Bitget Daily Morning Report: Hassett emphasizes Fed independence, says Trump's opinion "carries no weight"

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Hassett emphasizes Fed independence, says Trump's opinion "carries no weight"

The non-farm "bimonthly catch-up report" will reveal employment divergence, presenting the Fed with a sharper dilemma between inflation and employment.

Author: Bitget

Today's Outlook

1. The Guardian: The UK Treasury is drafting new regulations to bring cryptocurrency under the Financial Conduct Authority (FCA) framework from 2027, aligning it with oversight of other financial products.

2. Hassett emphasized the Federal Reserve's independence, stating Trump's views carry "no weight."

3. Bitwise advisor: Bitcoin market structure is unfavorable for upside movement, with current implied volatility suppressed.

4. Berachain's liquid staking protocol Infrared will conduct its TGE on December 17.

Macro & Highlights

1. Jinshi: The U.S. nonfarm payrolls report released this Tuesday will include data for October and November, finally providing policymakers and investors with a more complete picture of the U.S. labor market and ending months of partial blind spots. The Federal Reserve cut interest rates to a three-year low following a deeply divided meeting this week, with several officials dissenting over whether to prioritize high inflation or a weakening job market. Citi economists noted that the upcoming employment report may send more conflicting signals. The bank expects about 45,000 fewer jobs in October but an increase of 80,000 in November. Citi economists said this rebound may be more related to seasonally adjusted data than "a real improvement in worker demand." They also forecast the unemployment rate will rise from 4.4% to 4.52%, while a Reuters survey of economists shows a 4.4% rate. The Fed’s own quarterly projections indicate a median year-end unemployment rate of around 4.5% this year.

2. Cointelegraph reports some macro analysts believe if the Bank of Japan hikes rates as expected on December 19, Bitcoin could pull back further toward $70,000. Analyst AndrewBTC, tracking historical data, noted that every BoJ rate hike since 2024 has been accompanied by Bitcoin price drops exceeding 20%—for example, down ~23% in March 2024, ~26% in July 2024, and ~31% in January 2025. A similar downside risk could reappear if the BoJ hikes next week. Meanwhile, Glassnode co-founder analyzing the impact of Japanese rate hikes believes Bitcoin will thrive after policy tightening.

3. Analyst Ali Martinez: Markets are closely watching multiple macro data releases this week; if BTC falls below $86,000, a deeper correction may follow.

4. Michael Saylor has again posted Bitcoin Tracker information, with potential增持 disclosure expected this week.

Market Trends

1. Over the past 24 hours, the crypto market saw $280 million in total liquidations across all positions, including $234 million longs liquidated. BTC liquidation amounted to $103 million, ETH to $55 million.

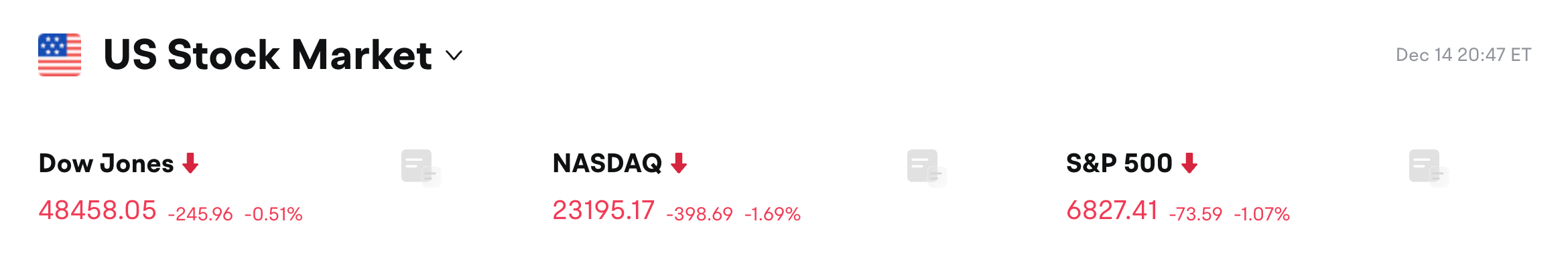

2. U.S. stocks: Dow -0.51%, S&P 500 -1.07%, Nasdaq Composite -1.69%. Additionally, Nvidia (NVDA) -3.27%, Circle (CRCL) -5.76%, Strategy (MSTR) -3.74%

