The Onslaught of MM 2: Market Makers, Order Books, and Order Flow

TechFlow Selected TechFlow Selected

The Onslaught of MM 2: Market Makers, Order Books, and Order Flow

The market makers' battlefield is not the K-line chart, but the LOB.

Author: Dave

The Rise of Market Makers 1: Market Maker Inventory and Quoting Systems

Why do things always go wrong right after you buy an altcoin? Why couldn't the seemingly massive market makers handle the sell orders during 1011? Why did every MM I talked to after 1011 casually claim they didn't lose much—or even made money that day? This article will introduce you to the market maker order book and order flow.

1. Limit Order Book (LOB)

The battlefield for market makers isn't the candlestick chart—it's the LOB.

Core concepts:

-

Depth: The volume of orders posted at each price level.

-

Tick Size: The smallest unit by which price can change. In high-frequency environments, tick size is crucial for queueing strategies.

-

Price Improvement: When your quoted price is better than the current best bid or offer (NBBO), you create value for the market.

For example, if BTC's current bid is 100,000 and ask is 110,000, and you place a bid at 101,000, you narrow the spread and create value for the market.

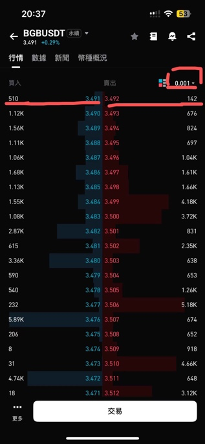

While writing this piece, I thought hard about how to explain this section clearly. Eventually, I realized nothing beats showing a real order book. Let me give a shoutout to bg's good friend—let's use bgb as an example.

The above is bgb's order book with minimum tick size. We see the smallest increment is 0.001. Current market depth is just over $1,000, and the spread is tightly controlled down to the minimum tick size. Depth is distributed in a "Christmas tree" shape—larger order sizes further from the mid-price. But when we increase the tick size, depth appears more like a horn shape—larger near the mid-price with higher liquidity, tapering off further away (one reason behind the liquidity vacuum during 1011).

Speaking of Christmas trees, since this article is scheduled for release on December 24—the eve of Christmas—happy holidays to everyone!

2. Market Maker Profit Source: Spread

The spread isn't just profit—it consists of three main cost components:

-

Order Processing Cost: Exchange fees, hardware latency, labor.

-

Inventory Risk: The risk of price moving against your position while holding inventory—we covered this in the previous episode.

-

Adverse Selection Cost: This is the most critical component—you may be trading against someone who has information you don't. In other words, you might be getting played by an insider.

-

There are three types of spreads: Quoted Spread, Effective Spread, and Realized Spread. Quoted Spread is simply the ask-bid difference. Realized Spread measures the actual profit a market maker captures after price adjustments: 2 x (P_trade – P_futuremid). It includes future mid-price, somewhat like incorporating opportunity cost.

3. Order Flow

Order flow refers to incoming orders received by market makers. This is a deep topic—market makers perform various operations on order flow such as hedging, matching, adjusting quotes, etc., in order to manage their books. There are many professional concepts and techniques involved, even legal issues—for instance, agency trades must not trade against principal trades due to conflict of interest. This article will only cover two concepts: Order Flow Toxicity and VPIN. If a market maker boss hires me later, I'll update fans with advanced order flow management.

Toxic Flow refers to orders from informed traders who know prices are about to move, causing losses in realized spread because they already know P_futuremid. So as market makers, we must also beware of being exploited by toxic insiders.

Non-toxic Flow (Noise/Retail Flow) comes from retail investors or passive funds rebalancing. This is the market maker's favorite "food".

To protect themselves, market makers adjust their quotes based on toxicity detection. A simple anti-toxicity method is assuming all aggressive orders are toxic—if there's buying pressure, the MM immediately lowers its reservation price, shifting quotes downward. This answers the earlier question: why do we always buy at the top? Because market makers adjust quotes defensively. But the sharp reader will ask again: what if insiders aggressively buy? What if they use information advantage to brute-force through the order book? Yes—that might be exactly what happened during 1011, and why even billion-dollar market makers failed to absorb the selling pressure.

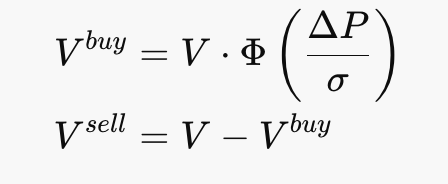

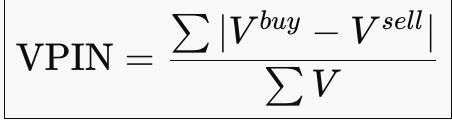

Key metric: VPIN (Volume-weighted Probability of Informed Trading).

VPIN ≈ the probability that market makers are being hit by sustained one-sided order flow. When strong one-way pressure occurs, MM inventory accumulates in one direction, breaking the mean reversion assumption. At this point, MMs pull quotes (Pull quotes), temporarily withdrawing liquidity until order flow regains symmetry. But what if symmetry never returns? Or what if order flow becomes so extreme it blows up their positions? That's exactly the 1011 disaster. Makes me want to write an episode on how exchanges profited from 1011—maybe later.

Back to the topic: after VPIN spikes, MMs either pull quotes (Pull quotes), widen spreads (Widen spread)—charging higher fees to offset potential losses—or reduce order size to slow inventory buildup.

This concludes Part 1 of our market maker series. From a retail trader’s perspective, the myth of manipulative "whales" controlling prices has now been demystified. Next, I’ll dive into more institutional-level topics from the MM perspective—hold tight.

Just like anime episodes end with a preview, here's one for this article: If we enter the world of Jujutsu Kaisen, where order flow is "Cursed Energy" and quoting strategies are "Cursed Techniques", then in the next episode, we’ll explore the "Domain Expansion" of market making.

To find out what happens next, stay tuned for the next chapter.

The Rise of Market Makers 3: Statistical Edge and Signal Design

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News