Bitmain's Self-Rescue Story: Who Watches the Building Fall, and Who Supports the Collapsing Tower?

TechFlow Selected TechFlow Selected

Bitmain's Self-Rescue Story: Who Watches the Building Fall, and Who Supports the Collapsing Tower?

Bitmain, losing control, sails through a foggy sea fraught with dangers—will it crash into an iceberg and sink, or regain its course and continue its long voyage?

Author | Rail Tracker

This article was originally intended to help readers understand the causes and consequences of the internal power struggle at Bitmain in one go. But after finishing it, I realized that rather than calling it an internal feud, it might be more accurate to describe it as a long journey of self-rescue.

The story is long. Let’s rewind the timeline to just before December 17, 2018—the most critical moment in Bitmain’s history and the starting point of everything that followed.

01 Self-Immolation

In September 2018, Bitmain’s finance department warned management: the company’s cash flow had become extremely tight. Operating costs had to be reduced immediately or the company would not survive. A blockchain unicorn valued at over $15 billion had stumbled mid-run and lost its horn in the struggle.

In 2017, Bitmain earned $1 billion in profit.

In the first half of 2018, Bitmain earned another $1 billion in profit.

Three funding rounds raised a total of $800 million.

Net assets should have exceeded $3 billion.

Yet by September 2018, Bitmain was facing a cash crunch and stood on the brink of bankruptcy.

A simple comparison reveals the astonishing truth: Bitmain was incredibly good at making money—but even better at burning through it.

How did Bitmain burn through so much cash? Did they literally pile up cash and set it on fire? Or hire staff solely to shred dollar bills? The reality is closer to the latter.

The following figures will help readers quickly grasp Bitmain’s money-burning techniques.

At the beginning of 2018, the entire market had already entered a bear phase, yet Bitmain’s monthly operating expenses kept rising sharply—from $10 million at the start of the year to $50 million by year-end. One major reason was massive R&D team expansion. A former Bitmain HR employee revealed that the company once onboarded over 50 employees in a single day, nearly 500 in a month. Even then, they were criticized for hiring too slowly. This alone consumed about $250 million in cash.

Operating costs were just the tip of the iceberg. Overproduction could serve as a classic case study in project management. Readers familiar with mining know that Bitmain was still clearing inventory of Antminer S9 units as late as 2019. Co-CEO Jiannan Zhan ignored warnings from the finance team and insisted on overproducing chips, leading to massive inventory buildup and strained cash flow. The other co-CEO, Jihan Wu, later estimated this misstep cost the company around $1.5 billion.

Then there was the BM1393 chip fiasco—an utter mystery. Chip expert Jiannan Zhan poured huge sums into a chip that had already failed, only to fail again spectacularly. Between 2017 and 2018, Bitmain suffered at least four mining chip tape-out failures—including on 16nm, 12nm, and 10nm nodes—with 16nm failing twice—costing the company at least $1.2 billion.

Rumors also suggest Bitmain held digital assets worth hundreds of millions in unrealized losses. Given the market recovery in 2020, we won’t dwell on this now—let the market decide. But the losses mentioned above are irreversible.

02 Seizing Full Control

By September 2018, Bitmain’s management finally grasped the severity of the situation: the money they’d earned could actually run out. Who knew? The leadership began discussing rescue plans, and the most obvious and effective solution was clear: layoffs.

But Jiannan Zhan strongly opposed any layoffs. New hires who hadn’t passed their probation period would be the primary targets—cheaper to let go. At Bitmain, the probation period lasted six months, with full salary during that time—no difference from permanent pay. But since they weren’t confirmed, termination costs were lower. This meant Zhan’s departments would face mass layoffs.

Due to Zhan’s fierce resistance, Bitmain temporarily abandoned layoffs. Instead, it slashed marketing and travel budgets, established a budget committee to scrutinize every expense, canceled employee perks like taxis, breakfast bread, and drinks, and even stopped the monthly tradition of gifting employees BTC/BCH worth 400 yuan.

But under immense cash pressure, such petty savings were meaningless. Soon, management revisited the layoff plan—this time, cuts were unavoidable.

