The Myth or Lament of Decentralization After the Wealth Effect Vanishes

TechFlow Selected TechFlow Selected

The Myth or Lament of Decentralization After the Wealth Effect Vanishes

We originally hoped to use the wealth effect to compensate for the numbness following the loss of decentralized beliefs, hoping we wouldn't lose both freedom and prosperity.

Ethereum is shifting toward L1 scaling and privacy, while DTCC, the back-end engine of U.S. equities, holding $100 trillion, begins migrating onto the blockchain—seemingly heralding a new and promising wave in crypto.

But institutional and retail investors operate under entirely different profit logics.

Institutions possess extraordinary tolerance across time and space; decade-long investment cycles and leveraged arbitrage on tiny spreads are far more reliable than retail fantasies of 1000x returns in a year. In the coming cycle, it's highly possible we'll witness simultaneously on-chain prosperity, institutional influx, and retail pressure.

Don't be surprised—BTC spot ETFs and DAT, the end of BTC's four-year cycle and altseason, along with Koreans "abandoning crypto for stocks," have repeatedly validated this logic.

After 10·11, as the final barrier for projects, VCs, and market makers, CEXs have officially entered garbage time. The greater their market influence, the more conservative their path becomes, gradually eroding capital efficiency.

Worthless altcoins and meme posts by minor influencers are merely side episodes of an inevitable trajectory collapsing under its own weight. Migration to chain is a reluctant necessity, but the resulting world will differ slightly from our imagined free and prosperous one.

We once hoped wealth effects would compensate for the numbness following the loss of decentralized belief. Let us not lose both freedom and prosperity.

Today will be my last discussion on decentralization, cypherpunk ideals, and stories of freedom and betrayal—they can no longer keep pace with the rolling wheels of history.

Decentralization: The Birth of the Pocket Computer

DeFi was never built upon Bitcoin’s ideas or infrastructure.

Nick Szabo created the concept of “smart contracts” (1994), Bit Gold (first proposed in 1998, refined in 2005), and inspired core concepts such as Bitcoin’s PoW (Proof-of-Work) and timestamped recordkeeping.

He once affectionately called Bitcoin a “pocket computer” and Ethereum a “general-purpose computer,” but after the 2016 DAO incident when Ethereum decided to roll back transaction records, Nick Szabo became a critic of Ethereum.

During the ETH bull run from 2017 to 2021, Nick Szabo was seen as an outdated stubborn relic.

On one hand, Szabo genuinely believed Ethereum had surpassed Bitcoin by achieving better disintermediation, with full implementation of PoW and smart contracts at that time.

On the other hand, he believed Ethereum reformed governance from a trust-minimized perspective, where the DAO mechanism first enabled efficient interaction and collaboration among strangers globally.

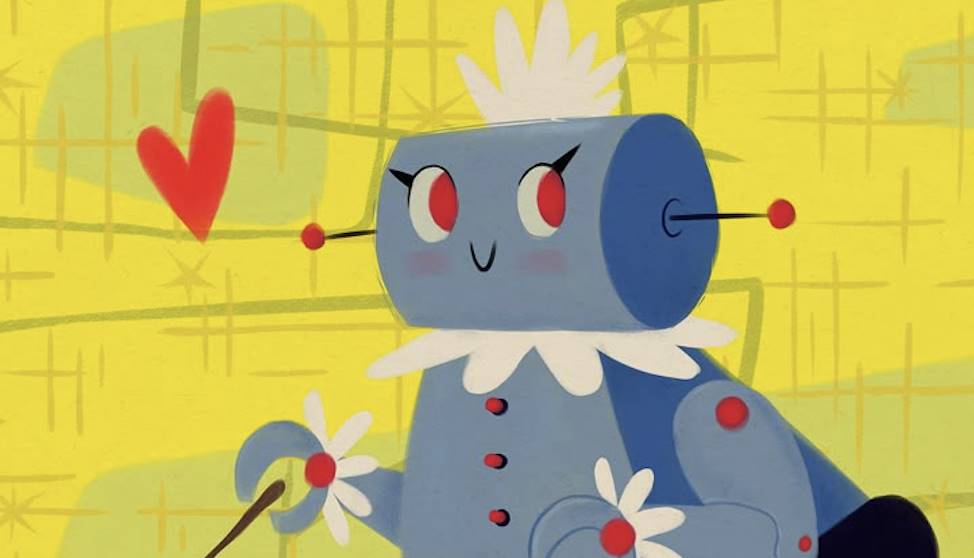

We thus outline what decentralization actually means: technical disintermediation → pricing cost + transaction consensus; governance-level trust minimization → minimized trust.

Image caption: Composition of Decentralization

Image source: @zuoyeweb3

-

Disintermediation: No need to rely on gold or governments; instead, use computational work as proof of individual participation in Bitcoin production;

-

Trust minimization: No reliance on human social relationships; openness under minimal-trust principles creates network effects.

