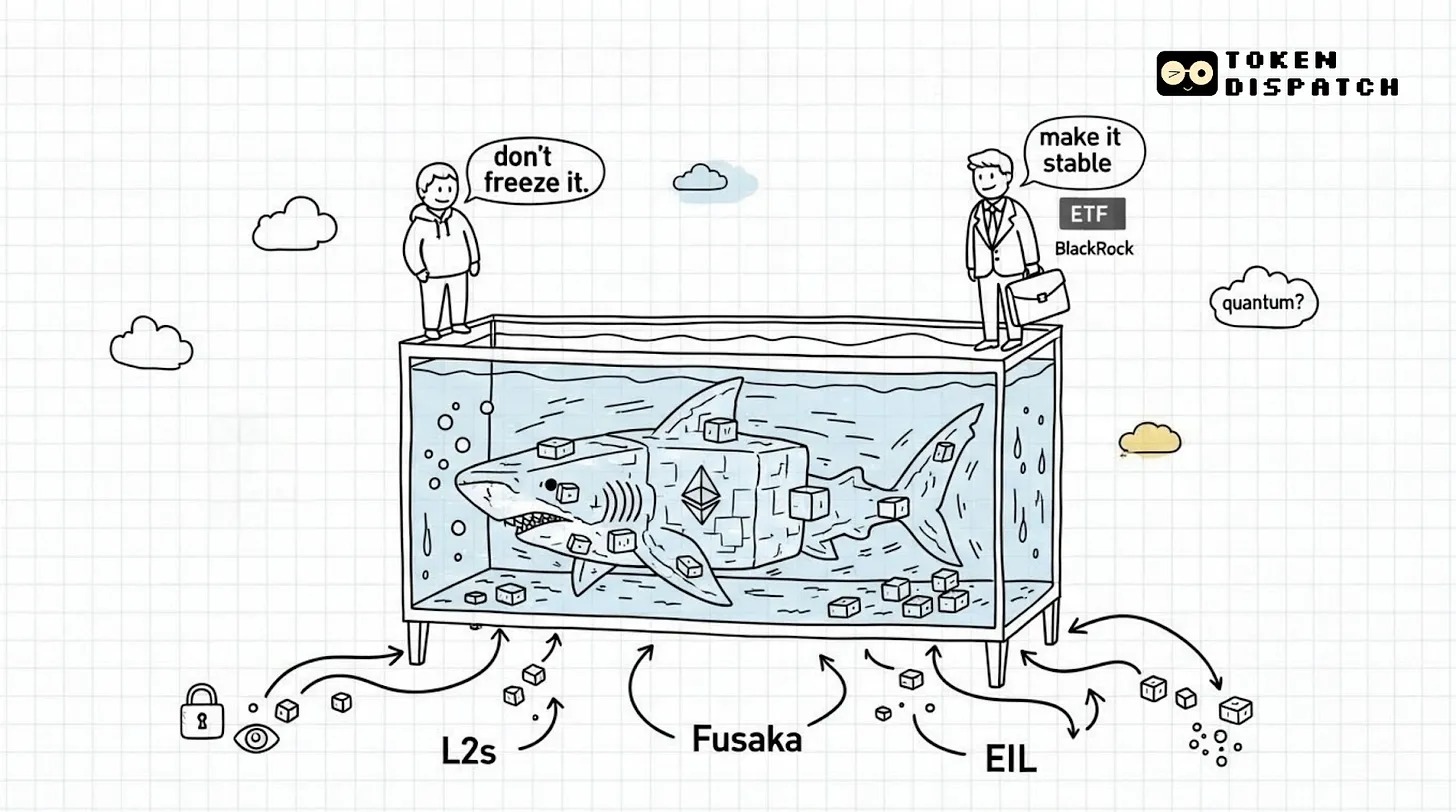

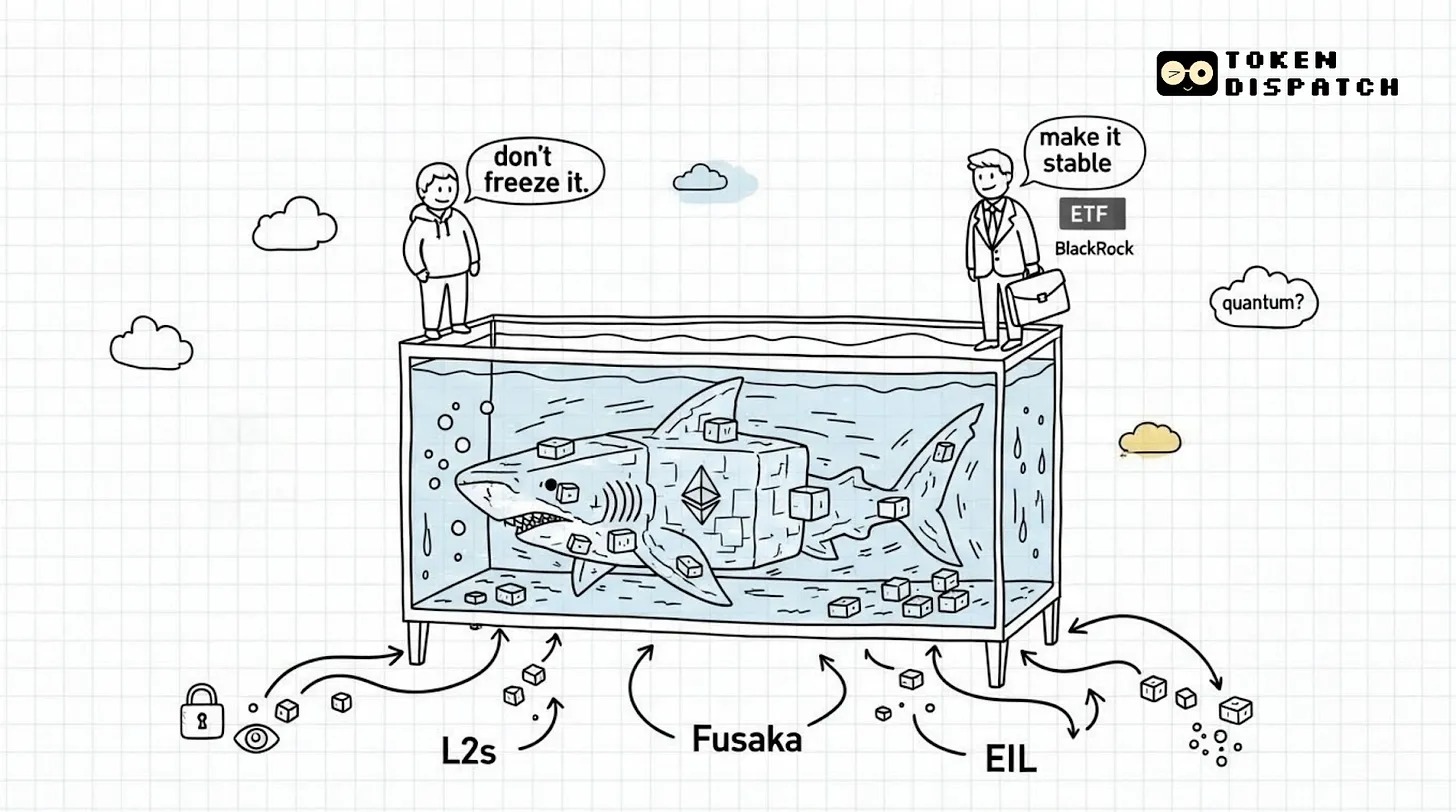

Ethereum: A "frozen bone shark" that longs for stillness but must keep running

TechFlow Selected TechFlow Selected

Ethereum: A "frozen bone shark" that longs for stillness but must keep running

Ethereum doesn't want to change anymore, but it can't afford the cost of stopping development.

Author: Thejaswini MA

Translation: Luffy, Foresight News

Ethereum is attempting a contradictory balance: hardening its base layer protocol (ceasing changes, locking core rules, achieving predictability), while maintaining unprecedented operational speed across the entire system. Layer 2s are scaling, Fusaka is paving the way for 10x data capacity in the future, the Ethereum Virtual Machine (EVM) is being restructured, and validators keep adjusting gas limits. Everything is in motion.

