Old Fashion Research: Decoding Thetan Arena's Economic Model and Investment Analysis

TechFlow Selected TechFlow Selected

Old Fashion Research: Decoding Thetan Arena's Economic Model and Investment Analysis

P2E games with a long-term sustainable model that can survive at least one bear market cycle

Author: bigfatpenguinQ (Analyst at Old Fashion)

Advisor & Editor: JX (Partner at Old Fashion)

Translated and republished by TechFlow with permission

Key Takeaways:

1) Unlike Axie Infinity and its clones, Thetan Arena introduces more internal mechanisms to consume its native reward token $THC, hedging against inflation caused by distributing tokens as rewards.

2) Thetan Arena attracts users not only through its P2E model but also via intense gameplay that locks players into the ecosystem. The more players it acquires, the greater value $THG tokens will gain, as the entire ecosystem's profitability depends on the number of active users generated by its predefined tax model.

3) GameFi projects that combine high-quality game development capabilities with deep crypto understanding will stand out and usher in the next era of the gaming industry.

A Rising Star in P2E Gaming — Why Thetan Arena?

#PlayToEarn has undoubtedly been the most discussed topic in the crypto market this year, sparked by the #AxieInfinity craze. Among millions of emerging P2E games, we identify #ThetanArena as a potential gem, officially launching its game on November 27 and publicly listing its in-game currency $THC token on November 26.

The main purpose of this article is to use Thetan Arena as a case study to deeply explore the token model design of P2E games. From our analysis, we aim to summarize general principles of token design, hoping to provide insights for crypto game developers and players alike.

Important note: This is for research purposes only and should not be considered financial advice.

Part One: Introduction to Thetan Arena’s Token and NFT System

Thetan Arena is a MOBA Play-to-Earn game available on PC, Android, and iOS systems. You can gather friends, form teams, battle others, and earn token rewards ($THC, $THG) represented in-game as NFT heroes.

Unlike traditional mobile games where in-game items typically lack liquidity, Thetan Arena’s core assets can be freely traded on cryptocurrency markets. Virtual assets mainly fall into three categories:

First are Hero NFTs. As a MOBA game, players control a hero character during combat.

Most heroes are represented as NFTs with three rarity tiers: Common, Epic, and Legendary, in ascending order of rarity.

To lower entry barriers, Thetan Arena allows players to obtain up to three free non-NFT heroes, which cannot be sold on secondary markets.

Heroes also come with skins, which have their own rankings: Common, Epic, and Legendary.

Generally, rarity determines a hero’s combat strength.

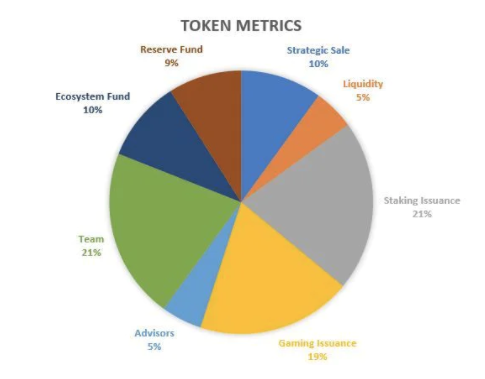

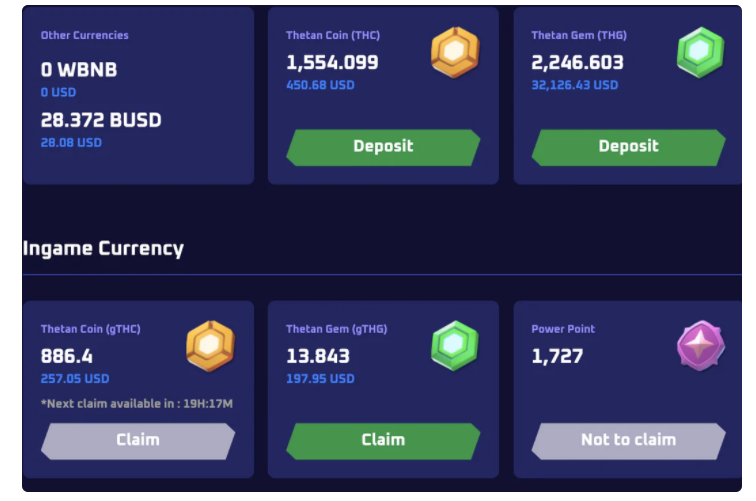

Second is $THG, a utility token serving as the medium of exchange among participants in Thetan Arena’s economic system. Its total supply is capped at 420,000,000. (Token distribution shown in chart below)

