The Hidden Market Makers: The Rise and Fall of Crypto Market Makers

TechFlow Selected TechFlow Selected

The Hidden Market Makers: The Rise and Fall of Crypto Market Makers

When the spotlight sweeps across the trading floor of the crypto world, the giant hands truly controlling the flow often remain hidden within the data torrent.

By: 1912212.eth, Foresight News

Rock singer Cui Jian once sang in "Fake Pilgrim": "I want people to see me, but not know who I am." In the volatile crypto market, similar "figures" are common—they draw endless curiosity.

In 2017, a young man left Wall Street, using his savings to build mining rigs, read whitepapers, and stay up late tuning algorithms. He brought on two colleagues from Optiver, a globally renowned market maker and high-frequency trading firm—one skilled in trading architecture, the other in risk control. During the brutal bear market of 2018, countless exchanges, projects, and media outlets collapsed. At their lowest point, with no external funding, they survived only through personal conviction and algorithmic models. When global financial markets swung violently due to the pandemic, their arbitrage algorithm earned them $120,000 overnight. A few months later, he began achieving seamless arbitrage across multiple trading platforms.

A year later, the quiet team behind him was managing hundreds of millions in capital, executing massive trades through algorithms he designed. He became the kind of figure “you never see, and never know who he is,” yet you always sense his presence in price movements.

This is Evgeny Gaevoy, founder of Wintermute, now among the world’s largest algorithm-driven crypto market makers. Based in London, he enjoys traveling to the U.S., often uses memes in posts, and speaks bluntly—once firing back at market manipulation accusations: “Don’t make me your imaginary enemy if you can’t handle me talking trash.”

So, what exactly is the role of a crypto market maker?

Typically, when a project launches a token, it can deploy it on a DEX by creating a trading pair such as X/ETH or X/USDT, then injecting both assets to form an initial liquidity pool—for example, 1 million X tokens and 100 ETH. But when a project wants to list on major exchanges like Coinbase or Binance, simply launching a token isn't enough; there's often insufficient buy/sell order volume. Exchanges need to ensure liquidity—there must always be someone willing to buy and someone willing to sell. This role is typically filled by market makers.

Compared to frequently discussed entities like exchanges and crypto VCs, market makers remain shrouded in mystery. They play a crucial role in the industry, yet are occasionally seen as driving forces behind token price drops—making them controversial.

The Old Order Crumbles

The crypto market saw an influx of professional market makers in the previous cycle.

At that time, the landscape was dominated by established players like Alameda Research, Jump Crypto, and Wintermute. These firms leveraged high-frequency algorithmic trading and vast capital to dominate liquidity provision on centralized exchanges (CEX). As FTX’s sister company, Alameda provided deep liquidity for major assets like Bitcoin and Ethereum during the 2021 bull run, accounting for over 20% of total market volume at its peak.

Alameda Research, a top-tier crypto market maker, began collapsing due to FTX’s liquidity crisis. In November 2022, CoinDesk exposed Alameda’s balance sheet, prompting CZ to announce the sale of all FTT holdings, triggering FTX’s liquidity crunch and user withdrawal surge. Investigations revealed FTX had diverted up to $10 billion in customer funds to Alameda for risky trades and loss coverage—a fatal cycle. FTX, Alameda, and over 130 affiliated entities filed for bankruptcy, and SBF stepped down as CEO.

Looking back at its rise, SBF founded Alameda in 2017, initially focusing on crypto arbitrage and quantitative trading, quickly rising thanks to algorithmic advantages. After launching FTX in 2019, Alameda became its primary liquidity provider, helping FTX reach a $32 billion valuation. Managing tens of billions in assets, Alameda profited handsomely from leveraged trading and market making during the bull market. SBF became a crypto billionaire, advocating for industry charity and regulatory engagement.

Caroline Ellison

The final collapse stemmed from internal governance failure. Alameda partner Caroline Ellison admitted in a staff meeting to misusing customer funds, shocking the industry. Her romantic relationship with SBF added drama: in 2023, she became a key prosecution witness, accusing SBF of orchestrating an $8 billion fraud, while pleading guilty to seven fraud charges herself. She was sentenced to two years in prison in 2024. In court, she tearfully apologized: “I feel pain every day for those I’ve hurt.”

