Bitget Daily Morning Report: BTC Spot Market Sees Net Inflow of $120 Million in a Single Day; Hyperliquid to Unlock Approximately 12.46 Million HYPE Today

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: BTC Spot Market Sees Net Inflow of $120 Million in a Single Day; Hyperliquid to Unlock Approximately 12.46 Million HYPE Today

Solana will launch the "Alpenglow" consensus upgrade to achieve sub-second confirmations.

Author: Bitget

Today's Outlook

1. Analyst: Yen depreciation gives Metaplanet a greater financial advantage compared to its U.S. peers.

2. Financial Times: PwC is actively expanding into the cryptocurrency space.

3. U.S. arrest of Venezuelan president did not affect Bitcoin price, but experts warn of potential market turbulence on Monday (today).

Macro & Hotspots

1. Spot gold reclaims the $4400 mark, silver breaks above $76/oz.

2. Data: ETH strategic entities and ETFs collectively hold over 12.99 million ETH, accounting for 10.74% of the total supply.

Market Trends

1. Over the past 24 hours, the cryptocurrency market saw $258 million in liquidations across all networks, with short positions accounting for $211 million. BTC liquidation volume was approximately $91 million, ETH liquidation volume was approximately $51 million.

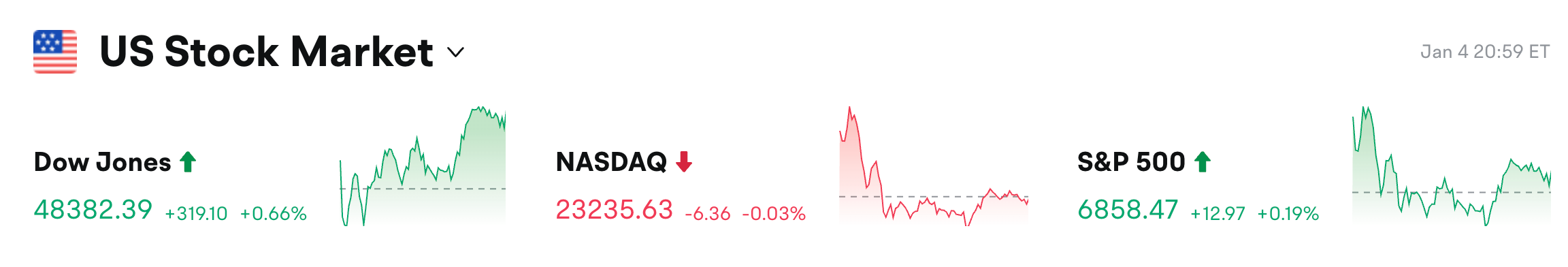

2. Weekend U.S. stock market closed: Dow +0.66%, Nasdaq -0.03%, S&P 500 -0.19%. NVIDIA (NVDA.O) +1.26%, Circle (CRCL.N) fell nearly +5.26%, MSTR (Strategy) +3.43%.