In the current ecosystem, $THG use cases include:

1: Incentives. Players are rewarded with $THG tokens for completing in-game tasks or ranking highly on leaderboards.

2: Governance voting. $THG holders can create and vote on on-chain governance proposals to shape Thetan Arena’s future features and parameters.

3: In-game currency. $THG is the only currency usable to acquire Legendary Boxes for recruiting new Hero NFTs. $THG can also be used to upgrade the level of NFT heroes within the game.

Lastly, there is $THC, a pure in-game currency with infinite supply, earned solely by playing the game.

In the current system, $THC use cases can be summarized as:

1: In-game rewards. Players earn $THC rewards by winning matches.

2: Purchasing Thetan Hero Boxes. $THC can be used to buy Common and Epic boxes.

Part Two: Deep Dive into Thetan Arena’s Economic Flywheel

Now here's a question: Between playing for free and paying upfront to potentially earn big later, which would you choose?

Unless you're extremely risk-averse about money, why not earn while playing? After all, whether you pay or not, you’re still playing the same game—so who could say no to free cash?

Welcome to the first loop: purchasing in-game assets.

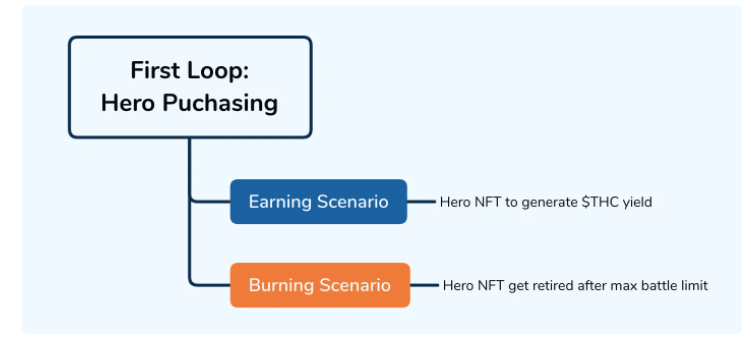

The initial access point to the game is the NFT-formatted hero. Notably, each Hero has a maximum battle limit beyond which it stops earning $THC tokens (see chart).

Once a hero reaches its battle cap, it generates no further revenue. Think of it like a sword that rusts after years of use.

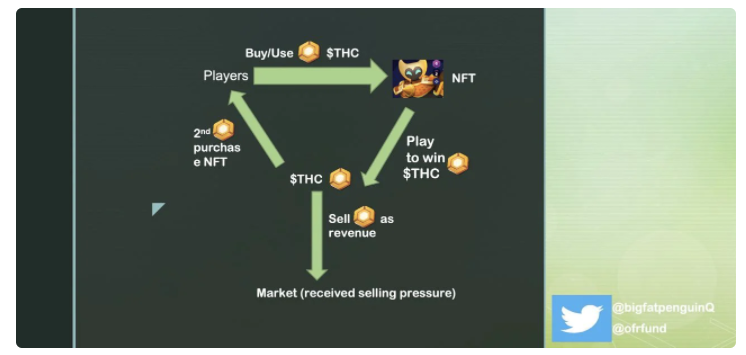

Now, our loop looks like this:

