Bitget Daily Morning Report: BlackRock transfers approximately $140 million worth of ETH to CEX; Visa launches USDC stablecoin settlement service, initially supporting Solana blockchain

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: BlackRock transfers approximately $140 million worth of ETH to CEX; Visa launches USDC stablecoin settlement service, initially supporting Solana blockchain

640,000 non-farm employment change in the U.S. for November, seasonally adjusted.

Author: Bitget

Today's Outlook

1. The U.S. FDIC proposes rules for a stablecoin application framework to advance implementation of the GENIUS Act.

2. The South Korean government allocates $15 million in debt relief funds—originally intended for small businesses—to cryptocurrency holders.

3. Chairman of Russia’s State Duma Committee on Financial Markets: Cryptocurrencies will never become legal tender in Russia and can only be used as investment tools.

4. According to PANews, CME Group announces that SOL, Micro SOL, XRP, and Micro XRP futures now support TAS (Trading at Settlement), enhancing traders’ flexibility in settlement risk management.

Macro & Highlights

1. U.S. November seasonally adjusted nonfarm payroll employment increased by 64,000, above expectations of 50,000. The unemployment rate stood at 4.6%, higher than the expected 4.4%. Additionally, August’s nonfarm payrolls were revised from -4,000 to -26,000, and September’s figure was revised from 119,000 to 108,000. Combined, the revisions for August and September show 33,000 fewer jobs added than previously reported.

2. Bitwise predicts Bitcoin will reach a new all-time high by 2026, with its correlation to equities decreasing.

3. Major Wall Street firms have cumulatively sold over $530 million in notes linked to BlackRock’s Bitcoin ETF.

4. U.S. Treasury Secretary Bessent: The Federal Reserve chair nominee will be announced in early January; both Walsh and Hasset are “very, very qualified” for the role.

5. Goldman Sachs: The Fed may cut rates more aggressively next year, with total nonfarm payrolls no longer being the primary indicator.

Market Trends

1. Over the past 24 hours, the crypto market saw $258 million in total liquidations across all positions, including $151 million in longs. BTC liquidation amounted to $61 million, while ETH liquidation reached $104 million.

2. U.S. stocks: Dow Jones -0.62%, S&P 500 -0.24%, Nasdaq Composite +0.23%. Additionally, NVIDIA (NVDA) +0.81%, Circle (CRCL) +9.9%, Strategy (MSTR) +3.34%.

3. Bitget BTC/USDT liquidation map shows: A large amount of long liquidation (red) is concentrated below approximately $87,548 in BTC price, indicating that a break below the 87k level could trigger consecutive long stop-losses, intensifying downward volatility. In the 88k–92k range above, short liquidation (green) is gradually accumulating; an upward breakout could lead to short covering, driving rapid price increases.

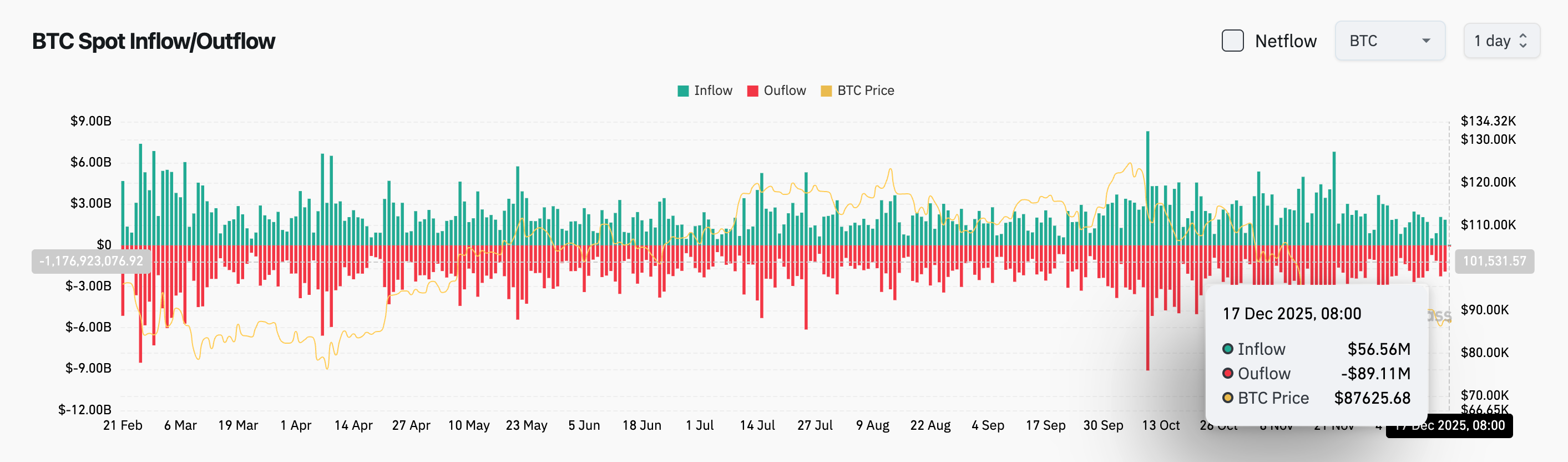

4. Within the last 24 hours, BTC spot inflows totaled about $56 million, outflows about $89 million, resulting in a net outflow of $33 million.

News Updates

1. The UK plans to review cryptocurrency donations to investigate political party funding issues.

2. U.S. Senator Warren demands investigation into crypto projects associated with Trump.

3. Number of cryptocurrency holders in the UK drops to 4.5 million, but average holding value rises to around $2,500.

4. Canadian publicly traded company Matador Technologies revises terms of its $100 million convertible bond, allocating the first tranche of $10.5 million solely for Bitcoin purchases.

5. According to AXIOS, Elon Musk has begun funding Republican congressional campaigns for the 2026 midterm elections, signaling a thaw in relations with Trump after their earlier conflict this year.

Project Developments

1. Former Alameda CEO Caroline Ellison was released from prison in October and transitioned to community supervision.

2. Yearn Finance V1 suffered a hack causing approximately $300,000 in losses.

3. The Marshall Islands launches the world’s first blockchain-based universal basic income program on the Stellar network.

4. AAVE token holders propose a DAO "poison pill" plan to absorb Aave Labs, escalating disputes over revenue distribution.

5. According to PANews, Aave founder Stani.eth announced on X that after four years, the U.S. Securities and Exchange Commission (SEC) has concluded its investigation into the Aave protocol, with the Aave team having devoted significant effort and resources to protect Aave and its ecosystem.

6. Stable launches Stable Swap, a Uniswap fork protocol, enabling both Uniswap V2 and V3 functionalities.

7. K33 analyst: Bitcoin significantly underperformed stock markets in Q4, which may signal positive momentum for January.

8. According to PANews, Bubblemaps reports that $PIPPIN’s price continues rising, but internal addresses now hold about 80% of supply, worth approximately $380 million.

9. Bloomberg reports Visa has enabled U.S. banks to use Circle’s USDC on the Solana blockchain for transaction settlements, marking the first full deployment of its stablecoin settlement service within the U.S. banking system.

10. Last night, BlackRock transferred over 47,000 ETH, valued at about $140 million, to Coinbase.

Disclaimer: This report is generated by AI, with human verification only for information accuracy. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News