Hotcoin Research | The "Invisible Hand" Controlling Market Liquidity: The Role, Landscape, and Future Order of Crypto Market Makers

TechFlow Selected TechFlow Selected

Hotcoin Research | The "Invisible Hand" Controlling Market Liquidity: The Role, Landscape, and Future Order of Crypto Market Makers

Systematically reviewing the backgrounds, styles, and representative tokens of seven leading market makers, the controversies surrounding market makers, and recommendations for rebuilding trust, this report opens the black box of market-making mechanisms, helping readers better understand "market-making activities."

1. Introduction

The October 11 crash delivered the most direct lesson to the market: prices are not broken by a single wave of selling, but consumed by a liquidity vacuum. As multiple market makers suspended operations to protect themselves and reduce risk exposure, traders lost their counterparty. Combined with forced liquidations and deleveraging, market prices were instantly shattered, amplifying downward price movement and slippage—becoming a key accelerator of the "waterfall" collapse. In crypto markets, token prices are not simply formed by natural order matching between buyers and sellers, but are supported by continuous pricing and depth provision from market makers. Market makers are not just lubricants for order matching—they are the central nervous system of price discovery. Once this "invisible hand" withdraws, the market loses its gravitational balance. So how exactly does this invisible hand stabilize price discovery, and why does it "absent" itself during extreme moments, thereby altering the trajectory and speed of market movements?

This article breaks down the role and profit models of market makers in the crypto world using plain language, systematically reviews seven major market makers' backgrounds, styles, and representative token holdings, discusses controversies surrounding market makers and suggestions for rebuilding trust, opening the black box of market-making mechanisms so readers can better understand "market-making behavior."

2. Understanding the Role and Function of Market Makers

Market makers serve as both price stabilizers and systemic risk buffers. When operating efficiently, they keep markets stable, deep, and low-slippage; when absent or malfunctioning, the entire system can instantly become unbalanced.

1. The Role and Function of Market Makers

Market makers (MM) are the "invisible hand" of crypto markets, fulfilling critical functions:

-

Continuous two-sided quoting and depth maintenance: Continuously posting bid/ask prices on CEX order books, DEX RFQs, and AMM pools, dynamically adjusting spreads and order sizes based on traffic and risk thresholds, maintaining 1%/2% depth and replenishment speed to reduce slippage and impact costs (including AMM position rebalancing and concentrated liquidity range management).

-

Price discovery and cross-scenario linkage: By arbitraging price differences across exchanges/chains, spot/futures, different maturities, and stablecoins/pegged assets, they rapidly align fragmented market prices; connecting ETF/ETP/RFQ networks to promote over-the-counter–on-exchange and on-chain–off-chain integration and basis correction.

-

Inventory management and risk underwriting: Temporarily absorbing supply-demand imbalances and consolidating dispersed trading demands; neutralizing inventory via perpetuals/futures/options/borrowing to bring funding rates and spot-futures basis back into normal ranges.

-

New listings and cold-start liquidity: Providing minimum depth and market-making commitments during TGE/initial listing phases, using token lending, inventory staking, and rebate agreements to smooth initial volatility; handling large institutional/whale orders to reduce explicit spreads and implicit impact costs, helping assets quickly reach a "tradable state."

Clearly, the social nature of market makers lies between public goods and competitive gaming. On one hand, they use capital, algorithms, and expertise to improve market efficiency, enabling everyone to trade at reasonable cost; on the other hand, they hold significant structural information and decision-making power—once incentives misalign or risk controls fail, they may shift from "market stabilizers" to "volatility amplifiers."

2. Main Types of Market Makers

Different market makers—varying in scale, strategy, and positioning—play distinct roles in crypto markets. Below are the three main types:

-

Professional Market Makers: These entities use advanced algorithms and high-speed matching to fill order book liquidity, narrowing spreads and improving execution experience. They possess substantial capital, algorithmic engines, cross-platform coverage (CEX, DEX, OTC, ETF/ETP), and mature risk management systems. They continuously quote major assets like BTC, ETH, SOL, providing depth; deploying market-making algorithms and hedging mechanisms across multiple exchanges and on-chain protocols.

-

Advisory/Project Market Makers: Typically enter via "listing support + liquidity packages," signing market-making agreements with projects to provide token lending, initial order placement, and rebate incentives. After listing, they handle early pricing and matching to maintain minimal tradability. Though possibly smaller in capital than top-tier professional makers, they are more active in "new coin cold starts vs. long-tail tokens." Contracts often include clauses such as "token lending," "market-making rebates," and "minimum liquidity guarantees."

-

Algorithmic Market Makers or AMM LPs: Include liquidity providers (LPs) in AMM models, partially automated low-intervention quoting systems, and small-scale market makers or bot services. Characteristics include modest to medium-sized capital, primarily participating in on-chain AMM pools or custom matching protocols; weaker risk control and hedging capabilities compared to professional market makers, prone to liquidity withdrawal or depth shrinkage during extreme conditions; fragmented presence, offering "thin liquidity" support for long-tail tokens and multi-chain protocols.

3. Market-Making Mechanisms and Revenue Models

Although outsiders often imagine market makers as "systemic insiders," their actual profit model resembles a "high-frequency fee factory"—accumulating small but steady profits from spreads.

-

Spread Capture: This is the foundation of all market-making. Market makers maintain stable two-sided quotes between best bid and ask; when trades occur, they earn the difference. For example, if BTC is quoted at $64,000 (bid) and $64,010 (ask), a taker buying at the ask gives the maker a $10 spread profit. While individual gains are tiny, annualized returns become substantial at millions of executions.

-

Fees, Rebates, and Incentives: Most exchanges use maker-taker fee structures: makers who provide liquidity enjoy lower fees or rebates, while takers pay higher fees. Market makers, leveraging massive volume and algorithmic automation, sustain positive rebate income. Additionally, exchanges or projects often offer extra incentives—such as partial fee refunds, token rewards, or dedicated market-making subsidy pools during early stages.