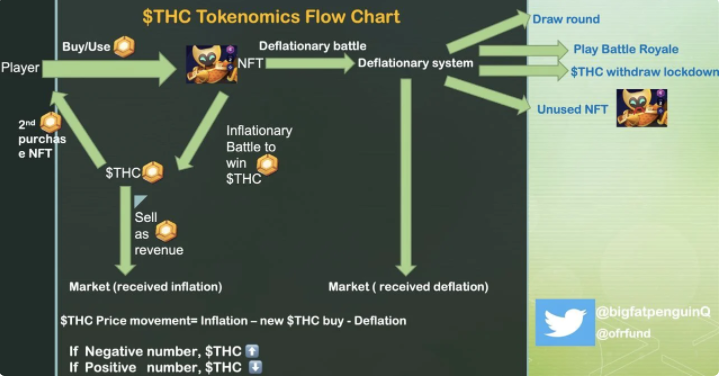

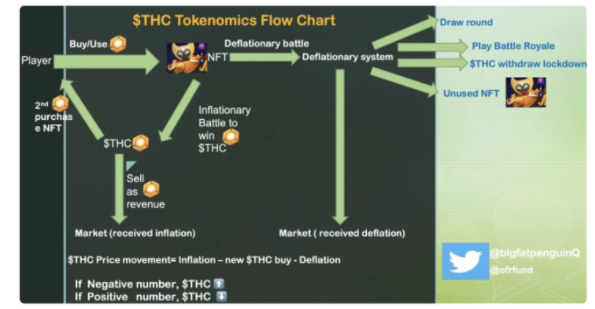

Next, $THC follows two paths.

One path uses $THC to buy new heroes, continuing the previous loop. The other involves selling $THC to lock in profits.

Choosing the former constitutes a repurchase (second purchase). This action does not necessarily cause $THC inflation, as the $THC remains locked within the ecosystem.

If we choose the latter path, it creates downward market pressure and increases the inflation rate of the $THC token.

Within this closed loop, $THC prices seem destined for an endless decline due to constant selling pressure.

Every game needs a resource consumption mechanism to maintain balance and health in its in-game economy. For Thetan Arena, so far, the consumption system is robust.

Nevertheless, in #Thetanarena, these consumption methods aren't easily observable.

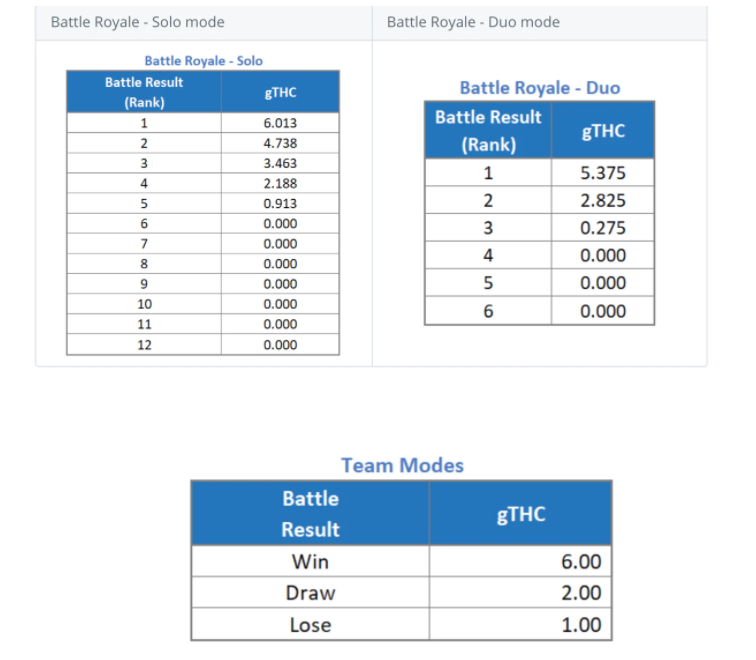

First, there are four game modes. We won’t detail them all here. However, one mode called Battle Royale actually has a negative $THC minting rate (other modes have positive $THC minting rates), meaning if you play Battle Royale, you’re actually helping compress $THC supply. With a 50% win rate, you’d lose money.

Another deflationary scenario for $THC occurs when playing team mode and encountering a draw. The expected model calculation is shown below.