In December 2018, Jihan Wu began rallying founding members and key executives to persuade Zhan to accept layoffs. But Zhan remained stubbornly opposed. The persuasion process went nowhere. After multiple meetings and heated debates, Bitmain’s executives found themselves stuck in endless arguments with Zhan. This exposed the flaws of the dual-CEO model and worsened the relationship between the two leaders.

On the night of December 16, Zhan abruptly called a management meeting at Fengdu Jiahe Hotel, two kilometers from the Aobei Science Park. Over 30 managers attended—and were required to hand over their phones.

Meanwhile, CEO Jihan Wu was on a business trip in Hong Kong, busy with IPO preparations.

At the meeting, Zhan’s core messages boiled down to three points:

- One: Bitmain cannot have two CEOs. There can only be one—and that one must be Jiannan Zhan. He claimed that during a business trip, he met an old superior. They reconnected warmly, and this mentor advised him that the company needed a single CEO—and it should be him. Zhan felt it was fate, a divine opportunity.

- Two: Zhan blamed the finance department for incompetence as the main cause of the cash crisis. To prove his point, he disclosed Bitmain’s financial data at the meeting. That very night, Taiwanese employees began posting on social media about the company’s broken cash flow and executive split.

- Three: Anyone who didn’t support Zhan would lose their stock options—equity would be voided.

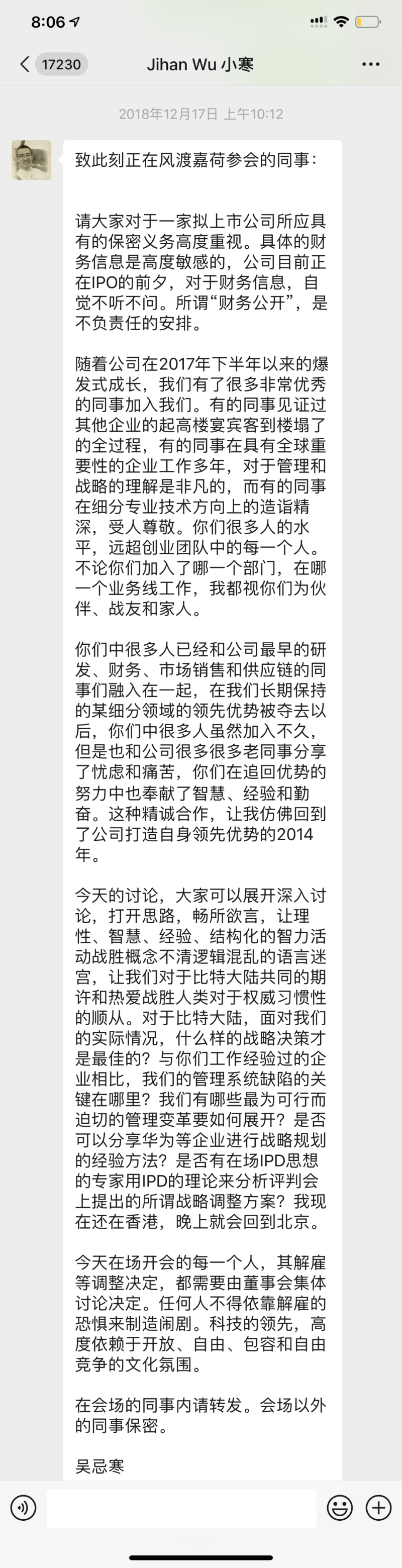

Upon hearing this, Wu—who was in Hong Kong—sent a WeChat message to the managers attending the meeting.

On the afternoon of December 17, Wu returned to Beijing. He negotiated with Zhan all night and finally reached a compromise at dawn. Bitmain co-founder Yuesheng Ge announced the outcome: both Wu and Zhan would step down as CEOs, and Haichao Wang would take over as CEO. Wu voluntarily stepped back, allowing Zhan to become sole chairman.

