blockchain to all others

(2) For DApp developers

Deploy your DApp anywhere, enabling cross-chain asset and information transfers between any chains via Axelar

(3) For users

Interact directly from your wallet with DApps across all blockchain ecosystems

2. Basic Principles

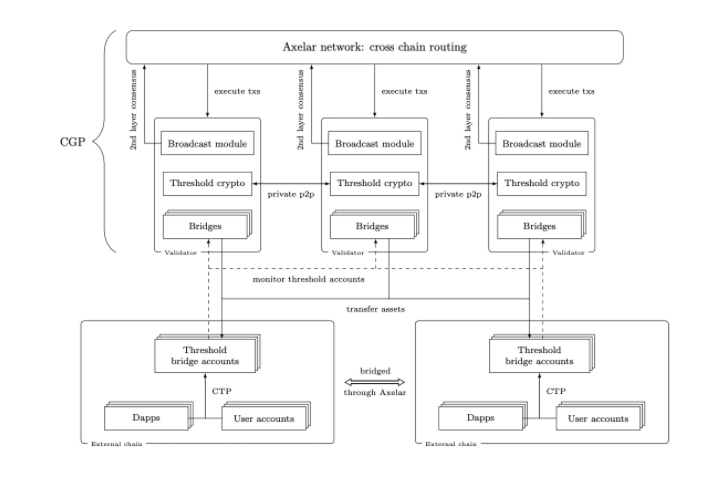

This figure comes from official documentation—it looks overly complicated. Let’s simplify it into textual flow.

3. Axelar Cross-chain Protocol Workflow

Assume Chain S and Chain D, with Axelar providing cross-chain services between them.

State Information Transfer

Axelar obtains and synchronizes state information (e.g., block hashes, current block height) from various blockchains by having validators in the Axelar network run nodes for different chains. Core workflow:

(1) A user on Chain D requests state data from Chain S via Axelar’s API, either sending the query Q to a cross-chain bridge account or directly on the Axelar blockchain.

(2) Each Axelar validator must run node software for Chains S and D. Validators query their Chain S node APIs for answer A and submit A to the Axelar chain.

(3) Once validators exceeding a threshold weight report identical answers in round R, a threshold signature signs the answer S, published in block R+11.

(4) Anyone can extract the signed answer S from block R+11 and publish it to Chain D. Users on Chain D can query this result via Axelar’s API.

Asset Transfer

Suppose a user wants to exchange x tokens on source chain S for x pegged tokens S’ on target chain D, deposited into wallet address WD. The workflow is:

(1) User sends a cross-chain transfer request (x, WD) to the bridge account. A listener captures and routes it to the Axelar network.

(2) Axelar’s current validator set jointly generates a new deposit address DS on Chain S using threshold signatures, broadcasting it to the Axelar network.

(3) User monitors the Axelar blockchain to obtain DS, then sends x tokens to DS.

(4) Validators check if the transfer succeeded. If validators exceeding a threshold weight confirm success in block R, they sign transaction txD, sending x S’ tokens to WD, broadcasting the signature in block R+11.

(5) Anyone can extract the signed transaction txD from block R+11 and post it to Chain D, completing the cross-chain asset transfer.

This scheme is more complex than LayerZero, involving longer verification logic. The key difference lies in LayerZero using external oracles as partial validators, relying on them for security and acting as an intermediate consensus layer. In contrast, Axelar builds a third-party chain using BFT Byzantine consensus. Through CTP, Axelar syncs other chains’ data into its network, then uses threshold signatures from its nodes to relay information across chains.

Essentially, this approach shares little distinction from Anyswap and THORChain, falling under the notary mechanism category—one of the most important schools in cross-chain communication.

4. Advantages of This Approach

(1) Independent third-party chain enables greater imagination

The Axelar network supporting heterogeneous chains is itself a blockchain network. While it supports routing DApps from Chain A to Chain B via Axelar, the optimal strategy for developers is direct deployment on Axelar. Future deployments become downward extensions rather than upward integrations.

If Axelar successfully develops its ecosystem, it may evolve into what’s called a Layer 3—akin to Polkadot’s relay chain. At that point, ETH, BTC could potentially become sub-chains of Axelar.

(2) No dependency on third-party oracles, potentially lower efficiency and overall cost

While LayerZero offers low endpoint and relayer deployment costs and lightweight architecture, Oracle usage costs and efficiency become critical factors influencing DApp developers’ choices.