Mathematical Expectation Model:

1: Assume you have a 50% win rate. Everyone pays $THC to enter using NFTs.

2: Compare your $THC earnings in Battle Royale mode versus the other three modes.

3: Pure Battle Royale $THC yield - $THC cost to buy NFT = negative number → i.e., $THC contraction

Pure other three modes $THC yield - $THC cost to buy NFT = positive number → i.e., $THC inflation.

4: "Draw" deflation can be calculated similarly: simply compare the pure draw $THC minting rate (negative = deflation) with pure win/loss $THC minting rates (positive = inflation).

There are also soft deflationary mechanisms in the game. In reality, many players who aren’t full-time crypto enthusiasts may abandon their purchased NFT heroes once they lose interest. This accelerates deflation because potential $THC minting ceases.

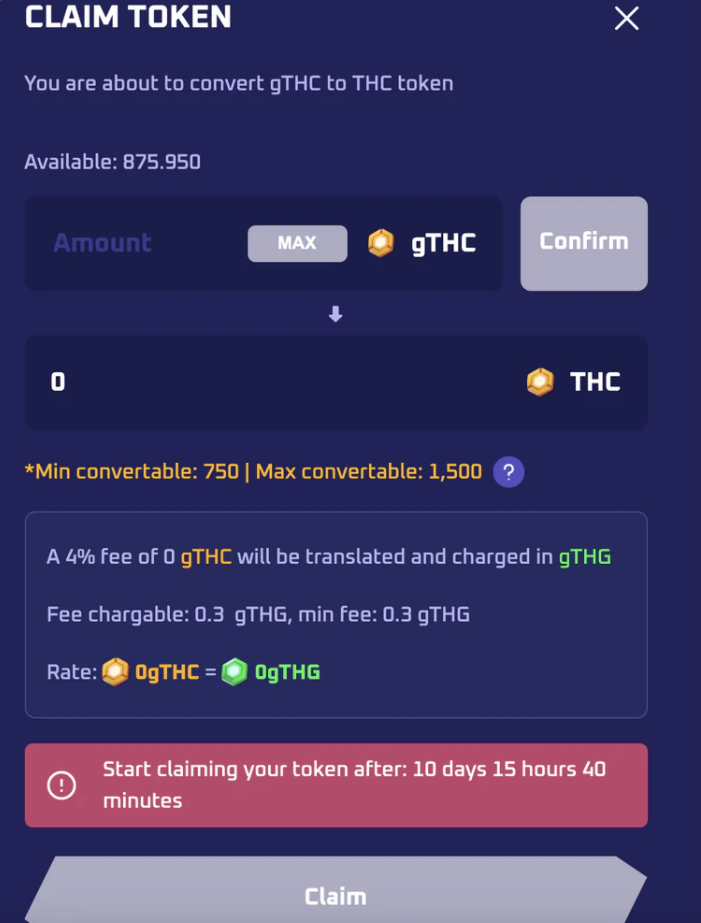

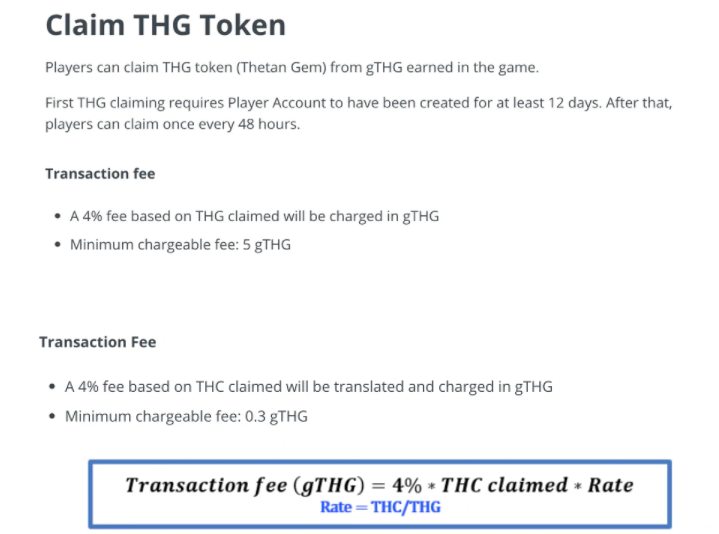

Another soft deflation mechanism in the game is $THC withdrawal locking.