Alameda’s high leverage left it exposed to market swings, while FTX’s misuse of customer funds to cover gaps proved fatal. In 2023, SBF was sentenced to 25 years in prison, and Alameda’s assets were liquidated—marking its complete downfall.

The exit or contraction of legacy market makers directly created a vacuum.

According to Kaiko data, one week after FTX’s collapse, global crypto liquidity halved, with Bitcoin’s 2% depth dropping from hundreds of millions to under $100 million.

In the early days of crypto liquidity battles, Jump Crypto and Wintermute were once the hottest players.

Jump originated from traditional HFT giant Jump Trading, leveraging deep algorithmic expertise and capital strength to aggressively enter crypto in 2021, becoming ubiquitous from the Solana ecosystem to Terra’s stablecoin system. However, following Terra’s collapse and an SEC investigation in 2023, Jump Crypto scaled back operations, exited parts of the U.S. market, and cut more than 10% of its workforce.

Wintermute rose rapidly with agile algorithmic market making and OTC services, briefly becoming the most influential liquidity provider across CeFi and DeFi. A 2022 hacking incident cost it nearly $160 million, exposing risks behind rapid expansion. Since then, Wintermute has shifted toward精细化 operations, avoiding blind growth.

Their trajectories encapsulate the past five years of crypto market makers—from wild expansion to cautious retrenchment: from high-frequency arbitrage to ecosystem support, from aggressive risk-taking to survival-focused prudence. Once pillars of market prosperity, they now seek balance between risk and liquidity.

Yet, as these players pull back and grow cautious, macro and micro factors have again opened doors for new entrants. The Fed’s rate cuts in 2023–2024 spurred capital inflows, and the 2024 Bitcoin halving reignited the market cycle. New token issuance surged: inscriptions, restaking, meme coins, AI agents, stablecoins, RWA, and on-chain equities rotated in succession. Additionally, U.S. spot ETFs attracted massive inflows, with data showing strong performance.

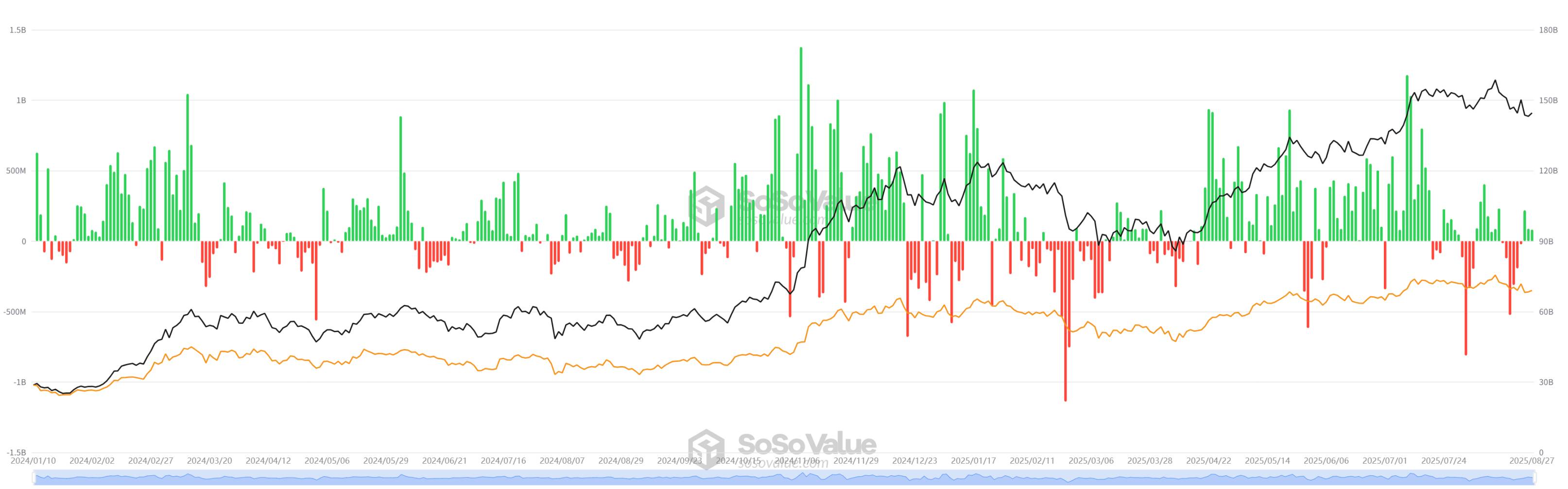

According to SoSoValue, as of August 28, cumulative net inflows into Bitcoin spot ETFs reached $54.19 billion, while Ethereum spot ETFs saw $13.64 billion. Regulatory easing also played a key role. Since Donald Trump took office in January 2025, he has emphasized supporting responsible growth of digital assets, blockchain technology, and related innovations, reversing Biden-era policies. The executive order also established a Digital Assets Working Group within the National Economic Council to propose a federal regulatory framework covering market structure, oversight, consumer protection, and risk management.

