From "decentralization" narrative to "centralized institutions with compliance-oriented narrative"

TechFlow Selected TechFlow Selected

From "decentralization" narrative to "centralized institutions with compliance-oriented narrative"

This is the strongest era of crypto centralization in history, as well as the most expensive era in terms of price.

By: Sima Cong, AI Channel

I'm observing a new dominant narrative and assessing its substance: the shift from the "decentralization" story to the "traditional centralized institutions adopting compliant narratives."

I'm asking myself a question: Is this a "new bull market," or merely a fleeting rebound before a major shakeout?

Don't say we didn't warn you

Technology should be a ladder for human progress, so why is it constantly hijacked by greed and speculation?

From the narrative of "decentralization" to that of "traditional centralized institutions operating under compliance," one thing remains unchanged: still harvesting retail investors.

From the introduction to the implementation of stablecoin legislation, you can see the world going extremely wild, with traditional listed companies, investment firms, and Wall Street becoming the biggest drivers of this speculative frenzy.

The victims are no longer limited to traditional crypto speculators... The risks have already spilled over into the traditional world and broader populations, infiltrating traditional finance.

Since the launch of the stablecoin bill, victims have extended beyond zero-sum games among cryptocurrency speculators to much wider groups of people.

Although the current size of the crypto market is still far smaller than the traditional financial markets that triggered the 2008 crisis, the underlying logic is consistent: highly leveraged speculation lacking transparency, asset valuations detached from fundamentals, and contagious risk across different financial segments. When even a pharmaceutical company (Windtree) starts talking about establishing a BNB reserve strategy, such cross-border risk transmission is truly alarming. This means non-specialist companies, chasing short-term market trends, may allocate core assets into areas they don’t understand and which are highly volatile—potentially damaging their core business and harming ordinary shareholders if the market reverses.

Let’s face reality: transitioning from the "decentralization" narrative to "traditional centralized institutions using compliance narratives" marks the most centralized era in crypto history—and also the most expensive period ever.

The "Mainstreaming" Path of Crypto Assets

2009–2017

Decentralization, anonymity, resistance to censorship

2018–2023

Rise of exchanges, institutional entry, regulatory exploration

2024–2025

Compliance, securitization, Wall Street integration

Narrative Shift: Who Dominates the Current Crypto World?

Traditional Financial Institutions

(Goldman Sachs, JPMorgan Chase, BlackRock) ----------------------- Driving ETFs, issuing stablecoins, tokenizing securities

Listed Companies

(MicroStrategy, Windtree, Qianxun Technology) --------- Holding crypto assets, hyping concepts, inflating stock prices

Wall Street Investment Banks

(Galaxy Digital, Grayscale) ------------------- Promoting token securitization, structured products

Politicians

(Trump, CZ, Musk) -------------------------- Leveraging crypto narratives for support, funding, influence

Crypto asset risks are spilling into the traditional financial system, just like in 2008—wider-reaching and harder to control

Lessons from the 2008 Financial Crisis:

• Financial derivatives decoupled from the real economy

• Uncontrolled leverage, cascading risk transmission

• Lagging regulation, systemic risk outbreak

• Ultimately, ordinary people bear the consequences

This Is Where It All Begins

In fact, Trump's "crypto-friendly" stance reflects a clear shift in his recent campaign strategy and political maneuvering. During his presidency, while the Treasury Department and Office of the Comptroller of the Currency (OCC) showed some openness toward the crypto industry in certain areas (e.g., allowing banks to offer crypto custody services), Trump himself was initially skeptical of cryptocurrencies and even called Bitcoin a "scam based on air."

His current positive attitude is more about attracting young voters, tech-savvy voters, and cryptocurrency holders' support, drawing a sharp contrast with the Biden administration—particularly SEC Chair Gary Gensler, seen by the crypto industry as "anti-crypto."

Party Division: Even within the Republican Party, views on crypto diverge—some embrace innovation and free markets, while others worry about illegal activities and money laundering.

During Trump’s second term (starting in 2025), he rapidly advanced pro-crypto policies, including establishing a Strategic Bitcoin Reserve in March 2025 (based on seized $17 billion worth of Bitcoin) and signing the GENIUS Act on July 19 to regulate stablecoins. These moves positioned the U.S. as the "global crypto capital," pushing Bitcoin’s price above $100,000 at one point.