The hardening argument holds that the base network (Layer 1) can be frozen, with innovation occurring only on top. But is this truly the case? Or has Ethereum merely repackaged continuous change as "minimalism," simply because it sounds more responsible?

First, examine what the Fusaka upgrade actually does. It introduces PeerDAS, fundamentally changing how validators verify data. Instead of downloading full rollup data blocks, validators randomly sample portions of data and use erasure coding to reconstruct the complete content. This is a major architectural shift in network operation, currently being deployed as part of the "Surge" scaling phase.

In addition, there are minor forks containing only blob parameters. These small hard forks aim to incrementally increase data capacity. After Fusaka launches on December 3, the first BPO fork will occur on December 17, raising the blob target from 6 to 10; a second fork on January 7 will push it further to 14. The ultimate goal is 64 blobs per block—eight times the current capacity.

Is this hardening? Clearly not. This is iterative capacity expansion on a fixed schedule, with rules still changing, albeit in smaller, more predictable increments.

Then there's EIP-7918, which sets a minimum reserve price for blob gas fees. In essence, Ethereum now controls the data availability market and will charge a floor fee even during periods of low demand.

This reflects Ethereum’s pricing power and serves as a mechanism to capture value as the data layer relied upon by Layer 2s. It may be smart business strategy, but it's certainly not hardening. On the contrary, it represents the base layer actively managing its relationship with Layer 2s to extract greater value.

So what exactly does hardening mean here?

It means the protocol aims to stop modifying core rules, while continuously adjusting various parameters:

-

Consensus mechanism frozen (maintaining Proof-of-Stake PoS)

-

Monetary policy frozen (retaining EIP-1559 burn mechanism)

-

Core opcodes frozen (smart contracts from 2020 still function normally)

But throughput, data capacity, gas limits, and fee structures? These continue to evolve.

It's like claiming the Constitution is "frozen" because amendments are rare, yet the Supreme Court reinterprets it every decade. Technically true, yet practically always changing.

The Ingenuity of the Ethereum Interop Layer (EIL)

If Ethereum wants to appear as one chain, while actually consisting of dozens of Layer 2s, it needs some unifying layer. This is where the Ethereum Interop Layer (EIL) comes in.

EIL aims to give users the experience of a “single Ethereum” across independent Layer 2s, without introducing new trust assumptions. Its technical mechanism allows users to sign a single Merkle root authorizing synchronized operations across multiple chains; cross-chain liquidity providers (XLPs), backed by staking on the base layer, front-run gas fees and funds required on each chain via atomic swap processes.

The key point is that XLPs must lock collateral on the Ethereum base layer with an 8-day withdrawal delay. This period exceeds the 7-day fraud proof window of Optimistic Rollups. If an XLP attempts to cheat, the fraud proof mechanism has sufficient time to slash their staked assets before funds are moved.

This design is clever, but adds another layer of abstraction: users no longer manually bridge between Layer 2s, instead relying on XLPs. Whether the system works depends on XLPs being reliable and competitive; otherwise, fragmentation resurfaces at a new level.

EIL’s success also hinges on actual adoption by wallets and Layer 2s. The Ethereum Foundation can build the protocol, but if major Layer 2s choose to confine users within their own ecosystems, EIL will become irrelevant. This is the "HTTP dilemma": even a perfectly designed standard remains ineffective if platforms refuse to implement it, leaving the network fragmented.

BlackRock and the Comfortable Cage

Meanwhile, Ethereum is attracting massive institutional capital. BlackRock launched its iShares Ethereum Trust ETF in July 2024, surpassing $13 billion in inflows by mid-2025, and subsequently filed for a staked Ethereum ETF. Institutions don’t just want exposure—they want yield.

BlackRock is also using Ethereum as infrastructure: its BUIDL fund tokenizes U.S. Treasuries and money market instruments and deploys them on Ethereum, extending to Layer 2s like Arbitrum and Optimism. To BlackRock, Ethereum functions like TCP/IP on the internet—a neutral settlement rail.

This is both recognition and control. When BlackRock designates Ethereum as the foundational layer for tokenized assets, it provides a strong endorsement—but it also implies Ethereum begins optimizing itself to meet BlackRock’s needs: predictability, stability, compliance-friendly features, and the dull reliability of infrastructure.