-

Hedging and Basis Trading: Market makers inevitably face price volatility on held inventory. To maintain "neutral positions," they hedge via perpetuals, futures, options, or borrowing. For instance, if holding excess ETH, they might short an equivalent amount in futures to lock in risk exposure. Meanwhile, if spot and futures prices diverge (basis), they conduct "buy low, sell high" arbitrage for risk-free gains.

-

Statistical Arbitrage and Structural Opportunities: Beyond standard spread income, market makers seek micro-structural opportunities:

-

Calendar Arbitrage: Price differences between same-token contracts with different expiries;

-

Cross-Currency Arbitrage: Price deviations between correlated assets (e.g., stETH and ETH);

-

Volatility Arbitrage: Exploiting gaps between implied and historical volatility in options;

-

Funding Rate Arbitrage: Balancing funding costs across markets via borrowing or hedging;

-

These strategies form the market maker’s "profit matrix." Unlike speculators, they don’t bet on direction but win through scale, speed, risk control, and algorithms. In a market with daily trading volumes exceeding tens of billions, even an average spread of 0.02% can sustain a massive revenue system.

3. Review of Major Market Makers

Market makers transform crypto markets from "disordered pricing" into "sustainable matching" systems. Leading current market makers include Jump Trading, Wintermute, B2C2, GSR, DWF Labs, Amber Group, and Flow Traders. This chapter analyzes their backgrounds, styles, scales, and token portfolio structures.

1. Jump Trading

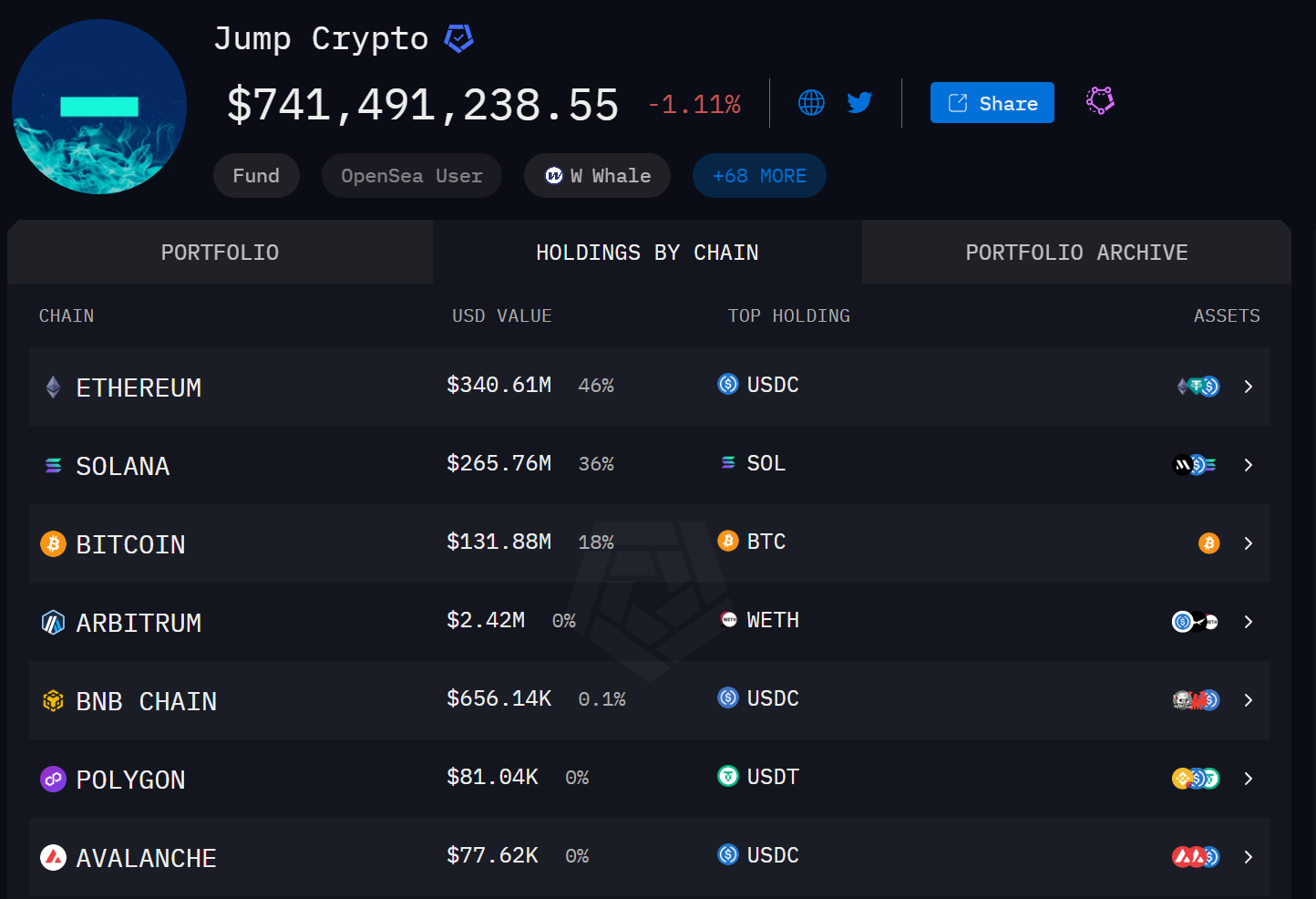

Source: https://intel.arkm.com/explorer/entity/jump-trading

Overview: Originated from traditional high-frequency quant trading, also investing in infrastructure research. According to Arkham data, as of October 23, 2025, Jump Trading's holdings totaled approximately $740 million.

Market-Making Style: Portfolio leans toward "capital preservation + low-to-medium beta exposure": high allocation to stablecoins and staking derivatives; dynamically adjusts staking/restaking positions during market volatility, conducting large-scale redemptions and conversions.

Representative Holdings

-

Top 5 Holdings: SOL, BTC, USDC, USDT, ETH

-

Trending Holdings: USD1, WLFI, W, SHIB, JUP, etc.