He appointed close allies (such as Paul Atkins as SEC Chair) and created a "Crypto and AI Czar" role (David Sacks) to push for lighter regulation, suspending 12 investigations against companies like Coinbase and Binance.

Potential Attack Points After Democrats Take Power

Bipartisan Divide:

The Democratic Party has traditionally taken a cautious approach to crypto. The Biden administration (2021–2025) pushed for regulation (e.g., EO 14067), and lawmakers like Elizabeth Warren warned about crypto’s money laundering risks. In May 2025, Democrats introduced the "End Crypto Corruption Act" to oppose Trump’s policies.

There is also division within the Republican Party—13 Republicans defected on July 15, 2025, voting against the GENIUS Act, indicating the policy lacks broad party consensus.

Potential Attacks:

-

Legal Accountability: After leaving office, Trump’s family businesses (e.g., World Liberty Financial) could face SEC investigations, especially regarding $500 million in profits from the $TRUMP token suspected of insider trading. Richard Blumenthal initiated a preliminary investigation in May 2025.

-

Political Accusations: Democrats might use congressional hearings to expose conflicts of interest involving Trump (e.g., his $75 million transaction with Justin Sun), damaging his reputation.

-

Policy Reversal: A Democratic administration might dismantle the Bitcoin reserve, selling off $17 billion in assets and undermining market confidence in crypto.

We Must Correctly Understand Stablecoins and the Bill

Early Bitcoin and Ethereum emphasized "resistance to censorship," "self-control of assets," and "escaping oppression by traditional finance"—a form of anti-establishment technological utopianism.

Today, the U.S. attempts to integrate crypto through legislation like the Stablecoin Bill, but those driving this transformation are no longer anonymous cypherpunks like Satoshi Nakamoto—they are Circle, BlackRock, Franklin Templeton, Fidelity, Visa, Mastercard, and even pharmaceutical companies.

Take Hong Kong, for example.

Hong Kong’s Stablecoin Ordinance will take effect on August 1, 2025, with license applications opening simultaneously.

The licensing process for stablecoin issuers will not involve applicants downloading forms and submitting written applications en masse. Instead, it will follow an invitation-based application model.

An insider explains that under this "invitation-based" system, the Hong Kong Monetary Authority (HKMA), responsible for regulating licenses, will first communicate with potential applicants to assess whether they meet basic eligibility criteria. Only after preliminary approval will the HKMA issue formal application forms.

Another source reveals that use cases are among the top factors regulators consider, showing the HKMA is taking licensing very seriously.

In fact, HKMA Chief Executive Eddie Yuen made similar remarks at the Hong Kong Investment Funds Association Annual Conference on June 23. He stated that stablecoin applicants must present concrete and practical use cases—"without a viable use case, you won’t even get the application form."

Currently, around 50 to 60 companies express interest in applying for Hong Kong stablecoin licenses, including mainland Chinese state-owned enterprises, financial institutions, and internet giants.

Hong Kong imposes strict requirements on stablecoin issuers’ risk management, especially regarding anti-money laundering and counter-terrorism financing standards, which are nearly equivalent to those for banks and e-wallets. Entry barriers are high, and only a few licenses will be issued initially.

On May 21, 2025, after the Hong Kong Legislative Council passed the Stablecoin Bill draft, Hong Kong’s stock market began speculating on stablecoin-related stocks, later expanding to the entire digital asset concept.

Beyond SOEs, internet giants, and traditional financial institutions, applicants for stablecoin licenses are diversifying. Hua Jian Medical (01931.HK), a Hong Kong-listed healthcare company, announced on the evening of July 17 its plan to build a "NewCo + RWA" Web3 exchange ecosystem centered on high-tech medical innovation drugs, accompanied by a proprietary stablecoin (IVDDollar). The company primarily engages in R&D, manufacturing, and sales of in vitro diagnostic instruments and consumables (IVD products), reporting revenue of RMB 3.162 billion and net profit attributable to owners of RMB 274 million in 2024. On July 14, the company also announced its board had resolved to pursue a dual primary listing on Nasdaq.

