When DeFi Meets Investor Rights Protection, How Can Regulation Innovate?

TechFlow Selected TechFlow Selected

When DeFi Meets Investor Rights Protection, How Can Regulation Innovate?

Perhaps, DeFi will ultimately stumble forward amid the turbulence of innovation and regulation.

As DeFi tokens one after another begin their plunge, voices demanding investor rights protection are growing louder.

While DeFi dismantles the traditional blockchain ecosystem, it also brings new challenges to rights protection. After suffering losses from DeFi investments, who should investors turn to? And on what basis can they claim their rights?

To date, no major regulatory authority has issued specific guidance or regulations regarding DeFi. Reports suggest that regulators still lack sufficient understanding of DeFi.

DeFi remains a lawless frontier—an unregulated wilderness with no rules and no oversight. Some have even claimed: "The sole purpose of most DeFi projects is regulatory arbitrage."

When will the sword of Damocles hanging over DeFi finally fall—and where?

Starting the Fight for Rights

"More and more DeFi projects are launching without audits or regulation," said Liu Qi.

Since last weekend, much like Beijing’s weather, the temperature of DeFi has plummeted sharply. "Previously bustling project groups have now turned into rights-protection groups," Liu Qi noted.

The good times are over. The DeFi world is now bleak. "Hardly any retail investors are making money—again, the 80-20 rule (or rather, 20% win, 80% lose) prevails."

The bear market starting in late 2018 may still be fresh in people's memories: cryptocurrency prices crashed, communities went dormant, and investors had nowhere to turn. Industry leaders fell silent, vented, fought, and eventually exited the space.

Now, the DeFi world seems to be replaying the so-called "glory days" of the 2018 crypto market.

According to statistics from Odaily, most DeFi tokens saw cumulative declines of around 50% in September. Established DeFi tokens such as LINK and MKR dropped about 30%, while the newer generation of liquidity-mining-focused DeFi tokens like SAL, KIMCHI, and SUSHI generally plunged over 70%.

Besides sharp price drops, numerous scam projects have emerged riding the DeFi hype.

Emeraldmine ("Jade"), once the top-ranked DeFi product on EOS, rug-pulled on September 9. The founder emptied the fund pool, transferred tokens worth $2.5 million, and sold them via DeFiBox.

Other projects such as Bread, Tuna, and Rose also experienced crashes or outright rug pulls. Such fraud cases continue unabated.

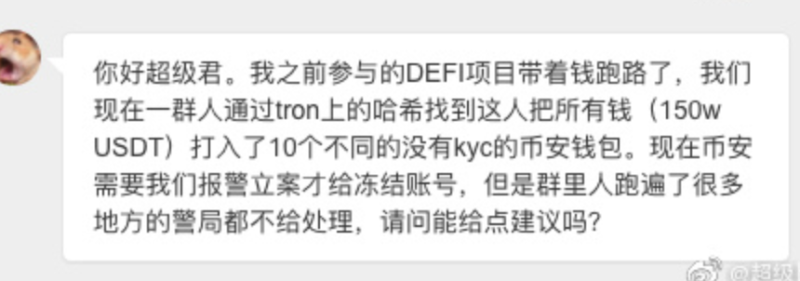

Faced with fraud and losses, who can investors turn to for redress?

In the traditional crypto world,维权 seekers might approach the project team, Token Fund,代投 agencies, or even cryptocurrency exchanges—all visible entities often seen as the public "scythe" reaping profits.

But in the DeFi world, these institutions may no longer exist. Anonymous developers may only submit code without further involvement; Token Funds and代投s vanish, and exchanges collectively FOMO-listing new tokens can openly disclaim responsibility.

In a decentralized world, rights protection must also be decentralized—in some sense, there is simply no right to protect.

On September 10, Gate.io was suspected of increasing the total supply of Kimchi (Pickle) tokens, causing a sharp drop in price, ultimately leading investors to file police reports.

However, due to the case's complexity and current legal limitations, after patiently listening to the details, authorities were unable to file charges on fraud grounds. This may reflect a disconnect between DeFi's evolution and existing regulation.

Beyond deliberate rug pulls and parameter manipulations, who actually earned most of the money? Likely the so-called "minbuyti" farmers—early participants who already cashed out into major cryptocurrencies. Like yield farmers, they bear no real responsibility for token prices.

The game rules were set from the beginning. Most维权 claimants are actually retail investors buying on secondary markets, who by definition assumed the risk when entering late.

If history repeats itself, regulation may only arrive after DeFi reaches a certain scale—just as ICOs were banned following the 2017 "9/4" crackdown in China.