2. Wintermute

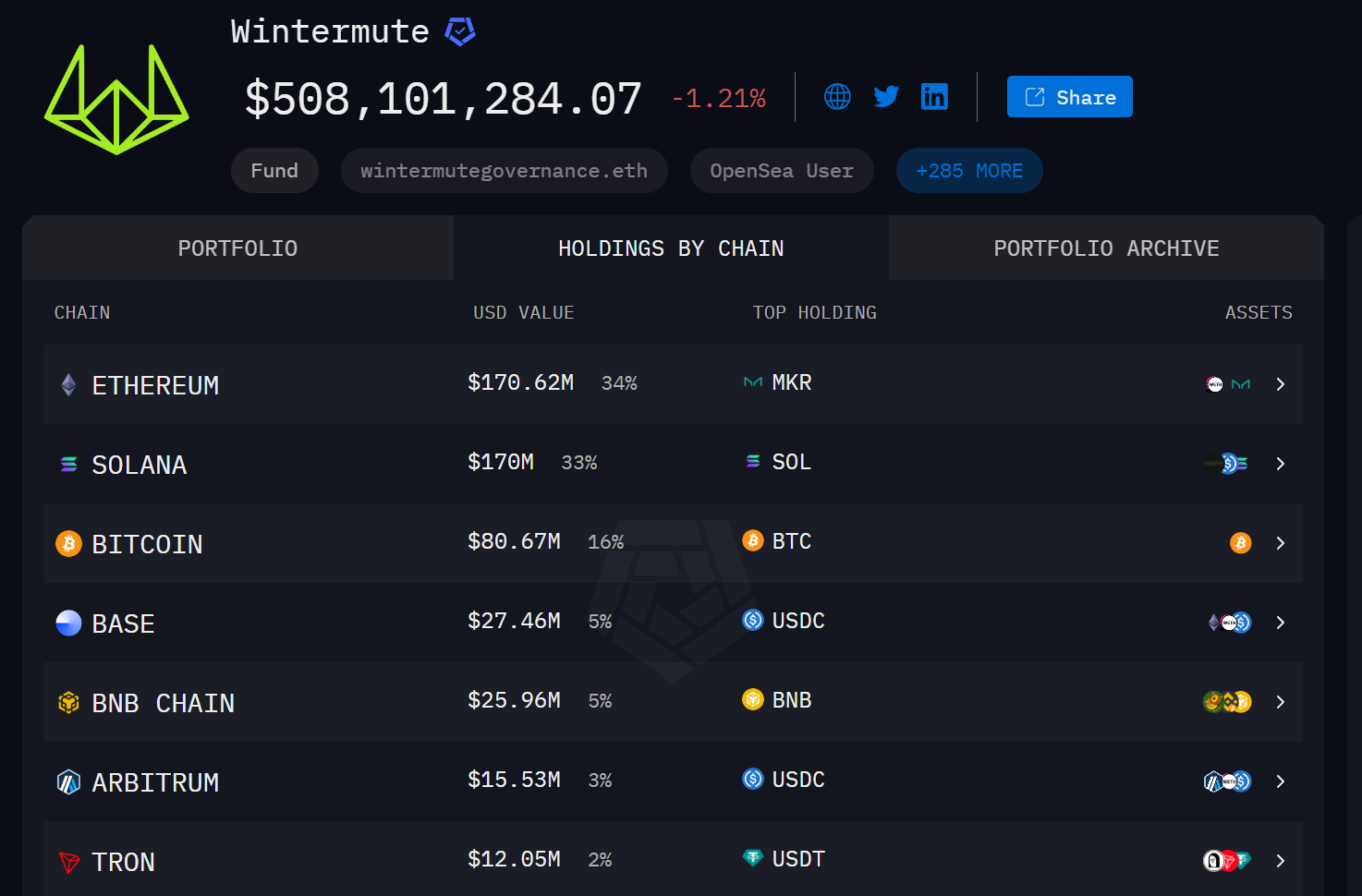

Source: https://intel.arkm.com/explorer/entity/wintermute

Overview: Veteran quant market maker covering centralized and decentralized environments; highly active in trending new tokens and meme coins in recent years, frequently serving as liquidity provider for new project launches. According to Arkham data, as of October 23, 2025, Wintermute's holdings totaled approximately $500 million.

Market-Making Style: Cross-market, cross-asset making + event-driven (new tokens/TGE) + combined high-frequency and grid strategies; typically receives allocations or accepts loans to provide two-way quotes during new asset cold starts. Publicly disclosed as one of Ethena (ENA)'s market makers.

Representative Holdings

-

Top 5 Holdings: SOL, BTC, USDC, MKR, RSTETH

-

Trending Holdings: LINK, ENA, PENGU, FARTCOIN, Binance Life, etc.