For example, if Project A wants to transfer debt data from its main contract on Chain A to Chain B via LayerZero and Chainlink, Chainlink calls may incur fees. Unlike Axelar, which directly listens to block data across chains, Chainlink pushes data periodically or conditionally—e.g., every minute or unless debt fluctuates less than 1%.

Such behavior requires payments to Chainlink. Chainlink Market hosts numerous data providers, each with contracts for specific data. To get data, you call the contract and pay LINK; the provider queries off-chain and feeds data back to your contract (thus asynchronous, with at least one-block delay). Payment is slightly above gas fees—about 1–3 LINK on Ethereum, ~0.1 LINK on BSC.

High-frequency asynchronous cross-chain communication incurs substantial cumulative costs. Thus, Axelar’s generalized solution may offer much lower total costs.

5. Subjective Outlook

(1) In terms of overall product design, Axelar resembles Anyswap. Most users tolerate relatively centralized intermediate consensus layers. Few care about decentralization levels of service providers or ecosystems behind Chainlink or Anyswap—they simply adopt the most widely recommended cross-chain solution on their chain. Thus, general-purpose heterogeneous cross-chain solutions ultimately test a project’s ability to engage Layer 1s. So far, we’ve seen little activity from Axelar, and technically, we don’t see self-propagating advantages.

Still, advancing the Axelar ecosystem should be easier than launching another Layer 1. It can serve as a tool layer instead of rebuilding an entire ecosystem.

(2) In narrative power, Axelar currently lags far behind Cosmos and Polkadot. Despite being equally cross-chain focused—and perhaps even more practical—Polkadot and Cosmos propose standardized blockchain protocols, giving them superior storytelling power.

(3) Polkadot and Cosmos

1. Basic Information

Polkadot and Cosmos are the loudest, richest in ecology, and highest market cap projects in this space. Overall, their articulated values and product visions surpass LayerZero and Axelar.

We won’t dive into detailed technical designs of Polkadot and Cosmos—documentation in multiple languages abounds. Instead, we focus on holistic comparison.

Both Polkadot and Cosmos mention cross-chain schemes between heterogeneous chains—e.g., Substrate/Tendermint chains interacting with ETH/BTC. The basic principles aren’t vastly different from Axelar or LayerZero, generally requiring an intermediate consensus layer using notary mechanisms for cross-chain functionality.

But Polkadot and Cosmos tell a more compelling story—standardized blockchains and homogeneous cross-chain solutions. Put differently: recreating ecosystems for universal interconnectivity.

2. Comparison with LayerZero & Axelar Models

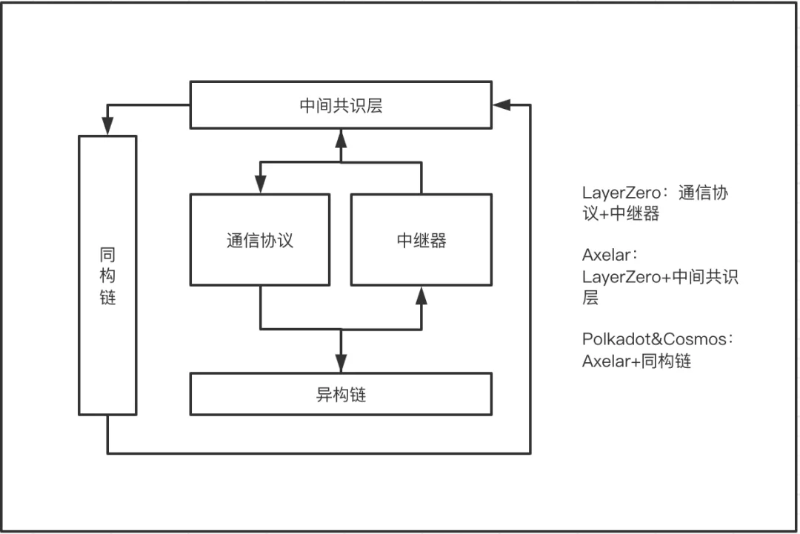

As shown above, after extreme simplification (thread labels aren’t precise—e.g., Polkadot’s heterogeneous cross-chain requires bridge chains rather than direct interaction with the relay chain), we conclude: there’s no fundamental difference among these three types regarding heterogeneous cross-chain. However, their philosophies diverge broadly on the overarching theme of cross-chain.

