Observation | On the Impact of Dollar Liquidity on Digital Currencies

TechFlow Selected TechFlow Selected

Observation | On the Impact of Dollar Liquidity on Digital Currencies

The subsequent macro environment will be unfavorable for the cryptocurrency market.

The topic I'm sharing today is about dollar liquidity and digital currencies. Before diving into the subject, I need to clarify some fundamental concepts with you — a process that may challenge your basic understanding of monetary creation.

(Author: Zhu Chen (Mikko), monetary scholar and founder of Zhi堡 (Zhibao). Formerly with Wall Street Insights' Insight Research Institute. A pioneer in global central bank monetary policy research, providing expert consulting services on central banking to numerous large public funds and asset management entities. Compiled by Fei at Distributed Capital.)

The Nature of Money Creation

First, where do you think the money banks lend you comes from? Most people believe banks act as financial intermediaries — collecting deposits from savers and then lending them out to borrowers. In reality, banks aren't legally allowed to simply reuse depositors’ funds this way. When making loans, banks actually engage in an act of money creation: they create new money (in the form of a deposit) for you, rather than transferring someone else’s existing deposit. So how exactly does a bank create such a deposit? We'll use double-entry bookkeeping and T-accounts to break down this process.

Double-entry bookkeeping is an accounting method, and the T-account (balance sheet) represents its structural framework. On a balance sheet, assets represent where your monetary resources are deployed — for example, purchasing real estate or Bitcoin. Liabilities refer to debts, such as credit card or Huabei balances owed. Equity refers to your own capital — funds not tied to any liabilities. For instance, if your parents give you 100 yuan, that becomes your equity. In a T-account layout, assets appear on the left, while liabilities plus equity appear on the right.

Let's take the example of a bank loaning you money. Suppose the Industrial and Commercial Bank of China approves a 100-yuan loan to you, which you are obligated to repay. Once approved, this credit line appears as a new deposit in your ICBC account. The moment the bank issues the loan, it creates new money — specifically, a new deposit entry on your behalf.

For the bank: Assets +100 yuan in loans; Liabilities +100 yuan in deposits

For you: Liabilities +100 yuan in debt (to be repaid); Assets +100 yuan in bank deposits

Bank

Assets Liabilities + Equity

Loan +100 Deposit +100

Individual

Assets Liabilities + Equity

Deposit +100 Loan +100

This is the classic case in money creation: loans create deposits, not the other way around.

Flooded Liquidity Fueled the Boom in Cryptocurrency Markets

Last year was extraordinary. Due to the pandemic, the Federal Reserve stimulated the U.S. economy through monetary easing — commonly known as "flooding the market with liquidity." This surge in liquidity also triggered a bull run in crypto markets. During the previous financial crisis, most of the newly created money by the Fed flowed into banks and non-bank institutions such as hedge funds and asset managers.

But this round of stimulus differs in nature. While the Fed expanded its balance sheet, the U.S. Treasury issued bonds to absorb the newly printed money and distributed it directly to citizens. Banks and hedge funds cannot easily invest in cryptocurrencies due to regulatory constraints, but ordinary individuals can. Whether looking at U.S. equities or digital currencies last year, one striking feature emerged: market movements were no longer driven solely by institutional investors, but significantly influenced by retail investors. Below, we’ll use T-accounts to illustrate how newly printed dollars reached households via Fed actions.

We need to set up T-accounts for the Federal Reserve, banks, the U.S. Treasury, and individuals. Prior to quantitative easing (QE), banks held significant amounts of U.S. Treasuries in their asset portfolios, and so did individual investors.

Bank

Assets Liabilities + Equity

U.S. Treasuries

Investor

Assets Liabilities + Equity

U.S. Treasuries

The Fed purchases Treasuries from banks and individuals, paying them in deposits. Since individuals cannot open accounts directly at the Fed, when the Fed buys Treasuries from individuals or non-bank entities, it pays their agent banks — such as JPMorgan Chase. After receiving reserve deposits from the Fed, JPMorgan records a corresponding deposit in the investor’s account.

