Galaxy's 26 Predictions: Bitcoin Will Still Hit ATH Next Year, Reach $250,000 the Following Year

TechFlow Selected TechFlow Selected

Galaxy's 26 Predictions: Bitcoin Will Still Hit ATH Next Year, Reach $250,000 the Following Year

Solana's internet capital market cap will surge to $2 billion (currently around $750 million).

Author: Galaxy

Translation: TechFlow

Introduction

Somewhat underwhelmingly, Bitcoin appears poised to end 2025 at roughly the same price level as it began the year.

In the first ten months of the year, the cryptocurrency market experienced a genuine bull wave. Regulatory reforms progressed, ETFs continued attracting inflows, and on-chain activity increased. Bitcoin (BTC) hit an all-time high on October 6, reaching $126,080.

However, the market's euphoria failed to deliver a breakout, instead defined by rotation, repricing, and realignment. A combination of macroeconomic disappointments, shifting investment narratives, leverage liquidations, and massive whale selling unbalanced the market. Prices declined, confidence cooled, and by December, BTC had fallen back to just above $90,000—though the journey was far from smooth.

Although 2025 may conclude with price declines, the year still witnessed genuine institutional adoption and laid the groundwork for real-world deployment in 2026. We expect stablecoins to surpass traditional payment networks, asset tokenization to emerge in mainstream capital and collateral markets, and enterprise-grade Layer-1 chains (L1s) to transition from pilots to actual settlement in the coming year. Additionally, we anticipate public blockchains will rethink their value capture mechanisms, DeFi and prediction markets will continue expanding, and AI-driven payments will finally materialize on-chain.

Below are Galaxy Research’s 26 predictions for the 2026 crypto market, along with a review of last year’s forecasts.

2026 Predictions

Bitcoin Price

Bitcoin will reach $250,000 by the end of 2027.

The 2026 market is too chaotic to predict with certainty, but Bitcoin still has a chance to set new highs that year. Current options markets show roughly equal probabilities of Bitcoin reaching $70,000 or $130,000 by mid-year 2026, and similarly balanced odds of hitting $50,000 or $250,000 by year-end. These wide price ranges reflect short-term uncertainty. At the time of writing, the broader crypto market is deep in bear territory, and Bitcoin has yet to reestablish bullish momentum. We believe downside risks persist until Bitcoin regains solid footing in the $100,000–$105,000 range. Broader financial market factors add further uncertainty, such as the pace of AI capital expenditures, monetary policy conditions, and the U.S. midterm elections in November.

Over the past year, we've observed a structural decline in Bitcoin's long-term volatility—partly due to the introduction of larger-scale covered options/BTC yield-generating programs. Notably, Bitcoin's volatility curve now prices implied volatility for puts higher than calls, which wasn't the case six months ago. In other words, we're evolving from the skew typical of emerging, growth-oriented markets toward something closer to traditional macro assets.

This maturation trend may continue regardless of whether Bitcoin falls further toward its 200-week moving average. The asset class’s maturity and institutional adoption keep rising. 2026 might be a relatively quiet year for Bitcoin; whether it ends at $70,000 or $150,000, our long-term bullish conviction only strengthens. With increasing institutional access, looser monetary policy, and growing demand for non-dollar hedges, Bitcoin is likely to follow gold’s path over the next two years and gain broad acceptance as a hedge against currency devaluation.

—Alex Thorn

Layer-1 and Layer-2

Solana’s internet capital markets will surge to a $2 billion market cap (currently around $750 million).

Solana’s on-chain economy is maturing, shifting from meme-driven activity to becoming a successful launchpad for revenue-focused business models. This shift is driven by improvements in Solana’s market structure and rising demand for tokens with fundamental value. As investors increasingly favor sustainable on-chain businesses over fleeting meme cycles, internet capital markets will become a core pillar of Solana’s economic activity.

—Lucas Tcheyan

At least one general-purpose Layer-1 blockchain will embed revenue-generating applications that directly benefit its native token.

As more projects rethink how L1s capture and sustain value, blockchains are moving toward more functionally explicit designs. The success of Hyperliquid embedding revenue models within its perpetuals exchange, alongside the trend of economic value capture shifting from protocol to application layers (“fat app theory”), is reshaping expectations for neutral base layers. More chains are exploring whether certain revenue-generating infrastructure should be built directly into the protocol to strengthen tokenomics. Ethereum founder Vitalik Buterin recently called for low-risk, economically meaningful DeFi to prove ETH’s value—a sign of pressure facing L1s. MegaEth plans to launch a native stablecoin returning revenue to validators, while Ambient’s AI-focused L1 intends to internalize inference fees. These examples show blockchains becoming more willing to control and monetize key applications. In 2026, a major L1 may formally embed revenue-generating apps at the protocol layer and direct those economics to its native token.

—Lucas Tcheyan

Solana’s inflation reduction proposal will not pass in 2026, and the current proposal SIMD-0411 will be withdrawn.

Solana’s inflation rate has been a point of community debate over the past year. Although a new inflation reduction proposal (SIMD-0411) was introduced in November 2025, consensus on the best solution remains elusive. Instead, a growing view holds that the inflation debate distracts from more important priorities—such as implementing microstructural reforms on Solana’s markets. Additionally, changes to SOL’s inflation policy could affect its future market perception as a neutral store of value and monetary asset.

—Lucas Tcheyan

Enterprise-grade L1s will move from pilot stages to real settlement infrastructure.

At least one Fortune 500 bank, cloud provider, or e-commerce platform will launch a branded enterprise L1 blockchain in 2026, settling over $1 billion in real economic activity while running production-grade bridges connected to public DeFi. Previous enterprise chains were mostly internal experiments or marketing initiatives. The next wave will resemble application-specific base layers designed for specific verticals, where validation layers are permissioned by regulated issuers and banks, while public chains handle liquidity, collateral, and price discovery. This will further highlight the divergence between neutral public L1s and enterprise L1s integrated with issuance, settlement, and distribution functions.

