MM on the Move 1: Market Maker Inventory Quotation System

TechFlow Selected TechFlow Selected

MM on the Move 1: Market Maker Inventory Quotation System

Unveiling the mystery behind the "dog lord" conspiracy.

Author: Dave

Has anyone ever experienced this: after you buy a meme coin, the price immediately moves in the opposite direction, as if the market makers were specifically targeting you? Why does this happen? Is it really some kind of conspiracy?

This post will explain market makers' quoting systems and demystify the so-called "market maker conspiracy." First, the conclusion: prices often moving against us isn't due to intentional manipulation, but rather Inventory-based pricing quote skew under the Avellaneda–Stoikov model, along with protective mechanisms for handling toxic flow. How exactly? Once upon a time…

First, let's understand the concept of inventory. As most know, market makers aren't directional investors. With strict hedging, spot price movements should have no impact on their overall PnL. In this case, holding inventory is a "passive" behavior. Changes in inventory lead to larger positions—the more position held, the greater the risk exposure to adverse price moves. When retail traders place buy/sell orders causing inventory shifts, market makers react to the risks introduced by these inventory changes.

In short: you disrupt their balance, so MM has to protect itself and tries to return to equilibrium. The tool for self-protection is the quoting system.

1. Quote Skew

When you aggressively buy from MM, it’s equivalent to MM selling heavily, leaving them with short inventory exposure. What does MM want now? (1) Replenish inventory quickly. (2) Protect the exposed short position.

So MM reacts by lowering prices—to attract sellers, prevent further buying, and keep their net short position temporarily unprofitable, giving them time to hedge.

2. Spread Widening

When inventory deteriorates further, MM not only skews prices but also widens the spread, reducing the probability of trades.

Their goal is to reduce execution risk per unit of time, while earning more profit via wider spreads to offset potential losses from price moves.

Every additional math formula in an article loses 10% of readers, but just in case someone wants some hardcore content, here's a brief look at how quotes are formed (the mathematical logic behind the above price adjustments).

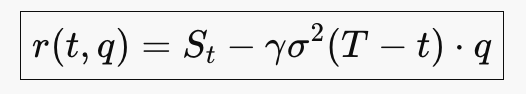

The price at which we trade with MM is called the Reservation Price, derived from the Inventory-based pricing model:

Reservation Price = Mid price − γ⋅q

q: current inventory

gamma γ: risk aversion coefficient

Actually, the full Reservation Price formula looks like this, but I don’t want to disgust everyone, so just a glimpse is enough:

When retail traders buy or sell heavily, q changes significantly, causing large shifts in the quoted Reservation Price. The exact amount comes from the Avellaneda–Stoikov model. You can guess—since small inventory changes drive this, it’s modeled using a partial differential equation. Want to know something? I have zero interest in deriving that equation either. So we just need to know the core conclusion:

Optimal quotes are symmetrically set around the Reservation Price. Inventory naturally reverts to zero. Optimal spread widens with increasing risk.

If you didn't understand the above, it's fine. Just grasp this: when price moves against bullish retail sentiment after their buys, it's essentially because our order flow changed the market’s risk pricing. The reason retail traders frequently face this is:

• Retail traders are almost always aggressive takers

• Orders are size-concentrated and timing is obvious

• No hedging

• No time-splitting or order slicing

In small meme coins, this effect is even worse due to poor liquidity. Often, your order is one of the few aggressive trades within a 5-minute window. In major assets, natural hedging might occur, but in small-cap coins, you become the direct counterparty to the market maker.

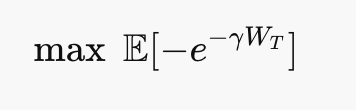

So professional MM isn't trying to blow you up, but rather aims to maxE[Spread Capture] − Inventory Risk − Adverse Selection. Actually, their objective function looks exactly like this—with inventory risk exponentially penalized:

If you've made it this far, you're clearly a retail trader with dreams of becoming a market maker. So to encourage brave souls, here's a small trick leveraging the quoting mechanism. We said retail traders are often size-concentrated and timing-obvious—so just reverse that. Suppose Dave wants to go long with 1000u. Instead of going all-in at once, mimic the MM approach: first buy 100u. The quoting system will then lower prices, allowing you to accumulate at cheaper levels. Buy another 100u, and the price drops again—your average entry cost becomes much lower than a single all-in trade.

This only tells half the story of retail misfortune. Beyond inventory-driven pricing, MM’s handling of order flow is another key factor behind price divergence—namely, the “toxic flow” mentioned at the beginning. In the next post, I'll dive into market makers’ order books and order flow, and speculate on the micro-market structure behind the 1011 crash.

To find out what happens next, stay tuned for the next episode.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News