A Decade of the World Computer

TechFlow Selected TechFlow Selected

A Decade of the World Computer

A decade ago, it ignited the imagination of decentralization with a white paper. A decade later, it remains the core of the crypto world, yet no longer the only stage.

Author: ChandlerZ, Foresight News

Over the past century, humanity has redefined the form of computers several times.

From the massive machines built in the mid-20th century to guide rockets, to IBM bringing mainframes into enterprises, then Microsoft and Apple putting personal computers into every household, followed by smartphones placing a computer into everyone's pocket.

Each leap in computing power has reshaped how humans connect with the world.

In 2013, 19-year-old Vitalik Buterin was playing World of Warcraft when Blizzard arbitrarily nerfed the Warlock class, prompting him to seriously consider a question for the first time: In the digital world, who ensures rules cannot be changed at will?

If there existed a "world computer" that belonged to no single company,不受 any one authority, and was accessible to anyone, could it become the starting point of the next era of computing?

On July 30, 2015, in a small office in Berlin, dozens of young developers stared at a block counter. When the number hit 1,028,201, the Ethereum mainnet launched automatically.

Vitalik recalled: "We all just sat there waiting, and then it finally reached that number. About half a minute later, blocks started being produced."

At that moment, the spark of the world computer was ignited.

The Beginning and the Spark

Ethereum had fewer than a hundred developers at the time. It was the first to embed smart contracts into blockchain, providing a Turing-complete platform, transforming blockchain from a mere ledger into a global public computer capable of running programs.

Soon, this nascent world computer faced severe trials.

In June 2016, a major security incident occurred involving The DAO, a decentralized autonomous organization built on Ethereum. A hacker exploited a vulnerability in the smart contract to steal approximately $50–60 million worth of Ether. The community fiercely debated whether to "roll back history," ultimately opting for a hard fork to recover the funds, which led to a split creating another chain—Ethereum Classic (ETC).

This event brought governance of the world computer into sharp focus for the first time: Should immutability be upheld, or should errors be corrected to protect users?

The ICO boom from 2017 to 2018 propelled Ethereum to new heights, as countless projects issued tokens on its network, raising billions of dollars and driving ETH prices to record highs. However, the subsequent bursting of the bubble plunged Ethereum into a downturn, with ETH losing over 90% of its peak value by the end of 2018. Network congestion and high transaction fees drew widespread criticism. At one point, the popularity of CryptoKitties caused such severe congestion that the mainnet nearly ground to a halt, exposing the world computer’s first significant limitation in computational capacity.

To address performance bottlenecks, the Ethereum community began researching on-chain sharding solutions as early as 2015, aiming to increase throughput by splitting node validation loads. However, sharding proved technically complex and progress was slow. Meanwhile, developers explored off-chain scaling paths—from early state channels and Plasma to the Rollup solutions that emerged in 2019. Rollups significantly boosted processing capabilities by bundling large numbers of transactions and submitting them for verification on the main chain, but required sufficient data availability support from the mainnet. Fortunately, around 2019, Ethereum made breakthroughs in data availability (DA), solving the problem of large-scale data verification.

Since then, Ethereum gradually established a scaling roadmap of "mainnet security, layer-two execution," and the world computer began evolving into a multi-layered collaborative system.