—Christopher Rosa

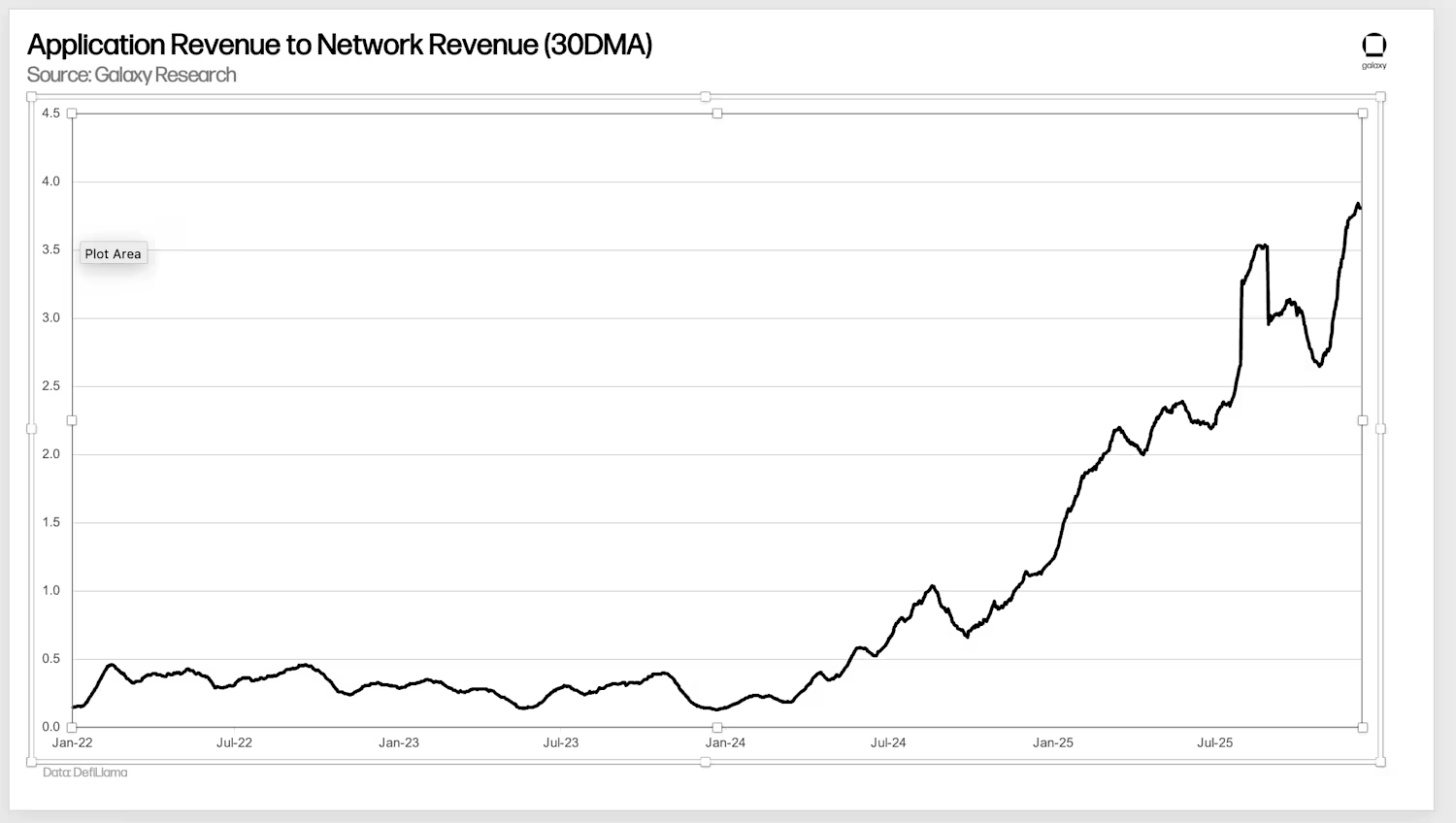

The ratio of application-layer revenue to network-layer revenue will double by 2026.

As trading, DeFi, wallets, and emerging consumer apps continue dominating on-chain fee generation, value capture is shifting from the base layer to the application layer. Meanwhile, networks are structurally reducing MEV (miner extractable value) leakage and pursuing fee compression on both L1 and L2, shrinking the revenue base for infrastructure layers. This will accelerate value capture at the application layer, allowing “fat app theory” to further surpass “fat protocol theory.”

—Lucas Tcheyan

Stablecoins and Asset Tokenization

The U.S. Securities and Exchange Commission (SEC) will provide some form of exemption for the use of tokenized securities in DeFi.

The SEC will offer some form of exemption enabling the development of on-chain tokenized securities markets. This could come in the form of a so-called "no-action letter" or a new "innovation exemption," a concept repeatedly mentioned by SEC Chair Paul Atkins. This would allow legitimate, non-wrapped on-chain securities to enter DeFi markets—not just limited to recent DTCC-style no-action letters applying blockchain tech to back-office capital market operations. Formal rulemaking is expected to begin in the second half of 2026, setting rules for brokers, dealers, exchanges, and other traditional market participants using crypto or tokenized securities.

—Alex Thorn

The SEC will face lawsuits from traditional market participants or industry groups over its “innovation exemption” program.

Whether trading firms, market infrastructure providers, or lobbying groups, parts of traditional finance or banking will challenge regulators’ granting of exemptions to DeFi applications or crypto companies, arguing they failed to establish comprehensive rules governing the expansion of tokenized securities.

—Alex Thorn

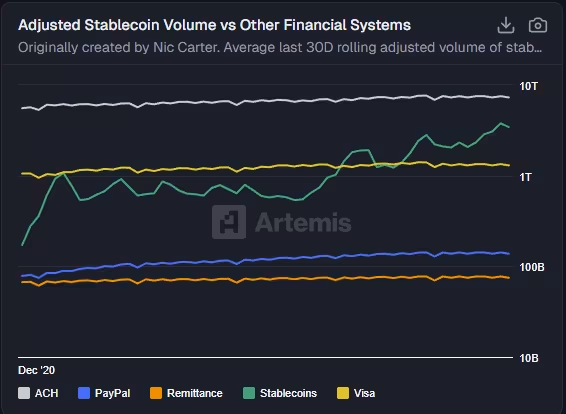

Stablecoin transaction volume will surpass the ACH system.

Compared to traditional payment systems, stablecoins circulate significantly faster. We’ve already seen stablecoin supply grow at a 30%-40% CAGR annually, with transaction volume rising accordingly. Stablecoin transaction volume has already surpassed major credit card networks like Visa and currently handles about half the volume of the Automated Clearing House (ACH) system. With the GENIUS Act’s definition finalized in early 2026, we may see stablecoin growth outpace historical averages, as existing stablecoins continue expanding and new entrants compete for a growing market share.

—Thad Pinakiewicz

Stablecoins collaborating with traditional finance (TradFi) will accelerate integration.

Despite the launch of many U.S. stablecoins in 2025, the market struggles to support numerous widely used options. Consumers and merchants won’t use multiple digital dollars simultaneously—they’ll gravitate toward one or two with the broadest acceptance. We’re already seeing this consolidation trend in major institutions’ partnerships: nine leading banks (including Goldman Sachs, Deutsche Bank, Bank of America, Santander, BNP Paribas, Citigroup, MUFG, TD Bank Group, and UBS) are exploring plans to launch G7-currency-based stablecoins; PayPal and Paxos partnered to launch PYUSD, combining a global payments network with a regulated issuer.

These cases show success depends on distribution scale—the ability to access banks, payment processors, and enterprise platforms. More stablecoin issuers are expected to collaborate or integrate systems to compete for meaningful market share.

—Jianing Wu

A major bank or broker will accept tokenized stocks as collateral.

