MonoX: Another DeFi 2.0, a New Paradigm for Capital Efficiency

TechFlow Selected TechFlow Selected

MonoX: Another DeFi 2.0, a New Paradigm for Capital Efficiency

Both GameFi and Web3.0 are fundamentally built upon the liquidity foundation established by DeFi. However, the current issue is that we haven't seen any truly groundbreaking DeFi innovations since AMM.

Looking at recent buzzwords in the crypto world, we find that the market has been dominated by three major trends: GameFi, Web3.0, and MEME coins.

As a result, DeFi—the once "savior" of the space—has become “old money.” Yet it remains an area that both early-stage and secondary-market investors cannot afford to ignore.

Whether GameFi or Web3.0, their underlying foundation is built on the liquidity infrastructure laid by DeFi. However, since the advent of AMMs, we haven't seen any truly groundbreaking innovation in DeFi for quite some time.

What does your ideal DeFi 2.0 look like?

I initially thought DeFi 2.0 would involve optimizing AMMs to improve capital efficiency, creating user-friendly entry points to attract external capital, or enabling uncollateralized lending and other forms of credit expansion... But what actually emerged was OlympusDAO’s concept of “protocol-controlled liquidity,” where capital flows into protocols, which then use early supporters’ funds to provide liquidity—adding a slight Ponzi flavor. Still, we continue to hope for new forms of DeFi 2.0.

Today, let's explore one such alternative DeFi 2.0 model: the DeFi protocol MonoX.Finance.

My first encounter with MonoX was when it was selected for CoinList’s Spring 2021 Seed Program. When trying to define what MonoX is, I felt somewhat at a loss because it isn’t just a single product—it should be understood as an entirely new DeFi ecosystem.

At its core, the protocol introduces a novel AMM architecture that automatically pairs users' deposited single assets with vCash—a stablecoin native to its ecosystem—to form LP positions, thereby significantly unlocking over-collateralized capital and boosting capital efficiency.

Building on this foundation, MonoX can serve as infrastructure for various next-generation DeFi products and services in the future, including lending, NFTs, IDOs, contracts, options, and other derivatives trading platforms.

This represents a new paradigm—a new DeFi ecosystem.

vCASH

To understand MonoX, start by grasping vCash—an innovative stablecoin developed by MonoX. vCash (Virtual Cash), with the dollar-pegged version called vUSD, doesn't rely on real-world USD backing like USDT. Instead, it acts as a virtual counterparty within liquidity pools—an asset mapping mechanism designed to release liquidity from already-pledged collateral.

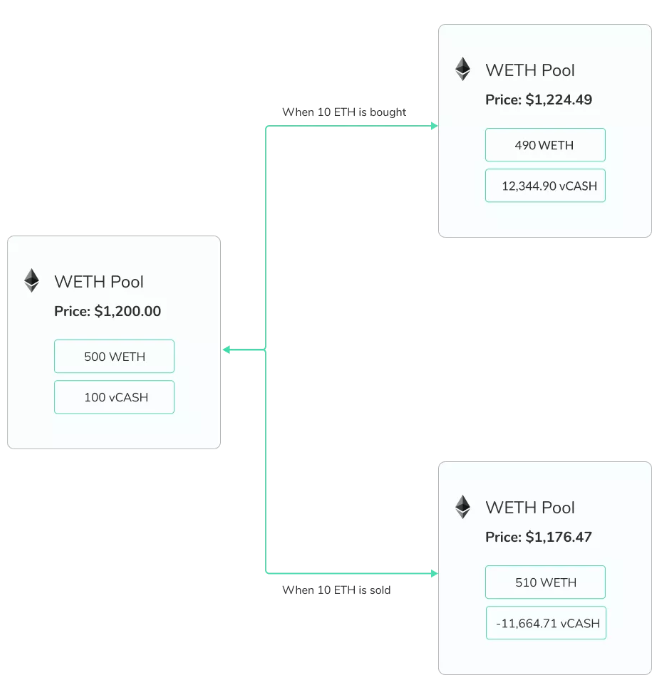

When a user first deposits liquidity to create a new pool, they set an initial price for their asset. Each asset in a MonoX pool expresses its value in terms of vCASH, starting with a zero balance. When Asset A is purchased, the vCASH balance increases; when Asset A is sold, the vCASH balance decreases.

Whenever users sell tokens, vCash is minted, allowing theoretically infinite supply expansion within pricing calculations. Users can also redeem any asset in the pool using vCash.