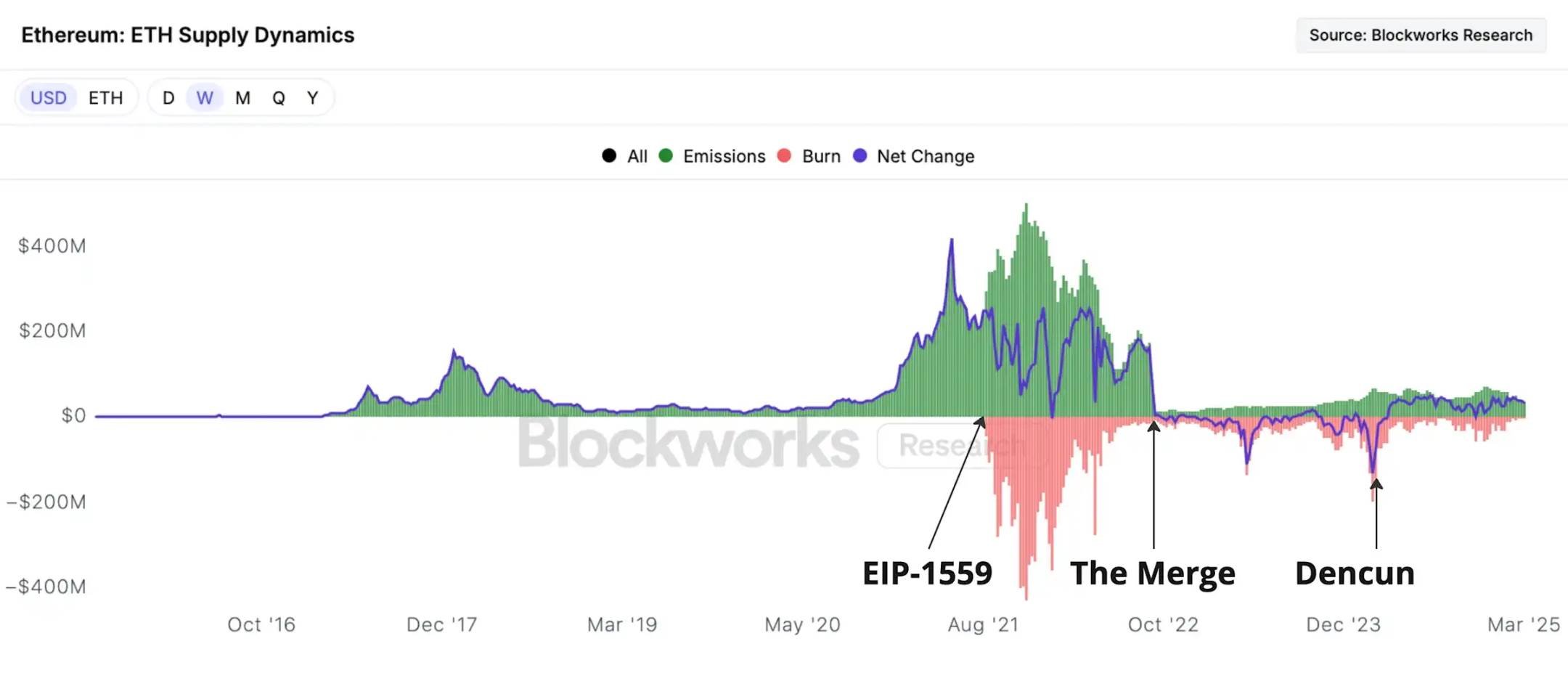

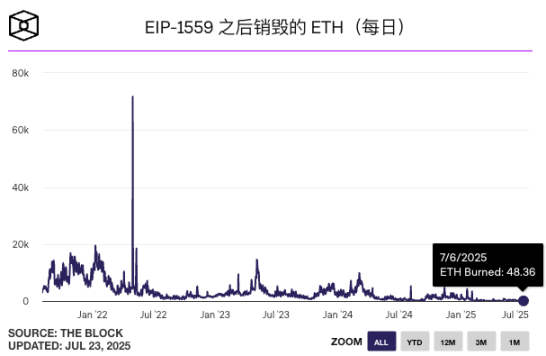

In the following years, DeFi exploded on Ethereum, with decentralized lending, trading, and derivatives sprouting up like mushrooms after rain. The NFT craze brought digital art into the mainstream, exemplified by Beeple's artwork selling for $69 million at Christie's. Although network prosperity came with persistently high gas fees, Ethereum responded through protocol improvements. In August 2021, the EIP-1559 upgrade introduced a base fee burning mechanism, destroying ETH used to pay base fees for each transaction, thereby reducing inflationary pressure during periods of high demand. This reform briefly made ETH net-deflationary during the 2021–2022 bull market, pushing its price close to an all-time high of $4,900.

On September 15, 2022, The Merge was completed, shifting the core energy source of the world computer from power-hungry PoW to PoS. Energy consumption dropped by 99%, new issuance rates fell by 90%, and ETH holders began participating in the network via staking. The world computer’s energy system had been completely overhauled.

Data one year post-Merge showed Ethereum’s net supply had decreased by about 300,000 ETH—a stark contrast to the amount that would have been issued under PoW—reinforcing market expectations around ETH scarcity.

Following these transformations, by the end of 2023, Ethereum’s mainnet performance and economic mechanisms had improved, but new challenges emerged. To reduce costs and encourage Rollup development, Ethereum implemented the "Dencun" upgrade (Deneb + Cancun) in March 2024, introducing EIP-4844, also known as Proto-Danksharding. This enhancement added special "data blob" transactions for Rollups to submit batched transaction data. Since blob data is stored only temporarily, it is far cheaper than regular call data, drastically lowering the cost for Layer 2 networks to submit data to the mainnet. The successful launch of Dencun marked a significant reduction in Rollup costs, advancing the world computer closer toward its sharding goals.