Moreover, falling technical barriers and shifting project demands have reshaped the industry.

New Contenders Rise

The vacuum created space for new players. Key names include Flow Traders, GSR’s new division, and DWF Labs. With diverse backgrounds, their operations span CEX/DEX market making, OTC, and structured products.

Flow Traders

Flow Traders, a Netherlands-based global liquidity provider originally known for exchange-traded products (ETPs), decisively pivoted to crypto in 2023—like a seasoned sailor catching the digital wind. Composed of quant experts and financial engineers, the team emphasizes a “strong team-driven culture.” Their Amsterdam headquarters resembles a precision lab, gathering elite talent from Wall Street and Silicon Valley.

Thomas Spitz

In July 2025, Thomas Spitz became Flow Traders’ new CEO. Previously at Crédit Agricole CIB, he enjoyed a 20+ year career holding senior roles, bringing deep experience in international team management and cross-cultural leadership. He led MiCAR-compliant stablecoin AllUnity, partnering with DWS and Galaxy Digital to reshape tokenized asset landscapes.

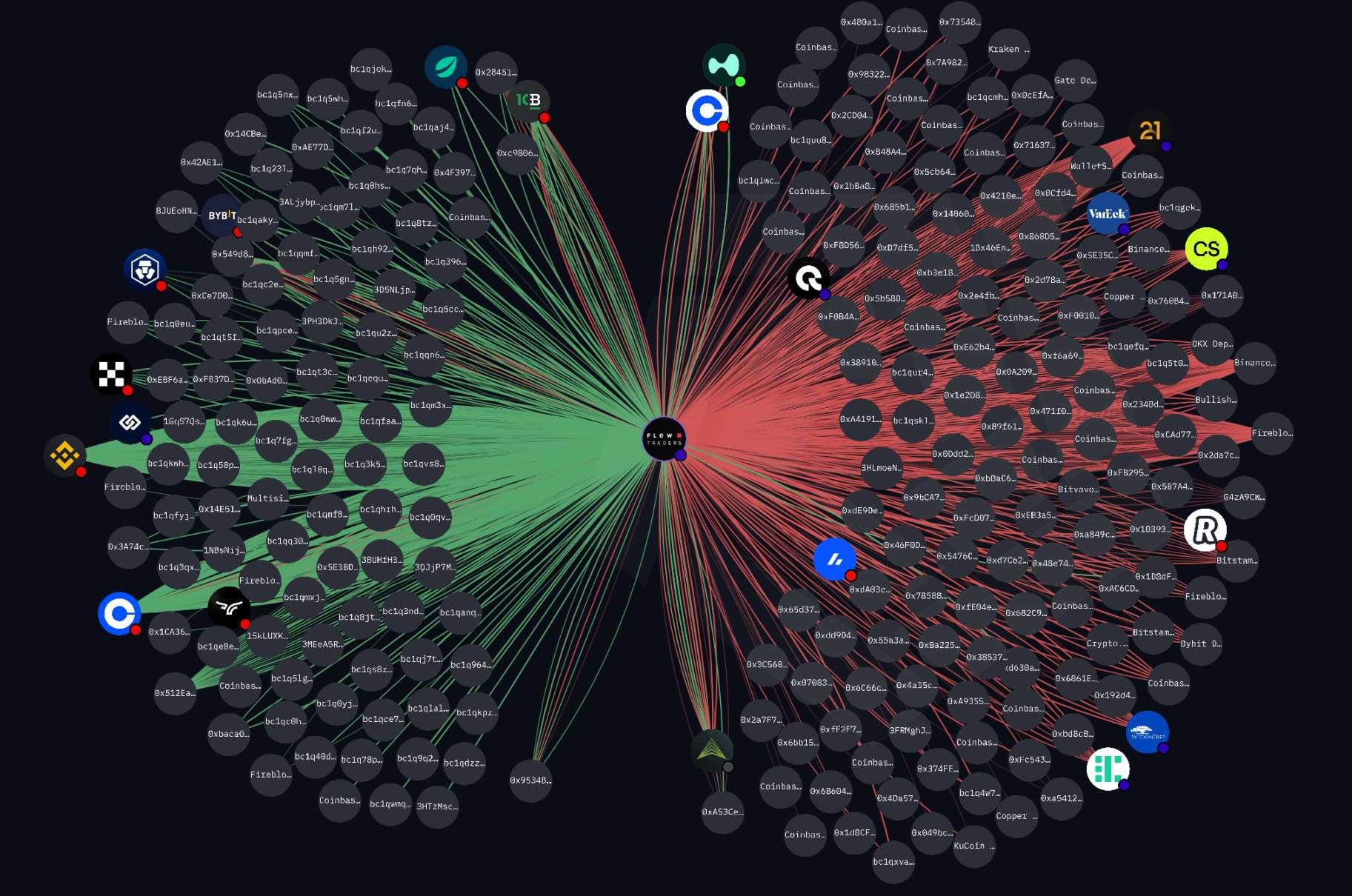

In Q2 2025, its net trading revenue hit €143.4 million, up 80% year-on-year. Known for cross-chain and institutional-grade support, Flow Traders provides continuous liquidity. Third-party monitoring shows it currently makes markets for tokens including AVAX, LINK, DYDX, GRT, STRK, PROVE, WCT, PARTI, ACX, and EIGEN. Notably, in mid-2024, Flow Traders helped the German government smoothly dispose of seized BTC without triggering significant downside risks in the secondary market.

