Understanding U.S. Stock Tokenization: Why Crypto Enthusiasts Are Turning to U.S. Stocks While Wall Street Is Moving Up the Chain?

TechFlow Selected TechFlow Selected

Understanding U.S. Stock Tokenization: Why Crypto Enthusiasts Are Turning to U.S. Stocks While Wall Street Is Moving Up the Chain?

A comprehensive breakdown of the underlying logic of the U.S. stock tokenization sector.

Authors: Changan, Amelia, Biteye Content Team

Over the past year, a fascinating phenomenon has repeatedly emerged:

U.S. equities and precious metals have hit new highs driven by productivity gains and the AI narrative, while the crypto market has fallen into cyclical liquidity droughts.

Many investors lament that "the end of crypto is U.S. stocks," with some even choosing to exit entirely.

But what if I told you that these two seemingly opposing wealth pathways are undergoing a historic convergence through tokenization—would you still choose to leave?

Why do top global institutions—from BlackRock to Coinbase—unanimously express optimism about asset tokenization in their 2025 outlooks?

This isn't simply about "moving stocks on-chain." This article breaks down the foundational logic of the tokenized U.S. stock sector from first principles and reviews leading trading platforms and in-depth perspectives from key industry voices.

1. Core: More Than Just On-Chain

U.S. stock tokenization refers to converting shares of American companies (such as Apple, Tesla, and NVIDIA) into tokens. These tokens are typically pegged 1:1 to the economic rights or value of real stocks and are issued, traded, and settled via blockchain technology.

In simple terms, it moves traditional U.S. stocks onto the blockchain, turning them into programmable assets. Token holders gain exposure to stock economics (e.g., price appreciation, dividends), though not necessarily full shareholder rights—depending on product design.

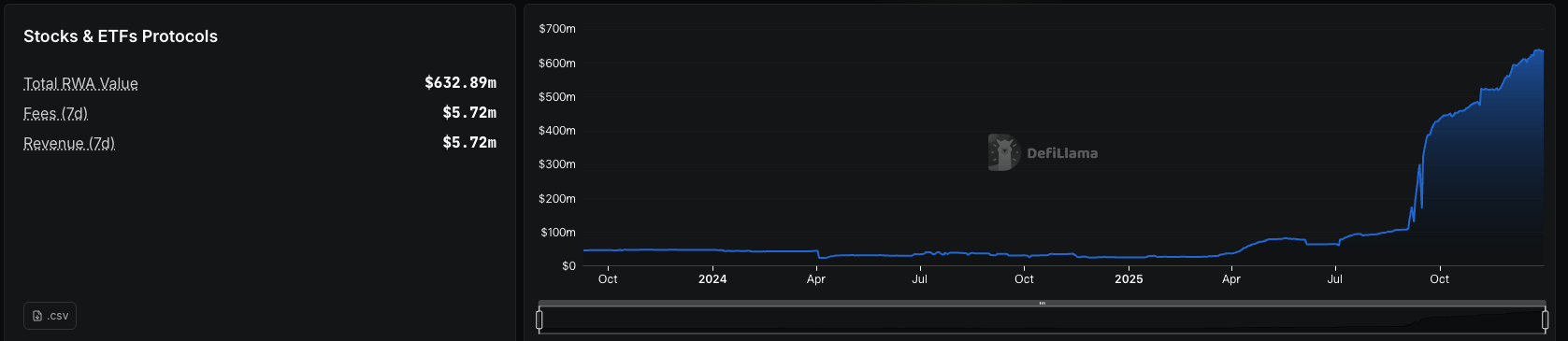

As shown in the chart below, the TVL of U.S. stock tokenization has grown exponentially since Q4 this year.

(Source: Dune)

After clarifying the basic definition of U.S. stock tokenization and how it differs from traditional assets, a more fundamental question arises: Given that traditional securities markets have operated for centuries, why go through the trouble of putting stocks on-chain?

The integration of stocks with blockchain brings numerous innovations and benefits to the traditional financial system.