On July 18, 2024, while preparing to establish a stablecoin licensing regime, the HKMA approved three candidate issuers from over 40 applications into its stablecoin testing sandbox. The three groups are: Yuanshi Innovation Technology Co., Ltd.; Jingdong CoinChain Technology (Hong Kong) Co., Ltd.; and a joint venture formed by Standard Chartered Bank (Hong Kong), Animoca Brands, and Hong Kong Telecom (HKT). These three issuers are respectively in the testing phase, second-phase testing, and late-stage testing.

Asymmetric Imagination Space

The crypto world is promoting and dragging all forces into a fantasy: the implementation of the stablecoin bill benefits coin speculation!?

But here’s the problem: after stablecoins become compliant, do they represent a new incremental source for on-chain investments?

Is that really the case?

The GENIUS Act clearly regulates payment stablecoins. First, the bill imposes strict准入 controls on stablecoin issuers, prohibiting them from offering interest on issued stablecoins. Issuers must meet bank-level compliance standards; foreign-registered or overseas-established stablecoin issuers operating in the U.S. must register with the OCC and maintain sufficient reserves at U.S. financial institutions to meet liquidity demands of their U.S. customers.

The bill also includes special provisions for non-financial public companies: if a public company is not primarily engaged in financial activities, its wholly owned subsidiaries, controlled entities, or affiliates may not issue payment stablecoins.

Second, the bill sets strict requirements on reserve assets to ensure redeemability—this is the core of the legislation.

It includes several supporting measures: first, strictly prohibiting re-pledging of reserve assets, explicitly banning issuers from using reserves for collateralized financing, lending, or other speculative transactions. Second, monthly public disclosure of reserve reports—including total outstanding stablecoins, amount and composition of reserves, average maturity and custodian locations of each reserve instrument—with certifications signed by the CEO and CFO. Issuers with combined issuance exceeding $50 billion must also publicly disclose annual financial statements, including any related-party transactions.

Third, strengthened anti-money laundering rules. The bill requires issuers to establish AML and KYC systems covering all business processes—properly retaining payment stablecoin transaction records, monitoring and reporting suspicious transactions, blocking, freezing, and rejecting illegal transactions—combining technical tools and procedural safeguards to prevent illicit fund flows and terrorist financing.

Foreign stablecoin issuers must additionally comply with "reciprocal arrangements" established between the U.S. Treasury and other jurisdictions, otherwise they cannot offer or sell their overseas-issued stablecoins in the U.S. Such reciprocal arrangements can be created if the other jurisdiction’s stablecoin regulatory framework is comparable to that established under the U.S. GENIUS Act.

Therefore, the GENIUS Act aims to solve trust and risk issues with payment stablecoins—not to directly stimulate investment in crypto assets.

Does the Logic That Stablecoin Bills Benefit Crypto Hold Up?

The real question is: what do unspecified individuals or institutions actually do once they obtain stablecoins?

Stablecoins and RWAs rely on the characteristics of blockchain infrastructure—stablecoins are pegged to fiat currencies/government bonds, using blockchain smart contracts to achieve 1:1 asset mapping, serving as a value bridge between traditional finance and Web3.0.

Domestic third-party payment platforms (WeChat Pay MAU over 1.1 billion, Alipay MAU reaching 900 million) essentially function as "quasi-stablecoins" anchored to the RMB, relying on legal reserves to maintain stability, with domestic fees as low as a few basis points (e.g., WeChat online payment fee at 0.6%), far superior to overseas platforms charging percentage points (e.g., PayPal).

Internet companies involved in cross-border payments (with actual cross-border goods/services transactions) are more actively entering the stablecoin space, such as JD.com and Ant Group.

Advantages: 1) User scenarios: Companies like Amazon have hundreds of millions of users and mature payment ecosystems, enabling rapid adoption of stablecoin applications; 2) Technical capabilities: Internet firms possess strong R&D capacity; 3) Ecosystem synergy: A closed loop combining B2B (supply chain) and B2C (retail payments) strengthens the network effect of stablecoins.