Two restrictions apply: new users must wait at least 12 days before claiming earned $THC tokens, and withdrawals are limited to between 750 and 1500 $THC per transaction.

Each withdrawal request requires a 2-day cooldown period.

In summary, the locking mechanism extends the inflation cycle of $THC tokens, helping maintain economic balance within the game ecosystem.

So far, the $THC loop is self-sustaining and functioning well.

We’ll complete the final step of the loop by providing derivations at the end of this section.

But what about $THG transactions? What is the relationship between $THC and $THG?

In short, the $THG token is Thetan Arena’s true value container.

1: Transactions involving NFTs and withdrawing $THC/$THC incur fees payable in $THG deposited within the game. Withdrawing $THG incurs taxes.

Additionally, each hero has three skin rarities: Common < Rare < Mythic

Therefore, as the user base grows, demand for $THG increases. Moreover, staking/depositing $THG in-game reduces supply on secondary markets.

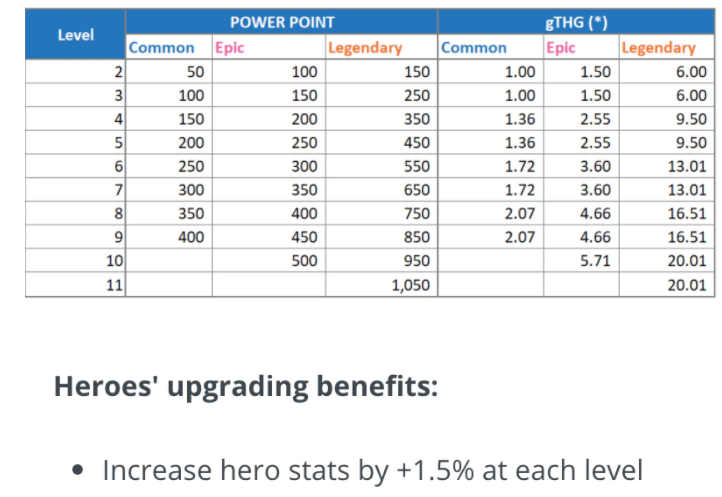

2: $THG can be consumed to upgrade Hero NFTs, further reducing $THG supply in the market.

We can imagine a scenario where both the author and you fight in the game, choosing identical heroes at the same level and earning equal $THC tokens, given both have a 50% win rate. Neither appears stronger since skills and stats are equal. But one day, the author decides to use a trick—upgrading his hero.

You begin noticing that as his hero grows stronger, winning becomes increasingly difficult. His win rate climbs from 50% to 55% or even 60% as his Hero NFT level increases.

So you decide to adopt the same trick—upgrading your hero.

Eventually, you both reach parity again, and win rates return to 50%.

But meanwhile, $THG has slipped out of both your wallets.

This is a classic mechanic found in many games, yet it continues to work effectively—after all, who doesn’t enjoy prestige in gaming? As more players join Thetan Arena, increasing numbers will upgrade their heroes, thereby boosting $THG’s value, since it is the sole material enabling upgrades.

Thus, if user growth remains consistently positive over time, the dollar price of $THG will undoubtedly rise.

And don’t forget—$THG has a hard-capped maximum supply.

In summary, $THG captures the intrinsic value of the game by reflecting user base growth.

Part Three: Comparing Token Models with Axie Infinity

So far, we’ve absorbed the overall vision of basic tokenomics in #ThetanArena, which leverages a dual-token model to sustain profitability while maintaining stable ecosystem development.