Although influenced by Bit Gold, Satoshi Nakamoto remained ambivalent about smart contracts. Guided by simplicity, he preserved only limited opcode combinations for complex operations, focusing overall on peer-to-peer payments.

This explains why Nick Szabo saw hope in PoW-based Ethereum—complete smart contracts combined with “self-limitation.” Of course, Ethereum faced similar L1 scalability barriers like Bitcoin, leading Vitalik to ultimately choose L2 scaling to reduce damage to the L1 core.

This “damage” primarily refers to the full-node size crisis. After losing Satoshi’s optimization, Bitcoin rushed headlong into ASIC mining and hashpower competition, effectively excluding individuals from the production process.

Image caption: Blockchain Node Sizes

Image source: @zuoyeweb3

Vitalik at least resisted—for a time. Before surrendering to the data-center-chain model in 2025, he maintained PoS while striving to preserve individual nodes.

While PoW is equated with hashpower and energy consumption to establish base production costs, in the early days of the cypherpunk movement, proof-of-work combined with timestamps served to confirm transaction times, forming overall consensus and mutual recognition.

Thus, Ethereum’s shift to PoS fundamentally excludes individual nodes from the production system. Combined with “cost-free” ETH accumulated through ICOs and nearly $100 billion invested by VCs into the EVM+ZK/OP L2 ecosystem, massive institutional costs have quietly accumulated—making ETH DAT effectively an OTC exit route for institutions.

After technical disintermediation failed, although node explosion was contained, Ethereum slid into mining pools and hashpower competition. After multiple oscillations between L1 (sharding, sidechains) and L2 (OP/ZK), it has now effectively embraced large nodes.

Objectively speaking, Bitcoin lost smart contracts and “personalized” hashpower, while Ethereum lost “personalized” nodes but retained smart contracts and ETH value capture.

Subjectively, Bitcoin achieves minimal governance but heavily relies on the “conscience” of a few developers to maintain consensus. Ethereum ultimately abandoned the DAO model, shifting to centralized governance (theoretically no, but in practice Vitalik controls the Ethereum Foundation, which steers the direction of the Ethereum ecosystem).

There is no bias here favoring ETH over BTC or vice versa. From a wealth-effect standpoint, early investors in both assets succeeded. But from the standpoint of decentralization practice, there appears no possibility for either to change course.

Bitcoin almost certainly won’t support smart contracts; Lightning Network and BTCFi remain focused on payments. Ethereum retains smart contracts but abandoned PoW as a pricing benchmark, and beyond trust minimization, chose a historically regressive path of centralized governance.

Let future generations judge the merits and faults.

Middleman Economy: The Fall of the World Computer

Wherever there is organization, internal conflict follows. Unity demands centralization, which inevitably breeds bureaucracy.

Token pricing mechanisms fall into two categories: narrative and demand. For example, Bitcoin’s narrative is application-oriented—peer-to-peer electronic cash—but people demand it as digital gold. Ethereum’s narrative is the “world computer,” yet demand for ETH centers on application use—Gas Fee.

The wealth effect aligns better with PoS. Participating in Ethereum staking requires ETH; using Ethereum DeFi also requires ETH. This value capture reinforces PoS legitimacy, making Ethereum’s abandonment of PoW correct under real-world demand.

At the narrative level, however, the model of transaction volume × Gas Fee closely resembles SaaS and Fintech, failing to match the grand vision of “computing everything.” Once non-DeFi users leave, ETH’s value lacks sustained support.

In the end, no one uses Bitcoin for transactions, yet someone always wants Ethereum to compute everything.