The GENIUS Act (effective July 19, 2025) clearly limits its scope to "payment stablecoins," defined as digital assets used for payment, transfer, or settlement, requiring 1:1 fiat backing and meeting bank-level compliance (e.g., OCC registration).

The bill does not directly mention "investment-focused stablecoins," but indirectly restricts investment functions of yield-bearing stablecoins (like DAI) by prohibiting interest payments and re-pledging (Reserve Asset Requirement #2).

The requirement that reserve assets be used solely for redemption—not for pledging, lending, or speculative trading (Clause 2.1)—means stablecoins issued under the bill (e.g., USDC) are designed exclusively for payment purposes. In July 2025, Circle’s CEO explicitly stated USDC would focus on cross-border payments, increasing daily transaction volume to $1.2 billion.

Stablecoins with clear investment purposes (e.g., algorithmic stablecoins, yield-bearing stablecoins, or those whose value growth depends on active investment efforts by the issuer) likely fall outside the direct scope of the GENIUS Act and instead remain subject to existing securities laws (regulated by the SEC) or other stricter financial product regulations.

Thus, a regulatory "gray zone" exists: investment-focused stablecoins are neither formally regulated nor explicitly banned—essentially “neither encouraged nor suppressed”—yet continue to exist in a legal vacuum.

The bill bans issuers from offering interest → suppressing the financial attributes at the issuance end.

But it does not ban users from using stablecoins for DeFi staking or RWA investments → preserving financial attributes at the user end.

The Answer Lies in Another Bill

Stablecoins begin being approved under the "payment" narrative, but may subsequently be used widely for speculative purposes—including secondary market investments, collateralization, institutional accumulation, etc.

This is the underlying logic behind the supposed benefit of stablecoin bills to the crypto world.

This is precisely one of the biggest risks in today’s crypto market:

• Under a structure of "payment in name, investment in reality," regulators aim to oversee payments, but the market circumvents this for speculation;

• Because issuers are compliant while investors are free, the regulatory chain is incomplete, ultimately leading to risk spillover into traditional finance;

• This could replay the 2008-style systemic risks: "AAA-rated packaging and widespread circulation + liquidity mismatch + lack of use-case oversight."

The CLEAR Act clarifies the respective regulatory authorities of the two main U.S. regulators—the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC)—in the digital asset market. Under the bill, the SEC primarily oversees trading of stablecoins and anti-fraud regulation of stablecoins and digital commodities, while the CFTC handles registration and trading oversight of digital asset markets.

The CLEAR Act defines digital assets as "digitally represented value secured via cryptography and recorded on a distributed ledger"; it also explicitly states that securities, security derivatives, stablecoins, bank deposits, commodities, commodity derivatives, art, pooled assets, and other investment products—even in digital form—are excluded from the definition of "digital commodities" and thus remain under existing regulatory frameworks.

The CLEAR Act mandates that within 180 days of enactment, digital asset exchanges, brokers, and dealers must temporarily register with the CFTC until the SEC and CFTC release formal registration procedures.

Additionally, the CFTC regulates trading of digital commodities and oversees contracts involving "permitted payment stablecoins" by registered entities, but lacks authority to set rules for permitted payment stablecoins or impose requirements on relevant parties or issuers.

The CLEAR Act further specifies that "investment contract assets"—recorded on blockchains, exclusively holdable, and transferable peer-to-peer without intermediaries—can be considered digital assets and are subject to the CLEAR Act.

Under the CLEAR Act, qualifying investment contract digital assets are exempt from registration with the SEC under the Securities Act—for example, if "the issuer operates the digital asset on a mature blockchain or intends to within four years," or "annual issuance does not exceed $75 million." Such qualifying investment contract assets will instead register with the CFTC.

The CLEAR Act assigns the SEC responsibility for regulating trading activities of permitted payment stablecoin issuers on dealers, brokers, exchanges, or other trading systems. Furthermore, digital commodity trading activities registered with the SEC but exempt from CFTC oversight also fall under SEC jurisdiction.

Moreover, the CLEAR Act stipulates that anti-fraud, anti-manipulation, and insider trading rules and judicial precedents under the Securities Act apply equally to permitted payment stablecoins and digital commodity trading—the enforcement of which remains under SEC authority.

