Ten Questions, Ten Answers: Unpacking the Market Maker "Black Box" – Why Are VCs Jumping Into Market Making? Can Projects Really Be Backstabbed?

TechFlow Selected TechFlow Selected

Ten Questions, Ten Answers: Unpacking the Market Maker "Black Box" – Why Are VCs Jumping Into Market Making? Can Projects Really Be Backstabbed?

This article outlines common questions and reference answers regarding cryptocurrency market makers (primarily referring to market makers serving projects on CEXs).

Written by: flowie, Nianqing, ChainCatcher

Last week, Binance suddenly banned market makers, shifting the spotlight from VCs and exchanges to market makers. However, for most people, market makers remain a black box—opaque and often misunderstood. This article compiles common questions and reference answers regarding crypto market makers (primarily those serving projects on CEXs).

1. Who are the major crypto market makers?

RootData currently lists around 60 crypto market makers. Yet the actual number of market participants is likely much higher, with many operating behind the scenes.

Of these publicly listed firms, only a few are active in the public eye. Which projects a market maker participates in remains largely unknown to ordinary users.

It's difficult to clearly categorize or rank market makers, but based on on-chain total holdings, the larger players include Jump Trading, Wintermute, QCP Capital, GSR Markets, B2C2 Group, Cumberland DRW, Amber Group, and Flow Traders—names widely recognized in the industry.

2. Which market makers might be manipulative "whales"?

From an insider perspective, market makers are typically divided into active and passive types. Maxxx, Head of Ecosystem at @MetalphaPro, provided a detailed explanation on X. Recommended reading: "Confessions of a Market Maker: A Project Team’s Guide to Surviving the Dark Forest"

In short, active market makers are often what people refer to as "whales"—they collude with or betray project teams to manipulate prices and profit at the expense of retail investors. Many such actors only come to light after being investigated or sued by regulators.

Passive market makers, on the other hand, mainly place maker orders on both sides of the order book on centralized exchanges to provide liquidity. They are more neutral, do not control token prices, and use relatively standard strategies and technologies.

Due to high compliance risks, most active market makers operate anonymously.

Some active market makers may disguise themselves as investment firms or incubators.

For example, Web3port—one of the market makers recently exposed and banned by Binance—posed as an incubator, participating in 26 investments over the past year, with at least six projects having launched tokens.

Profitability can also indicate whether a firm is actively or passively making markets. According to crypto KOL @octopusycc, “profitable market-making institutions” are likely acting as whales rather than genuine market makers.

Healthy market making involves quoting bid and ask prices to maintain liquidity and price stability. Under this model, profits are slim and depend heavily on exchange incentives.

3. Which crypto market makers have been sued or investigated by regulators?

Following the 2022 crypto meltdown, crypto market makers became key targets for regulatory scrutiny. However, under Trump’s administration, regulatory loosening led to some lawsuits being dropped or settled.

The first major target was Jump Crypto. In 2023, U.S. class-action filings revealed that Tai Mo Shan Limited, a subsidiary of Jump Crypto, had colluded with Terra to manipulate the UST stablecoin during its 2022 collapse, earning nearly $1.3 billion. The SEC subsequently charged Jump with market manipulation and operating as an unregistered securities dealer. By December 2024, Tai Mo Shan agreed to pay a $123 million settlement to the SEC and has since begun rebuilding its crypto team.

Besides SEC charges, according to Fortune on June 20, 2024, the CFTC was also investigating Jump Crypto, though no formal charges were filed.

Recommended reading: "Plagued by Past Scandals, Jump's Return to Crypto Faces Awkward Challenges"

Another large market maker, Cumberland DRW, was accused by the SEC of acting as an unregistered securities dealer and earning millions illegally through trades with investors. Recently, however, the lawsuit was dismissed.

Compared to these two giants, it wasn't until October 2024 that smaller players surfaced—when the SEC, alongside the FBI and DOJ, launched a sweeping indictment against 18 individuals and entities for fraud and market manipulation in crypto. Among them were Gotbit Consulting, ZM Quant Investment, and CLS Global—mostly meme-focused market makers.

Beyond official charges, DWF Labs—a highly active crypto market maker in recent years—has been repeatedly exposed by media outlets like CoinDesk and The Block for manipulation tactics.

For instance, The Block reported that DWF managed to partner with 35% of the top 1,000 market cap tokens within just 16 months. A key reason? DWF explicitly promised clients price pumps during negotiations. Shortly after its September 2022 launch, DWF’s promotional materials heavily emphasized price action. In a section titled “Price Management,” DWF claimed it could coordinate with potential clients’ marketing teams to align token prices with specific events—commonly known as “coordinated bullish moves.”

Recommended reading: "The Block Investigates DWF Labs: Secrets Behind Its 470 Investments"

4. What are common manipulative practices among market makers?

Market maker misconduct typically manifests in two forms: harming the broader market or exploiting project teams. Common manipulative behaviors include:

-

Wash trading: Simultaneously buying and selling assets to create artificial trading volume and liquidity.