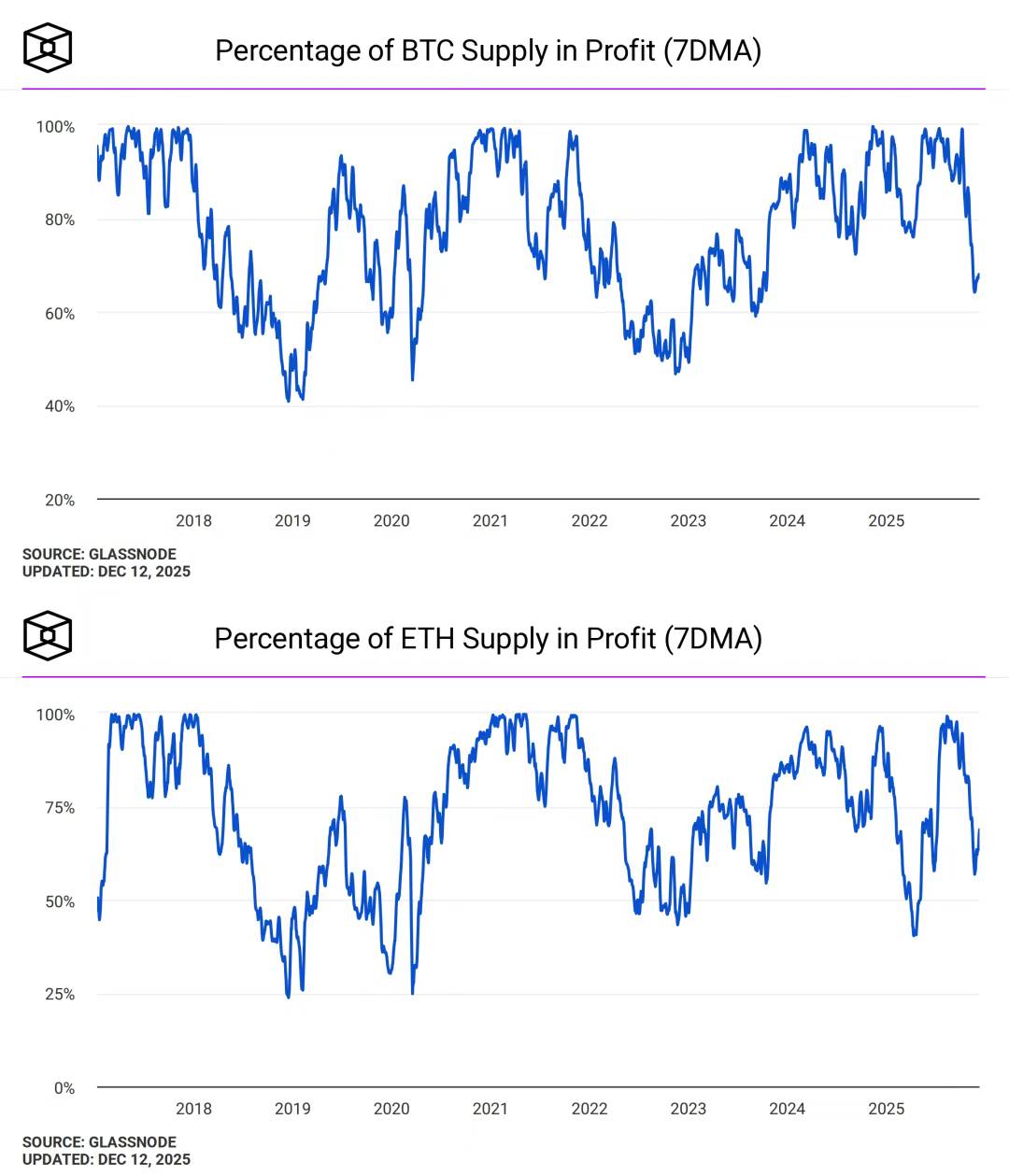

Image caption: BTC and ETH Address Profitability

Image source: @TheBlock__

Decentralization ≠ wealth effect. Yet after Ethereum shifted to PoS, it implicitly accepted that ETH’s capital value is its sole pursuit. Price fluctuations attract excessive market attention, further highlighting the gap between vision and reality.

By contrast, gold and Bitcoin price movements are now largely seen as indicators of baseline market sentiment—one worries about global affairs during gold rallies, but no one questions Bitcoin’s fundamental value during downturns.

It’s hard to blame Vitalik and EF alone for Ethereum’s “de-decentralization,” but we must acknowledge Ethereum’s increasing intermediation.

Between 2023 and 2024, it became fashionable for Ethereum Foundation members to serve as advisors to projects—Dankrad Feist with EigenLayer, for instance—while few remember The DAO and the murky ties between multiple core Ethereum figures.

This only ended when Vitalik publicly declared he would no longer invest in any L2 project, but systemic “bureaucratization” across Ethereum had already become unavoidable.

In a sense, middlemen aren’t necessarily negative—they represent efficient matching and facilitation of needs. The Solana Foundation, once hailed as an industry model, generally pushes project development through market and ecosystem growth.

But for ETH and Ethereum, ETH should become the “middleman” asset, while Ethereum itself should remain fully open and autonomous, preserving a permissionless public chain architecture.

