Bitget Daily Morning Report: Fed maintains interest rate at 4.25%-4.50% range

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Fed maintains interest rate at 4.25%-4.50% range

Approximately $23 billion in bitcoin options will expire next Friday, potentially exacerbating already elevated volatility.

Author: Bitget

Today's Outlook

1. The U.S. Federal Open Market Committee (FOMC) announced early on December 19 to keep the target range for the federal funds rate unchanged at 4.25%-4.50%, in line with market expectations. The dot plot shows that the expected number of rate cuts in 2026 has been revised down from three to two.

2. Cardano founder: Trump's crypto investments have undermined bipartisan regulatory progress in the U.S.

3. David Sacks, White House lead on AI and cryptocurrency affairs, said the crypto market structure bill, the CLARITY Act, is one step closer to formal legislation, with Senate review and revisions expected in January.

Macro & Highlights

1. The U.S. unadjusted CPI year-on-year rate for November was 2.7%, below the 3.1% forecast. The core CPI year-on-year rate was 2.6%, below the 3% expectation. Powell emphasized during the press conference that inflation remains above target and more evidence is needed before further easing.

2. The U.S. SEC released a "Statement on Custody of Crypto Asset Securities by Broker-Dealers," clarifying the applicability of Rule 15c3-3(b)(1) to crypto asset securities, providing a clearer compliance pathway for institutional custody.

3. The U.S. Senate confirmed Trump’s nominees for CFTC and FDIC leadership. Mike Selig will lead the CFTC, and Travis Hill will head the FDIC.

Market Trends

1. Over the past 24 hours, total liquidations in the crypto market reached $547 million, with long positions accounting for $390 million. BTC liquidations amounted to $183 million, and ETH liquidations reached $133 million.

2. U.S. major indices showed mixed performance: Dow +0.14%, S&P 500 +0.79%, Nasdaq Composite +1.38%. Additionally, Nvidia (NVDA) +1.87%, Circle (CRCL) -2.26%, MicroStrategy (MSTR) -1.33%.

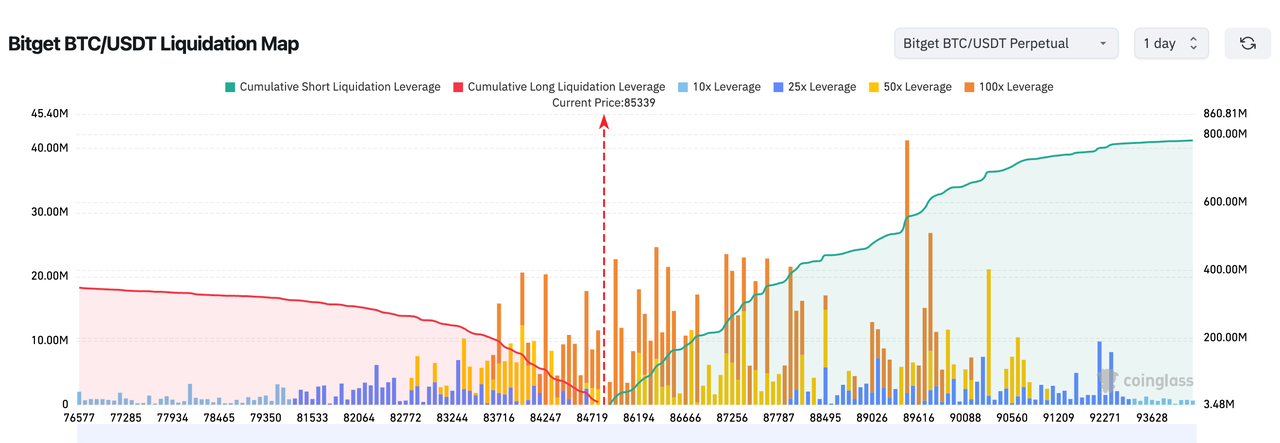

3. Bitget BTC/USDT liquidation map shows the current price of $85,339 sits within a dense zone of long liquidations. Above, a large volume of 50x–100x leveraged longs is stacked between $86,500 and $89,000. A breakout could trigger a short squeeze and cascade upward toward $90k+. Below, the short liquidation wall is thin, with almost no strong support beneath $84k. Long sentiment is extremely crowded, raising the risk of a fakeout trap.