To date, tokenized stocks remain marginal, limited to DeFi experiments and private blockchains piloted by major banks. But core TradFi infrastructure providers are now accelerating their shift toward blockchain-based systems, with growing regulatory support. In the coming year, we may see a major bank or broker begin accepting tokenized stocks as on-chain deposits, treating them as fully equivalent to traditional securities.

—Thad Pinakiewicz

Card payment networks will connect to public blockchains.

At least one of the world’s top three card payment networks will settle over 10% of its cross-border transaction volume via public chain stablecoins in 2026, even if most end-users don’t interact with crypto interfaces. Issuers and acquirers will still display balances and liabilities in traditional formats, but behind the scenes, part of the net settlement between regional entities will occur via tokenized dollars, reducing settlement cutoff times, pre-funding requirements, and correspondent banking risk. This development will make stablecoins a core financial infrastructure for existing payment networks.

—Christopher Rosa

DEFI

Decentralized exchanges (DEXs) will account for over 25% of spot trading volume by the end of 2026.

While centralized exchanges (CEXs) still dominate liquidity and user onboarding, structural shifts are driving more spot trading activity on-chain. DEXs have two clear advantages: KYC-free access and more economically efficient fee structures, making them increasingly attractive to users and market makers seeking lower friction and higher composability. Currently, DEX spot trading volume accounts for about 15%-17%, depending on data sources.

—Will Owens

DAO treasuries governed by futarchy models will exceed $500 million in assets.

Building on our prediction from a year ago that futarchy (prediction markets) as a governance mechanism would see wider adoption, we now believe it has proven effective enough in practice for decentralized autonomous organizations (DAOs) to adopt it as their sole decision-making system for capital allocation and strategic direction. Therefore, we expect DAO treasuries governed by futarchy models to collectively exceed $500 million in assets by the end of 2026. Currently, about $47 million in DAO treasury assets are fully governed by futarchy. We believe this growth will primarily come from newly formed futarchy DAOs, though existing ones will also contribute.

—Zack Pokorny

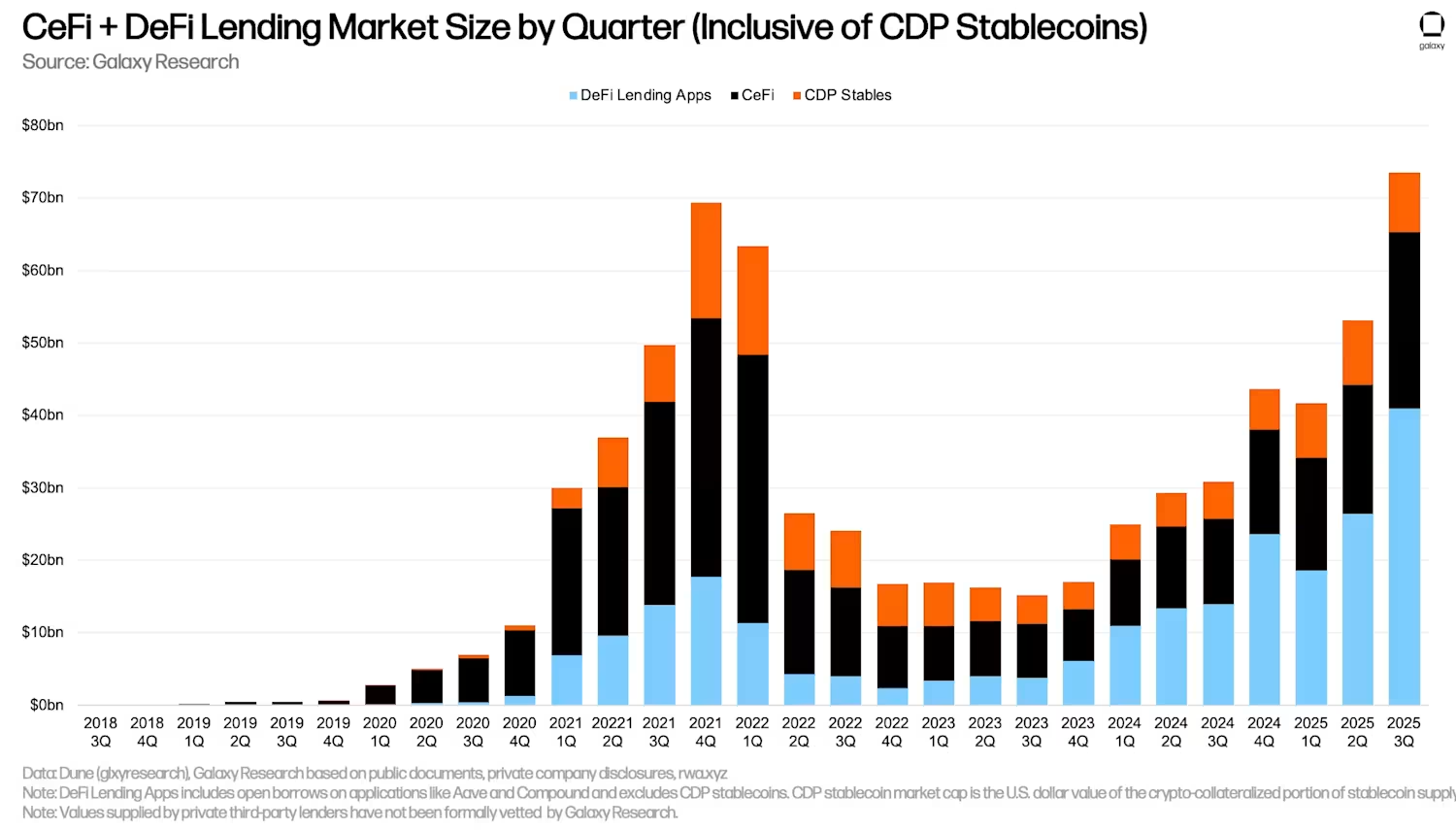

Total outstanding crypto-backed loans will surpass $90 billion in quarterly snapshots.

Continuing 2025’s momentum, total crypto-backed loans in both DeFi and CeFi are expected to expand further in 2026. On-chain dominance (the share of loans originated through decentralized platforms) will keep rising, as institutional participants increasingly rely on DeFi protocols for borrowing activities.

