When token issuance becomes an assembly line, someone is paying Bitcoin developers

TechFlow Selected TechFlow Selected

When token issuance becomes an assembly line, someone is paying Bitcoin developers

Industry hotspots have cycles, but Bitcoin development has no cycles.

Author: Cathy

A couple of days ago, the Bitcoin ecosystem research and consulting team 1A1z released an in-depth report on Bitcoin Core developers.

The article appears to be a standard developer interview, yet it reveals a layer of reality often overlooked in the crypto industry: a group of people operating far from the spotlight, avoiding narratives and marketing, who have long been maintaining the most fundamental and critical infrastructure of the entire industry.

In this list of sponsors supporting Bitcoin Core, OKX’s name does not stand out. Precisely because of its low profile, many only recently realized that large platforms still exist that allocate resources to “public R&D”—efforts with little short-term return but long-term impact on the direction of the industry.

After the report was published, OKX Star shared an internal quote: “From the very beginning, we’ve insisted on contributing our modest support to Bitcoin’s foundational development. Over the past decade, we’ve never hyped or promoted it, because we firmly believe in the future of blockchain.”

Similar statements are not uncommon in the industry. But when placed within the context of Bitcoin Core, the meaning shifts—it’s no longer a marketing slogan, but a value choice: whether one is willing to invest time, resources, and patience where no one is watching.

01 The People Paying Salaries for Bitcoin’s “Operating System”

To understand the significance, start with a core question: What exactly is Bitcoin Core?

In simple terms, Bitcoin Core is Bitcoin’s “operating system.” It is the software run by full nodes, enforcing network rules, validating transactions, and serving as the foundation for Bitcoin’s security, network consistency, and censorship resistance.

All familiar metrics—BTC price, block height, transaction confirmations, network stability—rely entirely on the correct operation of Bitcoin Core’s codebase.

More importantly, Bitcoin Core has never been a commercial project since its inception. It has no CEO, no KPIs, no revenue model, and certainly no “return-on-investment timeline.” It survives on global volunteer contributions and sustained external sponsorship.

Some developers focus on network performance optimization, others on validation rules and security, some on privacy improvements and user experience, while others work on tasks invisible to ordinary users—but which the entire ecosystem depends on.

Because Bitcoin Core has no profit model or corporate backing, it requires external funding. According to the 1A1z report, sponsors include foundations, research institutions, infrastructure companies, and a few exchanges. These funds primarily support node performance optimization, security research, network synchronization, privacy enhancements, and code review.

Without such continuous support, Bitcoin Core would struggle to maintain stable development over more than a decade.

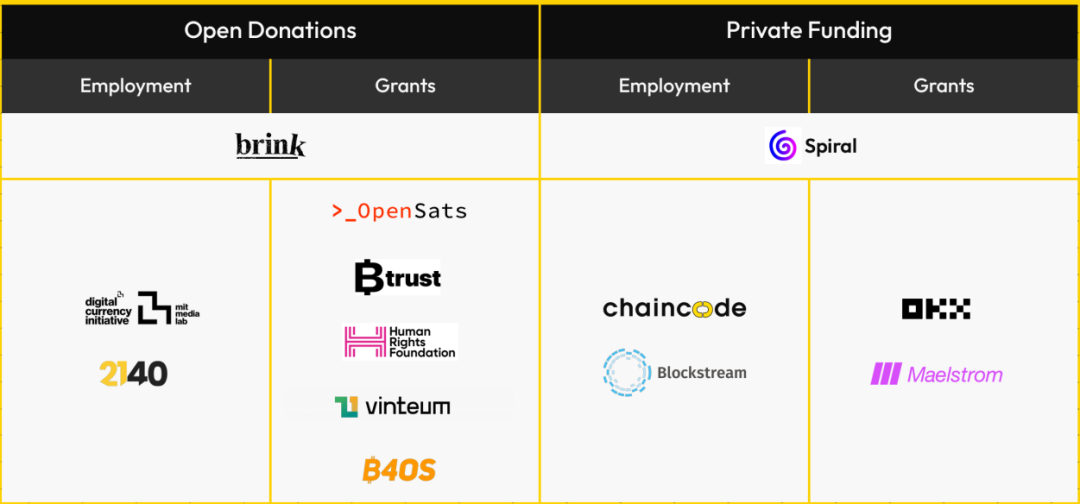

The report identifies 13 major sponsor organizations: Blockstream, Chaincode Labs, MIT, Spiral (formerly Square Crypto), OKX, Human Rights Foundation, Brink, Btrust, OpenSats, Vinteum, Maelstrom, B4OS, and 2140.

Figure: Major Bitcoin Core Sponsors, Source: 1A1z

The criteria for inclusion are clear: long-term, consistent, and low-key support.

This explains why although exchanges like Coinbase, Kraken, and Gemini previously had developer funding programs, they are not listed among the core sponsors—the report notes these initiatives are either inactive, infrequent, or no longer focused on Bitcoin development. In contrast, OKX’s funding program, ongoing since 2019, remains active, making it the only exchange among the 13 core sponsors.