-

Fraudulent orders: Placing large buy or sell orders without intent to execute, misleading other traders and influencing asset prices.

-

Pump-and-dump schemes: Coordinating with other market participants to artificially inflate an asset’s price through aggressive buying, then selling off holdings at peak prices, causing a crash.

Examples of market harm are plentiful. Jump Crypto, fined $123 million for manipulating UST alongside Terra, and Alameda Research, which contributed to the previous bull market’s collapse, are notable cases.

Now consider a case where a project team was exploited:

In October 2024, gaming startup Fracture Labs sued Jump Trading, accusing it of executing a "pump-and-dump" scheme using its DIO token.

According to the lawsuit, in 2021, Fracture Labs partnered with Jump to list DIO on Huobi (now HTX). Fracture lent Jump 10 million DIO worth $500,000 and sent another 6 million ($300,000) to HTX. The token price surged to $0.98, increasing Jump’s borrowed stake to $9.8 million. Jump then sold all its holdings at the peak.

This massive sell-off drove DIO down to $0.005. Jump repurchased 10 million tokens for about $53,000, returned them to Fracture, and terminated the agreement.

This case illustrates the Token Loan model—a common arrangement that, despite its prevalence, frequently results in project teams being exploited.

5. What are the common collaboration models between market makers and project teams?

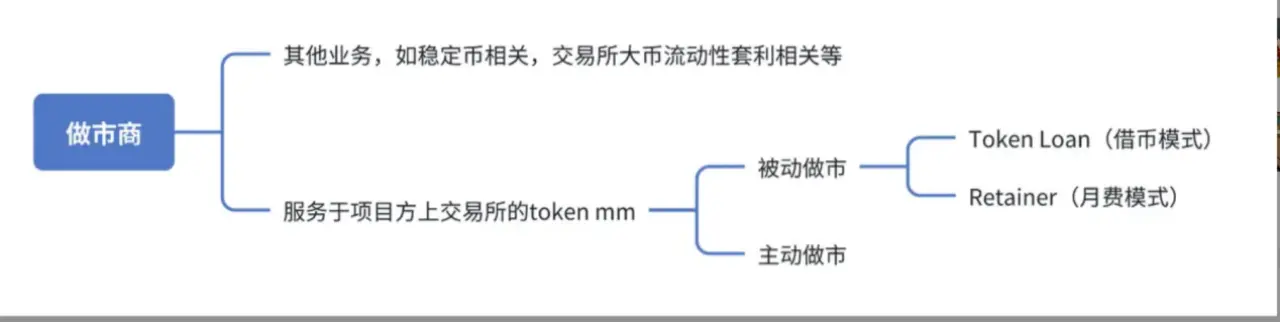

As previously mentioned, market makers fall into active and passive categories.

Active market makers often lack standardized terms. As Maxxx noted on X, agreements vary widely—covering token loans, API integration, capital matching, revenue sharing, and more. Some rogue operators even bypass communication entirely, using their own funds to accumulate tokens before taking full control.

How do market makers manipulate prices? Guangwu, founder of Canoe, once shared common institutional tactics:

-

Strong whale control: Selecting a project with acceptable fundamentals and starting operations (with or without the project team’s knowledge).

-

Accumulation phase: Quietly accumulating tokens at low prices.

-

Consensus-building phase: Focusing on volume—first pumping the price slightly, then exchanging positions with other market makers during volatility (recouping costs, improving capital efficiency, building risk models).

-

Farming phase: Further inflating the price while gradually offloading holdings; some may even support fundamental development to sustain momentum.

A second approach involves creating a value anchor for the token—using lending and derivatives to rapidly enhance perceived fundamentals. Former FTX trader @octopuuus explained that under lending models, staking FTT to borrow BTC/ETH effectively anchors FTT’s value to those assets. With leveraged recursive borrowing, one could even use borrowed BTC/ETH to pump FTT.

Recommended reading: "Inside the Whale’s Playbook: The Tangled Relationships Between Market Makers, Projects, and Exchanges"

In contrast, passive market makers offer more standardized services. The two primary models are Token Loan and monthly fee-based contracts. Token Loan is currently the most widely adopted model.

Source: Maxxx’s tweet

Under the Token Loan model, project teams lend a portion of their tokens to the market maker.

Upon contract completion, the tokens are returned based on a pre-agreed option value (the economic value of an option at a given time). For example, if 1 million USDT worth of tokens are loaned and the option value is set at 3%, the project earns $30,000 upon return—this is the market maker’s main source of income.

The benefit for project teams is gaining professional liquidity support quickly while avoiding self-operated risks.

The monthly fee model is simpler: the project does not transfer tokens. Instead, the market maker accesses the exchange via API. The project avoids counterparty risk but bears all gains and losses from order placement. Additionally, they must pay a recurring service fee.