Single-Asset Liquidity

If vCash is the cornerstone of the MonoX ecosystem, then single-asset liquidity is its soul.

Currently, nearly all DEX protocols require users to deposit two or more tokens simultaneously into a liquidity pool—a process that's often cumbersome.

For liquidity providers, this means having to pair their assets with equivalent amounts of mainstream tokens like USDT or ETH, leading to redundant capital usage and low capital efficiency.

For traders, transactions often involve multiple hops across different pools, resulting in slippage and high gas fees, increasing overall trading costs.

Single-asset liquidity pools help solve these issues.

When providing liquidity, users need only deposit one token into the pool. Monox automatically pairs the deposited asset with the vCash stablecoin to create an LP pair and issues corresponding LP tokens.

This could be exactly what project teams want: zero-capital startup for token liquidity pools, freeing up more funds for development.

Additionally, within the Monox ecosystem, vCASH serves as a universal connector among all assets. Transactions no longer require swaps across multiple pools—all trades follow the same path: A → vCASH → B—reducing slippage and saving on transaction fees.

Based on this mechanism, MonoX launched a new DEX called Monoswap, meeting the needs of projects launching assets and investors trading them.

Compared to traditional DEXs, Monoswap captures financial value more effectively.

In addition to earning income through trading fees (0.3%), Monoswap generates revenue via vCash in three main ways:

1) Automatic rebalancing of official pools: When the vCASH balance in an officially established pool goes negative, the system automatically sells off the pool's debt and resets the balance to zero.

2) When users directly purchase vCASH from the market.

3) When users sell vCASH back to the protocol.

Monoswap combines features of both an exchange and a market maker. With the same trading volume and TVL, it achieves significantly higher profitability than traditional DEXs.

Dual Pool Design

From order books to dual-token AMMs, and now to single-asset liquidity, each innovation marks a leap forward in capital efficiency—a milestone in DeFi evolution. But every coin has two sides: bad actors may exploit permissionless listing mechanisms to run scams, and under single-asset liquidity models, malicious projects could launch tokens at nearly zero cost...

To address this, MonoX implemented a dual-pool design.

The Monox protocol supports two types of liquidity pools: “Trustless Pools” and “Official Pools.”

Trustless Pools, as the name suggests, allow anyone to deploy smart contracts and create liquidity pools. To prevent fraud, the vCASH balance in trustless pools cannot go below zero. Once it hits zero, tokens in that pool can only be bought, not sold.

Official Pools carry a degree of “trust endorsement.” MONO holders can vote within the community DAO to designate certain pools as official. Initially, MonoX will also partner with several high-quality projects to help launch their official pools.

To avoid a flood of scam tokens, MonoX imposes certain constraints on LPs to protect traders and liquidity providers:

- The largest LP in a non-official pool cannot withdraw their liquidity within 3 months of pool creation.

- Within 3 months, the largest LP cannot transfer LP tokens to other users.

- Users who have just added liquidity cannot immediately remove it:

(1) For Trustless Pools: removal allowed after 24 hours.

(2) For Official Pools: removal allowed after 4 hours.

This design preserves decentralization and permissionless listing while maximizing capital efficiency through single-asset liquidity. At the same time, it leverages community-driven DAO governance to minimize fraudulent projects, helping serious developers and legitimate projects gain recognition.

According to official information, there are currently six official liquidity pools: ETH, WETH, WBTC, USDT, USDC, and MONO. These are in a blind mining phase with APY ranging from 50% to 200%. The more liquidity provided, the greater the airdrop rewards.

Looking ahead, two key developments stand out for MonoX:

First, the existence of single-asset liquidity pools turns market-making into a fixed-income mechanism, potentially attracting large amounts of risk-averse capital.

Large investors participating in liquidity mining often hedge impermanent loss risks using derivatives—or avoid participation altogether due to market volatility concerns. Single-asset pools naturally appeal to such capital, even drawing in traditional "old money" from outside the crypto space.

Second, the potential of Value-Backed Tokens (VBTs).

vCash is a concrete example of a VBT—essentially releasing liquidity for already-pledged tokens (since they’re backed by real value). Leveraging this model opens opportunities across multiple domains, such as:

1) Synthetic assets (already backed by underlying collateral)

2) Fractionalized NFTs (backed by the NFT itself)

3) Gaming tokens (backed by in-game assets)

4) Insurance tokens (backed by pledged collateral)

A reasonable vision is that in the future, MonoX could become the central hub for trading VBT assets—a true DeFi 2.0 platform.

Disclosure: The author holds a small position in MONO. This article does not constitute investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News