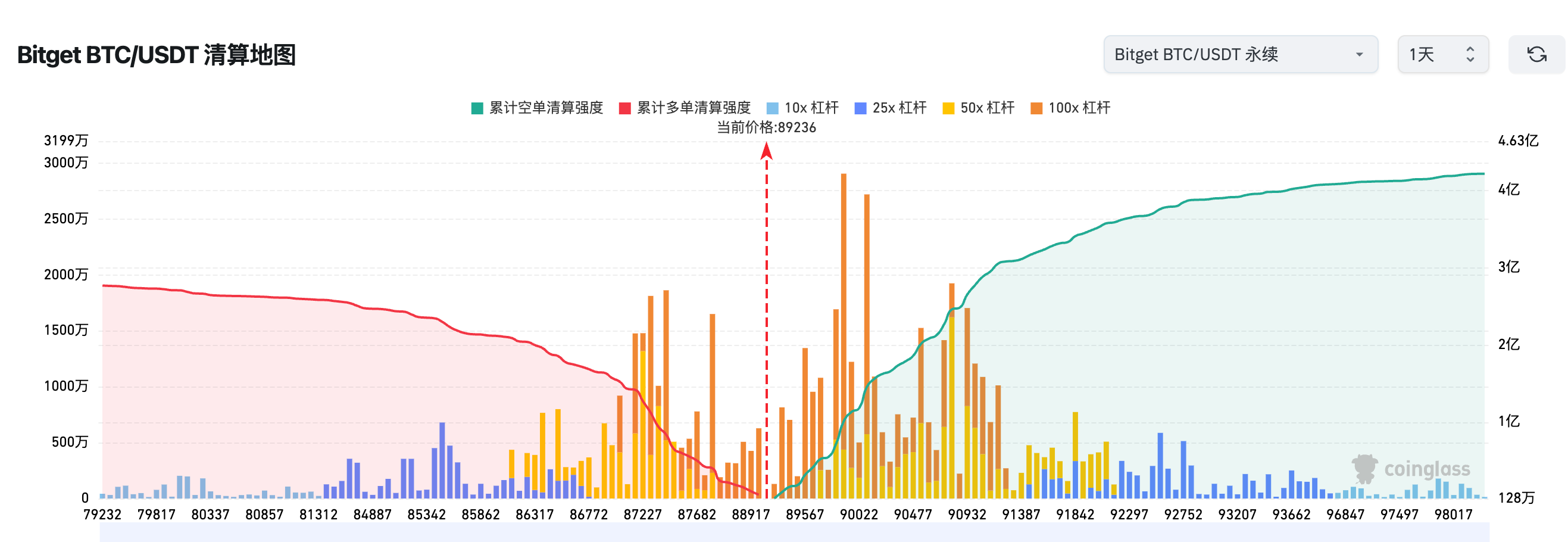

3. Bitget BTC/USDT liquidation map shows the current price level around 89,236 acts as a key turning point between long and short liquidations. Below this level, long liquidation pressure has largely been released, while short liquidations are concentrated in the 90,000–92,000 range, creating a clear magnetic effect for "short squeeze rallies." If price stabilizes above and breaks through 90K, it could trigger cascading liquidations of highly leveraged shorts, driving rapid upward momentum; conversely, if price drops below 88K, short-term bullish momentum will weaken significantly.