The “December 17 incident” severely damaged Bitmain’s reputation. Leaking the company’s financial status triggered supplier payment demands. A credit line just agreed upon with Bank of Beijing was cut off the next day. Wu’s resignation as CEO sent shockwaves across the industry, becoming hot topic among miners, blockchain professionals, and investors. Media widely interpreted Bitmain’s turmoil as a sign of impending IPO failure in Hong Kong.

On Christmas Eve, December 24, Bitmain finally implemented the long-delayed layoff plan—three months after it should have happened. AI teams in Beijing, Singapore, Taiwan, and Shanghai saw over 50% reductions. The Israel R&D center was shut down. Shenzhen-based Xinspecies Technology, acquired just ten months earlier, was dissolved. Even Copernicus, Bitmain’s elite blockchain development team, was wiped out. Many laid-off engineers, including Copernicus members, joined Matrixport, a new venture founded by Wu and Ge based in Singapore.

03 Early Entrepreneurial Days

After the “December 17 incident,” Jihan Wu gradually withdrew from Bitmain’s daily operations, focusing instead on the IPO and his new venture. This was another major mistake—allowing Jiannan Zhan to manage Bitmain unchecked.

In fact, Wu had sown the seeds of trouble as early as 2013.

Wu, trained in investment banking, was the first Chinese translator of the Bitcoin white paper. He entered the mining industry in 2012. The disappearance of "Kale" (Friedcat) and Zhang "Pumpkin"’s broken promises convinced Wu to develop his own chips. In 2013, Wu founded his own mining machine company. Together with 20-year-old Yuesheng Ge, he approached Zhan, an IC designer from the Chinese Academy of Sciences, to co-found what would become Bitmain—the digital mining giant at the heart of this story.

Wu promised Zhan’s team equity rewards for each successful mining chip developed. At the time, Zhan’s previous startup was on the verge of collapse. To rally his team, Zhan promised to share half his shares. Unfortunately, this turned out to be an empty promise. As Bitmain rapidly grew and valuation soared, the increasingly arrogant Zhan ended up hoarding almost all the shares.

Like many startups, early Bitmain faced numerous challenges requiring hands-on leadership. During the second half of 2013, while designing and taping out chips, Bitmain ran short of funds. Wu personally secured financing and met with TSMC sales reps to convince them to accept a startup’s tape-out request. Wu also contributed to fundamental design choices for the mining market and selected thermal parameters for heat sinks in the Antminer S1.

In 2014, Wu noticed serious problems arising from Zhan’s independent control. Risky moves forced Wu to stay involved in management.

At the time, Bitmain had gained some lead in standard chip design flows. Wu believed the next step was full-custom technology. But Zhan wanted to redirect resources toward mobile payment chips.

Zhan had met a mysterious figure from the Central Guard Bureau, who claimed influence over China’s next-generation mobile payment cryptography standards. But this detour risked squandering Bitmain’s hard-won lead in mining.

Wu, a graduate of an economics program, said he relied on faint memories from high school physics competitions and amateur knowledge of computer tech. He spent days searching databases and Google Scholar, studying full-custom theory, and trying to convince Zhan.

Fortunately, Zhan eventually listened. Bitmain quickly integrated experts from the U.S. and Russia introduced by Wu, dramatically improving chip and system design capabilities.

In 2015, Wu suggested exploring artificial intelligence. But Zhan wasn’t interested—he preferred CPU development. After sleepless research and deep analysis by Bitmain’s investment team, Zhan finally agreed. Sadly, it was too late. By the time Chen Tian-shi brothers achieved breakthroughs in theory and practice, Bitmain had already fallen behind.

Between 2016 and 2017, Bitmain experienced explosive growth, becoming a unique super-unicorn in the blockchain space. According to Frost & Sullivan, based on 2017 revenue, Bitmain Technologies was China’s second-largest and the world’s tenth-largest fabless chip designer, and the world’s fourth-largest fabless ASIC designer, capturing 74.5% of the global market.

But the seeds of a massive crisis had been planted long ago.

Zhan repeatedly revealed a severe lack of business acumen in major strategic decisions. Yet each of his mistakes had previously been blocked by core employees. His overconfidence in management and the resistance he encountered gradually intensified tensions, worsening the rift between the two founders.