Yet the first wave of DeFi维权 actors are knocking on the door of the real world. Amid their cries for help, will DeFi regulation arrive sooner than expected?

How to Regulate

DeFi has long been associated with the noble vision of financial inclusion.

"The capitalist system used to gradually distribute wealth downward by increasing workers’ incomes and improving their credit access. But this mechanism no longer works, leading to systemic failure," said Ray Dalio, founder of Bridgewater Associates.

DeFi precisely fills the gap left by this "systemic failure" in traditional finance. No approvals, no account openings, not even KYC required—everyone can access DeFi services.

Yet, as mentioned above, due to the lack of regulation, DeFi has instead become a playground for "regulatory arbitrage."

So how should DeFi be regulated?

Perhaps we can look at the development of the internet. In its early days, some legal scholars believed code would ultimately govern the internet. Over time, however, governments began leveraging code-based governance to enforce rule of law online, gradually expanding control.

When analyzing internet regulation, U.S. scholar Lawrence Lessig introduced the "modalities of regulation" theory, describing four mechanisms that shape individual behavior: state-enacted laws, social norms, market forces derived from supply and demand, and the architecture shaping physical and digital worlds.

Do these four regulatory models apply equally to blockchain systems?

Regulating Blockchain: Code as Law states: "Even the most autonomous systems are subject to certain forces and constraints, because blockchain systems rely on novel intermediary systems supporting the underlying blockchain network—systems highly susceptible to regulation."

"These systems depend on code (or architecture), operate according to market forces, and are constrained by social norms. Law can regulate blockchain technology by influencing these three forces."

Law, market, architecture, and social norms—like four horses pulling the chariot of blockchain regulation.

Take social norms, for example. After The DAO attack in 2016, the Ethereum community spent a month debating whether and how to recover the lost funds. Ultimately, they chose to fork Ethereum rather than seek external regulation.

The DAO incident demonstrated the critical role of social norms in regulating blockchain systems.

Regulation and Innovation

"The genie has escaped the bottle," wrote Timothy C. May, one of the cypherpunk movement's founders, noting that no force can stop the spread of anarchy driven by cryptographic technology.

DeFi protocols were designed from the outset to be permissionless. In theory, anyone, anywhere, can access DeFi protocols without regulatory or compliance barriers.

Within the DeFi community, many oppose any form of regulation or legal oversight. They embrace anarchism, aiming to build their own utopia on DeFi.

Is anarchism desirable?

Lawrence Lessig once warned: "When government disappears, what replaces it isn’t necessarily heaven. When government leaves, other interest groups take its place."

The current DeFi world resembles a battlefield. Under this "no-man's-land" scenario, DeFi becomes a wool-pulling machine for "regulatory arbitrage." As some have judged: "The only purpose of most DeFi projects is regulatory arbitrage."

In the real world, Compound and Aave might require banking licenses, Nexus Mutual could need an insurance license, and yearn.finance might be deemed an illegally operated investment fund.

Pan Chao, Head of MakerDAO China, recently commented on social media that Yield Farming has entered its third chapter—from offshore dollars to unregulated securities, now moving into high-leverage derivatives. "Calling unregulated CDS 'insurance' is deeply problematic."

Traditional regulation exists largely to protect ordinary people, ensuring they aren't exploited in financial activities.

Interestingly, blockchain technology in many ways restores the financial system to its historical origins—Wall Street initially started as informal and decentralized. Only later, in response to financial crises, did it gradually centralize.

Lack of regulation also hinders DeFi’s growth. Without proper regulatory frameworks, entrepreneurs and startups hesitate to proceed, fearing they might cross legal boundaries.

Shen Bo, partner at Distributed Capital, stated during a conference that current regulatory systems are largely incompatible with open finance. Financial regulation and open finance must coordinate for the latter to thrive; otherwise, it will forever remain in a gray zone.

Clearly, regulators have taken notice of DeFi's rise. As Hester Peirce, SEC Commissioner and known as "Crypto Mom," said in a recent interview, although DeFi is still in its infancy, the SEC is paying attention: "I think this will challenge our regulatory approach."

The enduring question in financial innovation remains: What level of regulation is appropriate to prevent harm while preserving its positive impact on societal progress?

Perhaps, in the end, DeFi will stagger forward, balancing uneasily between innovation and regulation.

References:

Regulating Blockchain: Code as Law, Primavera De Filippi, Aaron Wright

*TechFlow reminds all investors to beware of high-risk speculation. The views expressed in this article do not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News