6. How competitive is the market maker space? Why are VCs building their own market making teams?

As Maxxx pointed out, not only are market makers becoming increasingly cutthroat, but many VCs and even project teams are hastily assembling temporary market making teams—some lacking basic trading skills. But since most tokens eventually go to zero anyway, there's little concern about repayment.

The reason is clear: when token price becomes the sole product for most projects, unlocking liquidity at launch becomes the most valuable moment.

Traditionally, VCs receive early token allocations but must wait for gradual unlocks post-launch. Market makers, however, gain immediate access and flexibility at listing—giving them significant strategic advantage.

7. Why are crypto market makers investing directly?

Industry insiders suggest that top-tier projects are surrounded by competing market makers. By investing early, market makers gain access to project developments, enabling them to secure priority in future market making partnerships.

For project teams, direct investment brings immediate capital and a sense of alignment with a powerful ally. During listing, market makers can indeed provide crucial support, especially since exchanges often require proof of market making arrangements.

However, this isn’t always beneficial. Even after investing, market makers may not act in mutual interest.

Moreover, some so-called "investments" aren’t real equity stakes. As The Block reported, many in the industry view DWF’s multi-million-dollar investments in startups as essentially over-the-counter (OTC) deals. These allow startups to swap tokens for stablecoins, rather than receiving upfront cash—the DWF simply transfers tokens to exchanges afterward.

Such investment announcements have sometimes been interpreted by retail investors as bullish signals.

Beyond capital, market makers offer additional resources to win cooperation:

For DeFi projects, they may promise liquidity provisioning support.

They also facilitate connections with VCs and exchanges. For instance, introducing new investors or helping navigate exchange relationships—especially in strong-buying markets like South Korea, where some market makers offer comprehensive "full-cycle liquidity planning."

8. Why do most project teams work with multiple market makers?

Understanding the risk of overreliance, project teams often engage three or four market makers, distributing initial liquidity to reduce the chance of manipulation by any single party.

But as the saying goes, “too many cooks spoil the broth.” This approach carries its own risks. Industry sources note that some market makers may become complacent, and without transparent monitoring tools, project teams struggle to supervise or hold them accountable.

9. Do market makers really have that much power to cause harm?

A 2022 Forbes study analyzing 157 cryptocurrency exchanges found that over half of reported Bitcoin trading volume consisted of fake or non-economic wash trades.

As early as 2019, Bitwise Asset Management submitted a whitepaper to the U.S. SEC showing that 95% of Bitcoin trading volume across 83 analyzed exchanges was either fake or non-economic—a finding that sparked widespread industry concern over market maker behavior.

Market makers may not be the root cause, but they are certainly the primary instruments enabling manipulation.

As service providers, market makers are less the perpetrators and more the tools. The real drivers lie in the demands of exchanges and project teams.

During bull markets, the entire ecosystem collaborates to generate massive profits, maintaining surface-level harmony. But in bear markets, this system accelerates liquidity crises, reigniting blame games and public disputes.

Market makers aren’t solely to blame for liquidity droughts. While they directly enable “false prosperity,” the full chain of responsibility includes project teams, VCs, KOLs, and farming syndicates.

10. Why is it so hard to constrain malicious behavior by market makers?

Lack of regulation is indeed a core reason, but equally important is the inability of counterparties—project teams and exchanges—to effectively monitor or restrict market maker actions.

Given the opacity of market maker activities, the industry lacks clear, unified standards. Project teams struggle to supervise operations, and when misconduct occurs, they often resort to post-hoc legal action—which is usually ineffective.

Industry experts note that aside from on-chain data, only centralized exchanges can monitor market maker behavior. Although project teams may agree on monitoring methods with market makers, once tokens are transferred, they must rely heavily on the latter’s reputation and ethics.

Alternatively, project teams can opt for the monthly fee model, which typically uses short-term contracts (monthly settlements), allowing flexible adjustments based on performance. Teams can also negotiate KPIs (e.g., minimum daily volume, maximum spread limits) to ensure service quality. However, this shifts financial risk back onto the project team, which must absorb any losses.

While contracts may include clauses for breach-of-contract liability, proving such breaches remains challenging. Project teams need solid evidence, and even with trade records, establishing causation—that market maker actions directly caused a price crash—requires extensive data analysis, which is costly and time-consuming in litigation. Market makers can always argue that external factors (macroeconomic events, investor panic) were responsible.

The process involves multiple parties—exchanges, projects, market makers—and market maker actions are rarely fully transparent to project teams or the public.

Additionally, due to the symbiotic relationship between centralized exchanges and market makers, exchanges are unlikely to aggressively penalize their biggest contributors. Therefore, Binance’s decision to freeze accounts involved in the GPS and SHELL incidents—and publicly disclose evidence and manipulation methods—was groundbreaking. By proactively revealing wrongdoing and taking action, Binance not only responded to regulatory pressure but also demonstrated industry self-regulation. This could inspire other exchanges to follow suit, potentially setting a new precedent for user protection.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News