While Flow Traders grows profits using proprietary capital and algorithms, GSR receives partial funding from VCs like Pantera Capital.

Monitoring data shows its current market-making capital stands at $16.94 million, having fallen back to historical lows.

GSR Markets

GSR Markets is a Hong Kong-based algorithmic digital trading firm. It uses proprietary software to provide order execution solutions across multiple digital asset classes, delivering liquidity. With a diverse team of former hedge fund traders and blockchain engineers, its offices in New York and London attract global talent, offering institutional-grade market making, OTC trading, and risk management. GSR excels in precise risk hedging and global connectivity, linking dozens of exchanges to provide bidirectional liquidity, and uses high-frequency algorithms to navigate volatility.

In 2023, GSR scaled back U.S. trading to avoid regulatory storms, with CFO and other executives departing. In 2024, GSR transitioned from pure trading to becoming an ecosystem partner. At the 2025 Consensus summit, partner Josh Riezman stated: “The integration of DeFi and CeFi is the future—we’re preparing for the next phase.”

Riezman once mined Ethereum using his own server, earning his first fortune. His resume is impressive, with years spent at Deutsche Bank, Société Générale, and Circle across traditional finance and crypto. Under his leadership, GSR became the first crypto liquidity provider to obtain licenses from both the UK’s FCA (Financial Conduct Authority) and Singapore’s MAS (Monetary Authority).

