Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Overhaul

TechFlow Selected TechFlow Selected

Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Overhaul

The transition of the next Federal Reserve chair is a decisive factor in reshaping the macro environment for the future of the cryptocurrency industry.

Author: Paramita Venture

I. Executive Summary & Strategic Insights: The personnel shift in the next Federal Reserve Chair will fundamentally reshape the operating environment for the cryptocurrency industry, marking a pivotal turning point for digital assets transitioning from "fringe assets" to "mainstream finance." The Chair's policy stance determines the trajectory of the crypto market over the next four years through two core pathways: monetary policy transmission efficiency and the enforcement intensity of the GENIUS Act.

1.1 Key Conclusion: Strategic Impact of Federal Reserve Chair Transition

The Federal Reserve Chair acts as the "gatekeeper" of the global financial system, wielding influence far beyond that of an ordinary central banker. Although the Chair’s term is staggered with the presidential term (current Chair Powell’s term ends in May 2026), the President’s direct influence over nominations ensures the new Chair will largely reflect the White House’s economic policy orientation. The Trump administration has indicated it will announce its nominee before Christmas 2025.

The strategic divergence lies in this: dovish candidates (e.g., Kevin Hassett) represent liquidity-driven bull market opportunities, while hawkish candidates (e.g., Kevin Warsh) represent structural regulatory challenges under a high-interest-rate environment. According to prediction market Polymarket, Kevin Hassett currently leads the nomination race with approximately 80% probability.

A critical market phenomenon is that the market’s assessment of the new Chair’s policy inclination—i.e., the nomination itself—will occur well before actual policy changes take effect. If Hassett is formally nominated, this dovish expectation would immediately impact capital flows and derivatives pricing, potentially triggering a “policy-expectation-driven” market rally in Q1 2026, accelerating crypto market recovery without waiting for official rate cuts.

1.2 Macro Risk & Opportunity Matrix Overview

The primary macro opportunity lies in the fact that if Hassett wins, his aggressive rate-cutting stance would significantly reduce the opportunity cost of holding risk assets, driving institutional capital into the crypto market at an accelerated pace.

However, significant risks remain. A sustained high-interest-rate environment combined with strict enforcement of the GENIUS Act could amplify inherent systemic risks in the crypto market. In particular, MicroStrategy (MSTR) faces exclusion risk from MSCI indices; if the index provider determines that MSTR’s digital asset holdings exceed 50% of total assets, it could trigger up to $8.8 billion in passive sell-offs. This mechanical selling pressure would create a negative feedback loop, exacerbating short-term volatility even under slightly loosened macro conditions.

II. Structural Transmission of Macro Monetary Policy: Liquidity, Interest Rates, and DXY

The Fed Chair exerts decisive influence on monetary policy direction by shaping consensus within the Federal Open Market Committee (FOMC) and through public statements. Differences in the Chair’s policy stance directly affect market liquidity, thereby altering the valuation foundation of crypto assets.

2.1 Current High-Interest-Rate Environment & Opportunity Cost Analysis

As of early December 2025, the FOMC has voted to lower the federal funds target range to 3.75%–4.00%. Despite being in a rate-cutting cycle, this level remains historically high. Under these conditions, the yields on cash and U.S. Treasuries—risk-free assets—are relatively attractive, increasing the opportunity cost of holding high-risk, high-volatility crypto assets.

A dovish Chair would push for larger and faster rate cuts, directly lowering funding costs and releasing market liquidity. For example, Bloomberg analysis suggests each 0.25% rate cut could add $5–10 billion in potential liquidity to the crypto market. Aggressive easing would incentivize institutional investors to reallocate capital from traditional low-risk financial assets into crypto.

2.2 Correcting Historical Correlations: Deep Transmission Mechanism Between Interest Rates and Crypto Markets

Historical data shows a strong correlation between crypto market performance and the Fed’s interest rate policy. Loose policy enhances the relative appeal of risk assets by lowering the risk-free rate.