This means:

• Although these payment stablecoins themselves are not securities;

• As long as they circulate and trade on exchanges, broker-dealers, or other trading venues, the SEC’s trading oversight mechanisms apply.

Wherever a coin trades on exchanges or broker platforms, the SEC has regulatory authority.

The SEC’s jurisdiction extends beyond just stablecoin issuers and reserve management (the core of the GENIUS Act) to include secondary market trading behaviors of these stablecoins.

This confirms the formation of a "regulatory闭环": combining the GENIUS Act (regulating stablecoin issuance and reserves) and the CLEAR Act (clarifying token nature and granting the SEC broad powers over trading conduct and market integrity), the U.S. is indeed building a comprehensive, clearly divided yet complementary digital asset regulatory framework.

This information completely dismantles the oversimplified notion that "if it’s a commodity, the SEC doesn’t regulate it." Even digital commodities can be subject to SEC intervention if their trading methods or market behaviors involve fraud or manipulation. The SEC’s power permeates every corner of the digital asset market, ensuring fairness and integrity.

DeFi will face a "compliance filter," with some projects exiting due to lack of transparency, liquidity, or compliance pathways.

If a meme coin is hyped simply because it meets a regulator’s "registration requirement" (e.g., registering with the CFTC), that itself is a dangerous illusion. Registration does not equal fundamental value.

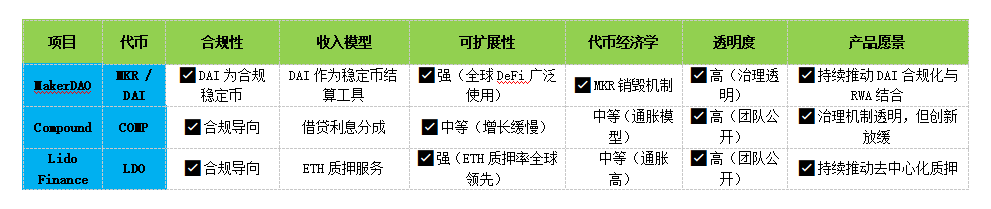

My Methodology: Identifying Valuable Projects, Especially Under New Narratives

1. Sustainable and Scalable Revenue

Does the project generate revenue? If yes, does it deliver necessary services? If again yes, then examine scalability.

How does a highway earn money? Every car passing through the toll booth pays a fee. However, the number of cars that can pass simultaneously isn’t infinite. To increase revenue, when nearing congestion, operators have two options: expand via new lanes and/or raise tolls.

A project satisfies scalability if its revenue grows with increased "traffic." The best projects are those where revenue can multiply while cost structures grow much slower.

2. Healthy Tokenomics

If a project regularly buys back and burns its tokens, by definition, each remaining circulating token represents greater economic value. This mirrors traditional finance stock buybacks—where even without profit growth, earnings per share (EPS) rise as shares outstanding decrease. Projects where profits rise while token supply shrinks are ideal.

3. Transparency

All information running on the platform must be accessible and verifiable.

4. Compliance

The existence of general laws and regulations that (do not yet) explicitly include the term "blockchain," or even if some do, aren’t consistently enforced, is no excuse for non-compliance. Of course, exceptions exist—such as the fully decentralized Bitcoin blockchain.

Are they complying with the CLEAR Act and GENIUS Act? Is the SEC treating them as securities?

5. Clear Product/Service Vision and Continuous Innovation

The most successful projects are always those that never significantly changed their product or vision from day one. If a project needs to "reinvent itself," I see it as a red flag—meaning prior investments were nearly worthless. Another red flag is changing names.

If a project continuously develops its product and expands its service offerings within the same domain, this is a strong sign of success and healthy demand. Conversely, if a project suddenly "branches out" into something unrelated to its core vision and product, it often signals limited perceived demand for its original offering.

6. Substitutability and Absorbability

Core considerations include technology, competitors, etc.

Background Reminder: What does the implementation of the stablecoin bill mean?