Josh Riezman

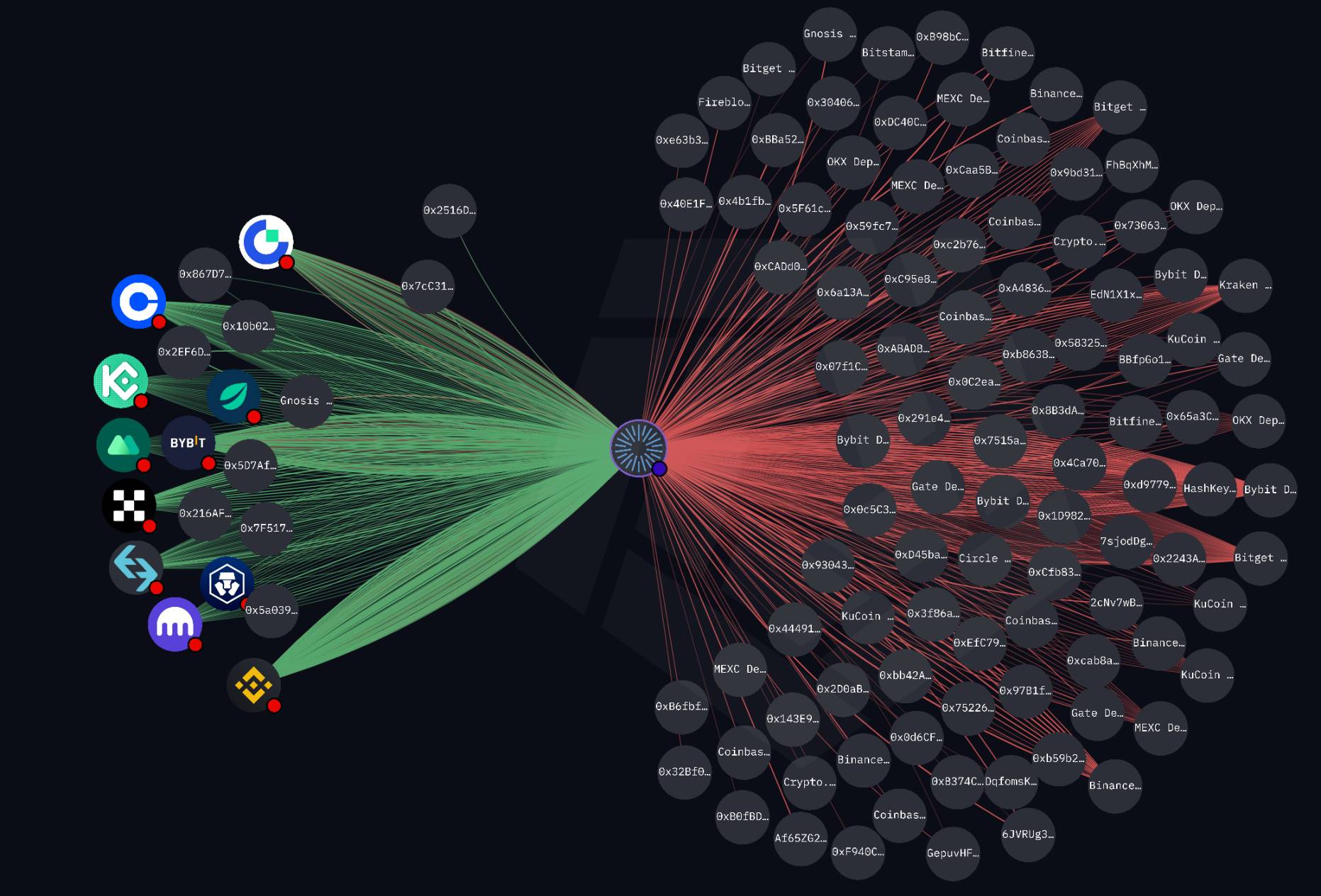

Public information indicates GSR makes markets for altcoins including: WCT, RNDR, FET, UNI, SXT, SPK, RSC, GALA, HFT, PRIME, ARKM, BIGTIME, USUAL, MOVE, BAN, TAI, PUFFER, ZRO, IINCH, ENA, and WLD. Careful observers may notice that among some altcoins newly listed on Binance, those where GSR provides liquidity tend to experience a gradual price rise rather than an immediate crash upon listing.