A common misconception about historical correlations must be corrected: that Fed rate hikes may coincide with a “booming” crypto market. In reality, Fed rate-hiking cycles typically lead to sharp crypto market declines. For instance, when the Fed began hiking rates in 2018, Bitcoin’s price plummeted by about 80%. Conversely, the aggressive rate cuts and quantitative easing after the 2020 pandemic drove Bitcoin from around $7,000 to a record high of $69,000.

Therefore, equating “rate cuts” simply with a “liquidity-driven bull market” is incomplete. The true drivers of liquidity and global capital appetite for risk assets are more closely tied to movements in the U.S. Dollar Index (DXY). Data shows every major Bitcoin bull run occurred during periods of falling DXY, while bear markets coincided with rising DXY. The new Chair’s policy stance influences global confidence in the dollar, thus affecting DXY trends, which serve as a key barometer for macro risk premiums. The policy’s impact lies in its ability to stabilize market confidence and indirectly boost prices of risk assets like Bitcoin by weakening the dollar’s relative strength.

III. Detailed Assessment of Core Candidates’ Policy Stances: Regulatory Attitudes vs. CBDC Approaches

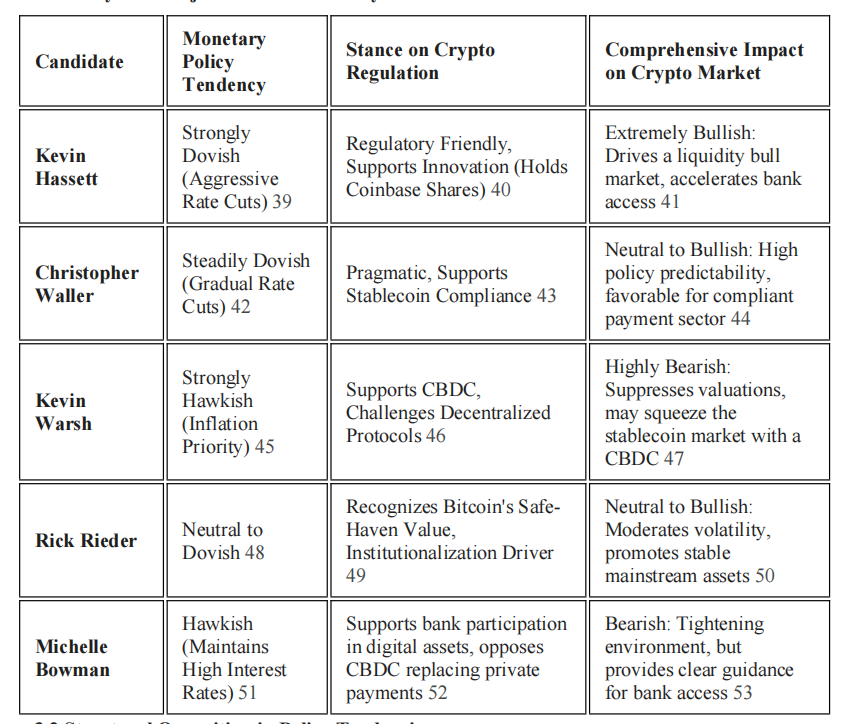

Differences among five leading candidates on monetary policy and digital asset regulation constitute the core variables shaping the industry’s future path.

3.1 Policy Stance Analysis of Major Candidates

3.2 Structural Policy Polarization

Kevin Hassett is viewed as the most pro-crypto candidate. He has publicly stated that if appointed Chair, he would “cut rates immediately.” As a core economic advisor to Trump, he advocates space for innovation in regulation, previously served as an advisor to Coinbase, and holds shares in the exchange. His regulator-friendly stance serves as a key catalyst for a liquidity-driven bull market.

Kevin Warsh represents the most hawkish position. He prioritizes inflation control, supports tighter interest rates and balance sheet reduction. More importantly, Warsh openly backs the development of a U.S. wholesale CBDC (central bank digital currency), believing it would strengthen the dollar’s dominance in the digital realm. This stance directly challenges decentralized crypto fundamentalism. His hawkish monetary policy and CBDC support form a dual headwind, potentially delaying rate cuts and squeezing private stablecoin markets through competition from state-backed digital currencies.