3. B2C2

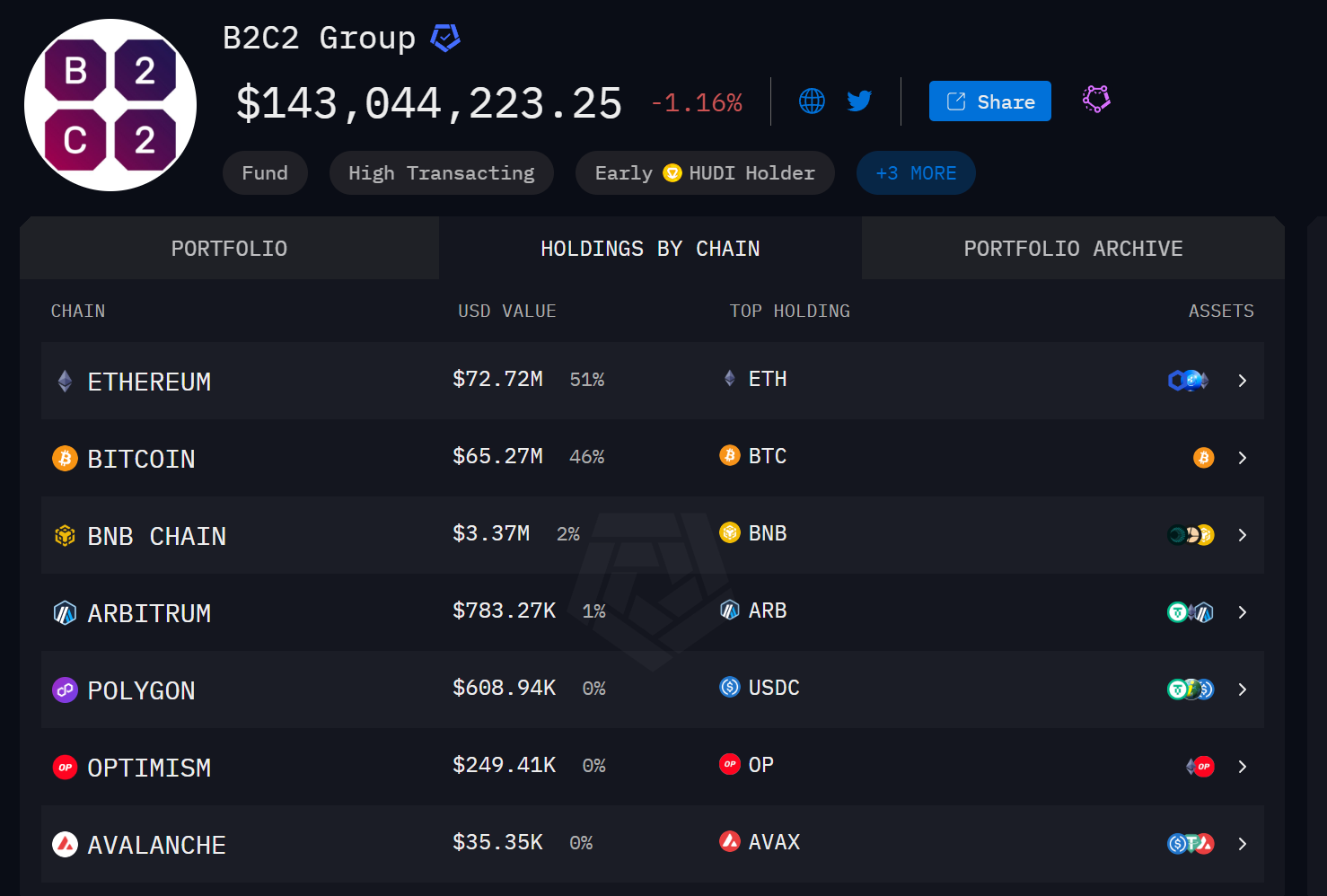

Source: https://intel.arkm.com/explorer/entity/b2c2

Overview: Veteran institutional market maker and OTC liquidity provider, controlled by Japanese financial group SBI; deeply collaborates with major exchanges and regulated platforms. According to Arkham data, as of October 23, 2025, holdings totaled approximately $140 million.

Market-Making Style: Strong "institutional prime brokerage + outsourced liquidity" characteristics; consistently covers major and long-tail high-liquidity coins; market reports disclose per-asset trading volume and buy/sell directions.

Representative Holdings

-

Top 5 Holdings: BTC, ETH, RLUSD, LINK, AAVE

-

Trending Holdings: LINK, BNB, UNI, FDUSD, ASTER, etc.

4. GSR Markets

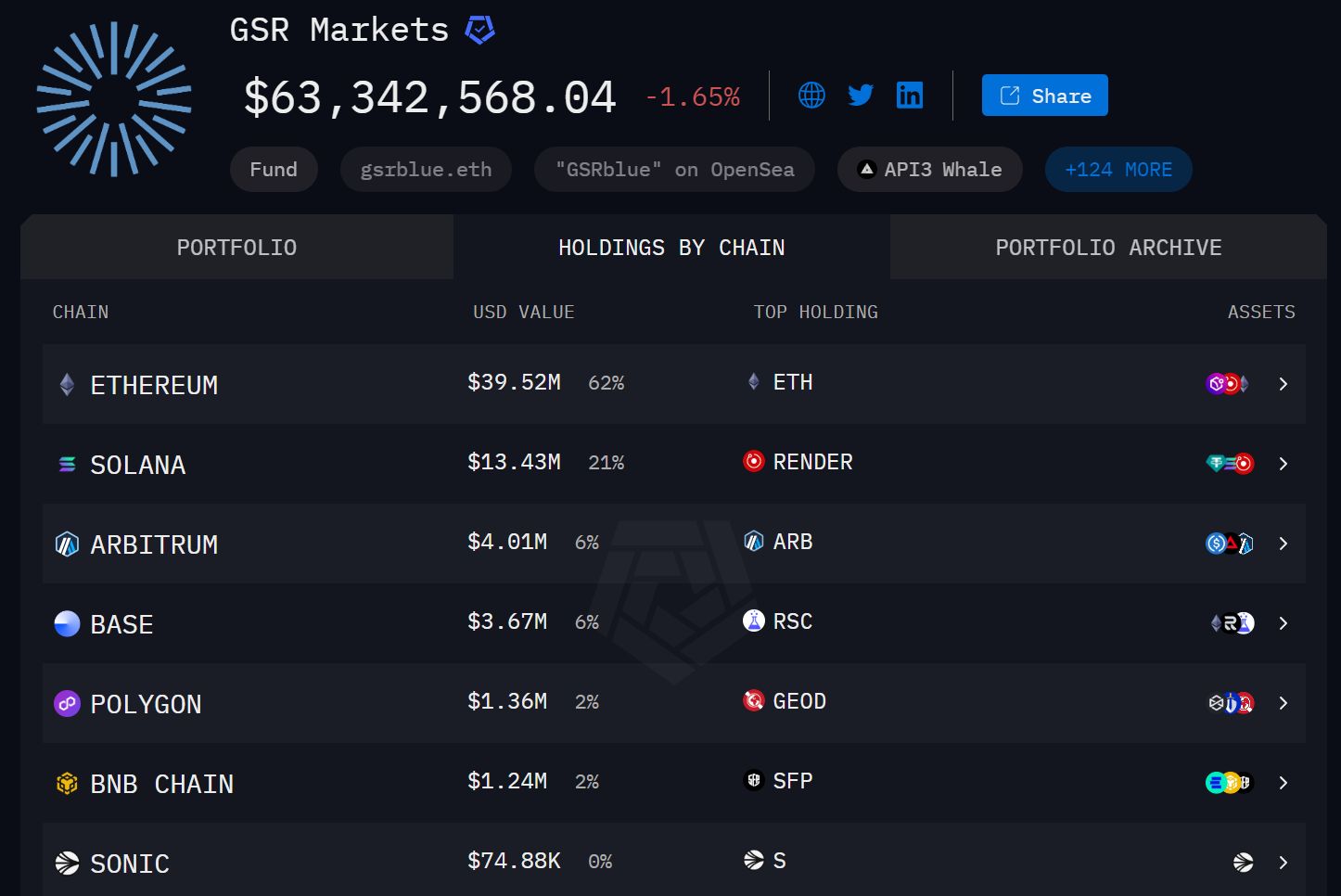

Source: https://intel.arkm.com/explorer/entity/gsr-markets

Overview: Founded in 2013, holds full compliance credentials (e.g., Singapore license), among the earliest professional crypto market makers. According to Arkham data, as of October 23, 2025, holdings totaled approximately $60 million.