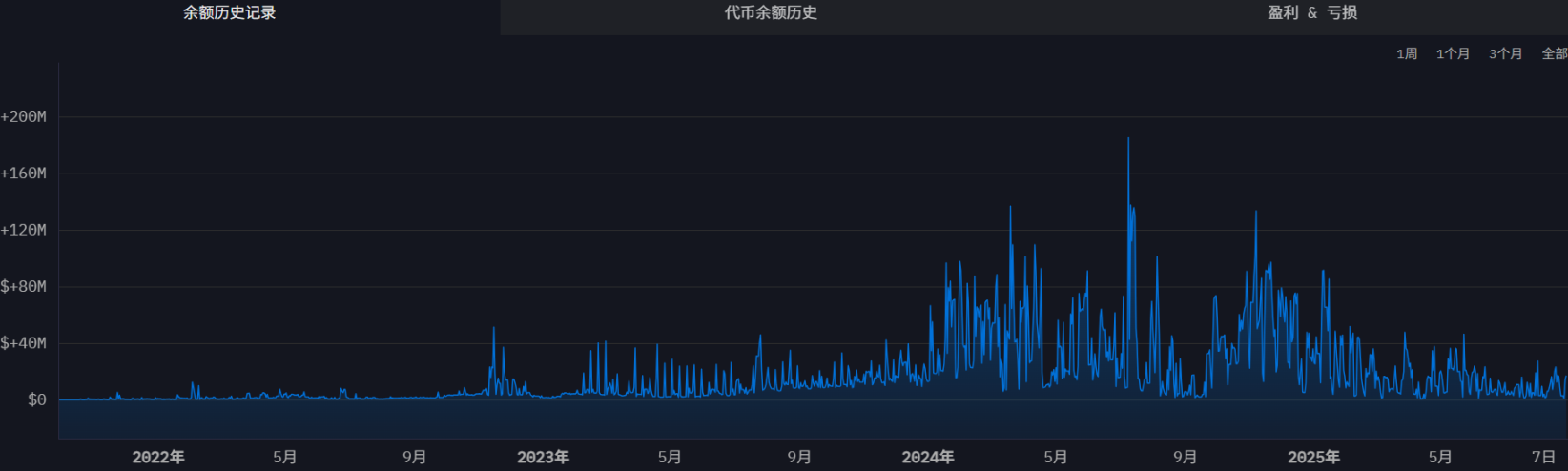

According to Arkham data, its publicly visible market-making capital amounts to $143.76 million, primarily focused on Binance. Its capital balance remains at a moderate level.

DWF Labs

DWF Labs was founded in 2022. Managing partner Andrei Grachev comes from a traditional trading background, formerly leading Huobi’s Russia operations. He entered logistics at 18, began trading in traditional markets in 2014, later moved into e-commerce, and made money as ETH rose from $7 to $350, launching his crypto journey.

He has five Chinese tattoos and embraces the controversy surrounding DWF. DWF plays multiple roles at once—VC, OTC desk, incubator, ecosystem builder, fundraiser, event brand, TVL provider, DeFi taker, advisor, listing agent, HR, PR/marketing firm, KOL, RFQ quotation platform, and more.

From 2023 to 2025, it invested in over 400 projects totaling more than $200 million.