Ten years on, the world computer has evolved from an ideal in a whitepaper into an indispensable real-world infrastructure.

Yet behind the brightly lit nodes, new difficulties quietly emerge...

The Fog of Midlife

Entering 2024–2025, Ethereum’s challenges became increasingly apparent.

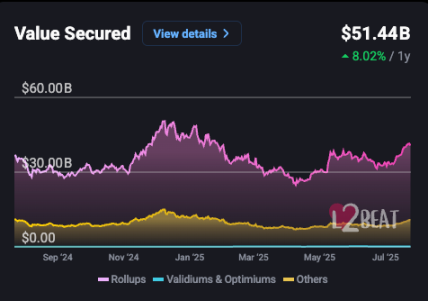

Significant Layer 2 Diversion Effect

Ethereum’s recent embrace of the Rollup-centric roadmap has alleviated mainnet congestion but also caused much of the transaction volume and value to remain on Layer 2 networks without flowing back to the mainnet. A report from Standard Chartered Bank in early 2025 stated bluntly that the rise of Layer 2 networks has eroded value capture on the Ethereum main chain. The report estimated that Base—one leading Ethereum L2 launched by Coinbase—alone had "taken away" around $50 billion in market capitalization from the Ethereum ecosystem.

Transactions and applications that might otherwise occur on the mainnet have shifted to lower-cost L2s, reducing mainnet transaction fee revenue and on-chain activity. This trend became even more pronounced after the Dencun upgrade: EIP-4844 dramatically reduced data submission costs for Rollups, further increasing the appeal of L2s to handle transactions. In recent years, daily transaction volumes on Rollups like Arbitrum and Optimism have frequently matched or even surpassed those of the main chain, confirming the vision of Ethereum outsourcing execution.

In other words, components of the world computer are operating efficiently externally, but the host’s ability to capture value is weakening.

Intensifying Competition from External Blockchains

Due to Ethereum’s early shortcomings in performance and cost, many competitors have sought to offer faster, cheaper alternatives.

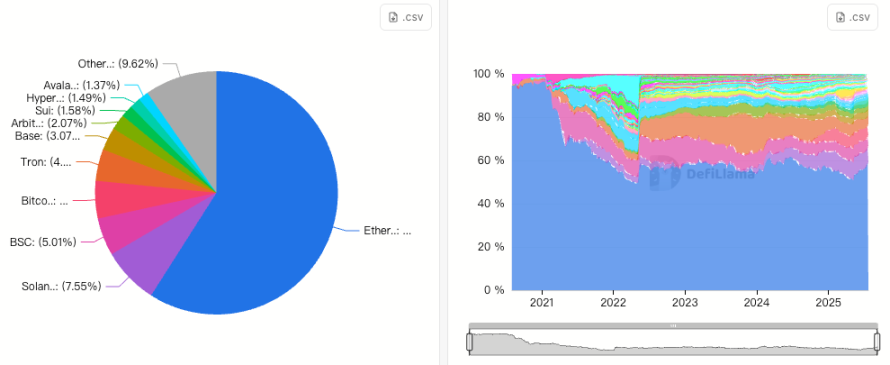

For example, Solana, emphasizing high throughput, has attracted numerous developers; most emerging and MEME projects in this bull cycle are primarily launching on Solana. In stablecoins, Tron leverages near-zero transaction fees to dominate the issuance and transfer of major stablecoins like USDT. Over 80 billion USDT now circulate on the Tron chain, surpassing Ethereum to become the largest stablecoin network by scale, with significantly higher transaction turnover. This means Ethereum has ceded leadership in the critical stablecoin sector.

Additionally, public chains like BNB Smart Chain have captured portions of GameFi and altcoin trading traffic. While Ethereum remains the dominant ecosystem in terms of DeFi protocol count and TVL—accounting for approximately 56% of all DeFi activity as of July 2025—it is undeniable that in a multi-chain environment, Ethereum’s relative dominance has declined from its peak.