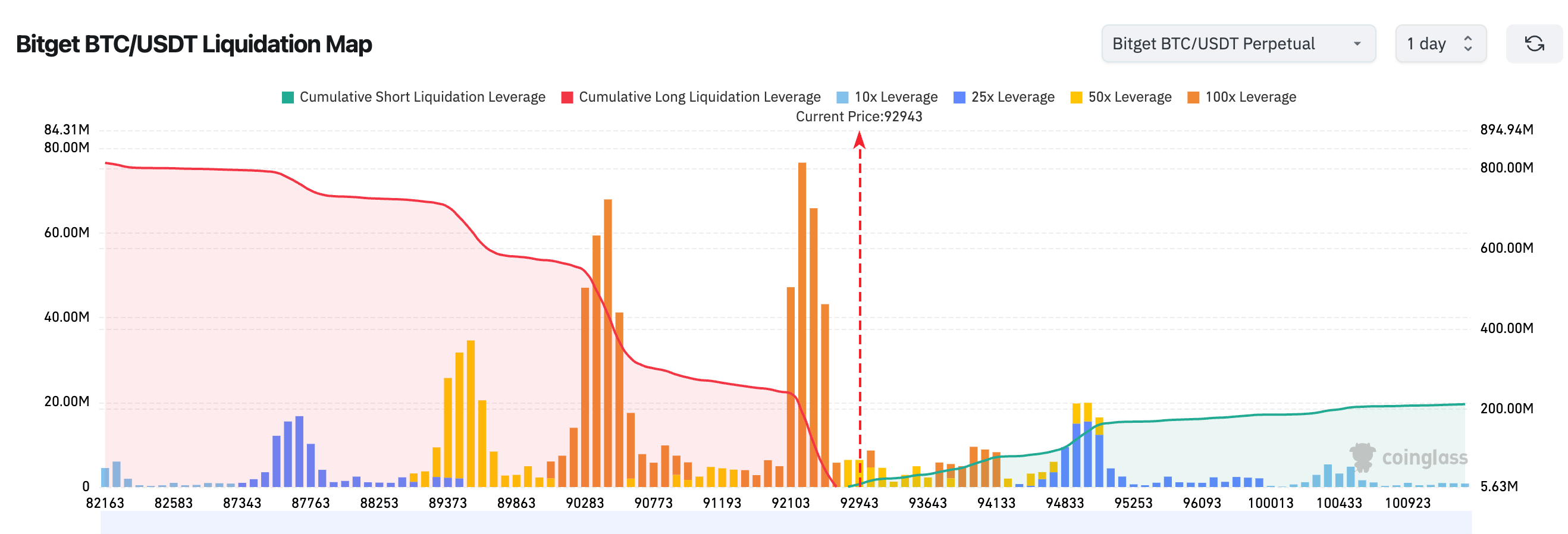

3. Bitget BTC/USDT liquidation heatmap shows: The current price around 92,900 is a key watershed. Below this level, long liquidations are concentrated; if the price falls and breaks below, it may trigger chain stop-losses, amplifying downward volatility. Above, the 94,800–95,300 range gathers a large number of short liquidations; once effectively broken through, it may trigger a short squeeze, driving a rapid price surge.

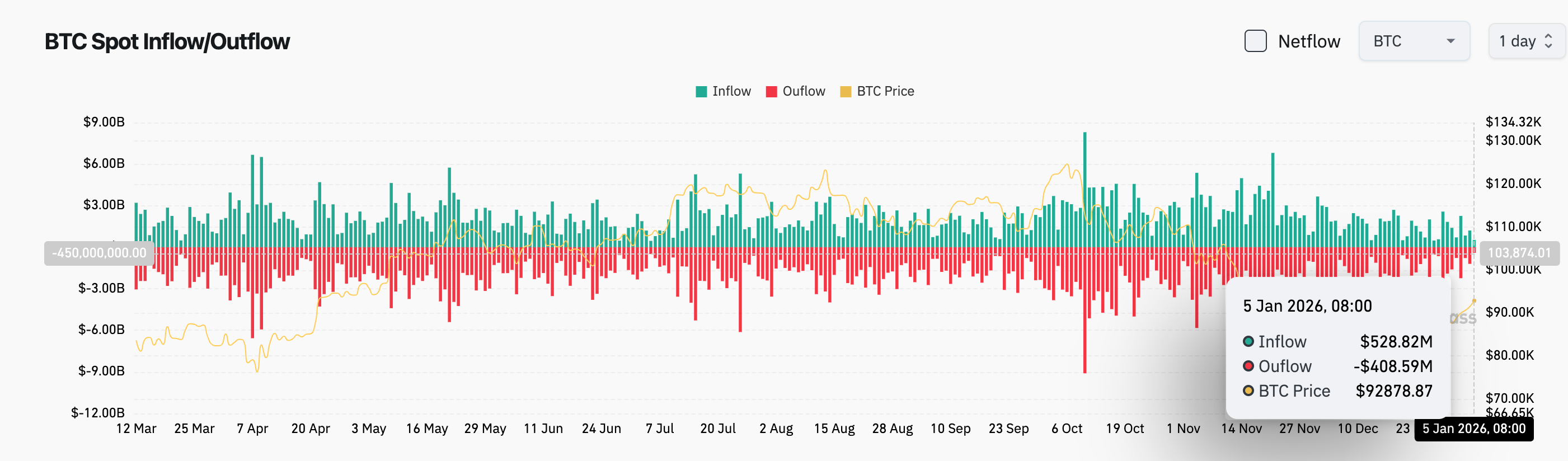

4. Over the past 24 hours, BTC spot inflows were approximately $528 million, outflows approximately $408 million, resulting in a net inflow of $120 million.

News Updates

1. Bloomberg: Strategy may face billions in losses in Q4 2025 due to the declining value of its Bitcoin holdings.

2. A Polymarket trader used the "Pentagon ordering pizza late at night" signal to bet on a U.S. attack on Venezuela, earning $80,000.

3. Musk: A new version of Grok has just been released.

Project Developments

1. Ethereum stablecoin transfer volume hits a quarterly all-time high, surpassing $8 trillion.

2. Jeff Bezos' Blue Origin now accepts Ethereum for space travel payments.

3. ether.fi CEO: Crypto neo-banks will drive Ethereum growth in 2026.

4. Michael Saylor has again posted Bitcoin Tracker information; data on increased holdings may be disclosed this week.

5. Data: Tokens including HYPE, ENA, and APT are set for significant unlocks next week, with HYPE's unlock valued at approximately $313 million. Among these, Hyperliquid (HYPE) will unlock about 12.46 million tokens today, representing 3.61% of the circulating supply, valued at approximately $314 million.

6. WLFI: The governance vote to use part of the treasury funds to accelerate USD1 adoption has passed.

7. Three wallets linked to the same entity spent 3.67 million USDC to purchase LINK tokens.

8. Multiple wallets have accumulated over $500,000 worth of IRYS from CEXs in the past week and consolidated it into a single wallet. According to Bitget market data, IRYS is currently at 0.366 USDT, up 21.48% in 24 hours.

9. Solana to launch "Alpenglow" consensus upgrade, aiming for sub-second finality confirmation.

10. A whale dormant for five months has returned, spending $1.73 million to purchase nearly 70,000 HYPE.

Disclaimer: This report is AI-generated. Human verification is for informational purposes only and does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News