04 The Mining Titan Adrift

Their conflict erupted fully on December 17, 2018. Through extreme tactics—threatening to cancel stock options—Zhan coerced management into submission to seize full control. Wu rushed back from Hong Kong and negotiated with Zhan through the night. Ultimately, both stepped down as CEOs. Wu retreated, and Zhan took sole control as chairman—in exchange for allowing the layoff plan to proceed.

Predictably, Wu’s retreat emboldened Zhan to rule arbitrarily.

One Bitmain employee summarized Zhan’s management style in two letters: SM.

As sole leader, Zhan quickly began “reorganizing” departments previously managed by Wu. At dinner meetings, he lectured sales teams, emphasizing that their success came not from skill but from company opportunities. He cited two sales leads, saying without Bitmain, they’d still be nobodies. He even taught them how to toast properly, sharing tips on banquet culture.

After these dinners, Zhan concluded that Bitmain’s sales team lacked quality. He decided to inject Huawei-style management to drive progress. Soon, a former Huawei marketing director officially took over Bitmain’s sales, ushering in an era of Antminer brand premium.

To better understand and guide sales, Zhan demanded to join client meetings. During negotiations, he once engaged in a heated debate with a client about traditional vs. Western medicine. Another time, despite insufficient production capacity, he pressured sales to deliver 10,000 machines.

Despite strict demands on sales, Zhan granted special favors to “Dalu Fangzhou” (Mainland Ark). Not only did he sell miners at discounted prices, but he also hosted Dalu Fangzhou’s miners at Wang Ming’s mining farm at electricity rates higher than market price. Reportedly, both Zhan and Wang Ming are shareholders in Dalu Fangzhou.

The new Huawei-style sales strategy brought noticeable changes. Arrogant brand premium reduced Antminer’s cost-performance ratio, allowing competitors to nibble away at Bitmain’s market share. When they realized the strategy was flawed and tried cutting prices, they found the market saturated and miner demand weakened.

Even more alarming: competitors were catching up—and sometimes surpassing—Antminer’s technological edge. Meanwhile, Bitmain’s two mining pools lost their top-two positions. And the AI division, which Wu had high hopes for and Zhan personally supervised, became an industry joke—unprofitable and nearly dragging down the whole company.

Blindly promoting Huawei veterans to key roles completely eroded Bitmain’s internal culture. Bureaucracy spread from top to bottom. Zhan remained oblivious, continuing to hire Huawei alumni, copying Huawei’s structure and strategies—even assigning HR to do sales, and R&D to handle HR tasks.

The October 2019 organizational reshuffle became the final straw that enraged Bitmain’s management. This time, Zhan completely sidelined veteran employees, suddenly promoting recently hired “parachute managers” to lead business lines. Former heads were made to report to new juniors. Peers became subordinate-superior. Operations and development across different units were merged into one giant department, making reporting chains more cumbersome and workplace relationships awkward.

Had this restructuring gone ahead, Bitmain would inevitably lose a large number of core employees—especially in blockchain, which would become the hardest hit.

05 Turning the Tide

On October 29, 2019, Jihan Wu urgently convened an all-hands meeting. Prior to this, the legal representative of Beijing Bitmain had already been changed back to Wu—including parent companies in Hong Kong and Cayman Islands. Standing in the lobby of Building 25, B1 floor, Wu announced that Jiannan Zhan had been stripped of all positions. No Bitmain employee was allowed to follow Zhan’s orders or attend meetings he convened. Violators would face demotion or dismissal. If company losses occurred, legal action would follow.

His speech was long, but can be summarized as follows:

- One: Jiannan Zhan has been removed from all positions. Also fired was Wang Zhi, the former Huawei HR executive Zhan brought in at the end of 2018. Wang had terrible reputation at Bitmain, mocked by employees as the “Nine-Thousand-Sui.”

- Two: Zhan no longer controls the company’s stock option plan and cannot arbitrarily cancel employee equity.

- Three: The organizational restructuring plan led by Zhan is suspended.

- Four: AI has future potential, but only if core operations remain profitable to fund continued investment.