Governance and Security Concerns

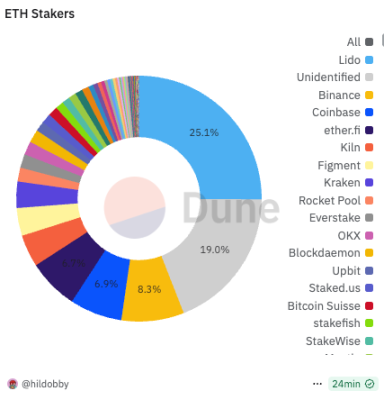

After transitioning to PoS, concerns have grown over centralization in staking. The requirement of staking 32 ETH to become a validator incentivizes retail users to participate via staking pools or exchanges, leading to dominance by a few large staking service providers. Lido, the largest decentralized staking pool, once held over 32% of the network’s total staked ETH. Although its share has slightly declined to around 25% with increased competition, it still leads far ahead of entities like Binance (~8.3%) and Coinbase (~6.9%). There is widespread concern that if any single entity controls more than one-third of the validation weight, it could compromise consensus and even network security.

Vitalik has urged limiting the stake concentration of any single validator entity through fee rate caps, such as keeping it below 15%. However, in a 2022 Lido governance vote, a proposal to self-impose such a cap was rejected by over 99% of votes. Currently, according to Dune data, there are over 1.12 million validators on the Ethereum network, with more than 36.11 million ETH staked—representing 29.17% of total supply. How to promote diversity among stakers without compromising network security remains an unresolved challenge.

Controversial Role of the Foundation

For years, the Foundation has been criticized for lack of transparency in ecosystem funding and fund management, with frequent community质疑over its sales of ETH holdings at market peaks without public explanation. Some early developers believe the Foundation’s "laissez-faire" approach has allowed fragmentation and narrative confusion to accumulate, making effective governance guidance difficult.

Meanwhile, influential voices have gradually faded. Vitalik and a few early developers still wield great influence but rarely make clear statements on key directions. They choose restraint to avoid swaying market sentiment or getting involved in governance disputes. Long-term, this restraint creates another kind of vacuum: the community lacks consensus, no one wants to take responsibility for decisions, and many proposals lack champions. Open discussions decrease, and technical roadmaps and ecosystem strategies shift increasingly toward closed-door deliberations.

Without a clear helmsman, the world computer keeps running—but loses its sense of direction.

A Blank Application Layer and Underwhelming Market Performance

If Ethereum aims to be the world computer on-chain, its value should not rest solely on providing computation and security at the base layer, but on whether it can sustainably support new applications and experiences that expand the frontier of imagination for developers and users.

Yet after ten years, only DeFi and NFT have achieved market validation and scalable success. After that, the application layer has remained quiet.

Promising areas like social, gaming, identity, and DAOs have yet to produce breakout products comparable to DeFi and NFTs.

Web3 social platforms like Friend.tech and Lens briefly went viral but quickly lost momentum with extremely low retention; on-chain games generated buzz but mostly remained simple token economy experiments, failing to enter the mainstream; decentralized identity and DAO governance remain largely in the realm of technical exploration and small-scale trials.

On-chain data confirms this gap. In July 2025, the daily amount of ETH burned on the Ethereum network dipped below 50 coins, hitting record lows—nearly negligible compared to the nearly 1,000 ETH burned daily during the 2021 frenzy.

Daily average active addresses dropped to about 566,000 during the same period, failing to surpass highs seen since March 2024; daily new addresses hovered around 120,000, with monthly on-chain transactions ranging between 35 to 40 million.

For a network claiming to be the world computer, this indicates a lack of sparks capable of igniting the next wave of mass adoption.

Ethereum boasts the industry’s largest developer community and deep technical reserves, but still hasn’t found the killer app that could draw in tens of millions of new users and change usage habits. Ten years on, the machine remains powerful—but is still searching for its next mission.

This stagnation in the application layer is also reflected in market performance. ETH approached a historical high of nearly $4,900 in November 2021 but failed to break through in the years since. Technical upgrades like The Merge and fee reforms delivered limited boosts. From 2022 to 2024, ETH consistently underperformed Bitcoin, Solana, and even BNB. Entering 2025, while other crypto assets repeatedly set new records, ETH lingered around $3,000, and in April, the ETH/BTC ratio even dipped below 0.02—the lowest in years. Once hailed as fuel for the smart contract era, ETH’s wealth effect in the market is fading.

Recently, strategic allocations from public companies and institutions have provided some support for ETH. Companies like Sharplink Gaming and BitMine publicly disclosed treasury strategies, issuing convertible bonds, preferred shares, and market-priced instruments to raise funds for ETH accumulation. Unlike Bitcoin, ETH generates protocol-level yield through staking and restaking, making it an "interest-bearing" digital asset within corporate treasuries—an inherent advantage that adds appeal. Within weeks, ETH rebounded from lows to trade above $3,600.