Christopher Waller is a pragmatic centrist. As a current Fed governor, he supports gradual rate cuts and holds an open view toward stablecoins, recognizing their supplementary role as payment tools and believing they can enhance the dollar’s status under proper regulation. His appointment would bring a relatively predictable policy environment, favorable for long-term growth of compliant institutions.

Bowman and Warsh differ subtly on crypto regulation: although Bowman supports maintaining high rates, she also backs banks participating in digital asset activities under safe and sound conditions, and remains skeptical of CBDCs. This suggests she favors private-sector-led innovation and enabling digital asset services within the banking system.

3.3 Regulatory Detailing Battle: Who Will Enforce the GENIUS Act?

The GENIUS Act has become law, and one of the new Chair’s core tasks is defining its regulatory details. The opposing approaches of the two leading candidates on implementing this act are crucial. Hassett may promote a more flexible framework, allowing stablecoins to scale rapidly under compliance, facilitating integration between on-chain dollars and traditional finance. However, Warsh could use his discretion to impose higher compliance barriers in anti-money laundering (AML) and reserve requirements, effectively constraining private stablecoin growth and indirectly paving the way for government-backed CBDCs. This battle over regulatory details will determine the future scale and nature of “on-chain dollars.”

IV. The GENIUS Act: Stablecoin Regulatory Framework and Industry Compliance Boundaries

The GENIUS Act was signed into law by the President in July 2025, establishing the first federal regulatory framework for payment stablecoins in the U.S. It requires stablecoin issuers to follow stringent rules similar to traditional financial institutions, profoundly reshaping the rules of engagement for on-chain dollars.

4.1 Core Provisions Explained: 100% Reserves and AML Requirements

The core objectives of the GENIUS Act are consumer protection and strengthening the dollar’s position. It mandates that stablecoin issuers:

1. 100% Reserve Backing: Must hold reserves equal to issuance value in U.S. Treasury securities, bank deposits, or similar short-term, highly liquid assets.

2. Transparency & Audits: Must publicly disclose reserve composition monthly and submit annual independent audit reports (for issuers with market cap exceeding $50 billion).

3. Anti-Money Laundering (AML) Requirements: Issuers are explicitly subject to the Bank Secrecy Act, requiring effective AML and sanctions compliance programs.

Additionally, the law requires all stablecoin issuers to possess technical capabilities to legally freeze, seize, or destroy issued payment stablecoins. This marks the beginning of on-chain dollars being held to regulatory standards comparable to traditional banks.

4.2 Structural Reconfiguration of DeFi by the Interest-Bearing Ban

One of the most structurally impactful provisions explicitly prohibits stablecoin issuers from paying interest or returns to holders in any form (cash, tokens, or other consideration). This aims to prevent stablecoins from being treated as “shadow deposit” products, which could pose financial stability risks or circumvent bank regulations.

This rule fundamentally invalidates the business model of “native-yield stablecoins.” Future DeFi yield generation will rely more on on-chain protocol activity (such as lending interest, transaction fees) rather than issuer reserve earnings. The Treasury Department is also required to broadly interpret the rule to prevent workarounds that offer interest or returns.

While the Act provides a compliance pathway for digital assets, it imposes significant trade-offs—mandating issuer capabilities for “freezing/destruction” and full 100% reserves—greatly compromising decentralization principles, illustrating a **“paradoxical centralization of compliant stablecoins.”** The extent to which the new Chair enforces these centralized requirements will determine how deeply stablecoins integrate into traditional finance while retaining digital asset characteristics.

4.3 Systemic Impact of Stablecoin Reserves on the Treasury Market

Because the GENIUS Act requires stablecoins to be backed by U.S. Treasuries or dollars, the stablecoin market has become a significant participant in the Treasury market.

Research by the Bank for International Settlements (BIS) reveals asymmetric risks posed by stablecoins to the Treasury market: a net inflow increase of 2 standard deviations can modestly reduce 3-month Treasury yields by 2–2.5 basis points within 10 days; however, a net outflow of the same magnitude can raise yields by 2–3 times more. This asymmetry implies that during market panic or regulatory uncertainty triggering massive redemptions, stablecoin sell-offs could disproportionately disrupt the short-term Treasury market. The Fed Chair’s stance on regulatory strictness and transparency will directly influence the scale of this systemic risk.