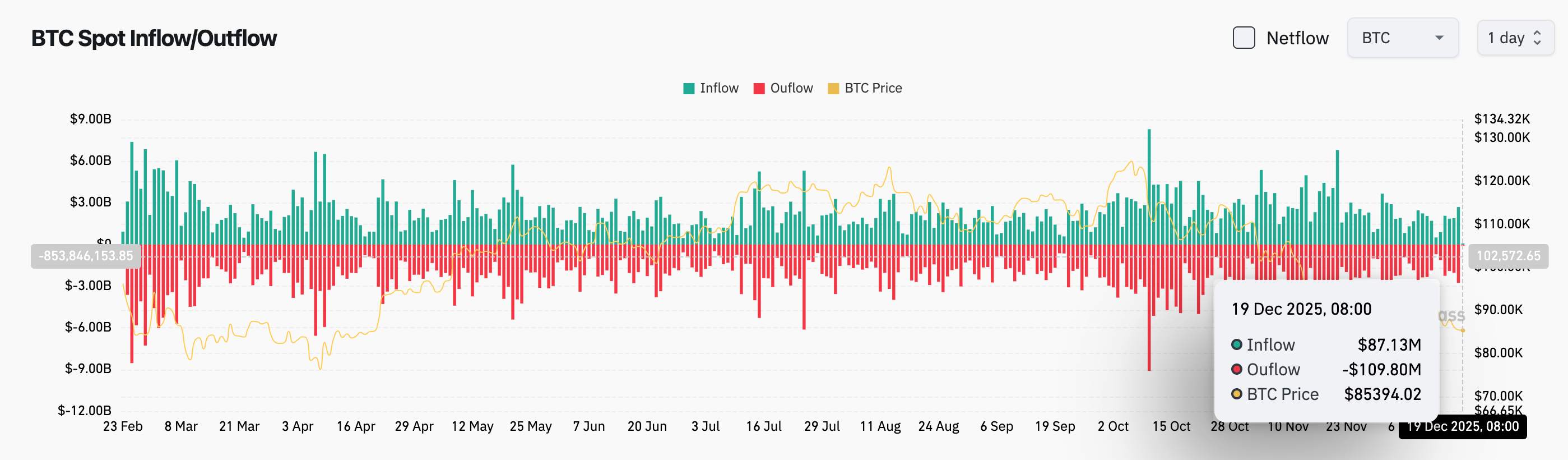

4. In the past 24 hours, BTC spot inflows were approximately $87 million, outflows $109 million, resulting in a net outflow of $22 million.

News Updates

1. Cointelegraph: If MSCI proceeds as planned to remove crypto treasury firms from its indices, these companies may be forced to sell up to $15 billion worth of cryptocurrencies.

2. Bloomberg analyst James Seyffart agrees with crypto asset manager Bitwise’s prediction that over 100 crypto ETFs will launch by 2026, but notes many products will struggle to survive. A wave of crypto ETP liquidations is expected, likely by end-2026, but more probably before end-2027.

3. CF Benchmarks views Bitcoin as a core portfolio asset, forecasting its price to reach $1.4 million by 2035.

Project Developments

1. CryptoQuant data: Ethereum exchange supply has dropped to its lowest level since 2016, reducing near-term selling pressure.

2. Bitcoin spot ETFs recorded a total net inflow of $457 million the previous day, led by Fidelity’s FBTC with $391 million. Ethereum spot ETFs saw a total net outflow of $22.43 million, marking five consecutive days of net outflows. U.S. Solana spot ETFs recorded a single-day net inflow of $10.99 million.

3. According to Cointelegraph, Ethereum network transaction throughput will increase again next month, with developers planning to raise Ethereum’s gas limit from 60 million to 80 million in January.

4. JPMorgan Chase has deployed JPM Coin on the Base blockchain, limited to transfers among whitelisted users.

5. As reported by Decrypt, influenced by the Fed’s rate cut on December 10 and new FASB rules, crypto asset treasuries (DATs), primarily holding Bitcoin and Ethereum, recorded $2.6 billion in net inflows over the past two weeks—the highest in seven weeks. Strategy Company purchased over 20,000 BTC worth nearly $2 billion in two transactions within one week.

6. U.S. national bank SoFi launched its dollar-pegged stablecoin SoFiUSD, now live on Ethereum.

7. NEAR tokens from Near Protocol are now bridged to the Solana network.

8. Bloomberg: Options markets indicate Bitcoin is under significant pressure entering the final weeks of 2025, with around $23 billion in contracts set to expire next Friday, potentially amplifying already high volatility.

9. A veteran Bitcoin whale has deposited 5,152 BTC to a CEX, valued at approximately $445 million.

10. Bitwise has filed a registration statement with the U.S. SEC for a Bitwise SUI ETF.

Disclaimer: This report is AI-generated. Human input was limited to information verification. No investment advice is provided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News