Bitget Daily Morning Brief: Venezuela's Situation Deteriorates Suddenly, December Non-Farm Payroll Report Most Anticipated

TechFlow Selected TechFlow Selected

Bitget Daily Morning Brief: Venezuela's Situation Deteriorates Suddenly, December Non-Farm Payroll Report Most Anticipated

Bitcoin Returns to $90,000, but Derivatives and Spot ETF Data Show Market Sentiment Remains Cautious.

Author: Bitget

Today's Outlook

According to PANews, the macroeconomic outlook for this week is as follows:

Monday 1:30, 2026 FOMC voting member, Minneapolis Fed President Kashkari speaks at the American Economic Association;

Tuesday 21:00, 2027 FOMC voting member, Richmond Fed President Barkin speaks;

Tuesday TBD, the "Tech Super Bowl" 2026 Consumer Electronics Show (CES) will be held in Las Vegas from January 6-9;

Wednesday 21:15, US December ADP Employment Change;

Thursday 20:30, US December Challenger Job Cuts;

Thursday 21:30, US Initial Jobless Claims for the week ending Jan 3, October Trade Balance;

Friday 0:00, US December New York Fed 1-Year Inflation Expectations;

Friday 21:30, US December Nonfarm Payrolls and Unemployment Rate, US October Housing Starts and Building Permits (annualized);

Friday 23:00, 2026 FOMC voting member, Minneapolis Fed President Kashkari delivers a welcome address and participates in an informal discussion at an online event hosted by the bank;

Friday 23:00, US January University of Michigan Consumer Sentiment Index (preliminary) and 1-Year Inflation Expectations (preliminary).

Macro & Hotspots

1. This week's macro outlook: The situation in Venezuela has suddenly deteriorated, with the December Nonfarm Payrolls report being the most watched.

2. Santiment analyst: If retail investors FOMO due to Bitcoin approaching $92,000, it could suppress the rally. Additionally, according to Glassnode analysis, the current market structure is showing typical characteristics of a long-term bear market.

3. Cryptopolitan: Total crypto venture capital investment in 2025 reached $49.75 billion, a 433.2% increase from 2024, although the number of projects for the full year fell 42.1% to 898, indicating a concentration of funds towards larger projects.

Market Trends

1. In the past 24 hours, the cryptocurrency market saw $179 million in liquidations across the network, with short positions accounting for $128 million. BTC liquidation amount was approximately $58 million, and ETH liquidation amount was approximately $30 million.

2. US Stocks: Dow +0.66%, Nasdaq -0.03%, S&P 500 +0.19%. Nvidia (NVDA.O) +1.26%, Circle (CRCL.N) fell nearly +5.26%, MSTR (Strategy) +3.43%.

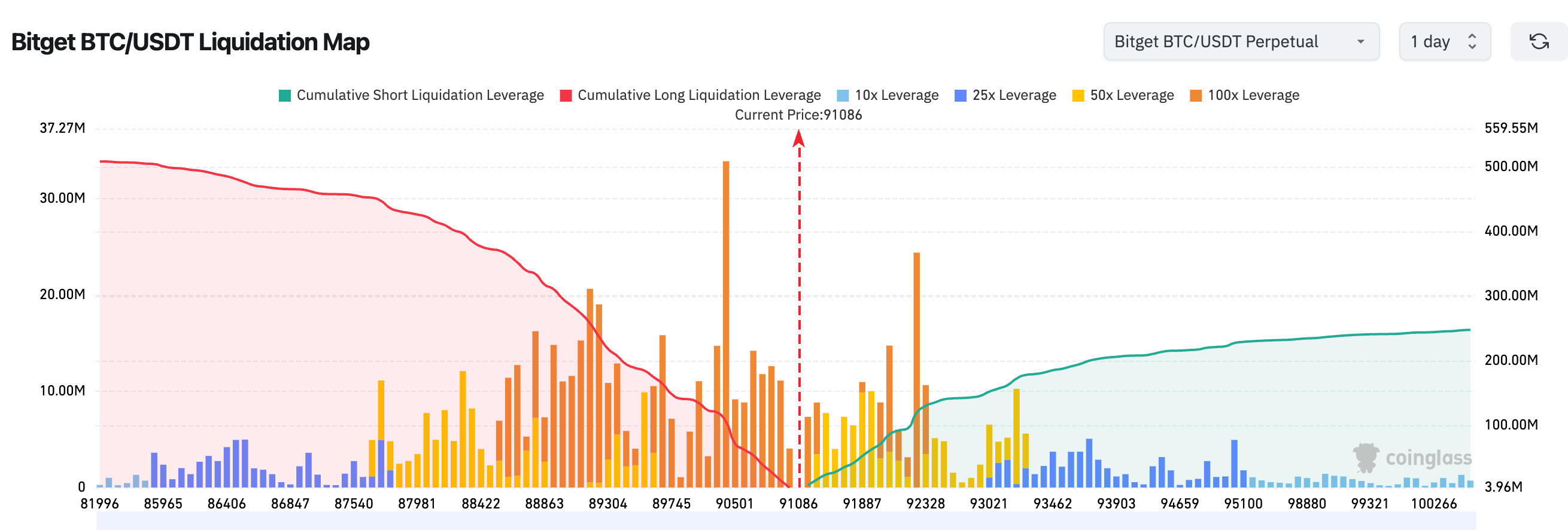

3. The current price area around 91,000 is a clear dividing line between bulls and bears. Below it, a large concentration of long liquidation risks exists; once broken, it could easily trigger chain stop-losses, amplifying downward volatility. Above it, there is a denser distribution of short liquidation zones. If the price effectively breaks above, it could trigger a short squeeze, driving a rapid price surge.

4. In the past 24 hours, BTC spot inflows were approximately $256 million, outflows approximately $214 million, resulting in a net inflow of $42 million.

News

1. Vitalik: ZK-EVM and PeerDAS will make Ethereum a new form of high-performance decentralized network.

2. US spot crypto ETF cumulative trading volume surpasses $2 trillion, doubling in half the time.

3. SpaceX, OpenAI, and Anthropic plan to launch IPOs in 2026, potentially becoming one of the most significant waves of listings in history. Additionally, crypto M&A and IPOs surged in 2025, with industry insiders expecting the boom to continue into 2026.

Project Developments

1. A whale deposited 2 million USDC and increased LIT holdings again, with cumulative purchases reaching $8.03 million within five days. Additionally, Sun Yuchen is suspected of selling approximately $200,000 worth of LIT, currently holding 13.23 million LIT.

2. Trust Wallet browser extension introduces user verification codes to advance the compensation process.

3. Analysis: Bitcoin returns to $90,000, but derivatives and spot ETF data show market sentiment remains cautious.

4. A whale deposited 74,002 ZEC to Binance yesterday, valued at $35.75 million.

5. The Bitcoin Premium Index has been negative for 20 consecutive days, currently reported at -0.0413%.

6. Ethereum treasury company Quantum Solutions disclosed its ETH holdings increased to approximately 5,418 ETH. Additionally, Bitmine's additional staking caused a surge in the ETH validator queue, extending the waiting period to 17 days.

7. A whale withdrew a total of 20,000 ETH from multiple CEXs, valued at $62.3 million.

8. Data: In 2025, total fee revenue for Meteora, Jupiter, and Uniswap each exceeded $1 billion.

9. Helium founder: Will stop HNT token buybacks due to lukewarm market response.

10. Jupiter co-founder seeks community opinion on whether to suspend JUP buybacks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News