—Zack Pokorny

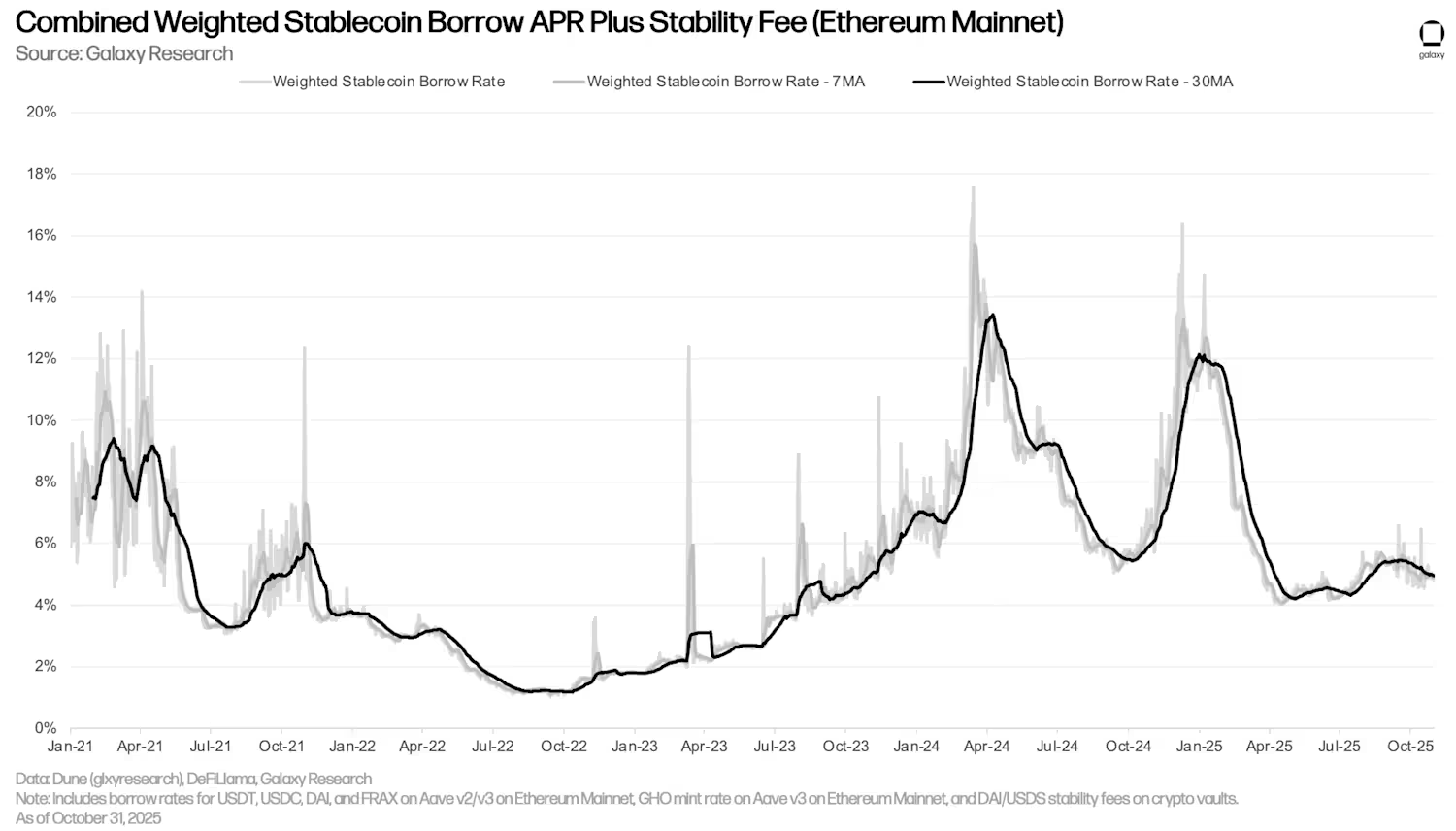

Stablecoin interest rate volatility will remain mild, and DeFi borrowing costs will not exceed 10%.

With growing institutional participation in on-chain lending, we expect deeper liquidity and more stable, slower-moving capital to significantly reduce interest rate volatility. Simultaneously, arbitrage between on-chain and off-chain rates becomes easier, while access barriers to DeFi rise. Off-chain rates are expected to fall further in 2026, keeping on-chain lending rates low—even during bull markets, off-chain rates will serve as a key floor.

The core points are:

(1) Institutional capital brings stability and persistence to DeFi markets;

(2) Falling off-chain rate environments will keep on-chain rates below typical expansion-era levels.

—Zack Pokorny

The total market cap of privacy coins will exceed $100 billion by the end of 2026.

In Q4 2025, privacy coins gained significant market attention as investors placed more funds on-chain, bringing on-chain privacy into focus. Among the top three privacy coins, Zcash rose about 800% that quarter, Railgun up about 204%, and Monero a more modest 53%. Early Bitcoin developers, including pseudonymous founder Satoshi Nakamoto, once explored ways to make transactions more private or even fully anonymous, but practical zero-knowledge technologies weren’t widely available or deployable at the time.

As more funds are held on-chain, users—especially institutions—are questioning whether they truly want their crypto balances fully visible. Whether fully anonymous designs or mixer-style approaches ultimately prevail, we expect the total market cap of privacy coins to exceed $100 billion by the end of 2026, compared to approximately $63 billion on CoinMarketCap today.

—Christopher Rosa

Polymarket’s weekly trading volume will consistently exceed $1.5 billion in 2026.

Prediction markets have become one of the fastest-growing categories in crypto, with Polymarket’s weekly notional volume already nearing $1 billion. We expect this figure to stabilize above $1.5 billion in 2026, driven by new capital-efficient layers boosting liquidity and AI-driven order flow increasing trade frequency. Polymarket’s distribution capabilities are also improving, accelerating capital inflows.

—Will Owens

TradFi

More than 50 spot altcoin ETFs and another 50 crypto ETFs (excluding single-spot-token products) will launch in the U.S.

With the SEC approving generic listing standards, we expect the pace of spot altcoin ETF launches to accelerate in 2026. In 2025, over 15 spot ETFs for Solana, XRP, Hedera, Dogecoin, Litecoin, and Chainlink went live. We expect other major assets to soon follow with spot ETF filings. Beyond single-asset products, we also anticipate multi-asset crypto ETFs and leveraged crypto ETFs will launch. With over 100 applications underway, 2026 is expected to see a steady stream of new product launches.

—Jianing Wu

Net inflows into U.S. spot crypto ETFs will exceed $50 billion.

In 2025, U.S. spot crypto ETFs attracted $23 billion in net inflows. With deepening institutional adoption, we expect this number to accelerate in 2026. As financial services firms lift restrictions on advisor recommendations of crypto products, and previously cautious major platforms (like Vanguard) join crypto funds, inflows into Bitcoin and Ethereum will surpass 2025 levels and enter more investor portfolios. Additionally, the launch of numerous new crypto ETFs—especially spot altcoin products—will unlock pent-up demand and drive additional inflows during initial distribution phases.

—Jianing Wu

A major asset allocation platform will include Bitcoin in its standard model portfolio.

After three of the four major financial services firms (Wells Fargo, Morgan Stanley, and Bank of America) lifted restrictions on advisors recommending Bitcoin and supported 1%-4% allocations, the next step is listing Bitcoin products on recommended lists and including them in formal research coverage—significantly boosting visibility among clients. The ultimate goal is incorporating Bitcoin into model portfolios, which typically requires higher fund AUM and sustained liquidity, but we expect Bitcoin funds will meet these thresholds and enter model portfolios with a 1%-2% strategic weight.