Market-Making Style: "Institutional-grade + full-stack trading"—parallel market-making, structured products, and algorithmic execution; often serves as official market maker managing liquidity during TGE/circulation phases.

Representative Holdings

-

Top 5 Holdings: ETH, RNDR, ARB, SOL, SXT

-

Trending Holdings: AAVE, FET, RSC, SKY, SHIB, etc.

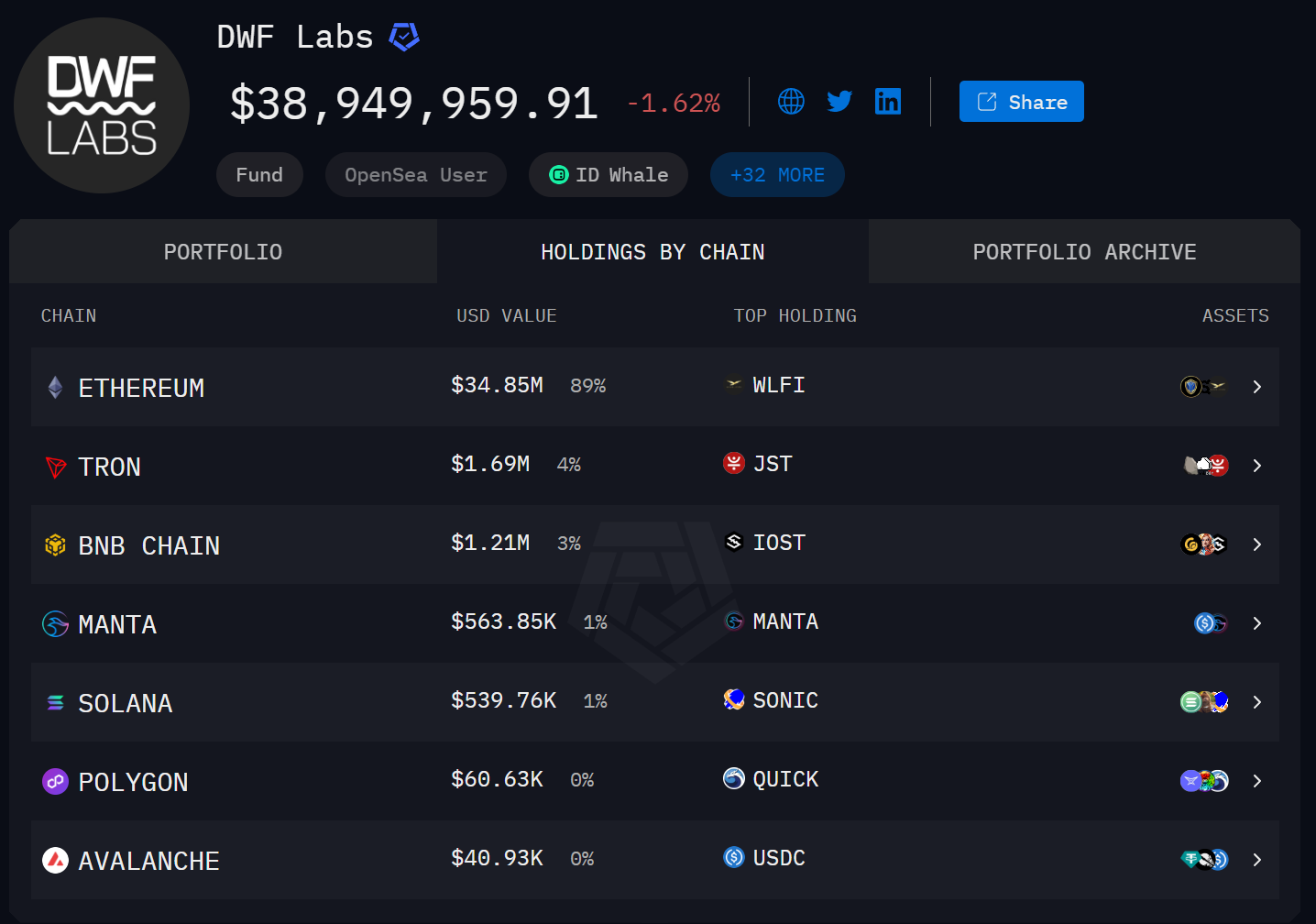

5. DWF Labs

Source: https://intel.arkm.com/explorer/entity/dwf-labs

Overview: Dual-engine model of "investment + market-making," highly active with broad token coverage. According to Arkham data, as of October 23, 2025, holdings totaled approximately $40 million.

Market-Making Style: Parallel new-asset cold starts and secondary market-making; skilled at leveraging wide exchange and multi-chain coverage for spread capture and inventory management; portfolio emphasizes both "beta and long-tail exposure."

Representative Holdings

-

Top 5 Holdings: WLFI, JST, FXS, YGG, GALA

-

Trending Holdings: SONIC, JST, PEPE, SIREN, AUCTION, etc.