Polkadot and Cosmos believe homogeneous cross-chain offers the best security and stability, with lower technical debt for newer projects. Though they support heterogeneous cross-chain, their primary focus remains intra-Substrate and intra-Tendermint homogeneous connectivity.

Axelar believes unified standards are the most efficient and secure way to enable heterogeneous cross-chain, hence building the Axelar Network—an intermediate consensus layer inheriting cross-chain communication and relay services for interaction with heterogeneous chains.

LayerZero, however, believes lightweight cross-chain communication protocols tailored for developers are essential. Thus, it provides only relayers and communication protocols, leveraging oracles as stand-ins for the intermediate consensus layer.

Which approach will gain more traction and promise in 2022’s competitive landscape?

(4) Comprehensive Outlook Analysis

1. Current Competitive Landscape

a. Intense competition among heterogeneous chains; multi-chain coexistence is now certain

b. Whales stay on ETH; users migrate to lower-cost, better-experience Layer 1s—BSC, AVAX, Solana

c. Composability-driven innovation dominates

d. EVM ecosystem holds dominant market share

2. Reference Model Benchmarking

From an ecosystem development standpoint, these three strategies differ greatly in narrative and growth tactics. Below is a comparative table across dimensions:

Due to grander ambitions, Polkadot and Cosmos face greater challenges. From the table, we can assess each solution’s biggest hurdles, future prospects, and key target audiences.

We can confidently conclude: unless their tools are sufficiently robust and ecosystems vibrant enough to form independent paradigms, achieving their whitepaper-stated visions will be extremely difficult.

At least in today’s multi-chain race, Polkadot and Cosmos’s core homogeneous cross-chain solutions don’t align well with current mainstream trends.

However, subtle differences exist between Cosmos and Polkadot. For instance, Cosmos offers a solution using IBC and peg zones to achieve heterogeneous cross-chain connectivity.

In short, Cosmos already enables rapid, efficient construction of Axelar-like networks—with added potential for future interactions among homogeneous chains.

This means even if core homogeneous cross-chain isn’t fully realized, successful adoption of efficient heterogeneous cross-chain can still count as a win for the Cosmos ecosystem.

In contrast, Polkadot’s XCMP (still unfinished) is tightly coupled with relay chain consensus, making it hard to decouple independently. Developers must build separate systems to connect with heterogeneous chains like BTC or ETH. While this lowers intermediate consensus layer development costs, it drifts far from the stated vision.

Thus, overall, Polkadot’s design may face severe difficulties today. After slot auctions conclude, Polkadot needs massive incentives to attract native Substrate-chain DApps to survive fierce competition. Among all observed projects, this challenge appears the greatest.

Of course, Parity and Web3 Foundation’s capabilities are unquestionable. This analysis focuses purely on product and technical difficulty—not investment advice.

03. Seer Perspective

(1) LayerZero May Reach Market Fastest

Because LayerZero better meets current DApp developers’ real-world needs. Using the earlier Synthetix case: Synthetix could quickly integrate Layer 1 and Layer 2 debt pools using LayerZero + Chainlink.

(2) Axelar Faces Highest Homogenization Competition

Compared to LayerZero’s lightweight, fast-deployment entry point, Axelar’s approach is more homogenized—facing competition from above (Polkadot & Cosmos), alongside (Anyswap & THORChain), etc. Layer 1 adoption rate will be its biggest barrier—we’re skeptical Axelar can outperform Anyswap, which despite focusing on asset bridging today, can upgrade to message passing with minimal effort and already enjoys high Layer 1 adoption. Meanwhile, Axelar refuses to settle as just a lightweight communication module due to poor narrative and value capture potential.

(3) Cosmos Expected Adoption Higher Than Polkadot

Cosmos’s more flexible architecture lowers technical barriers. Its application-centric design has already enabled standout products in the Tendermint ecosystem, including the recently popular LUNA (Terra).

(4) Polkadot Ecosystem Faces Immense Challenges

Among all discussed solutions, Polkadot faces the greatest publicity pressure. Repeated delays caused by complex technology continuously erode user confidence. What might finally validate Polkadot’s promise could be a “killer app fully leveraging inter-chain composability.” Of course, given Polkadot’s broad stakeholder base, late-mover advantages might help it succeed eventually.

TechFlow is a community-driven deep content platform dedicated to delivering valuable information and thoughtful insights.

Community:

WeChat Official Account: TechFlow

Telegram: https://t.me/TechFlowPost

Twitter: TechFlowPost

Join WeChat group: Add assistant WeChat TechFlow01

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News