1. 24/7 Trading: Breaks free from the trading hours of NYSE and Nasdaq, enabling uninterrupted 7×24 trading in crypto markets.

2. Fractional Ownership Lowers Investment Barriers: Traditional markets require purchasing at least one lot (100 shares). Tokenization allows assets to be divided into micro-units, letting investors buy $10 or $50 worth without paying full share prices. Global retail investors can now equally participate in the growth of top-tier companies.

3. Interoperability with Crypto and DeFi: Once stocks become tokens, they can seamlessly interact with the entire decentralized finance ecosystem. This enables actions impossible—or difficult—with traditional stocks. For example, you can use tokenized stocks as collateral for crypto loans or provide liquidity to earn trading fees.

4. Convergence of Global Liquidity: In traditional systems, U.S. equity liquidity is often isolated from other asset classes, causing macro tailwinds to benefit only one side. With stocks on-chain, crypto capital can directly access high-quality global assets. This represents a leap in liquidity efficiency.

BlackRock CEO Larry Fink also stated: The next generation of markets and securities will be tokenized.

This addresses crypto’s cyclical困境—when U.S. stocks and precious metals perform strongly, crypto often suffers from liquidity shortages and capital outflows. If “U.S. stock tokenization” matures, bringing more quality traditional assets into crypto, investors won’t feel compelled to exit, thereby enhancing the ecosystem’s resilience and appeal.

Of course, moving U.S. stocks on-chain is not a frictionless utopia. On the contrary, many issues it exposes stem precisely from its real integration into the existing financial order.

1. U.S. Stocks on-chain Are Not Truly Decentralized Shares

Most mainstream tokenized U.S. stock products rely on regulated custodians holding real stocks off-chain and issuing corresponding tokens on-chain. Users effectively hold claims to underlying stocks, not full shareholder status. This means asset security and redeemability heavily depend on the issuer's legal structure, custody arrangements, and compliance stability. Changes in regulatory environments or extreme risks at custodial institutions could impact the liquidity and redeemability of on-chain assets.

2. Price Vacuum and Depegging Risk During Non-Trading Hours

During U.S. market closures—especially for perpetual contracts or non-1:1 pegged products—on-chain prices lack real-time reference from traditional markets and are instead driven by sentiment and liquidity within the crypto market. When market depth is low, prices can deviate significantly or even be manipulated by large players. Similar to pre-market and after-hours trading in traditional markets, this issue is amplified in a 7×24 on-chain environment.

3. High Compliance Costs and Slow Expansion

Unlike native crypto assets, stock tokenization inherently operates under strict regulation. From securities classification and cross-jurisdiction compliance to custody and settlement design, every step requires deep coordination with the traditional financial system. This makes explosive growth paths like those seen in DeFi or Meme coins nearly impossible—each advancement involves legal structures, custody, and licensing.

4. A Dimensional Blow to Altcoin Narratives

When high-quality assets like Apple and NVIDIA become directly tradable on-chain, purely narrative-driven altcoins lacking real cash flows or fundamentals lose significant appeal. Capital begins re-evaluating between “high-volatility speculation” and “real-world returns.” While positive for long-term ecosystem health, this shift is fatal for altcoins reliant on emotional momentum.

In summary, moving U.S. stocks on-chain is a slow, pragmatic, yet highly certain path of financial evolution. It may not spark short-term frenzy, but it is likely to become a core infrastructure thread deeply integrated between crypto and traditional finance.

2. Implementation Logic: Custody-Backed vs Synthetic Assets

Tokenized stocks are created by issuing blockchain-based tokens that reflect the value of specific equities. Depending on the underlying mechanism, current market offerings generally follow one of two models:

- Custody-Backed Tokens: Regulated entities hold real stocks in traditional markets as reserves and issue corresponding tokens on-chain at a fixed ratio. On-chain tokens represent economic claims to the underlying stocks, with legal enforceability depending on the issuer’s compliance framework, custody setup, and transparency.

This model aligns closely with traditional finance in terms of compliance and asset security, making it the dominant approach in U.S. stock tokenization today.