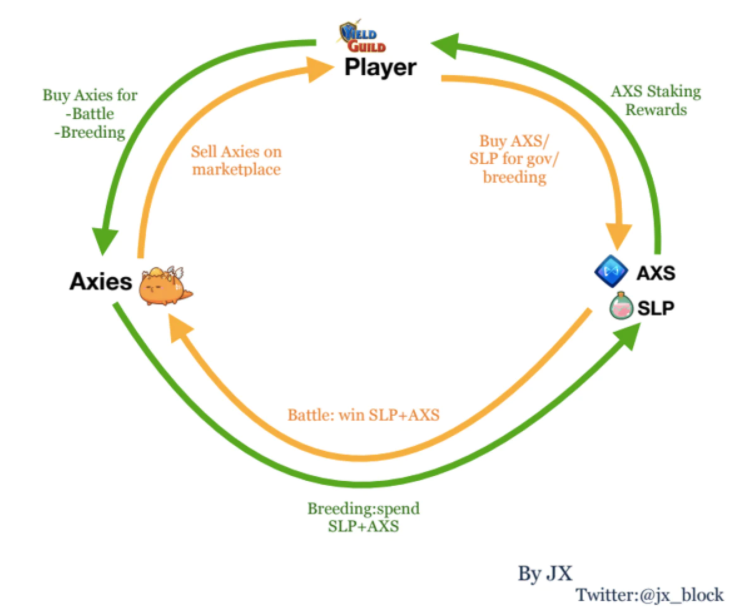

As a blue-chip crypto game, Axie Infinity also employs a dual-token model ($AXS, $SLP). How does it compare when placed side-by-side?

For comparison, we need to understand Axie Infinity’s fundamental tokenomics. Here’s a dedicated study by JX.

Let’s summarize some key characteristics of Axie Infinity:

1: Your main characters in Axie Infinity are your 3 Axie NFTs (similar to Hero NFTs in Thetan).

2: Axies can battle and earn $SLP.

3: $SLP utility is burned to breed new Axies.

There are various types of crypto games: card games like Axie Infinity, DeFi-style games like Mobox, and MOBA games like Thetan Arena.

Regardless of type, all crypto games rely on NFT and fungible token systems to operate their economies.

In Axie Infinity, NFTs are Axies that generate $SLP, and $SLP is burned to breed new Axies. In Thetan, NFTs are Heroes that generate $THC, which users spend to buy Heroes.

The difference lies in the production limits of the NFT lifecycle. As long as you play with an Axie NFT, it can generate $SLP indefinitely within the game. In contrast, in Thetan, once a hero reaches its battle limit, it can no longer generate $THC.

We can make a simple analogy.

Thetan Arena is like a casino, where chips are your Hero NFTs, and everyone gambles to win $THC. Winning isn’t just luck-based—it also depends on whether you’re a skilled player capable of defeating opponents. If you don’t play well, you’re likely to lose money.

Axie Infinity is like a utopia—once you pay the cost to purchase 3 Axies, you no longer worry about recouping your principal. As long as you keep playing Adventure Mode, you can earn at least $50 worth of SLP daily. It turns into a “when” rather than an “if” question. Beyond the initial cost, you bear no risk—you’ll eventually recover your investment someday.

It’s not hard to conclude that Axie’s economy heavily relies on the growth rate of new players.

Massive $SLP sell-offs hit the market daily. When the market saturates, new players won’t need $SLP to breed Axies anymore.

But in Thetan, if you’re in a deflationary game mode or below average win rate, you might end up losing money.

Overall inflation within the economy is internally offset, independent of inflows from new participants.

Axie Infinity’s sustainability hinges on how fast the Axie Metaverse expands and whether new players retain confidence in continued participation.

Thetan Arena’s sustainability depends on whether people genuinely enjoy the game and remain active within it.

Their paths to sustainability differ.

Hence, the Axie team began deploying new utilities for the $SLP token to support its price—for example, using $SLP to farm the native $RON token of the new Ronin chain.

From the chart, we can see SLP kept falling until yield farming on $RON was announced.

More real-world utilities for $SLP are expected in the upcoming Axie Infinity Metaverse.