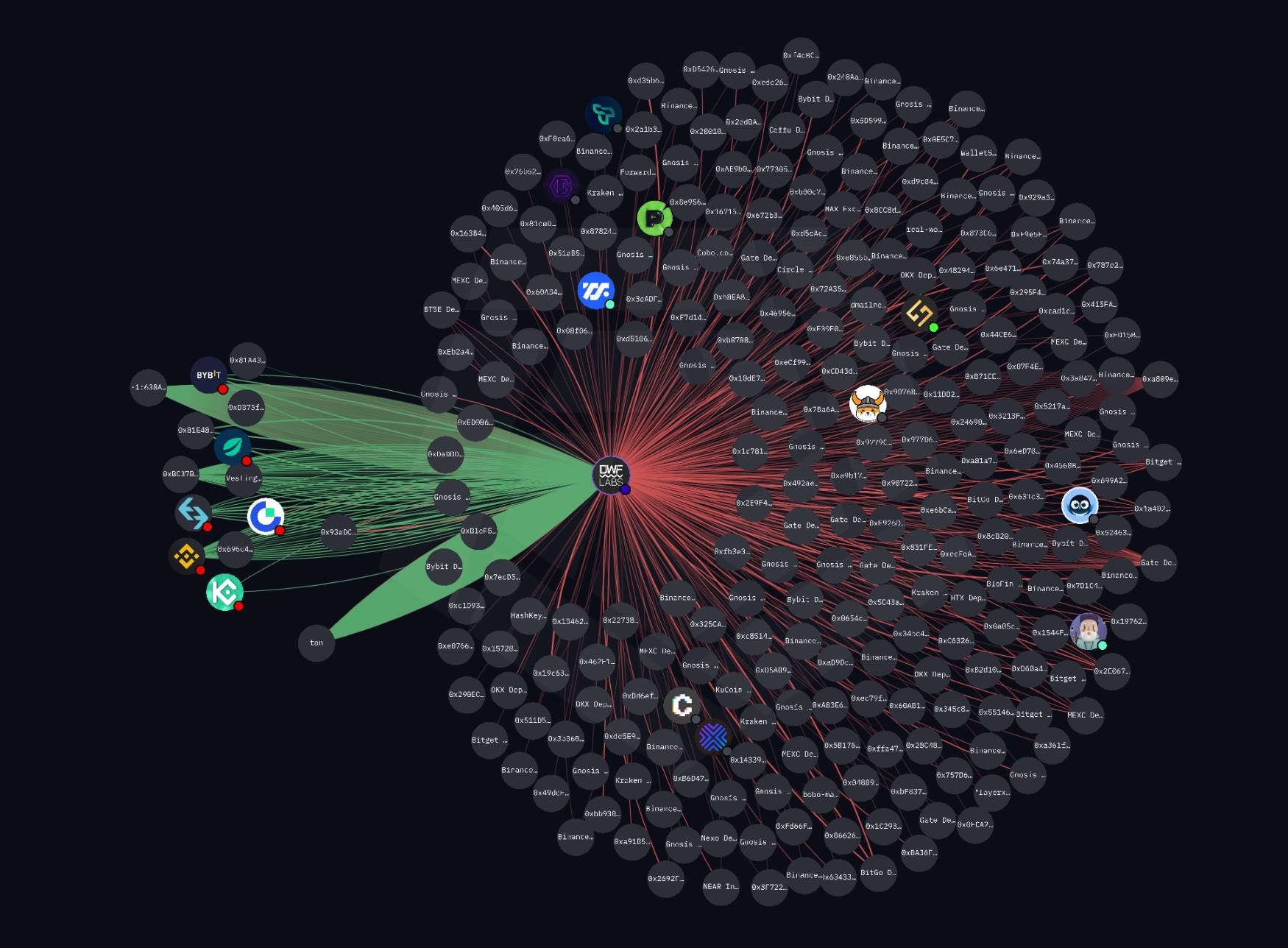

DWF primarily targets East Asian projects and various sentiment-driven narratives. Publicly available data shows it makes markets for altcoins including SOPH, MANTA, YGG, IOST, JST, MOVE, CAT, MONKEY, ID, XAI, and LADYS. Interestingly, as of now, DWF Labs’ official market-making address holds less than $9 million.

New entrants often receive Web3 VC backing or expand via trading profits. DWF Labs reinvests its own capital, becoming the most active investment firm in 2023–2024. By 2025, its “venture capital + market making + incubation” model spans multiple narratives. These funding sources enabled rapid deployment during the vacuum period—for instance, DWF Labs’ 2024 investments in AI and RWA projects demonstrated strong compounding effects.

Flexible token incentive partnerships are common, with some combining investment and market making. For example, in 2025, DWF Labs provided stablecoin support to Falcon Finance with annual returns of 12–19%, sparking bad debt controversy. GSR aggregates liquidity via 0x API, helping projects achieve efficient trading on Ethereum. Jupiter Aggregator routes optimal paths on Solana, allowing new entrants like Flow Traders to lower technical barriers. These innovations help newcomers stand out in fragmented markets, contrasting with legacy centralized models.

Controversies

The rise of market makers always brings controversy. In this cycle, none has risen faster or drawn more criticism than DWF Labs.

In September 2023, during the Token 2049 forum, co-founder Andrei Grachev tweeted gratitude for the invitation. Unexpectedly, market maker GSR fired back on Twitter, claiming it was an insult for DWF Labs to sit alongside legitimate participants like GSR, Wintermute, and OKX.

GSR lamented that at the end of 2023, bad actors like DWF Labs still received so much attention. Wintermute CEO Evgeny Gaevoy liked the tweet. More strikingly, in photos shared by GSR from the event, Andrei Grachev’s image was deliberately cropped out. Evgeny posted a thread exposing Andrei Grachev’s past, linking him to OneCoin, infamous as the largest scam in crypto history. While Evgeny mainly criticized DWF Labs’ poor investment track record, calling it a “wrong kind of market maker.”

Andrei responded in an interview with Foresight News interview, dismissing criticism: “As long as we operate correctly and legally, if a method proves effective, we’ll use it—no concern for others’ opinions, nor fear of competitors’ complaints.”

This was just one minor episode in tensions among market makers. Collusion between market makers and project teams, however, shocked investors.

In late April 2025, Layer-2 project Movement hired Web3Port as its official market maker, lending them 66 million MOVE tokens for liquidity. In practice, these tokens were transferred to an entity named Rentech, later confirmed as Web3Port’s proxy or shell company. The transfer likely involved insider fraud or knowing execution: contracts showed Rentech could profit-share by selling tokens once MOVE’s market cap hit $5 billion—creating clear incentives for price manipulation.