- Synthetic Tokens: These do not hold real stocks but instead track stock price movements via smart contracts and oracles, providing users with price exposure. Such products resemble financial derivatives, with primary utility in trading and hedging rather than ownership transfer.

Due to lack of real asset backing and inherent compliance and security flaws, pure synthetic models like Mirror Protocol have largely faded from mainstream relevance.

With tightening regulations and increasing institutional participation, custody-backed models using real asset reserves have become the standard in 2025. Platforms like Ondo Finance and xStocks have made significant progress in compliance, liquidity access, and user experience.

However, execution still requires coordination between traditional finance and on-chain systems, resulting in notable engineering differences.

1. Operational Differences Due to Batch Settlement Mechanisms

Platforms commonly use net batch settlement to execute real stock trades in traditional markets (e.g., Nasdaq, NYSE). While this leverages deep liquidity from traditional markets and keeps slippage extremely low (typically <0.2%), it also means:

1) Minting and redemption may experience brief delays during non-U.S. market hours;

2) In extreme volatility, execution prices may slightly deviate from on-chain pricing (due to platform spreads or fee buffers);

2. Centralized Custody and Operational Risks

Stocks are held by a small number of regulated custodians. In case of custodial errors, bankruptcy, delayed liquidation, or black swan events, token redemptions could theoretically be affected.

Similar issues exist in Perpdex platforms focused on U.S. stocks. Unlike spot 1:1 pegs, futures trading faces extreme conditions during U.S. market closures:

1. Depegging Risk:

During regular trading days, contract prices are forcibly anchored to Nasdaq via funding rates and oracles. Once markets close, external real-time prices freeze, and on-chain prices are driven solely by internal crypto market dynamics. If there’s sharp volatility or large sell-offs in crypto, on-chain prices can rapidly diverge.

2. Thin Liquidity Enables Manipulation:

Open interest and market depth are often shallow during non-trading periods. Large players can manipulate prices using high-leverage orders, triggering cascading liquidations. Similar to what occurred with $MMT and $MON, when investor sentiment becomes uniformly bearish (massive short hedging), whales can violently pump prices to trigger chain reactions.

3. Review of U.S. Stock On-Chain Trading Platforms

For most investors, the key question is: Amid the vast crypto landscape, which projects have already turned this vision into tangible reality?

Ondo @OndoFinance (Official XHunt Rank: 1294):

Ondo Finance is a leading RWA tokenization platform focused on bringing traditional financial assets on-chain. Launched Ondo Global Markets in September 2025, offering 100+ tokenized U.S. stocks and ETFs (for non-U.S. investors), supporting 24/7 trading, instant settlement, and DeFi integration (e.g., collateralized lending).

The platform has expanded to Ethereum and BNB Chain, with plans to launch on Solana in early 2026, supporting over 1,000 assets. TVL has grown rapidly, surpassing hundreds of millions of dollars by end-2025, making it one of the largest tokenized stock platforms.

Ondo has raised over hundreds of millions in cumulative funding (including early rounds). No major public fundraising occurred in 2025, but TVL surged from hundreds of millions at year-start to over $1 billion by year-end, backed strongly by institutions (e.g., partnerships with Alpaca, Chainlink).

On November 25, 2025, Ondo Global Markets was officially integrated into Binance Wallet, launching over 100 tokenized U.S. stocks directly in the app’s “Markets > Stocks” section. This deep collaboration with Binance allows users to trade on-chain (e.g., Apple, Tesla) without additional brokerage accounts and supports DeFi use cases like collateralized lending.

Ondo has become the world’s largest tokenized securities platform, with year-end TVL exceeding $1 billion, directly challenging traditional brokers.

Robinhood @RobinhoodApp (Official XHunt Rank: 1218):

Traditional brokerage giant Robinhood leverages blockchain to break financial barriers, bringing U.S. stock trading into the DeFi ecosystem. In the EU, it offers tokenized stocks as derivatives built under MiFID II regulations, operating as an efficient “internal ledger.”