Vitalik previously warned of this risk. At DevConnect, he noted the dangers if base-layer decisions primarily cater to Wall Street's "comfort": if the protocol favors institutions, the community rooted in decentralization ideals gradually departs; if it leans toward cypherpunks, institutions exit. Ethereum tries to serve both, and this tension will only intensify.

There’s also the issue of speed: some proposals advocate reducing block times to 150 milliseconds—highly beneficial for high-frequency trading and arbitrage bots, but too fast for ordinary users to effectively participate in governance or form social consensus. If the network operates too quickly, it becomes a tool for "machines talking to machines," undermining the political legitimacy that gives Ethereum its value.

Quantum Computers and the Coming Death of Elliptic Curves

Another threat comes from quantum computing. At DevConnect, Vitalik stated: "Elliptic curves will eventually die." He referred to elliptic curve cryptography (ECC), which secures user signatures and validator consensus. Quantum computers running Shor’s algorithm could derive private keys from public ones, breaking ECC.

Timeline? Possibly before the next U.S. presidential election in 2028. This means Ethereum has roughly 3–4 years to migrate its entire network to quantum-resistant cryptography.

Under these circumstances, hardening is meaningless.

If quantum attacks become real, Ethereum must survive through large-scale, disruptive hard forks. No matter how much the protocol values stability, once its cryptographic foundation collapses, everything falls apart.

Compared to Bitcoin, Ethereum is in a better position:

-

Public keys are hidden via address hashing, only exposed during transactions

-

Validator withdrawal keys are also concealed

-

The roadmap already includes replacing ECDSA with quantum-resistant schemes such as lattice-based or hash-based signatures

Yet implementing this migration poses enormous coordination challenges: How to convert keys for millions of users without compromising fund security? How to set deadlines for wallet upgrades? What happens to legacy accounts that fail to migrate? These are not just technical issues—they are social and political questions about who gets to decide the network’s future.

The quantum threat confirms a principle: hardening is a choice, not a physical law. Ethereum’s "skeleton" can remain frozen only as long as environmental conditions allow; when those change, the network must either adapt or perish.

Additionally, Vitalik donated $760,000 to encrypted messaging apps Session and SimpleX, calling privacy "crucial for protecting digital privacy," and set his next goal as permissionless account creation and metadata privacy protection.

The Ethereum Foundation has formed a dedicated privacy task force, aiming to make privacy a default feature rather than an afterthought add-on. Projects like Kohaku Wallet are developing easy-to-use privacy tools that require no understanding of complex cryptography.

The core idea is "privacy as hygiene"—as routine as handwashing. People should pursue financial privacy without needing special justification; it should be the default state.

But this contrasts sharply with regulators' demands for transparency and traceability. Stablecoins, tokenized Treasuries, BlackRock’s BUIDL fund—all come with compliance expectations. Ethereum cannot simultaneously serve as Wall Street’s infrastructure layer and fulfill the cypherpunk dream of "privacy-first." A middle path might exist, but it would require extremely delicate design.

The Shark That Wants to Freeze

Can Ethereum achieve this balance?

-

Frozen base layer while enabling continuous innovation on Layer 2?

-

Satisfy both BlackRock and cypherpunks?

-

Complete cryptographic upgrades before quantum computers arrive?

-

Maintain default privacy without alienating institutions?

Possibly. Modular design is ingenious: base layer handles security and settlement, Layer 2s handle execution and experimentation—this separation of concerns could work. But it requires EIL to unify the Layer 2 user experience and demands institutional trust that the base layer won’t make unexpected changes.

It also requires the Ethereum community to accept: hardening means giving up some control. If the protocol freezes, the community can no longer fix issues or add features via forks. It’s a trade-off: stability at the cost of flexibility.

Sergey is right that Ethereum needs continuous evolution; Vitalik is equally right that protocols can’t change forever. The key is to let innovation happen at the edges while keeping the core stable.

A shark claims it wants to freeze, cryptographers say its bones need replacement, Wall Street wants a docile tool, cypherpunks want wild freedom.

Ethereum tries to play all roles at once, while blocks keep getting produced. This is Ethereum: cold bones, a moving shark.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News