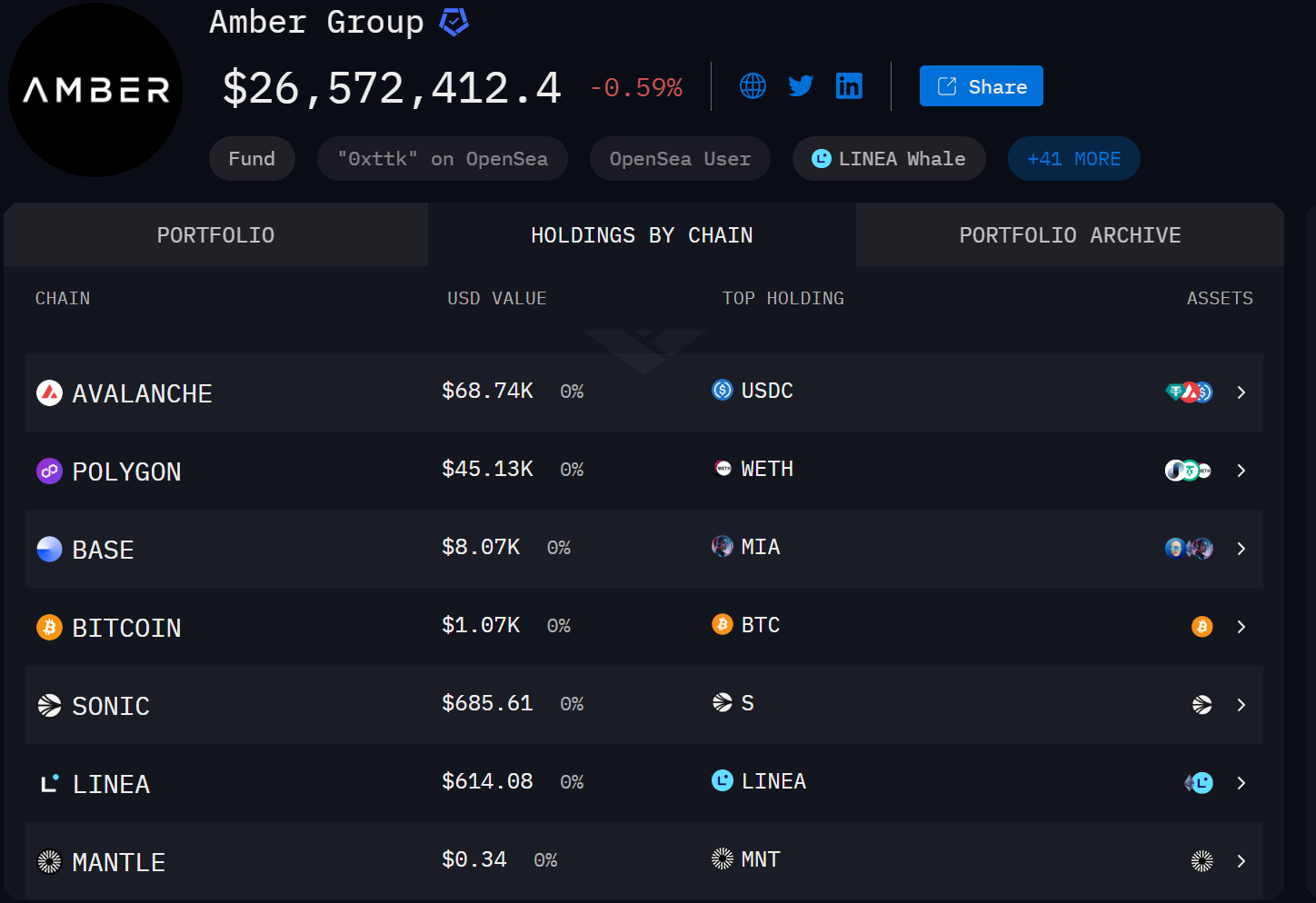

6. Amber Group

Source: https://intel.arkm.com/explorer/entity/amber

Overview: Full-stack trading and liquidity provider founded in Asia with global reach; offers market-making, derivatives, custody, and infrastructure services. According to Arkham data, as of October 23, 2025, holdings totaled approximately $26 million.

Market-Making Style: Primarily "institutional market-making + project cold start," enhanced with research- and event-driven strategies; frequently uses token lending or allocations during TGE/launch to stabilize quotes and depth.

Representative Holdings

-

Top 5 Holdings: USDC, USDT, G, ETH, ENA

-

Trending Holdings: G, ENA, MNT, LINEA, YB, etc.