Wu also recounted the full story of the “December 17 incident,” frankly admitting the company was in bad shape. Without immediate action, Bitmain could go bankrupt within three quarters. He had to return to save the company.

Jiannan Zhan, then on a business trip in Shenzhen, finally understood how Wu had felt during the “December 17 incident.”

After officially returning, Wu clearly identified various operational issues, diving deep into each business unit. At a mining sales meeting, employees spoke freely about difficulties and concerns. The Huawei-appointed sales director looked shocked and asked, “Why didn’t you tell me these problems earlier?” He was soon summoned and “voluntarily resigned.”

On November 2, Wu announced salary increases for all employees—the first raise since 2018. Bitmain traditionally offered two raises per year.

On November 7, Zhan posted publicly on social media for the first time, recounting his entrepreneurial hardships and accusing Wu of “stabbing him in the back.” If someone wants war, he declared, we’ll give them war. He closed with his 2020 KPIs: 90% market share in mining hardware and a “small goal” of $1 billion profit from AI.

But Zhan’s grand manifesto didn’t inspire employees—it sparked ridicule. Former close aides exposed his abusive behavior: cursing staff, obsession with traditional Chinese medicine, Buddhist beliefs, drinking during meetings, practicing qigong…

Meanwhile, with less than six months until the Bitcoin halving and no market recovery in sight, Bitmain’s leadership grew anxious. On January 6, 2020, Bitmain underwent another round of layoffs—about one-third of staff. Many newly promoted employees were deeply upset—some had just gotten raises, and the severance was less generous than in 2018.

Barred from entering Bitmain’s offices, Zhan again voiced opposition online: “We don’t need layoffs. We can’t commit suicide.”

During the Lunar New Year, the COVID-19 pandemic erupted. Mainland China extended holidays and encouraged remote work. Amid cascading disruptions, most companies chose pay cuts or layoffs—layoffs being the best, if not only, way to cut costs. In the first two months of 2020, China’s exports dropped 17%, orders were canceled, production halted, unemployment rose, and purchasing power fell—triggering global economic domino effects.

Starting March 9 with oil price crashes, 2020 saw four U.S. market circuit breakers, a 40% Bitcoin crash within 24 hours on March 12, and April 20 crude futures plunging 300% to nearly -$40/barrel.

Clearly, Wu couldn’t predict the future—but this layoff decision seemed correct again. Moreover, from January to April 2020, amid pandemic chaos and financial collapse, Bitmain generated over $400 million in revenue.

06 Burning Boats

While Wu tried to steer the company back on course, Zhan wasn’t idle. On April 28, 2020, after repeated administrative appeals, Zhan succeeded in reverting Beijing Bitmain’s legal representative status to pre-October 28, 2019—restoring himself as legal rep.

On the morning of May 8, a news item about Bitmain quickly topped real-time trending lists, dominating headlines. The framing was clever: at counter No. 52 on the second floor of Haidian Government Service Center, Jiannan Zhan, legal rep of Beijing Bitmain, had his business license snatched by a group of unidentified men as it was handed over by officials. A source claimed about 60 men were involved, with Liu Luyao directing them.

This was a skillfully crafted narrative—first painting Zhan as a victim, highlighting “60 thugs seizing a license” to attract attention. While public outrage targeted Wu’s side as lawless, few questioned whether 60 people could even fit in the service hall. Deeper issues—like only Hong Kong Bitmain having authority to appoint legal representatives—were ignored.

Later, Caixin reported the real scene: only about a dozen people showed up, both sides with security. Bitmain employees leaked on social media that Zhan’s bodyguards injured the authorized recipient and threatened, “Wen Guang, watch yourself!”

But the correction had little impact. Wu’s reputation suffered greatly—transformed from a bleeding warrior saving the company to a lawless gangster. A complete reversal.

With initial victory, Zhan launched continuous attacks. On the afternoon of June 3, Zhan’s “true tough guys” pried open the back door of Bitmain’s Beijing office and formally occupied the empty headquarters.