—Jianing Wu

More than 15 crypto companies will IPO or uplist in the U.S.

In 2025, 10 crypto-related companies (including Galaxy) successfully IPO’d or uplisted in the U.S. Since 2018, over 290 crypto and blockchain companies have completed private financings above $50 million. With easing regulatory conditions, we believe a large number of companies are now ready to pursue U.S. listings to access American capital markets. Among the most likely candidates, we expect CoinShares (if not listed in 2025), BitGo (already filed), Chainalysis, and FalconX to move toward IPO or uplisting in 2026.

—Jianing Wu

More than five digital asset treasury companies (DATs) will be forced to sell assets, get acquired, or shut down completely.

In Q2 2025, DATs experienced a wave of formation. Starting in October, their market net asset value (mNAV) multiples began compressing. At the time of writing, Bitcoin, Ethereum, and Solana DATs trade at an average mNAV below 1. During the initial frenzy, many companies across different business lines rapidly pivoted to become DATs to capitalize on favorable fundraising conditions. The next phase will separate durable DATs from those lacking coherent strategy or asset management capability. To succeed in 2026, DATs need robust capital structures, innovative liquidity and yield-generation strategies, and strong synergies with relevant protocols (if not already established). Scale advantages (like Strategy’s large Bitcoin holdings) or geographic edges (like Japan’s Metaplanet) may offer extra competitiveness. However, many early-market DATs lacked sufficient strategic planning. These DATs will struggle to maintain mNAV and may be forced to sell assets, get acquired by larger players, or in worst cases, shut down entirely.

—Jianing Wu

Policy

Some Democrats will focus on “debanking” issues and gradually embrace crypto as a solution.

Though unlikely, this scenario is worth noting: In late November 2025, FinCEN, a unit of the U.S. Treasury, urged financial institutions to “be alert to suspicious activities related to cross-border transfers involving illegal immigration.” While the warning emphasized risks like human and drug trafficking, it also noted that money service businesses (MSBs) must file suspicious activity reports (SARs), including for cross-border transfers linked to income from illegal employment. This could cover remittances sent home by undocumented immigrants (e.g., plumbers, farm workers, or restaurant staff)—groups whose work violates federal law but who enjoy sympathy among left-leaning voters.

This warning followed an earlier FinCEN Geographic Targeting Order (GTO) requiring MSBs to automatically report cash transactions in designated border counties above $1,000 (far below the $10,000 threshold for Currency Transaction Reports). These measures expand the scope of everyday financial behaviors that could trigger federal reporting, increasing the risk of frozen funds, denial of service, or other forms of financial exclusion for immigrants and low-income workers. These developments may lead some immigrant-supporting Democrats to grow more sympathetic to “debanking” issues (a concern previously championed mainly by the right) and more open to permissionless, censorship-resistant financial networks.

Conversely, populist, bank-friendly, and law-and-order Republicans may begin viewing crypto less favorably for similar reasons, despite strong support from the Trump administration and Republican innovators. Ongoing efforts by federal banking regulators to modernize the Bank Secrecy Act and anti-money laundering compliance will further spotlight the inherent trade-offs between financial inclusion goals and crime reduction—with different political factions assigning different priorities to these trade-offs. If this political realignment occurs, it will prove blockchains don’t belong to fixed ideological camps. Their permissionless design means acceptance or opposition isn’t based on ideology, but on how they impact the political priorities of different groups in different eras.

—Marc Hochstein

The U.S. will launch federal investigations into insider trading or match-fixing related to prediction markets.

With U.S. regulators allowing on-chain prediction markets to operate, their trading volumes and open interest have surged. At the same time, several scandals have emerged, including insiders allegedly using private information to front-run markets and federal raids on match-fixing rings within major sports leagues. With traders able to participate pseudonymously without going through KYC-required betting platforms, insiders are now more tempted to exploit privileged information or manipulate outcomes. As a result, we may see investigations triggered by anomalous price movements in on-chain prediction markets, rather than routine monitoring of traditional regulated sports betting platforms.