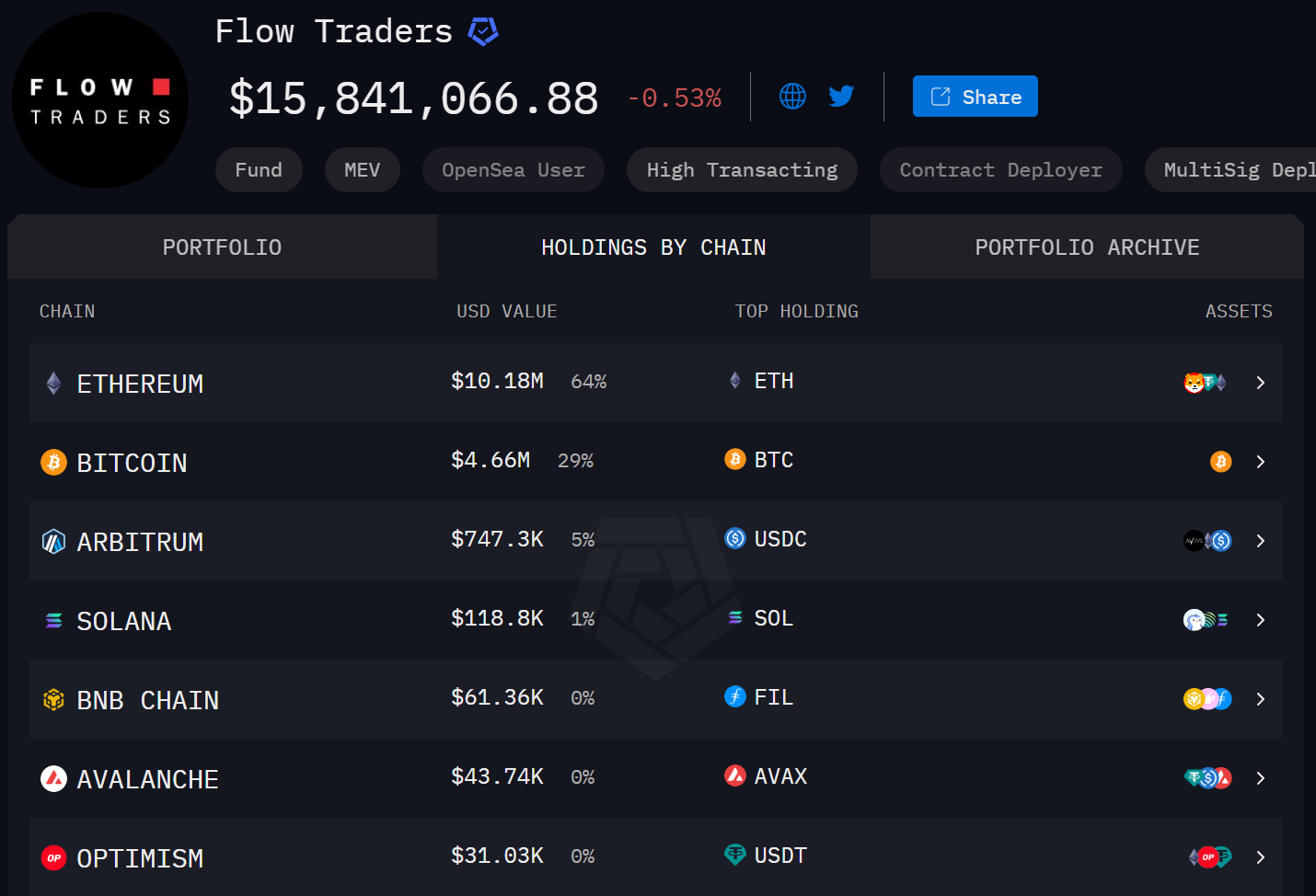

7. Flow Traders

Source: https://intel.arkm.com/explorer/entity/flow-traders

Overview: Europe-based global leader in ETP/ETF market-making, entered crypto in 2017, now one of the core market makers and risk hedgers for crypto ETPs. According to Arkham data, as of October 23, 2025, holdings totaled approximately $15 million.

Market-Making Style: Using on-exchange ETPs as hubs, provides continuous quotes and subscription/redemption services for passive/active products to secondary investors; covers over 200 crypto ETPs, with underlying assets spanning over 300 tokens.

Representative Holdings

-

Top 5 Holdings: ETH, BTC, USDT, USDC, SOL

-

Trending Holdings: FIL, AVAX, SHIB, WLFI, DYDX, etc.

These seven market makers collectively manage and operate over $1.5 billion in on-chain visible assets, supplying depth, enabling price discovery, and absorbing risk across multiple exchanges and on-chain protocols. From high-frequency quants to institutional makers, from new-coin cold starts to ETF hedging, from Asia to Europe and America, these seven firms cover nearly all top 500 market-cap mainstream and trending tokens, forming the backbone of global crypto liquidity.

4. Controversies and Conflicts Facing Market Makers

Due to information asymmetry, incentive misalignment, and opaque contract terms, market-making can shift from a public good to private博弈. Key conflicts involve price manipulation vs. liquidity provision, rational risk control vs. market volatility, and public-good attributes vs. profit-driven motives.

1. Conflict Between Price Manipulation and Liquidity Provision

In early crypto markets, the triad of "market maker = spontaneous quoting + investment + advisory" was common. But overlapping roles imply potential conflicts: one entity may simultaneously be responsible for price stability and liquidity while holding or being allocated large amounts of sellable tokens, creating incentives to pump prices before dumping cheaply. For example, the contract between Movement Labs and its designated market maker sparked serious controversy: about 66 million MOVE tokens (~5% of public float) were transferred to a dedicated market-making entity, with contractual rights to sell once market cap hits certain levels—resulting in ~$38 million in profits within one day of listing.

Thus, market makers can be both liquidity providers and tools for price manipulation. Any non-transparent market-making arrangement risks being seen as a "gray-zone transaction," eroding market-wide trust.

2. Conflict Between Rational Risk Control and Market Volatility

Market maker revenues come mainly from spreads, rebates, and hedging gains, while risks spike during extreme volatility. Rational profit maximization leads them to prioritize self-preservation over "defending depth." During crises, market makers may collectively withdraw liquidity, accelerating market collapse. The October 10–11, 2025 crash exemplifies this: when sudden risk events triggered multiple market makers’ risk models (single-asset exposure, VaR, hedging failure, liquidity stress thresholds), they had no choice but to "actively exit" or "temporarily reduce quotes."

While rational from a risk-control perspective, this collective retreat leaves the market with only "sell orders" and no "effective buy orders." Depth evaporates, market orders get filled instantly at worsening prices. Liquidation systems trigger cascading margin calls, causing second-by-second chain reactions, further price drops, re-triggering maker risk thresholds—a vicious cycle culminating in waterfall declines. In short, market collapse isn't due to "too much selling," but "too little buying."

3. Conflict Between Business Expansion and Depth Maintenance

As the total number of crypto tokens grows exponentially and narrative lifecycles shorten, market makers face unprecedented structural challenges. Traditional high-frequency models centered on major coins and few exchanges now confront a fragmented, multi-chain, multi-asset ecosystem. While top firms have advantages in algorithms and capital, their models are often designed around high-liquidity assets like BTC and ETH, making rapid replication across thousands of new tokens difficult. For market makers, the biggest challenge is no longer "can we profit?" but "how can we expand service scope without sacrificing depth?"

Market-making fundamentally requires integrated investment in capital, computing power, and data—all becoming scarce during rapid market expansion. To cover more assets, market makers must enhance automation and strategy reuse—using unified market-making engines, cross-chain algorithm routing, AI parameter scheduling—to accelerate response times for new listings. Yet this scaling brings inevitable risk spillovers: delayed strategy migration causes quote distortions, amplified volatility in low-liquidity tokens, and increased difficulty in position management.