Thus, the Fed’s balance sheet shows: Assets + U.S. Treasuries; Liabilities + Deposits (reserves)

Federal Reserve (QE)

Assets Liabilities + Equity

+Treasury Securities +Reserve Deposits

(This money is newly printed)

Meanwhile, banks and individuals who sold Treasuries see changes in their asset side:

Banks: Assets -Treasury Securities + Reserve Deposits;

Individuals: Assets -Treasury Securities + Bank Deposits

Bank

Assets Liabilities + Equity

Treasury Securities

-Treasury Securities

+Reserve Deposits

+Customer Deposits

Investor

Assets Liabilities + Equity

+Treasury Securities

-Treasury Securities

+Bank Deposits

Next, the U.S. Treasury issues new Treasury bonds. Under U.S. law, primary dealers must purchase newly issued government debt in the primary market. Whatever amount the Treasury issues, these primary dealers must absorb. Thus, the reserves (newly printed money) held by banks are converted back into Treasuries — either retained by the banks themselves or resold to clients. As banks acquire more Treasuries, their reserves and deposits are spent, flowing into the Treasury’s deposit account. At this point, the Treasury’s books are balanced.

U.S. Treasury Liabilities + Newly Issued Treasury Bonds (purchased by banks/investors);

U.S. Treasury Assets + Treasury Deposit Account

Bank Assets: -Reserves + Treasury Bonds

Bank

Assets Liabilities + Equity

+Treasury Bonds

-Treasury Bonds

+Reserve Deposits

-Reserve Deposits

+New Treasury Bonds

U.S. Treasury

Assets Liabilities + Equity

+Treasury Bonds

+Treasury Deposit

Then, the U.S. Treasury implements its "money-dropping" policy — distributing subsidies directly to individuals to stimulate economic recovery.

U.S. Treasury Assets: -Deposit

Individual Assets: +Deposit

U.S. Treasury

Assets Liabilities + Equity

+Treasury Bonds

+Treasury Deposit

-Treasury Deposit ("money drop")

Individual

Assets Liabilities + Equity

+Treasury Bonds

-Treasury Bonds

+Personal Deposit (from Treasury disbursement)

Regarding the Fed’s QE program, you can see that the U.S. financial system operates in a loop of money creation — liquidity circulates within the financial system without necessarily reaching the real economy. Once individuals receive direct cash transfers from the Treasury, they face two choices: first, keep the money in a bank account earning nearly zero interest; second, allocate it to higher-risk assets such as digital assets or tech stocks among Chinese or U.S. equities. In fact, the Fed created nearly $4 trillion in new money last year alone. If we include deposits generated through commercial bank lending, overall liquidity expansion was likely the largest in history. Last year, investors didn’t need to think hard — virtually all risk assets rose across the board.

Impact of Dollar Liquidity on Digital Currencies

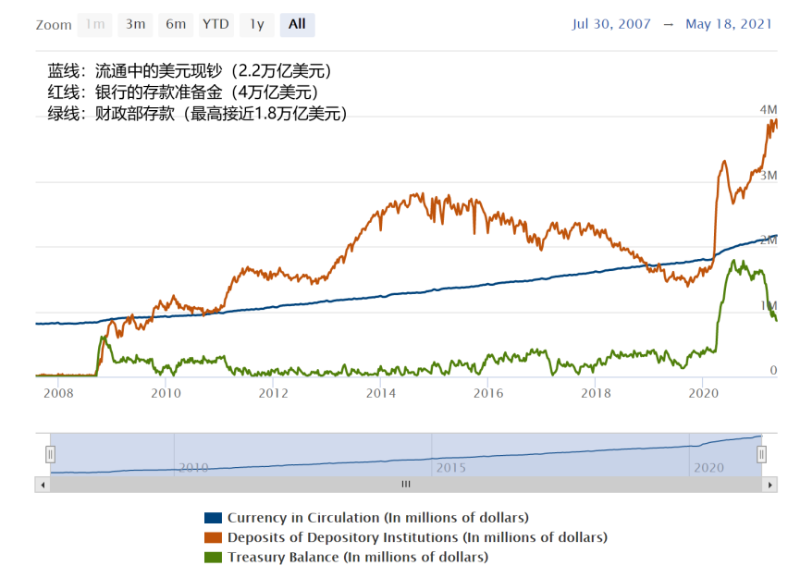

Now let’s discuss recent developments regarding dollar liquidity. From this Hard Money Data chart, we can observe how much money has increased. The blue line represents circulating U.S. dollar cash, which has steadily risen from 2008 to 2020. According to Fed data, it grows at approximately $90 billion per year.