—Thad Pinakiewicz

AI

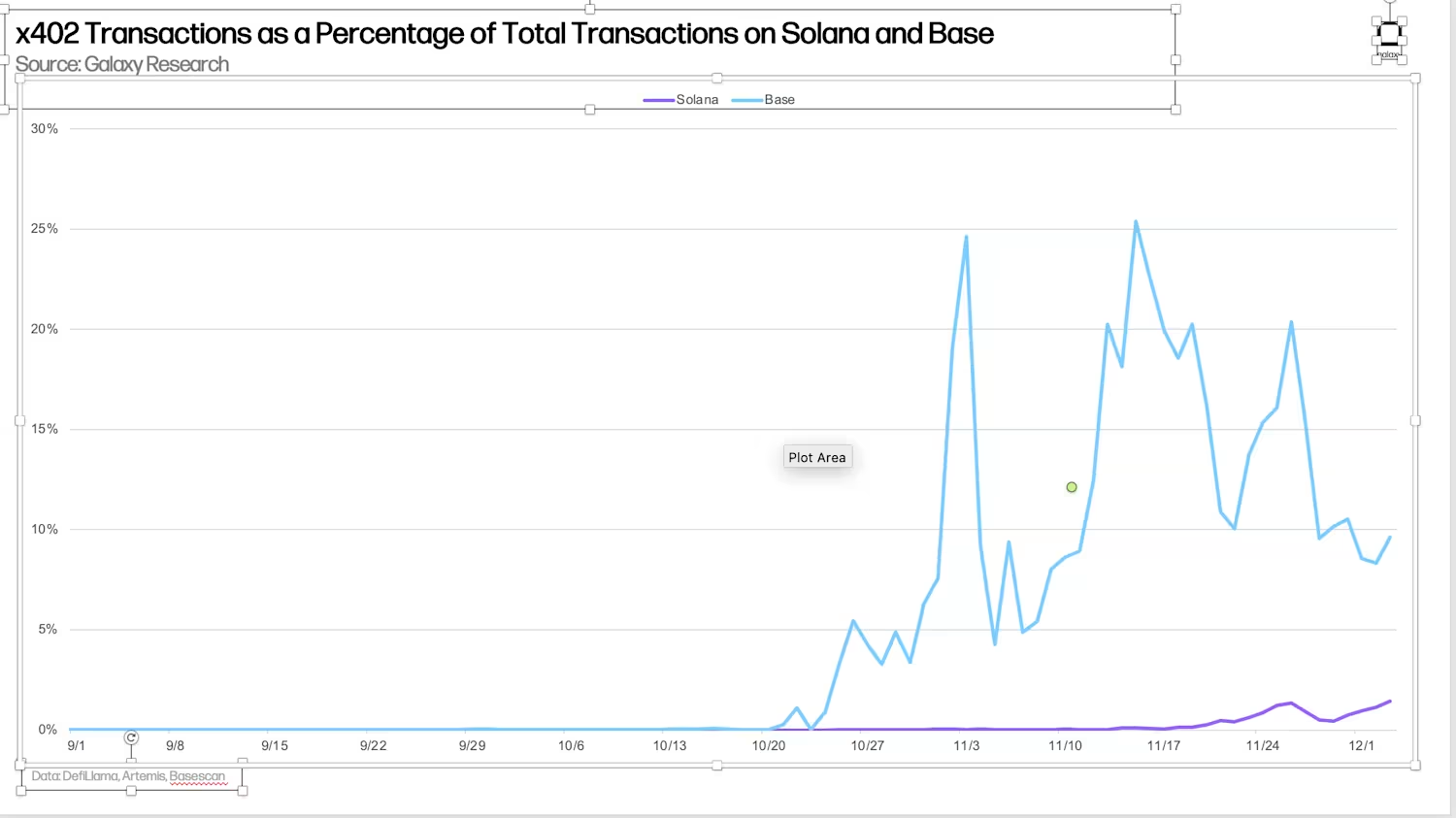

Payments based on the x402 standard will account for 30% of Base’s daily transaction volume and 5% of Solana’s non-voting transaction volume, marking widespread adoption of agent-based on-chain interactions.

With smarter AI agents, continued stablecoin adoption, and improved developer tools, x402 and other agent-based payment standards will drive a larger share of on-chain activity. As AI agents increasingly transact autonomously across services, standardized payment primitives will become core components of the execution layer.

Base and Solana have emerged as leaders in this space—Base benefits from Coinbase’s central role in creating and promoting the x402 standard, while Solana stands out due to its large developer community and user base. Additionally, we expect emerging payment-dedicated blockchains like Tempo and Arc to grow rapidly as agent-driven business models develop.

—Lucas Tcheyan

Reviewing 2025 Predictions: Wins and Losses in Bitcoin and Crypto Markets

At the end of 2024, optimism about Bitcoin and crypto’s future was boundless. The incoming presidential administration promised to end the Biden-era “regulation by enforcement,” and President-elect Trump vowed to make the U.S. the “crypto capital of the world.” One month before his second inauguration, being long Bitcoin became the hottest trade globally.

On December 31, 2024, we published 23 predictions for 2025, expecting further expansion in market breadth and narratives. Some predictions were spot-on, others missed badly. For many, our team got the direction right but not the timing or magnitude. From the revival of on-chain revenue sharing to the expanded role of stablecoins and steady institutional adoption, the broad trends we identified continue evolving.

Below, we review our 23 predictions for 2025 and assess their accuracy. If there was one theme we underestimated in 2025, it was the surge in digital asset treasury companies (DATs). Though the hype peaked briefly in summer 2025, its impact cannot be ignored. We evaluate our successes and failures rigorously and provide commentary where appropriate.

Bitcoin

❌ Bitcoin will break $150,000 in the first half of 2025 and test or exceed $185,000 in Q4.

Result: Bitcoin failed to break $150,000 but reached a new high of $126,000. In November, we revised our year-end target down to $125,000. At the time of writing, Bitcoin trades between $80,000 and $90,000, making it unlikely to reach our updated 2025 year-end target.

—Alex Thorn

❌ In 2025, the combined AUM of U.S. spot Bitcoin ETPs will exceed $250 billion.

Result: As of November 12, AUM reached $141 billion, up from $105 billion on January 1, but fell short of our forecast.

—Alex Thorn

❌ In 2025, Bitcoin will again be one of the top-performing assets globally on a risk-adjusted basis.

Result: This prediction was accurate in the first half of 2025. As of July 14, Bitcoin’s year-to-date Sharpe ratio was 0.87, exceeding the S&P 500, Nvidia, and Microsoft. However, Bitcoin is expected to finish the year with a negative Sharpe ratio, failing to rank among the top performers.

—Alex Thorn

✅ At least one top wealth management platform will announce a recommended allocation of 2% or more to Bitcoin.

Result: Morgan Stanley, one of the four major financial services firms, lifted restrictions on advisors allocating Bitcoin to any account. That same week, Morgan Stanley published a report suggesting up to 4% Bitcoin allocation in portfolios. Additionally, the Digital Assets Council of Financial Professionals, led by Ric Edelman, released a report recommending 10%-40% Bitcoin allocation. Ray Dalio, founder of Bridgewater Associates, also suggested allocating 15% to Bitcoin and gold. —Alex Thorn

❌ Five Nasdaq 100 companies and five nations or sovereign wealth funds will announce Bitcoin additions to their balance sheets.

Result: Currently, only three Nasdaq 100 index companies hold Bitcoin. However, around 180 companies globally hold or have announced plans to buy cryptocurrencies into their balance sheets, involving over 10 different tokens. More than five countries have invested in Bitcoin through official reserves or sovereign funds, including Bhutan, El Salvador, Kazakhstan, the Czech Republic, and Luxembourg. The DAT trend was one of the primary institutional forces behind crypto purchases in 2025, especially in Q2.

—Jianing Wu

❌ Bitcoin developers will reach consensus on the next protocol upgrade in 2025.

Result: Not only did developers fail to reach consensus on the next protocol upgrade, but controversy also emerged within the Bitcoin developer ecosystem over how to treat non-monetary transactions. In October 2025, the most widely used Bitcoin Core software released version 30, controversially expanding the OP_RETURN field limit.

This data field expansion aimed to route the most disruptive arbitrary data transactions to the least harmful location on-chain, but sparked significant opposition within the Bitcoin community. By late October, an anonymous developer proposed a new Bitcoin Improvement Proposal (BIP) suggesting a “temporary soft fork” to “combat spam transactions.” Though the proposal lost momentum over subsequent months, the debate consumed much of the energy that could have gone toward consensus on more forward-looking upgrades. While proposals like OP_CAT and OP_CTV received some attention in 2025, unresolved governance issues prevented developers from agreeing on the next major protocol upgrade by December.

—Will Owens

✅ More than half of the top 20 publicly traded Bitcoin miners by market cap will announce pivots or partnerships with hyperscale computing, AI, or HPC firms.

Result: Major miners broadly shifted toward hybrid AI/HPC mining models to more flexibly monetize their infrastructure investments. Of the top 20 publicly traded Bitcoin miners by market cap, 18 announced plans to pivot to AI/HPC as part of business diversification. The two that didn’t were American Bitcoin (ABTC) and Neptune Digital Assets Corp (NDA.V).

—Thad Pinakiewicz

❌ Bitcoin DeFi ecosystems—total BTC locked in DeFi smart contracts and staking protocols—will nearly double in 2025.