However, analysts note this recovery stemmed more from active capital allocation rather than significant leaps in the on-chain ecosystem. The price rebound did not accompany innovation from developers or user growth, but rather resembled a temporary choice by market capital seeking viable assets.

Technological advances and institutional entry cannot replace truly transformative applications that change user behavior and unlock new demand.

Ten years on, Ethereum still needs to answer the original question: As a world computer, what kind of program must it run to reignite global imagination?

The Unfinished Road: Directions for the Next Decade

Facing the midlife crisis from both inside and out, Ethereum’s ability to emerge from this slump depends on whether technology and ecosystem can open new avenues for growth.

Technology: Making the World Computer Faster and More Unified

The community has already mapped out a post-Merge upgrade roadmap.

In his article “A Possible Future of Ethereum: The Surge,” Vitalik outlined the next phase’s core goal: to increase the combined throughput of the mainnet and Layer 2 networks to 100,000 transactions per second, while preserving L1 decentralization and robustness. It also aims to ensure at least some L2s fully inherit Ethereum’s core traits (trustlessness, openness, censorship resistance) and to unify the user experience across the network—making it feel like one cohesive ecosystem rather than 34 fragmented blockchains. This means future cross-L1/L2 transfers, fund movements, and app switching will be as seamless as operations within a single chain.

EIP-4844 in 2024 was only the beginning, with further data sampling and compression technologies planned.

As zero-knowledge proof technologies like ZK-SNARKs and ZK-STARKs mature, performance bottlenecks may be overcome, potentially drawing users back from other public chains and L2s.

Governance and Economics: How the Main Chain Can Regain Value

It’s not just about performance—Ethereum is also rethinking how its core can continue capturing value.

In July 2025, the Ethereum Foundation launched a structural reform called “The Future of Ecosystem Development,” attempting to step forward from behind the scenes and act as a guiding force for ecosystem evolution. The Foundation set two long-term goals: maximizing the number of people directly or indirectly using Ethereum and benefiting from its foundational values, and strengthening the resilience of technical and social infrastructure.

To achieve this, the Foundation reorganized itself around four pillars—“accelerate, amplify, support, and long-term unblock”—restructured internal teams, established modules for corporate relations, developer growth, application support, and founder support, and enhanced content and narrative to boost community cohesion.

The Foundation also pledged greater transparency, emphasized targeted public goods funding, introduced Launchpad to support governance and sustainable operations, reduced operational spending ratios, and established a funding buffer of about 2.5 years.

These moves are widely seen as substantive adjustments responding to criticisms of inaction, and as a refueling effort for the next decade.

Within community discussions, new ideas have emerged: Could a portion of the prosperity from Layer 2 be drawn back? Or could protocol fees and MEV distribution mechanisms be optimized so the main chain shares in the growth dividends even in the Rollup era? These proposals are still exploratory but reflect a common concern—if no proactive adjustments are made, the main chain risks devolving into a mere settlement layer, with its value and vitality continuously diluted.

At a Crossroads, Seeking New Sparks

Technology and capital alone are not enough.

Every previous Ethereum high point was sparked by new applications and narratives. Now, the entire blockchain industry is in an innovation lull, lacking breakthrough phenomena.

Perhaps blockchain itself needs a self-revolution, catalyzing new narratives and applications in areas like social, identity, and AI. Others believe the next breakthrough may come from shocks in external ecosystems.

Vitalik reminded in his speech “The Next Ten Years of Ethereum” that developers should not merely replicate Web2, but aim toward future interaction paradigms—including wearables, AR, brain-computer interfaces, and local AI—and incorporate these new entry points into Web3 design thinking.

Looking back at the past decade, Ethereum still possesses the industry’s largest developer community, richest applications, and deepest technical foundation. Yet it stands at a juncture of bottlenecks, competition, and emerging alternatives.

As Vitalik said: “The past ten years of Ethereum were focused on theory. The next ten, we must shift focus to think about our impact on the world.” In his view, next-generation apps must not only offer different functionalities but also preserve shared values, and crucially, they must be good enough to attract those not yet in crypto.

The world computer, facing its ten-year itch. It hasn’t stopped running—just searching for a new direction.

The next decade belongs to it—and to everyone who still believes in this dream.

But as Vitalik put it, “Everyone who speaks up in the Ethereum community has the chance to co-build the future.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News