We can see that bank reserve deposits surged by $4 trillion in just one year — an astonishing figure. Between 2013 and 2014, total reserves were only around $2 trillion. Today’s $4 trillion level means financial institutions’ deposits have effectively doubled. If asset prices don’t double accordingly, wouldn’t that seem irrational? And this only accounts for money on the Fed’s balance sheet — we haven’t even included broader commercial banking activity yet.

The green line tracks Treasury deposits — a dynamic I’ve already explained. First, the Fed prints money; those funds flow back to the Treasury; then the Treasury spends the money (distributing it to people), which eventually returns to the banking system as deposits. Hence, the red and green lines sometimes move together, sometimes diverge. When moving together, it indicates excessive money printing; when diverging, it suggests slower printing and structural shifts in how money flows between personal and bank accounts.

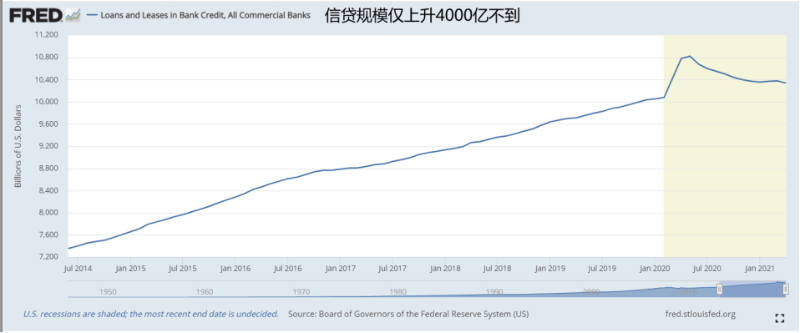

From these charts, we observe rising deposit levels at U.S. commercial banks, while loan growth remains modest — only about $400 billion. This implies current money creation is directly led by the Fed, not by commercial banks creating deposits through lending. Why is bank lending growth weak? Because the U.S. economy remains sluggish post-pandemic, leading to weak credit demand. With insufficient consumption and borrowing, newly created money fails to support the real economy and instead flows into stock markets, futures, and cryptocurrency markets.

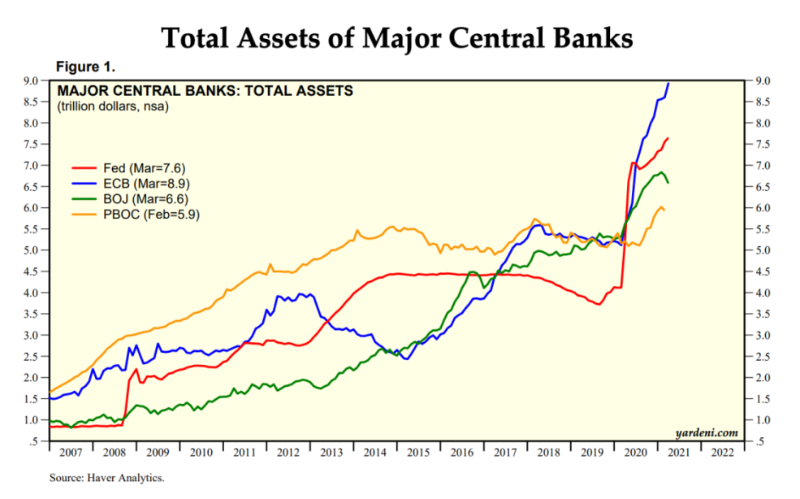

These graphs show that not only the Fed, but central banks worldwide, are engaged in massive money printing. ECB (European Central Bank) and BOJ (Bank of Japan) have particularly strong money-printing capacity. Notably, the ECB began aggressive easing this year. The BOJ’s balance sheet is comparable in size to those of the ECB and the Fed, despite Japan’s economy being much smaller — meaning its scale of monetary expansion is especially dramatic.