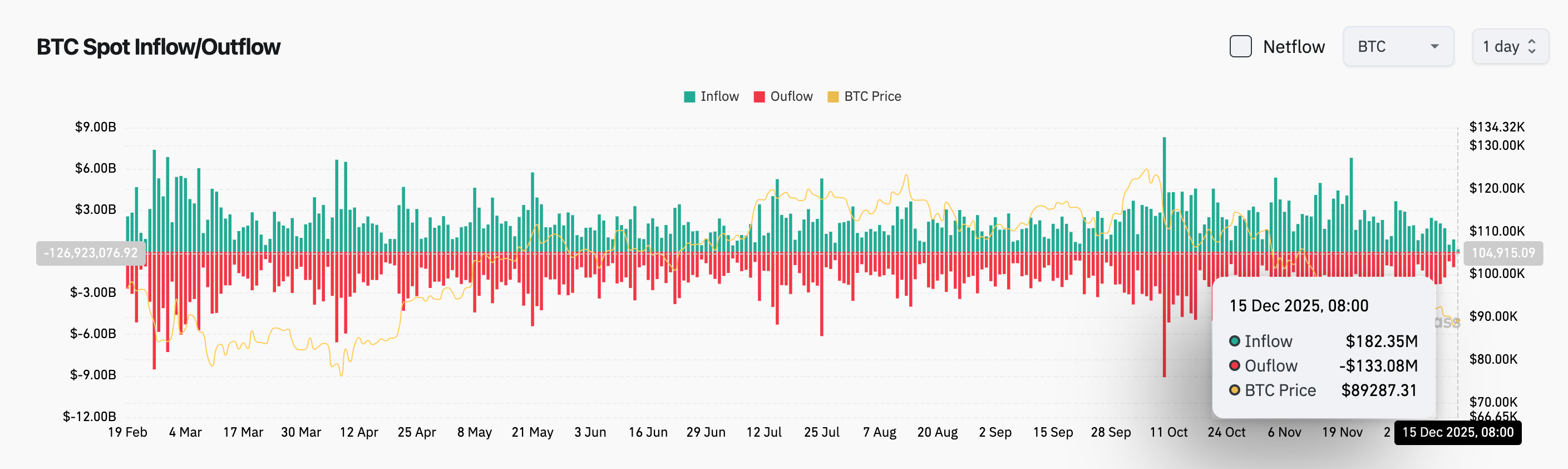

4. In the past 24 hours, BTC spot inflows were approximately $182 million, outflows $133 million, resulting in a net outflow of $49 million.

News Updates

1. 10x Research: Bitcoin's "four-year cycle" hasn't disappeared, but the market may no longer anchor itself strictly to halving events.

2. Charlie Noyes, Paradigm’s first employee and general partner, has resigned.

3. Tom Lee: Bitmine holds about 4% of Ethereum’s total supply and will never sell these ETH.

4. This week, 16 crypto startups raised $176 million, bringing total investments this year to over $25 billion.

5. Analyst Murphy: Long-term holders collectively hold 14.35 million BTC,约占 total supply 68.3%.

Project Updates

1. CZ responds to rumors of buying ASTER: Actual holdings exceed $2 million.

2. The "66kETH lending whale" who previously invested $1.5 billion to purchase 489,696 ETH has added to their position during the market pullback, buying nearly 38,600 ETH within 8 hours.

3. Bitcoin OG increases long ETH position, with total holdings valued at $676 million.

4. A mysterious whale address today bridged 317 BTC to exchange for 9,105 ETH, worth approximately $28.15 million. Within 20 days, this whale has converted over 2,289 BTC into more than 67,000 ETH.

5. Phantom launches early access to its cash debit card this week, initially available in the U.S.

6. YO Labs, the development team behind YO Protocol, completes $10 million Series A funding round led by Foundation Capital.

7. Mind Network announces holding 1% of Pippin token supply as long-term strategic reserve, and launches FHE lock-up airdrop incentive program.

8. Data: Tokens including ZRO, ARB, STRK face large unlocks this week, with ZRO unlocking tokens worth about $38.6 million.

9. Moonbirds plans to launch its BIRB token in Q1 2026.

10. Arkham monitoring indicates疑似ZORA team transferred approximately 52.525 million tokens to three new addresses, worth over $2.6 million.

Disclaimer: This report is AI-generated, with human verification only for information accuracy. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News