4. Conflict Between "Public Good" and Profit Motive

Market-making is essentially private capital providing public liquidity: it reduces friction for all traders and improves price discovery, yet individual institutions bear inventory and tail risks. Project-market maker contracts often include borrowing, rebates, and exit thresholds, with KPIs tied to "price/market cap" rather than "sustainable depth," encouraging "pump-and-dump" behaviors.

Without sufficient disclosure and constraints, market-making may deviate from its role as liquidity provider, regressing into opportunistic supply. They may stabilize markets—or become points of liquidity failure.

5. Future Outlook: From "Invisible Depth" to "Institutionalized Liquidity"

The true vulnerability of crypto markets lies not in capital size or volatility per se, but in the uncertainty of "who provides liquidity and when they might withdraw." With exploding token counts and accelerating narrative turnover, market makers are being forced to evolve—from quant teams serving only major assets to distributed liquidity networks covering thousands of tokens, cross-chain assets, and stablecoins. The future challenge is not just "how to do more," but "how to do it more stably, transparently, and compliantly."

1. Information Symmetry and Transparency

For a healthy market-making ecosystem, transparency is fundamental. Project-market maker cooperation should move beyond vague slogans like "liquidity support" toward institutionalized contract disclosure:

-

Disclose core contract terms: commitment size, borrowed token quantity, rebate rate, exit conditions;

-

Disclose primary market maker lists and address whitelists so the public can verify real quote sources;

-

Regularly publish depth data, spread changes, and market-making efficiency metrics (e.g., quote response time, cancellation rate, fill rate).

Exchanges should also monitor maker behavior routinely: track abnormal spreads, concentrated positions, unusual cancellation speeds; if signs of "fake orders," "self-trading," or "circular trading among related accounts" emerge, they should have authority to suspend or downgrade privileges. In the future, blockchain explorers and analytics platforms could standardize these metrics into publicly assessable "liquidity quality scores." When market participants can clearly see which makers "provide the most stable depth and fastest response," market-making will no longer be a black box, but a competitive, auditable service.

2. Circuit Breakers and Recovery Mechanisms

During extreme events, maker self-protection is rational—but markets need a "system-level buffer." Thus, circuit breakers and recovery mechanisms will become crucial directions for market institutionalization.

When major makers trigger risk controls and exit, exchanges or protocol layers should automatically activate a "backup market maker onboarding mechanism"—a pre-registered pool of makers stepping in sequentially to prevent instant depth evaporation. Simultaneously, depth-replenishment plans via matching engines could smooth transitions using algorithmic limit orders or virtual quotes at key price levels.

Additionally, tiered liquidity circuit breakers similar to traditional finance could be introduced:

-

Mild Stage: When spreads widen excessively or depth falls below warning thresholds, pause matching for 3–5 seconds and restrict market orders;

-

Moderate Stage: When multiple makers exit and order book depth drops below historical average by 30%, halt trading and broadcast risk alerts;

-

Severe Stage: Platform or on-chain governance contracts temporarily assume floor quoting until new makers resume operations.

The goal of such multi-layer protection is not to "force makers to stay," but to prevent the market from collapsing into vacuum when they leave.

3. Balancing Efficiency and Risk Control

With token counts growing exponentially and narrative half-lives shrinking, traditional high-frequency market-making clearly cannot cover all assets. For makers, the biggest challenge is expanding quote coverage without compromising risk control.

One future solution is RFQ 2.0 and intent-based matching. These systems let users express "intents," then allow different makers or "solvers" to compete in quoting, greatly improving matching efficiency for long-tail assets. For example, intent-based protocols like CowSwap and UniswapX already provide infrastructure for "distributed market-making" at the technical level.

Meanwhile, project-maker relationships must shift from implicit incentives to transparent collaboration. Many new tokens still rely on gray-area arrangements like "token lending + rebates," which facilitate short-term liquidity but plant seeds for price manipulation. In the future, both parties should replace hidden subsidies with on-chain contractual inventory incentives: every token loan, quote, or recall recorded on-chain with clear terms and time windows, eliminating perceptions of "subsidy → pump → dump."

4. Multi-Dimensional Regulation and Self-Regulation: Professionalization and Accountability

As crypto integrates with traditional finance, market makers will gradually fall under clearer regulatory frameworks. Regulation should not focus solely on "manipulation" or "insider trading," but establish a "market-making license + behavior logging" system.

-

After obtaining a market-making license from an exchange or regulator, institutions must sign liability clauses and accept periodic audits;

-

Market-making activity logs (including cancellation rates, abnormal spreads, circuit breaker triggers) should be archived on-chain for audit and traceability;

-

Non-compliant or high-risk behaviors (e.g., rebate abuse, undisclosed self-trading) should trigger "gray-listing" and suspension mechanisms.

Beyond regulation, industry self-regulation is also needed: establishing a market maker association or alliance to standardize SLAs and disclosure templates; introducing third-party data audits and publishing quarterly "market-making performance rankings" to incentivize transparency and stability. Only when market-making is seen as a "measurable, accountable profession" will liquidity cease to depend on trust and truly become a regulated infrastructure.

Conclusion

Over the past decade, crypto market liquidity has relied on a small group of algorithmic teams; in the next decade, it will be sustained by institutions, data, and trust. The role of market makers is being redefined—they are no longer just operators of "invisible depth," but co-builders of transparency, resilience, and responsibility. When on-chain data platforms make market-making "impossible to hide," when circuit breakers teach markets to self-heal, when disclosure systems and regulatory frameworks impose greater obligations on liquidity providers, crypto markets can finally transition from "flash-mob depth" to "institutionalized liquidity." Then, prices will no longer be driven by isolated trades, but upheld by transparent liquidity networks; and market makers will evolve from distrusted "backroom insiders" into trusted "market infrastructure operators."

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, is dedicated to transforming professional analysis into practical tools for your trading success. Through our "Weekly Insights" and "Deep Dive Reports," we unpack market trends; via our exclusive column "Top Picks" (AI + expert dual screening), we identify high-potential assets and reduce your trial-and-error costs. Each week, our analysts engage you live, explaining hot topics and forecasting trends. We believe that warm, personalized guidance combined with professional insights empowers more investors to navigate market cycles and seize Web3 value opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News