In June 2025, it officially launched tokenized U.S. stocks and ETFs on Arbitrum for EU users, covering over 200 U.S. equities, supporting 24/5 weekday trading with zero commissions. Future plans include launching its own Layer2 chain, “Robinhood Chain,” migrating assets there.

Driven by innovations like prediction markets, crypto expansion, and stock tokenization, $HOOD stock rose over 220% annually, becoming one of the standout performers in the S&P 500.

xStocks @xStocksFi (Official XHunt Rank: 4034):

xStocks is the flagship product of Swiss-compliant issuer Backed Finance, offering 1:1 custody of real U.S. stocks (60+ types, including Apple, Tesla, NVIDIA). Primarily traded on Kraken, Bybit, Binance, etc., supporting leverage and DeFi usage (e.g., collateral). Emphasizes EU regulatory compliance and high liquidity.

Backed Finance raised millions in early funding, no new public round in 2025, but achieved over $300 million in trading volume with strong partner expansion.

In H1 2025, it launched widely on Solana/BNB Chain/Tron, driving explosive volume growth; considered the most mature custody model, planning further ETF and institutional expansions.

@StableStock @StableStock (Official XHunt Rank: 13,550):

StableStock, supported by YZi Labs, MPCi, and Vertex Ventures, is a crypto-friendly neobroker aiming to enable borderless financial market access globally via stablecoins.

It deeply integrates licensed brokerage infrastructure with stablecoin-native crypto architecture, allowing users to trade real assets like stocks directly with stablecoins—bypassing traditional banking systems and drastically lowering cross-border financial barriers. Its long-term goal is to build a stablecoin-centric global trading system serving as the entry layer for tokenized stocks and broader RWAs. This vision is being realized through concrete product development.

Its core brokerage product, StableBroker, entered public beta in August 2025, and in October partnered with Native to launch 24/7 tradable tokenized stocks on BNB Chain. The platform now supports over 300 U.S. individual stocks and ETFs, with thousands of active users, daily spot trading volume nearing $1 million, and steadily growing asset size and metrics.

Aster @Aster_DEX (Official XHunt Rank: 976):

Aster is a next-gen multichain perpetual DEX (merged from Astherus and APX Finance), supporting stock perps (e.g., AAPL, TSLA) with up to 1001x leverage, hidden orders, and yield staking. Available across BNB Chain, Solana, and Ethereum, emphasizing high performance and institutional-grade experience.

Seed round led by YZi Labs, $ASTER reached a peak market cap over $7 billion post-TGE in 2025.

Post-TGE in September 2025 saw explosive trading volume, exceeding $500 billion cumulatively in the year; launched stock perps, mobile app, and Aster Chain Beta; surpassed 2 million users, with year-end TVL over $400 million, becoming the second-largest perps DEX.

Notably, CZ publicly confirmed secondary market purchases of $ASTER, underscoring Aster’s strategic importance on BNB Chain.

Trade.xyz @tradexyz (Official XHunt Rank: 3,843):

Trade.xyz is an emerging Pre-IPO tokenization platform focusing on unicorn equity (e.g., SpaceX, OpenAI), using SPVs to hold real shares and issue tokens, enabling on-chain trading and redemption. Emphasizes low barriers and liquidity.

No record of major public funding, remains an early-stage project relying on community and ecosystem growth.

Testnet launched select markets in 2025, integrated perps via Hyperliquid HIP-3; moderate trading volume, plans to expand to more companies and DeFi integrations in 2026.

Ventuals@ventuals (Official XHunt Rank: 4,742):

Ventuals, built on Hyperliquid using HIP-3 standard, creates perpetual contracts for Pre-IPO company valuations (not actual ownership, but price exposure, e.g., OpenAI, SpaceX). Supports leveraged long/short positions priced via valuation oracles.

Incubated by Paradigm, in October 2025 its HYPE staking vault attracted $38 million in 30 minutes (used for market deployment).

Launched on testnet in 2025, quickly becoming Hyperliquid’s dominant Pre-IPO perps platform; mainnet deployed multiple markets in October, with rapid volume growth; plans to expand to more companies and settlement mechanisms, positioning as innovative futures.