On June 4, Zhan called on Bitmain employees to return to work, promising to grow the company’s market cap to over $50 billion within three to five years. After making big promises, Zhan began contacting employees, attempting to buy back their stock options at a $4 billion valuation.

Then, Zhan recalled loyal Huawei executives and issued a series of appointments. By June 9, he had dismissed CFO Liu Luyao—who oversaw Bitmain’s IPO—and mining head Wang Wenguang. He appointed Ma Yanwu as HR director, Ren Gang as mining head, Sun Yonggang as supply chain head, Gu Ling as finance director, and Zhu Bin as head of mining hardware. Zhu Bin was the Huawei executive previously forced to resign. During his tenure, he drove Antminer’s market share from 90% down to 50%, drawing widespread miner complaints. Some internal staff even suspected he was a mole from a rival firm.

Besides reinstalling Huawei managers, Zhan aggressively pushed for employee return: those returning on day one got a 10,000 RMB red packet, halved the next day. Zhan appeared unusually warm—greeting everyone exiting elevators with intense eye contact, shaking hands, taking photos, handing out cash. Without personnel records, he couldn’t verify who were actual employees—many never showed up the next day.

When soft tactics failed, Zhan resorted to force—demanding returns or facing termination. With few responding, Zhan reverted to form: bombarding employees via SMS, phone, EMS, and email with threats—termination,社保 suspension, salary stoppage—and even sending groups to employees’ homes using personal data from Beijing Bitmain, demanding “work handover” and forcing return of work laptops.

- June 10: Media reported Zhan had taken control of Bitmain’s Shenzhen factory, Century Cloudcore, blocking shipments to paying customers—crippling mining operations.

- June 13: Hong Kong Bitmain (parent) accused Zhan and his-owned Hainan Dalu Fangzhou Data Technology of signing a “Sales Agency Agreement” to seize Beijing Bitmain’s assets.

- June 17: Media reported Zhan began dumping 14,000 T17+ miners at low prices.

- June 20: Hong Kong Bitmain officially cut off chip supplies to Shenzhen Century Cloudcore.

- July 13: In a letter to Century Cloudcore staff, Hong Kong Bitmain revealed further details behind Zhan’s desperate moves in June.

Zhou Feng, legal rep of Shenzhen Century Cloudcore, is related to Zhan by blood. After removing Zhan, Wu flew to Shenzhen for a long talk with Zhou. Believing Zhou suitable to manage Century Cloudcore and help the company through crisis, Wu decided to keep him on.

This mistaken decision played out like the fable of the farmer and the snake. When Zhan struck back, Zhou quickly defected, helping Zhan seize customer machines, move 17,000 T17 miners from warehouses, and sell them cheaply through Hainan Dalu Fangzhou, in which Zhan held shares.

To protect customer interests, Wu reluctantly compromised—pre-paying 109 million RMB to Zhan-controlled accounts to secure shipments. But after receiving payment and delivering goods, Zhan halted shipments again. By July 8, 5,600 miners were delayed.

Meanwhile, Century Cloudcore owed suppliers over 200 million RMB—including 140,000 RMB to a group of migrant workers. Its bank acceptance bills—over 36 million RMB due July 17 and over 34 million RMB due July 23—would soon mature. Zhan reportedly told banks he wouldn’t repay—threatening to destroy the company’s and entire group’s financial credibility.

This Is Not the End

By now, Bitmain had been mired in founder-led power struggles for over half a year. The office seized by Zhan remained empty. Most employees continued working from home. Some chip R&D staff quietly returned under Wu’s tacit approval to sustain innovation and minimize damage to competitiveness.

This former titan of superchip computing is veering toward an iceberg due to its ex-leader’s reckless actions. Zhan fights desperately, willing to burn everything down. Wu compromises, again and again. Bitmain has tried to save itself multiple times, yet remains trapped in the vortex.

If time could go back to that day in 2013, would Wu and Ge still call Zhan?

Obviously, there are no second chances.

Bitmain, now spiraling out of control, sails through foggy waters filled with danger. Will it crash into the iceberg and sink—or regain its bearings and sail on?

The mining empire adrift—this story continues.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News