Bitget Daily Morning Report: Grayscale XRP ETF and Franklin XRP ETF launch; global publicly traded companies net bought $13.4 million worth of BTC last week

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Grayscale XRP ETF and Franklin XRP ETF launch; global publicly traded companies net bought $13.4 million worth of BTC last week

The release of the US September PCE has been rescheduled to December 5, and the advance Q3 GDP report has been canceled.

Author: Bitget

Today's Outlook

1. The U.S.'s first DOGE spot ETF listed with no net inflow on its debut day; Grayscale XRP ETF and Franklin XRP ETF launched, bringing the total daily net inflow across four XRP spot ETFs to $164 million.

2. Multicoin Capital purchased $10.94 million worth of AAVE tokens today.

3. Last week, global public companies net bought $13.4 million in BTC; Strategy did not purchase bitcoin last week.

Macro & Hotspots

1. Federal Reserve's Daly supports a December rate cut, pushing the probability of a Fed rate cut in December up to 81%.

2. Bloomberg ETF analyst Eric Balchunas: Short positions in BlackRock's Bitcoin spot ETF $IBIT have declined significantly and are now near April's pre-rally lows.

3. Jinshi: The release of the U.S. September PCE has been rescheduled to December 5, and the preliminary Q3 GDP report has been canceled.

Market Trends

1. BTC rebounded above $89,000, ETH rebounded above $2,900; total crypto market liquidations over the past 24 hours reached approximately $356 million, including $237 million in short liquidations.

2. U.S. stocks: Dow rose 0.44%, S&P 500 rose 1.55%, Nasdaq Composite rose 2.69%.

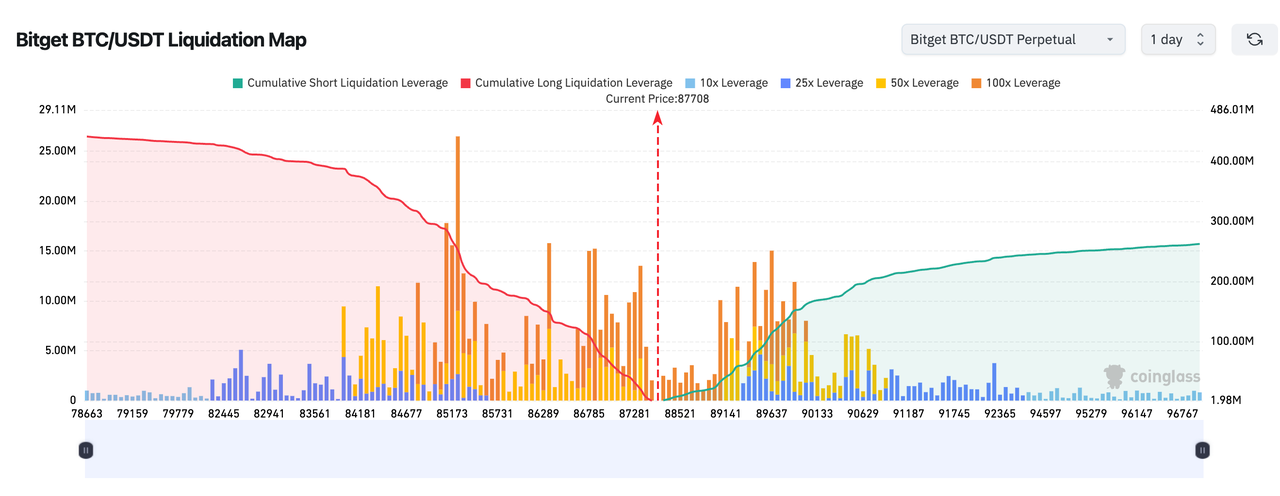

3. Bitget BTC/USDT liquidation map shows: BTC is currently around $87,708; the zone below between $85,400–$86,500 is a high-leverage long concentration area, and a price drop into this range could trigger consecutive long liquidations. The zone above $89,000–$90,500 has accumulated high leverage shorts; if price surges into this range, it may trigger short liquidations and drive prices higher.

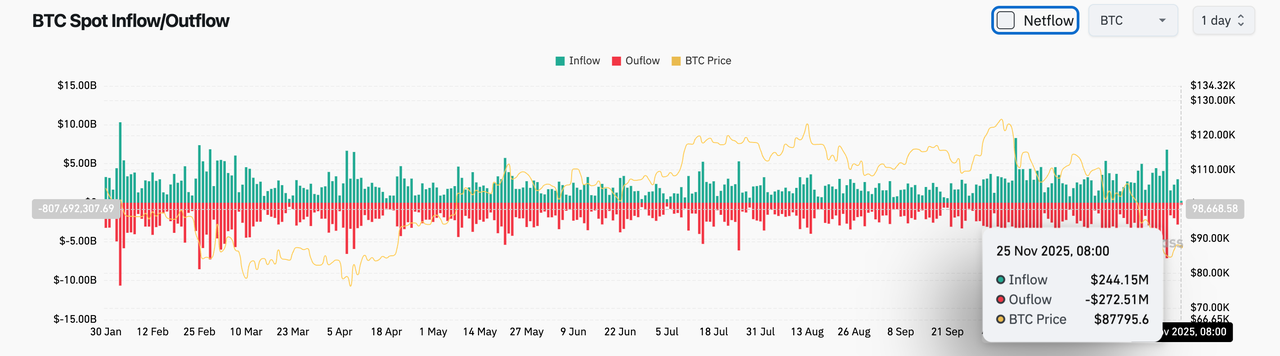

4. Over the past 24 hours, BTC spot saw $244 million in inflows and $272 million in outflows, resulting in a net outflow of $28 million.

News Updates

1. U.S. Department of Government Efficiency (DOGE): Reuters' report about its dissolution is fake news.

2. Japan's Financial Services Agency plans to introduce new regulations requiring crypto exchanges to establish liability reserves.

3. Crypto industry lobbying group "Stand With Crypto" launches candidate questionnaire for the 2026 midterm elections.

4. A San Francisco crypto holder was robbed by a fake delivery worker, losing up to $11 million in digital assets.

Project Updates

1. About 7 hours ago, a whale spent 1.35 million USDC to buy 37 million MON tokens.

2. Circle minted an additional 500 million USDC on the Solana network early this morning.

3. SPSC, a nonsensical meme coin inspired by WLFI's founder, surged 130% after receiving official endorsement from WLFI.

4. TD Cowen: Strategy's bitcoin premium is approaching lows seen during the "crypto winter," but maintains a buy rating.

5. Yesterday, BlackRock transferred another 900 bitcoins worth approximately $77.59 million to Coinbase.

6. BitcoinTreasuries.NET: New Jersey state pension fund increased its Strategy holdings to $16 million.

7. Arthur Hayes: Slight improvement in Fed liquidity suggests bitcoin may hold above $80,000.

8. CoinShares: Digital asset investment products saw $1.94 billion in net outflows last week.

9. Irys: IRYS token airdrop claim will go live today at 20:00 (UTC+8).

Disclaimer: This report is generated by AI, with human verification only for information accuracy. No investment advice is provided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News