The only relatively restrained central bank is China’s PBOC. Monetary policy in China has remained tighter compared to developed economies, primarily because China managed the pandemic more effectively and didn’t require massive stimulus for recovery. From one perspective, money creation does boost GDP: more money in circulation naturally leads to increased spending and economic activity.

Digital Currencies Recognized as Alternative Assets

JPMorgan report on Tether

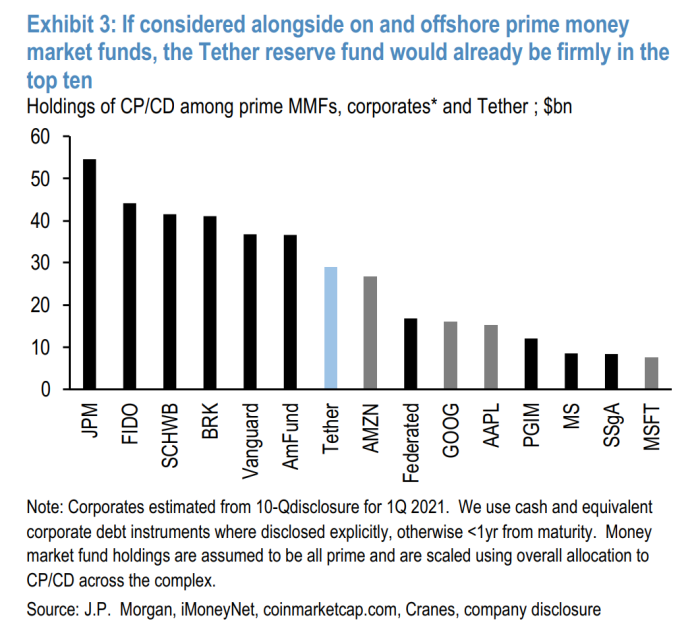

Have you noticed that major investment banks now treat Bitcoin and digital assets as a key category of alternative investments? Recently, JPMorgan’s U.S. fixed-income team published a research report on Tether. Tether recently disclosed its asset composition, revealing that over half consists of commercial paper. Let’s explore why commercial paper makes up such a large portion.

Tether must hold sufficient reserves to back USDT issuance. Previously, Tether held USD deposits at major banks like JPMorgan. To address compliance concerns, large banks refused to accept Tether deposits. So Tether moved its funds to smaller regional banks. These smaller banks, lacking direct access to central bank settlement systems, typically hold their own reserves at larger banks like JPMorgan. Because the financial system is layered, Tether’s deposits ultimately end up on the balance sheets of big banks.

Commercial paper is essentially short-term private IOUs. Two types of institutions issue such instruments in the U.S.: large corporations with traditional businesses (like Coca-Cola) and tech giants (like Apple). Tether uses its dollar holdings to buy IOUs issued by companies like Apple and Coca-Cola.

Does Tether’s liquidity reserve carry risks? Yes, it does. You might argue that IOUs from Coca-Cola or Apple are low-risk — their borrowing rates may even be lower than some sovereign nations. But corporate commercial paper still carries risk, since these firms cannot print money and must repay through actual earnings. So why do people accept Tether despite these risks? Because crypto traders don’t really care about Tether’s reserve adequacy — they simply ignore the risk.

Why has Tether attracted attention from major investment banks after disclosing its reserves? Because as a holder of commercial paper, Tether has become one of the largest players in the U.S. market. This shows that the scale of digital currency ecosystems is now substantial — a significant source of liquidity worthy of serious attention. And this doesn’t even include other stablecoins.

Recently, Federal Reserve Governor Brainard stated that the U.S. CBDC (central bank digital currency) must be launched quickly and should aim to lead globally. Why? Because she realizes that if the government doesn’t act, others will fill the void. If the Fed doesn’t issue a digital currency, Tether could dominate the market. There’s a precedent: the People’s Bank of China accelerated its CBDC development because WeChat Pay and Alipay already controlled 80–90% of payment market share. These tech giants can open reserve accounts directly at the central bank. When users deposit money in Alipay, and Alipay holds 100% of those funds at the PBOC, user deposits become nearly risk-free. In effect, Alipay functions as the world’s largest stable digital currency — it’s digital, and combined with WeChat Pay, dominates 80–90% of payments. China’s motivation for launching a CBDC is to regain control over the payment infrastructure.