Take Marco Falke as an example—one of only six individuals globally authorized to approve or reject changes to Bitcoin’s core codebase (he stepped down in February 2023). His role involves rigorously reviewing every proposed change to prevent malicious or flawed code from entering the Bitcoin protocol. This work is vital to the global crypto economy—yet entirely unpaid.

Since 2019, OKX (and its predecessor Okcoin) has provided continuous funding to Falke, enabling him to dedicate himself full-time to this mission-critical task. Beyond Falke, OKX has also supported Bitcoin Core developer Amiti Uttarwar, Lightning Network developer Antoine Riard, and nonprofit organizations including Brink and Vinteum.

To date, OKX’s total funding for these projects has approached $2 million. In fact, even before 2019, Okcoin had already established an open-source developer grant program.

Notably, this investment remained largely unpublicized for years. Only after the recent release of the 1A1z report did many realize how many organizations have quietly supported Bitcoin’s foundational development.

In an industry where most companies chase trends and craft narratives, these sponsors choose to fund what “must be done, though no one is obligated to do it.”

02 Not Just the Foundation, But Also the “Last Mile”

Support for core protocols is just one aspect. Even more overlooked are the seemingly “unimpressive” infrastructures that determine whether users can actually use the technology.

User-Side Barriers

Take OKX Wallet, for instance, which has become the entry point into Web3 for many. Supporting hundreds of chains, multiple account models, self-custody and MPC technology, rapid ecosystem integration, and compliance-ready chains—these may sound like “product details,” but they are fundamentally part of “user-side infrastructure.”

For an industry aiming at mass adoption, these details determine whether the last mile can truly be crossed.

Ordinary users don’t care about your consensus algorithm or how advanced your Layer 2 tech is. They care: Can I use it easily? Will I lose my coins? Are fees high?

CeDeFi is designed to solve these problems—combining the strengths of centralized and decentralized exchanges. Users can access over 100 decentralized liquidity pools without leaving the platform, with the system automatically finding the best prices. Crucially, there’s no need to remember seed phrases (using Passkey authentication), and no need for cross-chain bridges (routing happens directly within the platform), solving the two biggest pain points for DeFi users: lost funds and hacks.

These features may not seem flashy, but for mass adoption, they matter more than the underlying technology.

Developer Ecosystem and Long-Termism

Beyond user-facing tools, OKX has consistently invested in developer ecosystems, testnets, cross-chain infrastructure, hackathons, research collaborations, and audit systems.

These efforts may stay far from headlines, but they are crucial for the industry’s long-term health.

Hackathons don’t bring immediate users, testnets don’t generate trading volume, and audit systems don’t create buzz. But without them, developer ecosystems stagnate, security incidents multiply, and the industry’s trust foundation erodes.

In many ways, the real driving force behind crypto isn’t weekly trending narratives or exchange rankings, but those writing code, running nodes, testing protocols, and funding infrastructure.

03 The Value of Long-Termism

The phrase “a decade of dedication” sounds like marketing fluff in the crypto space. But look at the numbers—something real is happening.

Consider the state of the industry in 2025:

-

The number of tokens has exploded from hundreds of thousands in 2021 to tens of millions (over 50 million) in 2025

-

The token launch cycle has shrunk from two years to 3–6 months

-

A project spends less than 20% of its budget on actual technology development, while the rest goes to listing fees, market makers, KOLs, and media promotion (ICODA DeFi Marketing Budget Guide)

In such an environment, choosing to allocate resources to core protocols, developer ecosystems, and user infrastructure—areas with “invisible returns”—is difficult precisely because short-term gains are absent, yet long-term survival depends on it.

Such sustained investment eventually translates into competitive advantage:

Technical efficiency creates cost advantages. When your system is fast and cheap, you can naturally offer better pricing. This isn’t a price war—it’s a technological dividend.

User experience drives mass adoption. No need to remember seed phrases, no fear of bridge hacks, automatic best-price routing—these address real pain points. Get the details right, and users will stay.

Infrastructure determines future capacity. When the RWA market reaches $600 billion by 2030 (as projected by Boston Consulting Group), the infrastructure capable of handling this asset flow will be the scarcest resource. Those who prepared early will hold the greatest first-mover advantage.

This is the value of long-termism: laying foundations while others chase trends, and building skyscrapers while others are just waking up.

04 Summary

Industry trends come and go, but Bitcoin’s development has no cycles.

Markets may rise and fall, but foundational infrastructure must be built and maintained over decades. This may be the hardest—and most important—task in the industry.

In this sense, players like OKX deserve attention not for their marketing, but for choosing to do what “someone must do, though no one is obligated to do.”

Builders may not need applause, but they deserve to be seen.

And where the crypto industry ultimately ends up will depend largely on these invisible choices.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News