Result: The amount of Bitcoin locked in DeFi grew by about 30% in 2025 (from 134,987 BTC on December 31, 2024, to 174,224 BTC on December 3, 2025). This growth came mainly from lending activity, with Aave V3 Core adding 21,977 wrapped BTC and Morpho adding 29,917 wrapped BTC throughout the year. However, Bitcoin staking protocols as a category saw outflows, losing over 13,000 wrapped BTC.

—Zack Pokorny

ETH

❌ Ethereum’s native token ETH will break $5,500 in 2025.

Result: Ethereum’s native token ETH briefly hit an all-time high in September 2025 but did not break $5,000. Analysts attributed the price rise from April to autumn 2025 largely to purchases by treasury companies like Bitminer. However, as treasury company activity waned, ETH prices declined and have struggled to stay above $3,000 since October.

—Alex Thorn

❌ Ethereum’s staking ratio will exceed 50% in 2025.

Result: Ethereum’s staking ratio peaked at about 29.7% in 2025, up from 28.3% at the start of the year. Over recent months, ETH staking has been constrained by unwinding cyclic trades and key reorganizations among large validators, disrupting both exit and entry queues.

—Zack Pokorny

❌ The ETH/BTC ratio will fall below 0.03 and also rise above 0.045 in 2025.

Result: This prediction was close. The ETH/BTC ratio dipped as low as 0.01765 on April 22, meeting our downside target, and rose as high as 0.04324 on August 24, but fell short of the 0.045 upside target. While the ETH/BTC ratio rebounded, it’s expected to close the year down year-over-year.

—Alex Thorn

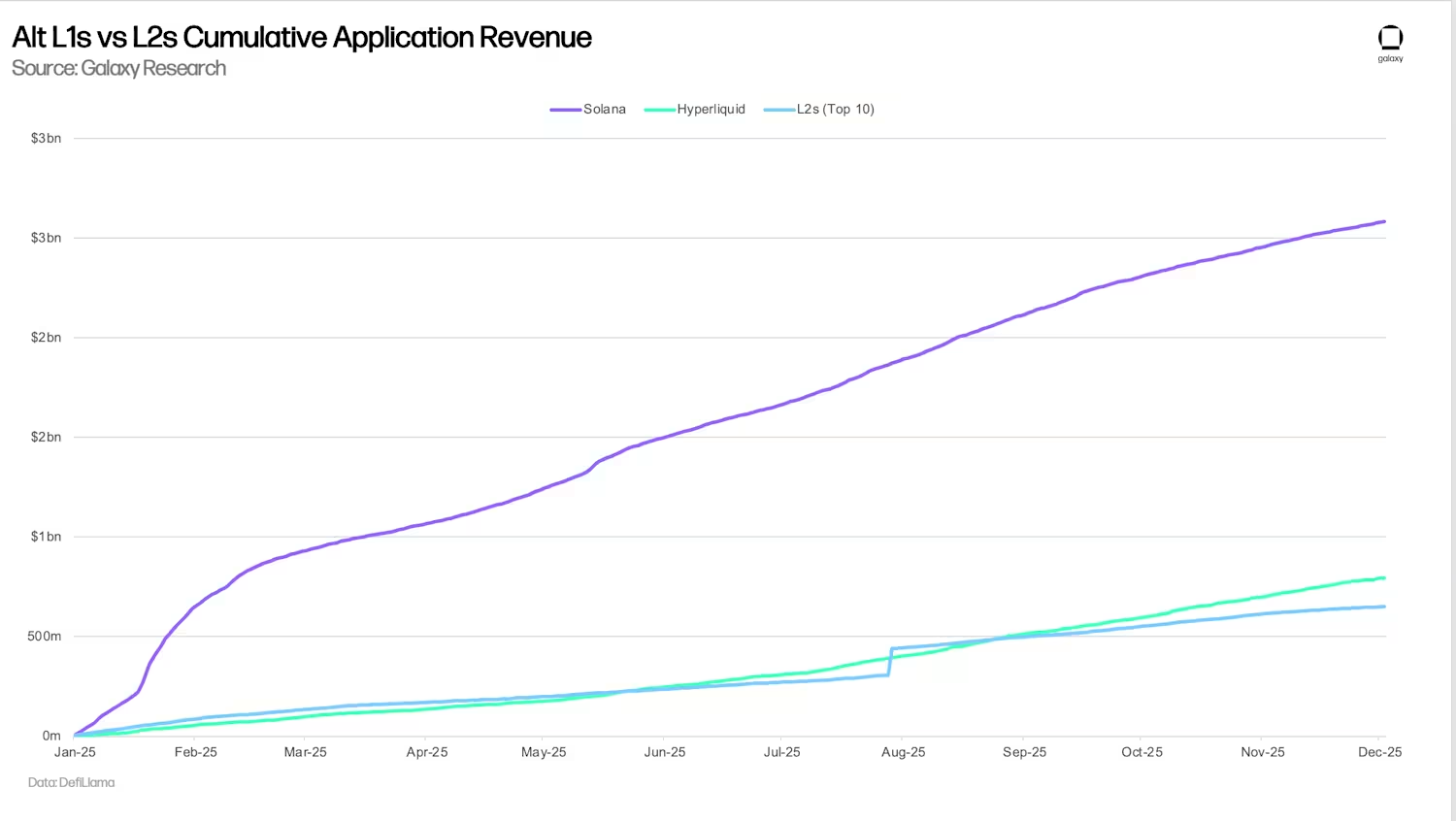

❌ Layer 2 (L2) overall economic activity will surpass Alt-L1 (alternative Layer-1 blockchains) in 2025.

Result: This prediction did not materialize. Across both network and application layers, L2s underperformed major Alt-L1 chains. Solana solidified its position as the de facto retail speculation chain, consistently capturing the largest share of industry-wide transaction volume and fee revenue. Meanwhile, Hyperliquid became the dominant platform for perpetuals trading, with its single platform generating more cumulative application revenue than the entire L2 ecosystem. Though Base was the only L2 approaching Alt-L1-level appeal—capturing nearly 70% of L2 application revenue in 2025—even Base’s growth wasn’t enough to surpass Solana and Hyperliquid’s economic gravity.

—Lucas Tcheyan

DeFi

✅ DeFi will enter a “dividend era,” with on-chain apps distributing at least $1 billion in nominal value to users and token holders via treasury funds and revenue sharing.

Result: As of November 2025, amounts repurchased via application revenue reached at least $1.042 billion. Hyperliquid and Solana-based apps were the biggest buyback performers this year. Buybacks became a major narrative, widely accepted by the market—and in some cases, projects lacking such activity were rejected. So far, top apps have returned $818.8 million to end users. Hyperliquid leads by far, having returned nearly $250 million through token buybacks.

—Zack Pokorny

✅ On-chain governance will see a revival, with apps experimenting with futarchy-based governance models, and active voters increasing by at least 20%.