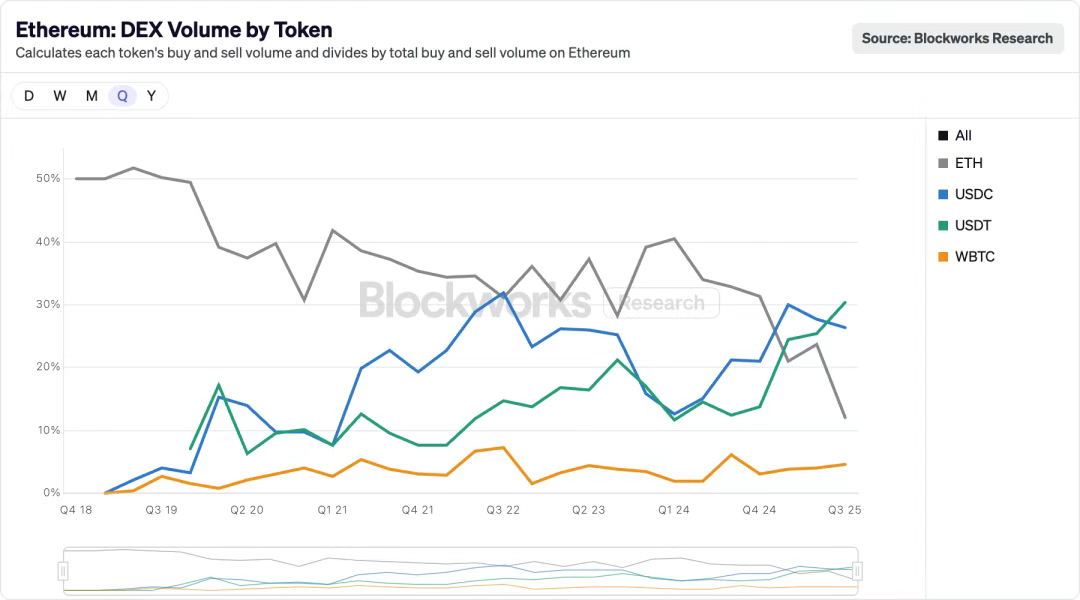

Image caption: Ethereum DEX Volume by Token

Image source: @blockworksres

Within the Ethereum ecosystem, stablecoins are gradually replacing ETH. As liquidity migrates to perpetual DEXs on-chain, USDT/USDC are profoundly reshaping the old order. The story of stablecoins replacing ETH/BTC as base assets inside CEXs is now repeating on-chain.

And USDT/USDC are precisely centralized assets. If ETH cannot sustain vast application scenarios and is used merely as an “asset,” then under the backdrop of faster speeds and lower fees, Gas Fee consumption must be sufficiently high to support ETH’s price.

Moreover, if Ethereum is to be truly open, it should allow any asset to serve as intermediary value—but this would severely undermine ETH’s value capture. Hence, L1 seeks to reclaim power from L2, aiming for L1 re-scaling. In this context, privacy can be interpreted either as an institutional necessity or a return to original principles.

There are many stories here, each worth hearing—but you must choose one direction to pursue.

Complete decentralization cannot achieve minimal organization, causing everyone to act independently. Under efficiency principles, the system inevitably tilts toward trust minimization—order derived from Vitalik offers no difference from Sun’s extreme freedom for illicit industries.

Either we trust Vitalik, or we trust Sun. Simply put, decentralization cannot create self-sustaining, autonomous order. People crave extreme chaos in spirit, yet their bodies deeply reject insecure environments.

Vitalik is a middleman, ETH is a middleman, and Ethereum will be the middleman between traditional worlds and blockchain. Ethereum desires products without products, but every product inevitably carries marketing, falsehood, and deception—Just use Aave is no different from UST at its core.

Only by repeating the first failed action can financial revolution succeed: USDT first failed on Bitcoin, UST failed by buying BTC, followed by the success of TRC-20 USDT and USDe.

Put differently, people suffer from ETH’s decline and stagnation, burdened by Ethereum’s bloating ecosystem, leaving retail powerless to distinguish themselves from Wall Street. Retail ETH should have been bought by Wall Street, but instead people are consuming the bitter fruits of ETFs and DAT.

Ethereum’s limitation is ETH capital itself. Production for production’s sake, production for ETH’s sake—these are two sides of the same coin, self-evident. East and West refuse to bail each other out. Preferring certain ecosystems, certain founders’ capital and projects, none are producing for the token of the invested project, but for ETH.

De–→“Centralization”: The Future of the Financial Computer

From the Second International to LGBT, from the Black Panthers to Black Panther, from Bitcoin to Ethereum.

After The DAO incident, Nick Szabo began despising all things Ethereum. True, Satoshi has long vanished, but Ethereum hasn’t performed poorly. I don’t have split personality—criticizing Ethereum one moment, then praising Vitalik the next.

Compared to next-gen blockchains like Solana and HyperEVM, Ethereum remains the best-balanced player between decentralization and wealth effects. Even Bitcoin, inherently lacking smart contract support, suffers from a major flaw.

As a 10-year-old chain, ETH and Ethereum have transformed from “dissidents” into “official opposition”—periodically invoking the spirits of decentralization and cypherpunk before advancing toward the pragmatic future of a financial computer.

Minerva’s owl can only fly at night. Debates between wealth effects and decentralization will be buried in Königsberg. Harsh historical practice has already interred both narratives together.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News