Jarsy @JarsyInc (Official XHunt Rank: 17,818):

Jarsy is a compliance-focused Pre-IPO platform, offering 1:1 tokenization of real private shares (e.g., SpaceX, Anthropic, Stripe), with minimum investments starting at $10. Uses presales to gauge demand before acquiring real shares and issuing tokens, supporting public proof-of-reserves and on-chain verification.

Raised $5 million in a pre-seed round in June 2025, led by Breyer Capital, with participation from Karman Ventures and several angels (e.g., Mysten Labs, Anchorage).

Officially launched in June 2025, rapidly adding popular companies; emphasizes transparency and compliance, with growing TVL; future plans include dividend simulation and enhanced DeFi compatibility.

In the wave of U.S. stocks going on-chain, major CEXs such as @BinanceWallet, @Bitget_zh, @Bybit_Official, and @okxchinese play crucial roles as traffic gateways. They typically adopt an aggregation model, directly connecting to regulated issuers like Ondo Finance and xStocks.

Binance Wallet, OKX Wallet, and Bitget offer deep integration with Ondo, providing U.S. stock trading services directly in their app’s market sections.

Bybit, meanwhile, offers U.S. stock contract trading via TradFi platforms—specifically synthetic derivatives whose underlying tracks real U.S. stocks or indices. Trading follows traditional market hours, offering only 24/5 availability.

4. KOL Perspectives: Consensus, Disagreement, and Vision

Jiayi (Founder of XDO) @mscryptojiayi(XHunt Rank: 2,529): Looking ahead, stock tokenization is unlikely to follow an explosive growth curve—but it could become a highly resilient infrastructure evolution path within Web3.

https://x.com/mscryptojiayi/status/1940782437879238992?s=20

Roger (KOL) @roger9949(XHunt Rank: 2,438): Top 10 Likely Beneficiaries of 2025 U.S. Stock Tokenization (RWA)

https://x.com/roger9949/status/2000177223874101705?s=20

Ru7 (KOL) @Ru7Longcrypto(XHunt Rank: 1,389): Stock tokenization isn’t about “copying stocks onto the chain.” It’s more like bridging traditional capital markets with open, composable decentralized finance.

https://x.com/Ru7Longcrypto/status/2003821123553902998?s=20

Lanhu (KOL) @lanhubiji (XHunt Rank: 1,473): Stock tokenization is fatally damaging to crypto projects—altcoins will have virtually no chance going forward.

https://x.com/lanhubiji/status/2001849239874531381?s=20

Lao Bai (Advisor at Amber.ac) @Wuhuoqiu(XHunt Rank: 1,271): The essence of U.S. stocks on-chain is 'digital migration' of assets: Just as the internet freed information and dismantled old intermediaries, blockchain is reconstructing the foundational logic of stock assets by eliminating settlement costs, breaking geographical boundaries, and decentralizing power.

https://x.com/Wuhuoqiu/status/2003447315139559911?s=20

5. Conclusion: From Financial “Parallel Worlds” to “Twin Systems”

Returning to the opening question: Why do all top institutions consistently favor tokenization in their annual outlooks?

From first principles, tokenization is liberating assets from traditional geographic, institutional, and time-bound silos, transforming them into globally programmable, composable digital assets. When the growth dividends of top companies are no longer constrained by borders or trading hours, the foundation of financial trust begins shifting from centralized intermediaries to code and consensus.

U.S. stock tokenization is far more than just moving assets on-chain—it is a fundamental restructuring of financial civilization.

Just as the internet dismantled information walls, blockchain is leveling investment barriers.

The crypto industry is now entering deeper waters of the real world.

It is no longer merely the antithesis of traditional finance, but evolving into a twin financial system—deeply coupled with and running parallel to the real-world financial infrastructure.

This is not just a leap in trading efficiency, but a critical step toward financial equality, empowering global investors to move from passive participants to active stakeholders.

In 2026, this migration of asset liquidity has only just begun.

(This article is for informational purposes only and does not constitute investment advice. The market carries risk—participate rationally.)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News