V. Opportunities in Traditional Finance Integration and Systemic Risk Transmission

The incoming Fed Chair will determine the banking sector’s openness to the crypto industry, shaping whether crypto remains an “independent ecosystem” or integrates into mainstream finance.

5.1 Banking System Access and the Role of RegTech

The Chair’s policy stance will directly affect whether banks and non-bank financial institutions can legally provide services to crypto firms. Fed Governor Michelle Bowman explicitly supports banks engaging in digital assets if done safely and soundly, arguing regulation should not stifle innovation, or else it may migrate to less transparent non-bank sectors.

If a dovish Chair is appointed, support for regulatory technology (RegTech) could accelerate bank partnerships. For example, blockchain-based RegTech solutions now enable near-zero-cost, rapid AML and KYC verification. Fed endorsement of such technologies would drastically lower compliance barriers for banks entering crypto services.

Moreover, tokenized financial markets represent the future convergence of traditional finance and crypto. Stablecoins may play a key role in converting securities into digital tokens and enabling real-time, low-cost DvP (delivery versus payment) settlement, enhancing liquidity and trading speed.

5.2 Institutional Risk Amplifier: The Feedback Loop of MicroStrategy’s Index Exclusion

Institutional capital flows are the core transmission mechanism linking crypto markets and Fed policy. MicroStrategy (MSTR), the largest corporate holder of Bitcoin with over 640,000 BTC, is seen by institutional investors as a proxy stock for Bitcoin. The correlation between MSTR’s stock price and Bitcoin has reached as high as 0.97, indicating strong co-movement.

Yet MSTR faces significant systemic risk. One of the world’s largest index providers, MSCI, is considering a rule to remove companies whose digital asset holdings exceed 50% of total assets from its indices. MSTR’s Bitcoin holdings already account for over 77% of its total assets.

If MSCI decides on exclusion in January 2026, it could trigger up to $8.8 billion in forced sell-offs by passive index funds. This selling is mechanical and mandatory, unrelated to Bitcoin’s fundamentals. If triggered, it would create a negative systemic feedback loop: hawkish Chair maintains tight policy → macro conditions pressured → BTC price falls → MSTR exclusion risk rises → passive index sell-off → further downward pressure on BTC.

The activation of this mechanical risk is directly tied to the new Fed Chair’s policy. If hawkish policies sustain macro liquidity tightening and continued pressure on risk assets, the likelihood of MSTR stock decline and index exclusion increases, delivering a disproportionate shock to an already illiquid crypto market.

5.3 Deepening Linkage Between Bitcoin and Traditional Equity Indices

The impact of macro policy is also evident in the growing correlation between crypto and traditional markets. Currently, Bitcoin’s correlation with the Nasdaq 100 Index has rebounded above 0.72. This confirms that, from an institutional perspective, Bitcoin is still regarded as part of equity risk assets in risk-on environments, not as a safe haven. The Chair’s policy will simultaneously affect valuations of both crypto assets and tech stocks by influencing overall risk appetite.

VI. Conclusion & Long-Term Outlook

The transition of the next Federal Reserve Chair is the decisive factor reshaping the future macro environment for the cryptocurrency industry. This personnel change not only affects short-term price volatility and market liquidity but also determines the regulatory framework and degree of integration with traditional finance over the next four years.

In the long run, implementation of the GENIUS Act will force “on-chain dollars” to become safer and more transparent, but at the cost of issuers sacrificing some decentralization principles by accepting strict centralized regulatory demands (e.g., freezing and destruction capabilities). The stablecoin market will trend toward centralization and high compliance.

For institutional and professional investors, the key lies in precisely understanding the differentiated impacts of different Chairs’ policy stances on the crypto market. Early management of policy expectations and mitigation of systemic risks like MSTR index exclusion are crucial. Only by treating macro policy analysis as a core risk management metric can one seize opportunities and navigate challenges at this historic inflection point.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News