After MOVE’s launch, Rentech quickly manipulated the price to breach the $5 billion threshold, then dumped $38 million worth of tokens (about 5% of total supply) the next day. This caused MOVE’s price to crash—down 86% from its initial high of $1.45, with daily declines of 20–30%, wiping out tens of billions in market cap. Once exposed, the fallout spread. Internal sources indicated Movement co-founder Rushi Manche may have been involved in signing the deal. While the project claimed it was “deceived,” contract details revealed hidden intermediaries and consultants.

Ultimately, Movement Labs terminated Manche’s co-founder role and rebranded as Move Industries. Binance froze the market maker’s proceeds and banned it from providing liquidity on the exchange.

The damage, however, was irreversible. MOVE’s price fell over tenfold from its peak, devastating most investors.

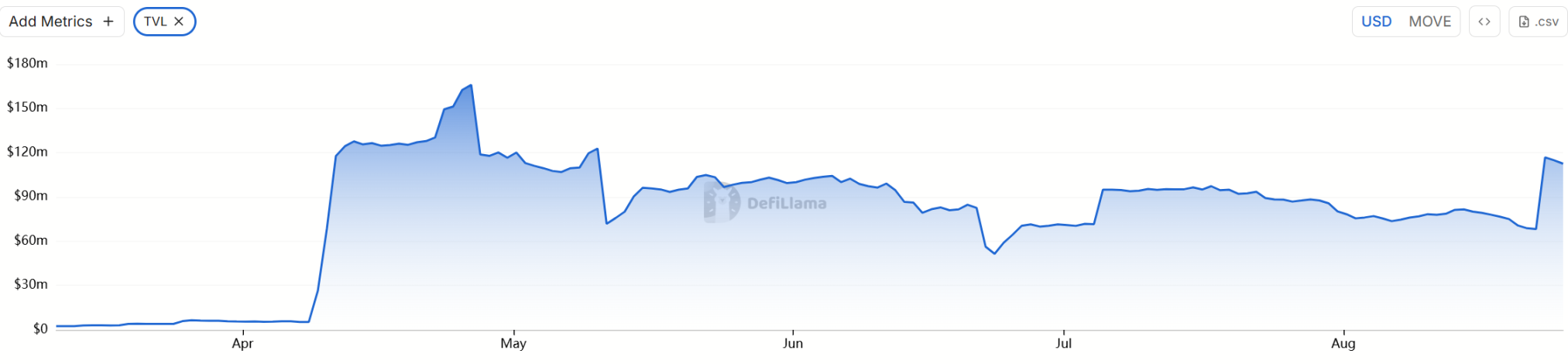

According to defiLlama, its TVL plummeted from a high of $166 million to $50 million—a drop exceeding 300%.

This notorious case exposed collusion between projects and market makers.

It also prompted industry-wide reflection. Contract and incentive design must avoid manipulative triggers like market cap thresholds, and should include clear buyback obligations and transparent audits. The Movement case shows hidden intermediaries easily enable fraud. Transparency requires projects to disclose market maker details, token transfer records, and commitments (e.g., buybacks). Delayed airdrops and unmet promises amplify trust crises, driving away communities.

New projects must also strengthen internal oversight to prevent founders from engaging in suspicious deals. Leadership integrity is vital. If a project exists only to launch a token and dump it on retail liquidity, the outcome will inevitably be mutually destructive.

Summary

When the spotlight scans the crypto trading floor, the hands truly controlling flow often hide within data streams. These “dark pool operators” of the digital finance world prefer code silently surging on-chain over public recognition. Among RootData’s latest capture of 63 active coordinates, the transaction volume of just top players can shake markets, while others like Web3Port, Kronos Research, and B2C2 weave trillion-dollar liquidity webs with algorithms.

Their offices lack triumphal arches, only ceaseless order flows; their names rarely make headlines, yet they can instantly freeze or ignite a token’s order book. When you trace the path of a mysterious large trade on-chain, you might be stepping into a carefully laid “liquidity trap” by a hidden market maker—yet this is merely the surface ripple of their vast strategic matrix.

Now, 63 known coordinates are lit—but how many unseen eyes still lurk in the dark forest?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News