In essence, the passage of the stablecoin bill does not directly benefit speculative crypto assets, but rather:

• Reinforces the positioning of "stablecoins = financial infrastructure" (the bill standardizes issuance mechanisms, reserve ratios, and issuance rights for banks vs. non-banks)

• Enables traditional financial institutions to legally and compliantly access the on-chain world (e.g., brokers, banks, payment platforms)

• Encourages regulated platforms to integrate with on-chain projects, thereby expanding real-world use cases for select high-quality crypto assets

Conclusion:

The bill benefits protocol projects with income models, compliance capability, and financial service attributes—but offers no fundamental upside for purely speculative Memecoins or Layer 1 speculative assets.

Detailed Analysis:

• Coinbase is a robust Web3 infrastructure platform, not a hype-driven Web3 stock, but belongs to the "Buffett-type company" in crypto—worth long-term attention.

• Circle, issuer of the stablecoin USDC, directly benefits from the stablecoin bill.

• Coinbase, as a leading U.S. compliant exchange and shareholder of Circle, benefits indirectly.

• Ethereum, as one of the carriers of the "on-chain dollar system," sees its infrastructure role favored by stablecoin policies, though immediate volume surge is unlikely.

• SOL has speculative advantages, but under clearer compliance policies, its valuation premium should gradually converge; regulatory risks remain. The SEC previously attempted to classify it as a security, leaving regulatory gray areas, coupled with high inflation and incomplete deflation.

• LINK is one of the few protocols with clear revenue and service support across bull and bear cycles—suitable for long-term allocation.

• UNI (Uniswap): High-risk, high-reward. Could see revaluation if it introduces protocol fee sharing and successfully resists regulation. High inflation, limited governance value. The SEC has drafted litigation intent; decentralization hasn’t eliminated risk. If Uniswap is deemed an "exchange" by the SEC, enforcement action is possible.

• AAVE has a stable revenue model and sound product logic, but compliance barriers remain the key constraint on further valuation growth.

• Pendle: Niche but specialized interest rate derivatives market, highly speculative, constrained by market size and regulatory ambiguity. Highly complex financial engineering, significant compliance challenges.

• ONDO is one of the most direct beneficiaries of the stablecoin bill—a high-quality bridge connecting real-world assets (RWA) to the blockchain, with vast future potential.

• Pyth Network (PYTH): Another critical on-chain oracle infrastructure, with long-term potential.

• Aptos (APT): Has potential to gradually become a second major chain alongside Ethereum—worth watching.

• Celestia (TIA): Worth early investment as modular development advances in Web3 infrastructure.

• BUIDL (BlackRock Tokenized Fund): Represents the trend of institutional adoption—stable in the short term, long-term beneficiary of traditional finance integration.

• TRAC (OriginTrail): Combines real-world applications with DeFi potential, minimally affected by regulation, with long-term growth prospects.

Underlying Technology: High substitutability. From a pure "writing asset data onto blockchain" perspective, the underlying tokenization standards (e.g., ERC-20) and smart contract programming are industry-standard and open-source. Any team with blockchain development capability can replicate basic tokenization functions.

Non-technical Barriers (High). ONDO’s true moat lies in its compliance framework, legal structure, ability to interface with traditional financial institutions (custodians, asset issuers), and experience obtaining regulatory approvals. This is a complex system engineering effort involving financial law, regtech, and traditional financial operations. Academically, this can be seen as "institutional technology" or "compliance as competitive advantage." This "technology" isn't code—it's the ability to translate complex legal and financial processes into executable blockchain protocols, extremely difficult to replicate non-technically.

Chainlink is a decentralized oracle network for blockchains, serving as a key middleware connecting on-chain smart contracts with off-chain real-world data. It addresses the core issues of blockchain "data silos" and "trust deficits."

As a service model, the basic concept of oracles can be replicated by other teams or protocols. Other oracle projects exist in the market (e.g., Band Protocol, Pyth Network).

Chainlink’s real barrier lies in its powerful network effects and unparalleled trust built within the industry.

From a pure code standpoint, its substitutability is moderate. But from deeper dimensions—network effects and trust accumulation—Chainlink’s barriers are extremely high, making its "ecological technological substitutability" very low.

Whether large tech companies (e.g., cloud providers needing to bring off-chain data on-chain) or traditional financial data providers (e.g., Bloomberg aiming to enter the on-chain data market), all may want to control or deeply participate in blockchain data gateways.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News