Current Monetary Conditions Are Unfavorable for Digital Currencies

The upcoming macroeconomic environment will likely be unfavorable for digital currency markets. Here’s an excerpt from recent Fed meeting minutes: “Many participants emphasized that the Committee must clearly communicate tapering plans to markets well before economic conditions are judged to have made ‘substantial further progress.’” Tapering refers to reducing asset purchases — meaning the Fed will soon print less money. Given the massive amount of money created last year, it may take 5–10 years to fully absorb the excess liquidity. Additionally, the June Fed meeting may begin signaling tighter dollar liquidity.

The U.S. Congressional Budget Office recently released a report titled *Options for Reducing the Deficit*, indicating that the U.S. intends to reduce its fiscal deficit over the next decade. The Treasury’s deficit is currently severe — it has been distributing money to citizens, funded by bond issuance supported by Fed money creation. The Treasury absorbed vast liquidity to cover deficit spending. Recently, Treasury Secretary Janet Yellen has taken multiple steps aiming to reduce the fiscal deficit — pushing for global tax reform, including higher personal income taxes, increased estate taxes, and higher capital gains taxes. Her goal is to restructure Treasury finances so revenues exceed expenditures. In the future, you may have to pay capital gains taxes on cryptocurrency trading directly into the Treasury’s coffers.

Starting in the second half of this year, the U.S. faces a major theme: gradually tightening monetary policy over the next decade. Over the past dozen years, the dollar has rarely tightened. Although there was a rate-hiking cycle from 2015 to 2018, the Fed’s balance sheet remained enormous. The U.S. government has never truly tightened liquidity in practice. Just as during the late 1990s under Clinton, prolonged fiscal tightening interrupted a decades-long bull market, many assumed governments would always remain accommodative. But when monetary tightening begins, people realize that easy money isn’t permanent. Currently, U.S. debt-to-GDP ratio is extremely high. This debt can only be rolled over through taxation or further money printing. Yet more money creation fuels asset inflation and increases bubble risks.

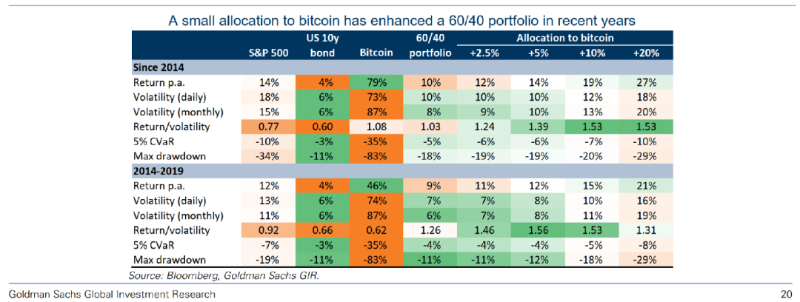

Despite an unfavorable macro backdrop, there remains a lifeline: digital assets are becoming a crucial component of portfolio allocation. Goldman Sachs’ flagship research series, *Top of Mind*, leverages its full research network and智库 connections. In one report, Goldman argues that crypto will emerge as a significant asset class. It also finds that allocating a certain percentage of Bitcoin into a traditional 60/40 stock-bond portfolio enhances overall returns, as Bitcoin has low correlation with other assets. Moreover, Bitcoin exhibits a clear negative correlation with the U.S. dollar. Thus, the only true enemy of digital assets is the dollar — yet the dollar is also what enabled their rise. Currently, the dollar index is very weak, and it is precisely under such weakness that digital and risk assets have achieved strong gains. When the dollar index begins to recover, caution will be warranted.

Finally, so-called “digital currencies” aren’t truly currencies. First, under today’s financial system, all money is already digital — your bank deposits are digital, Alipay is digital. So the term “digital” adds nothing meaningful to the concept of money. Second, Bitcoin and similar tokens aren’t currencies — they’re alternative assets. No one uses Bitcoin as a medium of exchange in mainstream economic activity — that’s a reality we must acknowledge. USDT has quasi-monetary characteristics, but still cannot be classified as a true currency. Therefore, when investing in digital assets, don’t harbor illusions that they will someday replace the U.S. dollar.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News