Part Four: Scenario Analysis of Thetan Arena’s Token Economics

Based on our analysis, $THG price is closely tied to the robustness and vitality of the Thetan ecosystem.

When the closed loop of consumption and inflation forms, the target for $THC price is relative stability.

But since launch, $THC price seems to have performed poorly. Will $THC ever have its day?

1: Let’s revisit our $THC loop and focus on areas we haven’t highlighted yet.

There is a time lag between purchasing a Hero NFT and the actual generation of $THC token earnings. The moment players use $THC (pump) to buy Hero NFTs becomes a precedent for $THC minting.

Under this assumption, we can expect $THC price to rise.

However, if we look at the current chart, the USD price of THC is relentlessly declining, showing no signs of rebounding.

This reflects traders’ lack of confidence and belief in $THC’s price. If uncertain about when $THC will stabilize at a certain level, they hesitate to enter the game—this keeps boxed Hero NFT prices low enough to attract bargain-seeking users.

In speculative thinking, discounted box sales trigger dumping. Near the end of the discount promotion, $THC price hovered around $0.4. Normally, one Common Box costs 1000 $THC ($400). But during the sale, it only required $150.

This move sacrifices early adopters to attract new players. If $150 were set as the regular Thetan Box price, $THC could reasonably settle at $0.15, allowing new players to arbitrage between price gaps using less capital.

The more discounted boxes they buy, the more the price rebounds from $0.15 toward $0.4.

It also suggests the project team believes $150 ($THC at $0.15) is a profitable entry point for early players. Given that all revenue from such discounted sales will go toward burning $THC, this could spark a future surge.

Moreover, Thetan Arena is a new game in the space—once FUD subsides, it naturally gains some price premium. Therefore, we predict a THC price around $0.3 is reasonable and will reach that target in the near term.

Closing Remarks from an Old Fashion Research Partner

Recently, Eva Wu from Mechanism Cap categorized crypto games into three categories in her seminal work:

1) Earn-First Games: Centered on earning, not gameplay; easy to bootstrap but not long-term sustainable. (Current stage)

2) Play-First Games: Fun games with crypto incentive systems. Rebuilding current high-quality games with crypto will be challenging. (Mid-term stage)

3) Financialized Fun Games: Native games built with embedded crypto assets and token economies; users achieve self-fulfillment while playing, retaining asset ownership and financial returns. (Ideal future stage)

Our analysis of Thetan Arena aims to illustrate how traditional mobile games can be rebuilt into fun crypto blockchain games. Thetan Arena evolved from a popular MOBA game “Hero Strikes”, which scored 4.4 out of 5 on Google Play Store. Wolffun, the developer behind both games, proves a strong team with solid expertise in both gaming and crypto, capable of delivering quality gameplay alongside financial incentives.

That said, we must point out the game isn’t without flaws: key metrics such as battle rewards and Thetan Box listing prices are still centrally controlled by the team. Certain users who are essentially ecosystem builders may be affected by adjustments to key attributes or metrics without notice—such as the discounted sale of new Thetan Boxes mentioned earlier.

Beyond the analysis itself, we want to describe the ideal crypto game we’re seeking—this also represents OFR’s investment thesis in the gaming sector:

1) P2E games with long-term sustainable models capable of surviving at least one bear market cycle

2) Traditional game teams with proven track records in building large-scale games, possessing either deep understanding of crypto or a humble willingness to learn.

Most traditional mobile game teams we’ve encountered still ignore the crypto disruption and remain unaware of what’s unfolding.

3) Native blockchain games: Originally built by DAOs; gameplay centered on or rooted in blockchain technology. Examples include Dark Forest, Worldwide Webb, etc.

Some metaverse projects like Sandbox and CryptoVoxel fall outside this discussion, as we prefer to categorize them as metaverses or virtual spaces rather than crypto games.

TechFlow is a deep-content platform focused on alternative asset investments. Follow our official account for more in-depth content, and add WeChat TechFlow01 to join the TechFlow community and participate in discussions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News