Result: In 2025, the use of futarchy models in DAO governance increased significantly. Optimism began experimenting with the concept, while Solana-based MetaDAO introduced 15 DAOs in a year, including well-known organizations like Jito and Drift. Currently, 9 of these DAOs fully use futarchy to manage strategic decisions and capital allocation. Participation in these prediction markets grew exponentially, with one MetaDAO market reaching $1 million in volume. Moreover, 9 of the top 10 highest-volume MetaDAO proposals occurred this year. We saw more DAOs using futarchy for strategic decisions, and some launching purely under futarchy models. However, most futarchy experiments occurred on the Solana network and were led by MetaDAO.

—Zack Pokorny

Banks and Stablecoins

❌ The world’s four largest custodial banks (BNY Mellon, JPMorgan Chase, State Street, Citigroup) will offer digital asset custody services in 2025.

Result: This prediction was close. BNY Mellon did launch crypto custody services in 2025. State Street and Citigroup haven’t launched yet but announced plans to offer related services in 2026. Only JPMorgan Chase remains hesitant, with one executive telling CNBC in October: “Custody is not on our roadmap right now,” though the bank will participate in digital asset trading. Overall, three of the four custodial banks now offer or have announced plans to offer crypto custody services.

—Alex Thorn

✅ At least 10 stablecoins backed by traditional finance (TradFi) partners will launch.

Result: Though some stablecoins haven’t officially launched yet, at least 14 major global financial institutions have announced related plans. For example, in the U.S., JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo formed a U.S. banking consortium planning a joint stablecoin; brokerage firms like Interactive Brokers, and fintech/payment companies like Fiserv and Stripe. The trend outside the U.S. is even stronger, including Klarna, Sony Bank, and a global banking consortium of nine major banks. Additionally, crypto-native stablecoin issuers like Ethena joined the race, partnering with federally regulated bank Anchorage to issue their native USDtb stablecoin.

—Jianing Wu

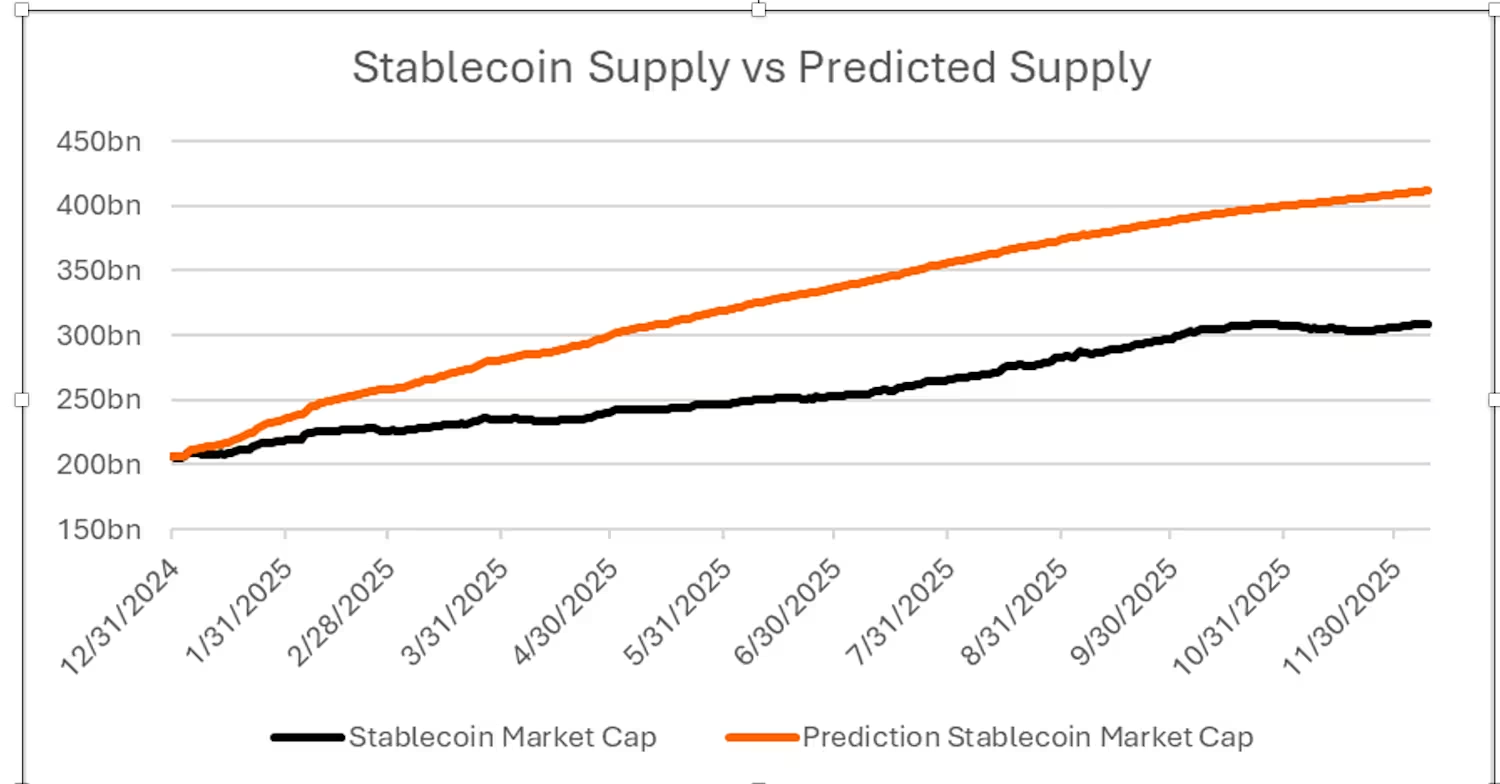

❌ Stablecoin supply will double in 2025, exceeding $400 billion.

Result: Stablecoin growth remains strong, up about 50% year-to-date to nearly $310 billion, but fell short of the predicted 100% growth. With the passage of the GENIUS Act and ongoing rulemaking, regulatory clarity for stablecoins is emerging, so growth is expected to remain strong.

—Thad Pinakiewicz

❌ Tether’s long-standing market dominance in stablecoins will fall below 50% in 2025, challenged by yield-bearing stablecoins like Blackrock’s BUIDL, Ethena’s USDe, and Coinbase/Circle’s USDC rewards.

Result: This narrative seemed plausible early in the year due to explosive growth in USDe and yield-bearing stablecoins. However, due to market downturns in the second half and a slight overall decline in stablecoin supply, Tether maintained its position as the leading stablecoin issuer in crypto markets. At the time of writing, Tether commands nearly 70% of market supply. Tether is preparing to launch USAT, a new stablecoin compliant with the GENIUS Act, to complement its flagship USDT, but appears not to have adjusted its collateral portfolio to meet proposed U.S. legal requirements. Circle’s USDC remains Tether’s main competitor, increasing its market share from 24% to 28% of total supply during the year.

—Thad Pinakiewicz

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News